- Home

- »

- Next Generation Technologies

- »

-

Smart Manufacturing Market Size, Industry Report, 2033GVR Report cover

![Smart Manufacturing Market Size, Share & Trends Report]()

Smart Manufacturing Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology (Machine Execution Systems, Programmable Logic Controller), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-028-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Manufacturing Market Summary

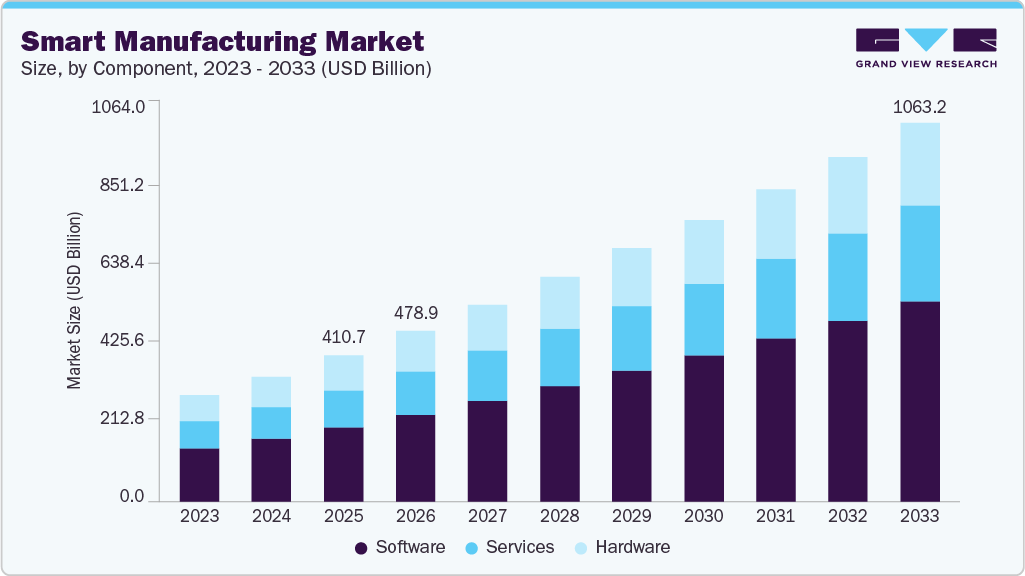

The global smart manufacturing market size was estimated at USD 410.68 billion in 2025 and is projected to reach USD 1,063.15 billion by 2033, growing at a CAGR of 12.1% from 2026 to 2033. This market expansion is driven by the widespread adoption of Industry 4.0 technologies, IoT, AI, machine learning, and cloud computing, and the growing demand for automation & cost efficiency.

Key Market Trends & Insights

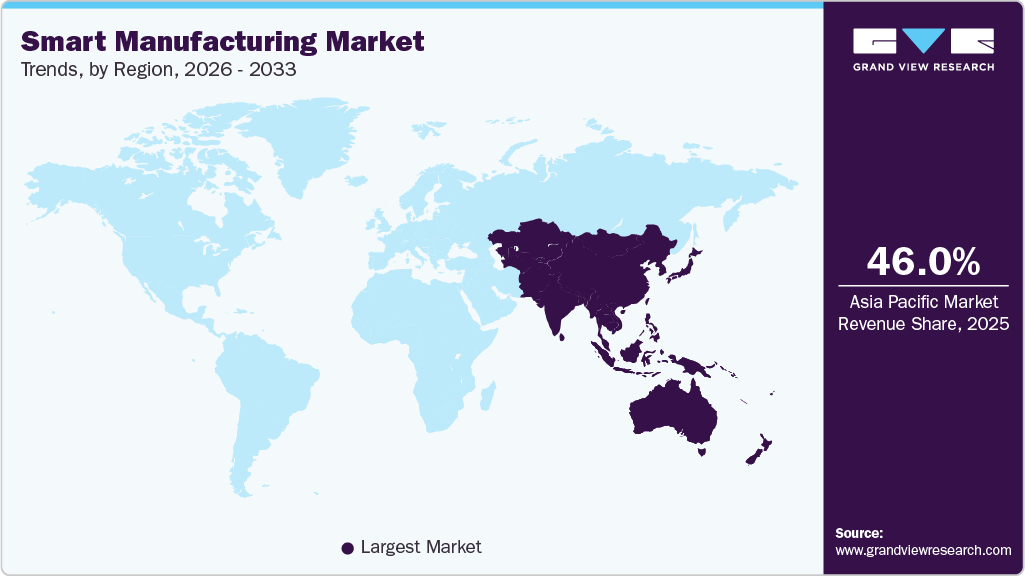

- Asia Pacific dominated the global smart manufacturing market with the largest revenue share of over 46% in 2025.

