- Home

- »

- Communications Infrastructure

- »

-

Location Intelligence Market Size, Share, Trends Report 2030GVR Report cover

![Location Intelligence Market Size, Share & Trends Report]()

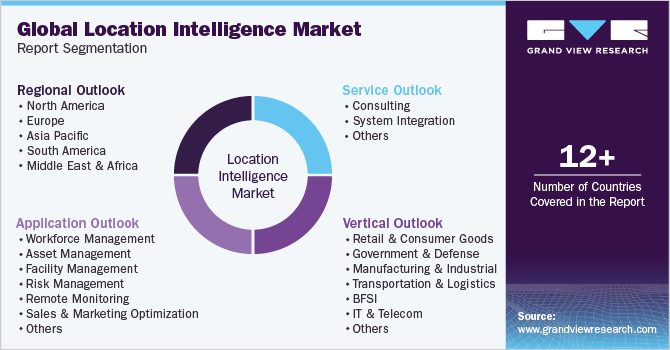

Location Intelligence Market Size, Share & Trends Analysis Report By Component, By Application (Workforce Management, Asset Management), By Location Type, By Deployment, By Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-401-7

- Number of Report Pages: 153

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2022 - 2030

- Industry: Technology

Location Intelligence Market Size & Trends

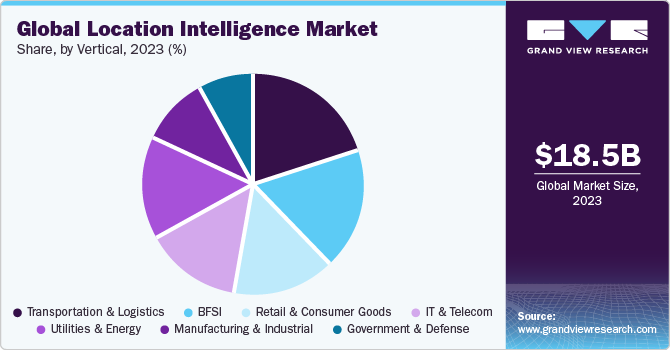

The global location intelligence market size was valued at USD 18.52 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 15.6% from 2023 to 2030. The industry is mainly driven by the growing penetration of smart devices and increasing investments in IoT and network services as it facilitates smarter applications and better network connectivity. The COVID-19 pandemic resulted in the increased adoption of location intelligence solutions to manage the changing business scenario as it helps businesses to analyze, map, and share data in terms of the location of their customers.

In addition, healthcare and government organizations implemented location-based solutions for vaccination drives to carry out successful COVID-19 public health strategies. Furthermore, the growing surge of asset management across industry verticals is expected to boost the demand for location intelligence over the forecast period. Location intelligence is a subpart of the IoT technology that makes businesses identify consumer trends, consumer behavior, and different information about niche markets to deliver better services and products, for better decisions and mitigate the uncertainties in the market.

Further benefits of location intelligence include risk management, predictive analytics, real-time tracking of trends and patterns, and streamlining the operations and services of companies. Moreover, rising digitalization has enabled organizations to collect user information, which is anticipated to spur industry growth further. Enhancing customer experience is one of the significant factors influencing the growing adoption of location intelligence. Increasing investments in infrastructure and the adoption of new technologies have resulted in several business-to-business (B2B) and business-to-consumer (B2C) applications, such as sales & marketing, customer management, and facility management.

The excessive use of mobile applications and enhanced location-sharing capabilities of mobile devices have revolutionized the way services are being delivered to the end-users. Location intelligence and in-store location technology enhance the customer experience by helping them locate the products they need quickly and efficiently. Furthermore, increasing investments in IoT is another crucial factor that has propelled industry growth. IoT is a rapidly growing network of internet-enabled gadgets, which can capture a vast amount of data with moving & fixed sensors. The processing of this captured data in real time is crucial for modern analytics in public or private services. The key driving force behind the adoption of location intelligence software is a growing awareness of the significance that spatial insights provide to business decision-making. Businesses across industries use location intelligence software to achieve a competitive advantage by optimizing operational processes and improving consumer experiences.

Spatial analysis or location intelligence allows placing these data within the critical context of ‘where’ and allows tying this extensive information together. Various industries, such as automotive, transportation & logistics, manufacturing, and healthcare, are discovering the potential uses of location data. Location intelligence offers real-time data processing by helping businesses analyze and identify hidden patterns, relationships, and unique insights that drive better decision-making. Although the industry is anticipated to record steady growth due to the benefits above, lack of awareness, expertise, and other operational challenges and data privacy concerns are expected to challenge growth.

Consumers are hesitant about technologies that could lead to personal information and safety-related risks. This factor also hinders market growth. Thus, manufacturers and service providers must implement appropriate security measures to assure the safety and privacy of a customer’s data. The changing scenario of how businesses are conducted across the globe has urged companies across various industries to adopt the technology. Location technology is one of the significant additions to business operations post-pandemic—the use of location analytics aids enterprises in coping with the uncertainties induced by the pandemic. As a result, the market experienced an elevated demand in 2020 and is expected to grow significantly over the forecast period.

