- Home

- »

- Biotechnology

- »

-

Mammalian Polyclonal IgG Antibody Market Size Report, 2030GVR Report cover

![Mammalian Polyclonal IgG Antibody Market Size, Share & Trends Report]()

Mammalian Polyclonal IgG Antibody Market Size, Share & Trends Analysis Report By Type (Mouse, Rabbit), By Product (Cardiac, Metabolic), By Application (Western Blotting, ELISA), By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-615-8

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global mammalian polyclonal IgG antibody market size was valued at USD 1.13 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.01% from 2023 to 2030. The growth of the industry is attributed to various factors, such as benefits over other antibody forms, rising R&D investments, and increasing adoption of novel diagnostic procedures. For instance, in January 2023, Xeno Thera published a favorable result on the use of XAV-19, a glycol-humanized polyclonal antibody, to treat all variants of COVID-19. The product is under clinical trials since 2020 and over 700 patients participated in the trials.

According to the company, polyclonal antibody-based treatment has raised no safety issues and enhanced the recovery rate. Hence, companies in this space are indulging in product development strategies to establish a strong offering portfolio. A rise in investments by biotechnology and pharmaceutical companies has led to technological advancements in the process of antibody production. These advancements have increased product demand, thereby augmenting the mammalian polyclonal IgG antibody market. For instance, in October 2021, Bharat Serums and Vaccines invested around USD 12.3 million in a year to enhance their manufacturing facility.

The company is working on establishing an in-house polyclonal antibodies-based product for treating COVID-19. The successful trials are expected to result in the first indigenously developed polyclonal antibodies-based product in India. The rising popularity of standard laboratory tests, such as microarray assays, western blot analysis, immunohistochemical, and cell imaging, is expected to boost mammalian polyclonal IgG antibody growth. For instance, GenScript provides customized polyclonal antibodies that are suitable for various assays type, including sandwich ELISA, Western Blot, CHiP, Immunoprecipitation, IF, IHC, and Flow Cytometry.

Developing polyclonal antibodies without assay type specification enables laboratories to incorporate polyclonal antibodies in the existing resources and avoid additional costs. Along with that, the rising occurrence of chronic diseases like cancer, among others, is driving the expansion of the industry. According to an article published in January 2023, MilliporeSigma is expanding its antibodies portfolio for tissue diagnostics to assist in the tumors of the nervous system. Gliomas account for 30% of central nervous system tumors. MilliporeSigma developed a rabbit polyclonal antibody product to identify ATRX, a significant classification of gliomas.

The company is expecting to develop more antibodies in the area of neuropathology and other applications. Succeeding in this market gives a competitive advantage to a firm. The factors are tax credit, government investment, acceleration in institutional and academic research, and affordability of supporting equipment and technology, which can encourage players to participate and drive the market demand. However, the industry is projected to be hampered by the stringent regulations related to the approval and use of biomarkers and the lack of awareness about the use of products.

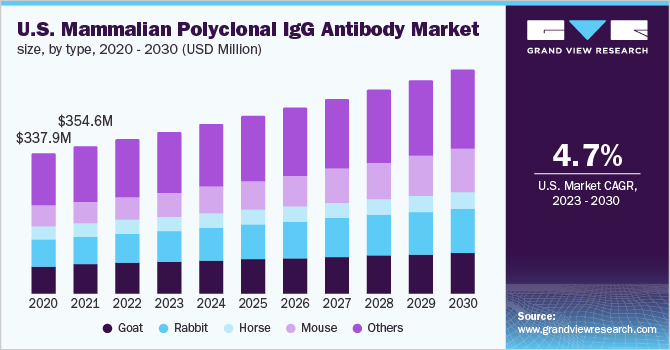

Type Insights

The mouse segment is anticipated to exhibit the fastest CAGR of 8.59% from 2023 to 2030 owing to the predominant use of these animals for polyclonal antibody production. Mice’s immune system is similar to the human immune system, their functions of all the genes and the development of egg and sperm are in the same way as a human. This genetic semblance helps researchers reduce the variability. Mice are easy to breed and economically friendly too. For instance, Bio X Cell offers mouse polyclonal antibodies ranging from USD 159 for 1 mg to USD 4,155 for 100 mg. These price ranges differ for non-profit and academic organizations.

