- Home

- »

- IT Services & Applications

- »

-

Loyalty Management Market Size, Industry Report, 2033GVR Report cover

![Loyalty Management Market Size, Share & Trends Report]()

Loyalty Management Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment (On-Premises, Cloud), By Organization Size (Large Enterprises, SMEs), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-504-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Loyalty Management Market Summary

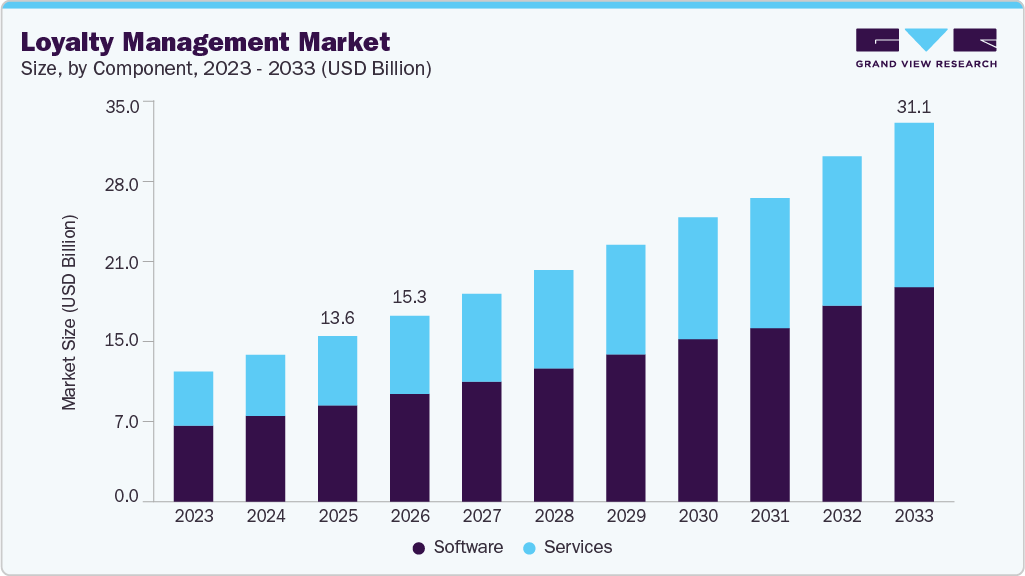

The global loyalty management market size was estimated at USD 13.59 billion in 2025 and is projected to reach USD 31.11 billion by 2033, growing at a CAGR of 10.7% from 2026 to 2033. Loyalty management platforms offer businesses the necessary tools to design, implement, and manage effective loyalty programs.

Key Market Trends & Insights

- North America held a 36.5% revenue share of the global loyalty management market in 2025.

- In the U.S., the market growth is driven by increasing demand for personalized, data-driven, and omnichannel loyalty solutions across retail, consumer goods, travel, hospitality, and BFSI sectors.

- By component, the software segment held the largest revenue share of 58.2% in 2025.

- By deployment, the cloud segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 13.59 Billion

- 2033 Projected Market Size: USD 31.11 Billion

- CAGR (2026-2033): 10.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Organizations across industries such as retail & consumer goods, travel & hospitality, BFSI, telecom, and digital commerce are increasingly adopting advanced loyalty management solutions over traditional points-based programs to strengthen customer retention and lifetime value in a highly competitive environment. This shift is driven by rising customer acquisition costs and growing demand for personalized, omnichannel engagement, prompting enterprises to deploy integrated loyalty platforms that combine customer data management, analytics, CRM integration, and real-time campaign orchestration. Cloud-based and SaaS loyalty solutions are gaining strong traction, enabling seamless integration with POS systems, e-commerce platforms, mobile apps, and marketing automation tools while supporting rapid scalability across regions and channels.

The loyalty management market is witnessing accelerated adoption of AI- and ML-driven personalization, real-time offer optimization, predictive churn analytics, and dynamic rewards engines, as brands seek to move beyond static discounting toward experience-led engagement. Vendors are differentiating themselves through capabilities such as behavioral segmentation, tier-based and gamified loyalty structures, coalition and partner loyalty ecosystems, and advanced reporting dashboards that help enterprises quantify their ROI and continuously refine their engagement strategies. At the same time, increasing regulatory focus on consumer data privacy is encouraging the use of zero-party and first-party data-driven loyalty models, ensuring compliance while enabling deeper customer insights.

