- Home

- »

- Consumer F&B

- »

-

Low Fat Cheese Market Size, Share & Trends Report, 2030GVR Report cover

![Low Fat Cheese Market Size, Share & Trends Report]()

Low Fat Cheese Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Feta, Ricotta, Mozzarella Sticks), By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-290-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Low Fat Cheese Market Size & Trends

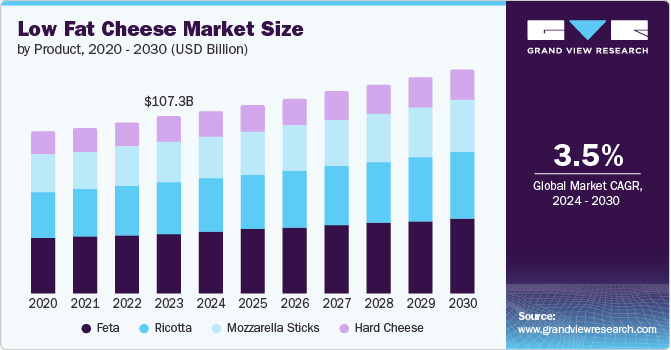

The global low fat cheese market size was valued at USD 107.31 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. As people become more informed about the health risks associated with high-fat diets, including obesity, heart disease, and diabetes, there is a growing preference for healthier food options. Low-fat cheese products cater to this demand by providing a flavorful alternative that allows consumers to enjoy cheese without the added calories and saturated fats.

Increasing health issues such as obesity, cardiovascular diseases, and diabetes have prompted consumers to seek healthier food options, including low-fat alternatives such as low-fat cheese, which is a rich source of vitamins and proteins and helps lower blood pressure. Furthermore, the rising obesity rate has led consumers towards low-fat and lower-calorie products, including low-fat cheese. In addition, the growing busier lifestyle and increasing health trends of health consciousness, including fitness activities, contributed to the growth of low-fat cheese.

Increasing innovation in dairy processors, such as longer shelf life, flavors, and texture optimization, is anticipated to positively influence and contribute to the health and wellness trend by developing low-fat cheese products and driving growth. The rise of infrastructural activities and the e-commerce industry further drives growth as low-fat cheese products are readily available in groceries and supermarkets, creating demand among health-conscious consumers.

Product Insights

Ricotta dominated the market and accounted for a market revenue share of 34.1% in 2023. Ricotta cheese naturally contains lower fat levels than many other cheese varieties. It comes in various textures and flavors, having versatility in sweet and savory dishes that expand its appeal beyond traditional cheese uses. Ricotta cheese contains high-quality protein and fiber and provides several health benefits to maintain health and wellness.

Mozzarella sticks segment is anticipated to register the fastest CAGR of 3.7% during the forecast period. The rise of snacking culture and the demand for convenient, on-the-go food options have contributed to the popularity of low-fat mozzarella sticks. These bite-sized treats offer a satisfying and portable snack option that caters to busy lifestyles while still providing the indulgent taste of cheese.

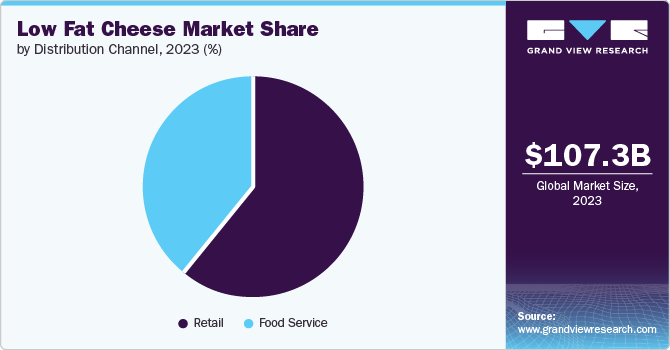

Distribution Channel Insights

Retail accounted for the largest market revenue share in 2023. Consumers prefer the ease of purchasing groceries from supermarkets, hypermarkets, and convenience stores where a wide range of low-fat cheese options are readily available. This convenience aligns with modern lifestyles characterized by busy schedules and the desire for quick, nutritious meal solutions.

Food service is anticipated to grow significantly over the forecast period. As health consciousness rises, more restaurants and food service providers are incorporating low fat cheese into their menus to appeal to health-oriented customers. This shift meets consumer expectations and aligns with broader trends towards healthier eating habits, making low fat cheese a staple ingredient in various culinary applications.

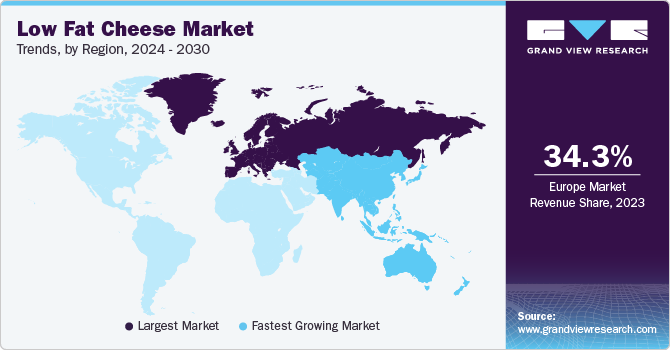

Regional Insights

North America low-fat cheese market held a substantial revenue share in 2023. The growth can be attributed to the increasing prevalence of health disorders such as cardiovascular diseases and obesity, along with a busier lifestyle that creates demand for alternative food products that contain low fat and healthier ingredients, such as low fat cheese. For instance, according to the National Institute of Health, one in six youth in the U.S. is obese. High consumer awareness about the benefits of low-fat cheese in countries such as the U.S. and Canada is driving the market.

