- Home

- »

- Medical Devices

- »

-

Mapping Catheters Market Size, Share, Industry Report 2030GVR Report cover

![Mapping Catheters Market Size, Share & Trends Report]()

Mapping Catheters Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (High-Density (HD) Mapping, Contact Force Sensing), By Indication (AF, AFL, VT), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-551-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mapping Catheters Market Size & Trends

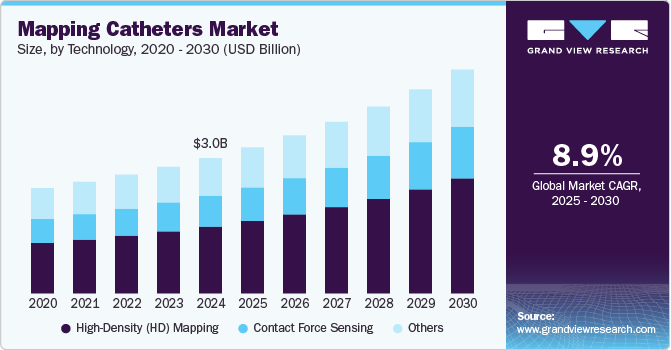

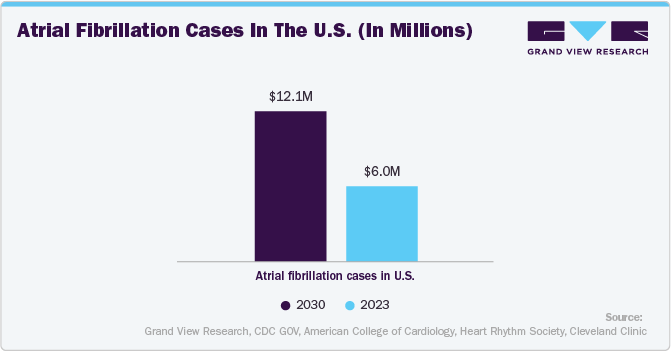

The global mapping catheters market size was estimated at USD 3.00 billion in 2024 and is projected to grow at a CAGR of 8.9% over the forecast period. The increasing prevalence of cardiac arrhythmias is one of the factors boosting market growth. Mapping catheters are specialized medical devices used during cardiac electrophysiology procedures to detect and record the heart’s electrical signals, helping doctors identify the source of abnormal heart rhythms. According to the Johnson & Johnson Services, Inc. article published in February 2024, more than 37.5 million people worldwide are currently affected by atrial fibrillation (AFib), and nearly one in four adults over the age of 40 are at risk of developing the condition during their lifetime. With AFib cases projected to increase by over 60% by 2050, the need for effective diagnostic and treatment solutions is becoming increasingly urgent. This growing demand is fueling the adoption of mapping catheters, essential for pinpointing abnormal electrical activity in the heart and guiding catheter ablation procedures.

Increased cardiac procedures drive the growth of the market. According to the NCBI article published in August 2023, globally, an estimated 313 million cardiac procedures are performed yearly, a figure expected to rise significantly as access to cardiac care improves. Around 4.5 billion people lack access to essential cardiac surgical services, highlighting a substantial gap in treatment availability. Cardiac interventions are projected to increase as healthcare infrastructure develops, particularly in low- and middle-income regions. This growing procedural volume directly supports the rising demand for mapping catheters, vital tools for diagnosing and treating cardiac arrhythmias. These devices enable precise localization of electrical disturbances in the heart, which is critical in guiding ablation therapies and improving patient outcomes.

Advancements in cardiac mapping technology are driving the growth of the mapping catheter market. According to a National Heart, Lung, and Blood Institute article published in October 2023, one key innovation is the basket catheters, which have transformed how cardiac electrical activity is recorded. These specialized catheters feature multiple electrode sensors arranged in a spherical structure of flexible metallic filaments at the tip. Unlike conventional mapping techniques that collect electrical signals point by point, basket catheters enable the simultaneous recording of signals from multiple locations during a single heartbeat. This capability provides a comprehensive, high-resolution view of the heart’s electrical patterns, greatly enhancing the accuracy and efficiency of arrhythmia diagnosis and ablation procedures. The growing adoption of such advanced technologies is driving market growth.

