- Home

- »

- Animal Health

- »

-

Livestock Animal Rehabilitation Services Market Report, 2030GVR Report cover

![Livestock Animal Rehabilitation Services Market Size, Share & Trends Report]()

Livestock Animal Rehabilitation Services Market Size, Share & Trends Analysis Report By Animal Type, By Therapy, By Indication, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-046-8

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

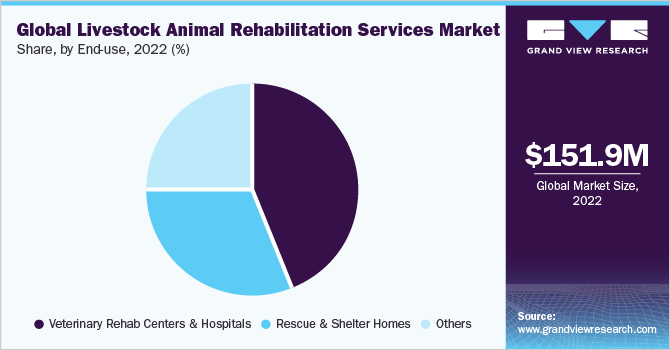

The global livestock animal rehabilitation services market size was valued at USD 151.93 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.87% from 2023 to 2030. The market is primarily driven by the rising livestock population in developing countries, growing awareness about the benefits of rehabilitation modalities in livestock treatments, and increasing adoption of physical therapy among injured farm animals to accelerate healing. In addition, government-sponsored livestock rehabilitation organizations and foundations are increasing in developing regions, which further propels the growth of the market.

In the fiscal year 2020, the COVID-19 pandemic negatively impacted the livestock animal rehabilitation services industry. This impact was majorly due to the statewide & nationwide lockdowns announced during the early stages of the health crisis in several countries, which led to the closure of veterinary hospitals and limited access to farm animal rehabilitation services. According to an article published on February 2021 by the Ohio State University (College of Veterinary Medicine), ensuring proper healthcare and well-being of livestock animals during this pandemic was important to maintain a safe and stable food supply for humans. Therefore, veterinary care for farm animals was considered necessary, and hence the services resumed gradually.

The occurrence of traumatic injuries in livestock animals and maintaining their welfare are some of the major concerns among farmers. Traumatic accidents in farms may cause unpleasant emotional impacts and painful wounds on animals, also leading to fear of further possible trauma. Therefore, routine veterinarian examination and post-wound care therapies are important in evaluating both the physical and mental health state of animals. In addition, often transportation of animals and the environment of farms with unsuitable floors, inadequate maintenance, and damaged facilities, may pose risks to farm animal injuries.

According to a study article published by the National Library of Medicine, in May 2021, cattle species face the frequent risk of limb injuries in intensive farm conditions, and they are six times highly prone to injuries than bulls. Next to cattle, pigs and ruminants (sheep) are frequently reported with findings of trauma on their body, which requires rehabilitation therapies for pain-free living. Furthermore, animals that have chronic diseases and decreased mobility are given rehab therapies such as manual massages by farmers, hydro therapies, and exercises to improve their range of motion and decrease pain. These affirmative factors are significantly contributing to the market growth.

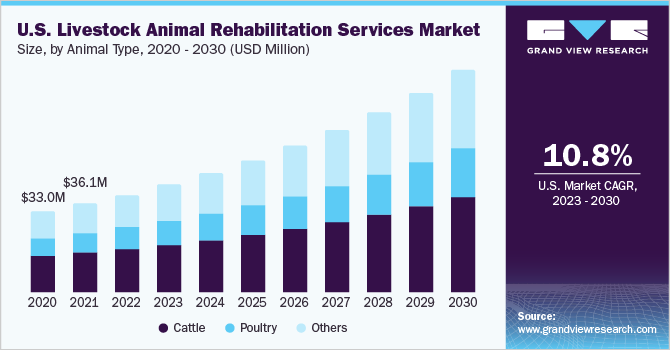

Animal Type Insights

By animal type, the cattle segment accounted for the dominant revenue share of over 45% in 2022. The stable growth in the cattle population worldwide, and increasing adoption rates of physical therapies as a part of veterinary care are contributing to this substantial market share. According to the data published on January 2023, by the United States Department of Agriculture (USDA), the cattle and calves population in the country totaled 89.3 million heads. The same source reported that the total cattle stock number in India reached 306.9 million heads for the fiscal year 2022, compared to 305 million in 2021.

