- Home

- »

- Clinical Diagnostics

- »

-

Lung Cancer Diagnostics Market Size, Industry Report, 2033GVR Report cover

![Lung Cancer Diagnostics Market Size, Share & Trends Report]()

Lung Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Small Cell Lung Cancer, Non-Small Cell Lung Cancer), By Test (CA Tests, HER2 Tests, ALK Tests), By End Use, Region And Segment Forecasts

- Report ID: 978-1-68038-888-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lung Cancer Diagnostics Market Summary

The global lung cancer diagnostics market size was estimated at USD 12.37 billion in 2024 and is projected to reach USD 23.31 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The market encompasses diagnostic technologies designed to facilitate the early detection and accurate classification of lung cancer, which remains one of the leading causes of cancer-related mortality worldwide.

Key Market Trends & Insights

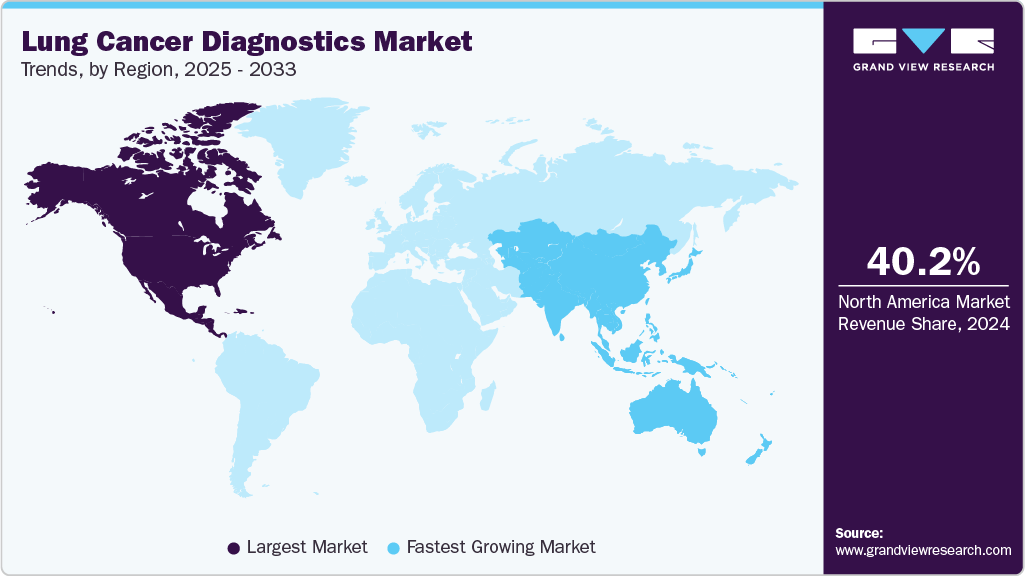

- North America dominated the global lung cancer diagnostics market with the largest revenue share of 40.17% in 2024.

- The U.S. led the North America market with the largest revenue share in 2024.

- Based on type, the non-small cell lung cancer (NSCLC) segment dominated the global market with the largest revenue share of 67.2% in 2024.

- Based on test, the EGFR mutation tests segment held the largest revenue share of 38.9% in 2024.

- Based on end use, the laboratories segment held the largest revenue share of 51.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.37 Billion

