- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Mannitol Market Size And Share, Industry Report, 2030GVR Report cover

![Mannitol Market Size, Share & Trends Report]()

Mannitol Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Food Additive, Pharmaceuticals, Industrial, Surfactants), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-900-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mannitol Market Summary

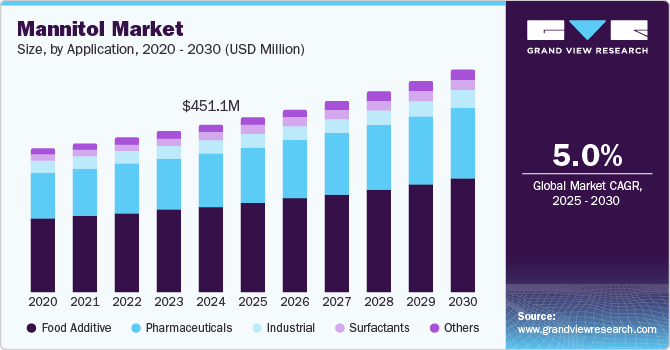

The global mannitol market size was estimated at USD 451.1 million in 2024 and is projected to reach USD 601.4 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. The growing population, evolving lifestyles, and the rise of certain diseases across various regions drive positive growth in the market.

Key Market Trends & Insights

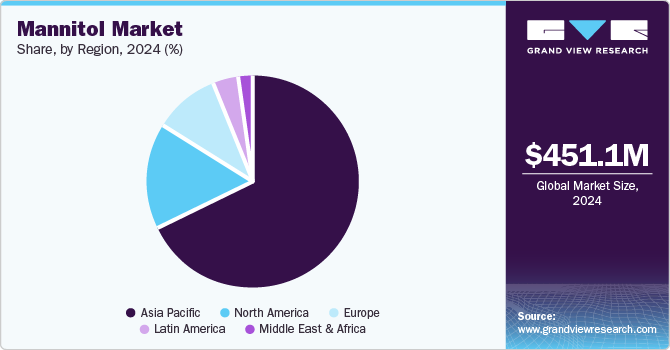

- The Asia Pacific mannitol market dominated the global market and accounted for the largest revenue share, 67.9%, in 2024.

- The U.S. mannitol market dominated the North America market, with the highest revenue share of 70.8% in 2024.

- Based on application, food additives dominated the mannitol market and accounted for a revenue share of 51.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 451.1 Billion

- 2030 Projected Market Size: USD 601.4 Billion

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2024

This product serves as an excipient in the pharmaceutical industry, aiding in the formulation of medications and treating conditions related to the kidney, brain, and heart. Additionally, it is used as a bulking agent in tablet manufacturing. Mannitol causes a much smaller increase in blood glucose compared to sucrose, making it popular in foods for diabetic patients. The rising prevalence of diabetes and obesity is driving demand for healthier food choices, positively impacting market growth. Additionally, mannitol's use in products such as butter, frozen fish, pre-cooked pasta, and infant formula is increasing. Growing consumer demand for low- and zero-calorie foods, driven by changing diets and heightened health awareness, is further fueling the need for artificial sweeteners such as mannitol.

Global demand for canned beverages, juices, coffee, and flavored drinks is rising. Most of these drinks rely on sugar to enhance taste and mouthfeel. However, regular sugar adds higher calories, leading more consumers to monitor their calorie, carbohydrate, and sugar intake due to the growing prevalence of chronic conditions such as diabetes and obesity. In response, beverage manufacturers are turning to sugar alcohol to align with this trend, boosting the demand for sugar alcohol in the beverage industry.

Application Insights

Food additives dominated the mannitol market and accounted for a revenue share of 51.2% in 2024 due to shifting consumer preferences to participate in diet and lifestyle management. Furthermore, manufacturers are incorporating mannitol into a variety of food products, including confectionery, baked goods, and beverages, to cater to this demand. The increasing incidence of chronic conditions such as diabetes and obesity has heightened the demand for sugar substitutes such as mannitol. Its minimal impact on blood glucose levels makes it suitable for diabetic-friendly products.

The surfactants segment in the mannitol market is expected to grow significantly at a CAGR of 4.9% over the forecast period. Rising consumer awareness of hygiene is increasing demand for surfactants in personal care and home products, with mannitol playing a crucial role in its formulation. The expanding food and beverage sector, where surfactants are vital in food processing, further drives this trend. Urbanization and industrial growth in the Asia Pacific, especially in India and China, are fueling the demand for surfactants, including mannitol-based formulations, particularly in the construction and automotive sectors, thus boosting mannitol’s demand.

Regional Insights

The Asia Pacific mannitol market dominated the global market and accounted for the largest revenue share, 67.9%, in 2024. Mannitol’s use in food processing as a sweetener, additive, and stabilizer is driving demand fueled by the region’s expanding food and beverage industry. Additionally, increasing consumer focus on hygiene and wellness is boosting the demand for mannitol-based surfactants in personal and home care products. Manufacturers in the Asia Pacific are enhancing research for new product launches, boosting the global low-intensity sweetener market. Focus has shifted to low-calorie food due to rising diabetes and obesity rates.

China Mannitol Market Trends

The mannitol market in China led the Asia Pacific market with the highest revenue share in 2024. China's massive population creates a substantial domestic market for mannitol products. The country is the top producer of sugar alternatives globally. The increasing demand for sweeteners is being driven by the country's expanding food and beverage industry. As a low-calorie sweetener, mannitol is favored in products targeting health-conscious consumers and those managing conditions such as diabetes. There is a wide prevalence of diabetes in China owing to its changing lifestyle and advancement of socioeconomic status.

