- Home

- »

- Homecare & Decor

- »

-

Luxury Travel Market Size And Share, Industry Report, 2033GVR Report cover

![Luxury Travel Market Size, Share & Trends Report]()

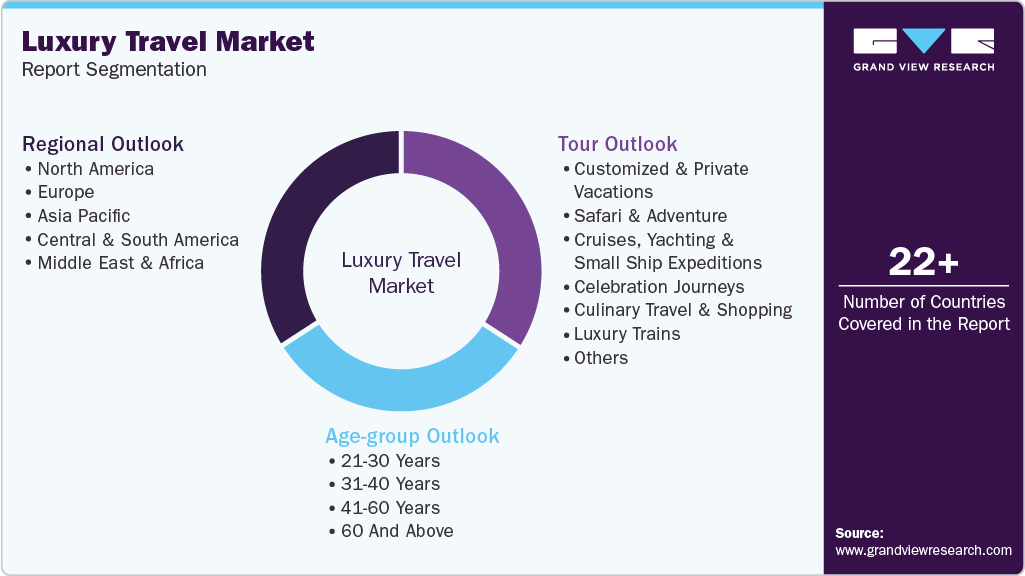

Luxury Travel Market (2026 - 2033) Size, Share & Trends Analysis Report By Tour (Customized & Private Vacations, Safari & Adventure, Celebration Journeys, Culinary Travel & Shopping), By Age Group (21-30 Years, 31-40 Years, 41-60 Years), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-974-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Travel Market Summary

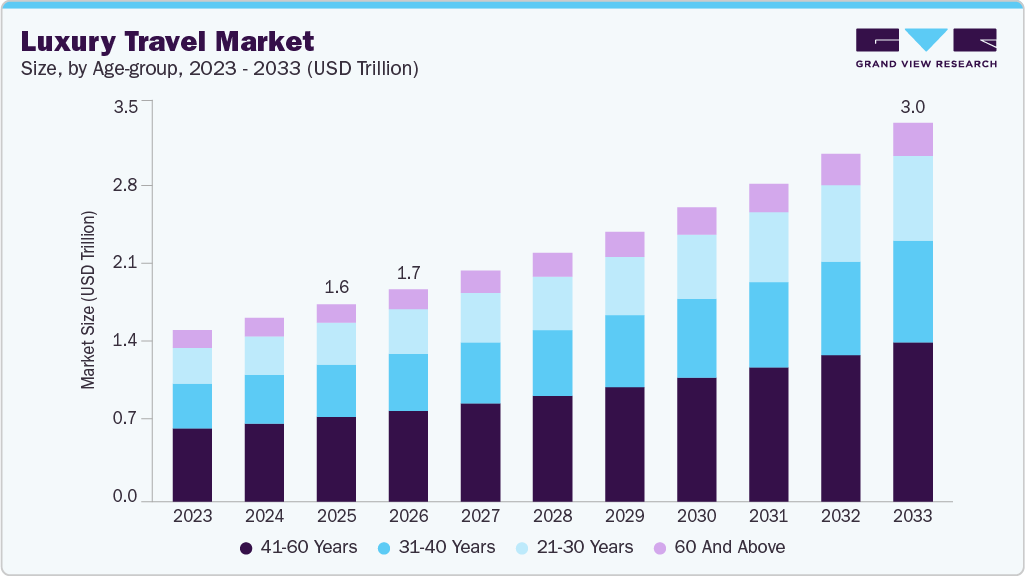

The global luxury travel market size was valued at USD 1.59 trillion in 2025 and is expected to reach USD 3.04 trillion by 2033, growing at a CAGR of 8.5% from 2026 to 2033. Increasing spending by elite travelers to visit unexplored destinations and gain new experiences is driving the market.

