- Home

- »

- Pharmaceuticals

- »

-

Liposomal Doxorubicin Market Size, Industry Report, 2033GVR Report cover

![Liposomal Doxorubicin Market Size, Share & Trends Report]()

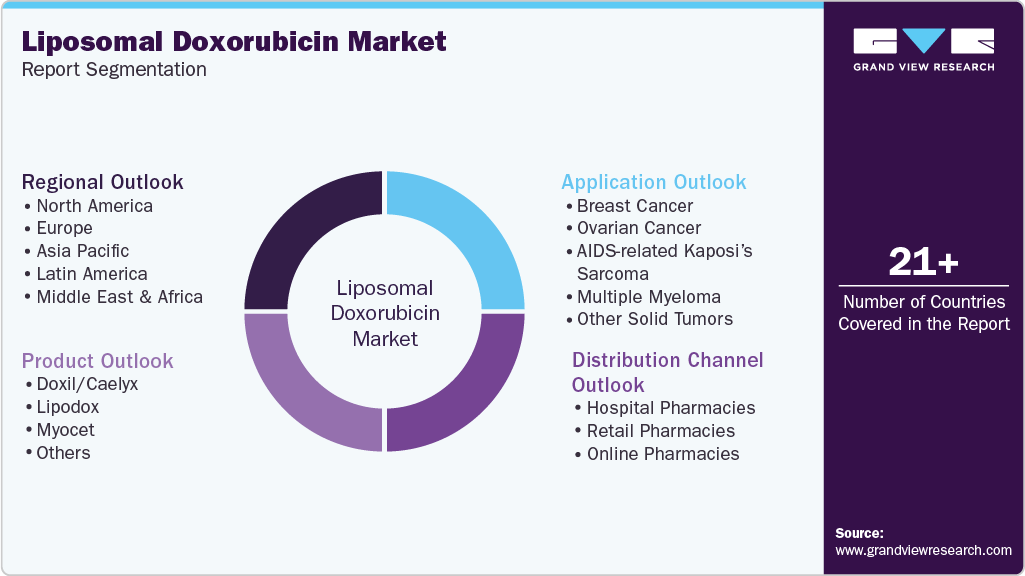

Liposomal Doxorubicin Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Doxil/Caelyx, Lipodox, Myocet), By Application (Multiple Myeloma, Ovarian Cancer, Breast Cancer, AIDS-related Kaposi’s Sarcoma), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-743-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liposomal Doxorubicin Market Summary

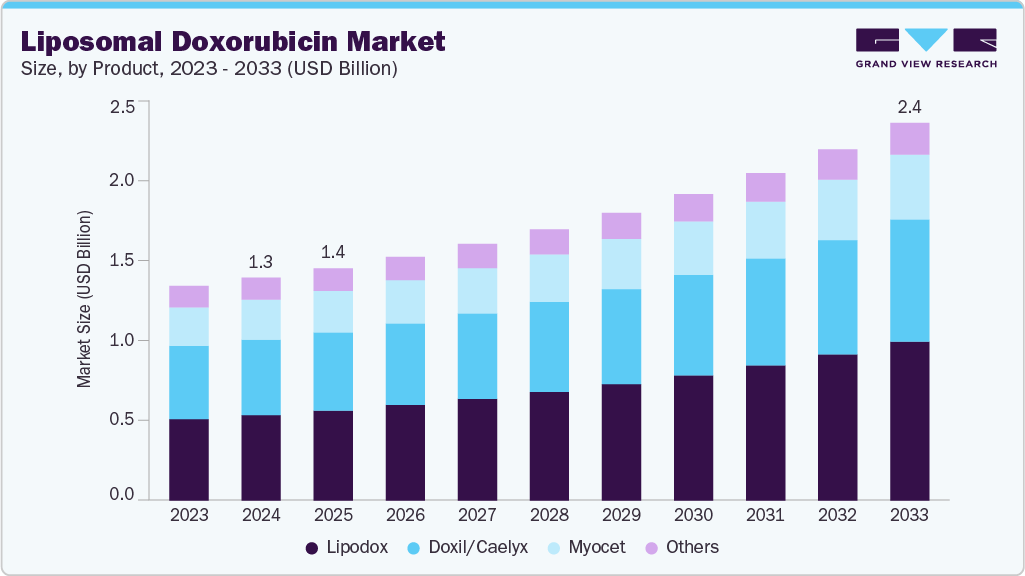

The global liposomal doxorubicin market size was estimated at USD 1.31 billion in 2024 and is projected to reach USD 2.38 billion by 2033, growing at a CAGR of 7.04% from 2025 to 2033. The rising number of cancer cases, particularly breast cancer, fuels the liposomal doxorubicin market.

