- Home

- »

- IT Services & Applications

- »

-

Loyalty Management Market Size And Share Report, 2030GVR Report cover

![Loyalty Management Market Size, Share & Trends Report]()

Loyalty Management Market Size, Share & Trends Analysis Report By Offering (Solution, Service), By Solution, By Services (Professional Services, Managed Services), By Operator, By Deployment, By Organization Size, By Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-504-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Loyalty Management Market Size & Trends

The global loyalty management market size was estimated at USD 10.67 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. Loyalty management platforms offer businesses the necessary tools to design, implement, and manage effective loyalty programs. The rapid digital transformation in the retail industry is driving the adoption of loyalty management solutions in this sector. Innovative digital loyalty and engagement platforms, including mobile apps and online platforms, are helping retail businesses engage with customers across various touchpoints. Digital loyalty cards, personalized offers, and mobile wallets are some significant tools of modern loyalty programs that are driving their demand in retail industries. These factors would further market growth.

Loyalty management software assists businesses in fostering long-term relationships with existing customers by encouraging repeated business and building brand loyalty. This strategy involves the implementation of loyalty programs, rewards, and incentives to motivate customers to make recurring purchases. Loyalty management software also allows businesses to go beyond mere transactions and build an emotional connection between the brand and its customers. By offering exclusive discounts, special offers, and VIP treatment, organizations can incentivize customers to stay loyal to their brand for a longer period. Therefore, the primary focus of loyalty management programs is to retain and nurture the customer base, as loyal customers tend to be more profitable and act as brand advocates. These factors are expected to drive market growth.

Industry players are utilizing advanced technologies, including AI, ML, and data analytics, to help businesses analyze large volumes of customer data for evaluating patterns and preferences, making the customer experience more engaging and rewarding. Furthermore, there is a significant rise in initiatives, such as new offering launches, partnerships, mergers, and acquisitions, by key players to integrate the latest technologies into their respective loyalty management solutions to enhance their offering performance and capabilities. For instance, in August 2023, Valuedynamx Ltd., a data-centric multichannel purchase rewards provider, announced the launch of the Pay with Points solution that helps banks or credit card issuers and airlines with miles-based loyalty programs to offer more dynamic reward options through Valuedynamx’s growing network of merchant partners.

These factors drive the market growth. The growing preference for automated and integrated solutions bodes well for market growth. The demand for technologically advanced loyalty management solutions is increasing as several organizations have started opting for streamlined and robust software to reduce dependency on human resolutions, minimize routine tasks, and reduce manual errors. For instance, mobile deployments and digital wallets replace traditional punch cards and physical loyalty cards. This shift offers customers convenience and provides businesses with more insights into customer behaviors. Moreover, it enables the integration of loyalty programs with other digital marketing efforts, creating a more seamless customer journey.

Various international regulatory bodies have drafted regulations to protect consumer data from unauthorized users and prevent any potential misuse of personal data. Market players must abide by various regulations and acts, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), related to personal data protection and other acts related to software design. Various governments are focusing on incentivizing indigenous software development, thereby encouraging market players to invest in their home countries, develop innovative solutions, provide employment opportunities to locals, and increase their regional customer base. These factors would further drive market growth during the forecast period.

Market Concentration & Characteristics

Industry players are adopting advanced technologies, such as artificial intelligence (AI), machine learning (ML), and data analytics, to help customers analyze large volumes of customer data and evaluate various patterns and customer preferences, making loyalty programs more customer-centric for greater customer engagement. There is a significant rise in initiatives, such as mergers and acquisitions, by market players to integrate the latest technologies into their respective loyalty management solutions to enhance their product performance and capabilities. In April 2023, Brierley+Partners was acquired by Capillary Technologies, an engagement platform and customer loyalty provider, to provide customers with more effective and efficient loyalty and customer engagement solutions via Capillary Technologies’ next-generation Software-as-a-Service (SaaS) platform.

With the rising initiatives by organizations to follow standardized practices, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) for data privacy, industry associations, and organizations have been working to establish guidelines and ethical frameworks promoting responsible data handling and usage.

The threat of substitutes can be termed as high owing to the presence of several external substitutes, including discounts and cashback, which businesses opt to acquire and build customer loyalty.

End-user organizations are buying loyalty management solutions based on multiple factors, such as pricing, product quality, features, and brand recognition. Furthermore, businesses in the market prefer integrated software suites that offer multi-purpose functionalities, which can be easily integrated with the incumbent systems of the businesses.

