- Home

- »

- Next Generation Technologies

- »

-

Manned Security Services Market Size, Industry Report 2033GVR Report cover

![Manned Security Services Market Size, Share & Trends Report]()

Manned Security Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Security Guards, Bodyguards, Bouncers), By End-use (Industrial, Commercial, Residential), By Region (North America, Europe, Asia Pacific, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-652-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Manned Security Services Market Summary

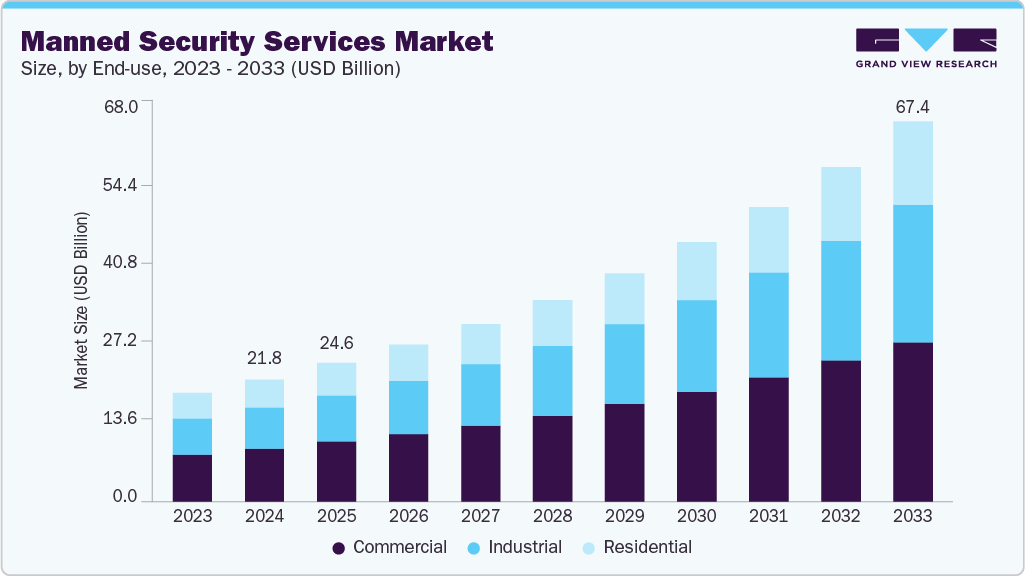

The global manned security services market size was estimated at USD 21.75 billion in 2024 and is projected to reach USD 67.36 billion by 2033, growing at a CAGR of 13.4% from 2025 to 2033. This growth is driven by rising demand for on-site security personnel across commercial, industrial, and residential sectors, fueled by increasing concerns over physical safety, asset protection, and regulatory compliance.