Key Market Trends & Insights

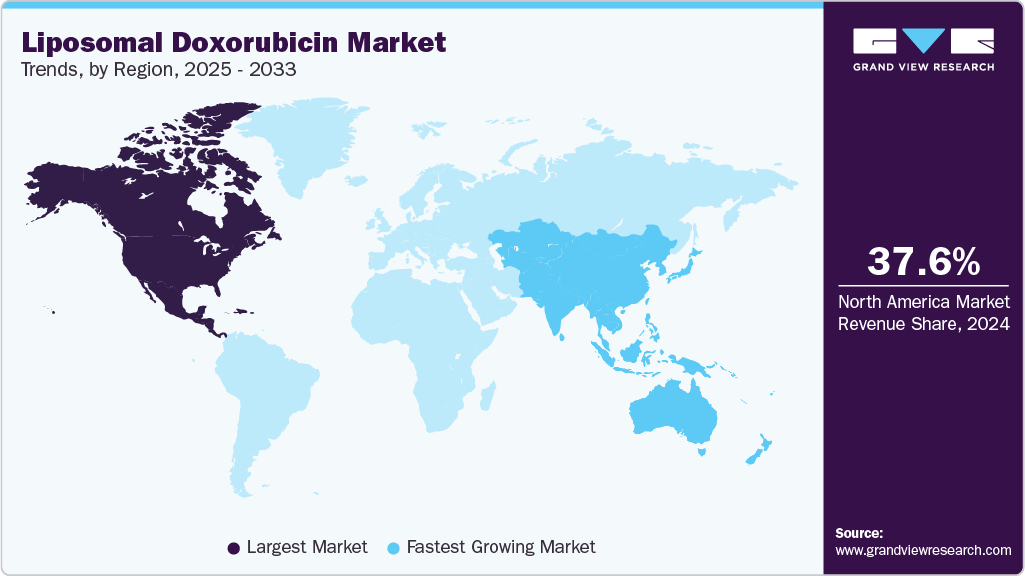

- North America liposomal doxorubicin market held the largest share of 37.60% of the global market in 2024.

- The liposomal doxorubicin industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the lipodox segment held the highest market share of 39.22% in 2024.

- By application, the breast cancer segment held the highest market share of 31.0% in 2024.