The other animal segment is anticipated to grow rapidly at a CAGR of over 12% during the forecast period. The growth is supported by the rising veterinary care services offered for species like swine and ruminants (such as sheep and goats). For instance, Goats of Anarchy rescues and rehabilitates goats and all other types of farm animals with physical disabilities. Furthermore, the significant presence of farm animal sanctuaries with a large team of volunteer & trained rehabilitators is further improving the market opportunities. The farm sanctuaries in the U.S., such as Woodstock Farm Animal Sanctuary and Sunny Meadow, are recruiting a large number of volunteers for the rescue & rehab teams.

Therapy Type Insights

Based on the therapy type, the therapeutic exercises segment held the largest revenue share of over 22% in the global livestock animal rehabilitation services industry in 2022. Directed or guided therapeutic exercises continue to gain more traction in livestock veterinary care. Animal species with limited mobility necessitate regular exercise to gain muscle strength, improved mobility, and healthy production rates. According to an analysis by Woodland Park Zoo, goats are given exercise therapies such as stretching and weight shifting to heal soreness.

On the other side, the hydrotherapy segment is anticipated to grow at the fastest CAGR of over 13% during the projected period. The floatation therapy system with warm or hot water remains an ideal solution to rehabilitate cows that have injuries or damaged limbs. The viscosity and buoyancy of warm water provide a major aid to disabled and injured animals by requiring them to support only 10% of their entire body weight, thereby enhancing the movement of the animal with relative ease. Some of the small animal rehabilitation centers offer underwater treadmills for goats and sheep to promote movement and balance with rapid wound healing.

Indication Insights

Based on indication, the post-surgery segment registered the largest revenue share of more than 30% in the market. The rate of surgeries performed on large animals such as cattle has been increasing in recent years, owing to the technological advancements in veterinary medicine and improved veterinary care access in rural areas. According to an article published by the National Library of Medicine, abdominal surgery, abomasal surgery, tail docking, and c-sections are routinely performed surgical procedures in dairy cattle. Hydrotherapies can decrease the healing time post-surgery in any farm animal.

Due to the growing prevalence and incidence rates of acute & chronic conditions in livestock animals, the segment is anticipated to grow rapidly during the forecast period. Next to infertility and mastitis, chronic or acute lameness is the major issue among dairy cattle worldwide. This condition leads to decreased mobility, reduced productivity, and huge economic loss. According to a project report published by Wageningen University & Research, physical-guided exercises in dairy cattle reduce the risk of diseases such as lameness at the early stages. It also improves the metabolism of animals, thereby making them more active than earlier.

End-use Insights

Based on the end-use, the veterinary rehab centers & hospitals segment is expected to be dominating the market with a revenue share of over 40% in 2022. This is due to a growing number of veterinary rehab centers and hospitals worldwide with advanced cutting-edge infrastructures. These centers are the major spot for veterinary physical therapies due to the availability of licensed rehabilitators. The rising number of veterinary rehab practitioners is another factor propelling the segment’s growth. According to the American Animal Hospital Association (AAHA), several veterinarians and veterinary technicians are trained & certified to rehabilitate large farm animals, in veterinary hospitals. These affirmative factors are boosting the growth of the segment.

The other segment is anticipated to grow at the fastest CAGR of over 12.5% over the projected period. Several farm animal sanctuaries are being established in developed & developing countries, with the mission of rescuing & providing homeless livestock animals an enriching environment with rehabilitation services.

Farm Sanctuary Organizations located in different states of the U.S. have rescued nearly 800 livestock animals and offer better rehabilitation therapies. They provide shelter for rescued & rehabilitated goats, cows, sheep, rabbits, poultry, and other livestock species. Therefore, rising strategies and programs by government organizations to protect animal welfare is boosting market growth.

