- Home

- »

- Electronic Devices

- »

-

Lighting As A Service Market Size, Industry Report, 2033GVR Report cover

![Lighting As A Service Market Size, Share, & Trends Report]()

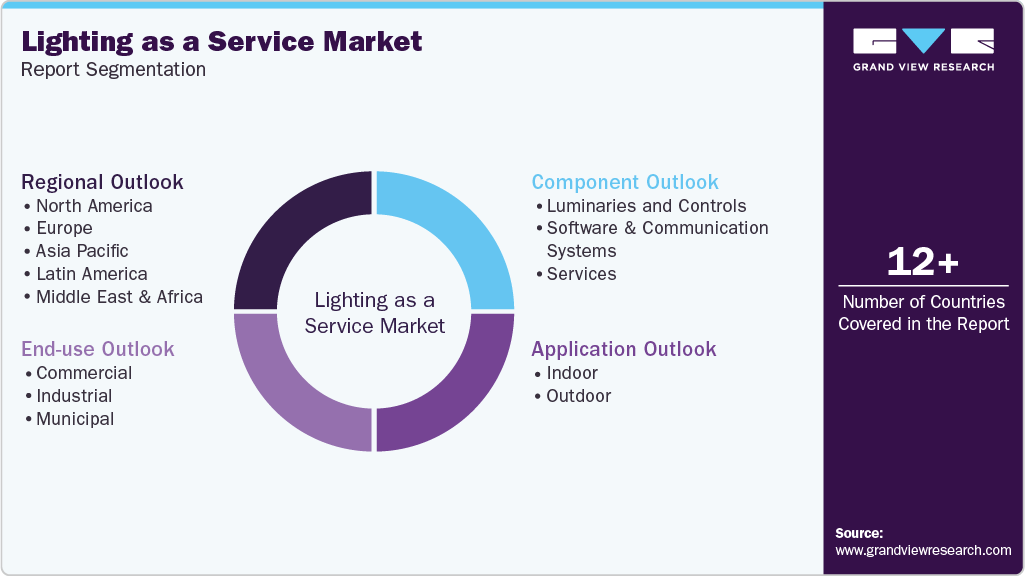

Lighting As A Service Market (2025 - 2033) Size, Share, & Trends Analysis Report By Component (Luminaries and Controls, Services), By Application (Indoor, Outdoor), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-723-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lighting As A Service Market Summary

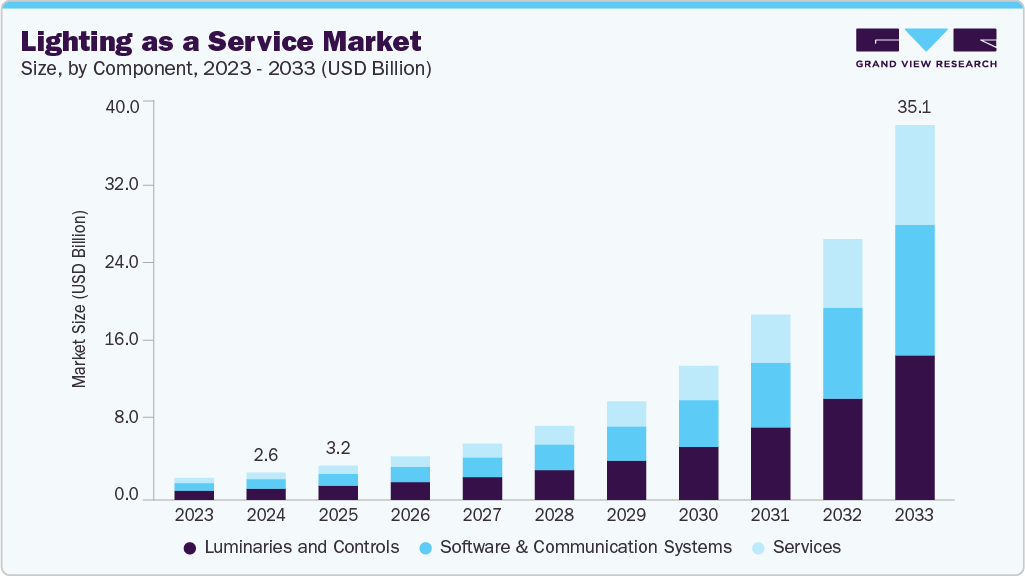

The global lighting as a service market size was estimated at USD 2.56 billion in 2024 and is projected to reach USD 35.13 billion by 2033. growing at a CAGR of 34.8% from 2025 to 2033. The growing demand for energy-efficient lighting solutions, paired with cost-effective financing models, drives demand in the lighting as a service (LaaS) market.