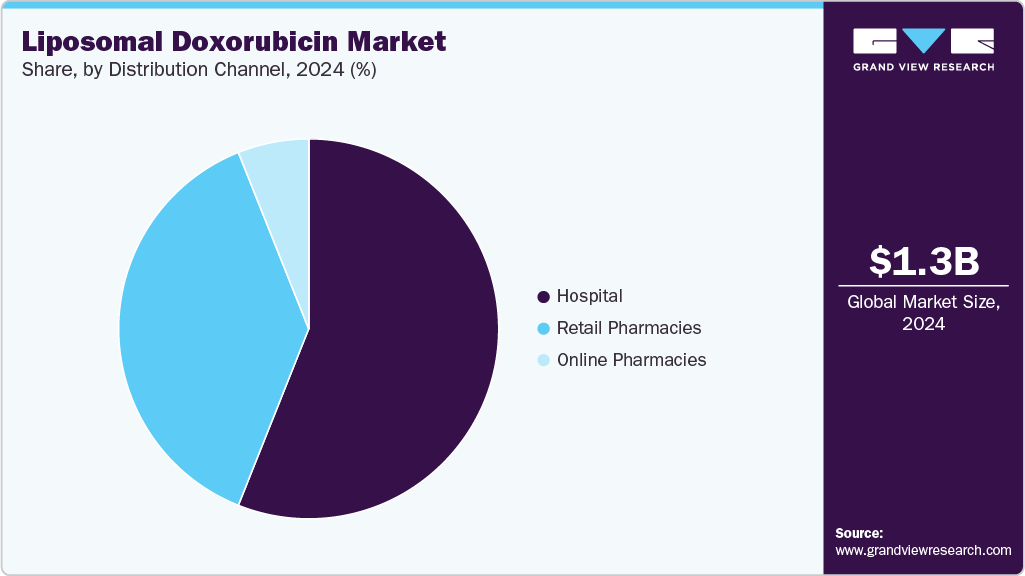

- Based on distribution channel, the hospital pharmacies segment dominated the market with a revenue share of 56.04% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.31 Billion

- 2033 Projected Market Size: USD 2.38 Billion

- CAGR (2025-2033): 7.04%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in nanotech for innovative drug formulations further strengthen this market. Liposomal delivery revolutionizes cancer treatment by offering increased effectiveness and lower side effects than traditional forms. Furthermore, ongoing research to improve delivery and stability and explore new therapeutic applications propels the market's rapid growth.Rising cancer diagnoses propel the liposomal doxorubicin market, as it offers targeted chemotherapy with reduced side effects, making it a preferred treatment. For instance, the International Agency for Research on Cancer (IARC) estimates 20 million new cancer cases in 2022, projected to rise to 35 million by 2050, highlighting a growing global cancer burden.

Nano-technological advancements in the drug delivery of liposomal doxorubicin are driving the market by increasing the demand for advanced liposomal doxorubicin formulations. For instance, according to a study published in ACS Publications, Nanobowl-supported liposomal DOX (DOX@NbLipo) is more resistant towards the plasma proteins and blood flow shear force that resulted in minimal drug leakage in the drug delivery at targeted tissue. The study showed that DOX@NbLipo led to prolonged survival of the mice (up to 50 days) compared to other controls. The DOX@NbLipo treatment also led to the biggest increase in the lifespan of the mice by 108.3%.

Ongoing research on liposomal doxorubicin for different indications is propelling the market. For instance, a study published in the European Journal of Cancer demonstrated the higher efficacy of TLD-1 (Novel liposomal doxorubicin) as compared to conventional doxorubicin formulations in patients with advanced solid tumors.

