- Home

- »

- Alcohol & Tobacco

- »

-

Luxury Cigar Market Size, Share And Growth Report, 2030GVR Report cover

![Luxury Cigar Market Size, Share & Trends Report]()

Luxury Cigar Market Size, Share & Trends Analysis Report By Type (Hand Rolled, Machine Rolled), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-691-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Luxury Cigar Market Size & Trends

The global luxury cigar market size was estimated at USD 13.34 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. The market growth is mainly driven due to a rise in demand for luxury cigars among premium smokers and millennials. The rising use of tobacco among the millennials, along with the emergence of numerous high-end cigar lounges globally, has increased the demand for luxury cigars. The growth of private clubs, cigar lounges, and the online retail sector is driving the popularity of luxury cigars. Cigar retailers have witnessed a substantial surge in their sales. This growth can be attributed to various factors, including an increasing consumer interest in premium cigars, favorable economic climate, and potential changes in smoking habits.

According to the Cigar Insider survey in 2023, the majority of cigar shops are experiencing increased sales this year compared to 2022. Out of the 81 U.S. retailers polled, who collectively represent 291 cigar shops, 69.1% reported higher sales in 2023 compared to last year.

Moreover, legislation by government bodies through the passing of bills aimed at expanding the number of smoking lounges will create lucrative opportunities for the luxury cigar industry. With the growth of cigar lounges, cigar enthusiasts will have greater access to dedicated spaces for an enhanced smoking experience. Such a factor will attract existing and potential cigar aficionados, making luxury cigars more readily available to a broader consumer base. A recently introduced bill 'Assembly Bill 451' in the Wisconsin State Assembly in October 2023 signals the potential opening of new cigar bars, marking the first such opportunity since 2009. Assembly Bill 451, which has received support from the Premium Cigar Association (PCA), has been forwarded to the State Affairs Committee for further consideration. This proposed change in the law will allow for more establishments to offer cigar-smoking experiences and broaden the options for cigar enthusiasts.

Furthermore, luxury cigar companies consistently focus on extending their distribution networks by collaborating with well-established retail channels. With such strategies, luxury cigar brands focus on broadening their presence and enhancing product visibility among the general population.

Casdagli Cigars expanded in the Middle East in April 2022, with a new presence in Bahrain. The company selected Luxury Tobacco World WLL as the brand's representative in this region.

Casdagli Cigars has been actively and rapidly broadening its distribution network recently, having added eight new markets in 2021. Bahrain is the latest addition to this growing list of countries. Casdagli Cigars has partnered with Luxury Tobacco World to introduce its brand to the cigar enthusiasts and community in Bahrain.

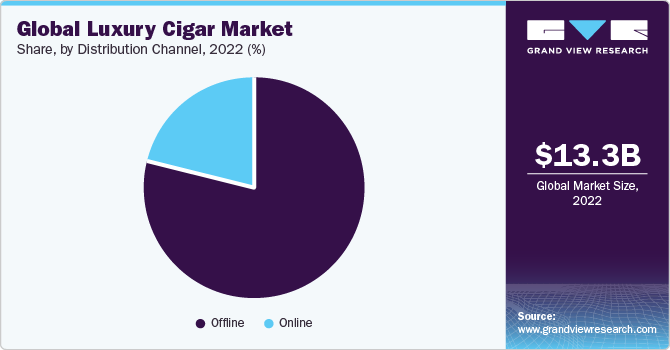

Distribution Channel Insights

The sales of luxury cigars through offline channels segment held a 78.7% share in 2022. Physical retail stores offer an extensive range of choices, often featuring attached warehouses to cater to diverse customer preferences in terms of brands and flavors. The wider the variety of brands available, the greater the potential to attract and engage a broad customer base. Manufacturers in the market are implementing strategic initiatives to boost offline distribution channel segment growth. For instance, in January 2021, Scandinavian Tobacco Group (STG) launched Forged Cigar Co., a new cigar distribution company that serves brick-and-mortar retailers. This new company will operate independently from STG's existing entity, General Cigar Co., and will take on a portion of the company's catalog of cigar brands. The move represents a strategic decision to divide the company's cigar brands and provide a dedicated distribution channel for specific products, improving its reach in the cigar industry.