Key Market Trends & Insights

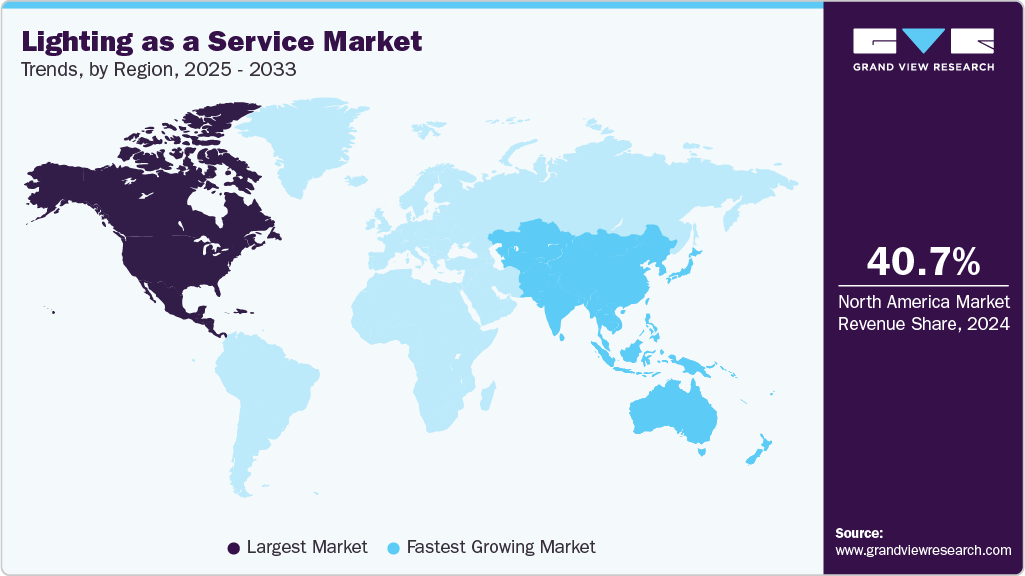

- North America held a 40.7% revenue share of the global lighting as a service market.

- In the U.S., the rapid development of smart city initiatives is accelerating the demand for lighting as a service market.

- By component, luminaries and controls segment held the largest revenue share of 41.7% in 2024.

- By application, indoor segment held the largest revenue share in 2024.