Offering Insights

The solution segment accounted for the largest share of over 58% in 2023 in the market. The segment growth can be attributed to the increasing use of loyalty management solutions by various end-use industries to launch and manage loyalty programs. Loyalty management solutions offer various features, such as tracking & analytics; flexible Deployment Programming Interface (API); and compliance with regulations, such as the Payment General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and Card Industry Data Security Standard (PCI DSS). Companies in this market are focused on introducing innovative loyalty management solutions to improve their brand value. For instance, in March 2023, Kognitiv Corporation, a technology company in Toronto, launched an AI-driven loyalty management and partner collaboration solution, Kognitive Pulse, which enables its clients to make data-driven personalization and optimization of consumers’ journey across omnichannel Software-as-a-Service (SaaS) platform.

The services segment is anticipated to grow at a CAGR of 9.6% from 2024 to 2030. The loyalty management services segment is anticipated to witness considerable growth from 2024 to 2030 owing to its wide range of features, such as customer report analysis, multichannel marketing, workflow management, dispute resolution, creation of new loyalty programs, and post-sale analysis. With loyalty management services, end-users can perform extensive data analysis to gain actionable insights and make data-driven decisions. Furthermore, loyalty management service providers, such as IGT Solutions Pvt. Ltd., Flatworld Solutions Inc., and OSF Digital, focus on providing 24x7 support to their clients to enhance their relationships with customers and increase their customer retention rate.

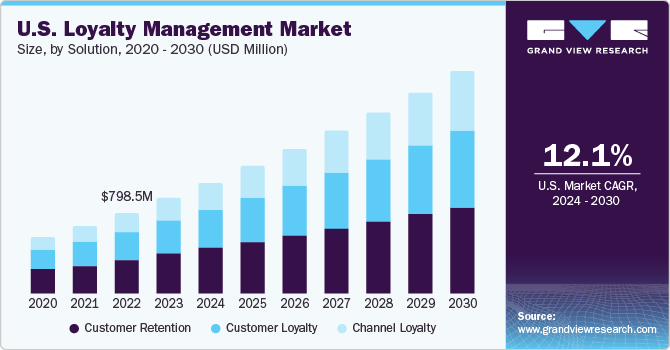

Solution Insights

The customer loyalty segment accounted for the largest share of over 39% in 2023. The shifting focus of various end-user companies on increasing customer loyalty amid growing competition is driving the segment growth. Many businesses are establishing strategic partnerships with other businesses to enable their customers to earn multiple rewards. For instance, in October 2022, Starbucks Coffee Company partnered with Delta Air Lines to provide loyalty programs for Starbucks Rewards and Delta SkyMiles members. At every eligible purchase at Starbucks, the members earn 1 USD/mile, which can be applied to their flight ticket from Delta Air Lines. Loyal customers yield considerable conversion rates of around 60-70%, whereas new customer conversion rates are only around 5-20%. Due to this, companies are adopting customer loyalty solutions to improve their relationship with existing customers and increase their revenue streams.

The channel loyalty segment is anticipated to grow at a CAGR of 9.8% from 2024 to 2030. The channel loyalty program is a crucial sales pillar in the growth strategy of a business. A well-driven channel loyalty program plays a key role in strengthening the brand identity by enhancing engagement with influencers, retailers, and partners, supporting the segment's growth. With a focus on onboarding new partners/retailers, the brand also needs to retain existing partners to establish a strong brand image. Channel loyalty solution assists companies in analyzing the performance of their partners/retailers and rewarding them according to their sales volume or achieved goals. For instance, in September 2023, oil & gas company BP Plc added loyalty pricing in its BPme Rewards loyalty scheme, offering customers exclusive discounts at around 300 company-owned retail stores in the UK.

Services Insights

Professional services are typically offered by specialized loyalty management solution providers or consultants with expertise in customer relationship management and marketing aspects. These services involve the development and implementation of effective loyalty program strategies tailored to the specific needs and goals of a business. This includes the design of reward structures, customer segmentation, and the integration of technology platforms to facilitate seamless program execution.

Managed services in loyalty management refer to the outsourcing of various aspects of loyalty programs to third-party service providers. Managed services allow businesses to focus on their core competencies while leveraging the expertise of specialized firms to design, implement, and maintain their loyalty initiatives. These services cover a wide range of activities, including program strategy, data analytics, technology infrastructure, customer support, and campaign management.

Operator Insights

In the Business-to-Business (B2B) segment, loyalty management solutions play a crucial role in facilitating and optimizing loyalty programs for large businesses. The loyalty programs specialize in developing and implementing loyalty solutions that cater to the unique needs and dynamics of B2B relationships. Their services often encompass the design and execution of loyalty programs tailored to foster long-term, mutually beneficial partnerships between businesses.

