- Home

- »

- Medical Devices

- »

-

Breast Imaging Market Size, Share, Industry Report, 2033GVR Report cover

![Breast Imaging Market Size, Share & Trends Report]()

Breast Imaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Ionizing, Non Ionizing), By End Use (Hospitals, Breast Care Centers, Diagnostic Imaging Centers), By Region, And Segment Forecasts

- Report ID: 978-1-68038-146-7

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Breast Imaging Market Summary

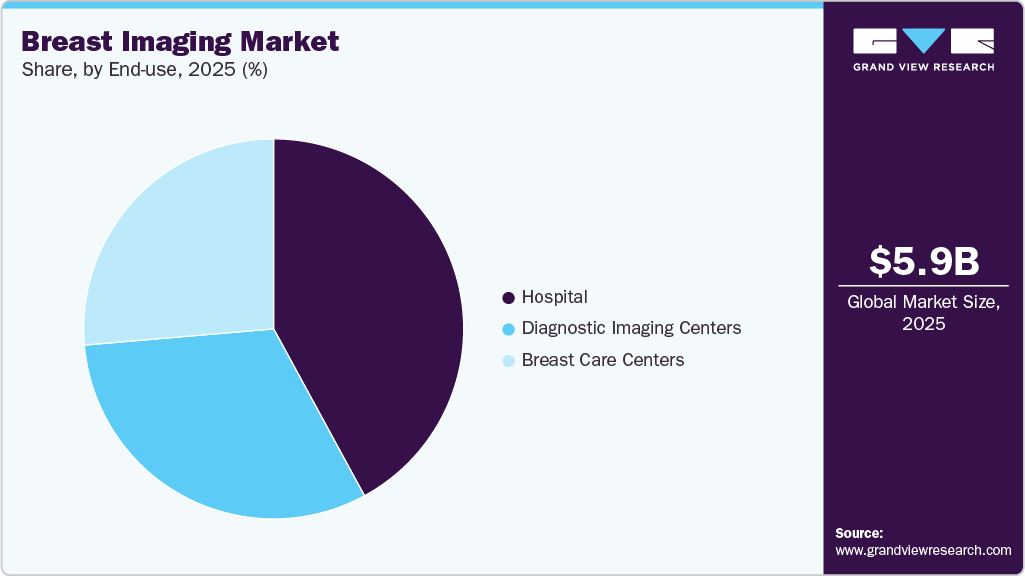

The global breast imaging market size was estimated at USD 5.88 billion in 2025 and is projected to reach USD 12.03 billion by 2033, growing at a CAGR of 9.7% from 2026 to 2033. Factors such as the rising prevalence of breast cancer, technological breakthroughs in the domain of breast imaging, and investment from several organizations in breast cancer screening programs drive the breast imaging market.

Key Market Trends & Insights

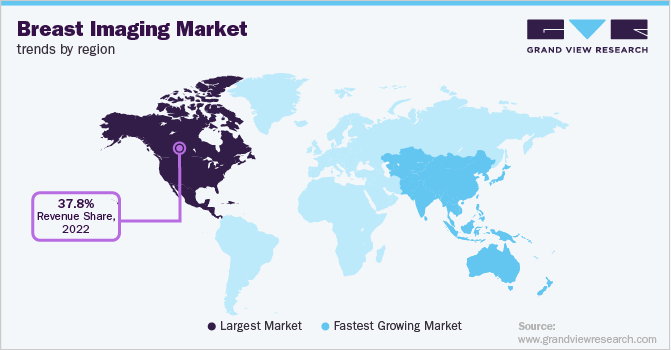

- North America dominated the breast imaging market with the largest revenue share of 37.09% in 2025.

- The breast imaging market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By technology, the ionizing segment led the market with the largest revenue share in 2025.

- By end use, the hospitals segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.88 Billion

- 2033 Projected Market Size: USD 12.03 Billion

- CAGR (2026-2033): 9.7%

- North America: Largest market in 2025

According to the World Cancer Research Fund (WCRF), by 2030, the number of cases of breast cancer is expected to reach about 2.1 million globally. According to a new report from the International Agency for Research on Cancer (IARC), breast cancer cases are expected to increase by 38 percent globally by 2050, with annual deaths from the disease projected to rise by 68 percent. This aspect is expected to contribute to the growth of the breast imaging market over the forecast period.The growing prevalence of breast cancer and other breast-related abnormalities is expected to drive the expansion of the breast imaging market significantly. According to data published by the National Breast Cancer Foundation, Inc. in June 2025, approximately 1 in 8 women in the U.S. is expected to be diagnosed with breast cancer during their lifetime. In addition, projections from the International Agency for Research on Cancer estimate a 27.8% increase in breast cancer incidence in the U.S. between 2022 and 2050, with cases expected to reach approximately 350,693 by 2050. This substantial rise in cancer cases is anticipated to fuel the demand for breast magnetic resonance imaging procedures across the country.

