- Home

- »

- Consumer F&B

- »

-

Liquor Confectionery Market Size And Share Report, 2030GVR Report cover

![Liquor Confectionery Market Size, Share & Trends Report]()

Liquor Confectionery Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Chocolates, Candies & Gums), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-418-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquor Confectionery Market Size & Trends

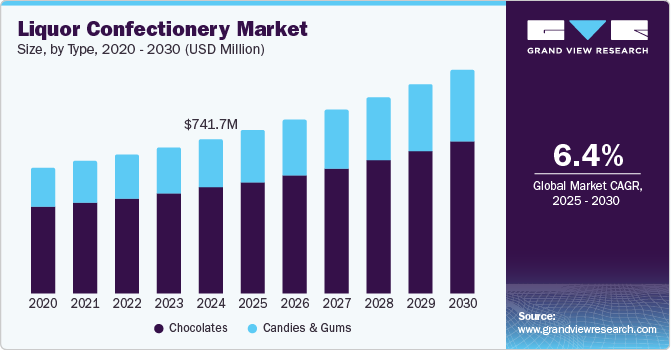

The global liquor confectionery market size was valued at USD 741.7 million in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. European countries such as the U.K., Germany, and Belgium have a high consumption level of liquor. Chocolates infused with alcohol introduced in these countries drive consumers to experiment and try out new ways of alcohol consumption. This scenario has been boosting the demand for the global market. The growing consumer preference for premium and artisanal products uniquely blending sweets with alcohol is expected to drive market growth. Furthermore, gifting and enjoying luxurious treats, especially during holidays and special occasions, has increased interest in alcohol-infused confectionery. Additionally, consumers are increasingly seeking out unique and sophisticated flavor profiles, leading to the emergence of innovative and experimental varieties. The rising demand for sugar-free and low-calorie options also contributes to market growth.

The increasing consumer interest in craft and artisanal products, combined with the luxury status of ingredients like whiskey, is driving market growth. Whiskey-based confections are gaining popularity in gifting and seasonal markets, further expanding their presence in the confectionery industry. The trend of premiumization, where consumers are willing to pay more for high-quality, unique products, also contributes to market expansion. Additionally, the growing influence of social media and food influencers promoting innovative and exotic confectionery items is creating more awareness and demand.

Type Insights

The chocolates segment dominated the market, with a revenue share of 68.5% in 2024. This dominance is driven by chocolate's universal appeal and versatility in seamlessly blending with various liquors to create indulgent and sophisticated treats. The trend towards premiumization has also played a significant role, as consumers are increasingly willing to spend more on high-quality, luxurious chocolates infused with fine spirits. The rise in gifting culture, particularly during festive seasons, has also boosted the demand for liquor-filled chocolates.

The candies & gums segment is expected to grow at the fastest CAGR of 6.6% over the forecast period. The increasing consumer preference for novel and exciting confectionery experiences propels the demand for liquor-infused candies and gums. These products offer a unique blend of sweetness and the distinctive flavors of various liquors, appealing to adventurous consumers and those seeking premium confectionery options. Additionally, the rising trend of innovative and artisanal candy production is leading to introducing a wide variety of liquor-flavored gums and candies. The convenience and portability of these products also make them attractive for on-the-go consumption.

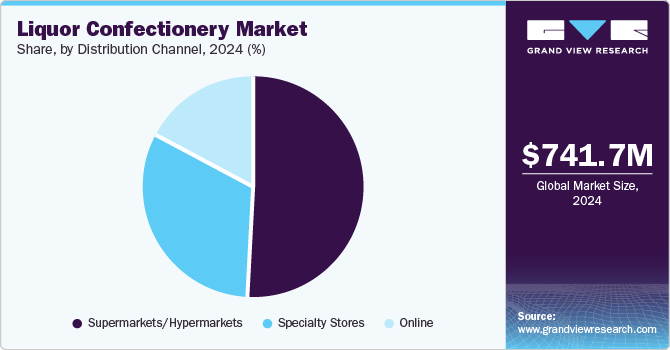

Distribution Channel Insights

The supermarkets/hypermarkets segment dominated the market with the largest revenue share in 2024. Supermarkets and hypermarkets offer a wide range of liquor confectionery products, providing customers with the convenience of one-stop shopping. These large retail formats are well-positioned to cater to the growing demand for premium and artisanal confectioneries, often featuring extensive type selections and exclusive deals. Additionally, attracting high foot traffic allows these retailers to reach a broad customer base, further boosting sales. The trust and familiarity of established supermarket and hypermarket brands also contribute to consumer confidence and repeat purchases.

The online segment is expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping allows consumers to browse and purchase a wide variety of liquor confectionery products from the comfort of their homes. E-commerce platforms offer detailed type descriptions, customer reviews, and competitive pricing, which enhance the shopping experience and build consumer confidence. Additionally, online retailers often provide exclusive deals and promotions, attracting price-sensitive shoppers. The increasing use of mobile devices and expanding internet penetration further support online sales growth.