In the Business-to-Consumer (B2C) segment, loyalty management solutions help in building and maintaining strong, lasting relationships with individual consumers. Loyalty management programs play a pivotal role in designing and implementing loyalty programs that cater to the specific needs and preferences of end-users. A key aspect involves leveraging customer data to understand behaviors, preferences, and purchasing patterns, enabling the creation of personalized and targeted loyalty initiatives.

Deployment Insights

The on-premise segment accounted for the largest share of over 51% in 2023. The segment growth can be attributed to the high adoption among large- and medium-sized businesses. Several businesses prefer on-premise solutions because of the ease of customization during implementation. On-premise solutions provide advanced data security, making it convenient to comply with various government regulations. The on-premise deployment also provides organizations with greater control over sensitive data while allowing them to roll out a personalized network for loyalty management programs that best meet their needs. The cloud segment is anticipated to grow at a CAGR of 9.8% from 2024 to 2030.

The segment growth can be attributed to various benefits offered by cloud-based loyalty management solutions, such as low maintenance costs, remote management of loyalty programs, and quick deployment. Cloud deployment allows employees in an organization to access measurement and analytical tools in real-time and make better decisions about the customer journey. Cloud-based solutions are widely preferred over conventional systems as they are more effective in meeting evolving customer expectations.Key players are making significant investments in the market owing to rising inclination of customers toward cloud-based solutions. For instance, in July 2023, International Business Machines Corporation launched a new cloud region in Madrid, Spain. This new cloud region comprises three data centers in Madrid, Las Rozas, and Alcobendas city.

Organization Size Insights

The large enterprises segment accounted for the largest share of over 62% in 2023. The segment growth can be attributed to the emphasis of these companies on increasing their customer retention rate by offering incentives and rewards. Furthermore, large-scale enterprises are making significant investments in customer loyalty solutions to maintain their position in the competitive industry. When implementing loyalty management solutions, large-scale enterprises focus on factors, such as the need for simplicity of framework coordination, better adaptability, and data protection. Their higher financial capability allows them to implement advanced loyalty management solutions, which bodes well for segment growth.

The Small & Medium Enterprises (SMEs) segment is anticipated to grow at a CAGR of 10.0% from 2024 to 2030. Initially, SMEs, together with their particular industries, play a critical role in a country's employment and economy. The benefits of cloud-based deployments, including cost savings and compatibility with their Customer Relationship Management (CRM) system, entice small- and medium-sized businesses to choose cloud-based loyalty management solutions. For instance, in April 2022, Virgin Australia, an Australia-based airline, launched the Business Flyer Loyalty Program to retain existing SME customers and attract new ones. With this program, their members are expected to earn Velocity Points for every dollar they spend on eligible flights and can redeem those points in hotel car hires, next flight booking, and at various brand partner stores.

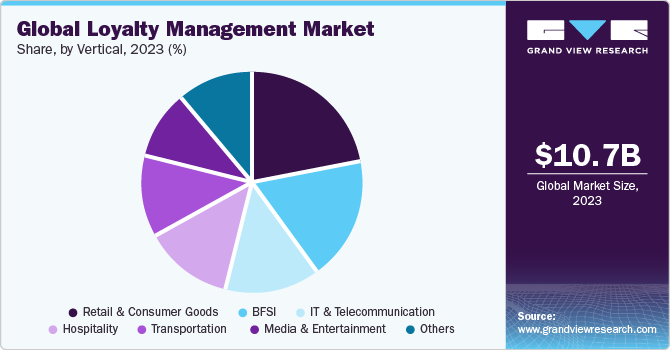

Vertical Insights

The retail & consumer goods segment accounted for the largest share of over 21% in 2023. The significant growth of the retail & consumer goods segment can be attributed to the increasing internet penetration rate and growing preference for mobile apps for making purchases and related decisions. Furthermore, consumer goods companies and retailers are utilizing loyalty programs in web deployments and digital e-commerce to retain existing customers and attract new customers. Various brands are launching loyalty programs to stay ahead of the competition and increase their customer base. For instance, in September 2023, children's clothing brand Hanna Andersson launched a loyalty program, Hanna Rewards, which offers one point for each dollar spent by customers on apparel. When the point count reaches 125, customers can convert them to a USD 10 reward. Customers can also get access to new offerings, sales, and limited-time deals.