The online distribution segment is anticipated to grow at a CAGR of 9.2% from 2023 to 2030. The expansion of the online distribution channel in the luxury cigar industry can be attributed to several driving factors. First, convenience plays a significant role in its growth. Online platforms provide a hassle-free shopping experience, allowing customers to explore, choose, and purchase luxury cigars from the comfort of their own homes. Extensive product descriptions, customer feedback, and educational content allow customers to make well-informed choices when selecting cigars. This transparency and easy access to information enrich the online shopping experience, assisting customers in choosing cigars that perfectly match their tastes and meet their expectations.

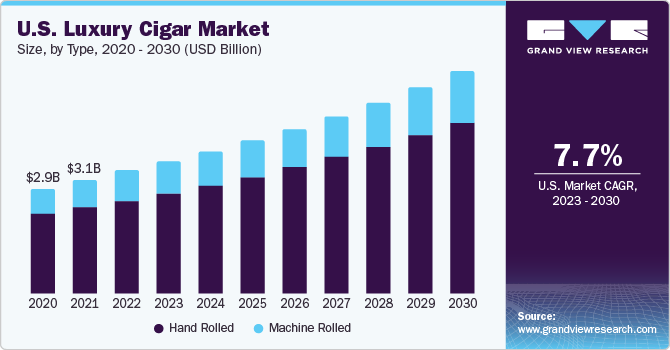

Type Insights

Hand rolled luxury cigars segment held a share of 75.5% of the global market in 2022. Hand-rolled cigars enjoy a more significant preference among premium smokers compared to machine-rolled cigars due to their notably higher quality. Luxury hand-rolled cigars exclusively use tobacco leaves for their fillers, resulting in a superior flavor profile. Moreover, the meticulously selected, moisture-retaining trimmed tobacco leaves used in the wrappers ensure a consistent and even burn, elevating the overall quality and satisfaction of the smoking experience. Hand-rolled cigars exude a sense of luxury, placing significant emphasis on the use of 100% pure tobacco, a feature greatly appreciated by cigar connoisseurs.

Machine rolled luxury cigar industry is anticipated to grow at a CAGR of 6.3% from 2023 to 2030. Machine-made luxury cigars are created through automated processes, as opposed to the meticulous hand-rolling method. This results in a reputation for reliability and consistency, making them an ideal choice for daily smoking. Machine-made cigars often employ different filler materials compared to hand-rolled cigars, featuring shorter fillers composed of a mixture of tobacco leaves, stems, and leftover scraps. This filler composition leads to a quicker and hotter burn than hand-rolled cigars.

Regional Insights

North America held a major share of over 36.8% of the global luxury cigar industry in 2022. In North America, changing consumer preferences and the increasing desire for top-notch, high-quality cigars are pushing the cigar market forward. Consumers who enjoy cigars are starting to see the fancy ones as sophisticated, cultured, and exclusive. The connection between these high-end cigars and moments of relaxation, parties, and social standing is attracting people who want to treat themselves to a lavish and distinguished experience.

The Europe luxury cigar industry is anticipated to grow at a CAGR of 7.0% over the forecast period. The rise in the number of cigar lounges in Europe offering luxury cigar products is a significant factor driving the market growth. Cigar lounges provide a premium and exclusive environment for cigar enthusiasts. These venues offer comfortable seating, knowledgeable staff, and luxury cigar selections. The overall experience of enjoying a cigar in such an upscale setting enhances the appeal of luxury cigars.

The Asia Pacific luxury cigar industry is anticipated to grow at a CAGR of 8.3% over the forecast period. The growing smoking culture in the Asia Pacific, coupled with a strong community of premium cigar enthusiasts, is fueling the demand for luxury cigars in the region. Several distributors, retailers, and manufacturers are actively working toward expanding their presence in the region. In August 2023, Honduras-based provider of luxury cigars Ferio Tego announced the distribution of its luxury cigars through the Davidoff of Geneva Asia website. Davidoff of Geneva, a key player in the market, now distributes Ferio Tego’s luxury cigar offerings to Japan, Macau, and Hong Kong. The company’s first Asian collection includes four blends: Supreme, Panamericana, Prestige, and Sterling. The blends fall under Ferio Tego’s Timeless Collection and are manufactured in Nicaragua and the Dominican Republic.