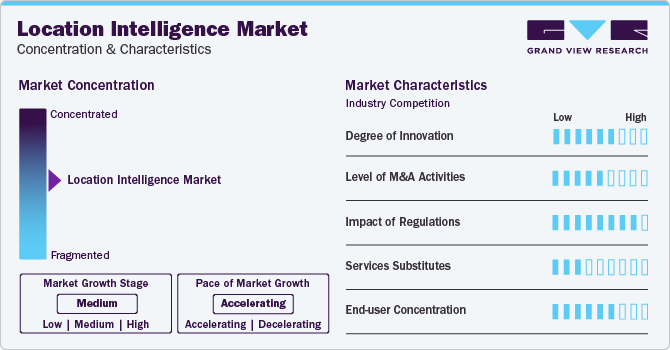

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The demand for current information has resulted in the incorporation of real-time location intelligence tools. This trend impacts domains such as logistics, transportation, and emergency services, wherein timely information is essential to decision-making processes. AI and machine learning are being integrated into location intelligence platforms to improve predictive analytics, automate data interpretation, and discover complicated patterns in spatial data. The location intelligence market has grown significantly in the past several years, driven by the incorporation of spatial data analytics into a variety of businesses. Businesses across industries, including telecom, retail, healthcare, logistics, and smart cities, are adopting location intelligence trackers to gain a competitive advantage.

To maintain their competitive advantage, key players are investing heavily in developing new products. It involves incorporating advanced technologies such as artificial intelligence, machine learning, and real-time analytics into Location Intelligence solutions. Leading players are investing in advanced visualization technologies such as 3D mapping, Augmented Reality, and Virtual Reality. These technologies improve the presentation of spatial data, resulting in more immersive and insightful user experiences.

The Location Intelligence as a Service (LIaaS) concept is gaining popularity, providing businesses with scalable and cost-effective access to location intelligence. Companies that use this model increase their competitiveness by catering to a larger consumer base.In the projected period location intelligence systems will provide users with more control over their location data. Smart contracts supported by blockchain will streamline services based on location.The future will witness seamless interaction between humans and artificial intelligence in the process of decision-making. Location intelligence platforms will offer augmented insights, enabling decision-makers with a complete understanding of spatial data and improving the quality of strategic decisions across diverse sectors by providinglive locations and live maps.

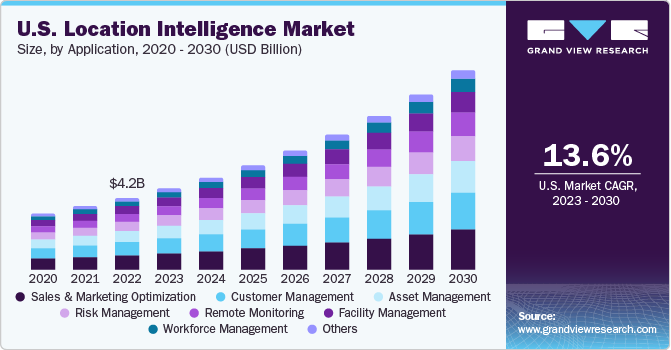

Application Insights

The sales & marketing optimization application segment dominated the global industry in 2022 and accounted for the maximum share of more than 20% of the overall revenue. The segment is expected to continue its dominance from 2023 to 2030. On the basis of applications, the industry has been segmented into asset management, facility management, workforce management, risk management, sales & marketing optimization, remote monitoring, customer management, and others. Location intelligence tools reduce the complexity of the sales and marketing processes by gathering enough relevant data for the marketing campaigns and predicting the outcomes.

Furthermore, location intelligence helps continuously monitor and manage inventory, energy utilization, and temperature in the facility remotely. It can also help the management trace and monitor the workforce in indoor and outdoor environments. Location intelligence enables companies to measure occupancy in rooms, estimate maintenance cycles for assets, monitor activities of employees, and manage staff remotely. Thus, increasing operational efficiency with the help of location intelligence tools is expected to increase the demand for the market.

Service Insights

Based on services, the global industry has been further categorized into consulting, system integration, and others. The system integration category segment dominated the industry and accounted for the maximum share of more than 45% of the overall revenue. The segment growth is driven by the rising need to integrate new data sources with the increasing penetration of IoT and increasing location-based data. System integrators help many industries integrate their assets, business processes, and products with location intelligence to collect information that can be further studied to gather meaningful insights. Moreover, system integrators have expertise in understanding and working with spatial and non-spatial data businesses, open data sources, or commercial data providers.

For instance, Korem company has complete experience in building solutions that integrate data from loads of databases and systems, breaking data warehouses while accelerating the business insights that appear from geospatial solutions. The consulting segment is estimated to grow at a rate of around 16% from 2023 to 2030. This service helps identify and prioritize several business use cases where location intelligence provides significant value. Location intelligence assists in consulting the companies to collect, analyze, and examine relevant information and offer a more precise opinion to other organizations. Various end-use industries take advice to integrate location intelligence tools with their business activities from IoT consulting and location intelligence firms.

