- Home

- »

- Next Generation Technologies

- »

-

Manufacturing Operations Management Software Market Report, 2033GVR Report cover

![Manufacturing Operations Management Software Market Size, Share & Trends Report]()

Manufacturing Operations Management Software Market (2025 - 2033) Size, Share & Trends Analysis By Component, By Deployment, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-031-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Manufacturing Operations Management Software Market Summary

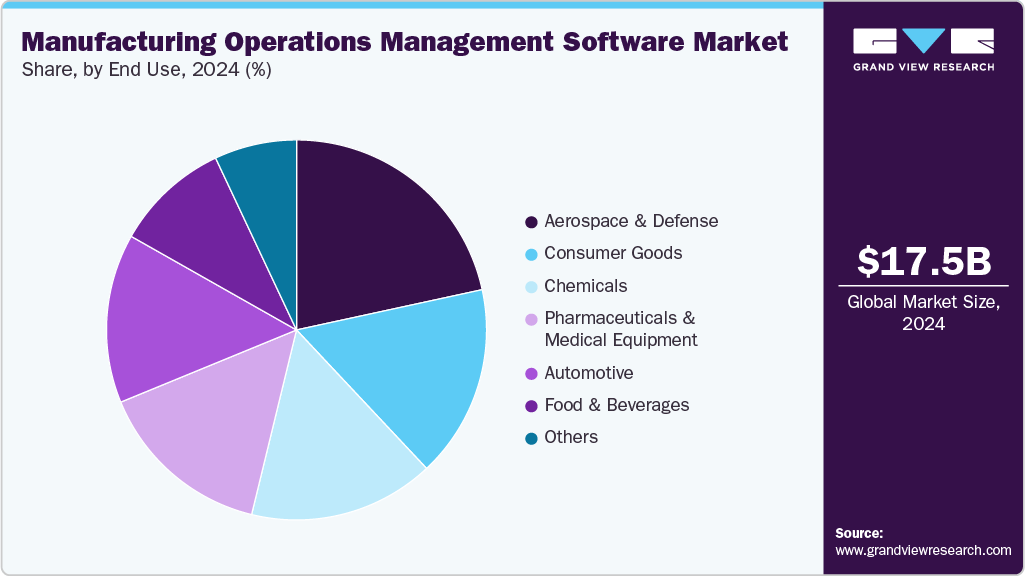

The global manufacturing operations management software market size was estimated at USD 17.46 billion in 2024 and is projected to reach USD 76.71 billion by 2033, growing at a CAGR of 19.1% from 2025 to 2033. The widespread adoption of Industry 4.0 principles has been a crucial driver for the MOM software market.

Key Market Trends & Insights

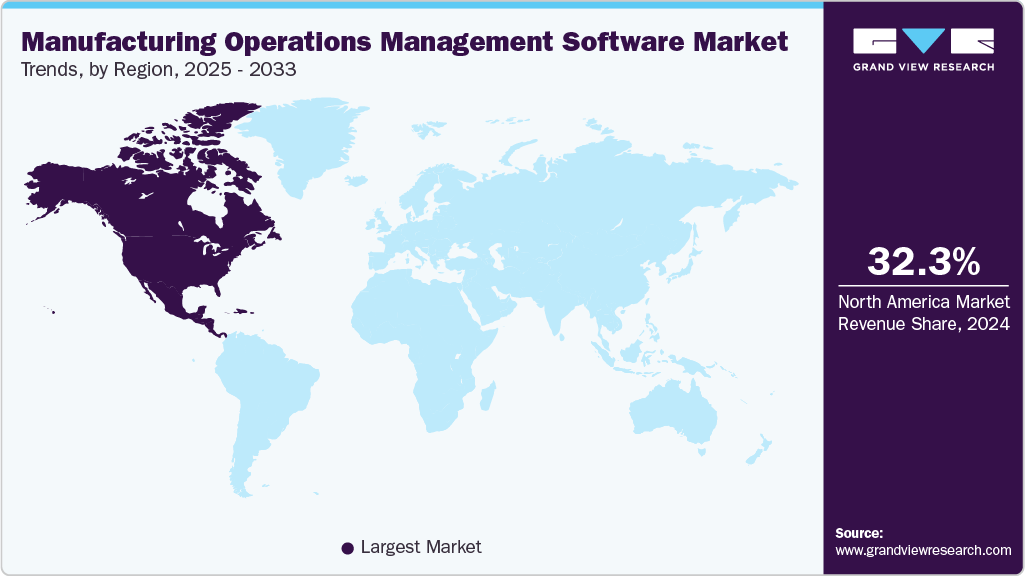

- North America manufacturing operations management software market dominated with the largest global revenue share of 32.3% in 2024.

