- Home

- »

- Healthcare IT

- »

-

Manufacturing Execution System in Life Sciences Market Report 2030GVR Report cover

![Manufacturing Execution System in Life Sciences Market Size, Share & Trends Report]()

Manufacturing Execution System in Life Sciences Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution Type, By Deployment (On-Premise, Cloud/Web-Based, Hybrid), By End-User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-206-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Manufacturing Execution System in Life Sciences Market Summary

The global manufacturing execution system in life sciences market size was estimated at USD 2,769.5 million in 2023 and is projected to reach USD 6,007.4 million by 2030, growing at a CAGR of 11.7% from 2024 to 2030. The increasing regulatory compliance, demand for real-time data and analytics, growing biopharmaceutical sector, technological advances, and globalization of the life sciences industry are some of the factors driving the demand for manufacturing execution systems in life sciences industry.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Canada is expected to register the highest CAGR from 2024 to 2030.

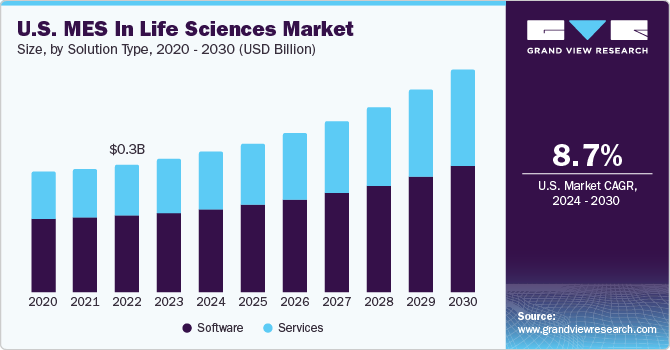

- In terms of segment, software accounted for a revenue of USD 1,673.3 million in 2023.

- Services is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2,769.5 million

- 2030 Projected Market Size: USD 6,007.4 million

- CAGR (2024-2030): 11.7%

- North America: Largest market in 2023

The increasing regulatory compliance, demand for real-time data and analytics, growing biopharmaceutical sector, technological advances, and globalization of the life sciences industry are some of the factors driving the demand for manufacturing execution systems in life sciences industry. The pharmaceutical industry is increasingly adopting digitization, driving the demand for Pharma 4.0 and manufacturing execution systems (MES) in the life sciences market. Pharma 4.0 enhances connectivity, productivity, compliance, and information management to address challenges effectively.

Developed by the International Society for Pharmaceutical Engineering (ISPE), this model revolutionizes manufacturing processes with more human-centric workflows, leveraging digitalization for faster therapeutic innovations and improved production processes for patient benefit. Moreover, the growing complexity of pharmaceutical and biotechnology manufacturing, along with the need for precise data management, has propelled MES demand in life sciences sector. These systems offer centralized platforms for data integration, process optimization, and quality assurance, thereby boosting overall productivity. In addition, the rise of personalized medicine and demand for innovative therapies have increased production intricacies, driving MES adoption to manage manufacturing complexities in the life sciences sector.

As the industry evolves and undergoes digital transformation, MES is set to play a crucial role in facilitating efficient, agile, and compliant manufacturing operations, driving sustained market growth. In August 2020, a survey sponsored by Appian highlighted the adoption of automation in the global life sciences and pharmaceutical industry. According to the survey, most respondents engaged in digital modernization efforts aimed at enhancing process and operational efficiency. However, automation is currently utilized in only 40% of respondents' organizations, with 75% anticipating the adoption of automation technologies in the future.

MES Implementation Case Studies

-

Repligen Corporation: Repligen, a life sciences company, implemented Emerson's Syncade Smart Operation Management Suite to enhance document control and revisions. This system significantly reduced production record issuance time from 4 hours to just one to two hours and decreased quality assurance time from approximately 16 hours to 4 to 6 hours per week. Syncade automated the review and approval process for controlled documents, ensuring adherence to schedule and garnering appreciation from Repligen's FDA-regulated customers

-

Tech Group: E Tech Group installed a $1.8 million process control system at Massachusetts Biologic Laboratories. The system, based on PLC and SCADA, utilizes Allen-Bradley ControlLogix 5550 processors with I/O, solenoid blocks, and scale indicators. PCS communicates 400 data points over Ethernet to various vendor-supplied equipment systems and includes a fault-tolerant SCADA/Historian server, a fault-tolerant manufacturing execution system (MES) server, and 11 portable client workstations

The PCS incorporates a Manufacturing Execution System (MES) that assists with material tracking, equipment management, barcode recognition and creation, and electronic work instructions (EWI) to execute process steps at the MBL facility. Operators use barcode scanners to validate and log raw materials, semi-finished goods, finished goods, and equipment produced or utilized in the MBL facility

The COVID-19 pandemic impacted the MES within the life sciences market. The necessity for quick adjustment to remote work, social distancing measures, and strict hygiene protocols presented operational hurdles for MES implementation and maintenance. However, the pandemic accelerated the uptake of digital technologies in manufacturing, resulting in increased interest in MES solutions providing real-time visibility, agility, and automation.

