- Home

- »

- Pharmaceuticals

- »

-

Local Anesthesia Drugs Market Size, Industry Report, 2030GVR Report cover

![Local Anesthesia Drugs Market Size, Share & Trends Report]()

Local Anesthesia Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug (Bupivacaine, Ropivacaine, Lidocaine, Chloroprocaine, Prilocaine, Benzocaine), By Application (Injectable, Surface Anesthetic), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-086-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Local Anesthesia Drugs Market Summary

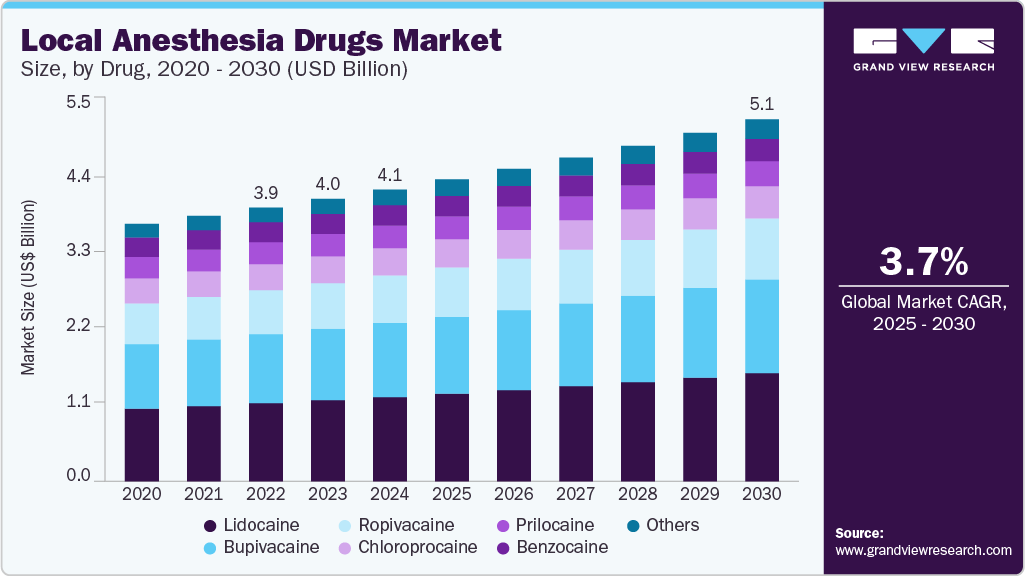

The global local anesthesia drugs market size was valued at USD 4.14 billion in 2024 and is projected to reach USD 5.13 billion by 2030, growing at a CAGR of 3.70% from 2025 to 2030. This growth is primarily driven by the expanding elderly population, which faces a higher risk of chronic conditions and often requires surgical interventions.

Key Market Trends & Insights

- North America local anesthesia drugs industry held the largest global revenue share of 35.41% in 2024.

- The U.S. local anesthesia drugs industry leads the North American market.