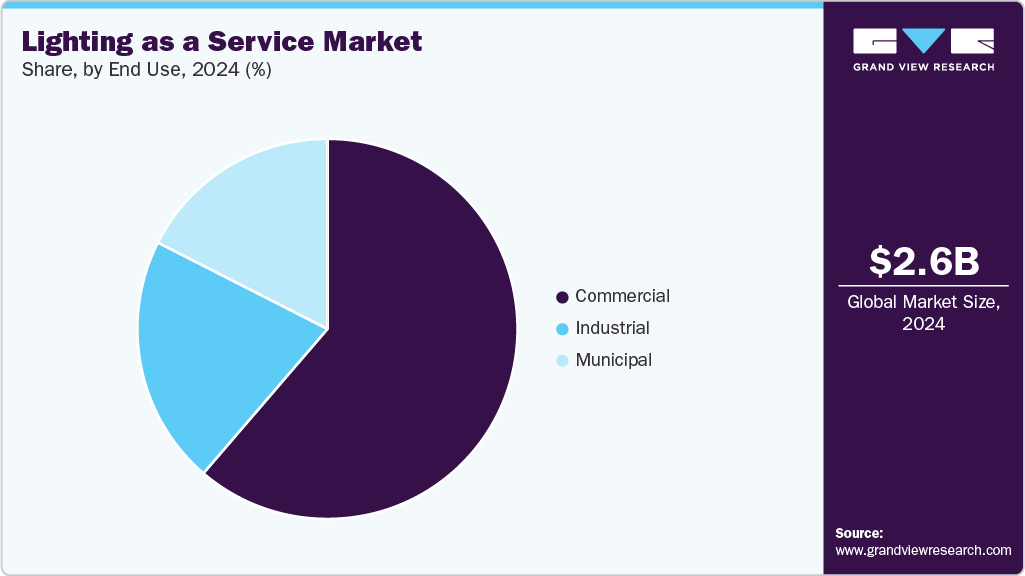

- By end use, commercial segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.56 Billion

- 2033 Projected Market Size: USD 35.13 Billion

- CAGR (2025-2033): 34.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing popularity of sustainability-linked financing and corporate ESG goals is also boosting LaaS adoption. Many organizations are now under pressure from investors and stakeholders to improve their sustainability performance. Lighting accounts for a significant portion of electricity usage in commercial and industrial buildings, and shifting to energy-efficient systems through LaaS is an immediate and measurable way to reduce carbon footprints. Moreover, as service providers track and report performance metrics such as energy savings and emission reductions, LaaS becomes a valuable tool for companies to demonstrate ESG compliance and environmental responsibility in their annual disclosures and sustainability reports.

The increasing complexity and specialization of lighting technologies also contribute to expanding the market. With the proliferation of adaptive lighting, daylight harvesting, color tuning, motion sensing, and AI-driven lighting controls, businesses find it challenging to keep pace with technological advancements and manage these systems in-house. LaaS provides access to the latest lighting technologies and expert design, installation, monitoring, and continuous optimization services. This full-service approach ensures that systems remain cutting-edge and functional without requiring internal expertise or ongoing capital reinvestments, thus appealing to a broad range of organizations from small offices to large manufacturing plants.

The LaaS model is gaining momentum in the educational and healthcare sectors, where institutions often face budget constraints and aging infrastructure. Schools, universities, hospitals, and clinics require reliable, high-quality lighting for safety, concentration, and healing environments. LaaS providers offer tailored solutions that include modern LED retrofits, automated lighting controls, and long-term maintenance, allowing these institutions to focus their limited resources on core services while benefiting from improved lighting quality and lower operational costs. Reducing maintenance burden and power consumption also enhances the operational efficiency of such facilities.

Moreover, the increasing digitization of building management and the shift toward smart infrastructure reinforce the appeal of LaaS. As commercial buildings become more connected and reliant on data for operational decisions, lighting systems integrated with IoT sensors and analytics platforms are becoming standard. LaaS facilitates access to this advanced technology and ensures that systems remain updated and optimized throughout the contract period. This continuous performance assurance, backed by service level agreements (SLAs), provides clients with peace of mind and predictable energy savings, key elements driving wider adoption across sectors and geographies.

Furthermore, the proliferation of smart cities and connected infrastructure projects significantly accelerates market demand. As municipalities aim to modernize public infrastructure while adhering to strict sustainability mandates, LaaS offers a scalable and cost-effective model to deploy intelligent street lighting systems. These systems provide energy-efficient illumination and integrate seamlessly with other urban technologies, such as traffic monitoring, environmental sensors, and emergency response systems. By leveraging LaaS, cities can implement advanced lighting controls like adaptive brightness, motion sensing, and remote diagnostics, which improve safety, reduce light pollution, and lower overall energy consumption. The subscription model ensures that these public-sector clients avoid large upfront investments, which is crucial given the budget constraints often faced by local governments.