Technological advancements are driving the growth of the breast imaging market, supported by increasing demand for earlier and more accurate cancer detection. Innovations such as molecular breast imaging, AI-assisted diagnostics, and enhanced breast imaging displays are improving clinical confidence and reducing interpretation challenges. As healthcare providers prioritize precision medicine and screening efficiency, these advanced tools continue to accelerate adoption and shape the future of breast cancer detection and care.

Widespread research in the development of hybrid imaging systems provides high growth opportunities and also aids the market growth. Recent developments in imaging technology have completely revolutionized the nature of treatment and how it is approached. To view the metabolic data and anatomical characteristics of the organs, it has become more crucial to combine imaging methods such as CT scans, MRIs, PET, and others. Furthermore, the quality of breast pictures, patient comfort, and patient dose have all been enhanced by these integrated imaging modalities. Thereby, owing to these advantages, manufacturers across the globe are concentrating more on the introduction of new products to improve the sensitivity and precision of breast cancer diagnostics. For instance, in February 2025, DeepHealth plans to introduce its Diagnostic Suite to the European market, offering a next-generation PACS system with a unified, workflow-optimized radiology workspace. The company also aims to expand access to SmartMammo, its AI-driven end-to-end mammography diagnostic solution, further integrating AI-enabled detection and clinical decision support into routine imaging workflows.

“At DeepHealth, we are harnessing the transformative power of AI to create cutting-edge solutions that are deeply rooted in real-world clinical needs,” said Kees Wesdorp, PhD, President and CEO of RadNet’s Digital Health division. “We believe that AI adoption at scale in radiology can only be achieved by embedding AI into and unifying data across clinical and operational workflows to empower radiologists and care teams that today are having to rely on disconnected devices and disparate data sources. At ECR 2025, we are excited to showcase our next-generation radiology informatics and population screening solutions designed to enhance operational efficiency, clinical confidence, and care delivery across the radiology continuum.”

Furthermore, the increasing number of clinical trials aimed at evaluating advanced magnetic resonance imaging modalities for cancer detection and developing innovative imaging solutions is expected to contribute significantly to the growth of the breast imaging market. These trials are crucial in improving diagnostic accuracy, enhancing early detection, and validating new technologies.

Table 1 Ongoing and Recently Conducted Clinical Trials for Breast Cancer MRI in the U.S.

Study Title

Intervention/Treatment

Sponsor

Completion Date

Enrollment

Quantitative MRI Assessment of Breast Cancer Therapy Response

Procedure: Diffusion Weighted Imaging

Procedure: Dynamic Contrast-Enhanced Magnetic Resonance Imaging

William Beaumont Hospitals

2027-05-31

135

To compare magnetic resonance imaging (MRI) with more well established diagnostic imaging techniques to determine which method best finds and defines breast cancer.

Procedure: MRI

Stanford University

2027-05

445

Development and Testing of an Accurate, Rapid and Inexpensive MRI Protocol for Breast Cancer Screening - A Pilot Study

Diagnostic Test: MRI Abbreviated Scan

Diagnostic Test: Abbreviated MRI Scan

University of Chicago

2024-09-14

200

TMEM-MRI: A Pilot Feasibility Study of Magnetic Resonance Imaging for Imaging of TMEM (Tumor Microenvironment of Metastasis) in Patients With Operable Breast Cancer

Device: TMEM-MRI

Procedure: FNA

Montefiore Medical Center

2026-12

75

Source: ClinicalTrials.gov

Such ongoing trials evaluating various MRI modalities for breast cancer are anticipated to create significant growth opportunities for industry stakeholders. These studies advance the understanding of imaging technologies and pave the way for the development of more precise, cost-effective, and patient-friendly diagnostic solutions, ultimately enhancing clinical outcomes and market potential.

The surge in AI-powered imaging solutions is driving the breast imaging market by improving diagnostic accuracy, reducing interpretation time, and supporting early cancer detection, particularly in cases involving dense breast tissue or high screening volumes. Artificial intelligence in breast imaging enhances radiologists’ efficiency, lowers recall rates, and standardizes image interpretation, thereby increasing clinical confidence and accelerating adoption across hospitals, diagnostic centers, and screening programs. As regulatory approvals and reimbursement frameworks strengthen, AI-enabled platforms are becoming integral to modern breast imaging workflows, fueling broader market growth.