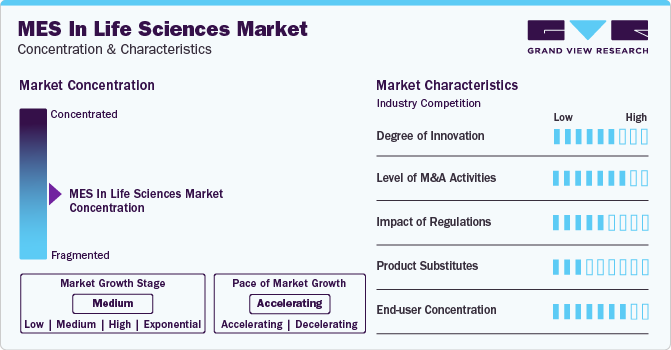

Market Characteristics

MES in life sciences market exhibits a high degree of innovation due to the integration of MES with Pharma 4.0, AI, and IoT, accelerating digital transformation in the industry

The MES market in life sciences sees a moderate to high level of merger and acquisition (M&A) activity among major players. Key players undertake strategic initiatives, such as geographical expansion, innovations, collaborations, and partnerships to strengthen their market presence. For instance, in January 2022, POMS Corporation launched new MES Dashboards and Batch Records for drug manufacturers in the pharmaceutical, biotech, and cell and gene industries. This launch is expected to offer significant benefits to manufacturers in these sectors

MES in life sciences market faces increasing regulatory scrutiny due to the growing complexity of regulations in pharmaceutical and medical device sectors. Regulations, such as Good Manufacturing Practice (GMP) and Good Automated Manufacturing Practice (GAMP), impose stringent requirements on system validation. MES solutions must undergo validation to consistently meet predefined specifications and comply with regulatory standards

The threat of substitute products is expected to be low to moderate in this market. MES uniquely controls, monitors, and digitally documents processes in real-time throughout the production cycle, making it a unique product in the market

End-users in the MES in life sciences market include pharmaceutical and biotechnology companies, Medical Device Companies, and Others (CDMOs, CROs, etc.). These users are increasingly adopting MES solutions to track and control the drug product lifecycle. Notable companies like Terumo Corporation, Thermo Fisher Scientific Inc., Fagron, and Teknor Apex are among the users currently utilizing MES solutions

Solution Type Insights

The software segment is expected to grow at a significant CAGR of 11.1% from 2024 to 2030. The growing emphasis on data integrity, traceability, and regulatory compliance in the life sciences sector propels the adoption of MES software, as these systems provide a comprehensive framework for real-time monitoring and documentation. Furthermore, rising demand for end-to-end visibility across the entire manufacturing life cycle, from research and development to production and distribution, encourages life sciences companies to invest in MES solutions that offer seamless data integration and analytics capabilities.

The services segment is expected to grow at the fastest CAGR from 2024 to 2030. With the increasing digitization of manufacturing processes, there is a growing emphasis on data security and cybersecurity. MES service providers offer expertise in implementing robust security measures, protecting sensitive data, and ensuring compliance with industry standards. Such factors are expected to drive segment growth over the coming years.

Deployment Insights

The on-premise deployment segment held the largest market share in 2023. On-premise solutions offer greater control over data security and privacy, addressing concerns related to sensitive information and intellectual property. In addition, life science companies often deal with large volumes of complex data generated during the manufacturing process, including critical parameters for quality control and batch tracking. On-premise MES solutions supply the necessary computing power and storage capacity to manage such data-intensive processes efficiently.

Furthermore, the need for seamless integration with existing enterprise resource planning (ERP) systems, laboratory information management systems (LIMS), and other legacy applications is crucial in the life science sector, owing to this, the cloud/web-based deployment segment is expected to grow at a significant CAGR from 2024 to 2030.