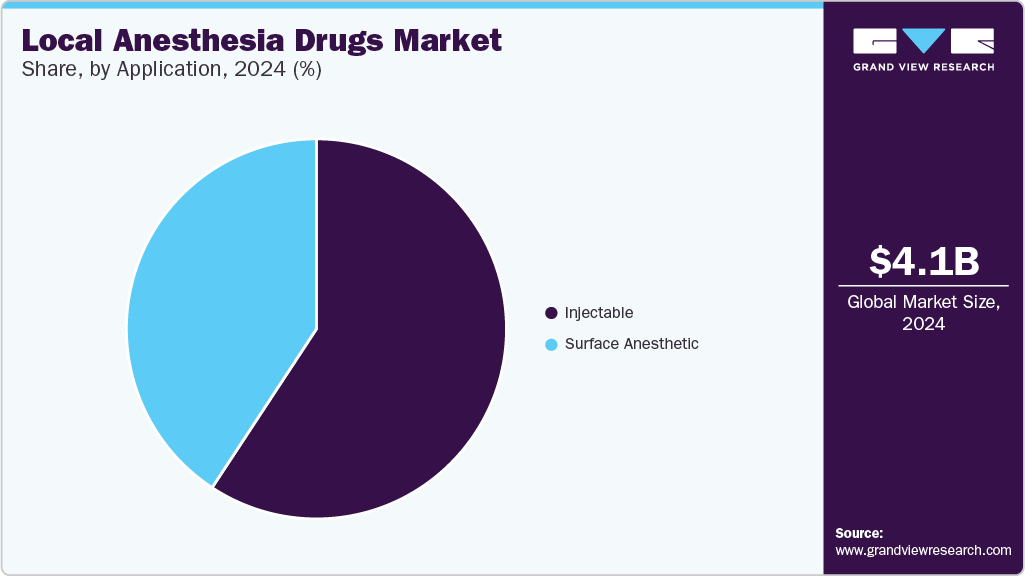

- By application, injectable segment accounted for the largest revenue share of 59.26% in 2024.

- By Drug, lidocaine segment dominated the market with a 28.88% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.14 Billion

- 2030 Projected Market Size: USD 5.13 Billion

- CAGR (2025-2030): 3.70%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As the World Health Organization noted in October 2022, people aged 60 and above are expected to comprise 22% of the global population by 2050. In addition, the increasing volume of surgical procedures, such as cosmetic, plastic, and dental surgeries, continues to support market expansion. Advancements in drug delivery technologies are projected to support the expansion of the market. Lipid-based delivery systems for local anesthetic drugs have shown significant effectiveness in managing pain. These systems are commonly employed in third molar removals, cesarean deliveries, breast surgeries, and cardiac operations. Their application continues to grow due to improved patient outcomes and ease of administration. Enhanced efficacy and lower systemic toxicity have made these delivery methods more desirable than traditional approaches. As a result, the shift toward innovative delivery formats fosters further development in this therapeutic space.

Emerging nanotechnology-based drug delivery strategies have further strengthened this market, offering enhanced effectiveness with fewer side effects. Changing demographics and heightened focus on aesthetics have led individuals to seek minimally invasive, low-pain procedures to boost self-image and confidence. Supporting this trend, the Aesthetic Society reported a 14% increase in aesthetic procedures in 2022. Common drugs used in these procedures include ropivacaine, tetracaine, and mepivacaine. Topical anesthetics like the lidocaine-based EMLA are widely used in dermatological applications, and cryoanesthesia is another technique used to reduce discomfort by cooling the skin. The growing popularity of aesthetic treatments continues to support demand for local anesthetic products.

Technological progress also includes the use of local anesthesia in complex procedures such as zygomatic implant surgeries. For example, a 2023 publication in the Journal of Oral Medicine and Oral Surgery documented 54 successful zygomatic implant placements using local anesthesia in 25 patients between 2019 and 2022. These instances underscore the increasing confidence in local anesthetics across various medical applications. Their expanding utility contributes to broader acceptance and integration into routine clinical practices. Adopting such techniques highlights a shift toward safer, more patient-friendly treatment models. Overall, these trends reinforce local anesthetics' role in modern healthcare.

In addition, regulatory frameworks are shaping the market landscape. Section 505(b) of the Federal Food, Drug, and Cosmetic Act offers detailed guidance for developing new local anesthetic products for prolonged postoperative pain control. Sponsors must file a new drug application (NDA) under this provision to ensure compliance and market readiness. These regulations are driving innovation and encouraging the introduction of improved formulations. The guidelines support market growth and enhance product quality by providing a clear path for approval. This regulatory support is key in expanding the availability of safer and more effective local anesthetic options.

Patent Analysis

Balanced Pharma Inc. (BPI) has recently expanded its patent portfolio with a new U.S. patent for its innovative dental cartridge technology. This advancement concerns BPI-001, a buffered lidocaine and epinephrine formulation devoid of the acid typically found in local anesthetics. The acid-free composition aims to deliver faster-acting, less painful, and more reliable numbing injections. Designed to fit standard dental cartridges, BPI-001 ensures seamless integration into existing dental practices without additional training or equipment. Research supports that removing acid from local anesthetics enhances their efficacy and patient comfort.