Key Market Trends & Insights

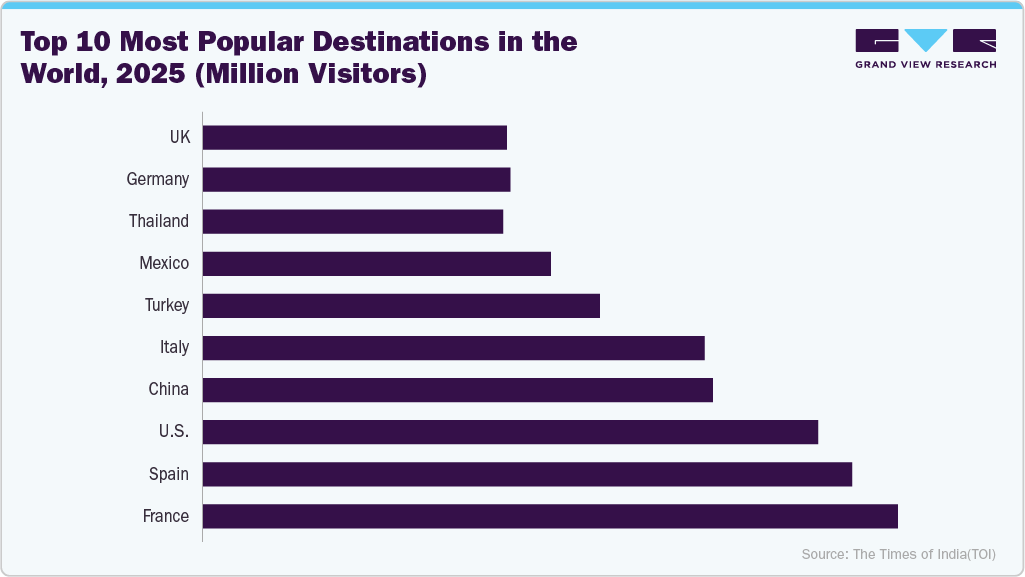

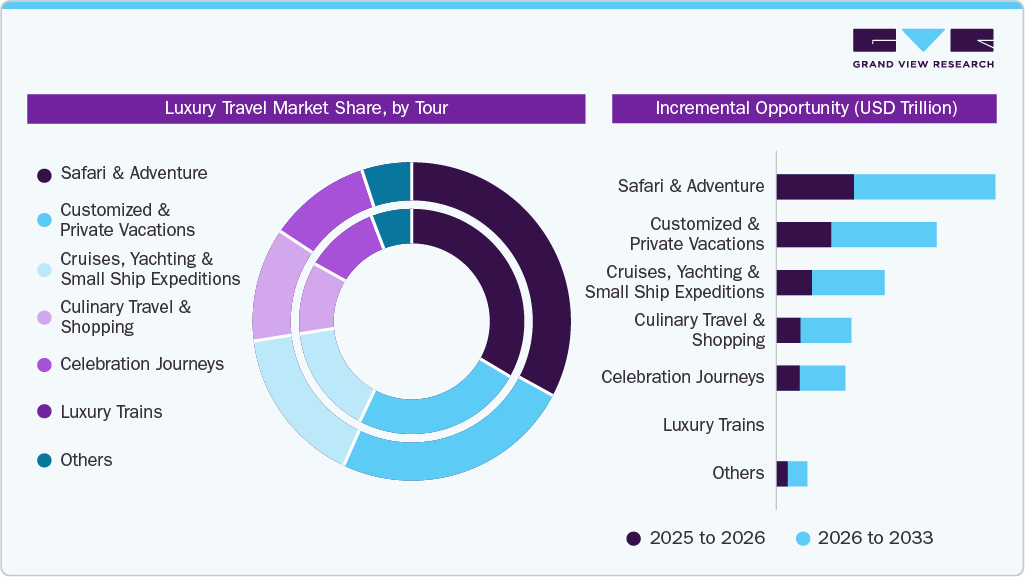

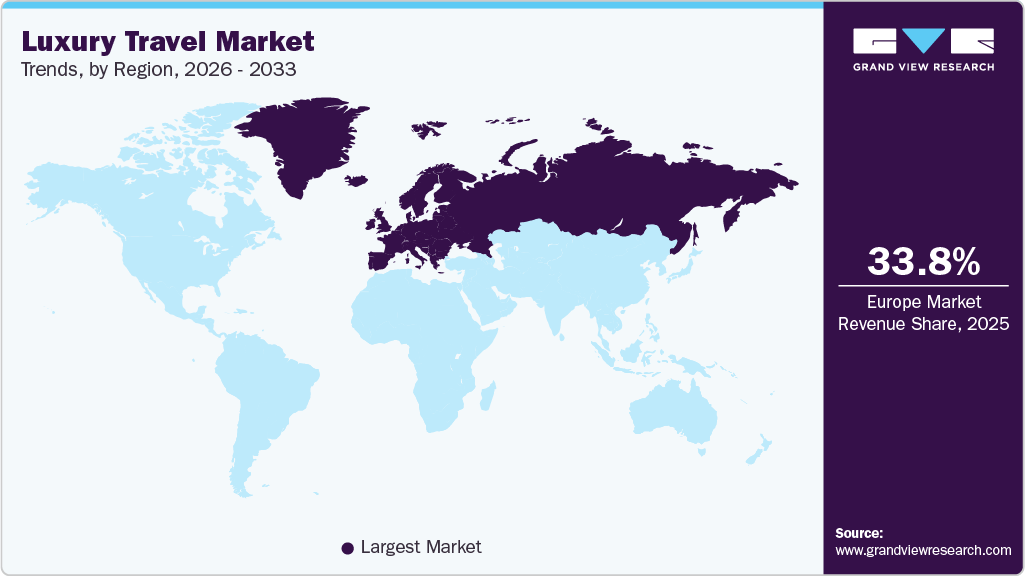

