Liquid Flavors Market Size & Trends

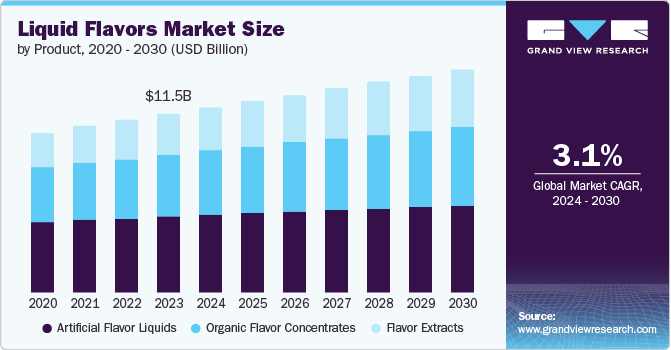

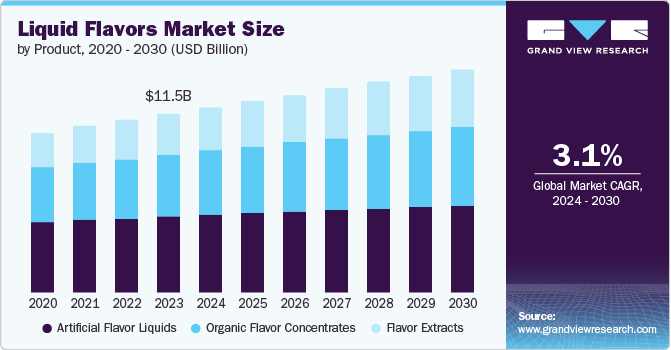

The global liquid flavors market size was valued at USD 11.46 billion in 2023 and is projected to grow at a CAGR of 3.1% from 2024 to 2030. The market growth is driven by the growing need from consumers for a variety of flavored drinks and food items. This market includes a variety of liquid flavor options, both natural and artificial, for different applications such as beverages, candies, dairy products, and baked goods. Increase in healthier living resulted in the rise in need for natural and organic liquid flavors made from fruits, vegetables, and herbs, as consumers are more inclined towards products with fewer artificial additives and preservatives.

Additionally, there are strict quality regulations and monitoring procedures overseen by local and state governments, leading to a simultaneous increase in raw material expenses. Companies in the liquid flavor industry are placing more emphasis on research and development efforts to produce new flavors that meet changing consumer tastes and dietary needs.

Product Insights

Artificial flavor liquids accounted for a share of 42.5% in 2023. The food industry has witnessed an increase in the use of artificial flavors to create new product and cater to various consumer tastes. Moreover artificial flavors are flexible and dependable tool to improving overall sensory experience, smell and taste in various products, leading to their growing popularity among food manufacturers. For instance, in October 2020, Firmenich, an organization in the flavor and fragrance industry, created a flavor using AI. This flavor is meant for use in plant-based meat substitutes and was created to replicate the taste of slightly grilled beef. AI enhances the ability of flavor manufacturers by offering accurate initial formulas and optimizing ingredient combinations, enabling them to meet precise product requirements like using 100% natural ingredients.

Flavor extracts are expected to grow rapidly during the forecast period. Home baking and cooking is driving the segment growth. The trend is fueled by desire to achieve restaurant-quality results, the public's growing awareness of the negative effects of sugar consumption, increasing demand for natural flavor extracts due to changing taste preferences. Furthermore, many consumers link natural ingredients with better health. Flavor extracts are preferred by health-conscious buyers as they typically contain fewer additives and artificial ingredients than other liquid flavor options.

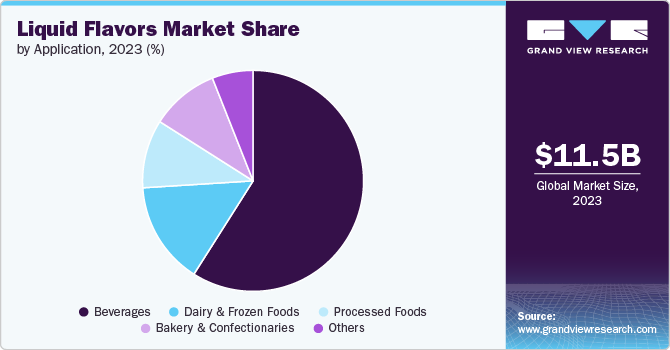

Application Insights

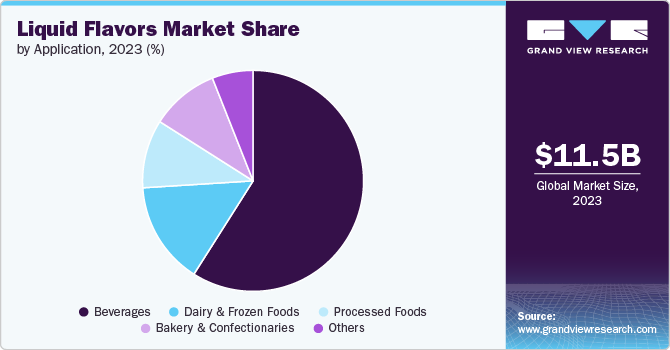

Beverages accounted for the largest revenue share of 58.8% in 2023. The rising interest of consumers in products that improve mood and wellness led to a higher demand for flavors in beverages. Flavor plays a vital role in functional beverages as consumers look for ways to handle stress, balance their moods, and enhance their mental and emotional health. Different flavors are chosen to match various moods. In September 2023, Coca-Cola introduced a new flavor called Coca-Cola Y3000, which was developed with the assistance of artificial intelligence (AI), to evoke future of beverages in the year 3000. It was created with the intention of "bring the flavor of tomorrow to Coke fans."