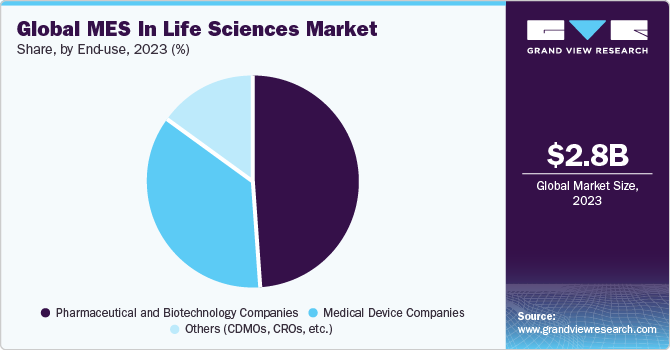

End-user Insights

Based on end-users, the pharmaceutical & biotechnology companies segment held the largest revenue share of 48.4% in 2023. The pharmaceutical industry is highly competitive and complex. To maintain a competitive edge, companies must scale operations, enhance processes, minimize errors, reduce lead times, and prioritize quality and compliance. MES solutions enable companies to manage production lines with precision, ensuring competitiveness. Biotechnology companies also benefit from MES by effectively managing the complex processes involved in producing biologics and personalized medicines.

The medical device companies segment is expected to grow at the fastest CAGR of 12.7% from 2024 to 2030. Medical device production presents distinct challenges that companies must navigate to maintain competitiveness. Achieving this requires a delicate balance between cost reduction and regulatory compliance, alongside consistent production of high-quality products. MES solutions play a crucial role in ensuring quality, automating processes, and enforcing control over the five M's of manufacturing: Man, Measure, Machine, Method, and Material.

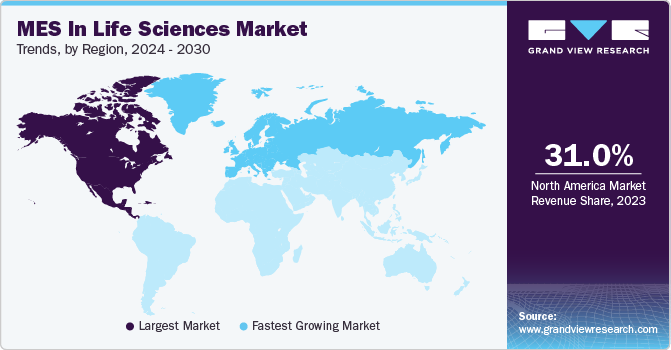

Regional Insights

The North America manufacturing execution system in life sciences market dominated the market and held the largest market share of 31.0% in 2023. This region, comprising major economies like the U.S. and Canada, is highly technologically advanced, driving the digitization of manufacturing processes in the pharmaceutical industry. Key players, such as Apprentice FS, Inc.; Atachi Systems; POMS Corporation; Emerson Electric Co; and Rockwell Automation, play a crucial role in simplifying healthcare manufacturing processes, further bolstering the market growth in North America.

U.S. MES in Life Sciences Market Trends

The manufacturing execution system in life sciences market in the U.S. is expected to grow significantly over the forecast period owing to the presence of key players and extensive adoption of software solutions in life science manufacturing. Moreover, the adoption of integrated laboratory automation solutions presents additional growth opportunities for MES providers. For example, Automata announced its intention to expand its services in the U.S. in February 2023.

Europe MES in Life Sciences Market Trends

Europe is the second-largest regional market witnessing increased adoption of advanced digital technologies and strategic partnerships facilitating MES implementation. Siemens' collaboration with BioNTech SE in June 2021 in converting a facility into a COVID-19 vaccine production site exemplifies this trend, accelerating project timelines significantly. Similarly, in December 2018, Körber AG's partnership with SPC Consultants aims to expand MES services in France, Belgium, and Switzerland, contributing to market growth.

MES in life sciences market in the UK benefits from increased healthcare spending and the integration of advanced technology solutions, such as cloud technologies and automated production processes.

Asia Pacific MES in Life Sciences Market Trends

Asia Pacific shows promising growth prospects, driven by the increasing number of pharmaceutical companies and presence of key market players. Asian pharma manufacturers face challenges in maintaining product quality and compliance with legal requirements, leading to increased adoption of MES solutions to digitize production processes and enhance efficiency.

China MES in life sciences market is expected to grow at a significant CAGR from 2024 to 2030. This can be attributed to the increasing demand for quality drugs and the need to increase pharmaceutical production in the country owing to the growing population.

