- Home

- »

- Medical Devices

- »

-

Lighted Surgical Retractors Market, Industry Report, 2030GVR Report cover

![Lighted Surgical Retractors Market Size, Share & Trends Report]()

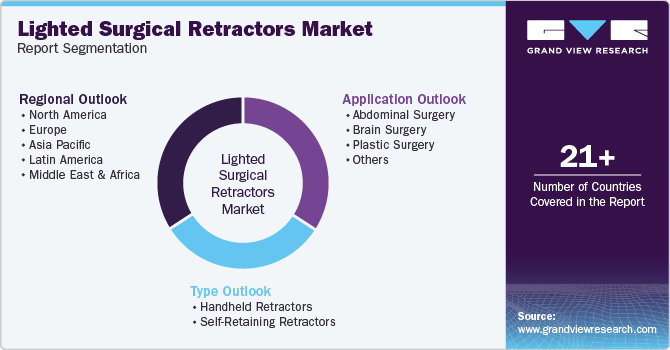

Lighted Surgical Retractors Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Handheld Retractor, Self-retaining Retractor), By Application (Abdominal Surgery, Brain Surgery, Plastic Surgery), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-513-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lighted Surgical Retractors Market Summary

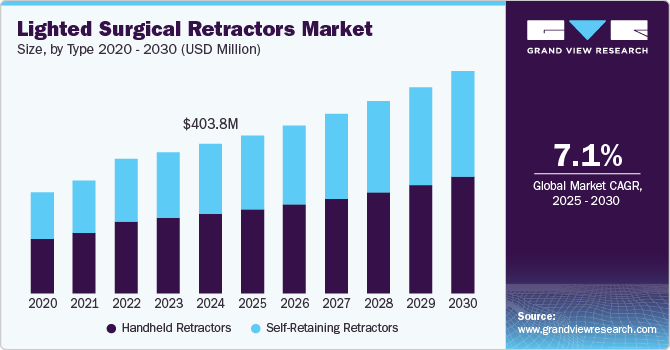

The global lighted surgical retractors market size was valued at USD 403.8 million in 2024 and is projected to reach USD 602.0 million by 2030, growing at a CAGR of 7.1% from 2025 to 2030. The industry is growing due to advancements in surgical precision and increasing demand for minimally invasive procedures.

Key Market Trends & Insights

- North America held a dominant position, capturing 30.3% of the global revenue share in 2024.

- U.S. held a significant share of North American market in 2024.

- By type, handheld retractors segment accounted for the largest revenue share of 53.2% in 2024.

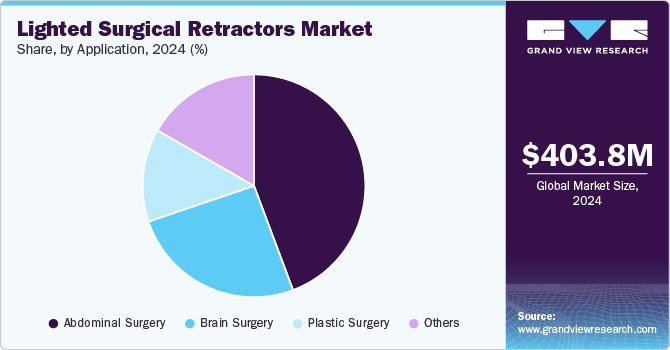

- By application, the abdominal surgery segment dominated the market and accounted for the largest revenue share of 44.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 403.8 Million

- 2030 Projected Market Size: USD 602.0 Million

- CAGR (2025-2030): 7.1%

- North America: Largest market in 2024

These devices enhance visibility in deep cavities, reducing procedural time and complications. Rising surgical volumes, particularly in orthopedic, cardiovascular, and neurosurgery, drive adoption. Technological innovations, including LED integration and ergonomic designs, improve efficiency and safety. Additionally, the growing prevalence of chronic diseases requiring surgical intervention fuels market growth.The industry is experiencing significant growth due to the rising number of surgical procedures worldwide. Neurological surgeries, in particular, are a major driver of demand, given the increasing prevalence of neurological disorders. According to the World Federation of Neurology, 12.0% of total neurology patients succumb to these conditions annually. Additionally, Medico Experts reports that 22.6 million people suffer from neurological injuries, with 13.8 million requiring surgery. The World Health Organization (WHO) projects that Disability-Adjusted Life Years (DALYs) lost due to neurological diseases will rise from 95 million in 2015 to 103 million by 2030. With surgical procedures being a primary treatment option for neurological conditions, the need for precision instruments such as lighted surgical retractors is expected to grow.