- The U.S. manufacturing operations management software market led North America and held the largest revenue share in 2024.

- By component, software led the market and held the largest revenue share of 71.5% in 2024.

- By deployment, the cloud segment held the dominant position in the market and accounted for the largest revenue share in 2024.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 20.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 17.46 Billion

- 2033 Projected Market Size: USD 76.71 Billion

- CAGR (2025-2033): 19.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Manufacturers are increasingly investing in smart factory solutions that integrate real-time data, IoT sensors, AI, and machine learning with manufacturing processes. MOM software plays a vital role in connecting these technologies to streamline production planning, enhance operational visibility, and enable predictive maintenance. As factories aim for greater agility and data-driven decision-making, the demand for integrated MOM platforms continues to increase.The increased adoption of digital twins and simulation technologies drives the growth and evolution of the manufacturing operations management industry. As manufacturers strive to enhance operational efficiency, product quality, and agility, the integration of digital twin capabilities into MOM platforms is becoming a transformative force. A digital twin, essentially a virtual replica of a physical process, product, or system, enables real-time monitoring, scenario testing, and predictive analysis, all of which are crucial for making informed decisions in fast-paced manufacturing environments.

The ability to digitally simulate operations and model outcomes before executing them on the shop floor enables companies to reduce errors, optimize resource allocation, and avoid costly downtime, thereby amplifying the value of MOM software solutions. A study conducted by Hexagon in 2024 indicates that the digital twin market grew by 71% from 2020 to 2024. Additionally, 29% of manufacturing companies worldwide have either fully implemented or are in the process of implementing a digital twin strategy for some of their operational assets, while another 63% are actively developing or have already established their digital twin strategy.

Component Insights

The software segment dominated the manufacturing operations management software market, capturing the revenue share of 71.5% in 2024. The segment’s growth is significantly driven by digital transformation and the adoption of Industry 4.0 technologies. Manufacturers are embracing smart factory initiatives and deploying digital twins to create real-time, data-rich environments that mirror physical operations. These technologies necessitate advanced MOM software capable of managing and optimizing production processes with high precision. Companies are increasingly implementing MOM software across their manufacturing factories to monitor operations and enhance organizational efficiency.

The services segment is anticipated to grow at the fastest CAGR of 20.3% during the forecast period. Manufacturers increasingly require customized MOM software to align with their specific industry workflows, regulatory requirements, and production models. This demand has greatly increased the need for expert configuration and customization services. Off-the-shelf solutions frequently lack the flexibility to manage complex manufacturing environments, particularly in sectors like automotive, pharmaceuticals, and aerospace, where precision, compliance, and traceability are vital.

Deployment Insights

The cloud segment dominated the manufacturing operations management software industry in 2024. Cloud-based software significantly reduces upfront investment by eliminating the need for costly on-premise servers, storage systems, and dedicated IT infrastructure. This makes it particularly appealing to manufacturers seeking to modernize without substantial capital expenditures. Instead of purchasing perpetual licenses, companies can subscribe to scalable, pay-as-you-go models that fit their usage and budget. These subscription-based plans not only enhance cost predictability but also lower the total cost of ownership by incorporating maintenance, updates, and support into the package.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. On-premise Manufacturing Operations Management (MOM) software continues to gain traction in industries that require stringent data security, control, and customization. The on-premise segment is witnessing notable expansion due to the high level of data security and governance it offers. Manufacturers in sectors such as aerospace, defense, and pharmaceuticals often manage highly sensitive intellectual property, trade secrets, and regulated information.

Enterprise Size Insights

The large enterprises segment dominated the market, accounting for over 61.0% of the revenue share in 2024. Large enterprises typically manage complex manufacturing environments involving multiple products, production lines, and geographically distributed facilities. This complexity demands a high level of operational coordination, consistency, and control to maintain efficiency and meet customer expectations. MOM software plays a vital role in helping these organizations standardize processes, synchronize production across sites, and maintain uniform quality and compliance.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. MOM software boosts operational efficiency for small and medium-sized enterprises (SMEs) by simplifying and organizing complex manufacturing processes. It reduces lead times by enhancing production scheduling, ensuring that resources like labor, materials, and equipment are used effectively. This streamlined coordination helps avoid delays and bottlenecks, resulting in increased production throughput. By minimizing waste and optimizing resource usage, MOM software enables SMEs to lower operational costs and enhance overall productivity.