Pipeline Analysis

The FDA’s draft guidance on developing local anesthetic drugs with prolonged duration of effect outlines key steps for advancing these products through the clinical pipeline. It emphasizes comprehensive pharmacokinetic and pharmacodynamic studies to determine anesthetic effects' onset, duration, and safety. Clinical trials should target specific indications such as peripheral nerve blocks and incisional infiltration, with primary endpoints focused on the duration of analgesia and reduction in rescue medication use. Safety evaluations, including monitoring for systemic toxicity and local tissue reactions, are mandatory. Human factors studies are also recommended for novel delivery systems to ensure ease of use and patient safety.

This guidance creates a clear regulatory pathway for pharmaceutical companies aiming to develop innovative long-acting local anesthetics that can improve postoperative pain management and reduce opioid dependency. However, it also sets rigorous clinical evidence and usability testing standards that may extend development time and increase costs. Aligning product development with these expectations will be crucial for companies to gain approval and compete effectively in the growing market focused on prolonged pain relief.

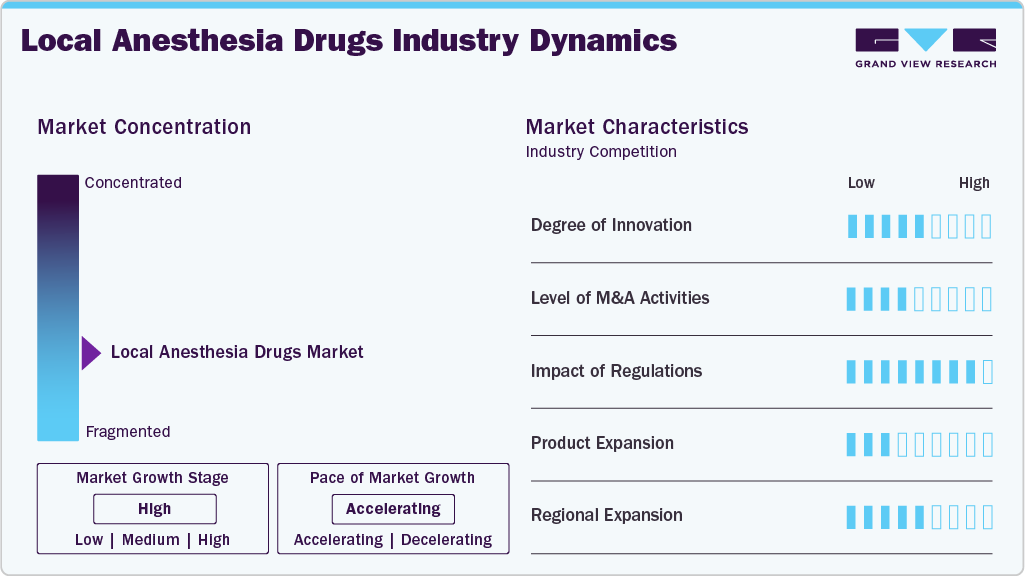

Market Concentration & Characteristics

The local anesthesia drugs industry shows gradual innovation, primarily centered around refining pharmacokinetics, enhancing safety profiles, and broadening clinical applications. Advances in amide-based agents like bupivacaine and ropivacaine include long-acting formulations aimed at reducing postoperative opioid use. Liposomal delivery systems are gaining traction to extend anesthetic effects while minimizing systemic toxicity. Surface anesthetics such as benzocaine are being reformulated for faster onset and reduced hypersensitivity. Research efforts focus on improving lidocaine derivatives to support rapid-onset anesthesia for outpatient and dental procedures. Combination therapies and multi-drug delivery formats are also under development to address complex surgical and trauma-related pain scenarios.

New players face significant entry barriers due to the established dominance of large pharmaceutical firms with broad anesthetic portfolios. Rigorous clinical trial requirements to demonstrate efficacy, safety, and low systemic absorption slow the introduction of novel agents. Market incumbents such as Pfizer Inc., Teva, and Johnson & Johnson benefit from strong brand loyalty, clinical trust, and longstanding hospital contracts. Manufacturing injectable anesthetics like chloroprocaine demands high precision and sterile production environments, elevating operational complexity. Regulatory scrutiny around local anesthetic systemic toxicity (LAST) and rare adverse reactions necessitates a robust pharmacovigilance infrastructure. In addition, intense pricing pressure from generics limits profitability margins for new entrants.