Another key factor driving the industry is increasing awareness and emphasis on women's health. The growing number of check-ups and diagnoses has led to a rise in surgical procedures addressing gynecological conditions. The WHO reported in June 2023 that polycystic ovary syndrome (PCOS) affects approximately 8 to 13% of women of reproductive age worldwide, with 70% remaining undiagnosed. As more women seek treatment, the demand for surgical interventions, including those requiring lighted retractors, is expected to increase.

Technological advancements in surgical instruments have also contributed to market growth. Leading manufacturers are investing in research and development to introduce innovative retraction systems that enhance surgical precision, reduce complications, and improve patient outcomes. In 2019, Thompson Surgical introduced a table-mounted hip retraction system using flexible tethers to secure retractor blades in place, reducing the need for additional staff. Similarly, in October 2020, June Medical launched the Galaxy II surgical retractor series, specifically designed for the male anatomy. This product includes a penile hammock that minimizes the need for sharp hook penetration, promoting faster recovery and reducing infection risks. Another notable advancement came in April 2022 when Cureus developed low-cost three-dimensional printed retractors to aid surgeons in pedicle screw insertion during transforaminal lumbar interbody fusion surgeries. These innovations highlight the ongoing efforts of manufacturers to improve surgical efficiency and patient care.

The increasing number of surgical procedures, coupled with a growing emphasis on advanced surgical tools, is fueling market expansion. Rising cases of chronic diseases requiring surgical intervention, such as cardiovascular conditions, orthopedic disorders, and gastrointestinal diseases, are further driving demand. Hospitals and surgical centers are investing in high-quality, technologically advanced retractors to enhance surgical accuracy and reduce operating times. However, challenges such as high costs and limited adoption in lower-income regions may hinder market growth. Despite these barriers, ongoing advancements and increasing surgical volumes are expected to sustain the upward trajectory of the lighted surgical retractors market. As healthcare systems continue to prioritize efficiency and patient safety, the adoption of these advanced surgical tools is set to rise, further solidifying their role in modern surgical practices.

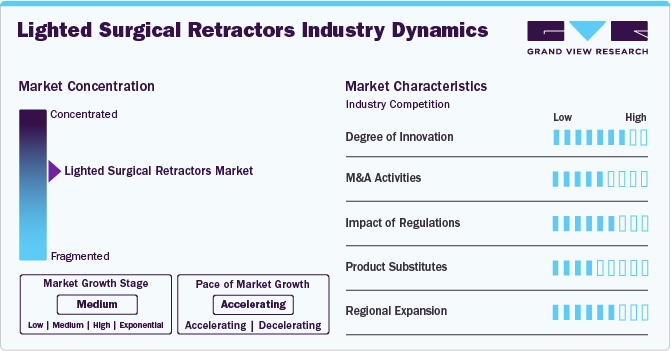

Market Concentration & Characteristics

The industry is characterized by moderate concentration, with global leaders like NIDEK CO., LTD, Medtronic, and JUNE Medical competing alongside regional manufacturers. It caters to diverse surgical specialties, including general, orthopedic, and minimally invasive procedures, with products ranging from hand-held to self-retaining retractors. Key industry traits include innovation in materials like titanium and stainless steel for durability and precision, regulatory compliance, and competitive pricing. Increasing surgical volumes, advancements in technology, and rising healthcare expenditure drive market growth. Emerging economies present significant opportunities, fueled by expanding healthcare infrastructure and unmet surgical needs, making the industry dynamic and growth-focused.