- Europe held a market share of 33.8% in 2025.

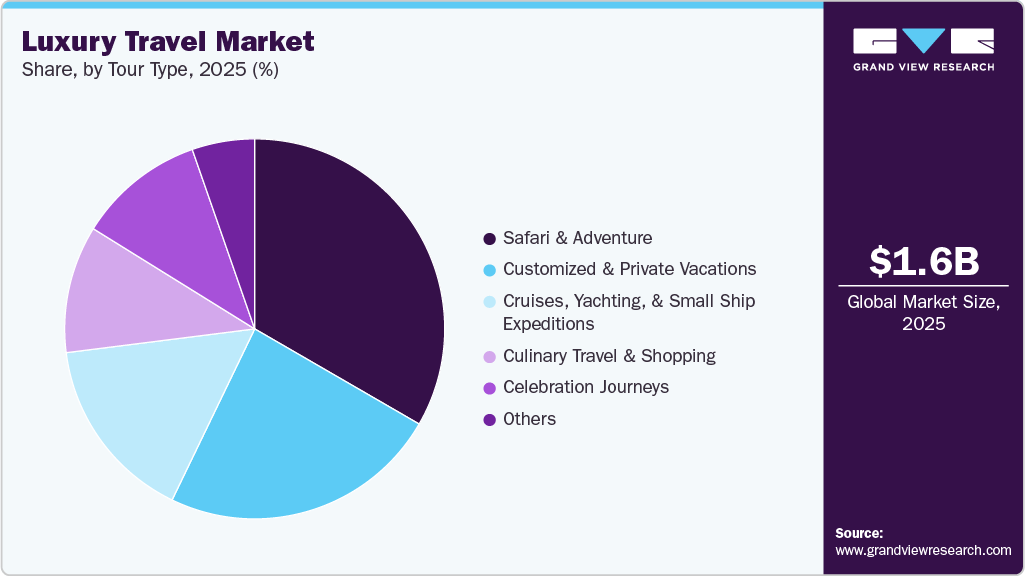

- By tour, Safari & Adventure led the market with a share of 33.3% in 2025.

