Loratadine Market Size & Trends

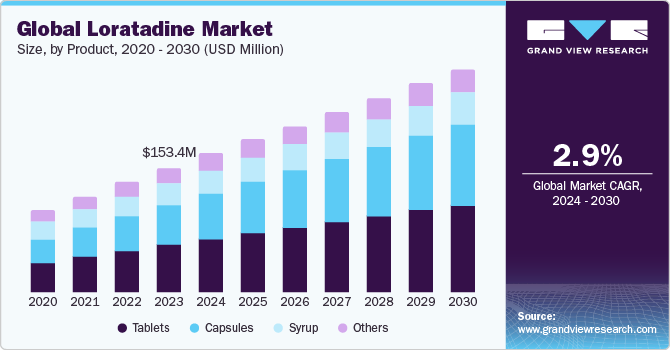

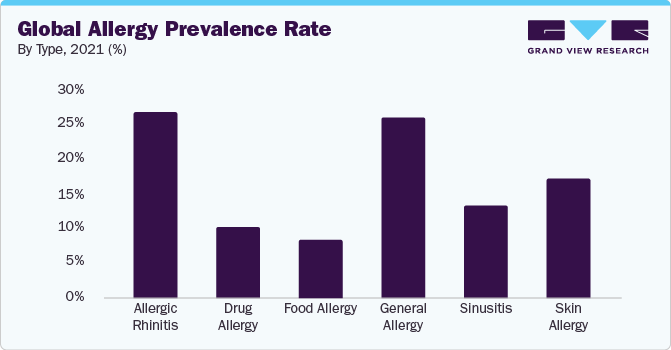

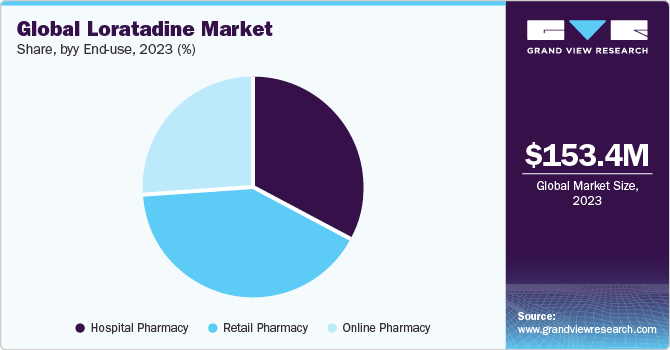

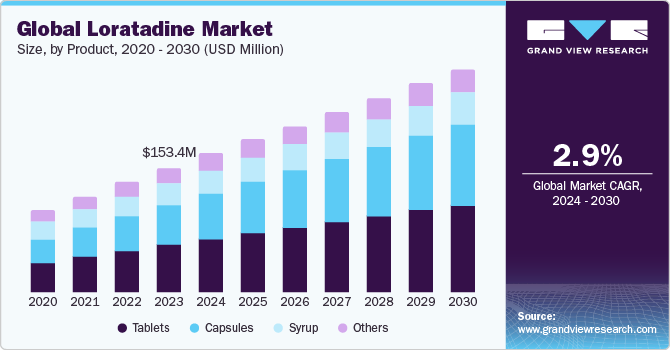

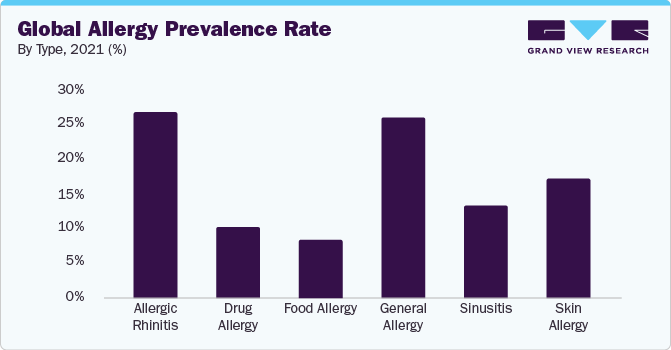

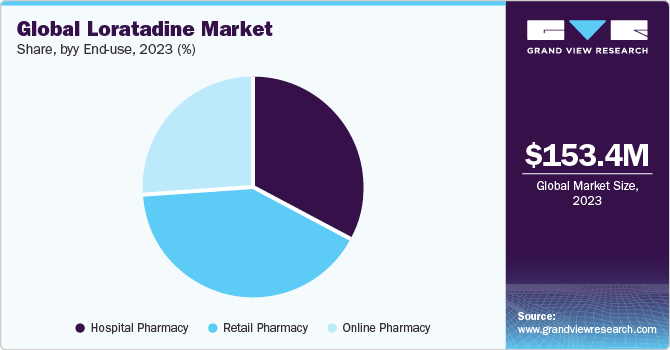

The global loratadine market size was valued at USD 153.4 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 2.9% from 2024 to 2030. The high prevalence rate of allergies worldwide, changing lifestyles, and favorable regulatory landscape are significant aspects driving the overall market growth potential. According to the American Academy College of Allergy, Asthma & Immunology, the global prevalence of allergic rhinitis was estimated to be between 10% and 30% worldwide in 2021.

The outbreak of the COVID-19 pandemic moderately impacted the growth of the loratadine industry. The market growth is owing to increased focus on respiratory health. Heightened awareness regarding respiratory disease management and patient preference towards antihistamines such as loratadine to minimize allergic conditions strengthened market revenue growth. Moreover, changes in allergens coupled with exposure patterns increased the number of indoor allergies, such as dust mites and pet dander, among others, positively contributed to product demand.

The rising prevalence of several allergic conditions, such as allergic rhinitis, allergic asthma, allergic conjunctivitis, allergic asthma, and skin allergies, among others, will bolster the demand for effective therapeutics in disease management. The high disease burden is owing to environmental factors, changing lifestyles, and genetic predispositions. For instance, according to the American Academy College of Allergy, Asthma & Immunology, in 2021, more than 25.7% of individuals aged 18-44 across the globe suffered from seasonal allergies. Also, over 7.8% of the population aged 18 and above are diagnosed with hay fever in the U.S. Thus, the growing disease burden coupled with demographic shift among high and middle-income economies is anticipated to propel market demand in the near future.

Grade Type Insights

Based on the grade type, the market is segmented into USP Standard Grade, EP Standard Grade, Medicine Standard Grade, and others. The USP standard grade segment held the largest market share in 2023. USP standard grade emphasis on regulatory compliance with established quality and safety regulations, thereby accelerating customer preference and adoption rate.

Dosage Form Insights