- The smart manufacturing market in China led the Asia Pacific market and held the largest revenue share in 2025.

- By component, the software segment led the market and held the largest revenue share of over 50% in 2025.

- By technology, the discrete control system (DCS) segment led the market and held the largest revenue share of over 16% in 2025.

- By end use, the automotive segment led the market, with the largest revenue share of over 19% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 410.68 Billion

- 2033 Projected Market Size: USD 1,063.15 Billion

- CAGR (2026-2033): 12.1%

- Asia Pacific: Largest market in 2025

Governments worldwide are promoting smart manufacturing through initiatives focusing on research in technologies such as digital twins and machine condition monitoring. Smart manufacturing market growth is driven by the convergence of edge computing, low-power microelectronics, and AI-based analytics that enhance device intelligence beyond basic automation. The integration of generative AI technologies further accelerates this transformation, turning traditional manufacturing devices into interactive digital companions that understand and anticipate operational needs. These ecosystems are becoming increasingly context-aware, responsive, and embedded across production environments, facilitating enhanced productivity, cost efficiency, and quality control.

The growing demand for seamless, always-on connectivity among industrial devices is significantly fueling the growth of the Smart Manufacturing market. Connectivity platforms supporting real-time data exchange, such as IoT sensors, smart machinery, and industrial control systems, enable devices to communicate, coordinate, and adapt to operational conditions. This ecosystem of interconnected devices help manufacturers achieve automation, predictive maintenance, and unified process control, thereby accelerating adoption in manufacturing environments.

In addition, rising enterprise expectations for operational efficiency, automation, and context-aware decision-making are key growth drivers. As industries demand systems that anticipate equipment needs, optimize workflows, and manage energy usage, manufacturers embed advanced sensors, AI, and connectivity into production lines. The need for smooth interoperability across equipment and software platforms pushes companies to invest in robust industrial connectivity infrastructure, edge computing capabilities, and collaborative ecosystem partnerships.

Moreover, evolving regulatory mandates and cybersecurity standards are pushing stronger adoption within the smart manufacturing industry. Government bodies require that manufacturing systems support data protection, secure firmware updates, and transparency in processing data. Platforms enabling automated alerts, anomaly detection, and secure provisioning help manufacturers comply with regulations, reducing operational risk and building trust in connected industrial ecosystems.

Furthermore, the proliferation of Industry 4.0 technologies, digital twins, and ambient intelligence is generating strong demand for integrated smart manufacturing solutions. Devices and systems become part of a unified digital ecosystem, allowing manufacturers to benefit from predictive analytics, cross-system control, and enhanced process optimization. These capabilities promote loyalty in the smart manufacturing market, as integrated solutions deliver greater value than standalone technologies.

Component Insights

The software segment accounted for the largest market share of over 50% in 2025, owing to its essential role in data analytics, process optimization, and system integration. Solutions such as ERP, MES, and advanced analytics support real-time monitoring, predictive maintenance, and overall operational efficiency. As manufacturers adopt more connected equipment and rely on consistent data flows, software becomes the central layer that coordinates these activities. This continued shift toward digitally managed operations is the main factor behind the steady growth of the software segment.

The services segment is expected to witness a significant CAGR of over 12% from 2026 to 2033, driven by the need for ongoing system integration, maintenance, and operational support. As manufacturers adopt IoT, AI, and cloud-based systems, demand for consulting, implementation, and managed services continues to rise. The expansion of predictive maintenance, remote monitoring, and data-driven decision tools further increases reliance on external expertise. Companies require support to keep systems updated, interconnected, and functional, which contributes to the sustained growth of the services segment in smart manufacturing.

End-use Insights

The automotive segment accounted for the largest market share in 2025, owing to its extensive use of smart manufacturing technologies to improve production efficiency, reduce costs, and maintain product quality. Manufacturers use robotics, AI, IIoT, and automation to streamline assembly lines and support mass customization. The rising demand for electric vehicles and the focus on sustainable manufacturing practices have further increased adoption. Therefore, these factors have contributed to the significant role of the automotive sector in the smart manufacturing market.

