- Home

- »

- Animal Health

- »

-

Livestock Identification Market Size, Industry Report, 2030GVR Report cover

![Livestock Identification Market Size, Share & Trends Report]()

Livestock Identification Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Cattle, Swine, Ovine/Caprine), By Solution (Hardware, Software, Services), By Usage, By Procedure, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-585-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Livestock Identification Market Summary

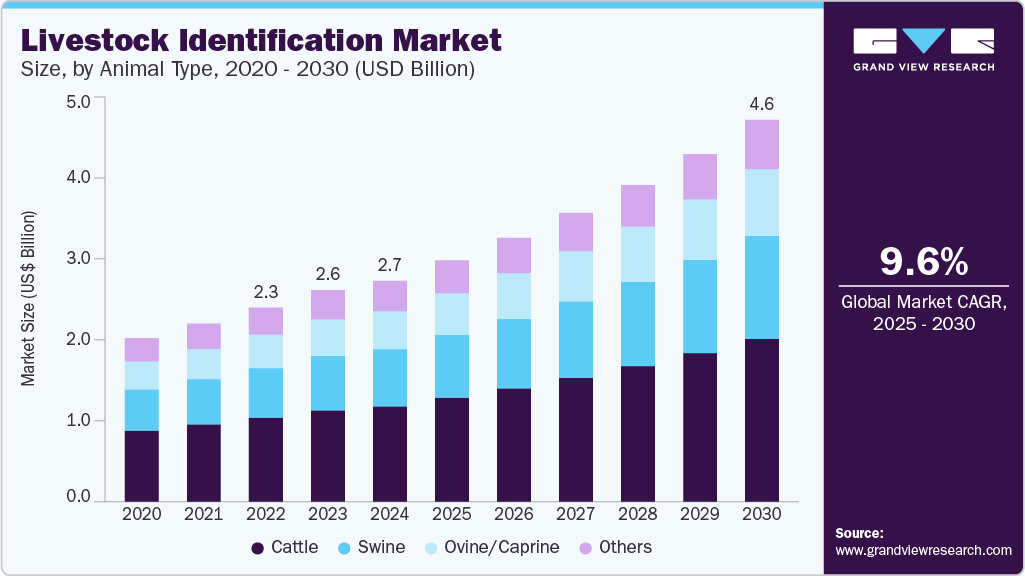

The global livestock identification market size was estimated at USD 2.7 billion in 2024 and is projected to reach USD 4.63 billion by 2030, growing at a CAGR of 9.61% from 2025 to 2030. Key growth drivers include increasing usage of livestock animal tag/ID systems to enhance animal health surveillance & disease eradication measures, easy tracking of animal mortality rate, vaccination status, import & export regulations, and production rates, among others.

Key Market Trends & Insights

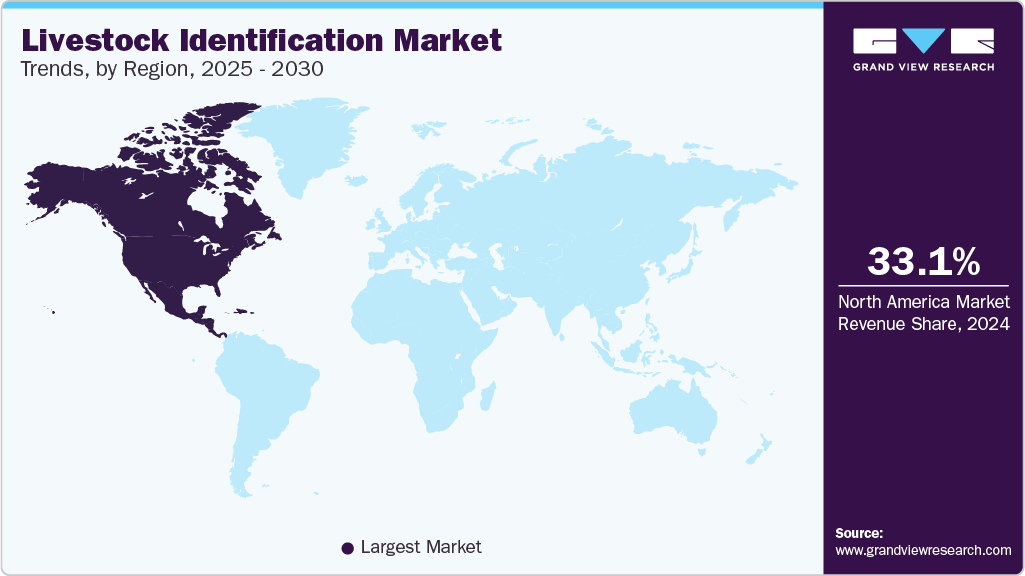

- North America livestock identification market held a 33.08% revenue share of the global market in 2024.

