- Home

- »

- Petrochemicals

- »

-

Marine Lubricants Market Size, Share, Industry Report, 2030GVR Report cover

![Marine Lubricants Market Size, Share & Trends Report]()

Marine Lubricants Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Engine Oil, Hydraulic Oil, Turbine Oil, Gear Oil, Greases), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: 978-1-68038-197-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Lubricants Market Summary

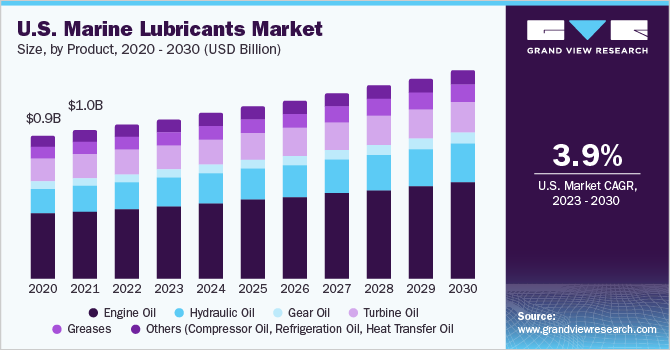

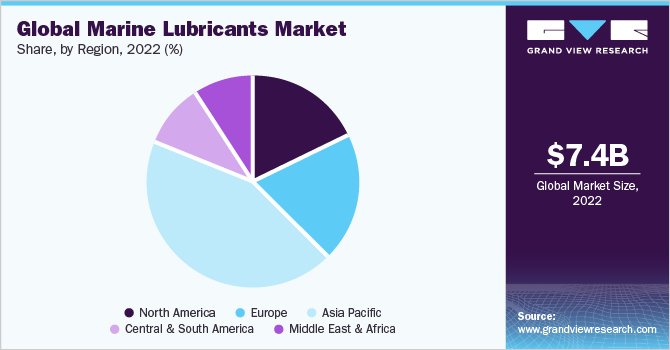

The global marine lubricants market size was valued at USD 7.40 billion in 2022 and is projected to reach USD 10.27 billion by 2030, growing at a CAGR of 4.2% from 2024 to 2030. Rising demand for durable products and increasing trade activities, especially in emerging economies of Asia Pacific, are among the key trends escalating market growth.

Key Market Trends & Insights

- Asia Pacific was the leading revenue contributor in the market in 2022, representing about 40% of the overall revenue.

- The marine industries in China, India, and Singapore are estimated to tread along a healthy growth track over the forecast period.

- By product, engine oil segment accounted for over 46.0% of the overall revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 7.40 Billion

- 2030 Projected Market Size: USD 10.27 Billion

- CAGR (2023-2030): 4.2%

- Asia Pacific: Largest market in 2022

The U.S. is the largest consumer of the product in North America with a revenue share of 70.9% in 2022. Marine engine oils are the major segment within the marine lubricants market space in the U.S. The production of finished goods that are in high demand in emerging economies is resulting in increased exports from the U.S. As air transport has its limitations, goods are transported through the sea route. Marine lubricants are widely utilized in the shipping industry to protect and enhance the efficiency of engines and equipment. These are high-performance fuels, specially designed to enable optimal performance in operations. They possess various exceptional inherent characteristics such as extending engine life and protecting components at high temperatures, improving performance and reliability of machinery, enhancing protection from mechanical wear and mitigating cold corrosion.Extensive R&D in the global marine industry Changing needs arising from various high-performance heavy shipping industries are leading to extensive R&D activities in the global marine sector. This is prompting the development of a variety of products to offer reduced maintenance, improved oil life, and superior machine operating performance.

Increasing oil-drain intermissions and decreasing oil consumption in inland or coastal shipping industry in recent years has created several demand-supply issues. Major industry players are therefore involved in the development of a broad range of high-quality oils for all types of marine engines, incorporating latest technological advances for consistently high performance.

Protecting the environment is of growing importance for every sector. With the increasing number of ships delivering cargo across the world, concerns over emissions and waste product disposal are estimated to increase as these ships are generally dependent on oil-based fuels. The International Marine Organization (IMO) is continually reviewing and updating requirements to tackle pollution due to dumping, oil, and exhausts.

Asia Pacific is anticipated to hold a prominent position in the global arena throughout the forecast horizon. Economic performance would rally in Southeast Asia, as major economies such as the Philippines and Indonesia ramp up investments in manufacturing & industrial activities, while Vietnam sustains its current expansion levels.

Volatility in crude oil prices coupled with tightening supply is likely to restrain the growth of the market over the forecast period. Overbuilding has converged with slowing economic growth and a raft of vessels today are chasing only a limited number of cargoes. This, in turn, is hindering the upward climb of the market.

However, various strategic partnership plans covering the future development of the shipping, ports, and business services sector have been cumulatively developed by industries and governments across various developed nations, including the U.K. This factor is projected to open new avenues for the growth of the market over the coming years.

Product Insights

The market has been segmented into engine oil, hydraulic oil, gear oil, turbine oil, greases, and others on the basis of product. Engine oil emerged as the leading segment in 2022 and accounted for over 46.0% of the overall revenue. This segment is likely to witness significant growth over the forecast period. Engine oils include system oils, cylinder oils, and trunk piston engine oils. The burgeoning population coupled with increasing consumer income levels is leading to an increase in the demand for commercial goods. This, in turn, is projected to influence the growth of the segment positively.

Hydraulic oils are expected to be the fastest-growing segment in the marine lubricants market, with a CAGR of 4.5% during the forecast period. It is used to extend the pump’s life under severe conditions, cleanliness, and reliable air release filterability. the Latest technology, which meets environmental norms, has led to low toxicity levels for marine life.

