Liquid Smoke Market Size & Trends

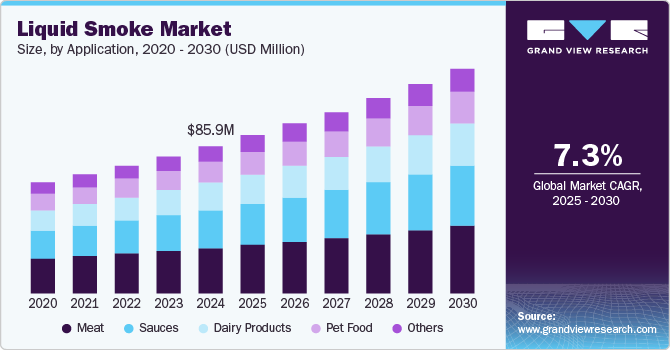

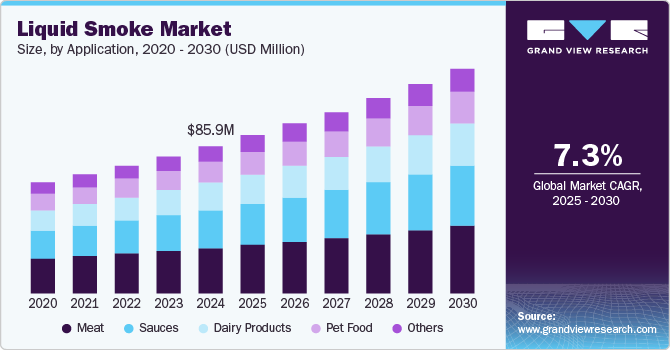

The global liquid smoke market size was valued at USD 85.9 million in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2030. Increasing applications in various industries, including food production, animal feed, dairy, and others, are primarily driving the growth of this market. The rise in demand for food products associated with meat, poultry, seafood, seasonings, sauces, snacking items, etc., is expected to generate a surge in demand.

The rise in disposable income levels of families and lifestyle changes have stimulated growth in the food service industry in recent years. Service providers' growing focus on customer engagement and retention, the increasing significance of aesthetic value additions in the food service business, and ease of availability have resulted in a rise in the use of liquid smoke in the food service industry.

Utilization by commercial users and growing demand from restaurants that offer luxury dining experiences and enhanced food services associated with multiple culinary affections are generating a large number of growth opportunities for the liquid smoke industry. Additionally, liquid smoke is extensively utilized in cooking activities for various purposes, including enhanced color, added freshness, and more. Commercial users also prefer it as a clean-label preservative. The cost-effectiveness of this product also contributes to its rising utilization in multiple application areas.

Inclination among consumers to order smoked versions of multiple food products, such as smoked salmon or smoked sausages, has stimulated growing demand in the food service industry. Increasing availability, ease of access, and growing acceptance by a large number of consumers worldwide have also contributed to the growth of this market.

Application Insights

The meat segment dominated the global liquid smoke industry with a revenue share of 31.2% in 2024. This market is mainly influenced by the benefits offered to meat sellers by the product, such as enhanced tenderness, improved shelf life, and more. The meat industry participants also utilize liquid smoke for added flavor, improvements in texture or color, and added authenticity. Liquid smoke is also vital as an efficient antimicrobial agent against various bacterial pathogens. Significant demand for packaged meat, processed meat, frozen meat, and various meat products has developed a surge in the utilization of liquid smoke. Evolved processes, the use of advanced technologies, and increasing demand for ready-to-cook or ready-to-make products from urban consumers also contribute to the growth of this segment.

The sauces segment is projected to experience the fastest CAGR of 7.9% from 2025 to 2030. An increase in demand for ready-to-make product offerings such as noodles, pasta, ravioli, frozen meat, and others has been developing significant demand for sauces. An increasing number of urban consumers seeking convenient food options add to the rising use of sauces in commercial and household kitchens. This has influenced the use of liquid smoke in manufacturing a variety of sauces. A clean-label preservative, liquid smoke, is extensively utilized in making barbeque sauce, vinaigrette or ranch dressing, marinades, and others. It is also preferred for achieving improved flavor.