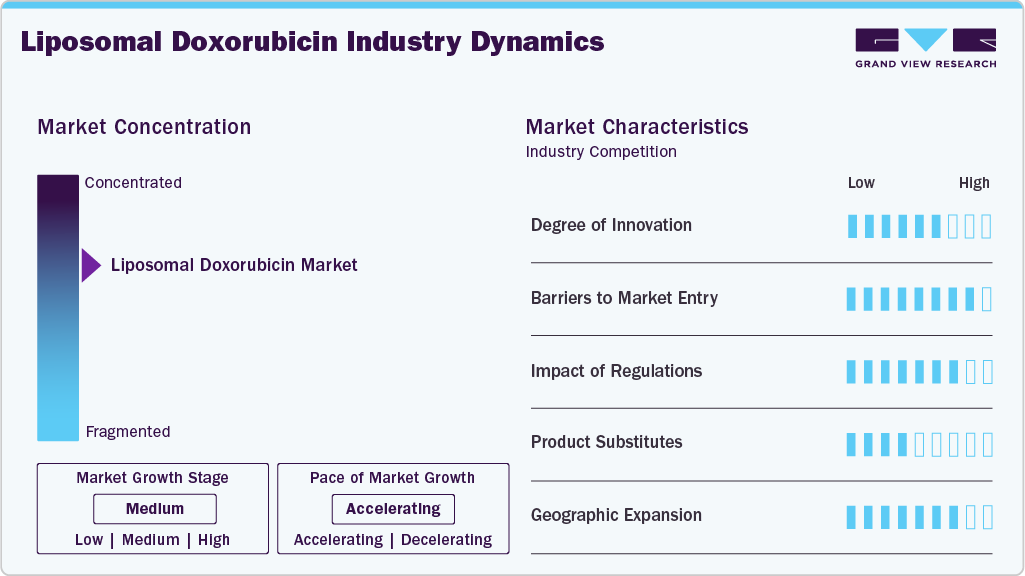

Market Concentration & Characteristics

The liposomal doxorubicin market reflects steady innovation in drug delivery technologies aimed at improving safety and efficacy profiles. Encapsulation in liposomes reduces cardiotoxicity and enhances targeted drug delivery, differentiating these formulations from conventional doxorubicin. Companies are investing in next-generation liposomal platforms with controlled release and tumor-targeted delivery. Research is ongoing into combination therapies pairing liposomal doxorubicin with immunotherapies and novel oncology agents. Innovation in formulation science and nanoparticle technology remains central to competitive positioning in this market.

High R&D costs, stringent bioequivalence requirements, and complex manufacturing processes create strong barriers to entry in the liposomal doxorubicin market. Liposome-based drug delivery requires advanced technology and strict quality control systems, restricting participation to firms with specialized expertise. Established brands such as Doxil (Johnson & Johnson) and Caelyx (Janssen) hold significant market presence, supported by proven safety and efficacy. Intellectual property protection and brand trust further discourage new entrants. Overall, high capital intensity and regulatory challenges ensure limited competitive entry.

The liposomal doxorubicin market is subject to rigorous regulatory oversight due to its complex formulation. Regulatory bodies mandate detailed clinical and pharmacokinetic data to establish equivalence with reference drugs. Manufacturing compliance under Good Manufacturing Practices (GMP) is strictly monitored, given the sensitivity of liposomal delivery systems. Post-marketing surveillance obligations further extend compliance requirements. While these regulations slow new approvals, they also safeguard established products, reinforcing market stability for leading players.

Substitutes for liposomal doxorubicin remain limited in oncology treatment, as conventional doxorubicin carries higher risks of cardiotoxicity. Other chemotherapeutic agents, targeted therapies, and biologics may serve as treatment alternatives in some cancer indications but do not directly replace the unique safety and efficacy profile of liposomal formulations. The reduced side-effect profile and targeted delivery mechanism of liposomal doxorubicin sustain its demand. Thus, substitutes exert only a moderate competitive threat.

Leading companies are expanding geographic reach to address unmet needs in cancer treatment across emerging markets. Asia-Pacific and Latin America present opportunities due to growing cancer prevalence and rising healthcare expenditure. Distribution partnerships with hospital and specialty pharmacies are strengthening access to liposomal therapies in these regions. North America and Europe remain core markets, driven by advanced oncology care and high treatment adoption. Geographic expansion is a critical strategy to balance established demand with high-growth regions.

Product Insights

The lipodox segment dominated the market with the largest revenue share of 39.22% in 2024 and is expected to grow at a CAGR of 8.11% over the forecast period. The FDA-approved generic formulations of liposomal doxorubicin for the treatment of ovarian cancer impacted the market, resulting in a decrease in sales of branded liposomal doxorubicin formulations. The availability of FDA-approved generic liposomal doxorubicin formulations drives the market because it lowers the treatment cost for various cancers. In August 2024, Lupin Limited introduced Doxorubicin Hydrochloride Liposome Injection in the U.S. market. It is available in 20 mg/10 mL (2 mg/mL) and 50 mg/25 mL (2 mg/mL) single-dose vials.

The myocet segment is projected to grow at the fastest CAGR of 6.53% over the forecast period. According to Cambridge University estimates, the global number of breast cancer cases is expected to reach over 3 million by 2040. The worldwide rise of breast cancer cases is driving the market because Myocet is a U.S. FDA-approved first-line drug in the treatment of metastatic breast cancer.

Application Insights

Breast cancer dominated the market with a revenue share of 31.00% in 2024. An increase in the incidence of breast cancer, among other cancers, is driving the market. According to a WHO report, in 2022, 2.3 million women were diagnosed with breast cancer, resulting in 670,000 deaths globally. Different environmental and hormonal factors cause breast cancer. Environmental factors responsible for the induction of breast cancer are radiation exposure and oncogenic chemical exposure.