Growing awareness of early detection of AF drives the growth of the market. According to the American Heart Association article published in November 2023, the guidelines released in 2023 by the American College of Cardiology (ACC), American College of Chest Physicians (ACCP), American Heart Association (AHA), and the Heart Rhythm Society (HRS) emphasize the need for heightened awareness and consistent screening for atrial fibrillation (AFib), particularly among older adults and other high-risk groups. With a strong focus on early detection through routine pulse assessments and electrocardiogram (ECG) screenings, these recommendations aim to facilitate timely diagnosis and intervention. This proactive approach supports the growing demand for advanced diagnostic tools, such as mapping catheters, which are instrumental in pinpointing abnormal electrical pathways within the heart. Early diagnosis becomes a clinical priority, and the use of mapping catheters is expected to increase, reinforcing their critical role in guiding effective AFib treatment and reducing the risk of severe complications like stroke.

Market Concentration & Characteristics

The market is witnessing high innovation, with advancements such as high-density electrode configurations, 3D electro-anatomical mapping, and integration with advanced imaging systems. These developments significantly improve arrhythmia detection and treatment precision, enabling more effective and minimally invasive procedures.

Market players, such as Abbott Laboratories, Boston Scientific Corporation, and Medtronic, are involved in merger and acquisition activities. Through mergers and acquisitions, companies actively pursue key strategies like developing innovative products, forming strategic partnerships, and expanding into new regions. These efforts strengthen their market position and meet the rising demand for less invasive cardiovascular treatment options. For instance, In October 2024, Abbott received FDA clearance for the Advisor HD Grid X Mapping Catheter, Sensor Enabled. This catheter offers a unique electrode configuration for high-density heart mapping, intended to enhance the detection of electrical signals regardless of the catheter's orientation during ablation procedures.

Regulatory frameworks play a crucial role in shaping the market. Stringent approval processes from health authorities like the FDA and EMA ensure safety and efficacy, which can lengthen product development timelines. However, supportive policies promoting innovation and fast-track approvals for breakthrough technologies are also helping manufacturers bring advanced cardiac mapping solutions to market more efficiently.

There are currently no direct substitutes. Their role in cardiac care is critical, as they provide real-time, high-resolution electrical mapping essential for the accurate diagnosis and effective treatment of arrhythmias. While technologies like ECG, Holter monitors, and imaging tools may support arrhythmia detection, they lack the precision and intra-procedural functionality mapping catheters offer.

Key manufacturers operating in the market are actively broadening their reach by exploring untapped regional markets, collaborating with local distribution partners, and customizing their product portfolios to meet distinct healthcare needs across various geographies.

Technology Insights

The High-Density (HD) mapping segment held the largest share of over 49.3% in 2024. The increasing incidence of AF and technological advancement drives the segment growth. High-Density (HD) Mapping is a technique that captures detailed electrical signals from the heart for precise arrhythmia diagnosis and treatment. According to the Springer Nature article published in November 2024, High-density (HD) mapping technologies are advancing the effectiveness of atrial fibrillation treatment, with systems like INTELLANAV STABLEPOINT OPAL HDx delivering strong clinical outcomes. A multicenter evaluation involving 299 patients demonstrated the system’s ability to precisely identify fractionated atrial signals, resulting in 90.3% freedom from atrial tachyarrhythmia at one year. Moreover, the system achieved 96% freedom from adverse events and 73.9% freedom from AF recurrence after 12 months. These results emphasize the growing value of HD mapping catheters in guiding more targeted and successful ablation procedures, supporting their expanded adoption in clinical electrophysiology.