Processed foods is expected to register the fastest CAGR during the forecast period. Bottled sauces, quick dinners, pre-packaged meals, packed vegetables and vegetarian meal packages are popular owing to hectic schedules. Food manufacturing companies utilize food flavors to preserve the taste of food as processed and preserved perishable food items often tend to lose their taste and flavors with time.

Regional Insights

North America liquid flavors market dominated the market in 2023. Factors driving growth include rising demand for various flavors in bakery, food and beverage sectors. The region is known for its strong focus on consumer demand for natural and clean-label products. There is a rising demand for natural and organic flavor solutions as consumers look for flavors that fit with health and wellness trends.

U.S. Liquid Flavors Market Trends

The U.S. liquid flavors market dominated the North America market in 2023 due to the growth of the food processing sector in the U.S. Liquid flavors are used as toppings in food and drinks, and the increasing demand for these products has led manufacturers to focus on creating attractive flavors.

Europe Liquid Flavors Market Trends

Europe liquid flavors market was identified as a lucrative region in 2023 due to increase in processed food, dairy products, and beverage sector in region. Moreover, rising demand for bakery and confectionary products in the region is driving the market growth.

The UK liquid flavors market is expected to grow rapidly in the coming years due to increasing popularity of clean labels and rising demand for exotic flavors. For instance, craft beers and artisanal food products also contribute to the demand for specialty liquid flavors.

The liquid flavors market in Germany held a substantial market share in 2023. Germany is famous for its extensive history of baked goods and sweets; a wide range of tasty and attractive products are made using liquid flavors.

Asia Pacific Liquid Flavors Market Trends

Asia Pacific liquid flavors market is anticipated to witness significant growth in the coming years due to growing population and shifting dietary choices. With increasing wealth and a willingness to try new foods, consumers are opting for unique flavors. The wide range of cuisines in the region, such as delicate sushi and spicy curries have influenced many different flavors.

The Japan liquid flavors market is expected to grow rapidly in the coming years due to growing popularity of frozen meals and convenience, resulting in a higher demand for liquid flavors to improve flavor.

The liquid flavors market in China held a substantial share in 2023 owing to increasing population which provides a large consumer base for liquid flavors, used in food and drink products.

Key Liquid Flavors Company Insights

Some of the key companies in the liquid flavors market include Nature's Flavors, Inc., Kerry Group plc., Gold Coast Ingredients and Givaudan.

-

Nature's Flavors, Inc. specializes in natural liquid flavors, providing a variety of syrups, extracts, and essential oils made from fruits, vegetables, and plants.

Key Liquid Flavors Companies:

The following are the leading companies in the liquid flavors market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan

- International Flavors & Fragrances Inc.

- Gold Coast Ingredients

- Nature's Flavors, Inc.

- Takasago International Corporation

- McCormick & Company, Inc.

- Kerry Group plc.

- Sensient Technologies Corporation

- Firmenich SA.

Recent Developments

-

In October 2023, Givaudan, The Institute of Food Technology (ITAL), The FoodTech Hub Latam, Bühler, and Cargill, announced the launch of the Tropical Food Innovation Lab. It is an innovation ecosystem focused on developing sustainable food and beverages, focusing on Brazilian biodiversity.

Liquid Flavors Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 11.87 billion

|

|

Revenue forecast in 2030

|

USD 14.29 billion

|

|

Growth rate

|

CAGR of 3.1% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

August 2024

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, New Zealand, Brazil, South Africa

|

|

Key companies profiled

|

Givaudan International Flavors & Fragrances Inc.; Gold Coast Ingredients; Nature’s Flavors & FregranceInc.; GivaudanTakasagoInternational; Corporation; McCormick & Company, Inc.; Kerry Group plc.; Sensient Technologies Corporation; Firmenich SA.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

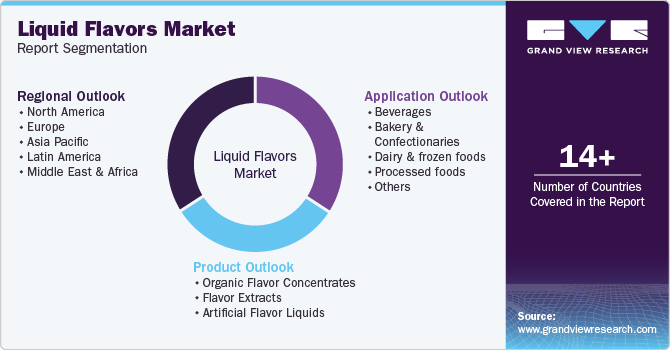

Global Liquid Flavors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquid flavors market report based on product, application and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beverages

-

Bakery & confectionaries

-

Dairy & frozen foods

-

Processed foods

-

Others

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)