- Home

- »

- Plastics, Polymers & Resins

- »

-

Long Fiber Thermoplastics Market Size & Share Report, 2030GVR Report cover

![Long Fiber Thermoplastics Market Size, Share & Trends Report]()

Long Fiber Thermoplastics Market Size, Share & Trends Analysis Report By Resin Type (Polypropylene, Polyamide, Polyether Ether Ketone), By Fiber, By Manufacturing Process, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-013-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

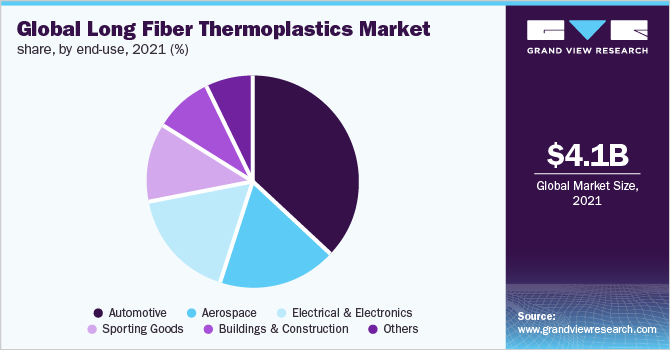

The global long-fiber thermoplastics market size was estimated at USD 4.06 billion in 2021 and is expected to exhibit a compound annual growth rate (CAGR) of 9.7% from 2022 to 2030. The market is anticipated to be driven by increasing demand for long-fiber thermoplastics in the automotive industry. In addition, numerous benefits of long fiber thermoplastics such as high strength, durability, toughness, fatigue endurance, and lightweight are making them better alternatives to metal and conventional thermoplastics in the end-use industries. Growing awareness regarding various characteristics of fiber-reinforced thermoplastics resins like lightweight, durability, flexibility, toughness, and thermal resistance is expected to boost the demand for various types of long fiber thermoplastics in coming years.

The ongoing R&D, technological developments in the field of long fiber thermoplastics, widespread adoption, and need for thermoplastics composites across various sectors are expected to drive the market's growth in the coming years. In June 2021, Zoltek Companies, Inc. (a carbon fiber manufacturer), expanded carbon fiber production in its Mexico Facility. The new facility can now produce carbon fiber up to 13,000 MT annually.

The government's policies to increase biodegradable plastics & emphasis on a sustainable future have resulted in the widespread use and demand for bio-based long-fiber thermoplastic. In November 2021, Arkema announced the construction of a new bio-based polyamide 11 powders (Rilsan polyamide 11 powders) plant. The COVID-19 pandemic had a negative impact on the long-fiber thermoplastics market. The pandemic led to the sealing of national borders and the temporary shutting down of numerous industries in 2020.

Before the pandemic, numerous countries were dependent on China for raw material supply. In 2020, restrictions imposed by the government on transportation and a lack of raw materials supply from China resulted in less production of long-fiber thermoplastics. In addition, the decrease in the production of automobiles owing to the reduced workforce and lack of demand from consumers resulted in the low demand for long-fiber thermoplastics in 2020.

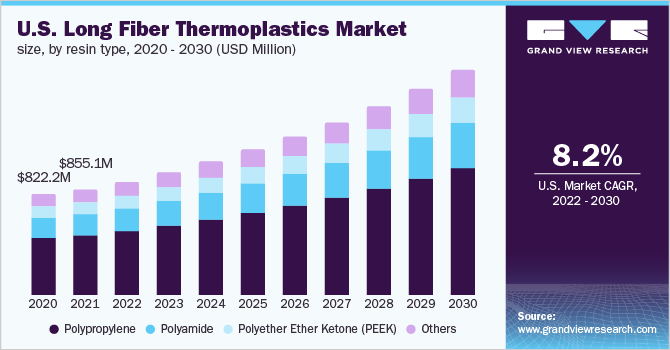

Resin Type Insights

The polypropylene segment accounted for the largest revenue share of 58.0% in 2021 and is expected to retain its dominance during the forecast period. Polypropylene-based thermoplastics are extensively used in the automotive, textile, packaging, and construction industry. Polypropylene-based long-fiber thermoplastics are very cost-effective compared to polyamide and polyether ether ketone. Thus, their penetration is increasing in the automotive and construction industry.

The polyamide segment is expected to witness a CAGR of 10.1% during the forecast period. Polyamide-based LFTs offer features such as durability, high toughness, and high strength which makes them a good option for automotive manufacturers. Polyamide-based LFTs are inexpensive compared to polyether ether ketone. Numerous players operating in the market such as Evonik Industries AG, LANXESS, and BASF SE are developing and offering a range of polyamide-based composites for the automotive, aerospace, and construction industries. For instance, in September 2019, Evonik Industries AG developed a new polyamide fiber named P84 HT. The new product offers high flexibility and improved mechanical stability at continuously high operating temperatures.

Fiber Insights

The glass fiber segment accounted for the largest revenue share of 50.3% in 2021 and is expected to retain its dominance during the forecast period. Glass fibers are extensively used in the making of long fiber thermoplastics as they are readily available and cost-effective. Long glass fibers improve the mechanical properties of any thermoplastic polymers. Glass fibers are almost ten times less expensive than carbon fibers. According to a 2020 report by the U.S. Commercial Service, glass-reinforced plastics are the most commonly used composite material in Europe.