- The livestock identification market in the U.S. is expected to grow significantly over the forecast period.

- Based on animal type, the cattle segment generated the largest revenue with a 43.12% share in 2024.

- Based on solution, the hardware segment dominated the market, with the highest revenue share of 49.49% in 2024.

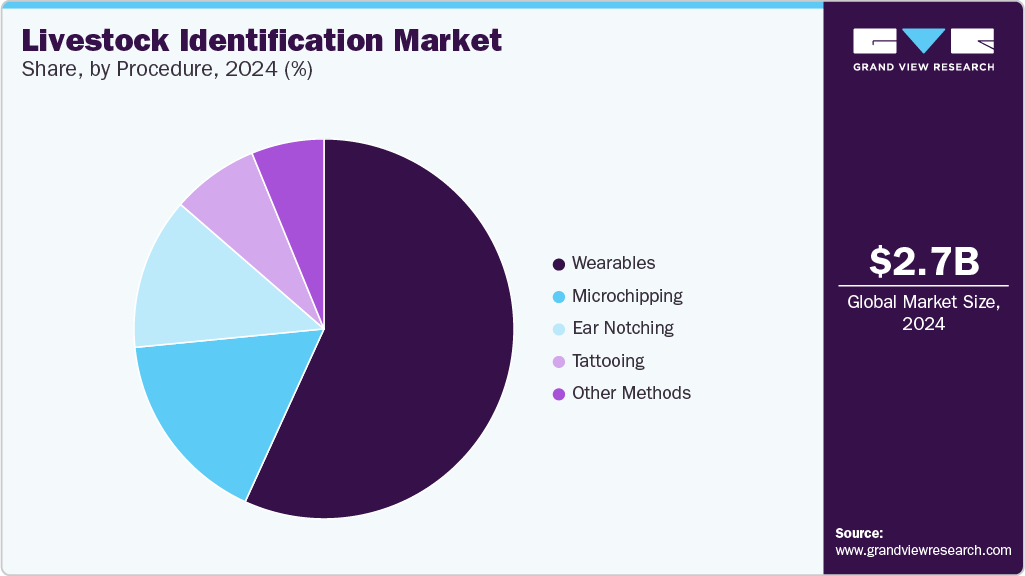

- Based on procedure, the wearable segment dominated the market, with a revenue share of 56.81% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.7 Billion

