- Home

- »

- Next Generation Technologies

- »

-

Low-code Development Platform Market Size Report, 2030GVR Report cover

![Low-code Development Platform Market Size, Share & Trends Report]()

Low-code Development Platform Market (2023 - 2030) Size, Share & Trends Analysis Report By Application Type (Web-based, Mobile-based), By Deployment Type (Cloud, On-premise), By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-949-8

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Low-code Development Platform Market Summary

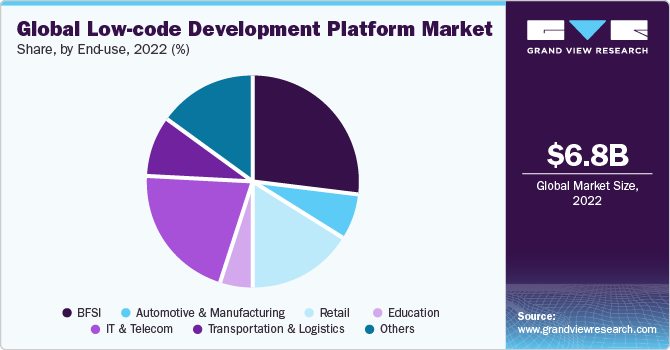

The global low-code development platform market size was estimated at USD 6.78 billion in 2022 and is projected to reach USD 35.22 billion by 2030, growing at a CAGR of 22.9% from 2023 to 2030. The growth can be attributed to organizations' increasing focus on digital transformation and the automation of their business operations.

Key Market Trends & Insights

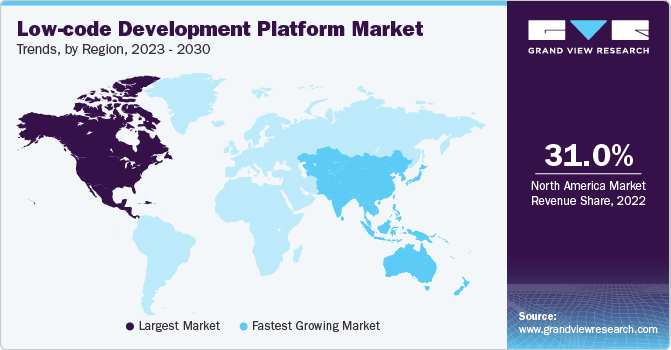

- North America accounted for a revenue share of nearly 31.0% in 2022 .

- U.S. is expected to register the highest CAGR from 2023 to 2030.

- Based on end use, the BFSI segment dominated the market with a revenue share of over 27.0% in 2022.

- Based on application type, the mobile-based segment accounted for more than 35.0% of the total revenue share in 2022.

- Based on deployment, the cloud segment is expected to grow at a significant CAGR of over 24.0% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 6.78 Billion

- 2030 Projected Market Size: USD 35.22 Billion

- CAGR (2023-2030): 22.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The rising demand for quick solutions to streamline business processes has opened up opportunities for the adoption of low-code development platforms. These platforms provide pre-built components that can be utilized by both business users and IT developers to create workflows and applications without the need for manual coding.

The growing popularity of low-code development among consumers has created the requirement for enhanced ways to scale applications and educate users, be they professional developers or business employees in the use of these solutions. For instance, in June 2023, Pegasystems Inc. launched the latest version of the Pega Infinity software suite, introducing a range of new capabilities designed to expedite low-code development, constantly optimize current workflows, and deliver seamless experiences for both employees and customers.

End-use Insights

The BFSI segment dominated the market with a revenue share of over 27.0% in 2022 owing to the growing demand for digitalization in financial services, including processes like client origination, back-office operations, onboarding, and self-service options. They are showing increased interest in low-code development platforms by streamlining operations, enhancing customer experiences, and accelerating digital transformation. With its agility and adaptability, the BFSI segment is leveraging the capabilities of low-code development to stay competitive in a rapidly evolving technological landscape while delivering innovative solutions to address the shifting needs of its customer base.

The education segment is expected to grow at a significant CAGR of more than 24.0% from 2023 to 2030. As institutions and educators increasingly recognize the need for streamlined and user-friendly software solutions, low-code platforms offer a promising avenue for developing custom applications and simplifying processes. This growing demand is driven by a desire to enhance the learning experience, automate administrative tasks, and enable students and faculty to create applications with minimal coding expertise. As a result, the education sector is expected to be a key driver of growth in the low-code development platform industry.

COVID-19 Impact

The COVID-19 pandemic made a positive impact on the concerned market as organizations faced unprecedented challenges and disruptions due to the pandemic, there was a heightened urgency to digitize and streamline their operations quickly. Low-code development platforms emerged as a valuable solution during this period, enabling businesses to rapidly create and deploy applications without extensive coding expertise. This newfound reliance on low-code platforms accelerated the market's growth as companies sought efficient ways to adapt to remote work, meet changing customer demands, and enhance their digital presence. The pandemic highlighted the need for agility and flexibility in software development, driving more enterprises to embrace low-code development to stay competitive in the rapidly evolving business landscape.

Regional Insights

North America accounted for a revenue share of nearly 31.0% in 2022 owing to the presence of numerous prominent players in the region that are primarily focusing on the development of technologically advanced products. Leading industry players in the region have expanded their offerings of low-code development platforms and services to meet the demands of their clients. In December 2022, Salesforce, Inc. announced a new service on its infrastructure – the low-code DevOps Center which offers developers a curated platform for creating customized applications. The platform allows development teams to manage and implement changes to bespoke elements within Salesforce, Inc.’s platform as task items, which can be linked with other tools in Salesforce Flows, the firm's suite of process management solutions.

