- Home

- »

- Biotechnology

- »

-

Live Cell Imaging Market Size & Share, Industry Report, 2030GVR Report cover

![Live Cell Imaging Market Size, Share & Trends Report]()

Live Cell Imaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Equipment, Consumable, Software), By Application (Cell Biology, Developmental Biology, Stem Cell & Drug Discovery), By Technology, By Region And Segment Forecasts

- Report ID: GVR-1-68038-448-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Live Cell Imaging Market Summary

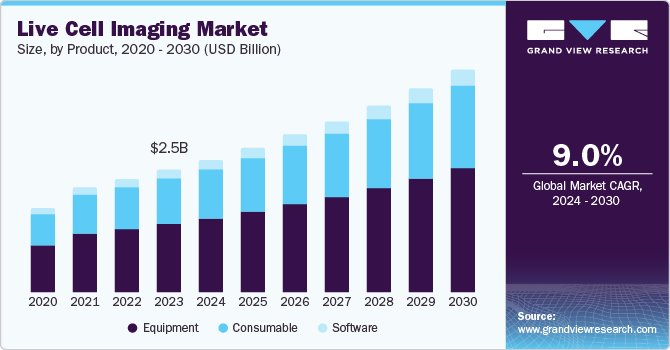

The global live cell imaging market size was estimated at USD 2.48 billion in 2023 and is projected to reach USD 4.49 billion by 2030, growing at a CAGR of 8.9% from 2024 to 2030. The market growth is due to advancements in technology, rising incidence of chronic diseases and growing demand for personalized medicine.

Key Market Trends & Insights

- North America dominated the global market with a 36.6% share in 2023.

- The live cell imaging market in the U.S. held a dominant share of 71.7% in 2023.

- Based on product, the equipment segment dominated the market with a 56.2% share in 2023.

- In terms of application, the stem cell & drug discovery segment dominated the market with 46.1% share in 2023.

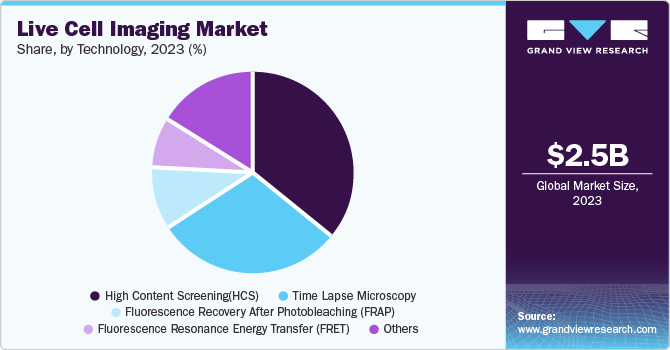

- On the basis of technology, the High Content Screening (HCS) segment dominated the market with a 35.8% share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.48 billion

- 2030 Projected Market Size: USD 4.49 billion

- CAGR (2024-2030): 8.9%

- North America: Largest market in 2023

Increasing cancer rates is one of the drivers due to its importance in cancer research, treatment and diagnostics. Furthermore, the increased funding for biomedical research, and expanding applications beyond biomedical research in live cell imaging is further fueling the market growth.

The latest technological advancements & developments in the field of imaging technology are expected to increase growth opportunities during the forecast period. In the past few years, advancements in detector’s sensitivity, introduction of imaging software and microscope designing have resulted in improved image quality with spatial and temporal resolution. As technology advances, advanced imaging modalities are expected to emerge, propelling the market growth and development. New imaging techniques are anticipated to rise in the future due to ongoing technological enhancement in live cell imaging and the market will continue to grow.

The shift in the approach from generalized patient treatment to focusing more on personalized treatment is the primary reason that boosted the growth of the live cell imaging market globally. Personalized treatments involve a system of treatments whereby treatment is tailored to suit an individual by considering their genetic makeup, lifestyle and disease characteristics.

Product Insights

The equipment segment dominated the market with 56.2% share in 2023.The growth in the equipment segment due to a surge in demand for advanced equipment, such as confocal microscopes, super-resolution microscopes, and automated imaging systems. These high-end instruments offer superior image quality, increased throughput, and enhanced data analysis capabilities. Moreover, the integration of AI and machine learning into these systems is driving innovation, enabling automated cell tracking, segmentation, and analysis.

The consumable segment is projected to grow at the fastest CAGR of 9.5% over the forecast period. This growth is due to growing need for reagents, culture media, and other consumable products that support live cell experiments. The development of new fluorescent probes with improved brightness, photostability, and specificity is fueling the market growth. Moreover, the increasing adoption of 3D cell culture models is driving demand for specialized media and matrices that support the growth and function of cells in a more physiologically relevant environment.

Application Insights

The stem cell & drug discovery segment dominated the market with 46.1% share in 2023. This is mainly due to the increasing demand for advanced imaging techniques that allow researchers to observe cellular processes in real-time. This technology enables scientists to monitor stem cell differentiation, proliferation, and interaction with various compounds, which is crucial for understanding the mechanisms of drug action and toxicity. The rise in chronic diseases and the need for personalized medicine are also driving investments in this area, as live cell imaging provides insights that can lead to more targeted therapies.