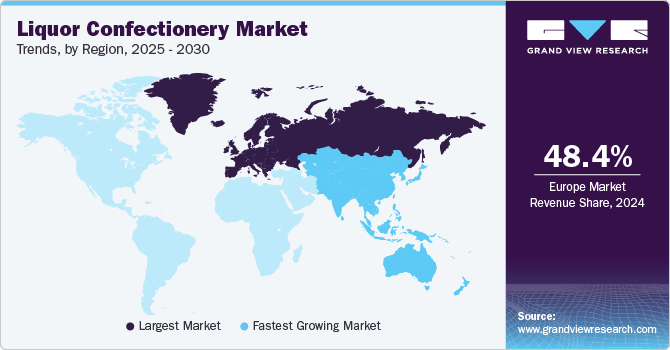

Regional Insights

Europe's liquor confectionery market dominated the global market, with the largest revenue share of 48.4% in 2024. The region's rich tradition of confectionery craftsmanship and its high demand for premium and artisanal products contribute significantly to this market share. European consumers strongly prefer quality and indulgence, driving the popularity of liquor-infused chocolates and sweets. Established and innovative European confectionery manufacturers also ensure a steady stream of new and exciting products, further fueling market growth. For instance, Lindt & Sprüngl, a Swiss chocolatier, is famous for its high-quality chocolates, including those infused with liquors. Their products are widely available in sophisticated retail landscapes across the globe. In addition, the region's robust distribution networks and sophisticated retail landscape also play a crucial role in maintaining its leading position in the global liquor confectionery market.

North America Liquor Confectionery Market Trends

North America liquor confectionery market was a lucrative region in 2024. The region's high consumer spending on premium and artisanal confectionery products, combined with a strong preference for innovative and unique flavors, has driven market expansion. The presence of well-established confectionery brands and the increasing trend of gifting luxury items have also contributed to the market's success. Additionally, the growing awareness of the health benefits of certain confectionery ingredients and the availability of these products through various retail channels have further supported market growth.

The U.S. liquor confectionery market is expected to grow significantly over the forecast period. The increasing consumer preference for premium and artisanal confectionery products and the rising trend of gifting luxury items, especially during holidays and special occasions, contribute to market expansion. Additionally, the growing awareness of the health benefits of certain confectionery ingredients and the availability of these products through various retail channels further support market growth.

Asia Pacific Liquor Confectionery Market Trends

Asia Pacific liquor confectionery market is expected to grow at the fastest CAGR of 5.1% over the forecast period. The region's increasing disposable incomes and rising middle-class population drive higher consumer spending on premium confectionery products. Additionally, the growing awareness of innovative and unique flavors and the popularity of gifting confectionery items are boosting market demand. The expansion of e-commerce platforms and the convenience of online shopping also contribute to the market's growth.

Key Liquor Confectionery Company Insights

Some key companies in the liquor confectionery market include Chocolaterie Abtey, Neuhaus, Mars, Incorporated, The Hershey Company, and others. Companies focus on developing new flavors, and several players are adopting strategies such as partnerships, mergers & acquisitions, and type development to remain competitive.

-

Chocolaterie Abtey is a renowned French chocolate factory based in Alsace. It specializes in creating exquisite liquor chocolates. Some of its popular offerings include Royal des Lys Liquor Bottles, Assorted Vodka Liquor Bottles, and Original Liquor Bottles.

-

Neuhaus is a Belgian chocolatier with a long history of crafting premium chocolates. Their liquor confectionery offerings include Chocolate Cocktails and Dark Collection. These chocolates are made with natural ingredients and are free from GMOs and palm oil.

Key Liquor Confectionery Companies:

The following are the leading companies in the liquor confectionery market. These companies collectively hold the largest market share and dictate industry trends.

- Chocolaterie Abtey

- Neuhaus

- Mars, Incorporated

- The Hershey Company

- Brookside

- Ferrero

- Mondelēz International

- Toms Gruppen

- Liqueur Fills

- MoreWines

Recent Developments

-

In July 2024, Neuhaus invested in luxury gifting and destination packaging. It launched a History Box gifting option for travelers exploring premium chocolates.

-

In December 2021, Dot’s Pretzels and Pretzels Inc. was acquired by The Hershey Company, bringing production capacity in-house to confirm Dot’s continued growth and expertise to drive snacking innovations in the upcoming years

Liquor Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 784.4 million

Revenue forecast in 2030

USD 1,070.7 million

Growth Rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Switzseland, Belgium, Belgium, China, Japan, India, South Korea, Australia, Brazil, Argentina, and South Africa

Key companies profiled

Chocolaterie Abtey; Neuhaus; Mars, Incorporated; The Hershey Company; Brookside; Ferrero; Mondelēz International; Toms Gruppen; Liqueur Fills; MoreWines

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

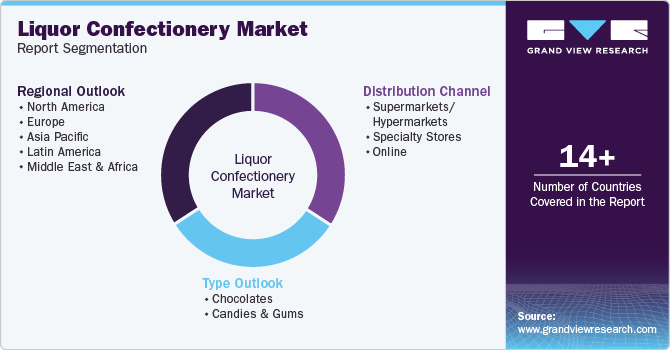

Global Liquor Confectionery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquor confectionery market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chocolates

-

Candies & Gums

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Switzerland

-

Belgium

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.