The renewable energy segment is expected to witness the highest CAGR from 2026 to 2033, driven by the use of advanced manufacturing technologies for precision and efficiency. Smart tools help meet the growing demand for sustainable energy solutions. Government support for renewable initiatives and the focus on reducing carbon emissions further encourage investment. These factors together increase the adoption of smart manufacturing in this sector. Hence, the renewable energy segment is likely to be the fastest-growing in the market.

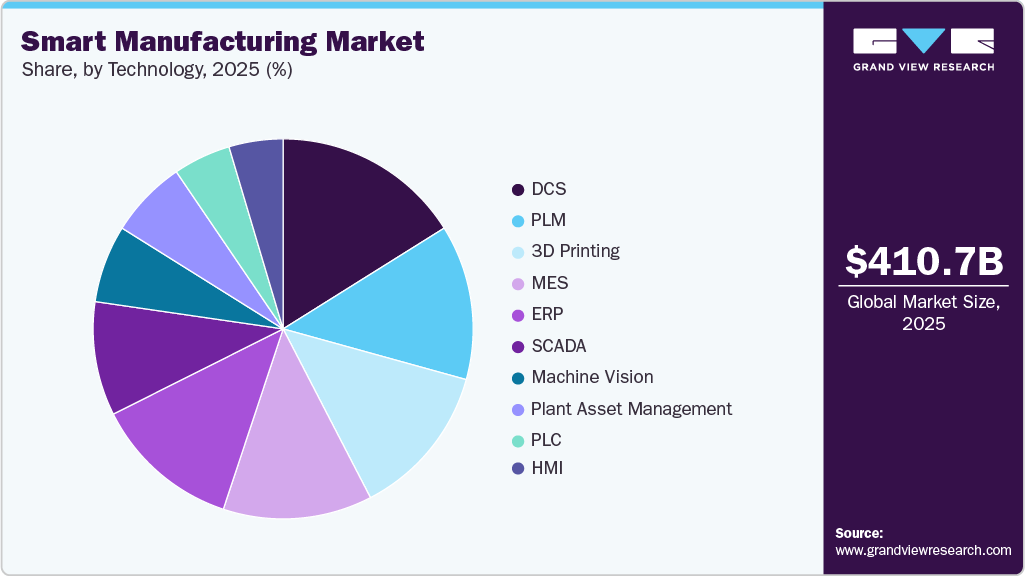

Technology Insights

The discrete control system (DCS) segment accounted for the largest market share in 2025, owing to its widespread adoption in sector such as manufacturing, energy, and utility industries. DCS systems help manage complex processes and maintain uninterrupted production. They are particularly suited for automated operations requiring precision and reliability. The addition of analytics and IoT capabilities supports better monitoring and control. These factors contribute to the sustained use of DCS in smart manufacturing.

The 3D printing segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its adoption in aerospace, automotive, healthcare, and consumer goods. It allows manufacturers to produce complex and customized parts more quickly and at lower costs. Advancements in materials and printing methods, along with the need for on-demand production and reduced inventory, support its growing use. Hence, these factors are likely to drive the rapid expansion of 3D printing in manufacturing operations.

Regional Insights

North America smart manufacturing market significantly dominated the global industry with a share exceeding 22% in 2025, driven the region's early and rapid adoption of Industry 4.0 technologies. Key drivers include widespread integration of IoT devices, advanced AI analytics, and robotics that enhance automation and operational efficiency across manufacturing sectors. The increasing focus on sustainable and energy-efficient production methods further boosts market growth by reducing environmental impact and operational costs. These combined factors create a robust ecosystem that accelerates North America's smart manufacturing deployment and innovation.

U.S. Smart Manufacturing Market Trends

The U.S. smart manufacturing market dominated in 2025, driven by rapid technological advancements in automation, robotics, AI, and IoT. The U.S. government’s support for advanced manufacturing through initiatives such as Manufacturing USA has accelerated the deployment of smart manufacturing solutions. In addition, the growing focus on sustainability and energy efficiency, along with the rise of smart factories, is driving manufacturers to adopt innovative solutions for real-time monitoring, predictive maintenance, and improved supply chain management.

Europe Smart Manufacturing Market Trends

Europe smart manufacturing is expected to grow at a CAGR of over 11% from 2026 to 2033. The European Union’s Industry 4.0 initiative encourages the adoption of smart manufacturing technologies, such as AI, IoT, and robotics, to enhance competitiveness. The region’s emphasis on environmental sustainability drives the demand for energy-efficient and low-emission manufacturing solutions, making smart manufacturing an attractive option in the Europe region.

