- Home

- »

- Conventional Energy

- »

-

Liquefied Petroleum Gas Market Size, Industry Report, 2033GVR Report cover

![Liquefied Petroleum Gas Market Size, Share & Trends Report]()

Liquefied Petroleum Gas Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Refinery, Associated Gas, Non-Associated Gas), By Application (Chemical, Industrial, Autogas), By Transportation, By Region, And Segment Forecasts

- Report ID: 978-1-68038-026-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquefied Petroleum Gas Market Summary

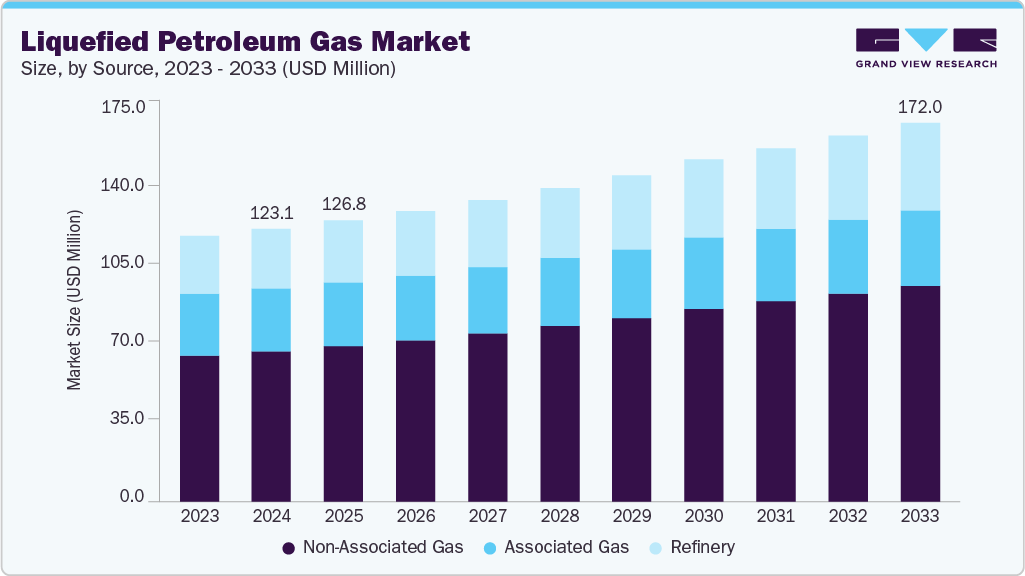

The global liquefied petroleum gas market size was estimated at USD 123.14 billion in 2024 and is projected to reach USD 172.01 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The growth is primarily driven by the increasing use of Liquefied Petroleum Gas (LPG) as a cleaner alternative to traditional fossil fuels across residential, commercial, and industrial sectors.

Key Market Trends & Insights

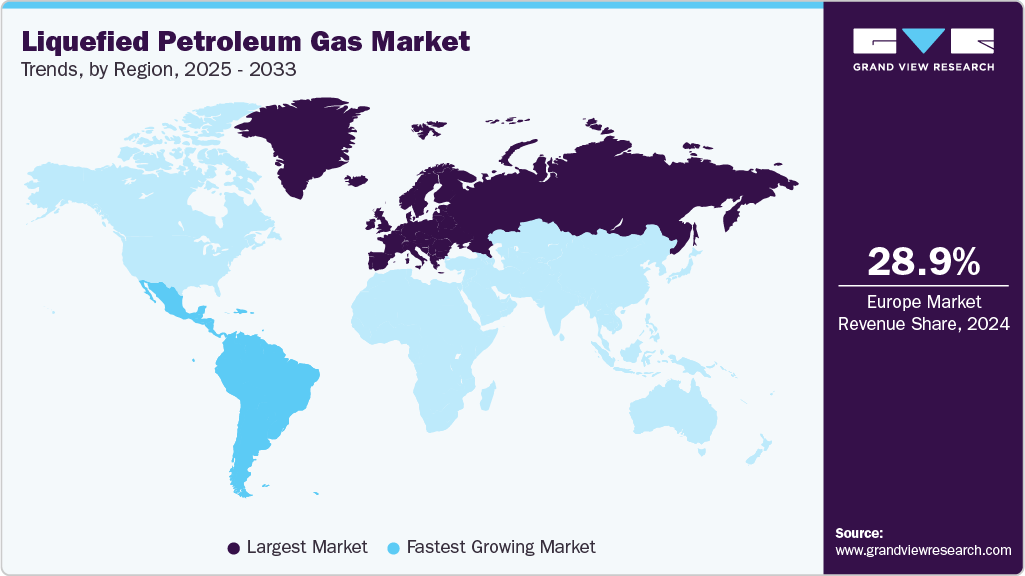

- The Europe liquefied petroleum gas market held the largest global share of 28.9% in 2024.