Regional Insights

North American region dominated the livestock animal rehabilitation services industry with the largest revenue share of around 30% in 2022. The substantial share is attributed to the large presence of licensed veterinary rehabilitators, the increasing number of veterinary hospitals, farm sanctuaries, & rehab centers, advancing veterinary care services, and the rising adoption of physical therapies for farm animals. Europe region held the second-largest share in the market, owing to its growing livestock populations and farms. In addition, the rising awareness of rehabilitation therapies in developing countries of the region is further propelling market growth.

On the other hand, the Asia Pacific market is anticipated to grow at the fastest pace in the next few years, with a CAGR of over 13%. This is attributable to the large livestock population present in the region, growing access to veterinary care in rural farms, rising disposable income of households, and relative increase in veterinary services expenditure in developing countries. Furthermore, with rising requirements for healthy & enriched livestock production rates, the animals are timely treated and rehabbed to protect & heal from painful conditions.

Key Companies & Market Share Insights

The key players in the market are focused on unveiling advanced therapeutic rehabilitation services, especially for large farm animals such as cattle. In addition, the collaborative initiatives of animal welfare organizations, rescue centers, and sanctuary homes in developed countries to protect farm animals are further enhancing the market’s competitiveness. Some prominent players in the global livestock animal rehabilitation services market include:

-

Greenside Veterinary Practice (Affiliate of Mars, Inc.)

-

Chaseview Farm Animal Service

-

St Boniface Veterinary Centre

-

Deepwood Veterinary Clinic

-

Desert Forest Animal Hospital

-

REC Vet Physio

-

Animal Health & Rehab Center

-

Pedernales Veterinary Center

-

Ladson Veterinary Hospital

-

Tabernacle Animal Hospital

Livestock Animal Rehabilitation Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 169.4 million

Revenue forecast in 2030

USD 371.42 million

Growth rate

CAGR of 11.87% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, CAGR % from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Animal type, therapy, indication, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Spain; Italy; Japan; China; India; Australia; Brazil; Mexico; South Africa.

Key companies profiled

Greenside Veterinary Practice (Affiliate of Mars, Inc.); Chaseview Farm Animal Service; St Boniface Veterinary Centre; Deepwood Veterinary Clinic; Desert Forest Animal Hospital; REC Vet Physio; Animal Health & Rehab Center; Pedernales Veterinary Center; Ladson Veterinary Hospital; Tabernacle Animal Hospital

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Livestock Animal Rehabilitation Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global livestock animal rehabilitation services market report based on animal type, therapy, indication, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Poultry

-

Others

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Exercises

-

Manual Therapy

-

Hydrotherapy

-

Hot & Cold Therapies

-

Electro Therapies

-

Acupuncture

-

Shockwave Therapy

-

Other Therapies

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Post-Surgery

-

Traumatic Injuries

-

Acute & Chronic Diseases

-

Developmental Abnormality

-

Other Indications

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Rehab Centers & Hospitals

-

Rescue & Shelter Homes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global livestock animal rehabilitation services market size was estimated at USD 151.93 million in 2022 and is expected to reach USD 169.4 million in 2023.

b. The global livestock animal rehabilitation services market is expected to grow at a compound annual growth rate (CAGR) of 11.87% from 2023 to 2030 to reach USD 371.42 million by 2030.

b. North American region registered the highest market revenue share of about 30% in 2022, closely followed by Europe and Asia Pacific regions. The substantial share is attributed to the large presence of licensed veterinary rehabilitators, the increasing number of veterinary hospitals, farm sanctuaries, & rehab centers, advancing veterinary care services, and the rising adoption of physical therapies for farm animals.

b. Some key players operating in the global livestock animal rehabilitation services market include Greenside Veterinary Practice (Affiliate of Mars, Inc.); Chaseview Farm Animal Service; St Boniface Veterinary Centre; Deepwood Veterinary Clinic; Desert Forest Animal Hospital, among others.

b. The key factors driving the market growth include the rising livestock population in developing countries, growing awareness about the benefits of rehabilitation modalities in livestock treatments, and increasing adoption of physical therapy among injured farm animals to accelerate healing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."