Vertical Insights

The transportation & logistics segment dominated the industry in 2022 and accounted for the largest share of more than 19% of the overall revenue. Location intelligence helps in understanding the distance and drive times between destinations with precise geographic coordinates and the current routable road network, which increased its usage in the transportation & logistics segment. Also, it offers various routes to reach the goal with drive time and real-time traffic analysis. It also provides road blockages and actual daily closures on the site. Location Intelligence solves retail challenges, including store sales predictions, drive time & distance profiling, network optimization & scenario modeling, site selection planning, franchise area evaluation & overlap analysis, sales & market share analysis, market size & demand estimation by location/product, territory optimization & planning, and customer segmentation & profiling.

The retail and consumer goods segment is expected to record the fastest growth rate over the forecast period. The reason for the segment growth is solving retail challenges, including store sales predictions, drive time & distance profiling, network optimization & scenario modeling, site selection planning, franchise area evaluation & overlap analysis, sales & market share analysis, market size & demand estimation by location/product, territory optimization & planning, and customer segmentation & profiling. Location intelligence offers a framework that utilizes site selection techniques, such as sophisticated modeling and the “kicking-the-dirt’ technique. It helps find the right site for a distribution center, store, and service center.

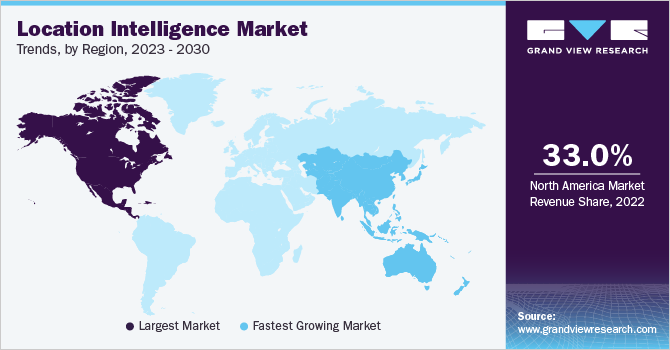

Regional Insights

North America dominated the industry in 2022 and accounted for the largest share of more than 33% of the overall revenue. It is expected to grow steadily from 2023 to 2030. The penetration of smartphones in North America was around 80% in 2022 and is steadily increasing. Thus, the regional market is expected to grow at a steady pace. Similarly, the market in Europe is also expected to record healthy growth, driven by rapid business intelligence analytics and geographic information systems technology expansion. Asia Pacific is expected to register the fastest CAGR from 2023 to 2030 owing to the growing number of smartphone users, increasing number of service providers, enhancement of networking technologies, and rise in the popularity of social media.

Europe Location Intelligence Market

The Europe location intelligence market was estimated to occupy a market share nearly of 27% in 2022. The growth of the Europe location intelligence market can be attributed to the increased adoption of digital technology, IoT device popularity, location-based services, and IoT and connected device investment, among others.

U.K. Location Intelligence Market

The U.K. location intelligence market was expected to occupy around 19% of the Europe location intelligence market in 2022. The growth of the location intelligence market in the U.K. can be attributed to factors such as increased strategic initiatives, which have enabled the companies in the country to offer advanced solutions. For instance, January 2023, precisely announced the acquisition Transverse. Following the acquisition of Transerve, Precisely's suite of data integrity software and data also now incorporates additional SaaS location intelligence capabilities, enabling clients to leverage location data and analytics and gain new business insights without specialized knowledge or experience.

Germany Location Intelligence Market

The location intelligence market in Germany was estimated to be valued at USD 0.93 billion in 2022. The growth of the location intelligence market in Germany can be attributed to factors such as increased adoption of digital technologies, rising smartphone penetration, and the increasing popularity of IoT. Moreover, the use of location intelligence utilizes geospatial data, which would help businesses to make better decisions.

France Location Intelligence Market

The France location intelligence market was estimated to hold a market share of around 13% in 2022 in the Europe location intelligence market. The growth of the location intelligence market in France can be attributed to factors such as the increasing affordability of smartphones, the growing availability of high-speed mobile internet, and the rising popularity of mobile apps are driving the growth in the number of smartphone users. Moreover, Infrastructure developments, along with the increasing use of smart devices and connected devices, are contributing factors expected to boost the market for location intelligence.

Asia Pacific Location Intelligence Market

Several businesses and service providers are introducing new products and services to increase their share in developing markets. In the APAC region, governments and municipal corporations are improving their services by analyzing information about asset locations to deliver a better standard of living and ease citizens’ workload. Thus, companies are opting for location intelligence tools for improving asset management to make operations more efficient, which is expected to increase the demand for location intelligence. Therefore, the regional market is expected to grow at the fastest higher CAGR from 2023 to 2030.