Latin America Mannitol Market Trends

The Latin America mannitol market is expected to grow significantly at a CAGR of 5.3% over the forecast period. Rising health consciousness among consumers and the increasing prevalence of lifestyle diseases such as diabetes are key factors driving the demand for low-calorie sweeteners such as mannitol. With the rising industrial development in the region, the demand for mannitol has also increased as it is employed in various industrial processes, including the production of cosmetics and personal care products; due to its moisturizing and texturizing properties and in the pharmaceutical sector, mannitol serves as an excipient in drug formulations, including tablets and syrups.

The mannitol market in Brazil dominated the Latin America market with the highest revenue share in 2024. Brazil's high obesity and type 2 diabetes rates have led the government to implement measures to reduce sugar consumption, with mannitol emerging as a popular sugar substitute. As the incidence of diabetes continues to rise, there is an increasing focus on health and wellness, presenting significant opportunities for the mannitol market's expansion. Food processing companies are incorporating natural ingredients into their products due to growing demand for organic and natural foods, further boosting mannitol’s usage in Brazil’s food industry.

North America Mannitol Market Trends

The North America mannitol market held a substantial market share in 2024. As consumers access vast information, they become more conscious of their dietary choices. Growing health awareness is driving demand for low-calorie food and beverages to support balanced diets. Mannitol is commonly used in the pharmaceutical industry as a bulking agent and excipient, particularly in treating kidney disorders and cerebral edema. In North America, the aging population and rising health conditions such as diabetes and neurological disorders are boosting its demand. Additionally, its use as a sweetener and bulking agent in low-calorie food products is rising due to consumer preference for natural ingredients.

The U.S. mannitol market dominated the North America market, with the highest revenue share of 70.8% in 2024. The pharmaceutical and food industries play a crucial role in the country’s economy. Mannitol is extensively used in the pharmaceutical sector as a bulking agent and excipient in tablet and syrup formulations. In the food industry, it serves as both a sweetener and bulking agent in products such as chewing gum, candies, and baked goods. The rising demand for natural and low-calorie ingredients in food is fueling the increased use of mannitol.

Key America Mannitol Company Insights

Key companies in the global mannitol market include Roquette Frères; Cargill, Incorporated; Ingredion; and SPI Pharma; among others. Companies heavily invest in R&D to enhance the efficiency and cost-effectiveness of mannitol production, focusing on sustainable processes, improving quality, and exploring new applications. Collaborations with food and pharmaceutical companies expand global reach while expanding operations into emerging markets helps capture growing demand. Adhering to international regulatory standards and maintaining high-quality manufacturing practices are essential for building trust and gaining a competitive edge in the global market.

-

Roquette Frères manufactures mannitol as a key excipient in the pharmaceutical industry, where it is used as a bulking agent and sweetener. Additionally, Roquette supplies mannitol for food and beverage applications, offering low-calorie, natural ingredients that meet the growing demand for healthier alternatives in consumer products. It is headquartered in Lestrem, France. It operates globally, with production and distribution facilities across multiple continents.

-

Cargill, Incorporated operates in the food, agriculture, and industrial sectors. It offers mannitol as a low-calorie, sugar-free alternative for various food and beverage products. Cargill's mannitol is utilized in products such as chewing gum, candies, baked goods, and pharmaceuticals, helping meet the growing consumer demand for healthier, low-calorie ingredients. It is headquartered in Minneapolis, Minnesota, U.S.

Key America Mannitol Companies:

The following are the leading companies in the america mannitol market. These companies collectively hold the largest market share and dictate industry trends.

- Roquette Frères

- Cargill, Incorporated

- Ingredion

- SPI Pharma

- Singsino Group Ltd.

- Shijiazhuang Huaxu Pharmaceutical Co.,Ltd

- Merck KGaA

- Rongde Seaweed Co., Ltd.

- Qingdao Mingyue Seaweed Group Co.

- Moga International Ltd.

Recent Developments

-

In February 2025, Roquette opened its first Roquette Beauté Expertise Center in Shanghai, marking a commitment to innovation in plant-based cosmetics. The center, featuring an advanced application lab and sensory analysis capabilities, serves as a hub for co-creation and collaboration within China’s cosmetics market. It aims to support the development of high-performance, sustainable, and effective plant-based formulations for makeup, skincare, haircare, and oral care.

-

In November 2024, Cargill enhanced its Singapore Innovation Center, which will be completed by early 2025, to support food manufacturing, food service, and retail customers across Asia. The upgrade includes a reimagined food service space, expanded kitchen, Chocolate Academy, and a Product and Process Development Lab. These enhancements aim to address the growing demand for indulgent and functional foods. Supported by Singapore’s strong innovation ecosystem, the center will foster collaboration, strengthen food solutions, and meet evolving Asian consumer trends.

Mannitol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 471.6 million

Revenue forecast in 2030

USD 601.4 million

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Tons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Brazil, Argentina, Saudi Arabia, and South Africa

Key companies profiled

Roquette Frères; Cargill, Incorporated; Ingredion; SPI Pharma; Singsino Group Ltd.; Shijiazhuang Huaxu Pharmaceutical Co.,Ltd; Merck KGaA; Rongde Seaweed Co., Ltd.; Qingdao Mingyue Seaweed Group Co.; and Moga International Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mannitol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global mannitol market report based on application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Food Additive

-

Pharmaceuticals

-

Industrial

-

Surfactants

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.