- 2033 Projected Market Size: USD 23.31 Billion

- CAGR (2025-2033): 7.5 %

- North America: Largest market in 2024

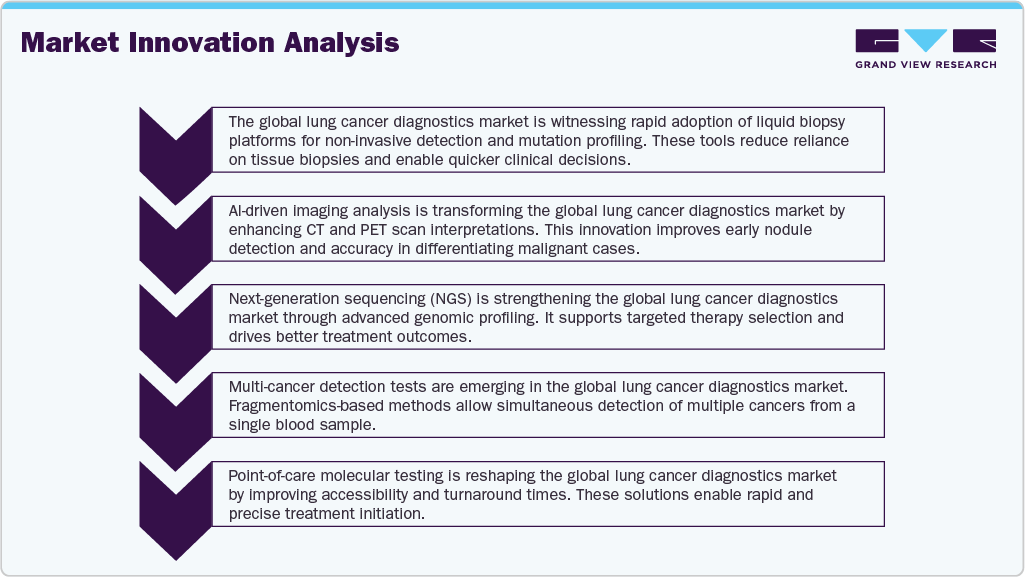

A broad range of diagnostic modalities, such as imaging techniques, molecular tests, and biopsy-based assessments, are employed to support clinical decision-making. The adoption of advanced molecular diagnostics and liquid biopsy methods is gaining traction, driven by the rising focus on personalized medicine and the identification of actionable genetic mutations for targeted therapy.Growing awareness about the importance of early cancer detection, coupled with ongoing developments in imaging systems and next-generation sequencing platforms, is shaping the market landscape. The integration of AI-based image analysis and the expansion of point-of-care testing solutions are also improving diagnostic accuracy and reducing turnaround times. In addition, increased screening programs, particularly in high-risk populations, and supportive initiatives by health authorities are accelerating the demand for innovative diagnostic tools. These factors contribute to the growth of the global lung cancer diagnostics industry.

Worldwide, lung cancer is the second leading and most occurring cancer in men. However, in several countries, lung cancer has become one of the prominent causes of cancer-related deaths. The common symptoms include hemoptysis, cough, or systemic symptoms such as weight loss or anorexia that increase the chances of developing chronic conditions, including cancer. The WHO estimates around 1.80 million deaths due to lung cancer worldwide annually. Excessive smoking habits are highly prevalent in men, and tobacco exposure contains around 7,000 chemicals, with more than 50 known cancer-causing chemicals. Therefore, excessive tobacco consumption and smoking are likely to be significant factors for lung screening and diagnostics.

Over the past few years, there has been a prominent rise in patients with chronic lung cancers irrespective of smoking. For instance, patients with small-cell lung cancer (SCLC) may or may not have a smoking history. However, 15 to 20 percent of patients are exposed to secondhand or passive smoking. Besides smoking, other factors such as radon exposure, asbestos, genetics, air pollution, and dietary factors develop chronic conditions in patients. Genetics and asbestos account for a high probability of developing cancerous conditions in patients.

Overall, the global lung cancer diagnostics industry is progressing toward more precise, faster, and less invasive diagnostic approaches. Continuous integration of AI, NGS, and liquid biopsy solutions is streamlining clinical workflows and enabling early detection, which is essential for improving patient outcomes. Growing investments in innovative technologies and the expansion of screening initiatives are expected to further strengthen diagnostic capabilities across healthcare systems.

Market Concentration & Characteristics

Innovation is high in the global lung cancer diagnostics market, driven by the demand for accurate, non-invasive, and rapid diagnostic solutions. Developments in liquid biopsy, next-generation sequencing (NGS), and AI-based imaging tools are improving early detection and clinical decision-making. Multiplex assays and integrated digital platforms are also supporting the trend toward precision diagnostics and personalized medicine.

Mergers and acquisitions are moderately active, with diagnostic companies seeking to enhance their molecular and imaging portfolios. Many acquisitions focus on expanding capabilities in liquid biopsy technologies, genomic testing, and AI-driven platforms. Strategic partnerships between diagnostic firms and digital health companies are also gaining traction to improve interoperability and accelerate innovation.

Regulatory authorities such as the U.S. FDA play a pivotal role in shaping market access and product approvals. Compliance with guidelines and certifications, including CE marking and ISO standards, remains critical for the commercialization of diagnostic solutions. Regulatory frameworks are increasingly focusing on the validation of AI-based tools and liquid biopsy platforms for clinical use.

Companies are diversifying their product offerings by incorporating advanced imaging modalities, molecular testing kits, and blood-based diagnostics into their portfolios. Compact and automated platforms that reduce diagnostic turnaround times are being developed, while cloud integration and digital connectivity enhance real-time data sharing for better clinical outcomes.

North America dominates in terms of adoption, but Asia Pacific and Latin America are emerging as key growth regions. Expanding screening programs, rising awareness about early detection, and supportive government initiatives are boosting demand. Local partnerships and manufacturing strategies are further improving accessibility and reducing costs in these markets.