- By age group, the 41-60 years segment held a market share of 42.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.59 trillion

- 2033 Projected Market Size: USD 3.04 trillion

- CAGR (2026-2033): 8.5%

- Europe: Largest market in 2025

In addition, the growing trend of micro trips and the rapidly expanding tourism sector across the globe have been boosting the market growth. Personalized services, reliable transport, exclusivity, and positive & professional interaction with staff are what set the benchmark for luxury travel. Traveling around the world is being greatly influenced by favorable factors such as growing political stability, improving attitudes toward gender, ethnicity, sexual orientation, and race, and more accommodating visa regulations. Travelers are looking to create their own unique experiences through flexible itineraries that combine entertainment as well as relaxation.An increasing number of travelers are opting for tours of their preferred destinations due to the desire to learn more about the place that they are visiting. Luxury travelers often prefer customized and private tours to general tour packages for unique and highly personal experiences. The post-pandemic trends of private tours due to concerns for health and safety are driving the luxury travel market. Customized and private tours let people travel with their friends and family at their own pace.

Social connectivity is another emerging trend among luxury travelers to connect and experience different societies and cultures. For example, G Adventures (formerly known as Gap Adventures) is a social enterprise and small-group adventure travel company that brings travelers closer to society and its culture. G Adventures is capitalizing on the social connectivity trend by providing an opportunity for local communities to connect and socialize with travelers seeking cultural exploration. In recent years, there has been an increasing trend of travelers packing in more destinations on a short trip, giving rise to the concept of “country coupling”. For instance, travelers plan a ski adventure in the first half of a trip and end with a beach destination, or combine a safari, jungle, or nature-based adventure with a stay with locals in an exotic city.

Consumer Insights

Rising disposable incomes, wealth accumulation among high-net-worth and upper-middle-income consumers, and a strong preference for experiential consumption are encouraging travelers to invest in premium accommodations, exclusive experiences, and tailored itineraries. Luxury travel is no longer limited to status signaling; it is increasingly associated with comfort, privacy, authenticity, and meaningful engagement with destinations.

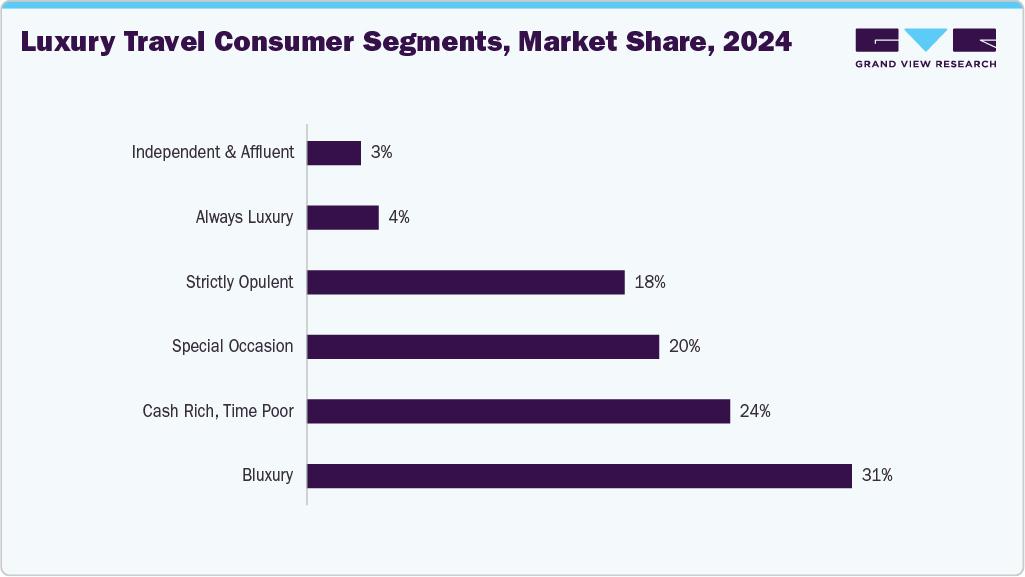

The luxury travel industry is highly segmented, with distinct traveler “tribes” driven by different motivations, wealth levels, and planning behaviors. According to Shaping the Future of Luxury Travel - Future Traveler Tribes 2030 report, the largest group, Bluxury travelers (31%), combines business with indulgent leisure, reflecting a rising trend of extending corporate trips for personal enjoyment. The cash-rich, time-poor (24%) segment follows closely, prioritizing flexibility, privacy, and turnkey service due to their demanding schedules. Meanwhile, special occasion travelers (20%) view luxury as a treat for memorable milestones, making strategic upgrades using loyalty points.