Key Market Trends & Insights

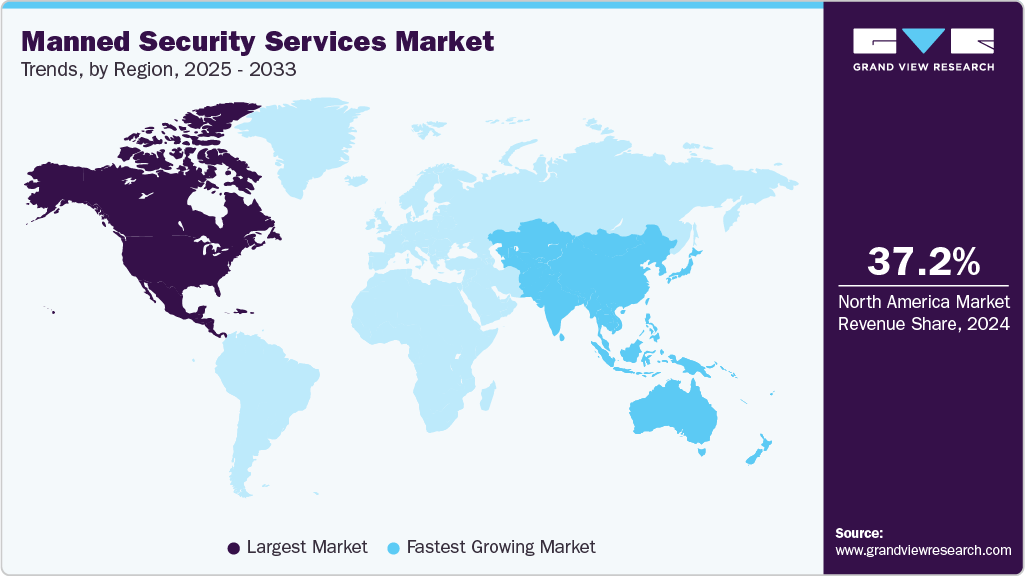

- North America dominated the global manned security services market with the largest revenue share of 37.2% in 2024.

- The manned security services market in the U.S. led the North America market and held the largest revenue share in 2024.

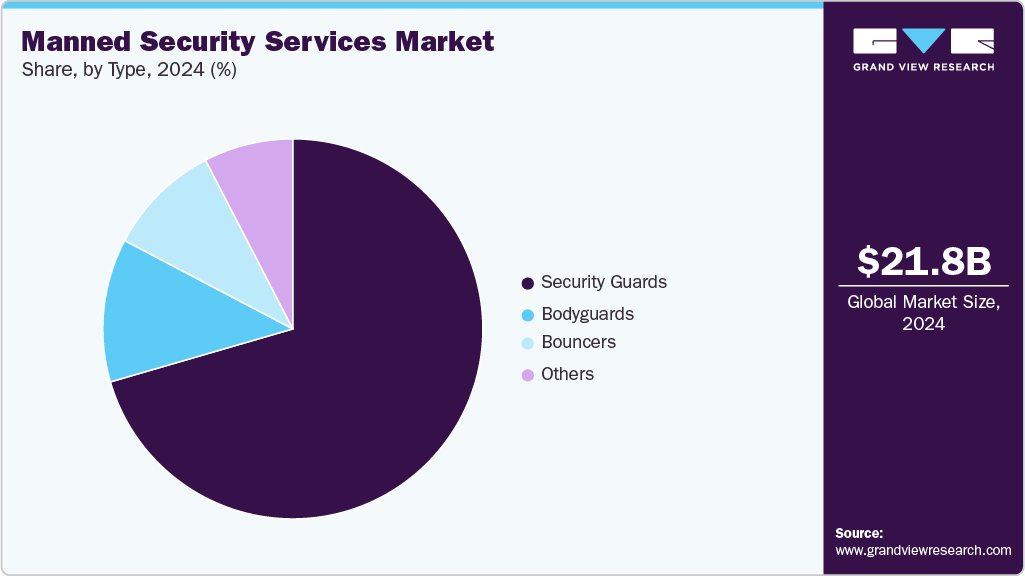

- By type, the security guards segment accounted for the largest market revenue share of over 69% in 2024.

- By end-use, the commercial segment led the market, holding the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.75 Billion

- 2033 Projected Market Size: USD 67.36 Billion

- CAGR (2025-2033): 13.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

The current state of the global manned security services market reflects ongoing demand for visible, human-centric security solutions across commercial, industrial, and public sectors. Heightened concerns about crime, vandalism, and workplace safety continue to drive organizations to deploy trained security personnel for access control, patrolling, and emergency response. The presence of valuable assets, sensitive information, and high foot traffic in commercial and industrial environments further supports the need for manned security services. In addition, regulatory compliance and insurance requirements encourage businesses to maintain a physical security presence as part of their risk management strategies.

In addition, the market is expected to experience growth due to several emerging trends and evolving security challenges. Increasing urbanization and infrastructure development, especially in emerging economies, create new opportunities for manned security services. Demand for specialized security personnel, such as bodyguards and event security teams, rises as high-profile individuals and large gatherings face greater risks. Integration of technology with manned services such as real-time communication devices, surveillance systems, and incident management software enhances the effectiveness and efficiency of security operations. These advancements allow security providers to offer more comprehensive and responsive solutions tailored to diverse client needs.