The multiple myeloma segment is expected to grow at a significant rate over the forecast period. The rising global incidence of Multiple Myeloma, where liposomal doxorubicin is a first-line treatment, fuels the market growth. For instance, according to the Lancet Haematology study in 2020, data showed a higher incidence of Multiple Myeloma, particularly in men aged 50 and above, and those from higher-income countries.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share of 56.04% in 2024.Hospital pharmacies play a critical role in treatment as they prepare and dispense chemotherapy drugs and other therapies to patients. They are also responsible for managing the inventory and storage of these drugs, ensuring that they are stored and handled according to strict regulations.

The online pharmacy segment is projected to grow at a CAGR of 12.48% over the forecast period due to the convenience of choosing websites offering various products and detailed product information. The market segment is expected to grow due to lucrative offers and discounts on different websites. Thus, the rise in e-commerce drives the market by facilitating consumers' convenience in purchasing products.

Regional Insights

North America liposomal doxorubicin market held the largest share of 37.60% of the market in 2024. Liposomal doxorubicin's market is expected to rise due to ongoing trials exploring its use for new medical conditions. For instance, an ongoing study by the National Cancer Institute on the effectiveness of Pegylated Liposomal Doxorubicin Hydrochloride with Atezolizumab and/or Bevacizumab in the treatment of patients with recurrent Fallopian Tube, Ovarian, or Primary Peritoneal Cancer.

U.S. Liposomal Doxorubicin Market Trends

The U.S. liposomal doxorubicin market dominated in 2024. Recent investments in combining doxorubicin with other anti-cancer drugs have made the US Liposomal Doxorubicin market lucrative for investors. For instance, the current research being conducted by the National Cancer Institute on the testing of Low-Dose Common Chemotherapy (Liposomal Doxorubicin) combined with the anti-cancer drug Peposertib in advanced sarcoma.

Europe Liposomal Doxorubicin Market Trends

The European liposomal doxorubicin market was identified as a lucrative region in 2024. The growth is due to the rapidly growing number of breast cancer cases in the region. For instance, in February 2024, WHO released a study predicting an increase of over 20% in cancer cases in Europe by 2045.

The UK market for liposomal doxorubicin is poised for rapid growth, driven by rising demand and potential regulatory approvals for its use in treating various cancers. For instance, in July 2023, the WHO released a new essential medicine list that included liposomal doxorubicin for treating Kaposi Sarcoma.

Asia Pacific Liposomal Doxorubicin Market Trends

The APAC liposomal doxorubicin market is expected to register a significant CAGR of 8.03% over the forecast period, the growing number of patients, market potential, and increasing healthcare expenditure are expected to provide a favorable chance for established global firms looking to expand in the market. Recent findings in new targets of liposomal doxorubicin are anticipated to drive exponential growth in the market. For instance, a research paper released on Dovepress in April 2024 detailed how targeting the EGFR with liposomal doxorubicin enhances the detection and control of non-small cell lung cancer.

China liposomal doxorubicin market held a significant market share in the liposomal doxorubicin market in 2024 due to high demand and ongoing research into its use with other cancer drugs for treating children with solid tumors. For instance, a study published in The Lancet in June 2024, the research investigated the safety and effectiveness of combining pegylated liposomal doxorubicin with cyclophosphamide and vincristine for treating relapsed/refractory solid tumors in pediatric patients.Latin America Liposomal Doxorubicin Market Trends

The liposomal doxorubicin market in Latin American is anticipated to grow significantly over the forecast period. Collaborations and investments from key industry leaders are currently propelling the market.

In 2024, the liposomal doxorubicin market in Brazil had a significant market share, and it is predicted to increase significantly because of its higher effectiveness in treating Kaposi Sarcoma. For instance, a retrospective study published in the ESMO OPEN Journal in March 2024 proved the optimal efficiency of liposomal doxorubicin compared to Paclitaxel in the first-line treatment of Kaposi Sarcoma.

Middle East & Africa Liposomal Doxorubicin Market Trends

The Middle East and Africa liposomal doxorubicin market is expected to grow substantially. This is fueled by advancements in drug formulations, attracting investment in innovative products from various regional players.