- The liquefied petroleum gas (LPG) market in the U.S. is expected to grow significantly from 2025 to 2033.

- By source, the non-associated gas segment held the highest market share of 55.1% in 2024.

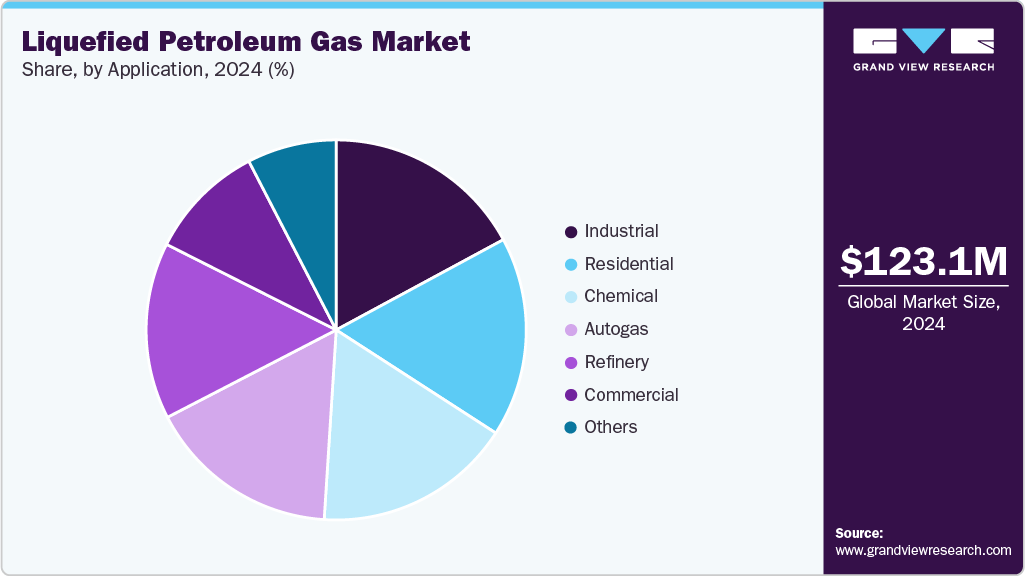

- By application, the industrial segment held the highest market share in 2024.

- By transportation, the ship segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 123.14 Billion

- 2033 Projected Market Size: USD 172.01 Billion

- CAGR (2025-2033): 3.9%

- Europe: Largest market in 2024

- Latin America: Fastest growing market

The rising demand for low-emission energy sources to curb urban air pollution and achieve carbon neutrality targets is driving the expansion of the liquefied petroleum gas industry. The availability of abundant natural gas feedstock, ongoing refinery upgrades, and government-led initiatives to expand LPG distribution infrastructure, especially in developing economies, are further accelerating adoption. Additionally, the rising transition from biomass to LPG for domestic cooking and heating, coupled with the expansion of autogas applications and the development of renewable LPG (bio-LPG) production technologies, continues to shape a positive long-term outlook for the market.

In North America, the growth of the liquefied petroleum gas market is supported by strong LPG production capacities, advanced export infrastructure, and growing utilization as a petrochemical feedstock and for residential heating. The United States dominates regional supply, benefiting from shale gas expansion, midstream investments, and strong export flows to Latin America and Asia. The increasing adoption of propane autogas and strategic storage developments in the Gulf Coast region are enhancing market resilience. Canada contributes through its robust propane and butane production from the Western Canadian Sedimentary Basin, as well as ongoing investments in liquefaction terminals for Asian export. The region’s market outlook is further supported by clean energy transition policies and rural electrification programs promoting LPG as a low-carbon bridge fuel.