The industry has seen notable innovation with the development of the TITAN CSR, designed by Dr. Ramon Cestero, a trauma surgeon and former U.S. Navy officer in September 2021. Frustrated by outdated tools like the Balfour retractor, he created a device combining speed and superior exposure. The TITAN CSR sets up in six seconds-50 times faster than traditional designs-without compromising functionality. Supported by UT Health San Antonio’s Office of Technology Commercialization and internal funding, Dr. Cestero patented the design in multiple countries and founded Advanced Surgical Retractor Systems, Inc. in 2019, advancing surgical efficiency and improving patient outcomes.

Regulations in the lighted surgical retractors industry ensure the safety, efficacy, and quality of devices used in medical procedures. Governing bodies like the FDA in the U.S. and the CE marking system in Europe require rigorous testing and compliance with standards such as ISO 13485 for medical device quality management. These regulations mandate pre-market approvals, clinical evaluations, and post-market surveillance to minimize risks. Strict adherence impacts innovation timelines and production costs but also enhances patient safety and trust. Evolving regulatory frameworks, particularly for advanced devices, encourage manufacturers to balance compliance with innovation, fostering safer and more effective surgical retractor solutions.

Mergers and acquisitions (M&A) in the industry are rapidly increasing as companies aim to bolster their technological capabilities and market reach. For instance, in August 2024, CooperCompanies announced that CooperSurgical acquired obp Surgical, a U.S.-based medical device company, for USD 100 million. Specializing in single-use cordless lighted surgical retractors with integrated LED lights and smoke evacuation features, obp Surgical’s ONETRAC portfolio generated USD 14.5 million in trailing twelve-month revenue. This acquisition, expected to be earnings-neutral in fiscal 2024 and accretive thereafter, strengthens CooperSurgical’s portfolio, which includes products like INSORB, Lone Star, and Doppler Blood Flow Monitors. This strategic acquisition aims to improve product offerings and accelerate the development of innovative health solutions. Additionally, partnerships between established firms and startups are becoming common, enabling knowledge sharing and resource pooling, which fuels growth and innovation within the lighted surgical retractors industry.

Product substitutes for lighted surgical retractors include standard surgical retractors with external lighting, fiber optic illumination systems, and headlamp-based lighting solutions. Traditional retractors paired with overhead surgical lights can provide sufficient visibility in some procedures, reducing reliance on integrated lighting. Additionally, fiber optic cables integrated into surgical tools offer a flexible alternative by delivering focused illumination without built-in retractors. Wearable LED headlamps also serve as substitutes, offering surgeons direct control over illumination without altering instrument design. While these alternatives may be cost-effective, they may lack the precision and convenience of lighted surgical retractors in complex procedures.

The industry is witnessing significant regional growth driven by increasing healthcare demands and technological advancements. JUNE Medical recently secured an agreement with a leading US hospital group to provide Galaxy II self-retaining lighted surgical retractors to over 1,600 hospitals starting April 15, 2023. This innovative device enhances surgical retraction safety and efficiency for both patients and medical professionals. Its ergonomic design revolutionizes surgical workflows, making it an excellent choice for group purchasing organizations aiming to equip hospitals with high-quality, cost-effective products.

Type Insights

Handheld retractors accounted for the largest revenue share of 53.2% in 2024. Handheld retractors primarily assist in maintaining the desired position of a given tissue area. It requires the assistance of a surgeon or other medical professional to hold the tissue during the procedure, thus restricting the surgeon’s free use of hands. Various types of retractors are available based on the surgical procedure being performed. Some common retractors are rectal, finger, nerve, abdominal, orthopedic, thoracic, and ribbon retractors. In June 2021, Ethicon launched an advanced bipolar energy device, ENSEAL X1 Curved Jaw Tissue Sealer, that offers more robust sealing. This device is used in bariatric, gynecological, colorectal, and thoracic procedures.

Self-retaining lighted surgical retractors are expected to experience the fastest growth during the forecast period, owing to their ease of use. These retractors do not require assistance to hold them in place, which permits surgery to be conducted without second assistance, thus allowing less crowding. Various advantages, such as decreased infection risk, adequate surgical site exposure, and low assistance requirement during the process, are expected to contribute to segment growth.