More exclusive but influential are strictly opulent travelers (18%), who chase glamor and status, often guided by influencers and focused on social media presence. Always luxury travelers (4%) live and breathe luxury daily, opting for the highest-end, curated experiences without financial limits. At the niche end, independent and affluent travelers (3%) value freedom, self-pampering, and trusted advice for personalized escapes.

Culinary travel has also emerged as a popular trend and is carving a niche in the luxury travel market. An increasing number of enthusiasts are embarking on a culinary journey to experience food beyond restaurants, by participating in cooking classes, eating in private homes and Michelin-starred restaurants, and engaging in farm-to-table visits and truffle hunting.

Experiential luxury that links high-end hotels, resorts, cruises, and restaurants has been one of the most dynamic and fast-growing components of the luxury travel market. The increasing indulgence of young consumers pertaining to luxurious experiences has gathered higher attraction in recent years, thereby driving the luxury travel industry.

Tour Insights

Safari and adventure luxury tourism accounted for a share of 33.3% in 2025 as luxury travelers are seeking more depth to understand the local culture, sense of adventure, nature, historical infrastructure, and a less crowded environment. Luxury tents, commonly known as "Glamping" accommodations, are primarily employed for group experiences during safaris or outdoor-focused tours. These tents typically come equipped with modern amenities, including private bathrooms and showers, and frequently feature elegant teak floorings. Luxury safari tours generally also have an on-site personal guide available for the duration of each tour.

For instance, MILIMA, one of the most popular deluxe lodges in South Africa, provides various options such as luxury tents, manor houses, and villas with various benefits, which sets a standard bar for its competitors as well as new entrants in the market.

Culinary travel and shopping are expected to grow at a CAGR of 9.8% from 2026 to 2033. The primary purpose of culinary travel is to experience the unique food and drink of a particular region or area and understand the culture. The growing popularity of cooking programs on television and online influences people to travel abroad and experience local cuisines. According to the Godrej Food Trends Report 2022, in the coming years, around 90% of people in India are predicted to be interested in travel related to culinary experiences and cuisines. This trend is driven by the growing curiosity among people to taste new flavors suggested by food bloggers, health professionals, chefs on TV shows, and many other trends that emerged during the COVID-19 pandemic.

Age Group Insights

Luxury travelers in the age group of 41-60 years contributed to the global market revenue with a share of 42.8% in 2025. These consumers have the time, budget, and desire to travel and visit multiple adventurous destinations due to no-child responsibilities, and a wide bucket list ranging from taking a world cruise, long vacation on a luxury cruise liner, exotic ports, and enjoying an upscale safari destination, is accelerating the market growth. According to AARP 2021 Travel Trends, in the U.S., approximately 54% of baby boomers planned to travel in 2021, on which they planned to spend an average of USD 6,691, which is about 20% to 50% more than their Gen X or millennial counterparts.

Revenue from luxury travelers in the age group of 21-30 years is expected to grow at a CAGR of 9.3% from 2026 to 2033. Millennials have a mindset for luxury and its meaningful consumption. They tend to be more independent in their religious and political views, more entrepreneurial, less likely to be married, distrustful of authority, better educated, and more travel-oriented than any other generation. This may fuel the market growth over the forecast period.

Regional Insights

North America luxury travel market accounted for a share of 32.20% of the global market revenue in 2025. High-net-worth individuals and affluent middle-income travelers are increasingly willing to spend on premium experiences that offer exclusivity, comfort, and status, driven in part by strong economic performance and wealth accumulation. Changing consumer preferences favor experiential over material purchases, with travelers seeking bespoke itineraries, unique destinations, and high-end services such as private guides, luxury accommodations, and curated cultural or adventure experiences.

