- Home

- »

- Medical Devices

- »

-

Cosmetic Surgery & Procedure Market, Industry Report 2033GVR Report cover

![Cosmetic Surgery And Procedure Market Size, Share & Trends Report]()

Cosmetic Surgery And Procedure Market (2025 - 2033) Size, Share & Trends Analysis Report By Procedure Type (Invasive, Non-invasive), By Gender (Male, Female), By Age Group (13-29, 30-54, 55 & Above), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-517-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cosmetic Surgery & Procedure Market Summary

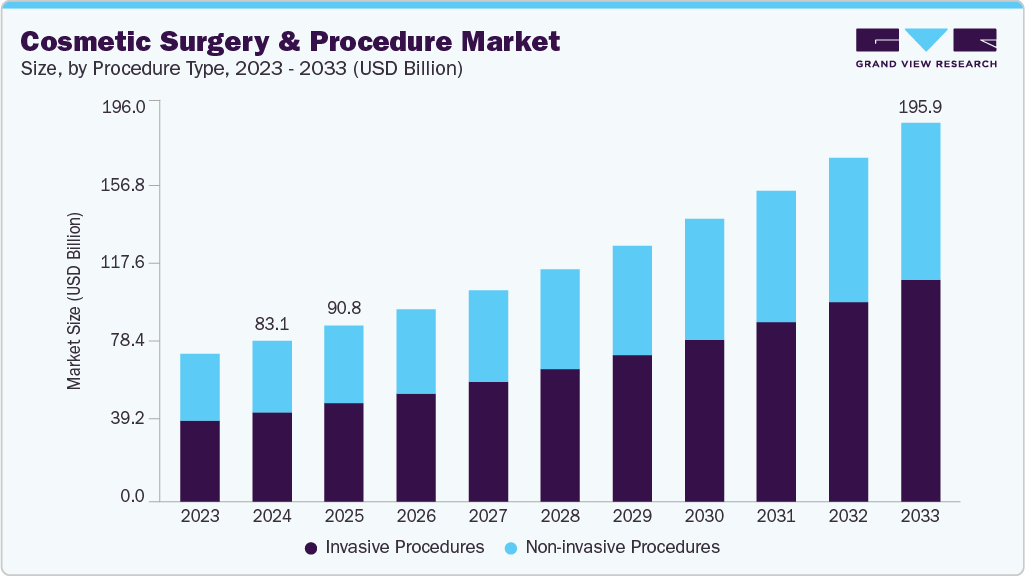

The global cosmetic surgery and procedure market size was estimated at USD 83.07 billion in 2024 and is expected to reach USD 195.87 billion by 2033, growing at a CAGR of 10.09% from 2025 to 2033. The industry is driven by a growing awareness of aesthetic treatments, spurred by social media and celebrity culture, which has led to a higher demand for procedures to enhance physical appearance.