The developmental biology segment is projected to grow at a CAGR of 7.7% over the forecast perioddue to the use of live cell imaging in observation of cell embryogenesis and to study the physiological state of the cell. It allows researchers to view the cell activity and proliferation throughout the developmental procedure. The other applications of the imaging technique include fields such as drug genetics, neurobiology, immunology, and microbiology. Advancements in these fields are also expected to contribute to growth in the coming years.

Technology Insights

The High Content Screening (HCS) segment dominated the market with 35.8% share in 2023.The increased incorporation of automated platforms increases the efficiency and scalability of HCS hence enhancing high-throughput screening capability and contributing to growth of the HCS segment. Development of new image analysis software and advances in microscopy have made HCS more versatile and powerful. Furthermore, the development of high-content screening platforms with multi-parameter capabilities, including the ability to measure multiple cellular features simultaneously, is driving growth in this market.

The time lapse microscopy segment is projected to grow at a CAGR of 8.7% over the forecast period. This growth is due to its ability for continuous and real-time monitoring of cellular processes. The development of more sensitive detectors, and advanced image stabilization techniques has improved the quality and resolution of time-lapse images. Moreover, the integration of automated image analysis tools has facilitated the quantification and analysis of time-lapse data, enabling researchers to study cellular behaviors such as migration, division, and death with greater precision.

Regional Insights

North America dominated the global market with 36.6% share in 2023. The growth in this region is due to various factors such as increasing number of investments in research and development in market, rising prevalence of chronic diseases and increasing use of advanced imaging techniques.

U.S. Global Live Cell imaging Market Trends

The live cell imaging market in the U.S. held a dominant share of 71.7% in 2023 due to the country’s well-established infrastructure and increasing number of R&D activities in market. In the U.S. there is presence of number of leading live cell imaging companies which is driving the market growth.

Europe Global Live Cell imaging Market Trends

Europe live cell imaging market was identified as a lucrative region in 2023. The increasing demand for imaging techniques in market and presence of well established biotechnology and pharmaceutical companies in region is driving the market growth.

The Germany live cell imaging market held a substantial market share in 2023. This is due to presence of number of research institutes in the country and the rising demand for real time monitoring of microscopy techniques and rising focus on development of diagnostic tools.

Asia Pacific Global Live Cell Imaging Market Trends

Asia Pacific live cell imaging market is expected to grow rapidly in coming years. The region is witnessing a boost due to an increasing number of chronic diseases and growing adoption of imaging techniques.

Key Live Cell Imaging Company Insights

Some of the key companies in the global market include Nikon Corporation; Carl Zeiss AG; GE HealthCare.; PerkinElmer; Leica Microsystems and others. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

PerkinElmer is a prominent American corporation that specializes in providing products, services, and solutions across various sectors including diagnostics, life sciences, and applied markets. Company offers a diverse range of products and services tailored for hospitals, clinicians, medical laboratories, and research professionals.

Key Live Cell Imaging Companies:

The following are the leading companies in the live cell imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Nikon Corporation

- Carl Zeiss AG

- GE HealthCare.

- PerkinElmer

- Leica Microsystems

- Olympus Corporation

- Biotech Instruments Inc.

- Thermo Fisher Scientific Inc.

- CYTENA GmbH

- Corning Incorporated

- Bruker

Recent Developments

-

In December 2023, Thrive Bioscience debuted CellAssist Software Release 5.0 at Cell Bio 2023. It is anticipated to be launched with Beta versions in mid-2024 and now with available software to customers and collaborators.

-

In May 2022, CytoSMART Technologies launched CytoSMART Omni FL. It is a fluorescence version of the CytoSMART Omni, reducing the manual labor and amount of time spent on experiments and enabling scientists in gaining more insights.

Live Cell Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.68 billion

Revenue forecast in 2030

USD 4.49 billion

Growth Rate

CAGR of 8.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Nikon Corporation; Carl Zeiss AG; GE HealthCare. ; PerkinElmer; Leica Microsystems; Olympus Corporation; Biotech Instruments Inc.; Thermo Fisher Scientific Inc.; CYTENA GmbH; Corning Incorporated; Bruker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Live Cell Imaging Market Report Segmentation

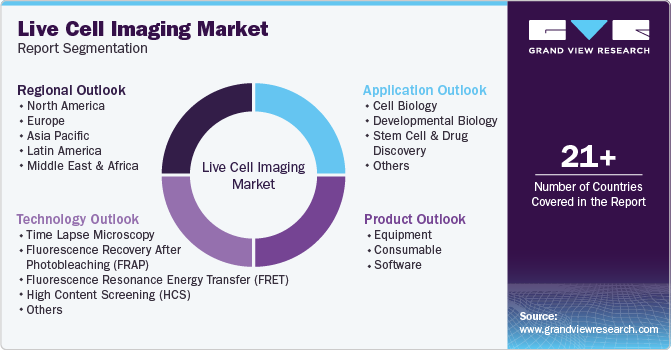

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global live cell imaging market report based on product, application, technology and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Consumable

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Biology

-

Developmental Biology

-

Stem Cell & Drug Discovery

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Time lapse Microscopy

-

Fluorescence recovery after photobleaching (FRAP)

-

Fluorescence resonance energy transfer (FRET)

-

High content screening (HCS)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East And Africa (MEA)

-

UAE

-

South Arabia

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.