U.S. Luxury Travel Market Trends

The luxury travel market in the U.S. is expected to grow at a CAGR of 7.8% from 2025 to 2030. The U.S. is a popular luxury travel destination with a diverse range of luxury experiences, from high-end shopping in cities like New York and Los Angeles to exclusive resorts in scenic locations like Hawaii and Colorado. The country boasts world-class attractions such as luxury hotels, fine dining restaurants, iconic landmarks, and cultural experiences that appeal to affluent travelers seeking unique and memorable experiences. Moreover, the country's advanced infrastructure, well-developed transportation networks, and safety standards make it a convenient and secure destination for luxury travelers.

Europe Luxury Travel Market Trends

The luxury travel market in Europe accounted for a share of 33.8% of the global market in 2025. The market for luxury travel in Europe is growing due to a convergence of rising affluent consumer demand, experiential preferences, and strong destination appeal. Wealthy travelers are increasingly seeking personalized, high-quality experiences over traditional sightseeing, placing greater value on curated itineraries, exclusive access, and bespoke services that luxury travel providers can deliver. Europe’s diverse portfolio of high-end offerings from historic cities and Michelin-starred dining to private villas, boutique hotels, and luxury cruises continues to attract premium spending, particularly from both intra-regional and international visitors.

Asia Pacific Luxury Travel Market Trends

The luxury travel market in Asia Pacific is expected to witness a CAGR of 9.9% from 2026 to 2033. The market is growing in the Asia Pacific region due to a combination of expanding economic prosperity, shifting consumer preferences, and enhanced travel infrastructure. Rising disposable incomes and a growing affluent middle and upper class, particularly in countries such as China, India, South Korea, and Southeast Asian economies, have increased spending power and willingness to pay for premium travel experiences. Additionally, greater exposure to global lifestyles and social media has heightened demand for personalized, exclusive, and culturally immersive travel offerings that go beyond traditional tourism.

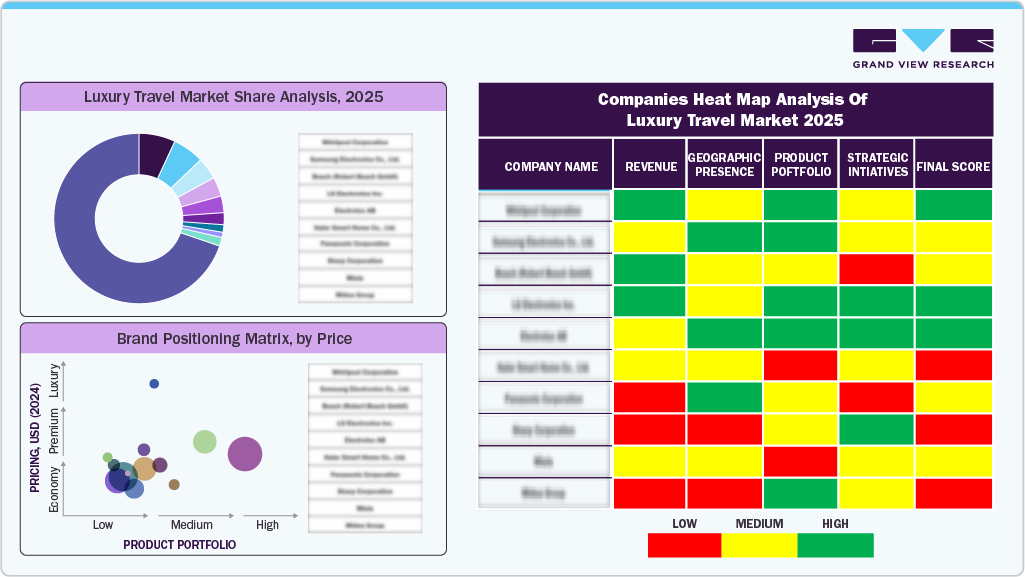

Key Luxury Travel Companies Insights

The presence of global companies and emerging players characterizes the luxury travel industry. The major players of the industry emphasize product innovation & differentiation and unique designs aligned with the changing consumer trends. These players have extensive distribution networks worldwide, which enable them to reach a wide customer base and expand into emerging markets. The emerging companies, on the other hand, are focused on niche markets, specialized product portfolios, and fresh designs to improve their visibility in the market.

Key Luxury Travel Companies:

The following key companies have been profiled for this study on the luxury travel market.

- TUI Group

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Scott Dunn Ltd.

