- Home

- »

- Medical Devices

- »

-

Male Urinary Incontinence Market Size & Share Report, 2030GVR Report cover

![Male Urinary Incontinence Market Size, Share & Trends Report]()

Male Urinary Incontinence Market Size, Share & Trends Analysis Report By Product (Non-absorbents, Absorbents), By Incontinence Type, By Usage, By Distribution Channel, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-127-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global male urinary incontinence market size was valued at USD 6.37 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.87% from 2023 to 2030. Rising incidences of urological disorders such as cystitis, urinary retention, urinary incontinence, and kidney stones & benign prostatic hyperplasia, which leads to bladder dysfunction, are major factors driving market growth for male urinary incontinence. The increasing incidence of UTIs and urethral obstructions, along with the rising geriatric population, further boosts industry growth. The involuntary discharge of urine is a characteristic of urinary incontinence, which can have several causes and levels of severity. It requires management techniques to assist people in recovering control of their bladder function as it significantly affects a person's quality of life.

Male urine incontinence can be caused by a variety of health issues, including neurological disorders, trauma, aging, and prostate problems (such as a prostatectomy or an enlarged prostate). UI has a significant negative impact on the quality of life, leading to limitations in conducting daily activities. Men with urine incontinence are more prone to experience depression and a decrease in their activity levels, resulting in adjustments to their working hours, job changes, or even early retirement. Furthermore, men may experience greater emotional and social challenges related to UI compared to women, fueling market growth.

In addition, the rising prevalence of hypertension and diabetes is one of the major factors causing UI, which is driving the demand for male urinary incontinence products. According to a report published by the WHO in March 2023, approximately 1.28 billion people between 30-79 years of age suffer from hypertension globally. Consequently, the increasing number of patients suffering from associated diseases is expected to surge the demand for male urinary incontinence products.

In addition, the National Library of Medicine reported in 2022 that there are around 423 million UI sufferers globally who are 20 years of age and older. Thus, the need for urinary drainage bags for post-operative convenience has increased due to the rising prevalence of urological dysfunctions and related surgical treatments. Over the projection period, this is anticipated to have a favorable effect on market growth.

UI is a prevalent condition in people of and above 60 years of age, according to the WHO. Urge incontinence and stress incontinence are the most prevalent types of UI among older people. For instance, as per reports by the World Health Organization, around 80% of elderly people by 2050 will reside in low- or middle-income nations. It is also expected that the population of 80 years or older people will triple by 2050, reaching around 426 million. Thus, a rapid increase in the elderly population is a major factor driving the need for urinary drainage bags, as the urinary system is affected by age-related changes.

Moreover, product launches to treat UI by key market players for product portfolio expansion boosts industry growth. For instance, in May 2022, the novel implantable tibial neuromodulation equipment ‘RENOVA iStim’, invented by BlueWind Medical, closed a USD 64 million Series B financing round. It has been studied for the treatment of sense of urgency incontinence alone or coupled with urinary urgency or regularity. ConvaTec, a leading provider of healthcare equipment and services with a focus on therapy for managing chronic illness symptoms including continence care, led the investment round.

Around 13 million Americans, mostly senior males between the ages of 30 and 60, have UI, according to National Library of Medicine reports published in 2023. It is believed that 2-11% of this population experiences UI on a daily basis. Elderly people are more likely to have UI, which has a negative impact on their quality of life, mortality, and costs.

The COVID-19 pandemic had a major impact on the market since those who had the virus were more likely to experience urinary tract infections. A study revealed that COVID-19 infections induce irritation and degeneration in the pudendal nerves, which ultimately result in incontinence of the urine, as stated in an article released by PubMed Central in February 2021. Thus, the COVID-19 pandemic originally had a considerable influence on the market. However, as the pandemic’s impact has decreased, the market will likely see continued growth over the course of the projection period.

