- Home

- »

- Biotechnology

- »

-

Mammalian Cell Fermentation Technology Market ReportGVR Report cover

![Mammalian Cell Fermentation Technology Market Size, Share & Trends Report]()

Mammalian Cell Fermentation Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Monoclonal Antibodies, Recombinant Proteins), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-071-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

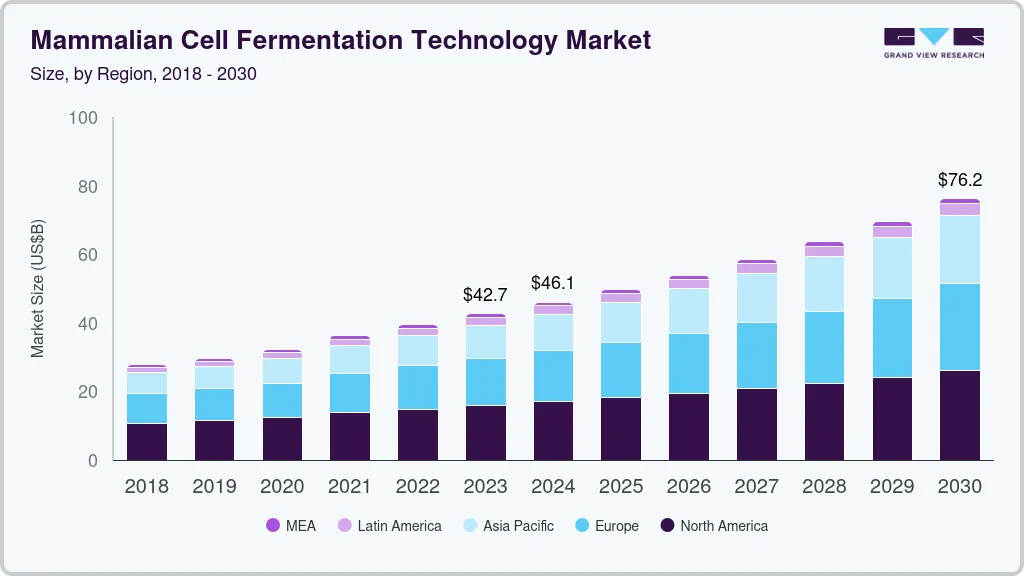

The global mammalian cell fermentation technology market size was valued at USD 42.68 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030. Mammalian cells are commonly used for manufacturing therapeutic proteins such as monoclonal antibodies, vaccines, and other biologics, along with several source materials such as Chinese Hamster Ovary (CHO) cells, Human Embryonic Kidney (HEK) cells, and others. The increasing prevalence of chronic diseases coupled with the growing demand for biologics is fueling the demand for fermentation technologies. After the COVID-19 outbreak, many companies have shifted their focus to manufacturing COVID-19 vaccines and therapies. This has had a significant impact on the mammalian cell fermentation business due to increased demand for mammalian cells for R&D activities. For instance, mammalian cell fermentation technology was used in the Pfizer-BioNTech COVID-19 vaccine to synthesize the mRNA required to make the spike protein of the SARS-CoV-2 virus.

The market for mammalian cell fermentation technology is experiencing a significant surge due to the rising demand for biologics and biosimilars. These treatments have become crucial in managing various ailments, including cancer, autoimmune conditions, and infectious diseases. As pharmaceutical companies increasingly invest in the development of new biologics, interest in mammalian cell fermentation technology continues to grow. A recent example of this growth is Lonza's company expansion of its biologics manufacturing facility in Switzerland.

Technological developments in cell culture are another driver boosting the market for the fermentation of mammalian cells. Higher yields of recombinant proteins and other biologics may now be produced by serum-free media and advancements in bioreactor technologies, which have completely changed the industry.

The market for mammalian cell fermentation technology has expanded as a result of the rise in chronic diseases like diabetes, heart disease, and cancer. There is a constant need for mammalian cell fermentation tools because many illnesses necessitate long-term therapy, frequently with biologics. Overall, it is anticipated that the market for mammalian cell fermentation technology will expand over the next several years because of the continuous need for biologics and biosimilars, as well as developments in an increase in chronic diseases.

Type Insights

Chinese Hamster Ovary (CHO) cell fermentation segment is dominating the market in 2022 with a market share of 65.52%, this is due to their capacity to generate significant amounts of recombinant proteins and their well-understood genetic and biochemical characteristics, Chinese hamster ovary (CHO) cell have gained popularity in the biopharmaceutical sector for the synthesis of therapeutic proteins. The industry has embraced CHO cell technology largely because it is well-established, has undergone considerable research, and has been optimized. This equipment is a great place to produce proteins because of its high productivity, affordability, and regulatory acceptability by organizations like the US FDA. For instance, the FDA's approval of Semglee in 2020 is a recent example of the effectiveness of CHO cell fermentation technology. Semglee, a biosimilar version of insulin glargine, was produced using technology for CHO cells and is expected to provide a more cost-effective alternative to existing insulin products, hence through this the market of mammalian cell culture is growing.