Application Insights

The abdominal surgery segment dominated the market and accounted for the largest revenue share of 44.3% in 2024 and is expected to experience the fastest growth during the forecast period. This dominance is driven by the rising prevalence of gastrointestinal disorders, hernia repairs, and bariatric surgeries. The increasing adoption of minimally invasive procedures and advanced surgical tools has fueled the demand for efficient illumination in deep cavities. Lighted retractors enhance visibility, reduce procedural time and improve surgical precision. Additionally, growing awareness of laparoscopic and robotic-assisted surgeries further supports market expansion.

The brain surgery segment is also experiencing significant growth due to increasing demand for precision and enhanced visibility during complex neurological procedures. Lighted retractors provide surgeons with better illumination and control, reducing complications and improving patient outcomes. These specialized retractors have gained popularity as brain surgeries become more advanced and minimally invasive. Technological innovations in lighted retractors, such as adjustable lighting and ergonomic designs, further contribute to their growth. Additionally, the rise in neurological disorders and the growing focus on precision medicine drive the expansion of this market segment.

Regional Insights

North America lighted surgical retractors market held a dominant position, capturing 30.3% of the global revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40-50 million surgeries annually for conditions like cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments. Additionally, 702,880 heart disease deaths in 2022 highlight the growing demand for minimally invasive techniques, boosting market growth.

U.S. Lighted Surgical Retractors Market Trends

The lighted surgical retractors market in the U.S. held a significant share of North American market in 2024. This dominance can be attributed to advanced technological innovations, increasing demand for wearable health monitoring devices, and a growing focus on patient-centric healthcare solutions. The U.S. is home to key players and research institutions that drive innovation in lighted surgical retractor technology. Additionally, regulatory support and investment in healthcare technology contribute to market growth. As the adoption of lighted surgical retractor applications expands across various sectors, including medical, consumer electronics, and robotics, the U.S. market is poised for continued growth and development.

Europe Lighted Surgical Retractors Market Trends

The lighted surgical retractors market in Europe is growing due to rising chronic diseases like diabetes, affecting 61 million people in Europe and projected to reach 67 million by 2030. Increased adoption of robotic-assisted surgeries and expanding outpatient clinics further drive demand for advanced handheld tools.

The UK lighted surgical retractors market is witnessing significant growth due to the rising incidence of chronic diseases like diabetes and the expanding elderly population. For instance, according to the Department of Health & Social Care in the UK, the population aged 85 and older is expected to increase by one million between 2021 and 2036.

The lighted surgical retractors market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

Germany lighted surgical retractors market is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools. Furthermore, the presence of stainless-steel retractor manufacturers in Germany is also expected to fuel market growth. For instance, MPM Medical Supply is a global medical distributor that operates completely from Germany and has been offering high-quality stainless-steel retractors manufactured in the country across the globe since the 1600s.

Asia Pacific Lighted Surgical Retractors Market Trends

The lighted surgical retractors market in Asia Pacific is growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is surging. Additionally, the adoption of minimally invasive techniques and innovations in surgical technology, such as robotic systems, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving market growth across the region.

Japan lighted surgical retractors market is driven by the country’s aging population, with approximately 30% aged 65 and older in 2023, according to World Bank data. Growth is further fueled by the introduction of advanced surgical tools and frequent product launches. Manufacturers are heavily investing in R&D to develop innovative instruments that enhance precision, efficiency, and patient care.

The lighted surgical retractors market in China is expected to grow over the forecast period. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the lighted surgical retractors market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

India lighted surgical retractors market is set for significant growth, driven by the increasing prevalence of gastrointestinal disorders and colorectal cancer. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has surged. India's aging population, projected to reach 20% by 2050, further fuels this demand. Government initiatives, such as the Ayushman Bharat scheme, are enhancing access to advanced healthcare boosting lighted surgical retractors adoption.

Latin America Lighted Surgical Retractors Trends

The lighted surgical retractors market in Latin America is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Lighted Surgical Retractors Market Trends

The lighted surgical retractors market in the Middle East & Africa is growing due to the increasing prevalence of gastrointestinal disorders and colorectal cancer. The adoption of minimally invasive procedures is expanding, driven by a growing awareness of endoscopic techniques. Investments in healthcare infrastructure, particularly in the UAE and Saudi Arabia, are increasing, enhancing access to advanced medical devices. Additionally, the aging population in the region, expected to reach 7% by 2030, further supports market growth alongside government initiatives promoting advanced diagnostic and therapeutic solutions.