Type Insights

The non-small cell lung cancer (NSCLC) segment accounted for the largest revenue share of 66.9% in 2024. NSCLC is further divided into squamous cell carcinoma, adenocarcinoma, and large cell carcinoma of the lung. While diagnostic methods for these subtypes are similar, treatment plans differ based on the molecular and pathological characteristics of the cancer. NSCLC is commonly suspected in patients with persistent cough, chest pain, breathlessness, coughing blood, or hoarseness, particularly in individuals with a long history of smoking. The growing need for imaging techniques, targeted therapies, chemotherapy, and immunotherapy is supporting the dominance of the NSCLC diagnostics segment.

In May 2025, the U.S. FDA approved the VENTANA MET (SP44) RxDx Assay as a companion diagnostic for identifying NSCLC patients with high c-MET protein overexpression who are eligible for telisotuzumab vedotin-tllv (Emrelis) therapy. This approval, based on phase II LUMINOSITY trial data, highlights the rising importance of biomarker-driven diagnostics in optimizing treatment pathways for NSCLC

The small-cell lung cancer (SCLC) is expected to witness a CAGR of 6.5% during the forecast period. In the U.S. alone, more than 50 people in 100,000 develop lung cancer annually. Small-cell lung cancer represents around 20% of those cancers. The condition is uncommon compared with non-small cell lung cancers. SCLC is further bifurcated into small-cell carcinoma and combined small-cell carcinoma. Patients who possess genetic conditions and have a shared history of lung cancer in the family are susceptible to developing SCLC. Technological developments such as imaging, biopsy, and bronchoscopy have emerged as diagnostic solutions catering to patient needs. Therefore, their significance to the healthcare industry accelerates the demand for lung cancer diagnostics.

Test Insights

EGFR mutation tests led the lung cancer diagnostics industry, capturing approximately 38.9% share in 2024. EGFR mutations-including exon 19 deletions, L858R, and T790M-are among the most common actionable biomarkers in NSCLC. Unregulated EGFR signaling drives rapid tumorigenic growth, underscoring the importance of mutation-driven testing for guiding targeted therapies. While tissue biopsy remains the standard diagnostic approach, liquid biopsy is growing in use for advanced disease, though broader adoption awaits further validation of its accuracy in broader clinical settings.

In July 2025, the U.S. FDA cleared the Oncomine Dx Express Test-an NGS-based companion diagnostic-for identifying EGFR exon 20 insertion mutations in NSCLC patients eligible for sunvozertinib (Zegfrovy) therapy. This marks a breakthrough in enabling rapid, in-house genomic profiling, delivering results in under 24 hours, and facilitating timely treatment decisions for a difficult-to-target NSCLC subtype.

The HER2 test segment is expected to witness the fastest CAGR over the forecast period. HER2 tests include next-generation sequencing (NGS), which involves placing damaged tissue from the patient’s tumor within a machine that looks for several biomarkers at one time. Other treatment options, such as pills that inhibit HER2 from spreading in the body. However, pills are clinical trials for these therapies, and presently, chemotherapy and immunotherapy are the first-line treatment for patients with chronic conditions.

End Use Insights

The laboratories segment dominated the global lung cancer diagnostics market with a revenue share of 51.6% in 2024. This dominance is driven by their ability to perform a wide range of diagnostic procedures, such as tissue biopsies, molecular testing, and immunohistochemistry, with high accuracy and efficiency. Laboratories often handle large test volumes, maintain standardized workflows, and employ trained personnel to ensure reliable results. Many have integrated advanced tools like next-generation sequencing and liquid biopsy to support targeted treatment decisions, especially in non-small cell lung cancer. Their collaborations with hospitals and oncology centers further reinforce their critical role in the diagnostic pathway.

The hospitals segment is experiencing notable growth in the forthcoming years, supported by their ability to offer integrated diagnostic and treatment services under one roof, improving patient convenience and care coordination. Hospitals are increasingly adopting advanced diagnostic tools, such as molecular assays and imaging technologies, to facilitate early and precise detection of lung cancer. The presence of multidisciplinary teams allows for immediate interpretation of results and faster treatment planning. In many cases, hospitals also act as referral centers, receiving complex cases that require specialized diagnostic evaluation, further driving demand within this segment.

Regional Insights

North America dominated the global lung cancer diagnostics market in 2024 due to its advanced healthcare infrastructure, high healthcare spending, and strong reimbursement regulations for cancer diagnostics. The healthcare industry in North America has witnessed a rise in the patient pool, attributed to unhealthy lifestyles, poor diet habits, and growing cases of stage-IV lung cancer in patients. On the other hand, the regional industry is well equipped with state-of-the-art research laboratories, availability of quality treatment, a qualified medical workforce, and high spending on lung cancer screening.