Application Insights

The quality management segment dominated the manufacturing operations management software industry in 2024. Manufacturers are increasingly adopting quality management software to meet strict industry standards such as ISO, FDA, and OSHA. These systems support closed-loop corrective and preventive actions (CAPA), enabling companies to quickly identify, address, and prevent quality issues, thereby enhancing product reliability and customer satisfaction. Centralizing quality records and documentation helps ensure ongoing compliance and reduces the risk of regulatory penalties, which is critical in highly regulated industries.

The manufacturing execution systems (MES) segment is expected to grow at a significant CAGR over the forecast period. Manufacturers are increasingly adopting quality management software to comply with strict industry standards, including ISO, FDA, and OSHA. These systems facilitate closed-loop corrective and preventive actions (CAPA), enabling companies to swiftly identify, address, and prevent quality issues, thereby enhancing product reliability and customer satisfaction. Centralizing quality records and documentation ensures ongoing compliance and minimizes the risk of regulatory penalties, which is crucial in highly regulated industries.

End Use Insights

The aerospace & defense segment dominated the manufacturing operations management software market in 2024. The aerospace and defense (A&D) industry is heavily regulated, with strict compliance requirements set by authorities such as the FAA, EASA, and ITAR. These regulations require complete traceability of parts and processes, making Manufacturing Operations Management (MOM) software essential. MOM systems facilitate serialized part tracking and support digital thread integration, ensuring every component can be traced throughout its lifecycle. A&D manufacturers are increasingly prioritizing regulatory compliance and quality assurance.

The automotive segment is expected to grow at a significant CAGR over the forecast period. The automotive sector is undergoing rapid transformation, driven by the adoption of Industry 4.0 technologies. The Integrating of IoT, AI, machine learning, and cloud computing into automotive manufacturing operations enables real-time monitoring and data analysis. These technologies equip manufacturers to make quicker, more informed decisions by providing visibility into production metrics, equipment health, and supply chain dynamics. Consequently, operations can be continuously optimized for efficiency, which reduces waste, minimizes downtime, and enhances overall productivity.

Regional Insights

North America dominated the manufacturing operations management software market. It held a revenue share of nearly 32.3% in 2024, driven by the region's strong emphasis on Industry 4.0 adoption, with manufacturers investing in smart factory solutions to enhance efficiency. Additionally, stringent regulatory compliance requirements (e.g., FDA, OSHA) push industries like pharmaceuticals and automotive to adopt MOM software for traceability and quality control. The presence of major tech innovators and cloud providers also accelerates digital transformation in manufacturing.

U.S. Manufacturing Operations Management Software Market Trends

The manufacturing operations management software industry in the U.S. is expected to grow significantly at a CAGR of 15.9% from 2025 to 2033, driven by the increasing demand for real-time production monitoring and predictive maintenance aimed at reducing downtime. The rise of reshoring initiatives, focused on bringing manufacturing back from overseas, further enhances the need for advanced MOM solutions to optimize domestic production. Additionally, the aerospace and defense sector’s strict compliance requirements drive the adoption of better workflow and documentation management.

Europe Manufacturing Operations Management Software Market Trends

The manufacturing operations management software industry in Europe is anticipated to register considerable growth from 2025 to 2033, driven by strong government support for smart manufacturing initiatives, such as the EU’s Industry 5.0 framework, which emphasizes sustainability and human-centric automation. The region’s commitment to energy-efficient production and circular economy practices also motivates manufacturers to implement MOM solutions for waste reduction and process optimization.

The UK manufacturing operations management software market is expected to grow rapidly in the coming years due to the post-Brexit push for industrial self-sufficiency, prompting manufacturers to invest in MOM software to enhance competitiveness. The automotive and aerospace sectors, crucial to the UK economy, are adopting MOM solutions for supply chain resilience and regulatory compliance (e.g., UKCA marking). Furthermore, the emergence of digital twins and AI-driven analytics fosters smarter manufacturing processes.

The manufacturing operations management software market in Germany held a substantial revenue share in 2024, owing to strong automotive and machinery sectors, which necessitate high-precision production control. The emphasis on cybersecurity in manufacturing IT is driving demand for secure, integrated MOM platforms. Additionally, labor shortages are prompting manufacturers to automate operations, which increases the reliance on MOM software for workforce productivity.