Lubricants provide robust protection to hydraulic pumps, which also contain antiwear additives, corrosion and oxidation inhibitors, foam and aeration suppressants, and a shear stable viscosity index improver. Critical lubricated hydraulic components are vane pumps, piston pumps, and gear pumps. Generally, lubricants are available in multiviscosity ISO 15, 22, 32, 46, 68, and 100 grades. The multiviscosity feature promotes smooth power transmission over a wide range with a minimum of shudder and maximum accuracy.

Regional Insights

Asia Pacific was the leading revenue contributor in the market in 2022, representing about 40% of the overall revenue. The presence of a large number of ports, along with a rapidly expanding shipbuilding sector, and increasing trade activities with the U.S. and other developed economies are the primary growth stimulants of the market. Major Asian ports are quickly acquiring foreign ports and are expected to penetrate the U.S. market in the offing.

The marine industries in China, India, and Singapore are estimated to tread along a healthy growth track over the forecast period. The factor is anticipated to stir up the consumption of marine lubricants in the region. Several industries are opening their manufacturing units in Asia Pacific, owing to the availability of cheap labor and raw materials in the region. It is poised to provide a significant push to the market in Asia Pacific. Additionally, the region has been witnessing increasing investments in the manufacturing sector, primarily due to increasing trade activities in China.

The Asia Pacific shipping sector is primarily driven by Singapore’s core business of container. Singapore is focused on developing its port to become a premier global hub port and an international maritime center over the forecast period. Furthermore, to ensure that Singapore maintains its edge in terms of quality, the Maritime and Port Authority is also involved in the promotion of maritime R&D with a focus on off-shore and marine engineering, port, and shipping.

North America accounted for close to 19.0% of the total market value in 2022. The industry is experiencing a renaissance and has a significant contribution to the national, economic, and homeland security of the U.S.

The domestic maritime transport sector is playing a pivotal role in the development of energy infrastructure. With the increasing movement of refining petroleum, crude products, and chemicals, especially after the shale oil revolution in the U.S., the shipbuilding sector in North America is growing at an accelerated rate. Construction of several types of vessels, which include roll-on/roll-off vessels, offshore supply ships, and containers has significantly increased in recent years.

Key Companies & Market Share Insights

The industry is characterized by the presence of a few multinational companies catering to the majority demand across the globe. Price fluctuation owing to ever-changing and mostly rising crude oil prices is also creating the need for companies to seek out new ways of increasing revenue generation. Companies are entering into mergers and partnerships to strengthen their position in the market. For instance, In February 2019, Lukoil Marine Lubricants Middle East signed a three-year contract with Oman Shipping Company (OSC). Under the agreement, Lukoil will supply lubricants covering OSC’s fleet of 39 vessels consisting of very large crude carriers (VLCC), product tankers, chemical tankers, LPG Carriers, very large ore carriers (VLOCs), and bulk carriers. Some of the prominent players operating in the global marine lubricants market include:

-

Bel-Ray Co. Inc.

-

Quaker Chemical Corp.

-

Zeller+Gmelin GmbH & Co. KG

-

Blaser Swisslube AG

-

Repsol

-

Kluber Lubrication

-

Pennzoil

-

Phillips 66

-

PetroChina Co. Ltd.

-

JX Nippon Oil & Energy Corp.

-

Petrobras

-

PetroFer Chemie

-

Buhmwoo Chemical Ind. Co. Ltd.

-

Innospec

-

Gulf Oil International

-

UniMarine Inc.

-

Quepet Lubricants LLC

Marine Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.9 billion

Revenue forecast in 2030

USD 10.27 billion

Growth rate

CAGR of 4.2 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Switzerland; France; Italy; Spain; Netherlands; Russia; China; India; Japan; South Korea; Southeast Asia; Oceania; Kyrgyzstan; Brazil; Argentina; Chile; Colombia; Iran; Oman; UAE; Qatar; Kuwait; Saudi Arabia; South Africa; Angola; Nigeria

Key companies profiled

Bel-Ray Co. Inc.; Quaker Chemical Corp.; Zeller+Gmelin GmbH & Co. KG; Blaser Swisslube AG; Repsol; Kluber Lubrication; Pennzoil; Phillips 66

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marine lubricants market report on the basis of product, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Engine oil

-

Hydraulic oil

-

Gear oil

-

Turbine oil

-

Greases

-

Others (Compressor Oil, Refrigeration Oil, Heat Transfer Oil)

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Switzerland

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

Oceania

-

Kyrgyzstan

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Saudi Arabia

-

South Africa

-

Angola

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global marine lubricants market size was estimated at USD 7,395.1 million in 2022 and is expected to reach USD 7.9 billion in 2023.

b. The global marine lubricants market is expected to grow at a compound annual growth rate of 4.2% from 2022 to 2030 to reach USD 10.3 billion by 2030

b. Engine oil dominated the market with a revenue share of 46.0% in 2022. The burgeoning population coupled with increasing consumer income levels is leading to an increase in the demand for commercial goods. This, in turn, is projected to influence the growth of the segment positively

b. Some of the key players in marine lubricants market include Bel-Ray Co. Inc., Quaker Chemical Corp., Zeller+Gmelin GmbH & Co. KG, Blaser Swisslube AG, Repsol, Kluber Lubrication, Pennzoil, Phillips 66

b. Rising demand for durable products and increasing trade activities, especially in emerging economies of Asia Pacific, are among the key trends escalating marine lubricants market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.