U.S. Low Fat Cheese Market Trends

The U.S. low-fat cheese market is anticipated to grow significantly over the forecast period. The influence of social media and digital platforms has heightened consumer awareness and engagement with health and wellness trends, including low-fat cheese consumption. Influencers, bloggers, and health advocates often promote nutritious eating habits and recommend low fat cheese products as part of balanced diets in the U.S. This online visibility not only educates consumers but also fosters a culture of health-consciousness, further driving demand for low-fat cheese among digitally connected audiences.

Europe Low Fat Cheese Market Trends

Europe low fat cheese market accounted for the largest market revenue share of 34.3% in 2023. Cultural preferences and culinary traditions in Europe have influenced the growth of the low-fat cheese market. Cheese is a staple in many European diets, with a rich history of cheese-making and consumption across various regions. Low-fat cheese varieties, such as reduced-fat mozzarella, feta, and cottage cheese, are integrated into traditional and contemporary European dishes, catering to both local tastes and international dietary trends.

Germany low fat cheese market is anticipated to grow rapidly over the forecast period owing to the robust dairy industry and consumer demand in the region. Germany is the largest exporter of cheese, sharing approximately 15% of global cheese exports. The rich tradition of cheese and high consumer awareness in the region drive the growth of low fat cheese. In addition, the rising obesity rates and increasing aging population further accelerate the consumption and growth of low-fat cheese in the country.

Asia Pacific Low Fat Cheese Market Trends

Asia Pacific low fat cheese market is anticipated to witness the fastest CAGR over the forecast period. Cheese consumption, including low-fat varieties, has increased as consumers adopt Western-style diets and incorporate cheese into their meals and snacks. This trend is particularly notable in urban areas where exposure to international cuisines and food trends drives demand for low-fat cheese as a healthier alternative to traditional high-fat cheeses.

China low fat cheese market is anticipated to grow significantly over the forecast period. As busy lifestyles lead people to seek convenient snack options, low fat cheese products such as cheese sticks or spreads are becoming increasingly popular due to their portability and nutritional benefits. These snackable formats allow consumers to enjoy healthy snacks on the go, making them an attractive choice for those looking for quick yet nutritious food items during their daily routines in the country.

Key Low Fat Cheese Company Insights

Some of the key companies in the low fat cheese market include Kraft Heinz Company, Dairy Farmers of America, Nestlé S.A., Danone S.A., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Dairy Farmers of America produces many products that meet diverse consumer preferences and dietary needs. Their low-fat cheese line includes reduced-fat mozzarella, cheddar, and cream cheese varieties crafted to maintain flavor while reducing fat content. These products are designed for retail consumers, food service operations, and manufacturers who require quality ingredients for their recipes.

-

Danone S.A. operates across various segments, including dairy and plant-based products, water, nutrition, and medical nutrition. The company's offerings under low fat cheese include brands such as "Light & Fit" and "Oikos," which are designed to provide lower fat while maintaining high protein levels and essential nutrients.

Key Low Fat Cheese Companies:

The following are the leading companies in the low fat cheese market. These companies collectively hold the largest market share and dictate industry trends.

- Kraft Heinz Company

- Dairy Farmers of America

- Nestlé S.A.

- Danone S.A.

- Arla Foods

- Amul Limited

- Arla Foods, Inc.

- Lactalis Group

- FrieslandCampina

- Unilever N.V.

Recent Developments

-

In June 2022, Nestlé and NIZO developed a new process for fat-reduced Edam cheese specifically for frozen pizza. The newly launched cheese has 30% less fat than full-fat Edam cheese. Through this introduction, Nestlé aims to reduce high saturated fat, reduce frozen pizza, and meet health-conscious consumer needs and preferences.

Low Fat Cheese Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 110.92 billion

Revenue forecast in 2030

USD 136.06 billion

Growth rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Middle East & Africa, Central & South Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, Saudi Arabia, Brazil

Key companies profiled

Kraft Heinz Company; Dairy Farmers of America; Nestlé S.A.; Danone S.A.; Arla Foods; Amul Limited; Arla Foods, Inc.; Lactalis Group; FrieslandCampina; Unilever N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Fat Cheese Market Report Segmentation

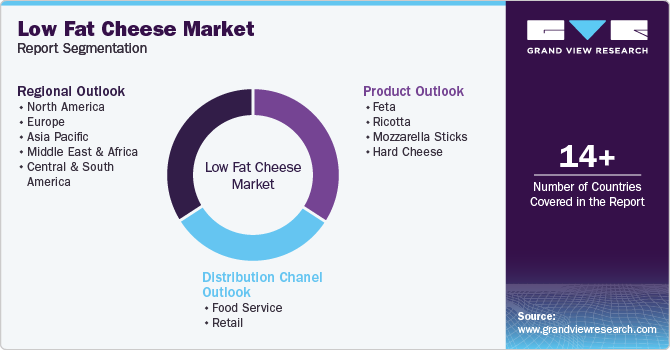

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the low fat cheese market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Feta

-

Ricotta

-

Mozzarella Sticks

-

Hard Cheese

-

-

Distribution Chanel Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Central & South America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.