Contact force sensing is expected to show lucrative growth during the forecast period, owing to the increase in the elderly population, rising incidence of cardiac arrhythmia cases, and technological advancements. Contact Force Sensing is a technology that measures the pressure a catheter tip applies to heart tissue during procedures, ensuring safer and more effective ablation. For instance, in June 2023, a significant development included the CE Mark approval of Abbott’s Sensor Enabled TactiFlex Ablation Catheter, recognized as the first ablation catheter to feature a flexible tip and integrated contact force sensing capabilities. This catheter is designed to improve procedural efficiency and safety in patients with atrial fibrillation and other arrhythmias. The system enables more precise ablation, potentially reducing procedure duration and improving clinical outcomes by offering real-time measurement of the contact force between the catheter and cardiac tissue.

End Use Insights

The hospital segment held the largest share at 36.8% in 2024. Hospitals increasingly perform catheter procedures, reflecting the growing demand for advanced electrophysiological interventions. According to the National Cardiovascular Data Registry (NCDR) article published in March 2023, hospitals typically perform about 130 atrial fibrillation ablation procedures each year, as reflected by the median annual case volume across 162 hospitals and 708 physicians, with an interquartile range of 61 to 224. In particular, 71% of hospitals perform more than 100 such procedures each year. This substantial volume underscores hospitals' critical role in the market, driven by the increasing prevalence of cardiac arrhythmia and the adoption of advanced mapping technologies to enhance procedural efficacy and patient outcomes.

Ambulatory Surgical Centers (ASCs) is expected to grow at the fastest CAGR during the forecast period. Due to their cost-effectiveness and efficiency, ASCs are increasingly adopting advanced electrophysiology procedures, including those involving mapping catheters. According to a Surgical Information Systems article published in August 2024, there are over 6,300 Medicare-certified ASCs in the United States, with over 18,000 operating rooms. Primarily, cardiology is among the fastest-growing specialties within ASCs, indicating a rising demand for cardiac procedures that utilize mapping catheters. This expansion reflects a broader trend of shifting complex procedures from traditional hospital settings to ASCs, driven by advancements in medical technology and a focus on reducing healthcare costs. ASCs continue to grow and diversify their services, and the demand for mapping catheters is expected to increase correspondingly.

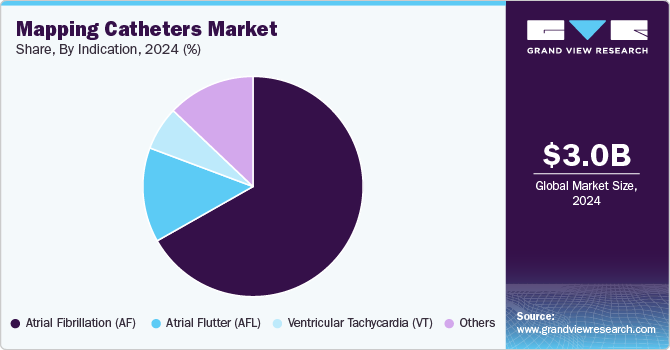

Indication Insights

The Atrial Fibrillation (AF) segment held the largest share of over 66.8% in 2024 due to the increasing incidence of AF, growing initiatives by key players, and technological advancements. According to the NCBI article published in April 2023, recent developments in AI-integrated electrocardiograms (ECGs) have significantly improved early atrial fibrillation (AF) detection. AI-enhanced ECGs can identify subtle patterns indicative of AF, even when patients are in normal sinus rhythm, facilitating earlier diagnosis and intervention. This technological progress is particularly beneficial for asymptomatic individuals or those with atypical symptoms, as it automates ECG data analysis to uncover abnormalities that traditional methods might overlook. The enhanced accuracy and efficiency in AF detection provided by AI-integrated ECGs drive their adoption in clinical settings and boost market growth.

The Atrial Flutter (AFL) segment will show lucrative growth during the forecast period, owing to the rising incidence of cardiac arrhythmia cases and technological advancements. Atrial Flutter (AFL) is a fast, regular heart rhythm originating in the atria, often causing poor blood flow and increased stroke risk. According to a Verdict Media Limited article published in May 2024, A notable example is HeartBeam's development of AI-enhanced vector cardiography (VCG) technology, which has demonstrated exceptional sensitivity in detecting atrial flutter. The HeartBeam AI+VECG system achieved a 97.3% sensitivity rate, significantly outperforming expert cardiologists using traditional single-lead ECGs. This leap in diagnostic accuracy facilitates earlier detection and intervention, directly supporting the clinical need for precise cardiac mapping. AI-integrated technologies streamline and enhance the identification of abnormal rhythms like AFL, and the demand for advanced mapping catheters essential for targeted treatment planning is expected to rise.