China Location Intelligence Market

The China location intelligence market is expected to hold a market share of around 32% in 2022. The growth of the location intelligence market in China can be attributed to high mobile device penetration, growing need for location data for targeted marketing campaigns, increasing adoption of location-based technologies, high demand for better customer service experience, and rising importance of location data in several industries, among others.

Japan Location Intelligence Market

The Japan location intelligence market was estimated to be around USD 0.81 billion in 2022. The growth of the location intelligence market in Japan can be attributed to factors such as rising investment in IT infrastructure development, growing adoption of advanced location intelligence technologies, and increasing urbanization, among others.

India Location Intelligence Market

The India location intelligence market was expected to hold around 18% in 2022. The growth of the location intelligence market in India can be attributed to increasing purchasing power, improving digital infrastructure, increasing adoption of location-based technologies, growing need for real-time data and insights, and improved decision-making capabilities through location insights.

Middle East & Africa Location Intelligence Market

The Middle East & Africa location intelligence market was estimated to hold around 5% of the market share in 2022. The growth of this region in the location intelligence market can be attributed to factors such as rapid urbanization, improving digital infrastructure, expansion activities carried out by several key companies in the market, and advancement in location technologies, among others.

Saudi Arabia Location Intelligence Market

The location intelligence market in Saudi Arabia was expected to have a high growth rate, which can be attributed to factors such as the increasing use of GPS devices, rising usage of location applications, improved organizational need to gain competitive advantage, and growing need for real-time data and insights.

Key Location Intelligence Company Insights

Some of the key players operating in the market include IBM Corporation, Microsoft and Qualcomm Technologies, Inc., among others.

-

IBM corporation is a technology-based service provider.IBM Corporation’s Location-Based Services are the core of the company's Location Intelligence offering. This suite includes several geospatial products designed to meet a variety of business requirements. IBM Corporation enhances Location Intelligence with the power of Artificial Intelligence. Businesses can gain greater insights into their spatial data by integrating AI-driven algorithms.

-

Microsoft is a multinational technological conglomerate, which offers services in the software, hardware, and cloud computing sectors. The company’s product offerings include Microsoft Power BI, a business analytics application, effortlessly integrates Location Intelligence. Power BI Location Analytics allows users to examine and analyze spatial data, resulting in an improved awareness of business performance. Azure Maps, a complete geospatial platform, is one of Microsoft's location intelligence services. Azure Maps offers a suite of location-based services and application programming interfaces (APIs) that allow developers to easily incorporate maps, navigation, and traffic data into applications.

-

Qualcomm Technologies, Inc. is a developer of wireless telecommunication services. It offers system software and integrated circuits for wireless products and mobile devices.Qualcomm's location intelligence capabilities are based on its Snapdragon mobile platforms. These integrated systems-on-chip (SoCs) power a broad spectrum of components, including smartphones and IoT devices. Qualcomm's Snapdragon Location Studio includes a full set of location-based services and tools. It enables developers to construct unique applications using accurate information related to location, geographic boundaries, and motion-based context-awareness.

LocationIQ, Trimble, Inc., and Foursquare. are some of the emerging market participants in the location intelligence market.

-

Foursquare is a cloud-based location technology firm. The company's product portfolio includes Foursquare City Guide, a consumer-facing app that assists users in discovering and experiencing new regions based on their interests and location. Foursquare uses its huge location intelligence capabilities to provide solutions for a variety of industries such as telecommunication, retail and real estate analytics, and developer tools for incorporating location intelligence into applications.

-

LocationIQ provides creative solutions that make use of location data. The company's product offerings include geocoding, mapping, and navigation. LocationIQ specializes in geocoding and reverse geocoding services, which enable businesses to convert addresses to geographic coordinates and vice versa. The fundamental technology serves as the foundation for a variety of location-based applications and services.

Key Location Intelligence Companies:

The following are the leading companies in the location intelligence market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these location intelligence companies are analyzed to map the supply network.

- Autodesk, Inc.

- Bosch Software Innovations GmbH

- ESRI

- Foursquare.

- HERE Technologies

- IBM Corporation

- LocationIQ

- MDA Corp.

- Microsoft

- Pitney Bowes, Inc.

- Comp11

- Qualcomm Technologies, Inc.

- Supermap Software Co., Ltd.

- Tibco Software, Inc.

- Trimble, Inc.

- Wireless Logic

Recent Developments

-

In July 2023, Trimble announced the launch of Trimble Terra Office add-in. This innovative solution is a function of Trimble's TerraOffice suite of desktop solutions for the incorporation of TerraFlex data collection software with the GIS systems of record, which highlights the crucial role of location intelligence capabilities.

-

In June 2023, Qualcomm Technologies, Inc. announced the launch of advanced IoT-driven satellite solutions for seamless remote monitoring & asset tracking. These solutions include the Qualcomm 9205S Modem and Qualcomm 212S Modem chipsets with satellite functionalities.