Surge in AI-Powered Imaging Solutions - Key Developments

Source / Date / Publication

AI Innovation / Development

Impact on Breast Imaging Market - Key Highlights

Qure.ai (November 2023)

Deployment of MammoScreen - an AI-based mammography diagnostic tool that analyzes 2D and 3D mammograms with high precision. qure.ai

Improved detection of subtle anomalies reduced false-negatives, and streamlined workflow - enabling radiologists to read more screenings efficiently, increasing throughput and access, especially where radiologists are scarce.

iCAD, Inc. (2024)

AI-powered interpretation tools (e.g. deep-learning models for digital mammography / tomosynthesis) for faster and scalable detection of breast cancer.

Enables radiologists to process complex imaging data more effectively and accurately - helping manage high screening volumes, reducing diagnostic delays, and improving early detection rates.

Academic Review 2024 - A Review of Artificial Intelligence in Breast Imaging (NIH)

Comprehensive overview of AI applications for mammography and ultrasound: lesion detection, classification, risk assessment, and image-quality enhancement. PMC

Demonstrates growing evidence base that AI can improve diagnostic accuracy, reduce inter- and intra-observer variability, and support earlier detection - strengthening clinical and regulatory confidence in AI tools.

Source: NIH Journals, iCAD, Inc., Qure.ai, Grand View Research Analysis

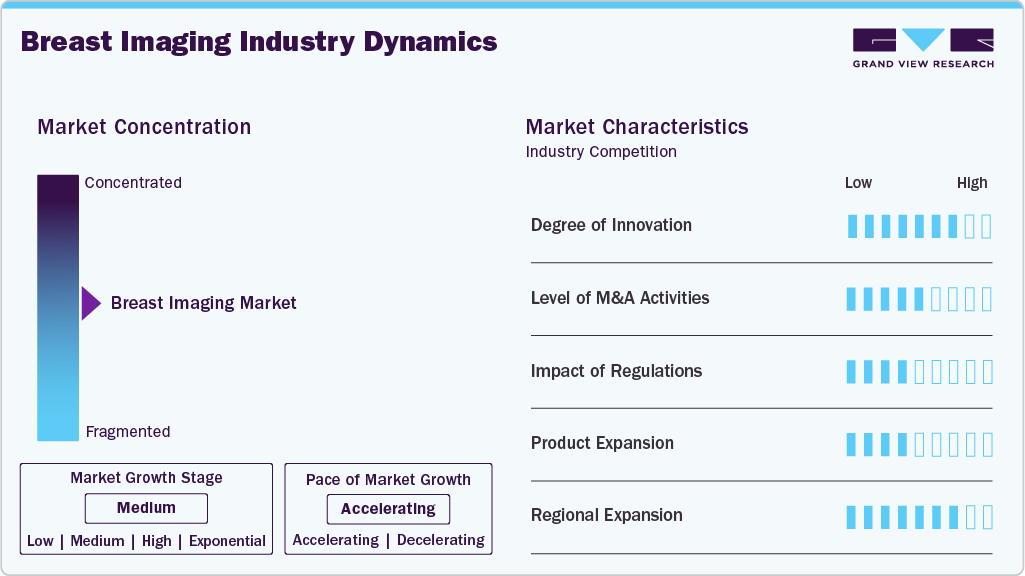

Market Concentration & Characteristics

Degree of Innovation: The breast imaging market demonstrates a high level of innovation, driven by rapid advancements in imaging technologies, breast imaging software, and AI integration. Companies are increasingly focused on developing advanced modalities that improve diagnostic accuracy, minimize false positives, and support earlier detection of breast cancer. Breakthroughs such as digital breast tomosynthesis (3D mammography), contrast-enhanced mammography, molecular breast imaging, and AI-driven image interpretation tools are transforming clinical workflows. In addition, hybrid approaches, such as integrating ultrasound with mammography, and the expanding use of cloud-based platforms for secure image sharing, predictive analytics, and remote collaboration, are enabling a more precise, personalized, and patient-centric approach to breast cancer screening and diagnosis.