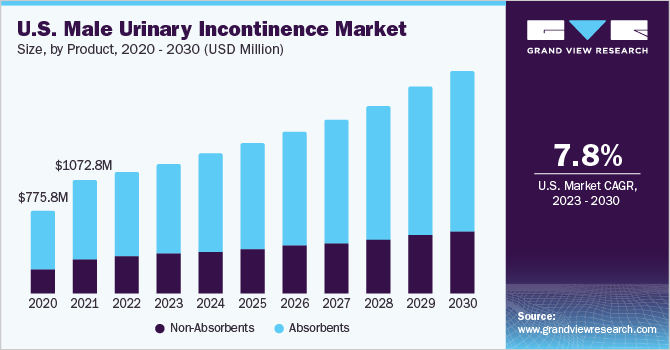

Product Insights

Absorbents held the largest market share of around 70.60% in 2022. Absorbent products include underwear & briefs, drip collectors & bed protectors, and pads & guards. The quality of life for people with urine incontinence has improved as a result of the introduction of more comfortable, covert, and efficient absorbent solutions. It can be anticipated that additional developments will take place in this market sector as technology evolves.

The main drivers of product growth include improvements in product design and technology as well as the availability of a wider variety of options. These factors support the expansion and increase in demand for these products in the male UI market. To improve user experience and quality of life for people managing UI, manufacturers and healthcare providers are always innovating and improving these products.

Moreover, the segment is also anticipated to advance at the highest CAGR during the forecast period. The growing prevalence of UI, particularly among the aging population, is driving the demand for drip collectors and bed protectors. For instance, as per data published by the Continence Foundation of Australia in 2023, up to 1 in 10 men suffer from UI in Australia, which translates to an estimated 2 million individuals experiencing this condition. The prevalence of incontinence is even higher among residents in nursing homes, where 40-60% of individuals are affected by this condition.

Incontinence Type Insights

The urge urinary incontinence segment held the largest market share of around 57.18% in 2022. Muscles, notably those in the pelvic floor that support the bladder, tend to deteriorate with age. Stress incontinence may develop as a consequence. Urgency and frequency problems may develop as a result of the bladder's control nerves losing their effectiveness with time. Moreover, elderly people frequently take several medications, some of which can affect bladder function and cause incontinence.

For instance, as per reports published by the National Library of Medicine in August 2023, research states that 423 million individuals worldwide suffer from urine incontinence. Urinary incontinence affects 13 million American citizens on average. Tenants of nursing facilities face a prevalence of at least 50% for this condition. Moreover, 53% of older people are housebound and incontinent, according to caretakers. According to an anonymous survey of senior citizen hospital patients, 23% of patients had persistent incontinence after they had been discharged, compared to 11% at admission. Urge urinary incontinence is estimated to affect 42% of men over 75 years of age.

Various products are available to manage male UUI, including external catheters, penile clamps, and absorbent products. A wide range of brands offer solutions for managing male UUI, such as Coloplast, Hollister, Cunningham Clamp, Depend, and TENA.

The mixed urinary incontinence segment is expected to expand at the highest CAGR during the forecast period. Male mixed UI is a combination of different urine incontinence patterns, including UUI and SUI. As well as sudden and uncontrollable UUI, men with mixed UI may also have involuntary urine leaking (SUI) in reaction to physical activity or exertion.

Additionally, it is anticipated that the segment would expand steadily throughout the projection period due to the rising frequency of neurological illnesses, pelvic floor dysfunction, and prostate conditions. Nerve stimulation therapies and injectable bulking agents are two less invasive treatments for urine incontinence that have gained popularity in recent years. In addition, there has been an increase in interest in the creation of wearable devices and smart technologies for treating incontinence and providing stimulation.

Usage Insights

The disposable segment held the largest market share of around 68.93% in 2022. For people with urine incontinence, those recovering from surgery, or individuals with limited mobility, disposable drainage bags are frequently used in hospitals, clinics, and home care settings to provide a practical and hygienic manner of regulating urinary output. For patient demands and diverse degrees of urine production, these bags are available in a variety of sizes and combinations.