- 2030 Projected Market Size: USD 4.63 Billion

- CAGR (2025-2030): 9.61%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

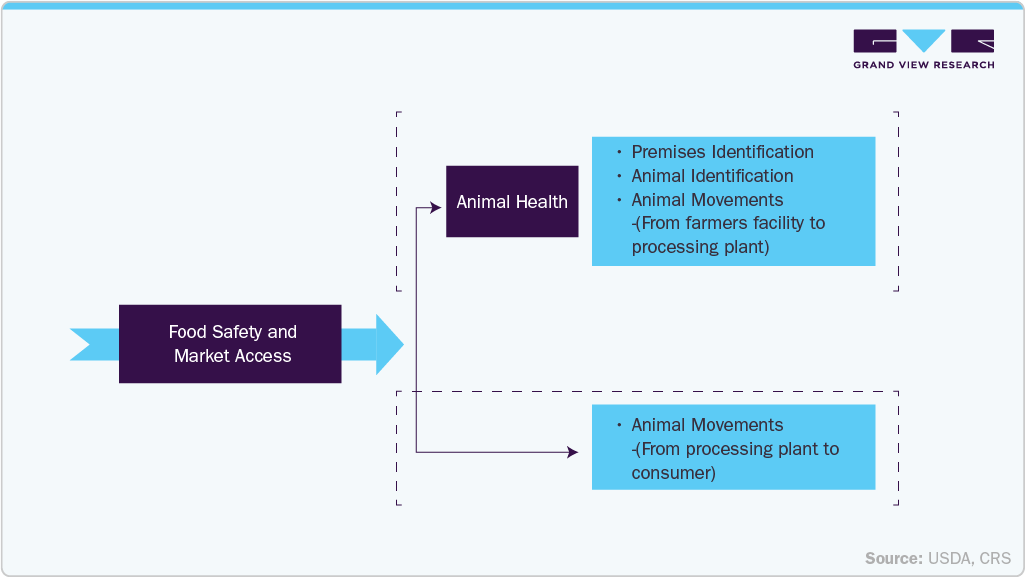

Rapid identification of disease outbreaks and regional compartmentalization can limit disease spread and minimize the respective economic impacts. In addition, technological advancements in animal healthcare have enabled farmers and other animal owners to use real-time tracking systems that simplify the monitoring processes with early emergency detection.

Several ranchers and farmers prefer keeping track of individual livestock to exploit & identify desirable production characteristics such as "hormone-free," "grass-fed," and "organic" to command premium prices in retail markets. To support this, the USDA launched a verification program called the Agricultural Marketing Service to provide "Process Verified" labels to such livestock suppliers. This voluntary, fee-for-service program enables farmers to have claims, such as breed labels, thereby increasing their domestic marketing opportunities. Furthermore, animal identification systems can help prevent the spread of foodborne illnesses by tracking the product back to the production unit and assisting authorities in preventing the spread of future incidents.

The increasing frequency of product launches incorporating smart identification and health monitoring technologies significantly expands the livestock identification market. These innovations enhance traceability and deliver real-time insights into animal health, productivity, and breeding efficiency. For instance, in October 2024, Merck Animal Health launched SENSEHUB Cow Calf. This remote monitoring system helps cow/calf producers optimize breeding through AI and ET by detecting estrus, reproductive issues, and overall health using real-time data from ear-mounted sensors. The system simplifies herd monitoring with alerts, visual tags, and intuitive dashboards. This innovation strengthens the livestock identification market by combining individual animal ID with real-time health and reproductive monitoring, promoting the adoption of integrated smart ID systems that go beyond traceability to deliver predictive insights and precision breeding.

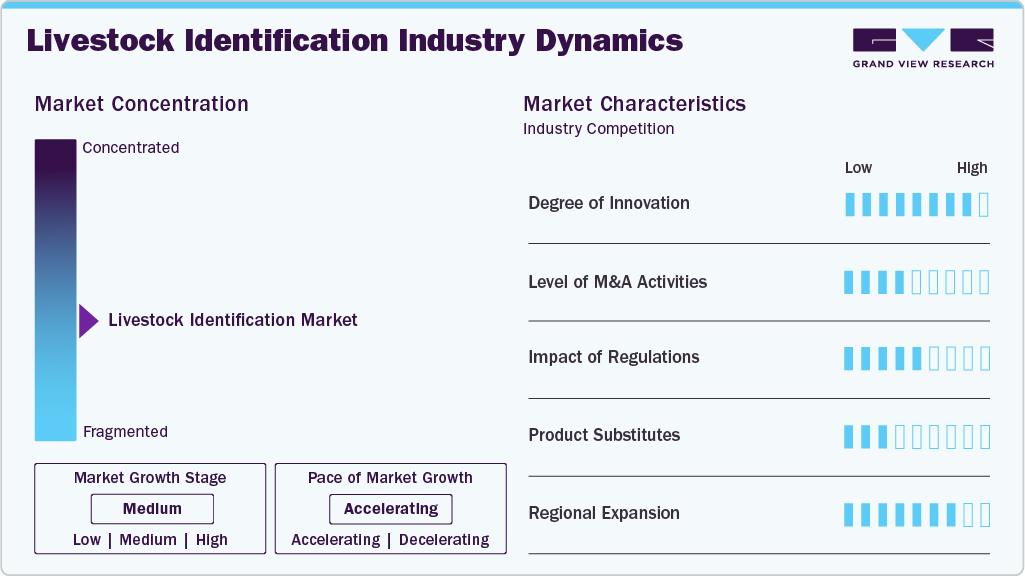

Market Concentration & Characteristics

The industry is moderately concentrated, with a few dominant global players accounting for a significant revenue share. Key companies such as Merck Animal Health (Allflex), Datamars, Nedap, and GEA Group lead the market through advanced RFID, sensor-based, and AI-integrated solutions. These firms benefit from strong distribution networks, high R&D investments, and strategic acquisitions, creating high entry barriers for new entrants.