Human Embryonic Kidney (HEK) cell fermentation finds applications in biotechnology and pharmaceutical research due to the ability of HEK cells to multiply quickly and generate large amounts of recombinant proteins. The segment is expected to grow at the fastest CAGR of 11.11% by 2030. The simplicity of HEK cell growth and culture maintenance further makes them a desirable option for extensive fermentation activities. Due to its high productivity, scalability, and affordability, the HEK cells fermentation technology market is rapidly expanding, making it the fastest-growing sector in the mammalian cells fermentation technology market. As a result, it is anticipated that the HEK cell fermentation segment will keep growing quickly.

Application Insights

Monoclonal antibodies segment had a dominating presence in the market in 2022 with a share of 42.38%, as these antibodies have become a crucial component in the production of biologics. This technology has the capability to effectively generate significant quantities of high-quality proteins that exhibit potent biological activity. Monoclonal antibodies are widely utilized due to their effectiveness in treating various diseases. The significance of monoclonal antibodies as a therapeutic alternative for infectious disorders has been brought to light by the COVID-19 pandemic. Therapies using monoclonal antibodies have been created to combat the COVID-19-causing SARS-CoV-2 virus. Mammalian cell fermentation technology can be used to produce these monoclonal antibodies using effective and scalable manufacturing methods.

Recombinant proteins segment is expected to grow at a significant CAGR of 9.04% over the forecast period as these proteins are crucial to produce pharmaceuticals, biologics, and diagnostic tools. Recombinant proteins, which are created by inserting foreign genes into mammalian cells, provide high purity, specialized activities, and functions for a range of clinical and medical research applications, making it the fastest-growing sector in the mammalian cells fermentation technology market. Genetic engineering has quickly expanded and will likely continue to do so in the coming years because of improvements in cell culture and genetic engineering technology that have made it a low-cost, high-throughput technique.

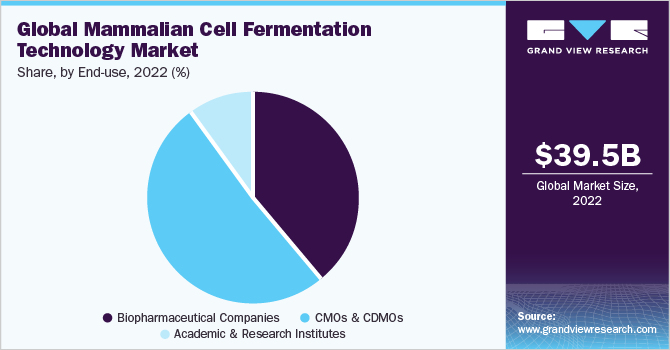

End-use Insights

The CMOs & CDMOs segment dominated the market with a share of 51.00% in 2022. The dominance is due to their ability to offer comprehensive services to pharmaceutical and biotech companies, including process development, and large-scale manufacturing, and to provide flexible business models to their clients. For instance, in 2021 PPD, a renowned CDMO, was purchased by Thermo Fisher Scientific for USD 17.4 billion. This acquisition demonstrates the rising demand for CDMO services, which is being fueled by the need for adaptable and scalable manufacturing solutions, which CDMOs can offer, as well as the complexity of biologics development.

The biopharmaceutical industry has experienced substantial growth in recent years and is expected to grow at a CAGR of 7.77% by 2030. One significant factor is the increasing demand for advanced therapies and personalized medicine, which require the use of biopharmaceuticals. The production of biopharmaceuticals using this method has also become simpler and more affordable thanks to developments in mammalian cell fermentation technology. As a result, the sector of biopharmaceuticals is expanding, and numerous businesses are making investments in this area to take advantage of the rising demand. As a result, compared to the market for mammalian cell fermentation technology, the biopharmaceuticals firms’ segment has experienced significant expansion.

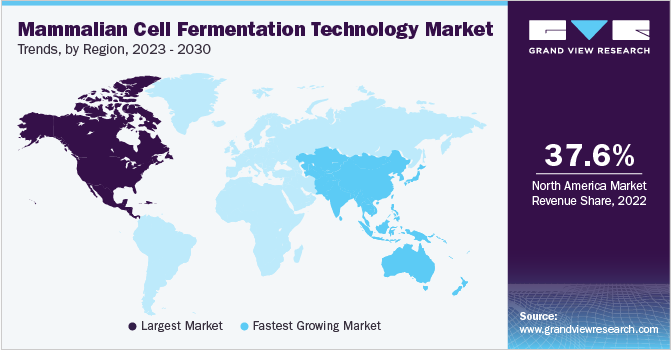

Regional Insights

North America accounted for the largest share of the mammalian cell fermentation technology market in 2022 and held around 37.61% of the market size. The region has a highly developed healthcare infrastructure, favorable government policies, and a strong presence of major biopharmaceutical companies, driving the growth of the market. Additionally, the increasing prevalence of chronic diseases and rising demand for biologics and biosimilars have also contributed to the growth of the market in the region. For instance, in 2020 Merck's expansion of its Antibody-Drug Conjugate (ADC) manufacturing facility in Madison, Wisconsin is expected to boost the growth of the mammalian cells fermentation technology market in the region. The expansion will increase the capacity of biologics, including ADCs, to meet the growing demand for cancer therapies.