-

In May 2023, Autodesk unveiled Autodesk Forma for cloud-driven next-gen building design. With a continued expansion of capabilities, Autodesk Forma has the potential to further boost location intelligence in the architecture, engineering, construction, and operations industry by streamlining automation, data, and machine learning to optimize the design process and accomplish sustainable results.

-

In March 2023, HERE Technologies announced a multi-year strategic collaboration with Iteris. This strategy was aimed at combining a broader suite of HERE’s location-based services with ClearMobility Platform of Iteris, comprising HERE Maps, HERE Traffic Products, and HERE platform services.

-

In March 2023, Autodesk announced its plans to acquire The Wild with the intent to leverage Extended Reality (XR) technology in the architecture, engineering, and construction (AEC) industry. The XR technology in the AEC arena represents a proliferating trend in the location intelligence market, presenting innovative ways for professionals to interact with project models, enhance efficiency, and attain better outcomes in projects.

Location Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.52 billion

Revenue forecast in 2030

USD 51.26 billion

Growth Rate

CAGR of 15.6% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, location type, deployment, organization, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Autodesk, Inc.; Bosch Software Innovations GmbH; ESRI; Foursquare.; HERE Technologies; IBM Corporation; LocationIQ; MDA Corp.; Microsoft; Pitney Bowes, Inc.; Qualcomm Technologies, Inc.; Supermap Software Co., Ltd.; Tibco Software, Inc.; Trimble, Inc.; Wireless Logic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Location Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global location intelligence market report based on component, application, location type, deployment, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Workforce Management

-

Asset Management

-

Facility Management

-

Risk Management

-

Remote Monitoring

-

Sales & Marketing Optimization

-

Customer Management

-

Others

-

-

Location Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & Consumer Goods

-

Government & Defense

-

Manufacturing & Industrial

-

Transportation & Logistics

-

BFSI

-

IT & Telecom

-

Utilities & Energy

-

Media & Entertainment

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global location intelligence market size was estimated at USD 16,095.5 million in 2022 and is expected to reach USD 18.52 billion in 2023.

b. The global location intelligence market is expected to grow at a compound annual growth rate of 15.6% from 2023 to 2030 to reach USD 51.25 billion by 2030.

b. North America dominated the location intelligence market with a share of 33.0% in 2022. This is attributable to the robust IT infrastructure, better connectivity, and rapid adoption of new technologies in the region.

b. Some key players operating in the location intelligence market include Pitney Bowes Inc.; Apple Inc.; Qualcomm Technologies; Wireless Logic; HERE Technologies; Bosch Software Innovations GmbH; and Trimble Inc.

b. Key factors that are driving the location intelligence market growth include growth in portable navigation devices, web-mapping services, and smartphone applications.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Location Intelligence Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Location Intelligence Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Location Intelligence Market: Component Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Location Intelligence Market: Component Movement Analysis, USD Million, 2023 & 2030

4.3. Software

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Service

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.2. Consulting

4.4.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.3. System Integration

4.4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.4. Others

4.4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Location Intelligence Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Location Intelligence Market: Application Movement Analysis, USD Million, 2023 & 2030

5.3. Workforce Management

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Asset Management

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Facility Management

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Risk Management

5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Remote Monitoring

5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. Sales & Marketing Optimization

5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

5.9. Customer Management

5.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

5.10. Others

5.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Location Intelligence Market: Location Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Location Intelligence Market: Location Type Movement Analysis, USD Million, 2023 & 2030

6.3. Indoor

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Outdoor

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Location Intelligence Market: Deployment Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Location Intelligence Market: Deployment Movement Analysis, USD Million, 2023 & 2030

7.3. Cloud

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. On-premise

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Location Intelligence Market: Vertical Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Location Intelligence Market: Vertical Movement Analysis, USD Million, 2023 & 2030

8.3. Retail & Consumer Goods

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4. Government & Defense

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5. Manufacturing & Industrial

8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Transportation & Logistics

8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7. BFSI

8.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

8.8. IT & Telecom

8.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

8.9. Utilities & Energy

8.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

8.10. Media & Entertainment

8.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Location Intelligence Market: Regional Estimates & Trend Analysis

9.1. Location Intelligence Market Share by Region, 2023 & 2030 (USD Million)

9.2. North America

9.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.2.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.2.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.2.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.2.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.2.7. U.S.

9.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.2.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.2.7.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.2.7.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.2.7.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.2.8. Canada

9.2.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.2.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.2.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.2.8.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.2.8.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.2.8.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.3. Europe

9.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.3.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.3.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.3.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.3.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.3.7. U.K.