Regional Insights

North America dominated the mapping catheters market with a share of 40.4% in 2024; the increasing prevalence of cardiac arrhythmia, including increasing cardiac procedures and technological advancements, drives the demand for mapping catheters in North America. According to a Heart Rhythm Society article published in 2023, In the U.S., approximately 6 million individuals are affected by atrial fibrillation (AF). This condition leads to a high number of hospital admissions and is associated with serious health complications, including increased mortality. This growing burden underscores the critical demand for advanced diagnostic and treatment tools. Mapping catheters play a central role in the effective management of AF, as they enable precise identification of abnormal electrical activity in the heart. Their use supports targeted interventions, improves procedural success rates, and helps reduce the risk of recurrence and complications.

U.S. Mapping Catheters Market Trends

The mapping catheters market in the U.S. accounted for the largest share of the North American market in 2024. Increasing cardiovascular cases in the U.S. boosts the growth of the market. According to an American Heart Association (AHA) article published in January 2024, Cardiovascular disease (CVD) remains a leading cause of mortality in the U.S., accounting for approximately 2,552 deaths every day as of 2021. This substantial public health burden highlights the urgent need for advanced solutions in diagnosing and treating cardiac conditions. Within this landscape, the increasing incidence of atrial fibrillation (AFib) is a key driver of market growth. These catheters play a vital role in electrophysiological procedures by accurately identifying arrhythmic sites within the heart, enabling targeted and effective interventions. As the prevalence of AFib rises and healthcare systems strive to enhance outcomes through precision-guided treatments, the demand for innovative mapping technologies continues to expand across the country.

Europe Mapping Catheters Market Trends

The mapping catheters market in Europe held the second-largest revenue market share in 2024. The elevated mortality associated with cardiovascular diseases in Europe is accelerating the demand for advanced mapping catheter solutions. In May 2024, as per a WHO article, Cardiovascular diseases (CVDs) account for more than 42.5% of all annual deaths in the European Region, making them the leading cause of premature death and disability. This high disease burden drives the demand for advanced cardiac care solutions, such as mapping catheters. These devices are essential in diagnosing and treating arrhythmias, supporting the growing adoption of precision-based electrophysiological procedures across Europe and fueling market expansion.

Germany mapping catheter market is dominated by the highest revenue share, 33.1%, in 2023. Increasing incidence of the AF and technological advancements drive the market's growth. According to the European Society of Cardiology, in February 2024, In Germany, atrial fibrillation (AF) impacts approximately two million people, making it one of the most prevalent cardiac arrhythmias in the country. Its rising incidence, particularly among the aging population, presents notable challenges for healthcare providers. This growing burden is driving increased adoption of advanced mapping catheter technologies, which play a critical role in diagnosing and treating AF more accurately. As a result, the demand for innovative electrophysiological tools is steadily contributing to the growth of the Germany market.

The mapping catheters market in the UK held the second-largest market share in 2024. The rising incidence of arrhythmias in the UK is boosting market growth. According to an NHS article in November 2023, more than 2 million people in the UK experience arrhythmias or heart rhythm problems, reflecting a significant health issue within the population. These conditions encompass a range of irregular heartbeat patterns that can impact cardiovascular health and quality of life. The prevalence underscores the need for advanced diagnostic technologies and effective treatment options, which drives market growth.

French mapping catheters market is anticipated to witness a significant CAGR of 9.5% during the forecast period. The increasing incidence of AF and technological advances drive the market's growth. In December 2023, as per the CardioSignal by Precordior article published, Atrial fibrillation (AF) affects more than a million individuals in France, posing a significant healthcare challenge due to its association with serious complications like stroke and heart failure. This high burden highlights the growing need for advanced diagnostic and treatment solutions. As a result, there is increasing demand for mapping catheters in France to support precise AF diagnosis and guide effective ablation procedures, driving growth in the country's mapping catheter market.