Europe represents another key market, characterized by efforts to diversify energy sources, supportive environmental policies, and growing integration of renewable LPG alternatives. Countries such as Germany, France, the United Kingdom, and Italy are expanding the role of LPG in heating, transportation, and agricultural applications amid efforts to phase out coal and heavy fuel oil. The European Union’s REPowerEU plan and related carbon reduction initiatives are stimulating demand for bio-LPG, driving innovation in renewable propane synthesis and circular carbon technologies. Additionally, supply diversification through imports from the U.S. and North Africa, combined with the expansion of LPG storage terminals and distribution networks, is enhancing energy security. As Europe intensifies its energy transition and seeks cost-effective, low-carbon alternatives, LPG, particularly renewable LPG, is emerging as a strategic component of sustainable energy supply chains.

Drivers, Opportunities & Restraints

The global LPG market’s growth is driven by rising demand for clean-burning fuels, expanding urban populations, and government initiatives aimed at reducing dependence on high-emission energy sources. LPG’s versatility across residential cooking, heating, commercial operations, industrial applications, and petrochemical feedstock makes it a key component of low-carbon transition strategies. The growing adoption of autogas, along with continuous improvements in storage safety, distribution networks, and digital monitoring systems, is further supporting market growth. Large-scale adoption programs in emerging economies-particularly for clean cooking-remain a significant catalyst for global demand.

Opportunities in the LPG market are expanding as countries seek reliable, portable, and low-emission fuel solutions. The ongoing shift from biomass and kerosene toward LPG in developing regions continues to open significant growth avenues, supported by international clean cooking initiatives. Renewable LPG (bio-LPG) is emerging as a transformative opportunity due to its compatibility with existing infrastructure and potential for near-carbon-neutral emissions. Growth in global LPG trade-supported by rising exports from the U.S., Middle East, and Africa-is fostering supply diversification. Additionally, LPG’s integration into hybrid microgrids and distributed energy systems is creating new applications in remote and off-grid markets.

However, the market faces several restraints, including price volatility linked to fluctuations in crude oil prices and geopolitical uncertainties that affect global LPG supply chains. High transportation and distribution costs, especially in rural and remote regions, can limit affordability and access. Safety concerns regarding handling and storage remain challenges in developing markets, despite ongoing improvements in cylinder design and safety standards. Regulatory differences across regions, particularly in taxation, subsidies, and emission standards, can create market fragmentation and hinder international trade consistency. Additionally, competition from natural gas, electricity, and emerging renewable fuels such as hydrogen and biogas poses a long-term challenge to LPG demand growth. The future of the market will depend on sustained investments in infrastructure modernization, safety compliance, and renewable LPG production technologies, ensuring the fuel’s continued role in the global clean energy transition.

Source Insights

The non-associated gas segment accounted for the largest revenue share, approximately 55.1% in 2024, establishing itself as the leading source category in the global Liquefied Petroleum Gas (LPG) market. This dominance is largely attributed to the increasing international production of natural gas and the rapid expansion of gas processing infrastructure in key producing regions, such as North America, the Middle East, and the Asia-Pacific. Non-associated gas, produced independently of oil extraction, provides a cleaner, more consistent, and reliable feedstock for LPG production. Growing investments in natural gas exploration, coupled with technological advancements in gas separation and liquefaction processes, have significantly improved yield efficiency. Additionally, government initiatives promoting gas-based energy transition, reduced carbon intensity, and the development of midstream infrastructure, including storage and pipeline facilities, have strengthened the position of non-associated gas as the primary source of global LPG supply.

Meanwhile, the associated gas segment is expected to witness the fastest growth at a CAGR of 4.5% from 2025 to 2033, driven by the steady recovery in global crude oil production and increasing efforts to utilize associated gas that was previously flared. As oil-producing countries such as Saudi Arabia, the United States, Russia, and Nigeria expand upstream activities, the capture and processing of associated gas are becoming integral to sustainability and emission reduction goals. The adoption of gas reinjection, gathering, and liquefaction technologies enables oil producers to convert flared gas into valuable LPG products, thereby enhancing both environmental and economic outcomes. Furthermore, regulatory mandates aimed at minimizing flaring, alongside rising investments by national oil companies in integrated oil-gas processing facilities, are boosting LPG supply from associated sources. This trend is expected to continue over the forecast period, positioning associated gas as a key contributor to the growing global LPG supply chain.