Impact of Regulations: Regulations play a critical role in shaping the breast imaging market by ensuring product safety, clinical effectiveness, and standardized diagnostic quality. Stringent frameworks such as the FDA’s MQSA (Mammography Quality Standards Act) in the U.S. and the EU MDR in Europe mandate rigorous validation, quality control, and performance reporting for breast imaging technologies, including mammography systems, AI-based diagnostics, ultrasound, and MRI solutions. These regulatory requirements help build clinician and patient confidence but also extend product development timelines, increase compliance costs, and delay market entry, particularly for emerging AI-driven tools.

Level of M&A Activities: M&A activity in the breast imaging market has been moderately high, as major players pursue strategic collaborations to strengthen their technological portfolios and expand their geographic presence. Established imaging companies are acquiring startups and AI-focused firms to integrate advanced analytics and automation into their systems.

Regulations have a significant effect on the breast imaging market, influencing product development, approval timelines, and clinical adoption. Stringent regulatory frameworks, particularly in the U.S. (FDA) and Europe (MDR/CE marking), ensure the safety, efficacy, and quality of imaging systems and AI-based diagnostic tools. While these regulations promote patient safety and standardization, they can also increase the cost and duration of bringing new technologies to market.

Product Substitutes: Product substitutes for breast imaging primarily include alternative diagnostic and screening methods that can reduce reliance on traditional imaging modalities such as mammography, ultrasound, and MRI. These substitutes include blood-based liquid biopsy tests, genetic risk assessment tools (e.g., BRCA1/BRCA2 screening), and emerging AI-enabled predictive analytics platforms designed to identify high-risk individuals before structural abnormalities are visible on imaging.

Technology Insights

The ionizing segment dominates the breast imaging market in 2025. It is expected to register the fastest CAGR over the forecast period, primarily due to its proven diagnostic accuracy and widespread clinical adoption. Technologies such as mammography, digital breast tomosynthesis, and contrast-enhanced mammography remain the gold standard for breast cancer screening and early detection. These modalities provide high-resolution images that accurately identify microcalcifications and subtle lesions, making them indispensable in routine screening programs. Continuous advancements in ionizing imaging technologies, such as low-dose radiation systems, enhanced image processing software, and AI integration for improved interpretation, drive their demand further. In addition, the growing prevalence of breast cancer, coupled with government-led screening initiatives and reimbursement support for mammography, continues to strengthen the dominance and growth potential of the ionizing segment in the global breast imaging market.

The non-ionizing segment of the breast imaging market is experiencing steady growth, driven by rising demand for safer, radiation-free diagnostic alternatives and advancements in imaging accuracy. Non-ionizing breast imaging technology, including ultrasound, magnetic resonance imaging, elastography, and optical systems, is increasingly being adopted, particularly for younger women and individuals with dense breast tissue, where traditional mammography may be less effective. The growing preference for supplemental and adjunctive imaging techniques, which improve lesion characterization and reduce false positives, continues to fuel the expansion of this segment. In addition, innovations such as automated breast ultrasound (ABUS) and contrast-enhanced MRI are enhancing diagnostic precision and workflow efficiency. The broader shift toward personalized and preventive healthcare, along with improvements in image resolution, portability, and cost efficiency, is further accelerating global adoption of non-ionizing breast imaging solutions.

End use Insights

Hospitals dominated the end use segment in 2025. The presence of advanced and well-equipped breast imaging facilities within a hospital positively affect various factors, such as duration of hospital stay, total healthcare cost, quality of care, and availability of emergency care. As investments in healthcare structures have increased over the world, this trend will aid in market expansion in the next years. Investing has enabled the procurement of improved infrastructure and diagnostic equipment. It has also been effective in providing good health coverage in all hospital-based health care services. These are the key factors that will contribute to hospital segment growth in the next years.

Large-scale hospitals usually have in-house breast imaging facilities; however, the requirement of high investments & frequent maintenance, space, and skilled professionals can act as an entry barrier. This can burden hospitals trying to manage their medical imaging facilities. To reduce this burden and to increase the reach of their facilities and services, hospitals can partner up with diagnostic imaging centers for providing medical imaging facilities.

The breast care centers segment is expected to grow at the fastest CAGR over the forecast period, driven by the rising focus on specialized, patient-centric diagnostic care and comprehensive breast health management. These centers offer integrated diagnostic, screening, and treatment services under one roof, improving patient convenience and clinical outcomes. The increasing prevalence of breast cancer and growing awareness about early detection have led to a higher influx of patients seeking specialized imaging and consultation services at these centers. Moreover, advancements in digital imaging, AI-based diagnostics, and tele-radiology enable breast care centers to deliver faster, more accurate, and personalized results. Supportive government screening programs, favorable reimbursement structures, and collaborations between hospitals and diagnostic networks further propel their expansion.