Asia Pacific Mapping Catheters Market Trends

The mapping catheters market in Asia Pacific is expected to grow fastest during the forecast period. The rising geriatric population, increasing AF cases, and technological advancements drive market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, APAC has around 697 million people aged 60 and above, representing about 60% of the world’s elderly population. This rapidly aging demographic is contributing to a surge in age-related cardiac conditions like arrhythmias, driving the need for advanced diagnostic and treatment technologies. As a result, the demand for mapping catheters is rising across the APAC region, supporting the market’s expansion through improved cardiac care for an aging population.

China mapping catheters market accounted for the second largest share in Asia Pacific in 2024. China's increasing CVD cases boost the demand for mapping catheter solutions. According to the NCBI article published in December 2023, China reported approximately 330 million cardiovascular disease cases in 2022, highlighting a major public health concern. This immense patient base underscores a growing need for precise arrhythmia monitoring and intervention tools. As cardiovascular conditions become increasingly common, the demand for advanced mapping catheters is accelerating in China, positioning the technology as a critical component in improving cardiac care outcomes across the nation.

The mapping catheters market in Japan held the largest market share in the Asia Pacific region. The increasing geriatric population and rising cases of AF drive market growth. According to the World Economic Forum, in March 2023, Japan had the highest proportion of elderly individuals globally, with around 36.23 million people aged 65 and above, nearly one-third of its population. This aging demographic is increasingly vulnerable to arrhythmias and other cardiac conditions, driving demand for advanced diagnostic and therapeutic tools. As a result, the need for mapping catheters in Japan is rising, positioning them as essential in addressing the growing burden of age-related cardiac rhythm disorders.

India mapping catheters market is experiencing significant growth driven by increasing CVD cases and technological advancement. According to the Economic Times article published in February 2024, India experiences a notably high cardiovascular disease (CVD) burden, with an age-standardized CVD death rate of 272 per 100,000-well above the global average. This elevated rate highlights the pressing need for advanced arrhythmia monitoring and treatment solutions. As cardiac conditions continue to rise, the demand for mapping catheters in India is expected to grow, supporting timely and accurate diagnosis and improving patient outcomes across the country.

Latin America Mapping Catheters Market Trends

The mapping catheters market in Latin America is growing due to several factors, including increasing investments by key companies in the arrhythmia market and the rising incidence of AF and atrial flutter.

Brazil mapping catheters market is expanding due to several distinct growth drivers. Rising CVD cases and government initiatives intended at improving cardiac care infrastructure. For instance, in September 2023, In Brazil, government initiatives and institutional collaborations are actively enhancing cardiovascular care. A notable example is the partnership between Mount Sinai and the Brazilian Clinical Research Institute, aimed at advancing research and education in cardiovascular diseases. These efforts highlight the country’s commitment to improving healthcare outcomes and fostering innovation key factors driving the adoption of advanced technologies like mapping catheters to support effective arrhythmia diagnosis and treatment in Brazil’s evolving cardiac care landscape.

MEA Mapping Catheters Market Trends

The mapping catheters market in MEA is expected to grow lucratively due to the rising prevalence of AF and the growing adoption of advanced medical technologies in the region.

Saudi Arabia mapping catheters market is growing at a CAGR of 5.8% over the forecast period. The increasing incidence of CVD and technological advancements drive the growth of the market. In March 2024, as per the article published by BMC Cardiovascular Diseases In Saudi Arabia, cardiovascular disease (CVD) affects approximately 1.6% of individuals aged 15 and older, underscoring a significant public health concern. This prevalence highlights the need for advanced cardiac care solutions, particularly for diagnosing and managing arrhythmia. As the country works to enhance cardiovascular health strategies, the demand for innovative technologies like mapping catheters is expected to rise, supporting more accurate interventions and improved patient outcomes in Saudi Arabia’s growing cardiac care market.