The industry exhibits a high degree of innovation, driven by integrating IoT, AI, and sensor technologies. Innovations like SENSEHUB Cow Calf and CattleEye’s AI-based video analytics enable real-time health, fertility, and behavioral monitoring alongside traditional ID. Continuous R&D investment by major players is transforming animal tracking into predictive herd management systems, enhancing both productivity and animal welfare.

The industry is experiencing a moderate yet strategic level of mergers and acquisitions (M&A), primarily driven by the need for technological integration and market expansion. Key industry players actively engage in M&A activities to enhance their product portfolios and strengthen their market positions. For instance, in March 2024, GEA acquired CattleEye Ltd., a Northern Ireland-based agri-tech company, integrating its AI-based lameness detection and body condition scoring system into GEA’s dairy solutions portfolio. The CattleEye system uses 2D video analytics and deep learning to monitor cow health, enabling early intervention to improve welfare and productivity. This acquisition enhances the livestock identification market by integrating AI-driven health monitoring with traditional ID systems, promoting smarter herd management and driving demand for integrated, tech-enabled animal tracking and health solutions.

Regulations mandating livestock identification are pivotal in driving the market's growth. For instance, Australia's National Livestock Identification System (NLIS) utilizes RFID ear tags to enhance food safety, disease control, and market access. Similarly, Tasmania's 2025 biosecurity regulations require electronic identification for sheep, goats, and bobby calves to bolster traceability and food safety. Such regulatory frameworks ensure compliance and stimulate the adoption of advanced identification technologies, thereby expanding the market.

The industry faces limited substitutes, as traditional methods like visual tags and branding are less efficient and less reliable for traceability and health monitoring. However, emerging alternatives such as biometric identification (e.g., nose prints or retinal scans) are being explored but have yet to gain widespread commercial adoption.

Key players like Merck Animal Health, Datamars, and GEA are expanding regionally, accelerating the livestock identification market by increasing accessibility to advanced ID technologies in emerging and underserved markets. Expanding into regions such as Asia-Pacific and Latin America boosts adoption through localized solutions, compliance with regional regulations, and enhanced distribution networks, driving overall market growth.

Evolution of Livestock Identification Regulations

Year

Region

Regulatory Milestone

Impact on Industry

2004

Australia

Introduction of the National Livestock Identification System (NLIS), mandating RFID ear tags for cattle.

Standardized traceability, improved disease control, and enhanced export market access.

2013

New Zealand

Implementation of the National Animal Identification and Tracing (NAIT) system for cattle and deer.

Strengthened biosecurity measures and facilitated disease outbreak management.

2020

United States

USDA's Animal Disease Traceability (ADT) rule updates require RFID tags for interstate cattle movement.

Improved response times to disease outbreaks and streamlined livestock tracking.

2024

United States

USDA mandates that all cattle tags applied after November 2024 must be visually and electronically readable.

Accelerated adoption of RFID technology and enhanced traceability capabilities.

2025

Australia (Tasmania)

Implementing new biosecurity regulations requires electronic identification for sheep, goats, and bobby calves.

Expanded scope of electronic identification, bolstering biosecurity and market confidence.

Animal Type Insights

The cattle segment generated the largest revenue with a 43.12% share in 2024. The governments of various countries around the globe have mandated official ID systems for livestock animals before moving them interstate or across state lines for public sale or any other event. For instance, in May 2024, the USDA's Animal and Plant Health Inspection Service (APHIS) mandated electronic identification (EID) tags for certain cattle and bison in interstate movement, effective 180 days after the publication of a new rule. This regulation enhances traceability, enabling rapid response to disease outbreaks and minimizing impacts on farms and markets. States and tribal nations will oversee intrastate traceability efforts.

Similarly, every cattle in the U.S. must have official and registered ear tags to identify & record each animal. This legal requirement was implemented to control and prevent disease outbreaks. The French government has made it compulsory for sheep and goats to be double ear-tagged with RFID systems since 2010. These factors support the largest revenue generated by the livestock animal segment. On the other hand, the other animal segment is anticipated to grow at the fastest CAGR of 10.63% during the projected timeline. This is owing to the large implementation of wildlife policies with necessary identification systems. For instance, the Australian Department for Environment & Water reported that the Wildlife Ethics Committee of the country recommends specific microchip implant sites and methods of administration for wild species to track their activities & records.