9.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.3.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.3.7.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.3.7.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.3.7.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.3.8. Germany

9.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.3.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.3.8.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.3.8.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.3.8.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.3.9. France

9.3.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.3.9.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.3.9.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.3.9.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.3.9.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.3.9.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.4. Asia Pacific

9.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.4.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.4.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.4.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.4.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.4.7. China

9.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.4.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.4.7.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.4.7.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.4.7.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.4.8. India

9.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.4.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.4.8.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.4.8.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.4.8.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.4.9. Japan

9.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.9.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.4.9.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.4.9.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.4.9.5. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.4.9.6. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.4.10. Australia

9.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.10.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.4.10.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.4.10.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.4.10.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.4.10.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.4.11. South Korea

9.4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4.11.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.4.11.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.4.11.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.4.11.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.4.11.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.5. Latin America

9.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.5.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.5.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.5.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.5.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.5.7. Brazil

9.5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.5.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.5.7.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.5.7.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.5.7.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.5.8. Mexico

9.5.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.5.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.5.8.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.5.8.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.5.8.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.6. Middle East & Africa

9.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.6.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.6.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.6.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.6.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.6.7. UAE

9.6.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.7.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.6.7.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.6.7.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.6.7.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.6.7.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.6.8. Saudi Arabia

9.6.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.8.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.6.8.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.6.8.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.6.8.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.6.8.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

9.6.9. South Africa

9.6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6.9.2. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Million)

9.6.9.3. Market Size Estimates and Forecasts by Application, 2018 - 2030 (USD Million)

9.6.9.4. Market Size Estimates and Forecasts by Location Type, 2018 - 2030 (USD Million)

9.6.9.5. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Million)

9.6.9.6. Market Size Estimates and Forecasts by Vertical, 2018 - 2030 (USD Million)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Share Analysis

10.4. Company Heat Map Analysis

10.5. Strategy Mapping

10.5.1. Expansion

10.5.2. Mergers & Acquisition

10.5.3. Partnerships & Collaborations

10.5.4. New Product Launches

10.5.5. Research And Development

10.6. Company Profiles

10.6.1. Autodesk, Inc.

10.6.1.1. Participant’s Overview

10.6.1.2. Financial Performance

10.6.1.3. Product Benchmarking

10.6.1.4. Recent Developments

10.6.2. Bosch Software Innovations GmbH

10.6.2.1. Participant’s Overview

10.6.2.2. Financial Performance

10.6.2.3. Product Benchmarking

10.6.2.4. Recent Developments

10.6.3. ESRI

10.6.3.1. Participant’s Overview

10.6.3.2. Financial Performance

10.6.3.3. Product Benchmarking

10.6.3.4. Recent Developments

10.6.4. Foursquare.

10.6.4.1. Participant’s Overview

10.6.4.2. Financial Performance

10.6.4.3. Product Benchmarking

10.6.4.4. Recent Developments

10.6.5. HERE Technologies

10.6.5.1. Participant’s Overview

10.6.5.2. Financial Performance

10.6.5.3. Product Benchmarking

10.6.5.4. Recent Developments

10.6.6. IBM Corporation

10.6.6.1. Participant’s Overview

10.6.6.2. Financial Performance

10.6.6.3. Product Benchmarking

10.6.6.4. Recent Developments

10.6.7. LocationIQ

10.6.7.1. Participant’s Overview

10.6.7.2. Financial Performance

10.6.7.3. Product Benchmarking

10.6.7.4. Recent Developments

10.6.8. MDA Corp.

10.6.8.1. Participant’s Overview

10.6.8.2. Financial Performance

10.6.8.3. Product Benchmarking

10.6.8.4. Recent Developments

10.6.9. Microsoft

10.6.9.1. Participant’s Overview

10.6.9.2. Financial Performance

10.6.9.3. Product Benchmarking

10.6.9.4. Recent Developments

10.6.10. Pitney Bowes, Inc.

10.6.10.1. Participant’s Overview

10.6.10.2. Financial Performance

10.6.10.3. Product Benchmarking

10.6.10.4. Recent Developments

10.6.11. Qualcomm Technologies, Inc.

10.6.11.1. Participant’s Overview

10.6.11.2. Financial Performance

10.6.11.3. Product Benchmarking

10.6.11.4. Recent Developments

10.6.12. Supermap Software Co., Ltd.

10.6.12.1. Participant’s Overview

10.6.12.2. Financial Performance

10.6.12.3. Product Benchmarking

10.6.12.4. Recent Developments

10.6.13. Tibco Software, Inc.

10.6.13.1. Participant’s Overview

10.6.13.2. Financial Performance

10.6.13.3. Product Benchmarking

10.6.13.4. Recent Developments

10.6.14. Trimble, Inc.

10.6.14.1. Participant’s Overview

10.6.14.2. Financial Performance

10.6.14.3. Product Benchmarking

10.6.14.4. Recent Developments

10.6.15. Wireless Logic

10.6.15.1. Participant’s Overview

10.6.15.2. Financial Performance

10.6.15.3. Product Benchmarking

10.6.15.4. Recent Developments

List of Tables

Table 1 Location Intelligence market 2018 - 2030 (USD Million)

Table 2 Global location intelligence market estimates and forecasts by region, 2018 - 2030 (USD Million)

Table 3 Global location intelligence market estimates and forecasts by component, 2018 - 2030 (USD Million)

Table 4 Global location intelligence market estimates and forecasts by application 2018 - 2030 (USD Million)