Key Market Trends & Insights

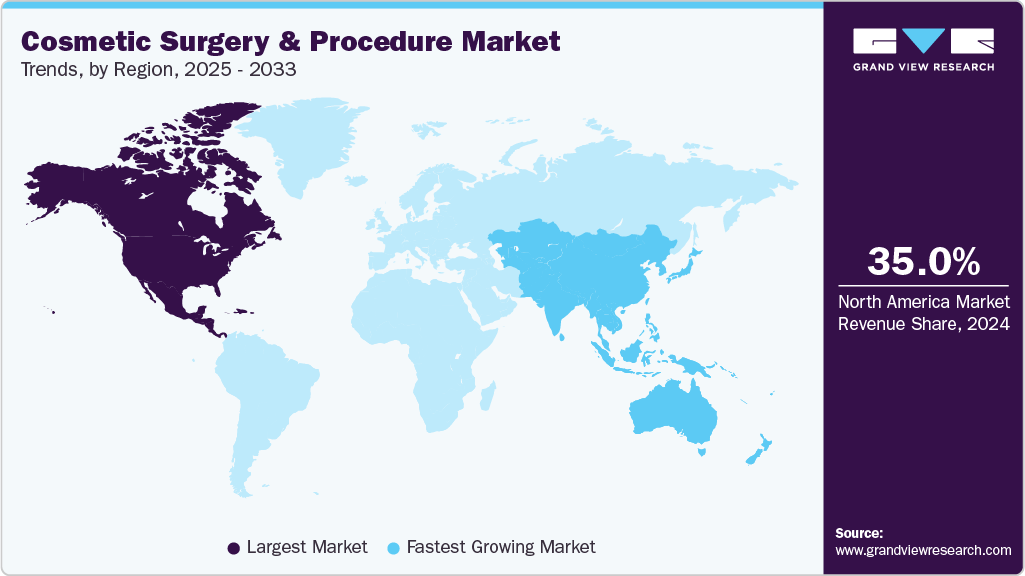

- North America cosmetic surgery and procedure market dominated the global market in 2024 and accounted for the largest revenue share of around 35.0%.

- The U.S. cosmetic surgery and procedure market is anticipated to register the fastest growth rate during the forecast period.

- In terms of procedure type, the non-invasive procedures segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 83.07 Billion

- 2033 Projected Market Size: USD 195.87 Billion

- CAGR (2025-2033): 10.09%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, technological advancements, such as minimally invasive techniques, laser treatments, and injectables such as Botox and dermal fillers, have made cosmetic procedures safer and more accessible, encouraging more individuals to consider them. In addition, the increase in healthcare tourism and the availability of well-trained specialists in emerging markets also support the expansion of this market.

Increasing Adoption of Minimally Invasive Treatments

The growing popularity of minimally invasive treatments is a significant factor driving the expansion of the aesthetic medicine market. Currently, patients prefer solutions that provide noticeable aesthetic improvements without the need for surgery, general anesthesia, or lengthy recovery periods. Minimally invasive treatments, such as botulinum toxin injections, dermal fillers, laser therapies, and non-surgical skin tightening procedures, effectively address common cosmetic concerns such as wrinkles, fine lines, and volume loss, while minimizing discomfort and downtime.

The convenience, lower costs, and improved safety profiles of these procedures make them particularly appealing to a diverse demographic, including younger individuals and working professionals. In addition, advancements in technology have improved treatment outcomes, leading to greater acceptance and repeat usage. The increasing availability of trained practitioners and aesthetic clinics further supports the widespread adoption of these treatments, contributing to the overall growth of the market.

Examples highlighting how the preference for minimally invasive solutions is reshaping patient expectations and fueling the market's steady growth:

Treatment Type

Key Benefits

Popular Use Cases

Botulinum Toxin (Botox)

Quick procedure, minimal pain

Wrinkle reduction, facial contouring

Dermal Fillers

Immediate results, low risk

Lip enhancement, volume restoration

Laser Therapy

Non-invasive, precise

Skin resurfacing, pigmentation removal

Cryolipolysis (Fat-freezing)

No surgery, outpatient

Body contouring, fat reduction

Radiofrequency Skin Tightening

Safe, gradual improvement

Skin laxity, facial rejuvenation

The table below presents a comprehensive overview of cosmetic surgery procedures performed in 2024 compared to 2023, highlighting the year-over-year percentage change. The data is categorized into three major areas: breast, body, and face procedures-covering both popular and specialized treatments.

2024 Cosmetic Surgery Procedures

Procedure Category

Procedure

2024

2023

% Change (2024 vs 2023)

Breast

Breast augmentation

306,196

304,181

1%

Breast implant removals

41,271

41,115

0%

Breast lift (mastopexy)

153,616

153,600

0%

Breast reduction

76,734

76,031

1%

Breast reduction in males (gynecomastia)

26,430

25,888

2%

Body

Abdominoplasty (tummy tuck)

