- Home

- »

- Pharmaceuticals

- »

-

Liver Health Supplements Market Size Report, 2030GVR Report cover

![Liver Health Supplements Market Size, Share & Trends Report]()

Liver Health Supplements Market Size, Share & Trends Analysis Report By Product (Vitamins & Minerals, Herbal Supplements), By Dosage Form (Capsules, Tablets, Liquids, Powders, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-929-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The global liver health supplements market size was valued at USD 816.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.03% from 2024 to 2030. Consumers increasingly adopt preventive healthcare measures and pursue natural and herbal supplements to enhance their health. Liver health supplements, formulated with ingredients such as milk thistle, turmeric, and dandelion root, offer natural support for liver function. In recent years, changing lifestyle patterns have led to a rise in the consumption of fast food and alcohol, contributing to the high prevalence of liver diseases such as liver cancer, fatty liver disease, and others. The growing trend towards health and wellness drives the demand for dietary supplements, including those for liver health.

The rising number of liver diseases, such as non-alcoholic fatty liver disease (NAFLD), hepatitis, and liver cancer, is a significant driving demand in the liver health supplements market. For instance, about 100 million people in the U.S. are estimated to have non-alcoholic fatty liver disease. Non-alcoholic fatty liver disease is the most common form of liver disease in children and has more than doubled over the past 20 years. Poor lifestyle choices, including unhealthy diets, excessive alcohol consumption, and lack of physical activity, have led to an increase in liver-related health issues, resulting in a growing demand for supplements that support liver function and promote liver health.

Consumers are becoming increasingly aware of the importance of maintaining liver health. Educational campaigns by health organizations, the availability of information through digital media, and endorsements by healthcare professionals are contributing to this awareness. As people become more conscious of their liver health, they pursue supplements that aid in detoxification and support liver function.

In the U.S., young adults with drinking habits generally consume supplements to maintain liver health. The rising inclination of consumers toward dietary supplements is expected to support the market growth in the forthcoming years. For instance, according to the data published by the Council for Responsible Nutrition (CRN) in September 2019, nearly 77% of Americans reported consumption of dietary supplements.

Various initiatives undertaken by the public and private organizations to increase the awareness among consumers about liver health are projected to support the market growth. In March 2019, Amsety, a nutrition company along with Fatty Liver Foundation launched the Kiss & Click campaign. It is designed to increase awareness regarding liver health. Similarly, the British Liver Trust runs campaigns to promote early diagnosis and intervention along with increasing awareness about all types of liver diseases. The Institute of Liver and Biliary Sciences (ILBS) based in Delhi, India undertakes various campaigns to increase awareness about hepatitis and the overall health of the organ.

In recent years, several developing countries such as China and India have witnessed significant economic growth, which has resulted in an increase in GDP at Purchasing Power Parity (PPP) of these countries. The growth in GDP-PPP has led to the development of a middle-class population in terms of their purchasing power. Due to this, the middle-class population is currently adopting quality health products including supplements. This factor is expected to contribute to the growth of the liver health supplements market.

Product Insights

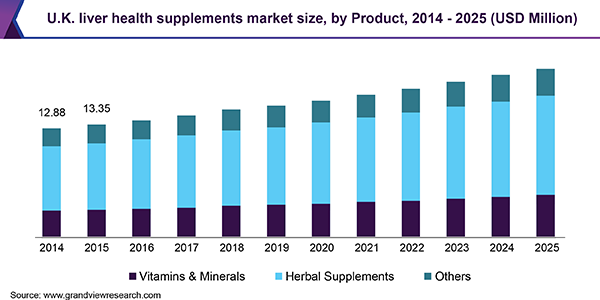

Herbal supplements dominated the market with a revenue share of 53.0% in 2023. Digital platforms are significantly raising awareness about the benefits of herbal ingredients for liver health. Scientific studies and endorsements by healthcare professionals highlight the effectiveness of herbs in promoting liver detoxification and regeneration. This awareness encourages consumers to choose herbal supplements. Additionally, there is a growing preference for natural and plant-based products over synthetic ingredients and pharmaceuticals for fewer side effects. This shift towards natural remedies drives the herbal liver health supplements market.Mushroom-based supplements are also anticipated to continue gaining momentum in terms of demand among consumers. Reishi and Chaga mushroom is considered to be an ideal herb for detoxification.