The hospitality segment is anticipated to grow at a CAGR of 10.0% during the forecast period. The hospitality segment is witnessing notable growth due to the increasing adoption of loyalty management solutions by various restaurants, hotels, and resorts to enhance their customer experience and loyalty to the brand. Hospitality loyalty programs are offered in various categories: personalized rewards, points system, and partnership rewards. Furthermore, apart from general rewards, guests can also receive service-based rewards such as free internet access, discounts on luxury suites for the next visit, instant redemption on food & beverage services, and no blackout dates.

Regional Insights

North America held the major share of over 34% of the loyalty management market in 2023. The regional growth can be attributed to the high adoption of loyalty management solutions in the region, led by significant competition in a majority of industries. North America is characterized by the presence of major loyalty management providers, namely Aimia, Inc., Bond Brand Loyalty, Inc., ICF International Inc., Kobie Marketing, and TIBCO Software, which are significantly investing in R&D to develop advanced loyalty management solutions and increase their customer bases, contributing to the regional market growth.

U.S. Loyalty Management Market Trends

Customers in the U.S. widely use debit and credit cards in stores to adopt monetary benefits and gain benefits from loyalty programs, such as product discounts, rebates, and cashback. These factors would further drive the growth of the regional loyalty management market during the forecast period.

Europe Loyalty Management Market Trends

The loyalty management market in Europe is growing significantly at a CAGR of 9.7% from 2024 to 2030. The European loyalty management market is driven by the growing demand for personalized loyalty management solutions, especially in the UK, France, and Italy, owing to factors such as brand investments in AI and customer engagement in these countries.

The loyalty management market in the UK is growing significantly at a CAGR of 7.3% from 2024 to 2030. The growing emphasis on the adoption of analytical tools and customer engagement software to support sales, customer service, and marketing activities across all industries and sectors are the key factors driving the UK loyalty management market growth.

Germany loyalty management market is growing significantly at a CAGR of 8.5% from 2024 to 2030. There is a rising demand for loyalty management solutions among small and medium-sized organizations in Germany owing to the shifting focus of these organizations toward attracting new customers and gaining a competitive edge are among the primary factors driving the Germany loyalty management market growth.

The loyalty management market in France is growing significantly at a CAGR of 11.4% from 2024 to 2030. The loyalty management market in France is a competitive and rapidly growing market. The increasing number of SMEs in France is anticipated to bolster the demand for loyalty management solutions to obtain customer insights and increase the customer base.

Asia Pacific Loyalty Management Market Trends

The loyalty management market in Asia Pacific is growing significantly at a CAGR of 10.3% from 2024 to 2030. The increasing internet usage and continuous growth of the retail, consumer goods, and e-commerce industries in countries, such as China, Japan, and India, are expected to boost regional market growth. Furthermore, advanced loyalty management solutions are easy to use and can be availed at an affordable price, which drives their demand among consumers across industries and sectors, such as hospitality, travel, retail, and consumer goods. In addition, significant penetration by global players and advancement in digital payment solutions is driving regional market growth.

The loyalty management market in China is growing significantly at a CAGR of 7.9% from 2024 to 2030. The proliferation of e-commerce platforms, increasing penetration by key retail brands, a significant presence of potential audience, and strategic initiatives by end-use companies to improve their customer base are further accelerating market growth.

Japan loyalty management market is growing significantly at a CAGR of 11.0% from 2024 to 2030. The rising government initiatives and e-government agendas promoting workforce optimization and enabling organizations to use electronic media to communicate with their customers, create robust market opportunities for the Japan loyalty management market.

The loyalty management market in India is expected to grow significantly at a CAGR of 11.7% from 2024 to 2030. In India, the continued deployment of cloud-based solutions, rising demand for big data analytics, and shifting focus of end-user companies toward loyalty management solutions are driving the market growth.

Middle East & Africa Loyalty Management Market Trends

The loyalty management market in Middle East & Africa is growing significantly at a CAGR of 7.7% from 2024 to 2030. Increasing internet usage, coupled with a significant tech-savvy population in Middle East & Africa, is projected to boost the demand for loyalty management solutions in the regional market.

The loyalty management market in Saudi Arabia is growing significantly at a CAGR of 8.7% from 2024 to 2030. As Saudi Arabia attracts top retail and electronics brands, it creates the need for offering improved customer experience services with the help of loyalty management solutions. Furthermore, supportive government initiatives for employee loyalty programs bode well for the regional market growth.

Key Loyalty Management Company Insights

Some of the key players operating in the market include Oracle Corporation, Salesforce, Inc., and IBM Corporation.