Regulatory agencies such as the FDA and EMA enforce stringent approval processes for local anesthesia drugs, particularly for new routes of administration and novel formulations. Injectable anesthetics must demonstrate predictable onset, duration, and minimal systemic exposure across diverse patient populations. Recent focus on reducing perioperative opioid use has increased the regulatory appeal of long-acting anesthetics, leading to some expedited review pathways. Post-marketing surveillance remains mandatory, especially for hospital-administered drugs, to monitor rare complications like methemoglobinemia and allergic reactions. HTAs play a role in market access, especially for higher-cost formulations claiming reduced recovery times or hospital stays. Regulatory guidance also promotes the development of preservative-free and pediatric-friendly formulations to expand patient accessibility.

Substitutes in the local anesthesia space are typically limited to systemic analgesics or general anesthesia, which carry higher risks and costs in certain procedures. Over-the-counter topical products like benzocaine gels may serve as alternatives for minor skin procedures or dental applications, but lack the depth of effect needed for surgical interventions. NSAIDs and acetaminophen are occasionally used for postoperative pain but do not match the efficacy of targeted nerve blocks. Surface anesthetics continue to be refined in non-invasive procedures, though they do not fully replace injectables. In high-stakes surgeries, local anesthesia is preferred to avoid systemic side effects, particularly in elderly or cardiovascular-compromised patients. Consequently, clinically validated local anesthetics maintain a competitive edge in surgical and emergency care.

Key companies such as Sanofi, AstraZeneca, and Novartis are expanding their local anesthesia portfolios into rapidly urbanizing regions, including Asia Pacific, Latin America, and Eastern Europe. Increased surgical volumes, enhanced access to healthcare facilities, and growth in outpatient procedures drive local demand. Strategies include technology transfers to regional production sites and partnerships with domestic distributors to streamline market entry. Adapting pricing strategies and regulatory alignment with the regional health ministry further supports commercialization efforts. Retail and hospital pharmacies remain the main distribution channels, with injectables typically limited to institutional use and surface anesthetics more accessible through OTC sales. These global expansions allow firms to mitigate risk from stagnant markets in North America and Western Europe while addressing unmet needs in surgical pain management.

Drug Insights

Lidocaine dominated the market with a 28.88% share in 2024, driven by its extensive use in injectable and topical anesthetic formulations. Its widespread adoption is linked to its proven efficacy in managing acute and chronic pain across diverse medical conditions. A January 2023 study published by the National Center for Biotechnology Information (NCBI) demonstrated that lidocaine transdermal patches effectively reduced pain intensity in neuropathic cancer patients already undergoing opioid treatment. These findings support its integration into multimodal pain management plans to enhance outcomes without increasing opioid dependence. As a local anesthetic, lidocaine plays a crucial role in minimizing the side effects associated with prolonged opioid use. Its clinical versatility continues to support its dominant position in the anesthetics market.

Ropivacaine is projected to experience the fastest CAGR over the forecast period. This trend is largely driven by its advantageous safety characteristics and extended duration of action when compared to other local anesthetics such as bupivacaine and prilocaine. A 2024 study published in the World Journal of Hernia and Abdominal Wall Surgery highlighted the effectiveness and safety of ropivacaine in open inguinal hernia repair procedures. Its integration into multimodal pain management protocols further enhances its clinical value. These factors are anticipated to boost its adoption in surgical settings significantly. As a result, ropivacaine is likely to play a key role in expanding the local anesthetic drugs market.

Application Insights

Injectable accounted for the largest revenue share of 59.26% in 2024, driven by their growing use in surgical procedures and advancements in drug delivery technologies. Innovations such as computer-assisted anesthetic delivery and vibrotactile devices are enhancing the precision and effectiveness of injectable treatments. A notable example is Exparel, highlighted in a 2023 Drug Delivery journal article, which utilizes DepoFoam technology to deliver bupivacaine through a liposome-based injectable suspension. Further boosting the market, PK Med received FDA approval in February 2024 to begin Phase II trials for PKM-01, an injectable gout therapy combining controlled-release colchicine with ropivacaine. Such developments underscore the increasing preference for injectable formulations in clinical settings. As a result, the segment is expected to maintain strong momentum in the coming years.