Vitamins and minerals are anticipated to witness the fastest CAGR over the forecast period. Many individuals suffer from deficiencies in essential vitamins and minerals such as vitamin D, vitamin E, zinc, and selenium, which are necessary for maintaining liver health. Campaigns by health organizations and the medical community educate consumers about the importance of these micronutrients. Additionally, the availability of vitamins and minerals supplements in various forms, such as tablets, capsules, powders, and liquids, makes them convenient for consumers to incorporate into their daily routines. This diversity in product offerings caters to different consumer preferences and needs, further driving market growth.

Dosage Form Insights

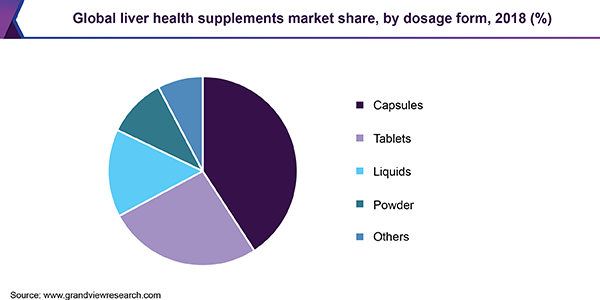

The capsule segment accounted for the largest revenue share in 2023. Capsules are easy to swallow and ideal for individuals with busy schedules. Their portability allows consumers to maintain their supplement routine while traveling or on the go. Additionally, capsules offer a precise dosage, ensuring that consumers receive the exact amount of active ingredients given by the manufacturer. Capsules provide protection from sensitive ingredients to the stomach lining and reduce gastrointestinal irritation. Growing awareness among consumers regarding the advantage of capsule formulations is further fueling the demand for these supplements in capsule form, boosting the growth of the segment.

Tablets as a dosage form are preferred due to their high shelf life. Currently, there are many domestic as well as international brands developing liver supplements in the form of capsules and tablets. Moreover, supplements in the form of liquids are becoming popular among children with diseases of the digestive system.

The powder segment is expected to witness the fastest CAGR over the forecast period. Powders easily mix into various beverages, such as water, smoothies, and juices, and in foods such as yogurt or oatmeal. This adaptability makes it easier for consumers to incorporate liver health supplements into their daily routines without changing their dietary habits. Additionally, powders are often more cost-effective compared to capsules and tablets. The manufacturing process for powders is generally less complex, and packaging costs are lower, driving its demand in the market.

Regional Insights

North America accounted for the largest revenue share in 2023. Public health campaigns, educational initiatives, and media coverage have raised awareness about liver-related issues. For instance, in July 2023, the World Health Organization (WHO) launched the "One Life, One Liver" campaign for World Hepatitis Day, emphasizing the importance of liver health for overall health. This campaign aims to raise awareness about hepatitis and its impact on liver health, encouraging people to take preventive measures to protect their liver. Individuals are becoming more proactive about maintaining their liver health, leading to a higher demand for liver health supplements. This increased awareness is driving demand for the liver health supplements market.

U.S. Liver Health SupplementsMarket Trends

The U.S. liver health supplements market accounted for the largest revenue share in 2023. In the U.S., modern lifestyle factors such as poor dietary habits, lack of physical activity, and high levels of stress contribute to liver health problems. The increasing consumption of processed foods, high in fats and sugars, leads to conditions such as non-alcoholic fatty liver disease and others, driving the demand for liver health supplements. Additionally, the rise in alcohol consumption, particularly among younger adults, raises concerns about liver damage and the need for supplements that support liver detoxification and repair.