Rising digital engagement, mobile commerce adoption, and social-media-driven interactions are further reshaping loyalty strategies, with brands embedding loyalty features directly into mobile wallets, apps, and digital touchpoints. For instance, in December 2025, PerfectVape launched a customer loyalty program that rewards shoppers with points for both purchases and social engagement activities, allowing accumulated points to be redeemed for meaningful discounts. This reflects a broader market trend toward engagement-centric loyalty programs that combine transactional rewards with digital and community interactions to drive repeat purchases and brand affinity.

Consequently, the loyalty management market is evolving from standalone, points-centric solutions to intelligent, data-driven ecosystems that support personalized experiences, omnichannel consistency, and measurable business outcomes. As organizations prioritize customer experience, brand differentiation, and long-term retention, loyalty management is increasingly viewed as a strategic growth enabler rather than a tactical marketing tool, underpinning sustained revenue growth and competitive advantage in a digitally transformed marketplace.

Component Insights

The software segment led the loyalty management industry, accounting for the largest revenue share of 58.2% in 2025, driven by the strong adoption of cloud-based and AI-enabled loyalty platforms by enterprises, which support personalized, omnichannel customer engagement. The growth is fueled by rising demand for centralized loyalty engines, real-time analytics, campaign management, and customer data integration software that seamlessly connect with POS systems, e-commerce platforms, CRM systems, and mobile applications. As organizations shift toward digital-first engagement models, SaaS-based loyalty solutions are increasingly preferred for their scalability, faster deployment, and lower total cost of ownership, while enabling advanced capabilities such as behavioral segmentation, predictive churn analysis, and dynamic reward personalization. For instance, in September 2025, Capillary Technologies launched the AWS Marketplace, highlighting the growing reliance on cloud-native loyalty software, allowing enterprises to rapidly deploy and scale loyalty programs within secure, flexible cloud environments. Consequently, the software segment continues to dominate as enterprises prioritize intelligent, data-driven, and highly integrated loyalty platforms to drive customer retention, optimize lifetime value, and achieve measurable business outcomes.

The services segment is expected to register the fastest CAGR during the forecast period, driven by rising enterprise demand for consulting, implementation, integration, and managed services to support increasingly complex and data-driven loyalty programs. As organizations adopt advanced, cloud-based loyalty platforms, they require specialized services for program design, omnichannel integration with POS, CRM, and marketing systems, data migration, and ongoing optimization. Additionally, the growing focus on personalization, AI-led analytics, and regulatory compliance is encouraging enterprises to rely on service providers for continuous program management, performance monitoring, and customer insights generation. The expansion of multinational loyalty programs across regions, coupled with the need for localization, partner ecosystem management, and ROI measurement, is further accelerating demand for loyalty management services, positioning this segment as a key growth driver within the overall market.

Deployment Insights

The on-premises segment accounted for the largest share of the global loyalty management market in 2025, driven by strong adoption among large enterprises that require greater control over customer data, customization, and integration with legacy IT and POS infrastructures. Organizations in highly regulated industries and data-sensitive environments prefer on-premises loyalty platforms to maintain data sovereignty, ensure compliance with internal governance policies, and support complex, rule-based loyalty structures. Additionally, enterprises with extensive brick-and-mortar networks leveraged on-premises deployments for low-latency transaction processing, offline functionality, and tight integration with in-store systems, reinforcing the segment’s dominance despite the growing momentum of cloud-based alternatives.

The cloud segment is expected to grow at a significant CAGR during the forecast period, driven by increasing adoption of SaaS-based loyalty management platforms that offer scalability, faster deployment, and cost efficiency compared to traditional on-premises systems. Enterprises are increasingly prioritizing cloud deployments to enable real-time data synchronization, omnichannel engagement, and seamless integration with e-commerce platforms, mobile applications, CRM, and marketing automation tools. The ability of cloud-based solutions to support AI-driven personalization, advanced analytics, and dynamic campaign management, while reducing infrastructure and maintenance overheads, is further accelerating adoption. Additionally, the growing demand from mid-sized enterprises, the expansion of digital commerce ecosystems, and the need to rapidly launch and scale loyalty programs across geographies are reinforcing cloud deployment as a key market growth driver.