U.S. Lung Cancer Diagnostics Market Trends

The U.S. continues to drive the global lung cancer diagnostics industry, supported by extensive screening infrastructure, favorable reimbursement policies (including Medicare coverage for annual low-dose CT in high-risk groups), and wide availability of cutting-edge diagnostic technologies. Both tissue-based and liquid-biopsy platforms are routinely utilized across academic centers and community hospitals to enable biomarker-guided therapies.

In April 2025, the U.S. FDA granted Breakthrough Device Designation to Roche’s VENTANA TROP2 RxDx Device, an AI-powered computational pathology assay designed for NSCLC. This first-of-its-kind companion diagnostic combines immunohistochemistry staining and digital image analysis to generate a quantitative TROP2 expression score, aiding identification of patients likely to respond to AstraZeneca/Daiichi Sankyo’s datopotamab deruxtecan (Datroway) therapy. This regulatory milestone underscores the growing role of AI-enhanced diagnostics in precision oncology.

Europe Lung Cancer Diagnostics Market Trends

Europe accounted for a substantial revenue share of the lung cancer diagnostics industry in 2024. European countries are gradually adopting low-dose computed tomography (LD-CT) that detects early-stage cancer and reduces the chances of mortality in cancer patients. As lung cancer is identified to be a major cause of death across European countries, an effective prognosis is expected to serve the need for customized treatment strategies. In addition, molecular diagnostic checks that pinpoint particular genetic mutations in patients are expected to become popular in the forthcoming years.

The UK lung cancer diagnostics market is supported by a well-structured healthcare system under the National Health Service (NHS), which emphasizes early detection through national screening initiatives and clinical guidelines. The rising incidence of lung cancer, combined with the adoption of low-dose CT scans and biomarker testing, is driving demand for advanced diagnostic tools. Efforts to improve access to molecular diagnostics and integrate AI-driven imaging solutions are shaping the diagnostic landscape in the country, while government-led awareness campaigns and funding programs further enhance the focus on early diagnosis and patient outcomes.

The lung cancer diagnostics market in Germany is characterized by strong adoption of advanced imaging modalities, molecular testing, and biomarker-driven diagnostics, supported by a well-established healthcare infrastructure. National cancer screening programs, combined with high awareness among healthcare professionals, contribute to early detection initiatives. Increasing utilization of liquid biopsy techniques and next-generation sequencing in clinical settings is enhancing diagnostic precision, while continuous investments in research and development further strengthen the country’s diagnostic capabilities.

Asia Pacific Lung Cancer Diagnostics Market Trends

The Asia Pacific lung cancer diagnostics industry is projected to witness the fastest growth in the coming years due to the rising adoption of advanced diagnostic technologies such as low-dose CT, molecular testing, and liquid biopsy. The increasing incidence of lung cancer, an aging population requiring regular screening, and the expansion of middle-income groups are fueling the demand for diagnostic solutions. Government-backed awareness programs and investments in early detection initiatives are further supporting market expansion across the region.

A key recent development took place in July 2025, when the Australian Government introduced the National Lung Cancer Screening Program, offering low-dose CT-based screening for high-risk adults aged 50 to 70 through the national healthcare system. This initiative underscores the region’s growing focus on structured diagnostic pathways for early lung cancer detection.

The lung cancer diagnostics market in Japan is supported by advanced healthcare infrastructure, high adoption of imaging technologies, and growing use of molecular and biomarker-based testing. Government-driven health programs, combined with strong awareness among healthcare professionals, contribute to early detection and improved diagnostic accuracy. The country’s aging population, coupled with a high prevalence of smoking-related lung cancer cases, continues to drive demand for efficient diagnostic solutions.

The China lung cancer diagnostics marketis expanding rapidly, driven by the high prevalence of lung cancer and increasing investments in advanced diagnostic technologies. Government initiatives aimed at early detection, along with the growing adoption of low-dose CT screening and molecular testing, are supporting market growth. Rising healthcare expenditure, an aging population, and improved accessibility to diagnostic services are further contributing to the development of the market in the country.

Latin America Lung Cancer Diagnostics Market Trends

The lung cancer diagnostics industry in Latin America, particularly in Argentina and Brazil, is growing due to the rising incidence of lung cancer and increasing awareness about early detection. Improvements in healthcare infrastructure, along with the gradual adoption of advanced imaging and molecular diagnostic tools, are driving the demand for accurate diagnostic solutions. Government health initiatives and collaborations with international healthcare organizations are further supporting the expansion of screening programs and diagnostic services across the region.