The UK smart manufacturing market is expected to grow significantly in the coming years, driven by government-backed programs such as the Made Smarter initiative and the growing adoption of advanced manufacturing technologies such as IoT, AI, and robotics. Additionally, there is a growing emphasis on sustainable manufacturing practices as the UK works towards its net-zero goals, driving the need for more efficient, resource-conscious manufacturing systems.

The Germany smart manufacturing market is characterized by its strong industrial base and commitment to Industry 4.0. German brands are increasingly using AR/VR to enhance product design and provide virtual product demonstrations. Moreover, Germany’s data protection laws and emphasis on user privacy shape how immersive technologies are deployed, creating a trend toward more secure and transparent customer experiences.

Asia Pacific Smart Manufacturing Market Trends

Asia Pacific is expected to grow at the highest CAGR of over 13% from 2026 to 2033, driven by the increasing adoption of advanced technologies in countries. The region’s strong manufacturing base, particularly in electronics, automotive, and consumer goods, has led to the adoption of robotics and digitalization to streamline operations, enhance efficiency, and reduce costs.

The Japan smart manufacturing market is gaining traction owing to the country’s high-tech industrial base, particularly in automotive, electronics, and robotics. The Japanese government’s push for advanced manufacturing technologies and the emphasis on innovation for sustainability and energy efficiency further drive the growth of smart manufacturing in the region.

The China smart manufacturing market is rapidly expanding. The country invests heavily in automation, robotics, AI, and IoT to improve production efficiency, product quality, and competitiveness. China's large-scale manufacturing sector, particularly in electronics, automotive, and consumer goods, increasingly integrates digital technologies to streamline operations and reduce costs while supporting its transition to high-tech industries.

Key Smart Manufacturing Company Insights

Some of the key players operating in the market are ABB Ltd. and Siemens AG, among others.

-

ABB Ltd. provides innovative solutions that drive digital transformation in industries such as manufacturing, utilities, and transportation. ABB specializes in industrial robotics, AI-powered automation, and IoT systems that enhance operational efficiency, reduce costs, and improve sustainability. Its smart manufacturing solutions, including advanced automation and digital services, support manufacturers in optimizing production processes and achieving real-time operational insights, playing a key role in the smart manufacturing industry.

-

Siemens AG is a global technology conglomerate known for its cutting-edge innovations in automation, digitalization, and electrification. Siemens AG offers a comprehensive range of smart manufacturing solutions, including industrial automation, AI-driven analytics, digital twins, and IoT platforms. These solutions enable manufacturers to optimize production, improve asset management, and enhance operational efficiency.

FANUC Corporation and Mitsubishi Electric Corporation are some of the emerging market participants in the smart manufacturing market.

-

FANUC Corporation specializes in manufacturing computer numerical control (CNC) systems, lasers, industrial robots, and robot machines such as electric injection molding machines and wire electrical discharge machines under brands such as ROBOSHOT and ROBOCUT. With operations spanning Asia, Europe, the Americas, and South Africa, the company is renowned for its innovative automation solutions and robust service support.

-

Mitsubishi Electric Corporation is a multinational company specializing in industrial automation and smart manufacturing technologies. The company offers advanced solutions such as programmable logic controllers (PLCs), industrial robots (MELFA series), and servo motors. The company is committed to Industry 4.0 innovations through strategic investments and partnerships.

Key Smart Manufacturing Companies:

The following are the leading companies in the smart manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Cisco Systems, Inc.

- Siemens AG

- General Electric

- Rockwell Automation Inc.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- FANUC Corporation

- Mitsubishi Electric Corporation

Recent Developments

-

In March 2025, ABB Ltd. expanded its presence in the U.S. and China, strengthening its position in the smart manufacturing industry. The company’s investment in new facilities and technology aims to enhance its production capabilities and support the growing demand for automation and advanced manufacturing solutions.

-

In March 2025, Schneider Electric SE announced a 44 million euros investment in its Dunavecse facility in Hungary to enhance its smart manufacturing capabilities. This investment aims to support the company's commitment to increasing production capacity for energy management and automation solutions.