Key Liposomal Doxorubicin Company Insights

Some of the key companies in the liposomal doxorubicin market include Sun Pharmaceutical Industries Ltd., Johnson & Johnson, Merck & Co., Inc., Cipla, Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co.,ltd, Lupin, Cadila Pharmaceuticals, SRS Life Sciences, Cadila Pharmaceuticals, GSK plc., Pfizer Inc., Sanofi, and Sigma-Aldrich Co. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Johnson & Johnson, through its subsidiary Janssen Pharmaceuticals, operates in the oncology market, including developing and distributing liposomal doxorubicin. Their focus on innovative drug delivery systems and commitment to enhancing cancer treatment options position them as a significant contributor to the liposomal doxorubicin market, which aims to improve therapeutic outcomes and patient safety.

-

Merck & Co., Inc. is involved in the oncology sector, developing advanced chemotherapy formulations such as liposomal doxorubicin. By leveraging its extensive research capabilities and commitment to innovative cancer therapies, Merck contributes to the advancement and availability of liposomal doxorubicin to improve patient outcomes.

Key Liposomal Doxorubicin Companies:

The following are the leading companies in the liposomal doxorubicin market. These companies collectively hold the largest market share and dictate industry trends.

- Sun Pharmaceutical Industries Ltd.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Cipla

- Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd.

- Lupin

- Cadila Pharmaceuticals

- SRS Life Sciences

- GSK plc

- Pfizer Inc.

- Sanofi

- Sigma-Aldrich Co.

Recent Developments

-

In June 2025, Alembic Pharmaceuticals Limited announced its USFDA approval for Doxorubicin Hydrochloride Liposome injection. It is indicated for the treatment of multiple myeloma, ovarian cancer, and AIDS related Kaposi Sarcoma.

-

In January 2024, the CHEPLAPHARM Group gained commercial rights for Myocet in Europe from Teva, broadening its oncology portfolio. The drug is prescribed as the initial therapy for metastatic breast cancer in women who are adults. Myocet is the initial product that CHEPLAPHARM purchased from Teva.

-

In January 2024, Johnson & Johnson Services, Inc. officially announced acquiring Ambrx Biopharma, Inc. through a firm agreement. Ambrx is a biopharmaceutical company developing a distinct synthetic biology technology platform for creating advanced antibody-drug conjugates (ADCs) in the clinical stage.

Liposomal Doxorubicin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.38 billion

Revenue forecast in 2033

USD 2.38 billion

Growth rate

CAGR 7.04% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Sun Pharmaceutical Industries Ltd.; Johnson & Johnson; Merck & Co.; Cipla; Cadila Pharmaceuticals; SRS Life Sciences; GSK plc.; Pfizer Inc.; Sanofi; Sigma-Aldrich Co.; Lupin; Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co.,ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liposomal Doxorubicin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global liposomal doxorubicin market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Doxil/Caelyx

-

Lipodox

-

Myocet

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Breast Cancer

-

Ovarian Cancer

-

AIDS-related Kaposi’s Sarcoma

-

Multiple Myeloma

-

Other Solid Tumors

-

-

Distribution ChannelOutlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global liposomal doxorubicin market size was estimated at USD 1.31 billion in 2024 and is expected to reach USD 1.38 billion in 2025.

b. The global liposomal doxorubicin market is projected to grow at a CAGR of 7.04% from 2025 to 2033 to reach USD 2.38 billion by 2033.

b. Based on product, lipodox segment led the market with the largest revenue share of 39.22% in 2024, driven by FDA-approved generic formulations of liposomal doxorubicin for the treatment of ovarian cancer impacted the market, resulting in a decrease in sales of branded liposomal doxorubicin formulations.

b. Some key players operating in the liposomal doxorubicin market include Sun Pharmaceutical Industries Ltd., Johnson & Johnson Services, Inc., Merck & Co., Inc., Cipla, Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd., Lupin, Cadila Pharmaceuticals, SRS Life Sciences, GSK plc, Pfizer Inc., Sanofi, Sigma-Aldrich Co.

b. Key factors driving market growth include the rising incidence of cancer, particularly breast cancer. Advancements in nanotechnology for innovative drug formulations are further supporting market expansion, while liposomal delivery is transforming cancer treatment by improving effectiveness and reducing side effects compared to traditional therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.