Application Insights

The industrial segment accounted for the largest revenue share of 17.1% in 2024, reaffirming its dominant role in the global Liquefied Petroleum Gas (LPG) industry. This leadership is primarily driven by the extensive use of LPG as a clean and efficient fuel for heating, metal cutting, drying, and power generation across various industrial sectors. Industries such as manufacturing, ceramics, textiles, food processing, and metallurgy are increasingly relying on LPG due to its high calorific value, ease of storage, and reduced emissions compared to coal and fuel oil. The growing focus on decarbonizing industrial operations and adhering to stricter environmental regulations has further accelerated the shift toward LPG, particularly in emerging economies where electrification remains limited. Moreover, the versatility of LPG in small- and medium-scale industrial applications, coupled with its cost competitiveness and steady availability, continues to reinforce its significance as a reliable energy source for industrial production and process heating.

The chemical segment, on the other hand, is projected to grow at the fastest CAGR of 5.4% from 2025 to 2033, driven by the increasing use of LPG as a key feedstock in petrochemical and specialty chemical manufacturing. Propane and butane derived from LPG are essential raw materials for producing propylene, ethylene, and other olefins used in plastics, synthetic rubber, and various chemical intermediates. Rapid industrialization and the expansion of petrochemical capacities in regions such as the Asia-Pacific and the Middle East are driving this growth trajectory. Additionally, the growing trend of using LPG-based feedstock to replace naphtha for cost and emission efficiency further strengthens its adoption in chemical production. Investments in integrated refinery-petrochemical complexes, coupled with innovation in catalytic cracking and gas-to-chemicals technologies, are expected to enhance LPG utilization in the sector. As global demand for polymers, solvents, and other chemical derivatives continues to rise, the chemical application segment is set to play an increasingly pivotal role in the long-term expansion of the LPG market.

Transportation Insights

The ship transportation segment accounted for the largest revenue share, approximately 23.8% in 2024, establishing itself as the dominant mode in the global liquefied petroleum gas market. This leadership is primarily attributed to the increasing international trade of LPG and the expanding seaborne movement between major exporting regions such as the United States, Qatar, and the United Arab Emirates, and key import destinations including China, India, Japan, and South Korea. Marine transport remains the most economical and efficient method for long-distance LPG delivery, supported by advancements in Very Large Gas Carrier (VLGC) and mid-sized gas carrier fleets. Growing investments in port infrastructure, terminal expansions, and ship-to-ship (STS) transfer facilities have further enhanced global shipping capacity. Additionally, the rising demand for flexible and large-scale LPG exports, coupled with the expansion of liquefaction and fractionation facilities, continues to strengthen the dominance of ship-based transportation in global trade flows.

Meanwhile, the intermodal ISO tank containers segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033, driven by increasing demand for flexible, safe, and cost-efficient LPG transport solutions across shorter regional routes. ISO tank containers enable efficient multimodal transportation via rail, road, and sea, thereby reducing logistical bottlenecks and improving accessibility in markets that lack large-scale pipeline or shipping infrastructure. Their growing adoption is supported by the expansion of LPG distribution networks in emerging economies, the rise of decentralized storage facilities, and the increasing preference for small-scale and last-mile LPG deliveries. Technological advancements in cryogenic and pressurized tank design, along with stricter international safety standards, are enhancing operational reliability and reducing transit losses. Furthermore, the growth of cross-border trade within regions such as Asia-Pacific and Europe is boosting intermodal LPG logistics, positioning ISO tank containers as a rapidly expanding segment that complements traditional marine and pipeline transportation modes.

Regional Insights

Strong regulatory frameworks, diversified supply sources, and well-established storage and distribution networks support the liquefied petroleum gas market in Europe. The region relies on LPG as a cleaner alternative to coal and fuel oil across residential, commercial, industrial, and transport sectors. Countries such as Germany, France, Italy, and the United Kingdom are expanding LPG applications to meet energy diversification goals under the European Green Deal and REPowerEU initiative. Growing interest in renewable LPG (bio-LPG), produced from sustainable waste-based feedstocks, is further strengthening Europe’s transition toward low-carbon fuels. Strategic imports from North America and North Africa, combined with investments in modernizing terminals, ports, and autogas infrastructure, are enhancing supply security. As Europe accelerates its clean energy transition and tightens emission standards, LPG is expected to remain an important transitional and decentralized heating fuel across the region.