171,064

170,110

1%

Buttock augmentation with fat grafting

29,466

29,383

0%

Buttock implants

1,245

1,234

1%

Buttock lift

7,954

7,748

3%

Labiaplasty

10,827

10,631

2%

Liposuction

349,728

347,782

1%

Lower body lift

10,957

10,947

0%

Thigh lift

9,914

9,600

3%

Upper arm lift (brachioplasty)

23,527

23,058

2%

Face

Buccal fat pad removal

4,903

4,866

1%

Cheek implant (malar augmentation)

9,130

8,825

3%

Chin augmentation (mentoplasty)

5,529

5,484

1%

Ear surgery (otoplasty)

4,825

4,817

0%

Eyelid surgery (blepharoplasty)

120,755

120,747

0%

Facelift (rhytidectomy)

79,058

78,482

1%

Facial fat grafting

34,260

34,216

0%

Forehead lift

13,621

13,518

1%

Liposuction (submental/chin)

24,000

23,667

1%

Neck lift

22,445

22,007

2%

Nose reshaping (rhinoplasty)

48,423

47,307

2%

Total

All procedures

1,585,878

1,575,244

1%

Source: Secondary Research, 2024 Plastic Surgery Statistics Report

Rising Disposable Income and Standard of Living

As economies expand and disposable incomes rise, individuals are more likely to invest in luxury services such as cosmetic surgeries, which are considered elective and non-essential. This trend is especially evident among middle-class and affluent people who can afford treatments such as Botox, fillers, and liposuction. Economic growth enhances access to healthcare services, advanced technology, and skilled professionals, making these procedures safer and more effective. Overall, increased financial flexibility leads to a greater willingness to pursue aesthetic enhancements that align with personal and societal beauty standards.

Disposable Income per Capita 2023

Country

Gross Disposable Income Per Capita 2023

U.S.

USD 62,722

Switzerland

USD 47,124

Germany

USD 42,417

Australia

USD 41,194

UK

USD 36,077

Canada

USD 35,561

France

USD 35,001

Italy

USD 34,703

Sweden

USD 31,882

Spain

USD 31,193

Denmark

USD 30,101

Japan

USD 28,040

South Korea

USD 27,304

Mexico

USD 17,736

South Africa

USD 10,058

Source: World Population Review

Growing Awareness and Acceptance of Cosmetic Procedures

Over the past decade, enhanced access to information through digital platforms, social media, and influencer culture has been crucial in educating people about the benefits, safety, and effectiveness of various aesthetic treatments. As a result, cosmetic procedures are no longer seen as taboo or exclusive luxuries for celebrities and the elite; they have become mainstream options for individuals seeking self-improvement. Moreover, campaigns by healthcare providers, medical conferences, and patient testimonials have helped demystify these treatments, reducing anxiety and dispelling misconceptions associated with surgery and injectable therapies. With societal norms shifting toward body positivity and self-care, more people are inclined to explore procedures that enhance their confidence, improve their appearance, and address age-related concerns.

In July 2025, Covalo launched a campaign that redefines beauty through longevity, focusing on science-backed skincare for long-term health. It features innovative ingredients such as PrimalHyal UltraReverse and PRO-LONGEVIA, which promote cellular repair and rejuvenation instead of just masking aging signs. This aligns with the pro-aging trend that embraces aging naturally and emphasizes skin resilience. Covalo aims to lead in sustainable, evidence-based beauty practices, appealing to consumers seeking holistic skincare solutions.

Growing Medical Tourism and Regional Hubs

The growing trend of medical tourism and the emergence of regional hubs for cosmetic surgery are significant factors driving the expansion of the cosmetic surgery and procedure market. Many individuals are seeking affordable, high-quality, and specialized treatments that may be unavailable or prohibitively expensive in their home countries. Regions such as Southeast Asia, the Middle East, and parts of Europe have become popular destinations due to their state-of-the-art medical facilities, skilled surgeons, and competitive pricing.