Surface anesthetics are projected to witness the fastest CAGR over the forecast period. This growth is driven by progress in drug delivery technologies that enhance their effectiveness. These agents are commonly applied to numb the skin, underlying tissues, and peripheral nerves during surgical or minimally invasive procedures. Compared to conventional formulations such as lidocaine and bupivacaine, surface anesthetics now offer better potency, faster onset, and extended duration of action. They are frequently utilized in ophthalmic procedures, such as cataract surgeries. The expanding range of clinical uses has significantly contributed to the rising demand for surface anesthetics in the local anesthesia industry.

Regional Insights

North America local anesthesia drugs industry held the largest global revenue share of 35.41% in 2024 due to the high prevalence of surgical procedures and dental treatments. The advanced healthcare infrastructure and widespread access to modern medical facilities strengthen market dominance. Increasing patient awareness about pain management options fuels demand for regional local anesthetics. The presence of major pharmaceutical companies investing in product innovation supports continuous market growth. Rising incidence of chronic conditions requiring minor surgeries adds to the steady market expansion. Technological advancements in anesthesia delivery systems enhance safety and efficacy, attracting more healthcare providers to adopt local anesthetic drugs.

U.S. Local Anesthesia Drugs Market Trends

The U.S. local anesthesia drugs industry leads the North American market by substantially adopting minimally invasive surgical techniques. Hospitals and outpatient surgical centers use local anesthesia drugs extensively for various procedures, driving sales. Strong research and development efforts contribute to frequent launches of novel local anesthetic formulations. High disposable income among patients facilitates access to elective surgeries requiring local anesthesia. The presence of skilled healthcare professionals ensures efficient and safe administration of these drugs. Increasing dental procedures, especially cosmetic dentistry, also boost local anesthetic drug consumption.

Europe Local Anesthesia Drugs Market Trends

The Europe local anesthesia drugs industry is growing steadily due to the increasing number of surgical and dental procedures across member countries. Healthcare facilities focus on enhancing patient comfort and minimizing procedural pain, encouraging local anesthetic use. Rising geriatric population leads to more age-related medical interventions requiring effective anesthesia solutions. The pharmaceutical sector actively develops new drug delivery methods to improve anesthesia's onset time and duration. Availability of advanced diagnostics allows for precise application of local anesthetics, reducing complications. Growing medical tourism in certain European countries further supports market expansion.

The local anesthesia drugs industry in the UK experiences steady growth in local anesthesia drug consumption, driven by a rise in outpatient surgeries. Increasing awareness of pain management among patients and healthcare providers supports market demand. The expanding cosmetic and dental surgery segments require efficient local anesthetics for better patient outcomes. Technological advances in drug formulations offer longer-lasting anesthesia with fewer side effects. Hospitals and clinics continue to prioritize safe anesthesia practices to reduce risks. Investment in continuing medical education helps professionals stay updated on the latest anesthetic techniques.

Germany local anesthesia drugs industry holds a significant share of the European market due to its robust healthcare system. Frequent use of regional anesthesia in orthopedic and dental procedures sustains market demand. Research institutions in Germany focus on developing improved anesthetic agents with faster onset and lower toxicity. High patient care standards encourage the adoption of safer and more effective anesthesia options. The country’s aging population increases the volume of surgeries requiring local anesthetics. Rising preference for outpatient and day-care surgeries further boosts market growth.

The local anesthesia drugs industry in France is stable with steady growth supported by a high volume of outpatient surgeries. Advanced healthcare infrastructure provides widespread access to quality anesthetic drugs. The increasing geriatric population requires frequent medical procedures, benefiting from effective local anesthesia. Continuous innovation in drug formulations improves safety and duration of anesthesia effects. Rising dental and cosmetic surgery rates enhance the consumption of local anesthetics. Healthcare providers emphasize pain management as a key component of patient care standards.