Thus, the mouse segment is expected to generate significant revenue by 2030. Rabbit antibodies, due to high specificity, showcase an enhanced immune response to small epitopes, facilitating increased recognition during disease diagnosis. The large variety of high-affinity antibodies produced by rabbits aids in finding immunoglobulins that have a wide range of applications, such as immunohistochemistry, ELISA, Western Blotting, immunocytochemistry, and others. As of January 2023, in the U.K., rabbits are involved in around 2.5% of the total scientific process and the majority of it was used in antibody research, such as diagnostics, analytics, and production. This is anticipated to have a positive impact on segment growth.

Product Insights

The metabolic biomarkers segment dominated the industry in 2022 and accounted for the largest share of 25.6% of the overall revenue. The increasing use of metabolic biomarkers for the diagnosis of diabetes is anticipated to propel segment growth. The estimates from the International Diabetes Federation indicate that there were over 537 million cases of diabetes globally in 2021. Type II diabetes is the most common type of diabetes and 90% of the affected population suffers from this type. Globally increasing cases of cancer are also anticipated to fuel the segment’s growth in the near future. Other biomarkers taken into consideration in the study are cancer and autoimmune biomarkers. The cardiac biomarker is projected to have significant growth during the forecast period.

The rising prevalence of Cardiovascular Diseases (CVDs) due to unhealthy eating habits, sedentary lifestyles, and lack of physical activity is driving the cardiac biomarkers segment. In 2020, CVDs accounted for 19.1 million deaths globally. The highest incidence rates were reported in the emerging regions of Eastern Europe, North Africa, and Central Asia. Life Diagnostics is a regional player in the U.S. with a distribution network in numerous countries, such as Australia, Belgium, China, Germany, India, Israel, and Hong Kong. The company offers cardiac biomarkers ranging from USD 110 to USD 500 for 0.1 mg. Hence, the increasing distribution network of market players is expected to boost the growth of the industry.

Application Insights

The ELISA segment is anticipated to register the highest CAGR of 7.48% over the forecast years due to its predominant use in antibody-related tests. It is the most often used test due to its accurate diagnosis of diseases, such as AIDS, Lyme disease, syphilis, pernicious anemia, and viral infections. Immunohistochemistry, used in tumor detection, is expected to account for a significant revenue share in the near future. This is mainly due to its higher specificity, which aids in the identification of structural differences, often seen in tumor cells. Rising adoption and advancements in equipment are also likely to propel segment growth.

On the other hand, the western blotting segment held the highest revenue share in 2022 owing to its sensitivity and specificity. The use of western blotting facilitates disease detection with few antibodies, considerably reducing laboratory costs. The protein specificity of these tests is another key factor responsible for their increased demand. Western blotting advantages for protein detection, such as rapid, inexpensive, convenient, higher sensitivity, and compatibility with immunodetection, assist the segment in maintaining a larger market share.

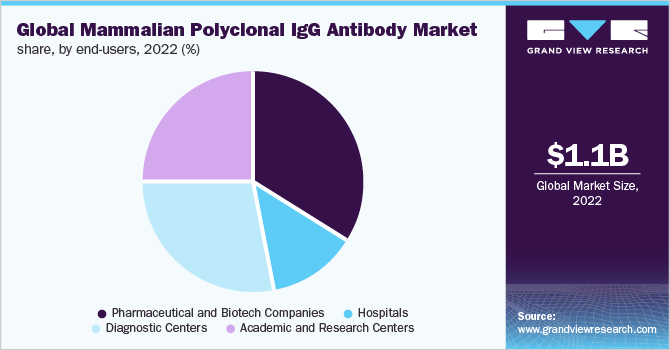

End-users Insights

The pharmaceutical and biotech companies segment is the major contributor to the industry and accounted for the maximum share of more than 34.15% of the overall revenue in 2022. The global pandemic can be a key driver for companies, as discovering an antibody for the coronavirus gives an upper hand to the company in leading the industry. For instance, in 2020, GlaxoSmithKline invested USD 250 million in Vir Biotechnologies to assist with the development of an antibody drug for COVID-19. Similarly, the U.S. government contributed USD 14.5 million to Emergent BioSolutions to support their work on antibody drugs.

The diagnostic centers segment is anticipated to exhibit the highest CAGR during the forecast period. Academic and research centers generated significant revenue in 2022 due to the increased number of research activities on personalized medicine and improving drug efficacy. For instance, in April 2020, The University of Arizona Health Sciences partnered with the State of Arizona to conduct an antibody blood test for COVID-19. The State offered monetary assistance of USD 3.5 million to the university. Hence, increasing demand for mammalian polyclonal IgG antibodies by the end-users is expected to boost the market growth.