Furthermore, the expanding focus on public safety, regulatory changes, and the need to protect infrastructure continue to shape the market’s trajectory. Organizations operating in the transportation, healthcare, and logistics sectors are increasingly emphasis on the importance of a reliable human security presence to complement digital solutions. The combination of professional training, rapid response capabilities, and adaptability positions manned security services as essential to modern security strategies. As a result, the market is set for steady expansion, reflecting sustained demand for effective and adaptable security solutions worldwide.

Type Insights

The security guards segment accounted for the largest market revenue share of over 69% in 2024 as organizations across commercial, residential, and public sectors consistently require a visible human presence to deter threats and ensure safety. Security guards perform a range of essential tasks, including access control, patrolling, surveillance, and emergency response, making them indispensable in safeguarding people and assets. Their adaptability to various environments and ability to provide immediate intervention in case of incidents contribute to their widespread deployment. The increasing urbanization and growing concerns about crime continue to drive the demand for trained security personnel.

The bodyguards segment is expected to grow at the fastest CAGR over the forecast period as the need for specialized personal protection services increases, particularly for high-profile individuals, executives, and celebrities. Rising security threats, targeted attacks, and public exposure have led to greater reliance on professional bodyguards who offer tailored protection strategies. This segment benefits from the growing demand for VIP protection at public events, political gatherings, and corporate functions, where risks are elevated. The evolving nature of threats and the need for discreet, highly trained personnel drive investments in this area. As a result, the bodyguards segment is rapidly expanding to address the complex security requirements of individuals facing elevated risks.

End-use Insights

The commercial segment accounted for the largest market revenue share in 2024 due to the high concentration of valuable assets, sensitive information, and human traffic within these environments. Office complexes, shopping centers, hotels, and financial institutions prioritize manned security services to manage access, monitor premises, and respond swiftly to incidents. The complexity of commercial properties, with multiple entry points and diverse tenant requirements, necessitates comprehensive security strategies. Enhanced regulatory requirements and insurance policies also encourage businesses to invest in professional security personnel.

The industrial segment is anticipated to grow at the fastest CAGR during the forecast period as industrialization expands and security risks in manufacturing, logistics, and energy sectors intensify. Industrial facilities face unique challenges, including protecting important infrastructure, hazardous materials, and high-value equipment. The rising incidents of theft, vandalism, and sabotage prompting companies to deploy specialized and well trained security personnel to handle such industrial threats. Integration with advanced monitoring technologies and strict compliance with safety regulations drive demand. As industries grow and diversify, the need for tailored manned security solutions in industrial settings accelerates.

Regional Insights

North America manned security services market dominated the global industry with a revenue share of 37.2% in 2024, driven by advanced infrastructure, a large commercial base, and heightened awareness of security risks. The region’s businesses and institutions prioritize comprehensive protection measures, often integrating physical security with advanced surveillance and alarm systems. Regulatory standards and insurance requirements further reinforce the adoption of professional security personnel.

U.S. Manned Security Services Market Trends

The U.S. manned security services industry is expected to grow significantly in 2024 as organizations respond to evolving security threats, regulatory changes, and increased public safety concerns. The country’s diverse economy, with its commercial and governmental concentration, drives continuous demand for skilled security personnel. Employment data reflects a steady rise in security guard positions, highlighting the need for human-centric solutions despite technological advancements.

Europe Manned Security Services Market Trends

The manned security services market in Europe is expected to grow significantly over the forecast period as businesses and public institutions address rising security challenges, including terrorism, organized crime, and civil unrest. The European regulatory environment emphasizes compliance, training, and certification for security personnel, ensuring high service standards. Growing urbanization, increased public events, and the need to protect important infrastructure drive demand for tailored manned security solutions. European companies also focus on integrating physical and digital security, reflecting the evolving nature of threats.

Asia Pacific Manned Security Services Market Trends

The manned security services industry in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period, driven by rapid urbanization, industrial expansion, and rising security awareness in countries such as China, India, and Japan. The region’s economic development fuels commercial and industrial infrastructure investments, which require comprehensive security coverage. Increasing crime incidents and the need for public safety in densely populated urban centers further stimulate demand for professional security personnel. Adopting modern security practices and traditional manned guarding supports the region’s dynamic growth. As Asia Pacific economies continue to develop, the reliance on manned security services intensifies, making it the fastest-growing region in the industry.

