- Home

- »

- Advanced Interior Materials

- »

-

Livestock Farm Equipment Market Size Report, 2020-2027GVR Report cover

![Livestock Farm Equipment Market Size, Share & Trends Report]()

Livestock Farm Equipment Market Size, Share & Trends Analysis Report By Product Type, By End Users, By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-815-2

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The global livestock farm equipment market size was valued at USD 16.4 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2020 to 2027. Continued implementation of advanced technologies in the agriculture sector to augment operational efficiency is expected to drive the market over the forecast period. Automated equipment is increasingly being implemented for managing the livestock and undertaking various tasks, including feeding, milking, monitoring, and cleaning. The myriad of benefits offered by livestock farm equipment in terms of easing the livestock farming activities is expected to drive the market over the forecast period. Livestock farming is expected to gain traction across the globe over the forecast period in line with the rising consumption of dairy products, meat, and eggs.

The number of chicken raised in the past years reportedly increased by more than 3.0 billion between 2013 and 2018. As a result, poultry farm owners have started deploying electric cages used to house poultry animals. Milking and breeding equipment are also being deployed to improve the overall yield. For instance, improved management practices and the use of better quality feeders can potentially help in increasing meat production.

The growing demand for livestock farm equipment from dairy and poultry farms is anticipated to drive the market over the forecast period. Various equipment, such as automated feeders and housing equipment is being adopted aggressively in poultry and dairy farms. At the same time, rising consumption of pork, particularly in China, the U.S., Germany, and the U.K., has triggered the demand for breeding equipment required on swine farms. The sustained growth in demand for the equipment from various end-use segments bodes well for market growth over the forecast period.

Livestock farm equipment can benefit farm owners in the form of improved operational efficiency and better management of livestock. Growing labor costs in countries, such as India, China, Germany, and the U.K., are expected to prompt the owners to deploy automation equipment in their farms. For instance, the ratio of workers working on farms in India decreased from 47.0% in 2012 to 43.2% in 2019. The growing preference for livestock farm automation in response to the rising labor costs is expected to open new opportunities in the market.

However, the outbreak of the COVID-19 pandemic is expected to restrain market growth in the short term. Several economies across the world, including the U.S, India, China, and Italy, have been severely affected by the pandemic. Lockdowns in several parts of the world have disrupted the supply chains and taken their toll on the manufacturing industry. As such, several production facilities remained shut during Q1/2020. Nevertheless, given that farm equipment remains essential for the food supply chain, the market is poised for stable growth in the long term.

Product Type Insights

The feed equipment segment accounted for a revenue share of more than 20.0% in 2019. Feed equipment includes automatic and semi-automatic feeders used for livestock feeding. These feeders are equally used by operators of poultry, dairy, and swine farms. The rising number of chicken being raised across the globe is also expected to drive the demand for feeding equipment. The segment is expected to continue dominating the market over the forecast period as feeders would play a decisive role in increasing the yield from the livestock.

The housing equipment segment is projected to register a CAGR of 4.2% from 2020 to 2027. Housing equipment is prominently used in poultry farms as special care needs to be taken while housing poultry animals. Housing equipment is also used to house hogs, cattle, and other farm animals. However, the adoption is not as significant as poultry farms owing to the high cost involved.

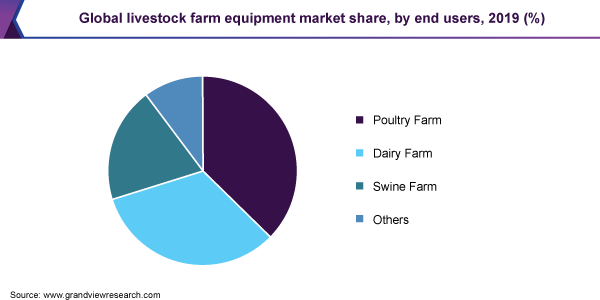

End-users Insights

The poultry farm segment dominated the market in 2019 with the largest market share of more than 35.0%. The consumption of chicken meat and eggs is growing owing to the high protein content and other health benefits, eggs, and chicken meat can offer. Efficient equipment would be crucial if poultry farms were to cater to the rising demand for poultry meat and eggs. Deployment of poultry equipment in poultry farms can also help in reducing manual intervention and saving on labor costs.