On the basis of dosage form, the market is segmented into tablets, capsules, syrup, and others. The tablets segment dominated the market in 2023 due to patient convenience, ease of administration, high availability, reliability, and longer shelf life. The strong presence of several industry participants who are manufacturing loratadine tablets in various strengths to cater to a large population base will accelerate the segment growth over the forecast period.

End-use Insights

Based on end-use, the loratadine market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The online pharmacy segment is expected to grow at the fastest CAGR during the forecast period. Upsurge in the adoption of online platforms owing to large availability and accessibility to diverse product offerings, affordable pricing, and offers driving segmental demand. Moreover, the integration of online pharmacy platforms with telemedicine is expected to provide enormous growth opportunities to the segment.

Regional Insights

North America dominated the market share in 2023. The high disease burden and strong presence of several manufacturers are anticipated to propel market growth in this region. Increasing prevalence of seasonal and perennial allergies in the region, accelerating demand for antihistamine medications, including loratadine. The surge in population awareness regarding allergy and consumer preference towards non-drowsy formulations is estimated to spur regional revenue growth potential.

Asia Pacific is predicted to witness the fastest CAGR over the forecast period. Rapidly growing awareness regarding allergic ailments, the rising geriatric population that is highly prone to several allergic conditions, and the increasing prevalence of lifestyle diseases are factors driving the Asia Pacific loratadine market.

Key Loratadine Company Insights

Key players operating in the market are Bayer AG, Morepen Laboratories Ltd, Cadila Pharmaceuticals, Pfizer Inc., Viatris Inc., Sun Pharmaceutical Industries Limited, and Perrigo Company PLC. The market participants are implementing new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In February 2022, Morepen Laboratories Ltd. received approval for its generic anti-allergy drug Fexofinadine Hydrochloride by the U.S. FDA as a Class II antihistamine drug for allergic rhinitis. This has strengthened the company's existing product portfolio, including Loratadine, Desloratadine Montelukast, and others.

-

In 2021, JB Chemicals and Pharmaceuticals received approval for its loratadine, an over-the-counter tablet by the U.S. FDA to treat hay fever and upper respiratory tract allergies in the U.S. The device can be easily customized and molded at home.