The lung cancer diagnostics market in Brazil is expanding due to rising lung cancer cases, increased adoption of advanced diagnostic technologies, and growing public awareness about early detection. Government efforts to strengthen cancer care infrastructure and improve access to screening programs are contributing to the demand for imaging, molecular testing, and biomarker-based diagnostics. The presence of both public and private healthcare initiatives is supporting the integration of innovative diagnostic solutions across the country.

Middle East and Africa Lung Cancer Diagnostics Market Trends

The lung cancer diagnostics industry in Middle East & Africa is gradually developing, driven by a rising burden of lung cancer and increasing adoption of advanced diagnostic tools in urban healthcare facilities. Countries such as South Africa, the UAE, and Saudi Arabia are increasingly focusing on improving cancer screening programs and expanding access to molecular and imaging-based diagnostics. Investments in healthcare infrastructure, combined with collaborations with global diagnostic companies and government-led awareness campaigns, are further enhancing early detection and diagnostic capabilities across the region.

Key Lung Cancer Diagnostics Company Insights

Key players in the global lung cancer diagnostics market are prioritizing new product development and obtaining regulatory approvals to broaden their diagnostic portfolios. In addition, companies are engaging in strategic initiatives such as partnerships, collaborations, mergers, and acquisitions to reinforce their market presence. These strategies are aimed at advancing technology portfolios, expanding geographic coverage, and improving accessibility to rapid and accurate diagnostic solutions across various healthcare environments.

Key Lung Cancer Diagnostics Companies:

The following are the leading companies in the lung cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific

- Illumina Inc.

- Agilent Technologies

- Qiagen

- Abbott

- Bio-Rad

- Neogenomics Laboratories

- bioMérieux

- Myriad Genetics, Inc.

Recent Developments

-

In June 2025, the U.S. FDA approved taletrectinib (Ibtrozi) for the treatment of ROS1-positive non-small cell lung cancer (NSCLC). This approval emphasizes the growing importance of ROS1 fusion testing as part of comprehensive biomarker diagnostics, ensuring the timely identification of patients eligible for targeted therapies and reinforcing the role of molecular diagnostics in guiding personalized lung cancer treatment.

-

In February 2025, Imagene announced a collaboration with Tempus to advance AI-driven diagnostics for non-small cell lung cancer (NSCLC). The partnership focuses on developing an AI-based multi-gene panel capable of predicting key NSCLC biomarkers, such as EGFR, ALK, and MET, directly from biopsy images within minutes. This initiative leverages Tempus’ extensive real-world clinical dataset to enhance the accuracy of Imagene’s AI models, aiming to accelerate biomarker profiling and streamline lung cancer diagnostic workflows

-

In December 2024, the U.S. FDA approved ensartinib (Ensacove) for the treatment of ALK-positive non-small cell lung cancer (NSCLC). This highlights the critical role of ALK mutation diagnostic testing in identifying suitable patients and guiding first-line targeted therapy decisions, reinforcing the significance of biomarker-driven diagnostics in clinical workflows.

Lung Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.28 billion

Revenue forecast in 2033

USD 23.31 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, test, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific; Illumina Inc.; Agilent Technologies; Qiagen; Abbott; Bio-Rad; Neogenomics Laboratories; bioMérieux; Myriad Genetics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lung Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the lung cancer diagnostics market report based on type, test, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Non-small cell lung cancer

-

Small cell lung cancer

-

-

Test Outlook (Revenue, USD Million, 2021 - 2033)

-

CA test

-

HER2 test

-

ALK test

-

Angiogenesis Inhibitors

-

EGFR Mutation test

-

KRAS Mutation test

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lung cancer diagnostics market size was estimated at USD 12.37 billion in 2024 and is expected to reach USD 13.28 billion in 2025

b. The global lung cancer diagnostics market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2033 to reach USD 23.31 billion by 2033

b. North America dominated the global lung cancer diagnostics market in 2024 due to its advanced healthcare infrastructure, high healthcare spending, and strong reimbursement regulations for cancer diagnostics

b. Some key players operating in the global lung cancer diagnostics market include F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific; Illumina Inc.; Agilent Technologies; Qiagen; Abbott; Bio-Rad; Neogenomics Laboratories; bioMérieux; Myriad Genetics, Inc.

b. The adoption of advanced molecular diagnostics and liquid biopsy methods is gaining traction, driven by the rising focus on personalized medicine and the identification of actionable genetic mutations for targeted therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.