- Abercrombie & Kent USA, LLC

- Lindblad Expeditions

- Geographic Expeditions, Inc.

- Micato Safaris

- Exodus Travels Limited

- Travel Edge (Canada) Inc.

Recent Developments

-

In August 2025, DTH Travel launched The Blue Jasmine, a nine-day luxury rail journey in Thailand starting 16 November 2025, using a beautifully restored Japanese sleeper train to offer a boutique-hotel-on-wheels experience across key cultural destinations like Bangkok, Ayutthaya, Uthai Thani, Sukhothai, and Chiang Mai, with private cabins, fine dining, curated cultural activities, and limited passenger capacity to create an intimate, high-end slow-travel experience that supports Thailand’s push for premium, experiential tourism.

-

In June 2024, The Ritz-Carlton Yacht Collection launched its third luxury superyacht, Luminara, and introduced its first Asia-Pacific season with 10 ultra-luxury voyages between December 2025 and May 2026, visiting 28 ports across 10 countries, such as Vietnam, the Philippines, Japan, Thailand, Singapore, and more. These 10-15 night itineraries from Tokyo, Hong Kong, and Singapore feature culturally immersive shore experiences and customizable excursions, while onboard Luminara will offer 226 suites for up to 452 guests, with high staff-to-guest ratios, fine dining, a Ritz-Carlton Spa, and a marina, further expanding a fleet that already includes Evrima (launched 2022) and Ilma (debuting 2024).

Luxury Travel Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.72 trillion

Revenue forecast in 2033

USD 3.04 trillion

Growth rate

CAGR of 8.5% from 2026 to 2033

Actuals

2021 - 2025

Forecast

2026 - 2033

Quantitative units

Revenue in USD billion/trillion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tour, age-group, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Austria; Belgium; Czech Republic; Denmark; Hungary; Netherlands; Norway; Portugal; Sweden; Switzerland; China; India; Japan; Australia; Uzbekistan; Malaysia; Singapore; Thailand; Vietnam; New Zealand; Brazil; Peru; Chile; Argentina; South Africa; UAE; Saudi Arabia; Turkey

Key companies profiled

TUI Group; Butterfield & Robinson Inc.; Cox & Kings Ltd.; Scott Dunn Ltd.; Abercrombie & Kent USA, LLC; Lindblad Expeditions; Geographic Expeditions, Inc.; Micato Safaris; Exodus Travels Limited; Travel Edge (Canada) Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Travel Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global luxury travel market report on the basis of tour, age-group, and region.

-

Tour Outlook (Revenue, USD Billion, 2021 - 2033)

-

Customized & Private Vacations

-

Safari & Adventure

-

Cruises, Yachting and Small Ship Expeditions

-

Celebration Journeys

-

Culinary Travel & Shopping

-

Luxury Trains

-

Others

-

-

Age-group Outlook (Revenue, USD Billion, 2021 - 2033)

-

21-30 Years

-

31-40 Years

-

41-60 Years

-

60 and Above

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Austria

-

Belgium

-

Czech Republic

-

Denmark

-

Hungary

-

Netherlands

-

Norway

-

Portugal

-

Sweden

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Uzbekistan

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

New Zealand

-

-

Central & South America

-

Brazil

-

Peru

-

Chile

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global luxury travel market was estimated at USD 1.59 trillion in 2025 and is expected to reach USD 1.72 trillion in 2026.

b. The global luxury travel market is expected to grow at a compound annual growth rate of 8.5% from 2026 to 2033 to reach USD 3.04 trillion by 2033.

b. Key factors that are driving the luxury travel market growth include the increasing spending by elite travelers to visit unexplored destinations and gain new experiences, and the growing trend of micro trips.

b. Safari and adventure luxury tourism accounted for a share of 33.3% in 2025 as luxury travelers are seeking more depth to understand the local culture, sense of adventure, nature, historical infrastructure, and a less crowded environment.

b. Some of the key players operating in the luxury travel market include TUI Group, Butterfield & Robinson Inc., Cox & Kings Ltd., Scott Dunn Ltd., Abercrombie & Kent USA, LLC, Lindblad Expeditions, Geographic Expeditions, Inc., Micato Safaris, Exodus Travels Limited, and Travel Edge (Canada) Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.