The carbon fiber segment is expected to witness a CAGR of 10.5% over the forecast period from 2022-2030. Long carbon-reinforced thermoplastics composites are easier to process and more convenient for recycling. Long carbon fiber composites are increasingly being used in the aerospace and sports goods industry. In May 2021, TEIJIN LIMITED launched two carbon fiber intermediate materials brands Tenax BM and Tenax PW for sports applications.

Manufacturing Process Insights

The injection molding segment accounted for the largest revenue share of 45.0% in 2021 and is expected to retain its dominance during the forecast period. The injection molding process has several benefits over other processes, it is very efficient, compatible with a wide range of materials, can be used for large volumes to scale up production, and offers high repeatability and reliability.

The D-LFT segment is expected to account for the fastest CAGR of 10.2% during the forecast period 2022 - 2030. D-LFT is also known as direct roving or single-end roving process, it is very efficient and cost-effective as it avoids the need for semi-finished products manufactured by the material supplier. This process is extensively used to make polypropylene and polyamide-based long-fiber thermoplastics.

End-use Insights

The automotive segment accounted for the largest market share of 37.3% in 2021, in terms of revenue and is expected to retain its position in the market over the forecast period. This can be attributed to the increasing application of fiber-reinforced thermoplastics composites in the automotive industry. Long fiber thermoplastics offer several properties such as stiffness, high strength, lightweight, toughness, and durability. LFTs are used in various parts of automobiles such as bumper moldings, door modules, instrument panel carriers, seat pans, bumper beams, and front-end modules, among others.

The aerospace segment is expected to account for a CAGR of 10.0% over the forecast period 2022-2030. The demand for long-fiber thermoplastics is increasing in the aerospace industry owing to their lightweight and high strength. Lightweight materials are the primary requirement among aircraft manufacturers as they help in reducing the overall weight of the aircraft and improve fuel efficiency. Carbon fiber thermoplastics are extensively used in the aerospace industry. In May 2022, Solvay, a renowned specialty chemical manufacturer launched a new composite material SolvaLite 714 Prepregs, made of carbon fiber and woven fabric products.

Regional Insights

Asia Pacific accounted for the largest revenue share of 40.2% in 2021 and is anticipated to account for the fastest CAGR of 10.4% during the forecast period. The region is expected to dominate owing to the large supply chain and availability of raw materials. In addition, the increasing production of electric vehicles (EVs) in the region is further increasing the demand for long-fiber thermoplastics. China is the largest manufacturer and supplier of Electric Vehicles. According to International Energy Agency (IEA), in 2021 sales of EVs were the highest in China at 3.3 million.

North America is expected to account for a CAGR of 8.5% during the forecast period. Penetration of long fiber thermoplastics is high in the automotive, aerospace, and electrical & electronics industry. The strong presence of these industries in the region is one of the key factors for the growth of long-fiber thermoplastics.

Key Companies & Market Share Insights

The long fiber thermoplastics market is highly competitive as it features various global and regional market players. The world’s leading companies are undertaking partnerships, collaborations, acquisitions, mergers, and agreements as strategies to withstand the intense competition and increase their market share. Moreover, long-fiber thermoplastics manufacturers are spending extensively on research and development activities to develop advanced products and integrate new technologies and characteristics to lead a sustainable future. For instance, in January 2020, BASF SE acquired the polyamide business of Solvay. This acquisition broadened BASF’s engineering plastics business with innovative products such as Technyl. Some of the prominent players in the global long-fiber thermoplastics market include:

-

SABIC

-

RTP Company

-

JNC Corporation

-

Avient Corporation

-

Celanese Corporation

-

LANXESS

-

Solvay

-

Daicel Corporation

-

Kingfa SCI. & TECH. CO., LTD.

-

SGL Carbon

-

Asahi Kasei Corporation

Long Fiber Thermoplastics Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.36 billion

Revenue forecast in 2030

USD 9.3 billion

Growth rate

CAGR of 9.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, fiber, manufacturing process, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; U.K.; France; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

SABIC; RTP Company; JNC Corporation; Avient Corporation; Celanese Corporation; LANXESS; Solvay; Daicel Corporation; Kingfa SCI. & TECH. CO., LTD.; SGL Carbon; Asahi Kasei Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Long Fiber Thermoplastics Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global long fiber thermoplastics market report based on resin type, fiber, manufacturing process, end-use, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

Polyamide

-

Polyether Ether Ketone (PEEK)

-

Others

-

-

Fiber Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Glass

-

Carbon

-

Others

-

-

Manufacturing Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Pultrusion

-

D-LFT

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Electrical & Electronics

-

Buildings & Construction

-

Sporting Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global long fiber thermoplastics market size was estimated at USD 4.06 billion in 2021 and is expected to reach USD 4,367.9 million in 2022

b. The global long fiber thermoplastics market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.7% from 2022 to 2030 to reach USD 9.3 billion by 2030

b. Asia Pacific accounted for the largest share of 40.2% in 2021 owing to the increasing demand for lightweight with high-strength materials in the automotive industry.

b. Some of the key players operating in the long fiber thermoplastics market include B SABIC, RTP Company, JNC Corporation, Avient Corporation, Celanese Corporation, LANXESS, Solvay, Daicel Corporation, Kingfa SCI. & TECH. CO., LTD., SGL Carbon, Asahi Kasei Corporation.

b. The key factors driving the long fiber thermoplastics market include increasing demand for long fiber thermoplastics in the automotive industry. In addition, numerous benefits of long fiber thermoplastics such as high strength, durability, toughness, fatigue endurance, and lightweight are making them better alternatives to metal and conventional thermoplastics in the end-use industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."