For instance, in April 2025, Azurite Medical and Wellness introduced an innovative luxury surgical retreat concept. This unique approach combines top-notch cosmetic surgery with exclusive, all-inclusive recovery experiences in Thailand. Founded by entrepreneur Trina Eliassen, the company offers comprehensive surgical packages that include pre-operative nutritional coaching, private transportation, luxury accommodations, personalized meal plans, and 24/7 nursing care. The duration of these packages ranges from 9 to 28 days, depending on the complexity of the procedure. Remarkably, these services are offered at a fraction of the cost compared to similar procedures in Western countries, with some packages priced up to 75% less than those in Australia.

Medical tourism is on the rise as advanced healthcare hubs offer comprehensive care packages that include accommodation and post-operative support. Both governments and private providers promote this trend through marketing and simplified visa processes. Consequently, more patients, especially middle-aged and affluent individuals seeking affordability and expertise, are traveling abroad for cosmetic enhancements, driving growth in the industry.

Increasing Influence of Social Media and Changing Beauty Standards

The growing influence of social media and evolving beauty standards have become significant factors driving the cosmetic surgery and procedure market. With platforms such as Instagram, TikTok, and YouTube shaping perceptions of beauty, individuals are more exposed than ever to curated images, celebrity transformations, and beauty trends emphasizing flawless skin, symmetrical features, and youthful appearances. This constant visual stimulation has increased self-awareness and a desire to emulate these idealized looks. Hence, more people are seeking cosmetic enhancements such as dermal fillers, Botox, lip augmentation, and facial contouring to align their appearance with current beauty trends.

Social media also provides easy access to information, treatment reviews, and expert advice, which helps reduce fears and encourages more individuals to consider aesthetic procedures. Moreover, influencers and beauty content creators openly sharing their experiences have normalized cosmetic interventions, making them more acceptable and desirable, especially among younger generations who are highly active online. This cultural shift, fueled by the widespread reach of social media, continues to expand the cosmetic surgery market by promoting aspirational beauty ideals and making treatments more accessible and socially endorsed.

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The industry is fragmented, with many services and end users entering the market. There is a high degree of innovation, moderate level of merger & acquisition activities, high impact of regulations, and market expansion of industry.

The industry is experiencing a high degree of innovation. In September 2024, Allergan Aesthetics launched BOTOX Cosmetic (onabotulinumtoxinA) in China to treat masseter muscle prominence (MMP) in adults, marking the first neurotoxin approval for this condition by the China National Medical Product Administration. MMP, caused by genetic factors or habits such as teeth clenching, results in a broader lower face and can affect self-esteem. This move reflects Allergan's dedication to expanding BOTOX applications and plans for regulatory approvals in other markets for facial contouring solutions.

"Masseter prominence is among the top aesthetics concerns for my patients and the broader Asian population, and there is a significant unmet need for minimally invasive treatment options for patients interested in addressing their lower face shape," said Professor Sun Jiaming, lead clinical study investigator and Director of the Plastic Surgery Department of Union Hospital Affiliated to Tongji Medical College of Huazhong University of Science and Technology. "The approval of BOTOX Cosmetic offers an effective option delivered in a single treatment dosed every six months that relaxes masseter muscles and helps patients achieve a slimmer and more defined jawline."

Several key players are actively engaging in partnerships & collaborations to promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in May 2025, Smile Source and ACT Dental announced their merger to form a united entity focused on empowering independent dental practices across the U.S. This strategic partnership combines ACT Dental's expertise in coaching and education with Smile Source's extensive network of over 1,000 private practice dentists. The aim is to provide enhanced support, resources, and a sense of community for dentists who seek to thrive in an evolving healthcare landscape.

The industry is regulated by a variety of guidelines designed to ensure patient safety, quality of care, and ethical business practices. These regulations differ by country and region but generally include requirements for licensing and accreditation of clinics and practitioners, mandatory training and certification, informed consent procedures, and strict advertising and promotion guidelines. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and national health authorities enforce standards related to medical devices, pharmaceuticals, and procedural safety. In addition, these policies cover patient data protection, post-operative care, and the reporting of adverse events.