Solution Insights

The hardware segment dominated the market, with the highest revenue share of 49.49% in 2024. This segment further comprises electronic hardware, visual hardware, and applicators or consumables used in animal identification processes. Growing government intervention in mandating electronic or RFID tags to manage livestock movement within or across state lines, increasing adoption of GPS-based identification tags for livestock animals, and growing implementation of the microchipping process for wild animals contribute to the largest share of the electronic hardware segment.

The United States Department of Agriculture, USDA, recommends that livestock producers use government-certified RFID tags commercialized in two forms (button tags or full tags), each with a readable registered ID number. In the U.S., since January 2023, RFID tags have been approved as the only official identification device for moving cattle species. These factors further support the market share of the hardware segment. On the other side, the software segment is anticipated to grow at the fastest CAGR of about 10.5% during the forecast period, owing to the growing availability of cloud-based software for remote monitoring, record maintenance, and alert notifying features within smartphones or smartwatches.

Usage Insights

The non-permanent segment held the dominant share in 2024. This segment comprises the largely adopted ID systems such as RFID ear or body tags, GPS-based wearables, visual tags, paints, and temporary branding. These non-permanent solutions are considered reliable, reusable, and flexible solutions for tagging animals such as livestock. For instance, RFID tags provide an easy & simple way to track each animal's breeding history and medical records, including poaching.

The non-permanent segment is also expected to grow at the fastest CAGR of 9.89% over the forecast period, owing to its cost-effectiveness, ease of application, and suitability for short to medium-term identification needs, especially in large-scale operations. These devices are increasingly integrated with real-time health and behavior monitoring, enabling disease detection, heat tracking, and herd management without invasive procedures.

Additionally, the growth of precision livestock farming and the expansion of subscription-based wearable technologies (e.g., Merck’s SenseHub at ~$3 per cow/month) support the rapid uptake of non-permanent solutions.

Procedure Insights

The wearable segment dominated the market, with a revenue share of 56.81% in 2024. Recent advancements in wearable technologies have customized identification devices to meet the specific requirements of individual animals, such as livestock. The tags that are GPS or RFID-enabled allow animal owners to track or record animal activities & locations remotely through IoT (Internet of Things) capabilities. In addition, Wearables like ear tags and collars enable real-time data collection on animal health, behavior, and location without stressing the animals, improving accuracy and ease of use. Their straightforward attachment procedure and integration with digital platforms make them highly preferred over implantable or injectable methods.

The conjunction of these wearable devices with mobile applications has further eased the process of animal identification remotely. On the other side, the microchip procedure segment is anticipated to grow at the fastest CAGR of 10.62% over the forecast period. This growth is attributed to the growing microchip technology used to mark the animals permanently for lifetime identification requirements. A registered microchip ID system provides the owners with up-to-date contact information in the recovery database of implanted animals. Other procedures, such as notching, branding, and tattooing, are still prevalent in developing countries, such as India, China, and Brazil, to mark their animals temporarily or permanently.

Regional Insights

North America livestock identification market held a 33.08% revenue share of the global market in 2024. The significant share can be attributed to technological advancements, regulatory mandates, and a focus on animal health and traceability. Government initiatives, like the USDA's National Animal Identification System (NAIS), mandate specific tracking methods, further boosting demand for identification solutions in the region. The presence of leading market players investing in R&D strengthens North America's position in the livestock identification market, ensuring continued innovation and compliance with evolving regulatory standards

U.S. Livestock Identification Market Trends

The livestock identification market in the U.S. is expected to grow significantly over the forecast period due to an increasing focus on disease prevention, food safety, and livestock traceability. The adoption of electronic identification (EID) technologies like RFID tags is expanding, driven by USDA regulations and consumer demand for transparency. For instance, in April 2024, the USDA's Animal and Plant Health Inspection Service (APHIS) finalized a rule requiring the use of electronic identification (EID) tags for certain cattle and bison involved in interstate transport. This rule, which updates the 2013 visual ID mandate, will go into effect 180 days after publication. It applies to sexually intact cattle and bison 18 months and older, dairy cattle, and rodeo or exhibition animals. The rule is expected to significantly accelerate the adoption of electronic and RFID-based identification systems across the U.S. livestock sector.