North America Liquefied Petroleum Gas Market Trends

North America represents a major hub in the global liquefied petroleum gas industry, underpinned by abundant shale gas resources, advanced export capabilities, and expanding petrochemical demand. The United States leads regional production and export, benefiting from extensive infrastructure across the Gulf Coast and a steady increase in propane and butane output from shale formations. The region’s LPG exports to Asia and Latin America continue to surge, driven by competitive pricing and production efficiency. In Canada, significant LPG output from the Western Canadian Sedimentary Basin, combined with the expansion of propane export terminals, such as those in British Columbia, further contributes to regional growth. Rising adoption of LPG as a transportation fuel, coupled with its growing role in heating and agricultural applications, is reinforcing market stability. Additionally, supportive government measures promoting cleaner fuel usage and investments in bio-LPG production are aligning the North American LPG market with broader decarbonization goals.

U.S. Liquefied Petroleum Gas Market Trends

The U.S. continues to lead LPG production in North America, driven by its vast shale gas resources and extensive midstream infrastructure across the Gulf Coast. The country plays a major role in global exports, supported by large fractionation units, expanding terminal capacity, and competitive production economics. Domestically, LPG demand is sustained by its increasing use as a petrochemical feedstock and its role in residential heating, agriculture, and autogas applications. Policy incentives promoting cleaner fuels and ongoing investments in renewable LPG technologies are further aligning the U.S. LPG sector with long-term sustainability goals.

Asia Pacific Liquefied Petroleum Gas Market Trends

Asia Pacific is one of the fastest-expanding regions in the liquefied petroleum gas industry, driven by population growth, rapid urbanization, and the shift toward cleaner energy alternatives. Major consumers, including China, India, Japan, and South Korea, are driving demand through the large-scale adoption of LPG for residential cooking, heating, and industrial purposes. In India, government-led clean cooking initiatives, such as the Pradhan Mantri Ujjwala Yojana (PMUY), have significantly increased LPG consumption in rural areas. Meanwhile, China continues to expand its LPG imports and petrochemical usage, while Japan and South Korea are promoting the use of autogas and industrial applications to reduce greenhouse gas emissions. Investments in storage terminals, refineries, and cross-border trade networks are enhancing regional supply security. The growing adoption of renewable LPG and increasing private participation in LPG distribution are expected to sustain the Asia-Pacific’s strong growth trajectory over the forecast period.

Latin America Liquefied Petroleum Gas Market Trends

The Latin America liquefied petroleum gas industry is projected to grow at the fastest CAGR of 4.4% from 2025 to 2033, driven by expanding residential and commercial consumption, as well as efforts to enhance access to clean fuels. Countries such as Brazil, Mexico, Argentina, and Chile are leading the regional demand, driven by government programs promoting LPG as a safe and affordable alternative to biomass and kerosene. The region’s growing investments in import terminals, storage facilities, and cylinder distribution infrastructure are further enhancing supply reliability. Additionally, increasing industrialization and rising petrochemical activities are creating new opportunities for LPG utilization. Collaborations between regional distributors and global energy companies, along with initiatives to introduce bio-LPG, are expected to enhance market sustainability. As Latin America continues its transition toward low-carbon fuels, LPG is poised to play a vital role in its energy diversification and rural electrification strategies.

Middle East & Africa Liquefied Petroleum Gas Market Trends

The Middle East & Africa liquefied petroleum gas industry is at a strong growth phase, supported by large-scale gas processing capacities, export-oriented infrastructure, and rising domestic demand. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia, Qatar, and the UAE, remain key global suppliers, leveraging their natural gas reserves and integrated refinery operations to maintain a leading export position. In Africa, growing urbanization and government initiatives to replace biomass with LPG in household cooking are driving consumption in nations such as Nigeria, Kenya, and South Africa. Furthermore, investments in LPG import terminals, cylinder distribution networks, and safety awareness campaigns are expanding market accessibility. The region’s focus on energy diversification, coupled with emerging opportunities for bio-LPG development and cross-border energy trade, is expected to support long-term market expansion, particularly in off-grid and rural applications.

Key Liquefied Petroleum Gas Company Insights

Some of the key players operating in the global Liquefied Petroleum Gas (LPG) market include Saudi Arabian Oil Co. (Saudi Aramco) and Royal Dutch Shell Plc, among others.