Organization Size Insights

The large enterprises segment accounted for the largest share of the global loyalty management industry in 2025, driven by the ability of large organizations to invest in advanced, scalable loyalty platforms that support complex program structures, omnichannel engagement, and deep personalization across global customer bases. Large enterprises typically manage high transaction volumes and diverse customer segments, requiring robust loyalty solutions integrated with CRM, e-commerce, mobile applications, analytics, and marketing automation systems. Their focus on enhancing brand equity, customer lifetime value, and long-term retention further accelerates the adoption of AI-driven personalization, real-time insights, and experience-led loyalty models. For instance, in 2024, HUGO BOSS launched an innovative customer loyalty program, introducing a new world of engagement through a digitally enabled, omnichannel experience designed to strengthen emotional connections with customers and deliver highly personalized interactions, highlighting how large enterprises are leveraging next-generation loyalty programs as a strategic differentiator in competitive markets.

The SMEs segment is projected to register the fastest CAGR over the forecast period, driven by increasing adoption of cloud-based and SaaS loyalty management solutions that offer affordable pricing, faster deployment, and minimal IT complexity. Small and mid-sized enterprises are increasingly leveraging loyalty programs to compete with larger brands, improving customer retention, repeat purchases, and brand engagement, all without significant upfront infrastructure investments. The availability of modular, subscription-based loyalty platforms with built-in analytics, mobile integration, and preconfigured campaign templates is enabling SMEs to launch and scale personalized loyalty initiatives quickly. Additionally, the growing adoption of digital commerce, mobile-first customer engagement, and awareness of the benefits of data-driven marketing are further accelerating the adoption of loyalty management among SMEs.

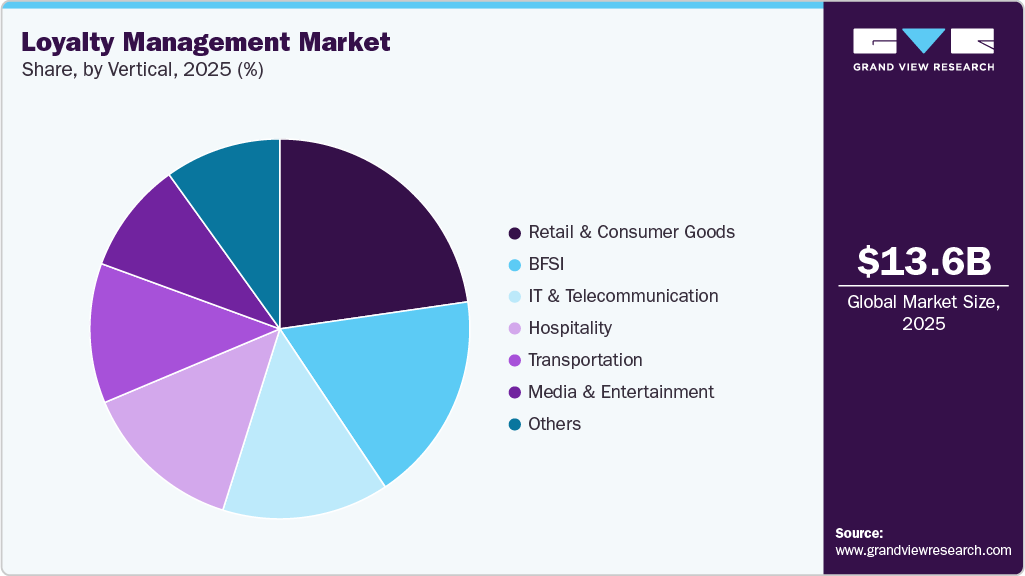

Vertical Insights

The retail and consumer goods segment accounted for the largest market share in 2025, driven by the sector’s intense focus on enhancing customer experience, increasing repeat purchases, and building long-term brand loyalty in highly competitive environments. Retailers and consumer brands are investing heavily in loyalty solutions that provide omnichannel engagement, real‑time personalization, integration with e‑commerce and POS systems, and advanced analytics to better understand and respond to evolving shopper behaviors. The complexity of managing high transaction volumes and diverse product portfolios further fuels the adoption of sophisticated loyalty platforms that support targeted offers, tiered rewards, and seamless redemption across digital and physical channels. For instance, in November 2025, Simon Property Group introduced the Simon loyalty program, connecting shoppers with multiple retailers through a unified rewards experience that enhances engagement and drives foot traffic and sales across its portfolio. This illustrates how retail leaders are leveraging loyalty management to deepen customer relationships and differentiate themselves in the marketplace.