-

Oracle Corporation specializes in providing technological solutions and enterprise software. The CrowdTwist loyalty and engagement solution offered by the company provides customers with a flexible SaaS platform, customizable loyalty programs, and superior customer engagement opportunities

-

Salesforce, Inc. is an enterprise software provider, which offers customer management software suites through the cloud platform. The Loyalty Management solution offered by the company is a standalone product, which can be integrated across various ecosystems. It helps organizations create more intelligent and personalized engagements with their customers, enhances Customer Lifetime Value, and boosts positive ROI

BOND BRAND LOYALTY INC., Comarch SA, and Aimia Inc. are some of the emerging market participants in the loyalty management market.

-

BOND BRAND LOYALTY INC. is a data-driven customer experience and loyalty management business company engaged in providing loyalty solutions and integrated marketing services. The company specializes in management marketing and measurement of experiences that build brand loyalty for organizations

-

Comarch SA designs, implements, integrates, and sells IT solutions globally. The company has categorized its offerings under the Customer Loyalty Marketing Platform into Loyalty Management, Data Analytics, Marketing Automation, Omnichannel Marketing Applications, and Loyalty Consulting

Key Loyalty Management Companies:

The following are the leading companies in the loyalty management market. These companies collectively hold the largest market share and dictate industry trends.

- Aimia Inc.

- BOND BRAND LOYALTY INC.

- Brierley+Partners

- IBM Corporation

- Comarch SA

- Five Stars Loyalty Inc.

- ICF International Inc.

- Kobie Marketing

- The Lacek Group

- Martiz Holdings Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- AnnexCloud

- Tibco Software Inc.

Recent Developments

-

In January 2023, IBM Corporation announced IBM Partner Plus, a program to reimagine the way the company engages with its business partners by providing unprecedented access to the company’s resources and incentives. The program envisaged fueling growth for both new and incumbent partners, including technology providers, resellers, and independent software vendors, by putting them in a position to control their earning potential

-

In March 2023, Salesforce, Inc. announced a partnership with Polygon, a blockchain platform for Non-Fungible Token (NFT)-based loyalty program. The partnership envisaged Salesforce Inc. assisting its clients in transitioning to Polygon by providing a management platform that would allow them to develop token-based loyalty programs

-

In August 2023, Comarch SA announced a partnership with Virgin Active, a health club based in South Africa, to enhance Virgin Active’s retention, members’ experience, and engagement. With the introduction of the new Virgin Active Rewards program and Virgin Active App, the company was looking forward to making leading a healthy lifestyle easier and more accessible to its members

Loyalty Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.07 billion

Revenue forecast in 2030

USD 20.44 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

March 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, solution, services, operator, deployment, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Aimia Inc.; BOND BRAND LOYALTY INC.; Brierley+Partners; IBM Corp.; Comarch SA; Five Stars Loyalty Inc.; ICF International Inc.; Kobie Marketing; The Lacek Group; Martiz Holdings Inc.; Oracle Corp.; Salesforce Inc.; SAP SE; TCP AnnexCloud; TIBCO Software Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Loyalty Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the loyalty management market report based on offering, solution, services, operator, deployment, organization size, vertical, and region:

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Service

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Channel Loyalty

-

Customer Loyalty

-

Customer Retention

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Consulting

-

Implementation

-

Support & Maintenance

-

-

Managed Services

-

-

Operator Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business-to-Business

-

Business-to-Customers

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise (SME)

-

Large Enterprise

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

IT & Telecommunication

-

BFSI

-

Media & Entertainment

-

Retail & Consumer Goods

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

UK

-

France

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Mexico

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

Frequently Asked Questions About This Report

b. The global loyalty management market size was estimated at USD 10.67 billion in 2023 and is expected to reach USD 12.07 billion in 2024.

b. The global loyalty management market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 20.44 billion by 2030.

b. The solution segment accounted for the largest market share of over 58% in 2023 in the loyalty management market. The segment growth can be attributed to the increasing use of loyalty management solutions by various end-use industries to launch and manage loyalty programs.

b. Some key players operating in the loyalty management market include Aimia Inc.; BOND BRAND LOYLATY INC.; Brierley+Partners; IBM Corporation; Comarch SA; Five Stars Loyalty Inc.; ICF International Inc.; Kobie Marketing; The Lacek Group; Martiz Holdings Inc.; Oracle Corporation; Salesforce Inc.; SAP SE; TCP AnnexCloud; and TIBCO Software Inc. among others.

b. Loyalty management software also allows businesses to go beyond mere transactions and build an emotional connection between the brand and its customers. By offering exclusive discounts, special offers, and VIP treatment, organizations can incentivize customers to stay loyal to their brand for a longer period of time. Therefore, the primary focus of loyalty management programs is to retain and nurture the customer base, as loyal customers tend to be more profitable and act as brand advocates.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."