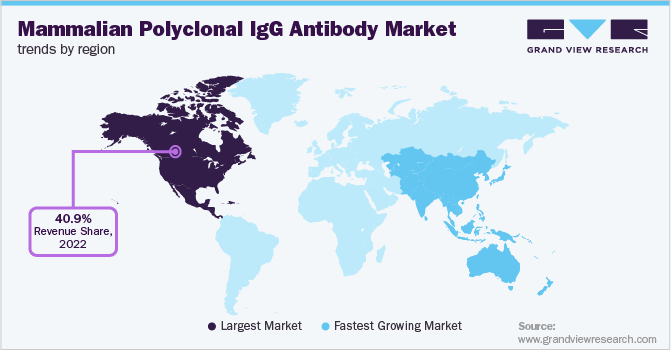

Regional Insights

North America dominated the industry in 2022 and accounted for the maximum share of 40.93% of the overall revenue, due to the presence of well-equipped research facilities and leading companies producing antibodies in the region. Moreover, the quick adoption of advanced technologies and focus on clinical research are expected to drive regional growth. Favorable reimbursement policies in the U.S. have propelled the use of polyclonal antibody techniques in the country. The presence of government organizations, such as the CDC, has contributed to the dominance of the regional market. Rising awareness among people and increasing R&D activities are some of the key factors contributing to the growth.

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period owing to rising disposable income and increasing prevalence of cancer and diabetes. The growing focus of leading manufacturers on strengthening their presence in the emerging countries of APAC will also augment the regional market growth. For instance, BI Biotech India is one of the key antibody manufacturers in India with the capacity to generate 200 rabbit polyclonal antibodies per month. Moreover, high demand for regenerative medicines and government support are expected to fuel growth in the APAC region.

Key Companies & Market Share Insights

Key companies have undertaken various business strategies, including M&A and strategic agreements, to gain a competitive edge over other companies. For instance, in January 2023, Immuron announced receiving a patent on drug composition, IMM-529, from the European regulatory authority. IMM-529 is a polyclonal antibody to treat Clostridioides difficile (C.difficile) infections. Through a patent on the drug, the company gets a competitive edge over other players. Regional expansion is another strategy undertaken by most market participants. Some of the key players in the global mammalian polyclonal IgG antibody market include:

-

Abcam plc.

-

Bio-Rad Laboratories

-

Thermo Fisher Scientific

-

Novartis AG

-

Geno Technology Inc.

-

Merck KGaA

-

Cell Signaling Technologies

-

F. Hoffmann-La Roche Ltd.

-

Stemcell Technologies Inc.

-

Phoenix Pharmaceuticals

Mammalian Polyclonal IgG Antibody Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.18 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 5.01% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abcam plc.; Bio-Rad Laboratories; Thermo Fisher Scientific; Novartis AG; Geno Technology Inc.; Merck KGaA; Cell Signaling Technologies; F. Hoffmann-La Roche Ltd.; Phoenix Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mammalian Polyclonal IgG Antibody Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global mammalian polyclonal IgG antibody market report on the basis of type, product, application, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Goat

-

Rabbit

-

Horse

-

Mouse

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Markers

-

Metabolic Markers

-

Renal Markers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ELISA

-

Immunoturbidometry

-

Immunoelectrophoresis

-

Antibody Identification

-

Immunohistochemistry

-

Immunocytochemistry

-

Western Blotting

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and biotechnology companies

-

Hospitals

-

Diagnostic Centers

-

Academic and Research Centers

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mammalian polyclonal IgG market size was estimated at USD 1.13 billion in 2022 and is expected to reach USD 1.18 billion in 2023.

b. The global mammalian polyclonal IgG market is expected to grow at a compound annual growth rate of 5.01% from 2023 to 2030 to reach USD 1.67 billion by 2030.

b. North America dominated the mammalian polyclonal IgG market with a share of 40.9% in 2022. This is attributable to the presence of well-equipped research facilities and leading companies producing antibodies in the region. Moreover, the quick adoption of advanced technologies and focus on clinical research are expected to drive regional growth.

b. Some key players operating in the mammalian polyclonal IgG market include Abcam PLC; Bio-Rad Laboratories; Thermo Fisher Scientific, Inc.; Merck KGaA; Cell Signaling Technology, Inc.; and F. Hoffman-La Roche among others.

b. Key factors that are driving the market growth include the rise in investments by biotechnology and pharmaceutical companies leading to technological advancements creating significant demand for these antibodies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."