Table 5 Global location intelligence market estimates and forecasts by location type, 2018 - 2030 (USD Million)

Table 6 Global location intelligence market estimates and forecasts by deployment, 2018 - 2030 (USD Million)

Table 7 Global location intelligence market estimates and forecasts by vertical, 2018 - 2030 (USD Million)

Table 8 Component market by region, 2018 - 2030 (USD Million)

Table 9 Software market by region, 2018 - 2030 (USD Million)

Table 10 Service market by region, 2018 - 2030 (USD Million)

Table 11 Consulting market by region, 2018 - 2030 (USD Million)

Table 12 System Integration market by region, 2018 - 2030 (USD Million)

Table 13 Others market by region, 2018 - 2030 (USD Million)

Table 14 Application market by region, 2018 - 2030 (USD Million)

Table 15 Workforce Management market by region, 2018 - 2030 (USD Million)

Table 16 Asset Management market by region, 2018 - 2030 (USD Million)

Table 17 Facility Management market by region, 2018 - 2030 (USD Million)

Table 18 Risk Management market by region, 2018 - 2030 (USD Million)

Table 19 Remote Monitoring market by region, 2018 - 2030 (USD Million)

Table 20 Sales & Marketing Optimization market by region, 2018 - 2030 (USD Million)

Table 21 Customer Management market by region, 2018 - 2030 (USD Million)

Table 22 Others market by region, 2018 - 2030 (USD Million)

Table 23 Location Type market by region, 2018 - 2030 (USD Million)

Table 24 Indoor market by region, 2018 - 2030 (USD Million)

Table 25 Outdoor market by region, 2018 - 2030 (USD Million)

Table 26 Deployment market by region, 2018 - 2030 (USD Million)

Table 27 Cloud market by region, 2018 - 2030 (USD Million)

Table 28 On-premise market by region, 2018 - 2030 (USD Million)

Table 29 Vertical market by region, 2018 - 2030 (USD Million)

Table 30 Retail & Consumer Goods market by region, 2018 - 2030 (USD Million)

Table 31 Government & Defense market by region, 2018 - 2030 (USD Million)

Table 32 Manufacturing & Industrial market by region, 2018 - 2030 (USD Million)

Table 33 Transportation & Logistics market by region, 2018 - 2030 (USD Million)

Table 34 BFSI market by region, 2018 - 2030 (USD Million)

Table 35 IT & Telecom market by region, 2018 - 2030 (USD Million)

Table 36 Utilities & Energy market by region, 2018 - 2030 (USD Million)

Table 37 Media & Entertainment market by region, 2018 - 2030 (USD Million)

Table 38 North America location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 39 North America location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 40 North America location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 41 North America location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 42 North America location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 43 U.S. location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 44 U.S. location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 45 U.S. location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 46 U.S. location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 47 U.S. location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 48 Canada location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 49 Canada location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 50 Canada location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 51 Canada location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 52 Canada location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 53 Europe location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 54 Europe location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 55 Europe location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 56 Europe location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 57 Europe location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 58 U.K. location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 59 U.K. location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 60 U.K. location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 61 U.K. location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 62 U.K. location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 63 Germany location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 64 Germany location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 65 Germany location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 66 Germany location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 67 Germany location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 68 France location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 69 France location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 70 France location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 71 France location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 72 France location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 73 Asia Pacific location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 74 Asia Pacific location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 75 Asia Pacific location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 76 Asia Pacific location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 77 Asia Pacific location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 78 China location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 79 China location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 80 China location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 81 China location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 82 China location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 83 India location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 84 India location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 85 India location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 86 India location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 87 India location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 88 Japan location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 89 Japan location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 90 Japan location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 91 Japan location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 92 Japan location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 93 Australia location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 94 Australia location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 95 Australia location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 96 Australia location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 97 Australia location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 98 South Korea location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 99 South Korea location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 100 South Korea location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 101 South Korea location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 102 South Korea location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 103 Latin America location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 104 Latin America location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 105 Latin America location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 106 Latin America location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 107 Latin America location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 108 Brazil location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 109 Brazil location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 110 Brazil location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 111 Brazil location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 112 Brazil location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 113 Mexico location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 114 Mexico location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 115 Mexico location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 116 Mexico location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 117 Mexico location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 118 MEA location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 119 MEA location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 120 MEA location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 121 MEA location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 122 MEA location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 123 UAE location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 124 UAE location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 125 UAE location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 126 UAE location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 127 UAE location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 128 Saudi Arabia location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 129 Saudi Arabia location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 130 Saudi Arabia location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 131 Saudi Arabia location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 132 Saudi Arabia location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

Table 133 South Africa location intelligence market, by component, 2018 - 2030 (Revenue, USD Million)

Table 134 South Africa location intelligence market, by application, 2018 - 2030 (Revenue, USD Million)

Table 135 South Africa location intelligence market, by location type, 2018 - 2030 (Revenue, USD Million)

Table 136 South Africa location intelligence market, by deployment, 2018 - 2030 (Revenue, USD Million)