Asia Pacific is expected to record the highest CAGR of more than 26.0% from 2022 to 2030 owing to the increasing adoption of mobile applications. The region includes a significant number of SMEs with limited resources, compelling them to adopt managed services. Several government bodies across the region have also adopted a mobile-first approach to provide enhanced services to their citizen, thereby propelling the market further. In China, IT developers are actively encouraged to implement low-code platforms to streamline their workflow processes. For instance, several Chinese companies such as Maxnerva Technology Services, SAIC Motor, and CIMC Vehicles, have adopted the low-code platform Mendix for this purpose.

Application Type Insights

Based on application type, the mobile-based segment accounted for more than 35.0% of the total revenue share in 2022. Mobile low-code development platforms usually consist of a mobile client application, a set of APIs, and a mobile middleware server. These components facilitate connectivity with other cloud-based applications and implement essential security protocols. The mobile client application connects to the middleware server, serving as both the user interface framework and the business sense tailored to specific mobile devices.

The web-based application segment is expected to record a CAGR of nearly 22.0% from 2023 to 2030. Low-code development platforms play a crucial role in expediting and streamlining the creation of web-based enterprise applications by harnessing robust integrated development environments (IDEs) and user-friendly interfaces. Many of these platforms seamlessly merge traditional and low-code development methods within a unified IDE. Furthermore, they offer tools for integrating, testing, and deploying applications, ultimately enhancing the productivity of enterprise development teams.

Deployment Type Insights

Based on deployment, the cloud segment is expected to grow at a significant CAGR of over 24.0% during the forecast period. This dynamic partnership offers businesses unparalleled flexibility and scalability, enabling rapid application development and deployment. By leveraging the capabilities of cloud resources, low-code platforms streamline the development process, reduce IT overhead, and enhance accessibility, making it easier for organizations to create, manage, and scale applications without the need for extensive coding expertise.

This trend not only accelerates digital transformation but also empowers businesses to adapt swiftly in an ever-evolving technological landscape. A few of the prominent low-code platforms from the public cloud providers include PowerApps on Microsoft, App Maker on Google Cloud Platforms (GCP), and Mendix on IBM Cloud.

Organization Size Insights

The SMEs segment is estimated to register a CAGR of more than 24.0% from 2023 to 2030. SMEs are recognizing the value of these platforms in accelerating their application development processes while minimizing the need for extensive coding expertise. The cost-effectiveness and agility provided by low-code solutions make them an attractive option for SMEs looking to stay competitive in the current fast-paced business environment. As a result, the market for low-code development platforms in the SME sector is expected to expand as companies seek to streamline their operations and innovate more efficiently.

Key Companies & Market Share Insights

Key companies are largely focusing on product innovation and forming strategic alliances to strengthen their presence in the industry. For instance, in June 2023, Sandhata announced its partnership withPegasystems Inc. to provide its clients with cutting-edge low-code workflow automation solutions. This partnership enables Sandhata to enhance its expertise, reach new performance milestones, and discover innovative avenues for business growth. Additionally, both firms will join forces to present tailored solutions to customers, leveraging Pegasystems Inc.'s top-tier capabilities and Sandhata's extensive experience in system integration and automation.

Similarly, OutSystems entered into a Memorandum of Understanding (MoU) with Petroliam Nasional Berhad (PETRONAS) with the aim of advancing the adoption of low-code application development within the PETRONAS Group. This partnership entails OutSystems offering training resources, research, and expertise in utilizing its low-code platform to support PETRONAS' Citizen Developer Program.

Key Low-code Development Platform Companies:

- Appian

- Creatio

- LANSA

- Mendix Technology BV

- Microsoft

- Oracle

- OutSystems

- Pegasystems Inc.

- Quickbase

- Salesforce, Inc.

- ServiceNow

- Zoho Corporation Pvt. Ltd.

Low-code Development Platform Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.48 billion

Revenue forecast in 2030

USD 35.22 billion

Growth rate

CAGR of 22.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application type, deployment type, organization size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; South Africa

Key companies profiled

Appian; Creatio; LANSA; Mendix Technology BV; Microsoft; Oracle; OutSystems; Pegasystems Inc.; Quickbase; Salesforce, Inc.; ServiceNow; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low-code Development Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low-code development platform market report based on application type, deployment type, organization size, end-use, and region:

-

Application Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Mobile-based

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SME

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Automotive & Manufacturing

-

Retail

-

Education

-

IT & Telecom

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global low-code development platform market was estimated at USD 6.78 billion in 2022 and is expected to reach USD 8.38 billion in 2023.

b. The global low-code development platform market is expected to grow at a compound annual growth rate of 22.9% from 2023 to 2030 to reach USD 35.2 billion by 2030.

b. North America dominated the low-code development platform market with a share of about 30% in 2022. This is attributable to a strong presence of prominent players, including Appian, Microsoft, LANSA, Pegasystems, Oracle, and OutSystems in the U.S.

b. Some key players operating in the low-code development platform market Appian; Creatio; LANSA; Mendix Technology BV; Microsoft; Oracle; OutSystems; Pegasystems Inc.; Quickbase; Salesforce, Inc.; Servicenow; Zoho Corporation Pvt. Ltd.

b. Key factors driving the low-code development platform market growth include growing need to accelerate digital transformation and increasing need to improve software development process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.