Component Insights

The luminaries and controls segment dominated the market in 2024 with a revenue share of 41.7%. The increasing demand for connected and automated building ecosystems drives market growth. Luminaires embedded with IoT-enabled controls are becoming integral to smart building frameworks, as they can collect and transmit data related to space utilization, energy consumption, and system health. These data-driven insights empower facilities managers to make informed decisions about space planning, energy optimization, and predictive maintenance. This functionality allows service providers to offer performance-based lighting packages, where the customer pays based on output or energy saved, rather than fixed ownership of fixtures. This shift to outcome-based models is particularly attractive to organizations aiming to lower operational risk and prioritize agility in infrastructure investments, further stimulating demand for sophisticated luminaires and controls.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing emphasis on long-term service partnerships that include performance guarantees and outcome-based models drives the segment growth in the market. Rather than simply selling a lighting system, service providers are expected to deliver measurable results such as energy savings, reduced carbon footprints, and improved lighting quality. This expectation has led to more dynamic service contracts, often incorporating service level agreements (SLAs), key performance indicators (KPIs), and predictive maintenance schedules. The ability of LaaS providers to offer these value-added services helps differentiate their offerings in a crowded market and builds stronger, longer-lasting relationships with customers.

Application Insights

The indoor segment dominated the market with a market share of over 46.0% in 2024. The increasing frequency of indoor renovations and space redesigns in commercial and educational sectors is boosting the market demand. As tenant needs evolve and spaces are repurposed, the lighting infrastructure must adapt accordingly. LaaS provides a solution that can easily accommodate layout changes without requiring a complete lighting system overhaul. The modular nature of many LaaS indoor offerings, combined with the promise of hassle-free upgrades and maintenance, aligns perfectly with the dynamic requirements of modern indoor spaces. This flexibility ensures that the indoor segment remains a strong and steadily growing component of the global market.

The outdoor cloud segment is projected to be the fastest-growing segment from 2025 to 2033. The expansion of large-scale industrial zones, transportation networks, and logistics parks is driving market demand. These areas require dependable, high-performance lighting for operations that often run 24/7. In such settings, downtime due to lighting failures can compromise safety and disrupt workflows. LaaS providers offer industrial-grade lighting solutions with performance guarantees, proactive maintenance, and rapid fault resolution, reducing operational disruptions and ensuring compliance with workplace safety standards. This reliability and responsiveness are crucial for industrial users, driving greater adoption of service-based lighting models for expansive outdoor environments.

End Use Insights

The commercial segment dominated the market in 2024. The growing demand for smart and connected infrastructure in commercial spaces contributes to market growth. Modern commercial buildings are evolving into digitally integrated environments where lighting systems are expected to interact with other smart building components such as HVAC, security, and occupancy sensors. LaaS providers offer intelligent lighting solutions that integrate seamlessly with building management systems (BMS), providing illumination, data analytics, automation, and energy optimization. Commercial tenants and owners increasingly value these added functionalities, improving space utilization, employee productivity, and customer experience, thereby creating a strong business case for LaaS adoption.

Retail is projected to be the fastest-growing segment from 2025 to 2033. The rise of Industry 4.0 and the digital transformation of manufacturing and industrial operations are also contributing significantly to the adoption of LaaS in this segment. Smart factories and automated warehouses increasingly demand intelligent lighting systems that integrate with IoT platforms and respond dynamically to occupancy, daylight, and machine activity changes. LaaS providers leverage technologies such as sensors, cloud-based monitoring, and AI-driven analytics to offer adaptive lighting systems that optimize energy usage and operational efficiency. The ability to monitor performance, detect faults, and adjust settings remotely is highly appealing to industrial clients seeking to streamline operations and reduce downtime.

Regional Insights

North America dominated the lighting as a service market with a market share of 40.7% in 2024. The increasing integration of lighting systems with other building automation technologies is driving market growth in North America. As buildings become smarter and more connected, lighting is no longer viewed as an isolated utility but a core component of integrated building management systems. Through LaaS, lighting can be synchronized with HVAC, security, and occupancy systems to create dynamic environments that enhance comfort, safety, and energy efficiency. This level of integration improves the user experience and provides actionable insights through data analytics, which can be used to optimize space utilization and reduce energy waste. Building owners and operators are beginning to recognize the strategic advantages of adopting such interconnected systems through the flexible and scalable LaaS model.