Asia Pacific region is estimated to grow at the fastest rate during the forecast period and is expected to grow at a CAGR of 10.68% by 2030. This can be attributed to the expansion of mammalian cell fermentation technology industry in the region due to the favorable regulatory environment, rising investments by multinational corporations, and the accessibility of trained staff at a reduced cost. The expansion of Samsung Biologics' manufacturing facility in Incheon, South Korea, is one recent example of the growth of mammalian cell fermentation technology in the growing area. The market for mammalian cell fermentation technology in the Asia Pacific area is anticipated to increase because of these investments in the future years.

Key Companies & Market Share Insights

The growing demand for mammalian cell fermentation technology for various applications has created numerous market opportunities for key players to capitalize on. Several players are involved in initiatives such as acquisitions, mergers, and collaborations to strengthen their market position. For instance, in January 2023, Fosun Pharma's exclusive license agreement with Shanghai Henlius Biotech for the commercialization of serplulimab, an anti-PD-1 monoclonal antibody, in the U.S. market is a significant development in the market. The agreement is expected to expand Fosun Pharma's biologics portfolio, including its development and manufacturing capabilities, in this fast-growing segment. Some of the key players in the global mammalian cell fermentation technology market include:

-

Thermo Fisher Scientific, Inc.

-

Merck KGaA

-

Danaher

-

Lonza

-

F. Hoffmann-La Roche Ltd

-

Sartorius AG

-

AstraZeneca

-

Bristol-Myers Squibb

-

Amgen

-

Gilead Sciences

-

Moderna, Inc.

-

Regeneron Pharmaceuticals

Mammalian Cell Fermentation Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.06 billion

Revenue forecast in 2030

USD 76.24 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher; Lonza; F. Hoffmann-La Roche Ltd; Sartorius AG; AstraZeneca; Bristol-Myers Squibb; Amgen; Gilead Sciences; Moderna, Inc.; Regeneron Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

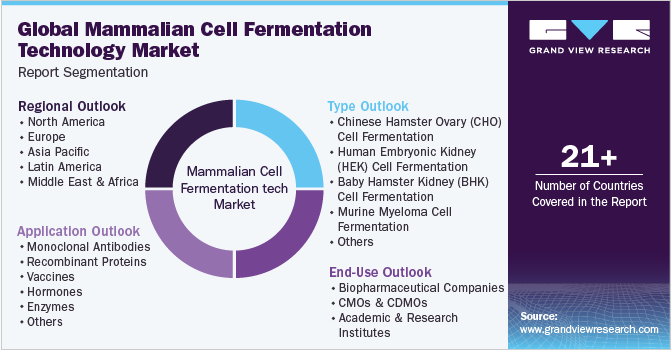

Global Mammalian Cell Fermentation Technology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mammalian cell fermentation technology market based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chinese Hamster Ovary (CHO) Cell Fermentation

-

Human Embryonic Kidney (HEK) Cell Fermentation

-

Baby Hamster Kidney (BHK) Cell Fermentation

-

Murine Myeloma Cell Fermentation

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Monoclonal Antibodies

-

Recombinant Proteins

-

Vaccines

-

Hormones

-

Enzymes

-

Others

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopharmaceutical Companies

-

CMOs & CDMOs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mammalian cell fermentation technology market size was estimated at USD 39.49 billion in 2022 and is expected to reach USD 42.68 billion in 2023.

b. The global mammalian cell fermentation technology market is expected to grow at a compound annual growth rate of 8.64% from 2023 to 2030 to reach USD 76.24 billion by 2030.

b. North America dominated the mammalian cell fermentation technology market with a share of 37.61% in 2022. This is attributable to the rising demand for biologics and increasing research and development activities in the biomanufacturing industries in the region.

b. Some key players operating in the mammalian cell fermentation technology market include Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher; Lonza; F. Hoffmann-La Roche Ltd; Sartorius AG; AstraZeneca; Bristol-Myers Squibb; Amgen; Gilead Sciences; Moderna, Inc.; Regeneron Pharmaceuticals.

b. Mammalian cell fermentation forms an integral part of biopharmaceutical production as the technology is commonly used for the manufacturing of various biosimilars, enzymes, vaccines, and other biologics. Increasing demand for these products is expected to drive the market in the near future.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.