Table 137 South Africa location intelligence market, by vertical, 2018 - 2030 (Revenue, USD Million)

List of Figures

Fig. 1 Location Intelligence Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 Location Intelligence Market: Industry Value Chain Analysis

Fig. 12 Location Intelligence Market: Market Dynamics

Fig. 13 Location Intelligence Market: PORTER’s Analysis

Fig. 14 Location Intelligence Market: PESTEL Analysis

Fig. 15 Location Intelligence Market Share by Component, 2023 & 2030 (USD Billion)

Fig. 16 Location Intelligence Market, by Component: Market Share, 2023 & 2030

Fig. 17 Software Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Service Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Consulting Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 System Integration Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Location Intelligence Market Share by Application, 2023 & 2030 (USD Billion)

Fig. 23 Location Intelligence Market, by Application: Market Share, 2023 & 2030

Fig. 24 Workforce Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Asset Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Facility Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 27 Risk Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 28 Remote Monitoring Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Sales & Marketing Optimization Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Customer Management Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Others Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 32 Location Intelligence Market Share by Location Type, 2023 & 2030 (USD Billion)

Fig. 33 Location Intelligence Market, by Location Type: Market Share, 2023 & 2030

Fig. 34 Indoor Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 Outdoor Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 36 Location Intelligence Market Share by Deployment, 2023 & 2030 (USD Billion)

Fig. 37 Location Intelligence Market, by Deployment: Market Share, 2023 & 2030

Fig. 38 Cloud Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 On-premise Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Retail & Consumer Goods Location Intelligence Market Share by Vertical, 2023 & 2030 (USD Billion)

Fig. 41 Location Intelligence Market, by Vertical: Market Share, 2023 & 2030

Fig. 42 Government & Defense Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Manufacturing & Industrial Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 44 Transportation & Logistics Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 45 BFSI Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 46 IT & Telecom Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 47 Utilities & Energy Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 48 Media & Entertainment Market Estimates & Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 49 Regional Marketplace: Key Takeaways

Fig. 50 North America Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 U.S. Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 52 Canada Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 53 Europe Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 U.K. Location Intelligence Market Estimates and Forecasts, 2018 - 2030) (USD Billion)

Fig. 55 Germany Location Intelligence Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 56 France Location Intelligence Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 57 Asia Pacific Location Intelligence Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 58 China Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 Japan Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 India Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 South Korea Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 62 Australia Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Latin America Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 64 Brazil Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 65 Mexico Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 MEA Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 67 Saudi Arabia Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 68 UAE Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 69 South Africa Location Intelligence Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 70 Key Company Categorization

Fig. 71 Company Market Positioning

Fig. 72 Key Company Market Share Analysis, 2023

Fig. 73 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Location Intelligence Component Outlook (Revenue, USD Million, 2018 - 2030)

- Software

- Service

- Consulting

- System Integration

- Others

- Location Intelligence Application Outlook (Revenue, USD Million, 2018 - 2030)

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- Workforce Management

- Location Intelligence Location Type Outlook (Revenue, USD Million, 2018 - 2030)

- Indoor

- Outdoor

- Location Intelligence Deployment Outlook (Revenue, USD Million, 2018 - 2030)

- On-premise

- Cloud

- Location Intelligence Vertical Outlook (Revenue, USD Million, 2018 - 2030)

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- Location Intelligence Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- North America Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- North America Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- North America Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- North America Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- U.S.

- U.S. Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- U.S. Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- U.S. Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- U.S. Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- U.S. Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- U.S. Location Intelligence Market Component Outlook

- Canada

- Canada Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- Canada Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- Canada Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- Canada Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- Canada Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- Canada Location Intelligence Market Component Outlook

- North America Location Intelligence Market Component Outlook

- Europe

- Europe Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- Europe Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- Europe Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- Europe Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- Europe Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- Germany

- Germany Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- Germany Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- Germany Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- Germany Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- Germany Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- Germany Location Intelligence Market Component Outlook

- U.K.

- U.K. Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- U.K. Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- U.K. Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- U.K. Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- U.K. Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- U.K. Location Intelligence Market Component Outlook

- France

- France Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- France Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- France Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- France Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- France Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- France Location Intelligence Market Component Outlook

- Europe Location Intelligence Market Component Outlook

- Asia Pacific

- Asia Pacific Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- Asia Pacific Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- Asia Pacific Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- Asia Pacific Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- Asia Pacific Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- China

- China Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- China Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- China Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- China Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- China Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- China Location Intelligence Market Component Outlook

- Japan

- Japan Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- Japan Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- Japan Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- Japan Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- Japan Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- Japan Location Intelligence Market Component Outlook

- India

- India Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- India Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- India Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- India Location Intelligence Market Deployment Outlook

- On-premise

- Cloud

- India Location Intelligence Market Vertical Outlook

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

- India Location Intelligence Market Component Outlook

- Australia

- Australia Location Intelligence Market Component Outlook

- Software

- Service

- Consulting

- System Integration

- Others

- Australia Location Intelligence Market Application Outlook

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

- Australia Location Intelligence Market Location Type Outlook

- Indoor

- Outdoor

- Australia Location Intelligence Market Deployment Outlook

- On-premise

- Cloud