-

In January 2025, Siemens AG unveiled groundbreaking innovations in industrial AI and digital twin technology at CES. These advancements are designed to enhance manufacturing processes by integrating AI-driven analytics and virtual representations of physical assets, known as digital twins in the smart manufacturing industry.

Smart Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 478.85 billion

Revenue forecast in 2033

USD 1,063.15 billion

Growth rate

CAGR of 12.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

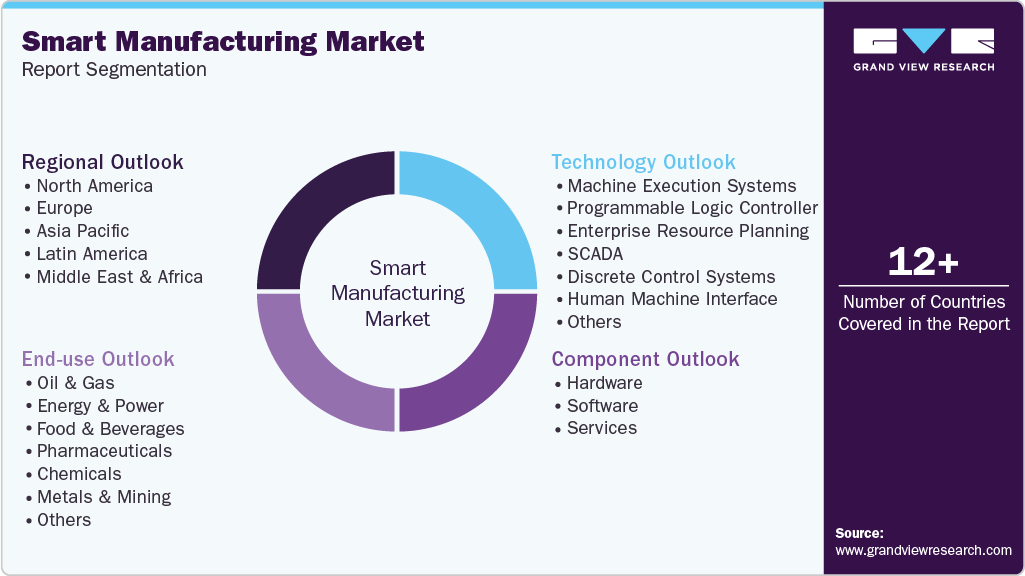

Component, technology, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB Ltd.; Cisco Systems, Inc.; Siemens AG; General Electric; Rockwell Automation Inc.; Schneider Electric; Honeywell International Inc.; Emerson Electric Co.; FANUC Corporation; Mitsubishi Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Smart Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart manufacturing market report based on component, technology, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Machine Execution Systems

-

Programmable Logic Controller

-

Enterprise Resource Planning

-

SCADA

-

Discrete Control Systems

-

Human Machine Interface

-

Machine Vision

-

3D Printing

-

Product Lifecycle Management

-

Plant Asset Management

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Oil & Gas

-

Energy & Power

-

Food & Beverages

-

Pharmaceuticals

-

Chemicals

-

Metals & Mining

-

Pulp & Paper

-

Automotive

-

Aerospace & Defense

-

Semiconductor & Electronics

-

Renewable Energy

-

Medical Devices

-

Heavy Machinery

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart manufacturing market was estimated at USD 410.68 billion in 2024 and is expected to reach USD 478.85 billion in 2025.

b. The global smart manufacturing market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2033 and to reach USD 1,063.15 billion by 2033.

b. The Asia Pacific smart manufacturing market accounted for the largest market share of over 46% in 2024, primarily driven by the increasing manufacturing base and adoption of Industry 4.0 technologies, particularly in electronics, automotive, and consumer goods, which has led to the adoption of robotics and digitalization to streamline operations, enhance efficiency, and reduce costs.

b. The key players in the smart manufacturing market are ABB Ltd., Cisco Systems, Inc., Siemens AG, General Electric, Rockwell Automation Inc., Schneider Electric, Honeywell International Inc., Emerson Electric Co., FANUC Corporation, and Mitsubishi Electric Corporation.

b. Key drivers of the smart manufacturing market include the widespread adoption of Industry 4.0 technologies, IoT, AI, machine learning, and cloud computing, and the growing demand for automation & cost efficiency. Governments worldwide are promoting smart manufacturing through initiatives focusing on research in technologies such as digital twins and machine condition monitoring.

b. The software segment accounted for the largest share of more than 50% in 2024 in the smart manufacturing market and is expected to continue its dominance over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.