In February 2025, Apollo Hospitals launched its first Cosmetic Clinic in North India, signifying a major expansion of its healthcare services. The new facility aims to provide advanced cosmetic surgery and aesthetic procedures all under one roof, ensuring high standards of safety, technology, and patient care. Focusing on both non-invasive treatments and surgical interventions, the clinic is designed to meet the increasing demand for cosmetic enhancements in the region. With its reputation for quality healthcare, experienced specialists, and strict adherence to regulatory norms, Apollo Hospitals is committed to delivering safe and effective cosmetic solutions to patients in North India.

Procedure Type Insights

Based on procedure type, the non-invasive segment held a significant share of 55.34% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This growth is primarily driven due to the increasing consumer preference for aesthetic treatments that avoid the risks, downtime, and costs associated with traditional surgical interventions. Advances in medical technology, including laser treatments, injectables, cryolipolysis, and radiofrequency devices, have made these procedures safer, more effective, and widely accessible. Furthermore, rising awareness of self-care, beauty standards influenced by social media, and a desire for natural-looking results have contributed to the growing demand. An aging population seeking minimally invasive solutions to address signs of aging, along with improvements in pain management and faster recovery times, has made non-invasive treatments more appealing.

The invasive segment is expected to grow to a significant CAGR during the forecast period. This growth is attributed to the advancements in technology, such as minimally invasive surgical techniques, improved anesthesia, and enhanced safety protocols, which have made these procedures more accessible and less intimidating. Urbanization and changing lifestyles also contribute to greater awareness and acceptance of cosmetic procedures. Furthermore, improvements in healthcare infrastructure, better postoperative care, and expanding insurance coverage in certain regions also support market growth. Together, these factors are driving the invasive segment of the cosmetic surgery market, making it a key area of growth globally.

Gender Insights

Based on gender, the female segment held a significant share of 85.52% in 2024, driven by the growing societal focus on physical appearance, which is amplified by social media, celebrity culture, and beauty standards that promote a youthful and flawless look. Many women are seeking treatments to boost their self-confidence, reverse signs of aging, or correct perceived imperfections. This has led to an increase in elective procedures. Furthermore, developments in minimally invasive techniques and safer anesthesia have made cosmetic treatments more accessible, less painful, and associated with shorter recovery times. These improvements encourage more women to consider these procedures.

The male segment is expected to grow at the highest CAGR during the forecast period. There is a growing societal acceptance and changing perceptions regarding male grooming and appearance. This shift has reduced stigma, encouraging more men to pursue aesthetic enhancements. Moreover, there is an increasing awareness of self-care, wellness, leading men to invest in treatments that boost their confidence and self-esteem. Furthermore, professional demands, particularly in image-conscious industries such as entertainment, fashion, and corporate sectors, have contributed to the rise in cosmetic interventions among men who want to maintain a youthful, fit, and energetic appearance.

Age Group Insights

Based on age group, the 30-54 segment held a significant share of 43.85% in 2024. This demographic is often at a point in their lives where career advancement, social visibility, and personal confidence are crucial. Hence, many invest in their appearance to maintain a youthful and professional image. In addition, this age group experiences the natural effects of aging, such as wrinkles, fine lines, and skin laxity. These changes encourage people to seek procedures such as Botox, fillers, and facelifts to achieve a refreshed look.

The 13-29 segment is expected to grow to the highest CAGR during the forecast period due to the increasing influence of social media platforms, where beauty standards and appearance-focused content significantly impact self-image and increase the desire for enhancements. Young people are frequently exposed to curated images and filters, which heighten body consciousness and encourage the pursuit of aesthetic improvements. Furthermore, psychological factors such as a desire to improve confidence, manage acne scars, or address perceived flaws motivate many young individuals to seek cosmetic solutions.