Regional Insights

North America dominated the breast imaging market with the largest revenue share of 37.09% in 2025 and is expected to exhibit a considerable growth rate over the forecast period. The rising number of breast cancer cases in this region is adding to the growth of the breast imaging market. For instance, in Canada alone, approximately 2,214,157 publicly funded MRI examinations were conducted during the 2022-2023 fiscal year, reflecting the scale of imaging utilization. These factors are expected to significantly propel the growth of the breast imaging market across North America.

U.S. Breast Imaging Market Trends

The U.S. breast imaging market is witnessing significant growth, driven by increasing breast cancer prevalence, rapid technological advancements, and evolving screening guidelines that promote early detection. In 2025, 316,950 women expected to be diagnosed with invasive breast cancer, with 59,080 new cases of ductal carcinoma in situ. The U.S. has one of the most established breast cancer screening programs globally, with growing emphasis on personalized screening approaches based on breast density and patient risk profiles. Government and healthcare initiatives to lower the recommended screening age and mandate breast density notifications have significantly boosted demand for ionizing and non-ionizing imaging modalities. Moreover, continuous innovation-such as integrating artificial intelligence for image analysis, contrast-enhanced MRI, and automated breast ultrasound systems- improves diagnostic precision and reduces false positives.

Europe Breast Imaging Market Trends

The Europe breast imaging market is witnessing growth, driven by strong government screening programs, rising breast cancer prevalence, and rapid technological advancements. Europe remains the second-largest regional market globally, supported by national initiatives such as the EU’s Beating Cancer Plan, emphasizing widespread early screening and access to advanced diagnostic technologies. For instance, in March 2022, the European Society of Breast Imaging (EUSOBI) suggested breast MRI screening for women with extremely dense breast tissue, reinforcing the clinical value and demand for advanced imaging modalities across Europe. Countries such as Germany, France, and the UK lead in adopting digital mammography, 3D tomosynthesis, and breast MRI, while AI-powered diagnostic tools and computer-aided detection (CAD) systems are integrated into imaging workflows to enhance accuracy and efficiency.

Breast imaging market in the UK is experiencing notable growth, driven by government initiatives, technological advancements, and increasing public awareness. The NHS Breast Screening Programme plays a central role in promoting early detection, while adopting digital mammography and 3D tomosynthesis has enhanced diagnostic accuracy. The integration of artificial intelligence is also a key development, with large-scale trials analyzing hundreds of thousands of mammograms to assess AI’s effectiveness in assisting radiologists, reducing workload, and expediting diagnoses. Rising breast cancer incidence, coupled with public education campaigns emphasizing the importance of regular screening, is further boosting demand for advanced imaging services. These factors are driving the expansion of the UK breast imaging market, strengthening early detection efforts and improving patient outcomes.

Asia Pacific Breast Imaging Market Trends

The Asia Pacific breast imaging market is experiencing growth, driven by rising breast cancer awareness, technological advancements, and expanding healthcare infrastructure. Countries such as India, China, Japan, and South Korea are leading this expansion, with initiatives to improve early detection and diagnostic accuracy. Technological innovations, including the adoption of digital mammography, 3D tomosynthesis, AI-based imaging protocols, and minimally invasive procedures, enhance both precision and accessibility of breast imaging services. Government-led screening programs, growing investments in healthcare facilities, and increased focus on preventive healthcare further support market growth.

The India breast imaging market is experiencing significant growth, driven by several interrelated factors. The rising incidence of breast cancer, particularly in urban areas, is a primary driver, fueled by lifestyle changes, delayed motherhood, and other demographic shifts. Government initiatives and awareness campaigns are crucial in promoting early detection, with programs and mobile health applications being deployed to increase screening accessibility. Technological advancements improve diagnostic accuracy and patient outcomes, including digital mammography, 3D tomosynthesis, and minimally invasive procedures such as Vacuum Assisted Breast Biopsy (VABB).

Middle East & Africa Breast Imaging Market Trends

The MEA breast imaging market is experiencing growth, driven by increasing breast cancer awareness, expanding healthcare infrastructure, and government-led screening initiatives. Countries in the Gulf Cooperation Council (GCC) such as Saudi Arabia and the UAE are leading the market’s growth due to rising investments in advanced healthcare facilities and the adoption of modern imaging technologies like digital mammography, 3D tomosynthesis, and breast MRI. Awareness campaigns emphasizing early detection and preventive care are encouraging more women to undergo regular screenings, while public and private hospitals continue to upgrade imaging equipment to meet international standards.