Asia Pacific Local Anesthesia Drugs Market Trends

Asia Pacific local anesthesia drugs industry is anticipated to witness the fastest CAGR over the forecast period due to rapid urbanization and improvements in healthcare infrastructure. Increasing accessibility to healthcare services in emerging economies drives demand for anesthesia drugs. Growing awareness of pain management options encourages more patients to undergo surgical and dental procedures. Expanding medical tourism hubs in the region will create additional market opportunities. Rising investments by pharmaceutical companies in product development enhance the availability of advanced anesthetics. The expanding middle-class population increases disposable income for elective procedures requiring local anesthesia.

The local anesthesia drugs industry in Japan is growing steadily, driven by a high volume of surgical and dental procedures. The country’s advanced healthcare system ensures widespread access to quality anesthesia services. An aging population requiring frequent medical interventions supports sustained demand. Continuous improvements in drug formulations provide safer and longer-lasting anesthesia effects. Healthcare providers prioritize patient comfort and pain reduction during procedures. Strong collaboration between research institutes and pharmaceutical companies fosters innovation in anesthesia products.

China local anesthesia drugs industry shows remarkable growth due to increased healthcare spending and the modernization of medical facilities. The surge in elective and cosmetic surgeries contributes to the rising demand for local anesthetic drugs. Adoption of minimally invasive surgical techniques supports the need for effective pain control. Pharmaceutical companies focus on launching innovative anesthetic formulations tailored for the Chinese population. Rising patient awareness about anesthesia safety fuels market expansion. Expansion of dental care services in urban areas further boosts the use of local anesthetics.

Latin America Local Anesthesia Drugs Market Trends

Latin America local anesthesia drugs industry is expanding due to increasing healthcare expenditure and improving medical infrastructure. Growing awareness about pain management and rising demand for dental and cosmetic procedures drive market growth. Urbanization contributes to better access to healthcare services, including minor surgeries using local anesthetics. Pharmaceutical companies are investing in new product launches tailored to regional needs. The increasing prevalence of chronic diseases requires more surgical interventions, supporting anesthetic drug demand. Expansion of private healthcare facilities also enhances the availability of advanced anesthesia solutions.

Brazil local anesthesia drugs industry leads the Latin American market with significant growth in the use of local anesthesia drugs, driven by rising dental care and cosmetic surgery procedures. The country’s expanding middle class has higher disposable income, enabling access to elective surgeries requiring local anesthetics. An increasing number of outpatient surgical centers supports the widespread use of regional anesthesia. Research and development in the pharmaceutical sector focus on improving drug formulations for better efficacy and safety. Patient preference for minimally invasive procedures encourages demand for local anesthetics. Strong healthcare infrastructure in major cities facilitates market penetration.

Middle East & Africa Local Anesthesia Drugs Market Trends

The MEA local anesthesia drugs industry experiences growth attributed to increased fungal infections associated with immunocompromised patients and tropical climate conditions. Demand for azoles and polyenes is strong across hospital and retail pharmacy channels. Rising urbanization and improved healthcare services drive better diagnosis and treatment rates. Pharmaceutical firms focus on expanding product portfolios and distribution networks. The growing prevalence of dermatophytosis among the population fuels market expansion. Investments in healthcare infrastructure promote access to advanced local anesthesia drugs.

The local anesthesia drugs industry in Saudi Arabia is expanding as healthcare infrastructure develops and surgical procedures increase in volume. The prevalence of chronic diseases necessitates more medical interventions that use local anesthetics. Cosmetic and dental surgery sectors show rapid growth, fueling drug demand. Improvements in healthcare delivery systems ensure better availability of anesthesia products. Patients increasingly opt for outpatient procedures where local anesthesia is preferred. International pharmaceutical firms actively introduce innovative anesthetic formulations tailored for the region.

Key Local Anesthesia Drugs Company Insights

Some key companies in the global local anesthesia drugs industry include Johnson & Johnson Services, Inc., Pfizer Inc.; AstraZeneca, Novartis AG and Teva Pharmaceutical Industries Ltd. The players in the market are focusing on increasing their customer base to gain a competitive edge in the market. Moreover, key players are undertaking several strategic initiatives, such as mergers & acquisitions and partnerships with other major companies.