MES in life sciences market in India is primarily driven by various factors, such as the rising adoption of AI and cloud technologies in healthcare for improved patient outcomes. In addition, advancements in healthcare infrastructure and digitalization efforts to support the integration of software technologies to assist the production process is anticipated to impel market growth.

Key MES in Life Sciences Company Insights

Notable market players, such as Siemens AG, Emerson Electric Co., AVEVA Group Limited, Cognizant, Rockwell Automation, and MasterControl Solutions, Inc. are implementing various strategies, including collaborations, new product development, and partnerships, to bolster their market presence.

Key MES in Life Sciences Companies:

The following are the leading companies in the MES in life sciences market. These companies collectively hold the largest market share and dictate industry trends.

- Körber AG

- ABB

- MasterControl Solutions, Inc.

- AVEVA Group Limited

- Cognizant

- Rockwell Automation

- nagarro

- Siemens AG

- Emerson Electric Co.

- iBase-t

Recent Developments

-

In January 2024, CGI Inc. joined forces with Körber AG to offer a comprehensive solution for enhancing the production processes of pharmaceutical and life sciences companies. By integrating CGI’s end-to-end Solution Types with Körber’s Werum PAS-X MES Suite, the partnership aims to facilitate improved accuracy, efficiency, and safety in the development of pharmaceutical products. Moreover, clients can leverage real-time data to make informative decisions and enhance their overall operations

-

In February 2023, AVEVA Group Limited, a prominent industrial software company, launched the new AVEVA Manufacturing Execution System. This new release aims to simplify the deployment of multi-site MES solutions and reduce their associated costs and complexities. With its latest version, AVEVA MES enables faster and more efficient implementation of best practices, which can lead to improved operational efficiency and sustainability

-

In September 2021, Honeywell International Inc. acquired Performix Inc., a private company that provides manufacturing execution system software for the pharmaceutical and biotech industries. This acquisition is part of Honeywell's strategy to become the world's leading provider of integrated software solutions for life sciences companies. The aim is to help clients achieve faster compliance, improved reliability, and better production throughput at the highest levels of quality

Manufacturing Execution System in Life Sciences Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.01 billion

Revenue forecast in 2030

USD 6.00 billion

Growth rate

CAGR of 12.2% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Spain; Switzerland; Sweden; Italy; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazi; Mexico; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

ABB; Körber AG; MasterControl Solutions, Inc.; AVEVA Group Ltd.; Cognizant; Rockwell, Automation; Nagarro; Siemens AG; Emerson Electric Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global MES in Life Sciences Market Report Segmentation

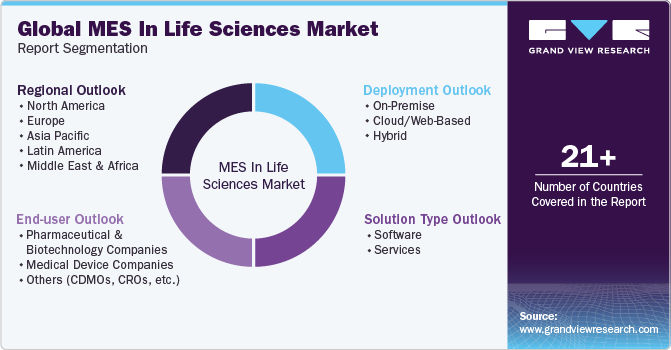

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the MES in life sciences market report based on solution type, deployment, end-user, and region:

-

Solution Type Outlook (Revenue, Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, Million, 2018 - 2030)

-

On-Premise

-

Cloud/Web-Based

-

Hybrid

-

-

End-user Outlook (Revenue, Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Medical Device Companies

-

Others (CDMOs, CROs, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global manufacturing execution system in life sciences market size was estimated at USD 2.77 billion in 2023 and is expected to reach USD 3.01 billion in 2024.

b. The global manufacturing execution system in life sciences market is expected to grow at a compound annual growth rate of 12.2% from 2024 to 2030 to reach USD 6.00 billion by 2030.

b. North America dominated the manufacturing execution system in life sciences market with a share of 31.0% in 2023. This is attributable to the increasing complexity of manufacturing processes along with the growing adoption of Industry 4.0 and digitalization.

b. Some key players operating in the manufacturing execution system in life sciences market include ABB; Körber AG; MasterControl Solutions Inc.; AVEVA Group Limited; Cognizant; Rockwell; Automation; Nagarro; Siemens AG; Emerson Electric Co.

b. Key factors that are driving the market growth include increasing regulatory compliance, demand for real-time data and analytics, growing biopharmaceutical sector, technology advances, and globalization of the life sciences industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.