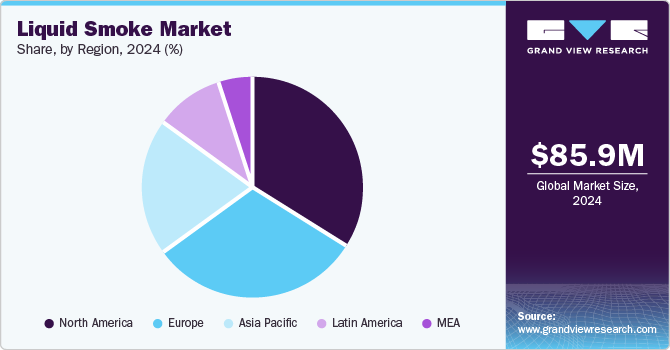

Regional Insights

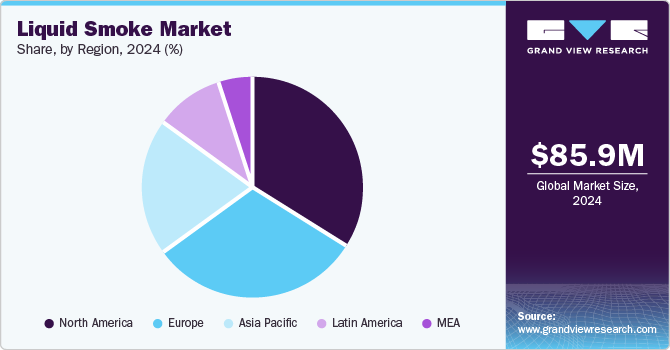

North America liquid smoke market dominated the global industry with a revenue share of 34.2% in 2024. This is attributed to factors such as enhanced availability, increasing growth experienced by the food service and food processing industry, and growing demand for convenient food products by urban customers. The focus of the hospitality and food service industry on enhancing customer experience while focusing on customer retention has also enhanced utilization.

U.S. Liquid Smoke Market Trends

The U.S. liquid smoke market held the largest revenue share of the regional industry in 2024. This market is primarily influenced by the growing food services and food processing industry in the country. According to the U.S. Department of Agriculture, the food, agriculture, and related industries held a 5.6% share of the U.S. gross domestic product in 2023. Spending on food by U.S. households in 2023 was 12.9% of total spending by U.S. households. Significant utilization of packaged meat, sauces, marinades, frozen seafood, and related products by commercial and residential kitchens is expected to fuel the growth of this market during the forecast period.

Europe Liquid Smoke Market Trends

Europe liquid smoke market held a significant revenue share of the global industry in 2024. The utilization of liquid smoke as a flavor enhancer and preferred preservative by multiple sectors, such as meat, meat processing, food services, dairy products, and others, has primarily driven the growth of this market. Germany held the largest revenue share of the regional liquid smoke market in 2024. Demand from commercial users such as restaurants, hotels, food processing, or packaging industry participants has added growth opportunities for this market in the recent past.

Asia Pacific Liquid Smoke Market Trends

The Asia Pacific liquid smoke market is projected to experience the fastest growth, with a CAGR of 8.4% from 2025 to 2030. Increasing meat consumption by urban consumers and growth experienced by the region's dining and food services industry are contributing to the rising demand for liquid smoke in this market. The presence of highly populated countries such as India and China adds a large number of growth opportunities. Increasing demand for packaged or processed food offerings is expected to fuel the growth of this market.

China liquid smoke market held the largest revenue share in 2023. This market is mainly influenced by the notable growth experienced by the country's meat and meat processing industry. Customers across various provinces increasingly prefer poultry, fish and seafood products, frozen meat, and packaged or processed meat products. Growing demand from commercial users is expected to drive the market growth.

Key Liquid Smoke Company Insights

Some of the key companies in the global liquid smoke market are Red Arrow International LLC, Baumer Foods Inc., Azelis, B&G Foods Inc., Ruitenberg Ingredients B.V., and others. To address growing competition and increasing demand from commercial buyers, multiple market participants have adopted strategies such as technology adoption, expanding collaborations with other organizations, and focusing on enhancing product quality.

-

Colgin, Inc. offers an extensive line of liquid smoke products. These include Colgin Authentic Hickory Liquid Smoke, Colgin Authentic Mesquite Liquid Smoke, Colgin Authentic Assorted Liquid Smoke, and Colgin Authentic Hickory with Chipotle, Habanero, Jalapeno, and others.

-

Ruitenberg Ingredients B.V., an innovation-based food industry solutions company, provides various solutions associated with meat substitutes, plant-based sausage casing, functional fillings and sauces, batters and bindings, and more. Its smoke portfolio includes Rudin Smoke for drenching, flavoring, dipping, Rudin CleanSmoke, and Rudin Smoke powders.

Key Liquid Smoke Companies:

The following are the leading companies in the liquid smoke market. These companies collectively hold the largest market share and dictate industry trends.

- Red Arrow International LLC

- Baumer Foods Inc.

- Azelis

- B&G Foods Inc.

- Ruitenberg Ingredients B.V.

- Colgin, Inc.

- Kerry Group plc

- MSK Ingredients

- International Flavors & Fragrances Inc.

- Besmoke Ltd.

Liquid Smoke Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 85.9 million

|

|

Revenue forecast in 2030

|

USD 131.1 million

|

|

Growth rate

|

CAGR of 7.3% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, South Africa

|

|

Key companies profiled

|

Red Arrow International LLC; Baumer Foods Inc.; Azelis; B&G Foods Inc.; Ruitenberg Ingredients B.V.; Colgin, Inc.; Kerry Group plc; MSK Ingredients; International Flavors & Fragrances Inc.; Besmoke Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Liquid Smoke Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global liquid smoke market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat

-

Sauces

-

Dairy Products

-

Pet Food

-

Others

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Latin America

-

Middle East & Africa