U.S. Lighting as a Service Market Trends

The lighting as a service market in the U.S. is projected to grow during the forecast period. The increasing adoption of circular economy principles across industries in the U.S. is further fueling the demand for lighting as a service. As companies shift away from the traditional buy and discard approach toward more sustainable business models, LaaS aligns perfectly by promoting long-lasting, energy-efficient lighting without the burden of ownership. This shift helps organizations reduce waste, extend the lifecycle of their infrastructure, and focus on core operations while leaving lighting management to specialized service providers. In addition, the LaaS model supports a maintenance-inclusive agreement, significantly reducing the environmental impact associated with frequent replacements of lighting components and materials.

Asia Pacific Lighting as a Service Market Trends

The lighting as a service market in the Asia Pacific is expected to be the fastest-growing segment, with a CAGR of 40.1% over the forecast period. The growing commercial real estate sector and regional industrial expansion are generating increased demand for efficient and cost-effective lighting solutions. Businesses are under pressure to lower operational costs and meet sustainability goals, prompting a shift from conventional lighting to service-based models that optimize energy usage. In the hospitality, retail, and manufacturing sectors, LaaS is being adopted to enhance energy management, improve lighting quality, and ensure compliance with environmental standards. These sectors benefit from the flexibility and scalability offered by LaaS, which aligns well with fluctuating operational needs and expansion plans.

China lighting as a service market is projected to grow during the forecast period. Rapid urbanization and infrastructure development further fuel demand for lighting services. With hundreds of millions of people migrating to urban areas, Chinese cities are expanding rapidly, creating the need for efficient and flexible lighting infrastructure. LaaS provides efficient, scalable, and cost-effective means to deploy and manage street, commercial, and industrial lighting solutions. Real estate developers and municipal authorities benefit from the ability to implement sophisticated lighting systems without deep technical knowledge or direct investment in system ownership and maintenance.

Europe Lighting as a Service Market Trends

The lighting as a service market in Europe is expected to grow during the forecast period. The rising demand for financial flexibility in capital-intensive infrastructure upgrades drives market growth. The LaaS model effectively addresses this challenge by shifting capital expenditure to operational expenditure, enabling these organizations to deploy advanced, energy-efficient lighting without incurring upfront costs. This pay-as-you-go structure has made it particularly optimal for municipalities, schools, and hospitals, where energy savings and service reliability are crucial but budgets are often limited or fixed.

The UK lighting as a service market is growing during the forecast period. The evolution of digital building management systems and the broader adoption of IoT in the UK are also accelerating LaaS adoption. Smart lighting solutions offered under LaaS agreements often integrate cloud-based controls and analytics, allowing facility managers to optimize usage patterns, reduce energy waste, and conduct remote diagnostics. These features are increasingly valued in the UK's digitally mature business environment, where data-driven decision-making and automation are becoming central to operational strategies.

Key Lighting as a Service Company Insights

Some key companies operating in the market include Signify Holding and Stouch Lighting, among the leading participants.

-

Signify Holding is a multinational lighting company. Through its Managed Services platform, customers benefit from tailored lighting design, seamless installation, ongoing operation, and maintenance, all structured within a subscription-based financing model that eliminates upfront investment. This aligns with the broader LaaS trend, where end users pay for lighting as a service, including design, upkeep, and upgrades. At the same time, providers retain ownership of the equipment throughout its lifecycle.

-

Stouch Lighting is a manufacturer-neutral LED lighting distributor and implementation company. It is also a growing provider offering subscription-based LED lighting retrofits and conversions. Their LaaS model enables customers to implement turnkey LED upgrades without large upfront capital expenditures. Instead, clients pay a predictable monthly fee over a 3-to-7-year period that covers equipment ownership, performance guarantees, maintenance, and warranty services.

ARQUILED and TRILUX Lighting Ltd. are some of the emerging market participants.

-

Arquiled is an industrial LED lighting company specializing in professional luminaires for street and architectural lighting, systems, and energy-efficiency services. Arquiled provides comprehensive subscription-based lighting models designed to eliminate upfront investment for clients. The combined rental and energy costs are consistently lower than previous lighting expenditures, and any equipment replacements are handled free of charge, ensuring guaranteed savings and peace of mind for clients.