Saudi Arabia lighted surgical retractors market is anticipated to expand during the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Lighted Surgical Retractors Company Insights

The market has the presence of some major players engaged in the manufacturing of lighted surgical retractors. Availability of raw materials and advanced manufacturing technology are some of the major factors deciding final product prices. Product differentiation and price are two major factors deciding the purchase decisions in developing countries where private companies mostly provide reimbursements and insurance. Strategic partnerships with local distributors and region-based product variations are some of the initiatives adopted by global players. In March 2021, Ascension, the largest Catholic health and non-profit system at a national level, collaborated with Regent Surgical Health to serve and provide patients with easy access to high-quality outpatient services.

The scenario in the lighted surgical retractors market is highly competitive, with key players such as NIDEK CO., LTD, Medtronic and JUNE Medical holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Lighted Surgical Retractors Companies:

The following are the leading companies in the lighted surgical retractors market. These companies collectively hold the largest market share and dictate industry trends.

- NIDEK CO., LTD

- Hayden Medical Inc.

- Medtronic

- Lumitex, LLC.

- Electro Surgical Instrument Company.

- Sunoptic Technologies

- JUNE Medical

- Advanced Surgical Retractor Systems, Inc.

- Gulmaher Surgico

Recent Developments

-

In December 2024, Nua Surgical, an Irish medical device company focused on maternal health innovation, announced the successful completion of a USD 6.95 million Series A funding round. The investment will support the manufacturing, testing, regulatory approval, and initial commercialization of their SteriCISION C-Section Retractor, a groundbreaking device developed to tackle the specific challenges faced during C-section surgeries.

-

In April 2023, Orthofix Medical Inc. launched two access retractor systems for minimally invasive spine procedures: the Lattus Lateral Access System and the Fathom Pedicle-Based Retractor System. These systems target the USD 1.8 billion MIS surgery market. The Lattus system enhances spine access, disc preparation, and interbody placement, and integrates with intraoperative monitoring, offering versatility and ease of use.

-

In December 2023, JUNE Medical's Galaxy II self-retaining surgical retractor received MDR certification from BSI Group for use in the EU. This innovative device enhances patient safety and surgical efficiency by enabling single-handed adjustments. The versatile Galaxy II Slider adjusts retraction tension in situ, offering multiple frame and hook options for various surgeries.

Lighted Surgical Retractors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 427.9 million

Revenue forecast in 2030

USD 602.0 million

Growth Rate

CAGR of 7.1% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

NIDEK CO., LTD, Hayden Medical Inc., Medtronic

Lumitex, LLC., Electro Surgical Instrument Company., Sunoptic Technologies, JUNE Medical

Advanced Surgical Retractor Systems, Inc., Gulmaher Surgico

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lighted Surgical Retractors Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lighted surgical retractors market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld Retractors

-

Self-Retaining Retractors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Abdominal Surgery

-

Brain Surgery

-

Plastic Surgery

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global market for lighted surgical retractors was estimated at USD 403.8 million in 2024 and is expected to reach USD 427.9 million in 2025.

b. The global market for lighted surgical retractors is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030, reaching USD 602.0 million by 2030.

b. North America led the global lighted surgical retractors market in 2024, capturing a 30.3% share. This dominance is driven by its well-developed healthcare infrastructure, high adoption of advanced surgical technologies, and increasing demand for precision in surgical procedures.

b. Some of the key player's global lighted surgical retractors market are NIDEK CO., LTD, Hayden Medical Inc., Medtronic, Lumitex, LLC., Electro Surgical Instrument Company., Sunoptic Technologies, JUNE Medical, Advanced Surgical Retractor Systems, Inc., Gulmaher Surgico and Others

b. Growing prevalence of chronic diseases, increasing demand for minimally invasive procedures, and rising surgical volumes, particularly in orthopedic, cardiovascular, and neurosurgery, drive adoption are the major factors driving the growth of lighted surgical retractors market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.