They might have components such as anti-reflux valves to stop urine from returning to the catheter, which can help lower the risk of infection. Due to their ease of use and convenience, disposable urine drainage bags are anticipated to stay in high demand. Disposable bags present a low risk of infection in contrast to reusable bags, which necessitate adequate cleaning and disinfection to prevent infection transmission. Another element that is anticipated to fuel the segment's expansion is the existence of multiple major companies in the market selling disposable urine drainage bags.

The disposable segment is also expected to progress at the highest CAGR during the forecast period. Increased healthcare spending across numerous nations and the different urinary drainage bag capacities provided by major players are expected to drive this segment’s market expansion in the ensuing years. Some of the primary growth drivers include a rapid increase in the incidence of disorders caused by limited mobility and the rising prevalence of urinary incontinence worldwide.

Distribution Channel Insights

The offline stores segment held the largest market share of 54.26% in 2022. The high market share is due to the long-established presence and wide availability of physical store across the globe. Numerous consumers prefer shopping through offline distribution channels as it provides them with product verification, authenticity, and certainty. Moreover, offline stores offer convenience, customization options, and personalized assistance, which are expected to drive the growth of this segment.

Through the offline mode, customers do not have to wait for shipping to complete their purchases. The sales staff might offer suggestions and guidance based on the needs of the consumer. Products can be physically inspected by customers to make sure they satisfy their needs. The stores that offer medical supplies, including urinary incontinence products, may be attached or located next to medical facilities such as hospitals and clinics. Patients and their carers may find this arrangement to be highly convenient.

Retail stores serve as the primary channel for companies to supply products and samples to consumers. The growth of the retail business is expected to enhance product accessibility and contribute to the expansion of this segment during the forecast period. Furthermore, the rising customer sophistication and their demand for enhanced value are anticipated to create favorable prospects for segment growth in the coming years.

On the other hand, the online channel segment is expected to grow at the highest rate during the forecast period. The growth is expected to be driven by the wide product selection and attractive discounts that are available online. In addition, chatbots and FAQ pages assist customers in addressing their queries related to product search, prescriptions, and overall user experience, thereby enhancing the online shopping experience. People may browse and buy things while resting at home via online shopping.

People with mobility challenges or those who feel uncomfortable making such purchases in person benefit from this buying mode. Some online merchants provide subscription services, which let customers receive their chosen products on a regular basis without having to place additional orders. Manufacturers and retailers in the urinary incontinence sector can build their online presence by working with well-known e-commerce platforms or by developing their own websites. To reach and inform their target audience, they also use digital marketing tactics which ultimately boost the industry growth.

The increased flexibility, ease of product availability, and rising trend of online purchases through smartphones are some other factors facilitating the segment’s growth. Online platforms offer external UCs at competitive prices, and customers can benefit from coupons and other promotional offers. The convenience, comfort, and easy payment options provided by online channels are expected to contribute to the growth of this segment during the projection period.

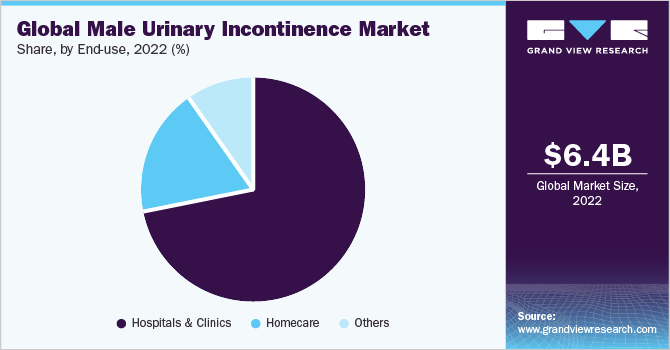

End-use Insights

Hospitals & clinics held the largest market revenue share of 72.01% in 2022. There was a surge in hospital admissions as a result of the COVID-19 outbreak, especially among older patients. To prevent frequent urination, older patients typically require urine control products upon hospital admission, which is expected to boost the category growth during the forecast period. The medical staff and diagnostic equipment required to correctly identify the type and degree of urine incontinence are available at hospitals and clinics.