The dairy farm segment is expected to exhibit a CAGR of 3.4% from 2020 to 2027 in the livestock farm equipment. Dairy farm owners are particularly opting for equipment as dairy cattle require special attention and have dedicated requirements for food and shelter. Proper care is of paramount importance if the owners were to maximize the yield from dairy animals. Livestock equipment can potentially simplify the operations of dairy farms and aid in better management of the cattle. The rising demand for dairy products would also prompt dairy farm owners to opt for automation and ensure hygienic production of dairy products, thereby driving the growth of the dairy farm segment.

Regional Insights

Asia Pacific accounted for a revenue share of more than 30.0% in 2019. The region reportedly has the largest livestock in the world. China and India particularly contribute to large livestock as compared to other countries. The growing need for farm automation in line with the increasing livestock is expected to drive the growth of the regional market over the forecast period. Governments in the region are also encouraging and supporting investments in the agriculture sector, thereby contributing to the market growth.

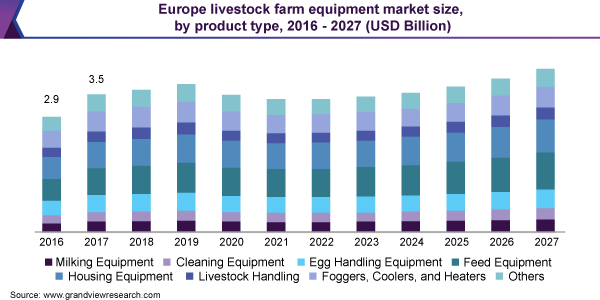

Europe accounted for a significant revenue share in 2019 and is projected to register a healthy CAGR from 2020 to 2027. The region is home to several market players and the growing imports and exports of agricultural machinery would particularly drive the growth of the regional market. Latin America is also anticipated to exhibit a substantial CAGR over the forecast period as the growing livestock in the region prompts farm owners to adopt innovative livestock farm equipment.

Key Companies & Market Share Insights

The presence of several players dominating different regional markets has culminated in a fragmented market. At the same time, the presence of regional market players is further intensifying the competition. At this juncture, companies are adopting aggressive pricing strategies to sustain in the competitive market.

Market incumbents are adopting various strategies, such as product portfolio expansions, mergers & acquisitions, and strategic partnerships, to strengthen their foothold in the market. They are also investing aggressively in research and development activities to provide innovative, reliable, and technologically advanced products. Strengthening the geographical presence is emerging as a key strategy being adopted by market players to increase their market share. For instance, Big Dutchman opened a logistics center and new regional head office in Malaysia to expand its footprints in the Asia Pacific and increase its sales. Some of the prominent players in the livestock farm equipment market include:

-

Pearson International LLC

-

Bob-White Systems

-

Murray Farm care Ltd.

-

Afimilk Ltd

-

FarmTek

-

Royal Livestock Farms

-

Real Tuff Livestock Equipment

Livestock Farm Equipment Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 15.3 billion

Revenue forecast in 2027

USD 19.3 billion

Growth rate

CAGR of 3.4% from 2020 to 2027

Base year for estimation

2019

Historic data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-users, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

The U.S.; Canada; The U.K.; Germany; France; China; India; Japan; Brazil; Mexico

Pearson International LLC; Bob-White Systems; Murray Farmcare Ltd.; FarmTek; IAE Agriculture; Texha PA LLC.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThe report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. Grand View Research has segmented the global livestock farm equipment market report based on product type, end-users, and region.

-

Product Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Milking Equipment

-

Cleaning Equipment

-

Egg Handling Equipment

-

Feed Equipment

-

Housing Equipment

-

Livestock Handling

-

Foggers, Coolers, and Heaters

-

Others

-

-

End-users Outlook (Revenue, USD Million, 2016 - 2027)

-

Poultry Farm

-

Dairy Farm

-

Swine Farm

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global livestock farming equipment market size was estimated at USD 16.35 billion in 2019 and is expected to reach USD 15.28 billion in 2020.

b. The global livestock farming equipment market is expected to grow at a compound annual growth rate of 3.4% from 2020 to 2027 to reach USD 19.34 billion by 2027.

b. Asia Pacific dominated the livestock farming equipment market with a share of 31.07% in 2019. This is attributable to increased spending on farm mechanization coupled with the presence of a large livestock population in the region.

b. Some key players operating in the livestock farming equipment market include Pearson International LLC, Bob-White Systems. Murray Farmcare Ltd., Afimilk Ltd, SANOVO TECHNOLOGY GROUP, FarmTek, and Royal Livestock Farms.

b. Key factors that are driving the market growth include the growing need for food and dairy production, decreasing manual labor availability on the farms, and easy availability of livestock machinery.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."