Europe Livestock Identification Market Trends

Stringent regulatory frameworks, animal disease prevention, and trade requirements influence the European livestock identification market. Initiatives like DAERA's introduction of 'XI' prefix livestock tags in June 2024 highlight the shift towards standardized systems to ensure traceability and compliance with export regulations. From 24 June 2024, new livestock tags with the 'XI' prefix will replace 'UK' tags, which will no longer be available for purchase. Existing 'UK' tags can be used until the final switchover in January 2025. DAERA advises using 'XI' tags for newborn animals, especially those intended for export, to avoid re-identification. Technological advancements like RFID tags and blockchain enhance efficiency and transparency in tracking livestock movement, further driving market adoption.

The UK livestock identification market held the largest share of the European market in 2024. Stringent government regulations and advancements in traceability technologies drive the UK livestock identification market. Initiatives like mandatory livestock tagging for disease control, welfare monitoring, and meeting international trade requirements fuel market growth, while innovations in RFID and DNA-based identification methods enhance accuracy and efficiency in animal management. Additionally, the UK's Department of Agriculture (DAERA) announced that from 30 June 2025, only 'XI'-prefixed tags can be used for identifying newborn cattle, sheep, and goats in Northern Ireland. Livestock previously tagged with 'UK' prefixes must be re-identified with 'XI' tags for export, mainly to Ireland or continental Europe, with cattle re-tagging requiring veterinary supervision. This regulatory shift is expected to increase demand for compliant ‘XI’-prefixed tags, driving short-term growth in tag manufacturing and supply.

Asia Pacific Livestock Identification Market Trends

The livestock identification market in Asia Pacific is anticipated to grow at the fastest CAGR of 10.86% over the projected period. Significantly improving measures for animal healthcare with disease traceability/eradication programs in developing countries, such as India and Australia, contributes to the growth. For instance, the Australian government announced in September 2022 that the country will mandate that every sheep and goat have electronic identification tags starting from January 1, 2025. Similar commitments are being routinely implemented by various Asian countries as a national approach to enhancing livestock traceability systems.

India livestock identification market is experiencing significant growth due to increasing focus on livestock management, disease control, and regulatory compliance. For instance, . Such initiatives showcase the rising adoption of modern identification methods. Additionally, government programs for cattle tagging under schemes like the National Animal Disease Control Programme (NADCP) emphasize traceability and health monitoring, driving market expansion. For instance, as of January 2024, over 16,242 cattle in Maharashtra were ear-tagged with 12-digit chip-based IDs containing detailed animal profiles. The tagging initiative gained momentum following a milk subsidy introduced for ear-tagged, registered cattle under the India Livestock Portal. This initiative is expected to significantly boost digital livestock identification adoption in India, especially due to direct financial incentives. It strengthens traceability, disease management, and anti-trafficking measures, driving demand for RFID and data-integrated tagging solutions.

Latin America Livestock Identification Market Trends

The livestock identification market in Latin America is witnessing growth driven by increasing regulatory requirements and technological advancements in livestock traceability. Initiatives like Brazil's mandatory traceability for cattle and buffalo, and rising demand for exportable meat products, are boosting the adoption of electronic identification solutions. This trend enhances animal health monitoring, improves disease management, and meets international market standards.

Brazil livestock identification market is set for significant growth as the government mandates traceability for cattle and buffalo by 2032. According to Brazil’s Ministry of Agriculture and Livestock (Mapa), starting in 2027, individual identification using electronic ear or flag tags will be implemented. This will enhance animal health, improve disease outbreak management, and meet international sanitary standards, potentially unlocking new export opportunities, including markets like Japan and South Korea.

Similarly, in December 2024, Brazil's Ministry of Agriculture launched the National Plan for Individual Identification of Cattle and Buffaloes (PNIB), aiming to enhance livestock traceability from birth to the consumer. This system ensures food safety, animal welfare, and transparency, bolstering global trust in Brazilian beef. Traceability helps producers meet international standards while improving market access and competitiveness. The PNIB is expected to significantly boost demand for animal identification technologies such as RFID tags, tracking software, and data systems. It will drive growth in Brazil’s livestock identification market by encouraging widespread adoption of traceability solutions, increasing regulatory compliance needs, and attracting investments in agri-tech innovations.

Middle East & Africa Livestock Identification Market Trends

The livestock identification market in the Middle East & Africa is growing due to increasing livestock management needs and government initiatives to track animal movements for health and safety. Technological advancements, such as RFID tagging, are enhancing the efficiency of animal monitoring, particularly in countries like Saudi Arabia and South Africa, where agriculture and livestock farming are vital.