Key Manned Security Services Company Insights

Some key companies in the manned security services industry are G4S Limited, I.S. International S.R.L., ICTS Europe S.A., and Securitas AB.

-

I.S. International S.R.L. is a company in the manned security services market, providing professional security personnel and related services tailored to client needs. The company emphasizes delivering high-quality, flexible security solutions such as manned guarding, mobile patrols, and alarm response to protect assets and premises. By focusing on client-specific requirements and maintaining a professional workforce, I.S. International S.R.L. supports organizations in managing security risks effectively across various sectors.

-

G4S Limited is a global integrated security company offering a wide range of security products, services, and solutions to protect people, assets, and operations. The company provides manned guarding, mobile patrols, alarm monitoring, and electronic security systems, supported by advanced technology such as AI-driven intelligence, video analytics, and remote surveillance. With operations in over 90 countries and a large workforce, G4S Limited delivers customized security services tailored to diverse industries.

Key Manned Security Services Companies:

The following are the leading companies in the manned security services market. These companies collectively hold the largest market share and dictate industry trends.

- C.S. Group Limited

- I.S. International S.R.L.

- ICTS Europe S.A.

- Securitas AB

- Tops Security Limited

- China Security & Protection Group Ltd.

- G4S Limited

- Transguard Group

- Axis Group Integrated Services Ltd.

- Andrews International Inc.

Recent Developments

-

In April 2025, the Bank of England awarded Amulet an 18-month contract to provide manned guarding services at its Threadneedle Street headquarters in London and its printing facility in Essex. This engagement highlights the Bank’s commitment to maintaining physical security measures at its critical sites, ensuring the protection of assets, personnel, and sensitive operations integral to the U.K.’s financial infrastructure.

-

In February 2025, Dunbar Security Solutions, Inc., a prominent provider of comprehensive security services, completed the acquisition of M&I Security, Inc., a manned guarding company based in Dallas, Texas. This acquisition represents a key component of Dunbar’s strategic expansion efforts, significantly enhancing its market presence in Texas. Integrating M&I Security, Inc.'s operations is expected to broaden Dunbar Security Solutions, Inc.'s service capabilities and strengthen its capacity to deliver high-quality security solutions to a diverse client base across the region.

-

In October 2024, UK based facilities transformation company Mitie Group plc acquired Grupo Visegurity, a Spanish security firm, for approximately USD 12 million. This acquisition expands Mitie Group plc's footprint in the European security market, particularly enhancing its capabilities in manned security services, which remain an important component of comprehensive security solutions.

Manned Security Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.60 billion

Revenue forecast in 2033

USD 67.36 billion

Growth rate

CAGR of 13.4% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

C.S. Group Limited; I.S. International S.R.L.; ICTS Europe S.A.; Securitas AB; Tops Security Limited; China Security & Protection Group Ltd.; G4S Limited; Transguard Group; Axis Group Integrated Services Ltd.; Andrews International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Manned Security Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global manned security services market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Security Guards

-

Bodyguards

-

Bouncers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global manned security services market size was estimated at USD 21.75 billion in 2024 and is expected to reach USD 24.60 billion in 2025.

b. The global manned security services market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2033 to reach USD 67.36 billion by 2033

b. North America dominated the manned security services market with a share of 36% in 2024, driven by advanced infrastructure, a large commercial base, and heightened awareness of security risks.

b. Some key players operating in the manned security services market include C.S. Group Limited; I.S. International S.R.L.; ICTS Europe S.A.; Securitas AB; Tops Security Limited; China Security & Protection Group Ltd.; G4S Limited; Transguard Group; Axis Group Integrated Services Ltd.; Andrews International Inc.

b. Key factors that are driving the market growth include rising demand for on-site security personnel across commercial, industrial, and residential sectors, fueled by increasing concerns over physical safety, asset protection, and regulatory compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.