Key Local Anesthesia Drugs Companies:

The following are the leading companies in the local anesthesia drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc

- Pfizer Inc.

- AstraZeneca plc

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Sanofi S.A.

- Merck & Co., Inc.

- Aspen Holdings

- Viatris Inc.

Recent Developments

-

In April 2025, Johnson & Johnson acquired Intra-Cellular Therapies, Inc. for USD 14.6 billion, paying USD 132 per share in cash. The deal strengthened Johnson & Johnson's neuroscience portfolio, adding Caplyta for schizophrenia and bipolar depression and pipeline drug ITI-1284. The acquisition was financed through cash and debt, with closure expected later in the year pending approvals.

-

In April 2024, Baxter International Inc. broadened its pharmaceuticals portfolio by introducing five new products in the United States. Among these launches was a ready-to-use, single-dose infusion bag of ropivacaine hydrochloride injection, designed to deliver local or regional anesthesia for surgical procedures and acute pain relief.

-

In May 2021, Pfizer reported that Hospira, Inc. issued a nationwide recall of one lot of 0.5% Bupivacaine Hydrochloride Injection due to a glass particle found during stability testing. The recalled lot (12919002) was distributed between September 13 and October 4, 2023, and expired on April 1, 2026. No adverse events were reported at the time of the recall.

Local Anesthesia Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.28 billion

Revenue forecast in 2030

USD 5.13 billion

Growth rate

CAGR of 3.70% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Johnson & Johnson Services, Inc.; Pfizer Inc; AstraZeneca; Novartis AG; Teva Pharmaceutical Industries Ltd.; GSK plc; Sanofi; Merck & Co., Inc.; Aspen Holdings; Viatris Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

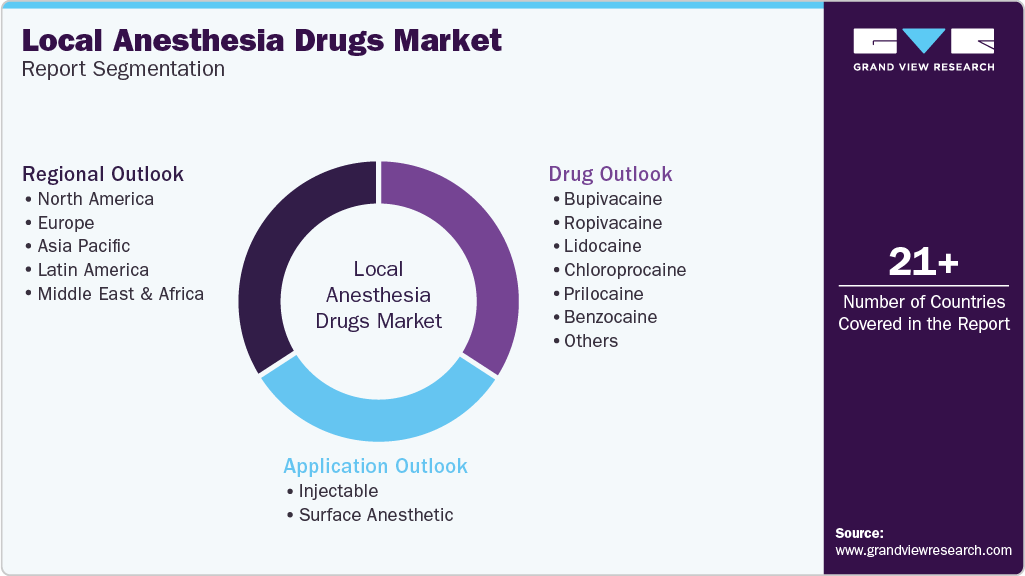

Global Local Anesthesia Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global local anesthesia drugs market report based on drug, application, and region:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Bupivacaine

-

Ropivacaine

-

Lidocaine

-

Chloroprocaine

-

Prilocaine

-

Benzocaine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable

-

Surface Anesthetic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.