South Africa livestock identification market is experiencing significant growth due to the growing demand for livestock traceability to meet export standards and improve disease management. Technologies like RFID tagging and digital traceability systems are increasingly adopted, reflecting global trade and biosecurity priorities. For instance, in February 2025, to fight rising cattle theft in South Africa, tech company ID-Scan launched a biometric app that uses unique muzzle print identification, similar to human fingerprints, to register and track cattle. The app, usable offline and online, links each animal to its rightful owner and offers a tamper-resistant alternative to ear tags and branding. With over a million free registrations available, the system aims to improve theft prevention, identity verification, and access to insurance and financing for livestock owners. ID-Scan's biometric innovation is set to transform the livestock identification market by introducing a non-invasive, reliable, and tech-driven alternative to traditional methods. It will likely boost demand for mobile-based animal ID solutions, encourage wider adoption of biometric technologies, and strengthen digital traceability and security infrastructure in the livestock sector, especially in high-theft regions.

Key Livestock Identification Companies Insights

Key players operating in the livestock identification market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Livestock Identification Companies:

The following are the leading companies in the livestock identification market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Avid Identification Systems, Inc.

- Datamars

- HID Global Corporation, part of ASSA ABLOY

- Shearwell Data Limited

- AEG Identification Systems

- AVERY DENNISON CORPORATION

- GAO RFID

- Nedap N.V

- RFID, INC.

Recent Developments

-

In January 2025, HID signed an agreement to acquire 3millID and Third Millennium, expanding its portfolio of access control solutions, including animal identification technologies. This acquisition enhances HID’s global presence and product offerings, particularly in North America and Europe, to serve enterprise and government clients more effectively.

-

In July 2024, Somark introduced the world’s smallest RFID fish tag, Digifish, designed to enhance identification in both laboratory and environmental research. At just 6mm in length, the bioinert tag ensures animal welfare and improves data accuracy in biomedical studies. With its use already expanding in preclinical research, it offers a significant advancement in tracking small fish species like zebrafish and salmonids.

-

In February 2024, ID Tech, an Indian company specializing in RFID animal identification, received ICAR certification for its RFID injectable transponders, marking a significant achievement in livestock technology. These subcutaneously injected transponders, designed for minimal animal discomfort, ensure global uniqueness and reliability, supporting enhanced animal welfare, breeding, and livestock management. This certification underscores ID Tech's commitment to international standards and innovation in agricultural and animal husbandry technologies.

Livestock Identification Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 2.93 billion

The revenue forecast in 2030

USD 4.63 billion

Growth rate

CAGR of 9.61% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, solution, usage, procedure, region

Regions covered

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain;Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck & Co., Inc.; Avid Identification Systems, Inc.; Datamars; HID Global Corporation, part of ASSA ABLOY; Shearwell Data Limited; AEG Identification Systems; AVERY DENNISON CORPORATION; GAO RFID; Nedap N.V.; RFID, INC.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Livestock Identification Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global livestock identification market report on the basis of animal type, solution, usage, procedure, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Swine

-

Ovine/Caprine

-

Others

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Electronics

-

Visual

-

Applicators & Consumables

-

-

Software

-

Services

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Permanent

-

Non-Permanent

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearables

-

Microchipping

-

Ear Notching

-

Tattooing

-

Other Methods

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global livestock identification market size was estimated at USD 2.68 billion in 2024 and is expected to reach USD 2.93 billion in 2025.

b. The global livestock identification market is expected to grow at a compound annual growth rate of 9.61% from 2025 to 2030 to reach USD 4.63 billion by 2030.

b. North America dominated the livestock identification market with a share of 33.08% in 2024. This is attributable to technological advancements, regulatory mandates, and a focus on animal health and traceability. Government initiatives, like the USDA's National Animal Identification System (NAIS), mandate specific tracking methods, further boosting demand for identification solutions in the region.

b. Some key players operating in the livestock identification market include Merck & Co., Inc.; Avid Identification Systems, Inc.; Datamars; HID Global Corporation, part of ASSA ABLOY; Shearwell Data Limited; AEG Identification Systems; AVERY DENNISON CORPORATION; GAO RFID; Nedap N.V; RFID, INC.

b. Key factors that are driving the market growth include increasing the usage of livestock animal tag/ID systems to enhance animal health surveillance & disease eradication measures, easy tracking of animal mortality rate, vaccination status, import & export regulations, and production rates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.