Regional Insights

North America cosmetic surgery and procedure market dominated with the largest revenue share in 2024. Technological advancements have greatly improved the safety, effectiveness, and accessibility of both surgical and non-surgical treatments. Innovations such as 3D imaging, virtual consultations, and AI-driven personalized treatment plans have led to better patient outcomes and increased satisfaction. In addition, societal acceptance of cosmetic procedures has grown, driven by media portrayals, celebrity endorsements, and the normalization of aesthetic enhancements. Social media platforms have played a crucial role in driving beauty standards and increasing demand for procedures such as Botox, dermal fillers, and body contouring.Z

U.S. Cosmetic Surgery & Procedure Market Trends

The cosmetic surgery and procedure market in the U.S.is experiencing significant growth, driven by the growing strategic initiatives. In July 2024, Dr. Lee B. Daniel, founder of Aesthetic Plastic Surgery, The Spa Side, and The Guy Side in Eugene, Oregon, announced a partnership with Cosmetic Physician Partners (CPP), a leading network of physician-led medical aesthetic clinics in the U.S. This collaboration aims to raise the standards of aesthetic medicine by merging Dr. Daniel's dedication to personalized, high-quality patient care with CPP's operational expertise and support. Dr. Daniel emphasized that this partnership would enable his team to concentrate more on patient outcomes. It will ensure that staff members are well-trained and up to date with the latest scientific advancements, thereby enhancing their treatment capabilities and providing a more efficient, patient-centered approach.

Asia Pacific Cosmetic Surgery & Procedure Market Trends

The cosmetic surgery and procedure market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The expansion of cosmetic surgery facilities in developing nations, rising healthcare costs, an aging population, and an increased emphasis on aesthetics are some of the major drivers of the regional industry. The demand for cosmetic procedures in China has increased recently due to the country's growth in obesity rate, which has resulted in people opting for more extreme weight-loss techniques such as liposuction.

Japan cosmetic surgery and procedure marketheld a significant revenue share in 2024. In January 2023, establishment Labs launched its innovative Mia Femtech breast enhancement procedure in Japan, partnering with Seishin Plastic and Aesthetic Surgery Clinic as its first collaborator. Seishin is a prominent network of 10 premium plastic surgery clinics and is expected to offer the Mia procedure at its flagship clinic in Roppongi and its newest location in Ginza. This collaboration marks a strategic entry into the Asian market, with plans to expand Mia Femtech offerings to additional clinics in Japan and Europe. This partnership highlights Establishment Labs' commitment to redefining breast aesthetics through innovative, patient-centric solutions.

Europe Cosmetic Surgery & Procedure Market Trends

The cosmetic surgery and procedure market in Europe is expected to witness high growth due to the growing popularity of aesthetic procedures, influenced by social media and celebrity culture, which has led to greater acceptance and demand for cosmetic enhancements. Economic factors also play a crucial role; rising disposable incomes and economic stability across Europe allow more individuals to afford cosmetic surgeries. Furthermore, the aging population is seeking anti-aging treatments such as facelifts and Botox, contributing to the market's expansion.

The UK cosmetic surgery and procedure market held a significant revenue share in 2024. In August 2025, the UK government partnered with TikTok to address the growing trend of "cosmetic tourism," where residents seek cheaper procedures abroad, often leading to complications that strain the NHS. The campaign features influencers such as Midwife Marley and Doc Tally to educate the public on the risks of overseas treatments, emphasizing the importance of consulting UK professionals and verifying clinic credentials. It also advises securing travel insurance and being cautious of social media promotions, aiming to protect consumers and reduce NHS costs from treatment complications.

Latin America Cosmetic Surgery & Procedure Market Trends

The cosmetic surgery and procedure market in Latin America is anticipated to grow significantly due to the rise of medical tourism. It has positioned Latin America as a destination for individuals seeking affordable cosmetic procedures without compromising on quality, attracting patients from North America and beyond. The increasing acceptance of aesthetic treatments among both men and women, coupled with a growing middle class and improved access to cosmetic services, further contributes to the market's expansion.