-

TRILUX Lighting Ltd. is a German light fixture manufacturer. TRILUX LaaS model covers everything from design and installation to operation, maintenance, and risk management, while allowing clients to preserve liquidity and often realize energy-cost savings from the outset. Beyond LaaS, TRILUX provides comprehensive support throughout the project lifecycle from consultation and financing to project management, commissioning, and ongoing services such as cloud-based monitoring, emergency lighting oversight, and even location-based functionality via beacon-enabled luminaires.

Key Lighting as a Service Companies:

The following are the leading companies in the lighting as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Signify Holding

- Future Energy Solutions

- Stouch Lighting

- ESB

- Airis Energy Solutions USA

- Facility Solutions Group

- LED SOLUTIONS

- Firefly Group

- Lusety

- US LED, Ltd.

- TRILUX Lighting Ltd.

- LumenStream

- TellCo Europe Sagl

- ARQUILED

- Urbanvolt

Recent Developments

-

In July 2025, LumenStream secured USD 1.4 million in funding to advance its lighting-as-a-service model. The investment will support the company in helping high-energy users reduce CO₂ emissions and lower operating expenses. Using its Pay-as-you-Save approach, LumenStream enables businesses to transition to energy-efficient lighting without any upfront costs, generating immediate positive cash flow. This milestone underscores the growing strength of Northern Ireland’s green economy and reaffirms LumenStream’s dedication to delivering practical, high-impact solutions for a more sustainable future.

-

In June 2025, Solas Capital AG signed a framework agreement with Signify Holding, allowing Signify to provide energy-efficient LED and connected lighting solutions across Europe using its Light as a Service (LaaS) model. This model eliminates upfront costs for private and public sector clients, helping overcome financial barriers to LED adoption. The planned projects aim to significantly reduce energy consumption and CO2 emissions, while delivering substantial cost savings and setting new standards for innovation in the energy efficiency sector.

-

In March 2024, Signify Holdings partnered with Nexans to support the decarbonization journey in Europe. Through this collaboration, Nexans is renovating the lighting systems across 12 European sites by transitioning to LED technology. The partnership exemplifies how suppliers contribute to the sustainability roadmap as integral components of the Group’s ecosystem. Signify’s Light as a Service solution enables cost optimization, carbon footprint reduction, and improved working conditions, aligning with the E3 performance approach that integrates environmental, economic, and engagement pillars into a unified strategy.

Lighting As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.22 billion

Revenue forecast in 2033

USD 35.13 billion

Growth rate

CAGR of 34.8% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Signify Holding; Future Energy Solutions; Stouch Lighting; ESB; Airis Energy Solutions USA; Facility Solutions Group; LED SOLUTIONS; Firefly Group; Lusety; US LED, Ltd.; TRILUX Lighting Ltd.; LumenStream; TellCo Europe Sagl; ARQUILED; Urbanvolt

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lighting As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lighting as a service market report based on component, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Luminaries and Controls

-

Software & Communication Systems

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial

-

Industrial

-

Municipal

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lighting as a service market size was estimated at USD 2.56 billion in 2024 and is expected to reach USD 3.22 billion in 2025.

b. The global lighting as a service market is expected to grow at a compound annual growth rate of 34.8% from 2025 to 2033 to reach USD 35.13 billion by 2033.

b. The luminaries and controls segment dominated the lighting as a service market in 2024 with a revenue share of 41.7%. The increasing demand for connected and automated building ecosystems is driving the lighting as a service market growth.

b. Some key players operating in the market include Signify Holding, Future Energy Solutions, Stouch Lighting, ESB, Airis Energy Solutions USA, Facility Solutions Group, LED SOLUTIONS, Firefly Group, Lusety, US LED, Ltd., TRILUX Lighting Ltd., LumenStream, TellCo Europe Sagl, ARQUILED, Urbanvolt.

b. Factors such as growing demand for energy-efficient lighting solutions and the rapid development of smart city initiatives are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.