The hospitality segment is expected to register the fastest CAGR during the forecast period, driven by the industry’s increasing focus on personalized guest experiences, repeat stays, and value‑added engagement across digital and physical touchpoints. Hospitality brands are investing in advanced loyalty platforms that integrate reservations, mobile apps, CRM systems, and real‑time analytics to deliver customized rewards, dynamic pricing benefits, tiered membership perks, and seamless cross‑channel interactions that enhance guest lifetime value. The rise of strategic partnerships and ecosystem‑based loyalty models is further accelerating this trend, enabling hospitality companies to extend their loyalty value beyond traditional hotel stays into broader lifestyle and commerce experiences. For instance, in August 2025, Marriott Bonvoy and Flipkart launched a strategic partnership in India to offer consumers enriched loyalty benefits, unlocking a world of unparalleled value and experiences and underscoring how hospitality brands are leveraging expansive loyalty programs to grow engagement and differentiate in competitive markets.

Regional Insights

The North America loyalty management market held the largest global revenue share of 36.5% in 2025. The regional growth can be attributed to the high adoption of loyalty management solutions in the region, led by significant competition in most industries. North America is characterized by the presence of major loyalty management providers, namely, Aimia, Inc.; Bond Brand Loyalty, Inc.; ICF International Inc.; Kobie Marketing; and TIBCO Software. These players are significantly investing in R&D to develop advanced loyalty management solutions and increase their customer bases, contributing to the regional market growth. Furthermore, customers in the U.S. widely use debit and credit cards in stores to reap monetary benefits and gain advantages from loyalty programs, such as product discounts, rebates, and cash back. These factors would further drive the regional market growth.

U.S. Loyalty Management Market Trends

The U.S. loyalty management industry is experiencing strong growth, driven by increasing demand for personalized, data-driven, and omnichannel loyalty solutions across retail, consumer goods, travel, hospitality, and BFSI sectors. Enterprises are leveraging AI and analytics to deliver targeted rewards, predictive engagement, and real-time personalization, while integrating loyalty programs with mobile apps, e-commerce platforms, and CRM systems. The rise of cloud-based and SaaS loyalty platforms enables rapid deployment, scalability, and seamless integration across multiple channels, supporting dynamic offers, tiered memberships, and behavioral incentives. Additionally, the growing focus on customer experience, retention, and lifetime value, coupled with partnerships and ecosystem-based loyalty models, is encouraging U.S. brands to adopt innovative loyalty strategies that drive engagement, repeat purchases, and long-term brand loyalty.

Europe Loyalty Management Market Trends

The loyalty management industry in Europe is anticipated to register significant growth from 2026 to 2033, drivenby strong growth and innovation, with a shift toward digital, personalized, and omnichannel loyalty solutions that integrate seamlessly across mobile, online, and in‑store channels to meet evolving consumer expectations. European brands are incorporating AI-powered personalization, advanced analytics, and real-time engagement features into their loyalty platforms to gain deeper customer insights and deliver tailored rewards, with a focus on data privacy and compliance under GDPR frameworks that promote consumer trust. The region also sees the growing adoption of coalition and cross-industry loyalty programs, subscription-based models, and gamification strategies that enhance customer stickiness and broaden program reach across the retail, travel, banking, and fintech sectors. Additionally, sustainability-linked and ESG-focused loyalty initiatives are gaining traction, aligning loyalty benefits with environmental and social values important to European consumers. Meanwhile, cloud-based deployments and mobile-first engagement continue to accelerate loyalty transformation across markets such as the UK, Germany, France, Spain, and the Nordics.

The UK loyalty management market is experiencing strong growth, driven by the growing emphasis on the adoption of analytical tools and customer engagement software to support sales, customer service, and marketing activities across all industries and sectors are the key factors driving the market growth.

The loyalty management market in Germany is witnessing robust growth. There is a rising demand for loyalty management solutions among small and medium-sized organizations in Germany, owing to the shifting focus of these organizations toward attracting new customers and gaining a competitive edge are among the primary factors driving the market growth.

The France loyalty management market is growing significantly at a CAGR from 2026 to 2033. The market in France is competitive and rapidly growing. The increasing number of SMEs in France is anticipated to bolster the demand for loyalty management solutions to obtain customer insights and increase the customer base.