Argentina cosmetic surgery and procedure marketheld a significant share in 2024. Argentina's recent decision to eliminate export duties on over 4,000 manufactured goods, including cosmetics and personal care products, has significant implications for Argentina's cosmetic surgery and procedures market. This policy shift enhances Argentina's competitiveness in the global beauty industry by reducing trade costs for local manufacturers, making it easier for them to access international markets. As a result, Argentina is positioned to become a more attractive sourcing hub for global beauty brands, potentially diverting some production away from Brazil.

Middle East & Africa Cosmetic Surgery And Procedure Market Trends

The cosmetic surgery and procedure market in the Middle East & Africa is anticipated to grow significantly. Innovative funding is revolutionizing the Middle East to become a hub for healthcare progress and access. Between 2021 and 2023, the Middle East saw about USD 103 million worth of healthcare investment added to a worldwide total of USD 48 billion. Governments, particularly Saudi Arabia and the UAE, are heavily investing in digital health and infrastructure. Private sector investors, including the Abu Dhabi Investment Authority, are making large bets too, with significant commitments to medical tech. The growth of health tech startups worth more than USD 1.5 billion indicates the direction toward new-age solutions. These projects are improving healthcare infrastructure and driving the uptake of cutting-edge technologies such as AI, giving rise to a viable healthcare ecosystem in the region.

Saudi Arabiacosmetic surgery and procedure market is driven by evolving beauty standards, increased disposable income, and advancements in medical technology. Moreover, in April 2025, Saudi Arabia launched 28 healthcare projects in Riyadh, as part of its Vision 2030 initiative. These projects aim to enhance healthcare infrastructure and services, significantly impacting the cosmetic surgery market. With advanced technologies and state-of-the-art facilities, demand for specialized services, including cosmetic procedures, is expected to rise. The increased private sector investment and promotion of medical tourism will position Saudi Arabia as a regional hub for aesthetic treatments, benefiting both local and international patients.

Key Cosmetic Surgery And Procedure Companies Insights

Key players operating in the cosmetic surgery and procedure market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Cosmetic Surgery And Procedure Companies:

The following are the leading companies in the cosmetic surgery & procedure market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Cynosure

- Evolus Inc.

- RevanceGalderma

- Lumenis

- Solta Medical

- Syneron Candela

- Alma Laser

- Airsculpt Technologies, Inc.

- The Esthetic Clinics

Recent Developments

-

In September 2025, Brown Gibbons Lang & Company (BGL) announced strategic partnership between The Cosmetic Surgery Group (CSG) and Olympus Cosmetic Group, with the goal of expanding CSG's reach and operational capabilities. This collaboration marks Olympus' entry into its sixth state, expanding its footprint into the Midwest and providing CSG with enhanced resources to support its growth.

-

In October 2024, Morales Plastic Surgery launched an innovative procedure called the Corset Contour. This groundbreaking advancement in body contouring aims to create a more defined, hourglass-shaped waistline. The technique involves reshaping and repositioning the lower ribs specifically ribs 11 and 12 using ultrasound-guided precision, all without the need for rib removal. By carefully adjusting the shape and position of these floating ribs, the procedure results in a slimmer, more proportionate waistline while preserving the structural integrity of the ribs.

Cosmetic Surgery And Procedure Market Report Scope

Report Attribute

Details

Market size in 2025

USD 90.81 billion

Revenue forecast in 2033

USD 195.87 billion

Growth rate

CAGR of 10.09% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, gender, age group, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Cynosure; Evolus Inc.; RevanceGalderma; Lumenis; Solta Medical; Syneron Candela; Alma Laser; Airsculpt Technologies, Inc.; The Esthetic Clinics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cosmetic Surgery & Procedure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cosmetic surgery and procedure market report based on procedure type, gender, age group, and region:

-

Procedure Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Invasive Procedures

-

Breast Augmentation

-

Liposuction

-

Nose Reshaping

-

Eyelid Surgery

-

Tummy Tuck

-

Others

-

-

Non-invasive Procedures

-

Botox Injections

-

Soft Tissue Fillers

-

Chemical Peel

-

Laser Hair Removal

-

Microdermabrasion

-

Others

-

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

13-29

-

30-54

-

55 and above

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.