To ascertain the underlying causes and provide suitable treatment options, doctors may carry out procedures such as urine analysis, urodynamic investigations, and pelvic examinations. For instance, according to statistics collected by the Endocrine Society, approximately 33% of persons over the age of 65 were considered to have diabetes in January 2022. The need for urine tests for this purpose is being driven by the fact that urinalysis is a good diagnostic tool for spotting early indicators of kidney impairment brought on by diabetes.

Moreover, hospitals provide better healthcare facilities and provisions to conduct complex surgeries. The segment’s growth can be attributed to the increasing number of surgical procedures and a rise in cases of end-stage renal diseases. For instance, according to the CDC, in 2021, around 786,000 individuals in the U.S. received treatment for end-stage kidney disease, with approximately 71% being on dialysis and 29% having undergone kidney transplants.

The homecare segment is expected to progress at the highest CAGR during the forecast period. Home care plays an important role in the management of incontinence in men. Homecare for male incontinence focuses on maintaining hygiene, utilizing absorbent products, managing fluids, exercising the pelvic floor muscles, adopting a healthy lifestyle, making environmental modifications, and seeking appropriate medical assistance when needed. It also promotes comfort, confidence, and overall well-being for individuals managing incontinence at home.

Innovations in homecare items and incontinence management tools have been made possible through advances in technology. These include incontinence symptoms that can be monitored, examined, and controlled in real time using smartphone apps, wearable sensors, and electronic reminders. The demand for home care solutions to effectively manage incontinence at home is being driven in part by considerations such as comfort, convenience, cost-effectiveness, tailored care, technology improvements, an aging population, and patient preference.

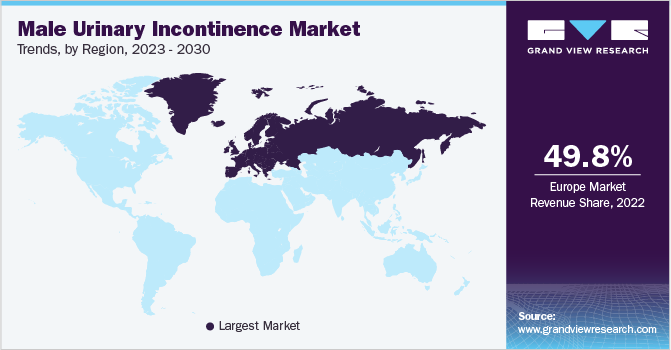

Regional Insights

Europe dominated the male urinary incontinence market with a revenue share of 49.81% in 2022. The industry’s strong growth is driven by the increasing prevalence of UI among men, especially with an aging population in the region. In addition, the growing awareness of available treatment options, advancements in healthcare infrastructure, and the rising adoption of innovative products are factors expected to boost the regional market. Key players are adopting strategic initiatives, such as partnerships and new launches, along with a focus on sustainability, which are poised to propel market growth.

For instance, in January 2022, Attindas Hygiene Partners introduced its environment-friendly adult incontinence protective underwear in Europe, aimed at reducing carbon emissions. The company also implemented a new product design that utilizes ultrasonic bonding instead of traditional glue adhesive, resulting in a significant reduction in greenhouse gas emissions, particularly carbon dioxide. This innovation aligns with Attindas' commitment to reducing its environmental footprint.

North America is expected to advance at the highest CAGR during the forecast period, owing to the presence of key manufacturers such as Boston Scientific Corporation, Coloplast A/S, Hollister Incorporated, Cook Medical Incorporated, and Kimberly-Clark Corporation, among several others. Furthermore, the rising prevalence of urology disorders drives the market growth for male urinary incontinence in this region. Also, increasing incidences of diabetes and obesity have created a significant risk of urology and bladder disorders in men.

For instance, the 2022 National Diabetes Statistics Report was recently made available by the Centers for Disease Control and Prevention. According to this study, there are more than 130 million persons in the U.S. who have diabetes or prediabetes. The increasing geriatric population, which is vulnerable to conditions such as colorectal cancer, bladder obstruction, UI, and urinary retention, is another major factor driving market growth. In addition, rapid developments in the medical devices market is expected to contribute to the growth.