-

Saudi Arabian Oil Co. (Saudi Aramco) is one of the world’s leading integrated energy and petrochemical companies, playing a central role in global LPG production and export. Headquartered in Dhahran, Saudi Arabia, Aramco utilizes its vast crude oil and natural gas resources to produce significant volumes of LPG as a byproduct of its refining and gas processing operations. The company exports LPG to major Asian markets, including China, Japan, and South Korea, through long-term supply agreements. Aramco’s ongoing investments in gas processing facilities such as the Fadhili and Hawiyah projects are expanding its LPG output capacity, supporting its strategy to diversify revenue streams and strengthen its presence in the global downstream and chemicals value chain.

-

Royal Dutch Shell Plc is a leading multinational energy company headquartered in London, United Kingdom, with a strong footprint in the global LPG value chain spanning production, storage, distribution, and retail. Shell markets LPG under the brand “Shell Gas,” serving residential, commercial, and industrial consumers across more than 50 countries. The company has been actively enhancing its supply and logistics network through strategic partnerships and acquisitions to ensure efficient and sustainable LPG delivery. Shell is also investing in digital transformation and cleaner fuel initiatives, positioning LPG as a transitional energy source that supports decarbonization in off-grid and rural markets. Its diversified portfolio and commitment to low-carbon solutions continue to strengthen its role as a global leader in the LPG sector.

Key Liquefied Petroleum Gas Companies:

The following are the leading companies in the liquefied petroleum gas market. These companies collectively hold the largest market share and dictate industry trends.

- Saudi Arabian Oil Co. (Saudi Aramco)

- Royal Dutch Shell Plc

- BP Plc

- Exxon Mobil Corporation

- TotalEnergies SE

- China Petroleum & Chemical Corporation (Sinopec)

- PetroChina Company Limited

- Qatargas Operating Company Limited

- Reliance Industries Limited

- Vitol Group

Recent Developments

- In February 2025, Saudi Aramco announced the expansion of its Yanbu Gas Plant in Saudi Arabia to enhance LPG production capacity by an additional 10%, strengthening its position as one of the world’s leading LPG exporters. The project aims to meet the rising global demand from the Asia-Pacific and European markets, aligning with Aramco’s downstream diversification strategy under Saudi Vision 2030.

Liquefied Petroleum Gas Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 126.83 billion

Revenue forecast in 2033

USD 172.01 billion

Growth rate

CAGR of 3.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in million tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Saudi Arabian Oil Co. (Saudi Aramco); Royal Dutch Shell Plc; BP Plc; Exxon Mobil Corporation; TotalEnergies SE; China Petroleum & Chemical Corporation (Sinopec); PetroChina Company Limited; Qatargas Operating Company Limited; Reliance Industries Limited; Vitol Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquefied Petroleum Gas Market Report Segmentation

This report forecasts revenue & volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global liquefied petroleum gas market report based on source, application, transportation, and region:

-

Source Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

Refinery

-

Associated Gas

-

Non-Associated Gas

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Chemical

-

Industrial

-

Autogas

-

Refinery

-

Others

-

-

Transportation Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

Ship

-

Railways

-

Intermodal ISO Tank Containers

-

Pipelines

-

Reticulated Gas Systems

-

Large Road Tankers

-

Bobtail Tankers

-

Bike Carts

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global liquefied petroleum gas market size was estimated at USD 117.31 billion in 2022 and is expected to reach USD 119.90 billion in 2023.

b. The global liquefied petroleum gas market is expected to grow at a compounded annual growth rate of 3.7% from 2023 to 2030 to reach USD 154.49 billion by 2030.

b. Europe dominated the LPG market with the highest share of 28.87% in 2022. Numerous summit meetings such as COP21 is taken into deliberation by many countries to decrease carbon emission into the atmosphere.

b. Some key players operating in the LPG market include Royal Dutch Shell, ExxonMobil Corporation, Royal Dutch Shell, Philips 66, Reliance Industries Ltd. (RIL), Chevron Corporation, and others.

b. Growing awareness regarding benefits correlated to the usage of liquified petroleum gas as a substitute to the fossil fuels, and rise their adoption level of clean and green energy sources across both developed and developing countries are some of the factors which are likely to boost the LPG market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.