Asia Pacific Liver Health Supplements Market Trends

The Asia Pacific liver health supplements market is anticipated to witness the fastest CAGR over the forecast period. Expanding distribution channels, including online platforms, health food stores, pharmacies, and supermarkets, make liver health supplements more accessible to consumers. Online shopping offers consumers convenience and a wide selection of products, and they are able to compare and read reviews. This distribution channel ensures that liver health supplements reach a wider audience and drive their growth.

The China liver health supplements market is expected to witness significant CAGR over the forecast period. The increasing age of individuals leads to the decline of the liver's natural function. Older adults pursue liver health supplements to maintain optimal liver function and overall health. As the elderly population grows, their demand for effective preventive health measures, including liver health supplements, is expected to expand the market.

Europe Liver Health SupplementsMarket Trends

The Europe liver health supplements market is expected to witness significant CAGR over the forecast period. Many fitness enthusiasts and athletes recognize the importance of liver health in overall physical performance and recovery. Liver health supplements are promoted as part of comprehensive fitness training that includes proper nutrition, exercise, and supplementation. Additionally, Innovative formulations that combine traditional herbal ingredients with modern scientific research are prevalent among European consumers.

The UK liver health supplements market is expected to witness significant growth over the forecast period. Companies offer various products in different forms, such as capsules, tablets, powders, and liquids, to cater to varying consumer preferences and needs. This wide availability in different forms enables consumers to choose suitable and convenient options to support their liver health. Moreover, personalized liver health supplements that cater to specific needs and conditions are growing as they are more effective and relevant to the consumer's unique health profile.

Key Companies & Market Share Insights

Some key companies in the liver health supplements market include Himalaya Wellness Company, Nature's Craft., Swisse Wellness PTY LTD, Irwin Naturals, and others.

-

Himalaya Herbal Healthcare provides natural and herbal health solutions. Himalaya offers diverse products, including dietary supplements, personal care products, and pharmaceuticals. Its product portfolio includes supplements for various health needs, such as liver health, digestive health, and others.

-

Irwin Naturals is a prominent company specializing in dietary supplements and natural health products. Its product lineup includes supplements such as immune support, digestive health, energy, mental clarity, and weight management.

Key Liver Health Supplements Companies:

The following are the leading companies in the liver health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Himalaya Wellness Company

- Nature's Craft.

- Swisse Wellness PTY LTD

- Integria Healthcare (Australia) Pty Ltd.

- Enzymedica.

- Nature's Bounty

- Jarrow Formulas, Inc.

- NOW

- Irwin Naturals

Recent Developments

-

In June 2024, Plexus Worldwide announced the anticipated launch of Restore. It is a liver support and detoxification product that empowers individuals looking for enhanced natural detoxification assistance and comprehensive liver support.

-

In January 2024, Cymbiotika announced the upcoming launch of Liver Health +. It is a groundbreaking formula and the benefits it offers include inflammation reduction, enhanced detoxification, liver regeneration, prevention of liver damage, support bile production, and others.

-

In February 2022, Garden of Life introduced beet supplements to its collection. These supplements are developed to promote liver function, anti-aging, and heart health. The supplements deliver the full benefits of beets.

Liver Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 879.3 Million

Revenue forecast in 2030

USD 1.32 Billion

Growth Rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018- 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Dosage Form and Region

Regional scope

North America, Europe, Asia Pacific, Latin America and Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Himalaya Wellness Company; Nature's Craft.; Swisse Wellness PTY LTD; Integria Healthcare (Australia) Pty Ltd.; Enzymedica; Nature's Bounty; Jarrow Formulas, Inc.; NOW; Irwin Naturals;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liver Health Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liver health supplements market report based on product, dosage form and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins & Minerals

-

Herbal Supplements

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Liquids

-

Powders

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."