Key Mapping Catheters Company Insights

Some of the key players operating in the industry include Medtronic, Abbott Laboratories, and GE HealthCare. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Lepu Medical. and Stereotaxis, Inc. are some of the emerging players in mapping catheters.

Key Mapping Catheters Companies:

The following are the leading companies in the mapping catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Acutus Medical, Inc.

- Johnson & Johnson

- Medtronic

- Boston Scientific Corporation

- Microport Scientific Corporation

- Lepu Medical

- Stereotaxis, Inc.

- Koninklijke Philips N.V.

Recent Developments

-

In March 2025, Stereotaxis submitted its MAGiC Sweep Catheter for FDA review, marking a milestone as the first high-density mapping catheter built specifically for use with the company’s Robotic Magnetic Navigation systems. This catheter is designed to deliver detailed electroanatomical maps quickly while allowing better navigation in difficult-to-access areas of the heart.

-

In October 2024, Medtronic plc, a prominent player in healthcare technology, received FDA approval for its Affera Mapping and Ablation System, featuring the Sphere-9 Catheter. This innovative device integrates high-density mapping with pulsed-field and radiofrequency ablation capabilities, offering a combined solution for managing persistent atrial fibrillation and performing RF ablation for cavotricuspid isthmus (CTI)-dependent atrial flutter.

-

In October 2024, Kossel Medical introduced the Cathvenus® Circular Mapping Catheter, featuring an O-shaped ring structure specifically engineered to capture electrical signals from the pulmonary veins. Available in multiple fixed ring sizes, this catheter enables accurate anatomical mapping, making it particularly effective for atrial fibrillation procedures.

Mapping Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.24 billion

Revenue forecast in 2030

USD 4.96 billion

Growth rate

CAGR of 8.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Abbott Laboratories; Acutus Medical, Inc.; Johnson & Johnson; Medtronic; Boston Scientific Corporation; Microport Scientific Corporation; Lepu Medical; Stereotaxis, Inc.; Koninklijke Philips N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mapping Catheters Market Report Segmentation

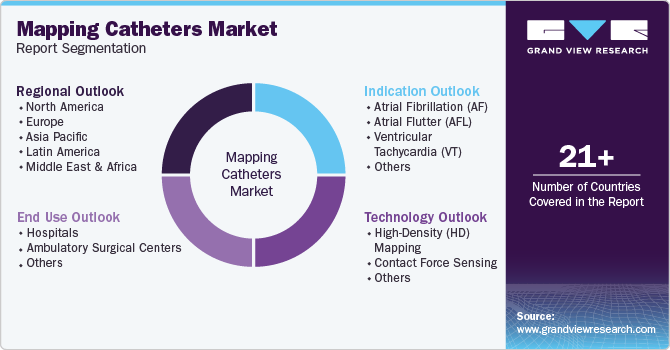

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 - 2030. for this study, Grand View Research has segmented the global mapping catheters market report based on technology, indication, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High-Density (HD) Mapping

-

Contact Force Sensing

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Atrial Fibrillation (AF)

-

Atrial Flutter (AFL)

-

Ventricular Tachycardia (VT)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory surgical centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mapping catheters market size was estimated at USD 3.00 billion in 2024 and is expected to reach USD 3.24 billion in 2025.

b. The global mapping catheters market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2030 to reach USD 4.96 billion by 2030.

b. North America dominated the mapping catheters market, with a share of 40.4% in 2024. This is attributable to the increasing prevalence of cardiac arrhythmia, including increased cardiac procedures and technological advancements.

b. Some key players operating in the mapping catheters market include Abbott Laboratories; Acutus Medical, Inc.; Johnson & Johnson; Medtronic; Boston Scientific Corporation; Microport Scientific Corporation; Lepu Medical; Stereotaxis, Inc.; and Koninklijke Philips N.V.

b. Key factors that are driving the market growth include the increasing prevalence of cardiac arrhythmias, increased cardiac procedures, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.