Latin America Breast Imaging Market Trends

The Latin America breast imaging market is experiencing steady growth, driven by rising breast cancer incidence, increased awareness, and expanding access to diagnostic imaging across emerging healthcare systems. A key trend is the accelerated shift from analog and 2D mammography to advanced digital and 3D tomosynthesis systems, which improve accuracy and reduce recall rates. Growing investments in healthcare infrastructure, particularly by private diagnostic chains, are making breast imaging services more accessible beyond major urban centers.

Key Breast Imaging Company Insights

Breast imaging market is competitive and consists of several major players. In terms of market share, few major players currently dominate the market. However, with technological advancements and product modernizations, mid-size to smaller firms are increasing their market presence by launching new products and reducing the side effects of the procedures. The players in the market are striving to maintain their potential market share. Growing competition by means of technological improvements and new product developments leading to a reduction in the cost of the product is projected to boost the market.

Key Breast Imaging Companies:

The following are the leading companies in the breast imaging market. These companies collectively hold the largest Market share and dictate industry trends.

- GE Healthcare

- Hologic, Inc.

- Philips Healthcare

- Siemens Healthcare

- Fujifilm Holdings Corp.

- SonoCine, Inc.

- Toshiba Corporation (Canon Inc.)

- Dilon Technologies, Inc.

- Aurora Imaging Technology, Inc.

Recent Developments

-

In October 2025, Radiology Partners (RP), the largest provider of technology-enabled radiology services in the U.S., has introduced Mammo Enhance Heart, an AI-powered clinical program aimed at advancing preventive care for women. The solution leverages screening mammograms to detect breast arterial calcifications (BAC), a key indicator of cardiovascular risk, and supports follow-up coordination with local cardiology networks.

-

In February 2025, DeepHealth plans to introduce its Diagnostic Suite to the European market, offering a next-generation PACS system with a unified, workflow-optimized radiology workspace. The company also aims to expand access to SmartMammo, its AI-driven end-to-end mammography diagnostic solution, further integrating AI-enabled detection and clinical decision support into routine imaging workflows.

-

In June 2025, The U.S. Food and Drug Administration (FDA) has granted De Novo authorization to Clairity Breast, the first AI-driven platform designed to predict a woman’s five-year risk of developing breast cancer using only a routine mammogram. This regulatory milestone is significant, as it represents the first approval of a predictive imaging model of its kind. Supported by the Breast Cancer Research Foundation (BCRF), Clairity, Inc. is now positioned to introduce a transformative approach to early detection and personalized screening in breast cancer prevention.

Breast Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.37 billion

Revenue forecast in 2033

USD 12.03 billion

Growth rate

CAGR of 9.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Hologic, Inc.; Philips Healthcare; Siemens Healthcare; Fujifilm Holdings Corp.; SonoCine, Inc.; Toshiba Corporation (Canon Inc.); Dilon Technologies, Inc.; Aurora Imaging Technology, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global breast imaging market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Ionizing

-

Full-field Digital Mammography

-

Analog Mammography

-

Positron Emission Mammography

-

Electric Impedance Tomography

-

Cone-beam Computed Tomography

-

Positron Emission Tomography & Computed Tomography

-

3D Breast Tomosynthesis

-

MBI/BSGI

-

-

Non Ionizing

-

MRI

-

Thermography

-

Ultrasound

-

Optical Imaging

-

Automated Whole-Breast Ultrasound

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Breast Care Centers

-

Diagnostic Imaging Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast imaging market size was estimated at USD 5.88 billion in 2025 and is expected to reach USD 6.37 billion in 2026.

b. The global breast imaging market is expected to grow at a compound annual growth rate of 9.7% from 2026 to 2033 to reach USD 12.03 billion by 2033.

b. North America dominated the breast imaging market with a share of 37.09% in 2025. This is attributable to technological advancements, favorable reimbursement policies, and the rising prevalence of breast cancer.

b. Some key players operating in the breast imaging market include GE Healthcare; Hologic, Inc.; Philips Healthcare; Siemens Healthcare; Fujifilm Holdings Corp.; SonoCine, Inc.; Toshiba Corporation (Canon Inc.); Dilon Technologies, Inc.; Aurora Imaging Technology, Inc.

b. Key factors that are driving the market growth include the rising prevalence of breast cancer, technological advancements, and government initiatives such as awareness programs and funding for R&D in the field of breast cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.