According to the Johns Hopkins University, around 200,000 procedures for prostatectomy for benign disease (BPH) are conducted in the U.S. every year. In addition, as per the Canadian Cancer Society, around 13,300 people were diagnosed with bladder cancer, and 2,500 succumbed to it, in 2022. Thus, the increasing number of BPH-related surgical procedures and rising cases of bladder cancer are expected to boost the North American market’s advancement.

Key Companies & Market Share Insights

Key market players are focusing on the launch of innovative medical devices, growth strategies, and technological advancements, as well as regulatory approvals for treatments associated with urinary incontinence. For instance, in August 2023, the U.S. Food and Drug Administration approved a De Novo commercialization application for the Revi System, a revolutionary tibial neuromodulation treatment for the management of urgent urinary symptoms on their own or in conjunction with urgency incontinence, based on a press release from BlueWind Medical, Ltd.

Doctors are expected to apply their expertise while considering whether Revi will be used prior to patients becoming ineffective or unable to take more conservative medication. Physicians must adhere to clinical requirements as applicable. Based on findings from the OASIS pivotal trial, where Revi revealed a substantial improvement in the relief of symptoms associated with UUI compared to the baseline and a positive safety profile, the FDA grant is intended for men and women with urge urine incontinence (UUI). Such advancements in male urinary incontinence products are anticipated to boost market growth over the forecast period.Some of the key players in the global male urinary incontinence market include:

-

Essity

-

Kimberly-Clark Worldwide Inc.

-

Attends Healthcare Products, Inc.

-

ABENA

-

Coloplast Corp.

-

Teleflex Incorporated

-

Boston Scientific Corporation

-

Ontex Healthcare

-

PAUL HARTMANN AG

-

First Quality

-

Medline

-

BD

-

Hollister Incorporated

-

Cardinal Health

Male Urinary Incontinence Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.72 billion

Revenue forecast in 2030

USD 10.02 billion

Growth rate

CAGR of 5.87% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Segments covered

Product, incontinence type, usage, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Essity; Kimberly-Clark Worldwide Inc.; Attends Healthcare Products, Inc.; ABENA; Coloplast Corp.; Teleflex Incorporated; Boston Scientific Corporation; Ontex Healthcare; PAUL HARTMANN AG; First Quality; Medline; BD; Hollister Incorporated; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Male Urinary Incontinence Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global male urinary incontinence market report on the basis of product, incontinence type, usage, distribution channel, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Absorbents

-

Urinary Catheters

-

Foley Catheters

-

External Catheters

-

-

Drainage Bags

-

External Compression Devices/Penile Clamps

-

Artificial Urinary Sphincter

-

Others

-

-

Absorbents

-

Underwear & Briefs

-

Drip Collectors & Bed Protectors

-

Pads & Guards

-

-

-

Incontinence Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stress Urinary Incontinence

-

Urge Urinary Incontinence

-

Overflow Incontinence

-

Functional Urinary Incontinence

-

Mixed Urinary Incontinence

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline Stores

-

Online Channels

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global male urinary incontinence market size was estimated at USD 6.37 billion in 2022 and is expected to reach USD 6.72 billion in 2023.

b. The global male urinary incontinence market is expected to grow at a compound annual growth rate of 5.87% from 2023 to 2030 to reach USD 10.02 billion by 2030.

b. The absorbents segment held the largest market share of 70.60% in 2022 and is anticipated to grow with the fastest CAGR of 6.36% during the forecast period. Technological advances and new product approvals are factors driving the market. This segment is majorly driven by increasing.

b. Some key players in the market are Essity, Kimberly-Clark Worldwide Inc., Attends Healthcare Products, Inc., ABENA, Coloplast Corp, Teleflex Incorporated, Boston Scientific Corporation, Ontex Healthcare, PAUL HARTMANN AG, First Quality., Medline, BD, Hollister Incorporated, Cardinal Health, and others.

b. The rising incidence of urological disorders, such as cystitis, urinary retention, urinary incontinence, & kidney stones and benign prostatic hyperplasia, which leads to bladder dysfunction, is a major factor that is anticipated to drive the male urinary incontinence market growth globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."