Key Companies & Market Share Insights

Companies have been diversifying their product lines by introducing new and innovative offerings. This approach allows them to cater to a wider range of customer preferences and needs, attracting a more diverse consumer base.

Key Luxury Cigar Companies:

- Scandinavian Tobacco Group A/S (General Cigars)

- Gurkha Cigar Group

- Davidoff of Geneva USA

- Fuente Marketing Ltd

- Piloto Cigars Inc. (Padrón Cigars)

- Royal Danish Cigars

- Montecristo

- Tatuaje Cigars, Inc.

- My Father Cigars, Inc.

- Daniel Marshall

Recent Development

-

In February 2023,Scandinavian Tobacco Group A/S acquired the Alec Bradley cigar business for USD 72.5 million. The brands under Alec Bradley are Alec & Bradley Kintsugi, Alec Bradley Double Broadleaf, and Alec Bradley Prensado. Each of these brands offers unique cigar blends and flavors, catering to the different preferences of cigar enthusiasts.

-

In February 2023, Davidoff re-released its Classic No. 1 cigar in a limited edition. The company also introduced a new marketing initiative called “The Difference,” highlighting its distinctive cigar creation process and providing customers with a deeper understanding of what makes its products unique in the market. The campaign was centered on the Davidoff White Band Collection, which includes renowned lines such as Signature, Grand Cru, Anniversario, and Millennium.

-

In July 2022, Carlito Fuente and Jorge Padró, sons of cigar makers Carlos A. Fuente, Sr. and José O. Padrón, respectively, launched a Legends cigar project in Florida, U.S. They launched a 40-cigar box to pay tribute to their father’s legacies. These cigars were handcrafted and featured cultural symbols from both families. A portion of the sales revenue from these cigars was to be donated to charity.

Luxury Cigar Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.30 billion

Revenue forecast in 2030

USD 23.27 billion

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; China; Japan; India; Indonesia; Brazil; Honduras; UAE; South Africa

Key companies profiled

Scandinavian Tobacco Group A/S (General Cigars); Gurkha Cigar Group; Davidoff of Geneva USA; Fuente Marketing Ltd; Piloto Cigars Inc. (Padrón Cigars); Royal Danish Cigars; Montecristo; Tatuaje Cigars, Inc.; My Father Cigars, Inc.; Daniel Marshall

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

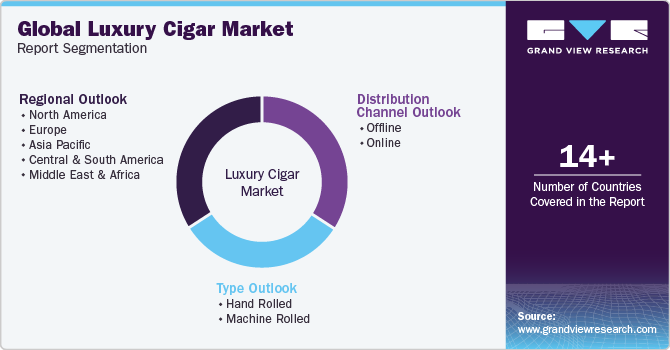

Global Luxury Cigar Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global luxury cigar market based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Hand Rolled

-

Machine Rolled

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

Honduras

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luxury cigar size was estimated at USD 13.34 billion in 2022 and is expected to reach USD 14.30 billion in 2023.

b. The global luxury cigar is expected to grow at a compounded growth rate of 7.2% from 2023 to 2030 to reach USD 23.27 billion by 2030.

b. Hand rolled luxury cigar accounted for the largest share of 75.5% in the global market in 2022. Hand-rolled cigars enjoy a more significant preference among premium smokers compared to machine-rolled cigars due to their notably higher quality.

b. Some key players operating in the luxury cigar market are Scandinavian Tobacco Group A/S (General Cigars), Gurkha Cigar Group, Davidoff of Geneva USA, Fuente Marketing Ltd, Piloto Cigars Inc. (Padrón Cigars), Royal Danish Cigars, Montecristo, Tatuaje Cigars, Inc., My Father Cigars, Inc., and Daniel Marshall.

b. The market growth is mainly driven due to a rise in demand for luxury cigars among premium smokers and millennials. The rising use of tobacco among the millennials, along with the emergence of numerous high-end cigar lounges globally, has increased the demand for luxury cigars.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."