Asia Pacific Loyalty Management Market Trends

The Asia Pacific loyalty management industry is expected to register the fastest CAGR from 2026 to 2033. The increasing internet usage and the continuous growth of the retail, consumer goods, and e-commerce industries in countries such as China, Japan, and India are expected to boost the market growth. Advanced loyalty management solutions are easy to use and can be accessed at an affordable price, which drives their demand among consumers across various industries and sectors, including hospitality, travel, retail, and consumer goods. Significant penetration by global market players and advancement in digital payment solutions are further driving the regional market growth.

The loyalty management market in Japan is poised for robust growth from 2026 to 2033, driven by the rising government initiatives and e-government agendas to promote workforce optimization and enable organizations to use electronic media to communicate with their customers, creating robust growth opportunities in Japan.

The China loyalty management market is witnessing rapid growth, driven by the proliferation of e-commerce platforms, increasing penetration by key retail brands, a significant presence of potential audiences, and strategic initiatives by end-use companies to improve their customer base, which are further accelerating the market growth.

Key Loyalty Management Company Insights

Key players operating in the loyalty management industry are Accenture, Check Point Software Technologies, Cisco Systems, and Cloudflare. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives:

-

In August 2025, Eagle Eye partnered with Cognizant to deliver real‑time personalized loyalty and promotions solutions at scale for enterprise retailers, combining AI‑powered engagement with implementation expertise.

-

In May 2025, Capillary Technologies completed the acquisition of Kognitiv’s loyalty assets, significantly expanding its global footprint and omnichannel loyalty capabilities by adding more enterprise clients and enhancing personalization offerings.

-

In January 2025, Loyyal announced a strategic partnership with travel marketplace tripXOXO to integrate enhanced loyalty experiences that allow members to earn and redeem points on global travel offerings.

Key Loyalty Management Companies:

The following are the leading companies in the loyalty management market. These companies collectively hold the largest market share and dictate industry trends.

- Aimia Inc.

- Bond Brand Loyalty

- Capillary Technologies

- Comarch SA

- Epsilon

- FIS Global

- Kobie Marketing

- LoyaltyLion

- Maritz Holdings Inc.

- Oracle Corporation

- Punchh Inc.

- Salesforce.com, Inc.

- SAP SE

- SessionM (Mastercard)

- Square, Inc.

Loyalty Management Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.25 billion

Revenue forecast in 2033

USD 31.11 billion

Growth rate

CAGR of 10.7% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Aimia Inc.; Bond Brand Loyalty; Capillary Technologies; Comarch SA; Epsilon; FIS Global; Kobie Marketing; LoyaltyLion; Maritz Holdings Inc.; Oracle Corporation; Salesforce.com, Inc.; SAP SE; SessionM (Mastercard); Square, Inc.; Punchh Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Loyalty Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global loyalty management market report based on component, deployment, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Channel Loyalty

-

Customer Loyalty

-

Customer Retention

-

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Transportation

-

IT & Telecommunication

-

BFSI

-

Media & Entertainment

-

Retail & Consumer Goods

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global loyalty management market size was estimated at USD 13.59 billion in 2025 and is expected to reach USD 15.25 billion in 2026.

b. The global loyalty management market is expected to grow at a compound annual growth rate of 10.7% from 2026 to 2033 to reach USD 31.11 billion by 2033.

b. The software segment accounted for the largest market share of 58.2% in 2025 in the loyalty management market. The segment growth can be attributed to the increasing use of loyalty management solutions by various end-use industries to launch and manage loyalty programs.

b. Some key players operating in the loyalty management market include Aimia Inc.; BOND BRAND LOYLATY INC.; Brierley+Partners; IBM Corporation; Comarch SA; Five Stars Loyalty Inc.; ICF International Inc.; Kobie Marketing; The Lacek Group; Martiz Holdings Inc.; Oracle Corporation; Salesforce Inc.; SAP SE; TCP AnnexCloud; and TIBCO Software Inc. among others.

b. Loyalty management software also allows businesses to go beyond mere transactions and build an emotional connection between the brand and its customers. By offering exclusive discounts, special offers, and VIP treatment, organizations can incentivize customers to stay loyal to their brand for a longer period of time. Therefore, the primary focus of loyalty management programs is to retain and nurture the customer base, as loyal customers tend to be more profitable and act as brand advocates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.