Asia Pacific Manufacturing Operations Management Software Market Trends

Asia Pacific is expected to be the fastest-growing region, registering the fastest CAGR of 21.1% from 2025 to 2033, due to rapid industrialization, particularly in emerging economies. Governments are promoting smart manufacturing policies such as China’s Made in China 2025 and India’s Make in India, which encourage digital adoption. The region’s expanding electronics and semiconductor industries also require MOM solutions for complex production management and yield optimization.

The Japan manufacturing operations management software market is expected to grow rapidly in the coming years, driven by the need for automation in aging factories to counter labor shortages. The country’s robust robotics and electronics manufacturing base requires precise MOM tools for quality assurance. Additionally, government subsidies for digital transformation, such as Society 5.0, support the integration of smart manufacturing technologies.

The manufacturing operations management software market in China held a substantial market share in 2024, due to the manufacturing sector’s shift toward smart factories, supported by state-led initiatives like Industrial Internet. The push for self-sufficiency in semiconductor and EV production increases demand for MOM solutions to enhance yield and supply chain agility. Additionally, rising labor costs are accelerating automation investments.

Key Manufacturing Operations Management Software Company Insights

Key players operating in the manufacturing operations management software industry are ABB; Dassault Systèmes; GE Vernova; iBase-t; and Honeywell International Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Epicor Software Corporation introduced a new Carbon Cost Rollup feature within Epicor Kinetic, its industry-specific ERP cloud platform tailored for manufacturers. This innovative solution adapts traditional cost rollup methods from standard costing systems to track carbon emissions, effectively treating CO2 as a measurable cost. By integrating emissions data in this way, the tool enhances the accuracy of compliance reporting and supports manufacturers in meeting sustainability goals with greater confidence

-

In April 2025, iBase-t partnered with Articul8 to integrate Articul8’s advanced generative AI capabilities into iBase-t sSolumina Manufacturing Operations Platform. This collaboration brings AI-driven insights and automation to aerospace & defense manufacturing operations. By combining iBase-t’s expertise in simplifying complex manufacturing workflows with Articul8’s autonomous generative AI for data perception and reasoning, the partnership aims to boost data-driven decision-making, streamline processes, and enhance overall productivity for manufacturers in the aerospace & defense sector.

Key Manufacturing Operations Management Software Companies:

The following are the leading companies in the manufacturing operations management software market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Aegis Industrial Software Corporation

- Aspen Technology Inc.

- AVEVA Solutions Limited

- Dassault Systèmes

- DURR Group

- Epicor Software Corporation

- GE Vernova

- Honeywell International Inc.

- iBase-t

- Oracle

- Rockwell Automation

- SAP SE

- Schneider Electric

- Siemens

Manufacturing Operations Management Software Market Report Scope

Report Attribute

Details

Market size in 2025

USD 18.96 billion

Revenue forecast in 2033

USD 76.71 billion

Growth rate

CAGR of 19.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB; Aegis Industrial Software Corporation; Aspen Technology Inc.; AVEVA Solutions Limited; Dassault Systèmes; DURR Group; Epicor Software Corporation; GE Vernova; Honeywell International Inc.; iBase-t; Oracle; Rockwell Automation; SAP SE; Schneider Electric; Siemens

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Manufacturing Operations Management Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the manufacturing operations management software market report based on component, deployment, enterprise size, application, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Advanced Planning & Scheduling

-

Manufacturing Execution Systems (MES)

-

Labor Management

-

Inventory Management

-

Quality management

-

Laboratory Management

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aerospace & Defense

-

Automotive

-

Pharmaceuticals & Medical Equipment

-

Chemicals

-

Food & Beverages

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global manufacturing operations management software market size was estimated at USD 17.46 billion in 2024 and is expected to reach USD 18.96 billion in 2025.

b. The global manufacturing operations management software market is expected to witness a compound annual growth rate of 19.1% from 2025 to 2033, expected to reach USD 76.71 billion by 2033.

b. North America dominated the manufacturing operations management (MOM) software market, with a share of around 32.0% in 2024. This is attributable to the shifting focus of various manufacturing industries towards smart factories and the presence of key market players offering extensive MOM software portfolios.

b. Some key players operating in the manufacturing operations management software market include ABB; Aegis Software; Aspen Technology Inc; AVEVA Group Limited; Dassault Systèmes; DURR AG; Epicor Software Corporation; GE DIGITAL; Honeywell International Inc.; iBase-t; Oracle; Rockwell Automation; SAP SE; Schneider Electric; Siemens.

b. The market growth can be attributed to the rising demand for tracking and monitoring manufacturing operations in real-time networks and the growing demand for industry 4.0 is offering exponential growth opportunities for all business sizes across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.