- Home

- »

- Automotive & Transportation

- »

-

Marine Vessel Market Size & Share, Industry Report, 2033GVR Report cover

![Marine Vessel Market Size, Share & Trends Report]()

Marine Vessel Market (2025 - 2033) Size, Share & Trends Analysis Report By Ship Type, By Deadweight Tonnage (100 DWT to 500 DWT, 500 DWT to 5000 DWT, 5000 DWT to 15000 DWT, More than 15000 DWT), By Operation (Inland, Seafaring), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-676-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Vessel Market Summary

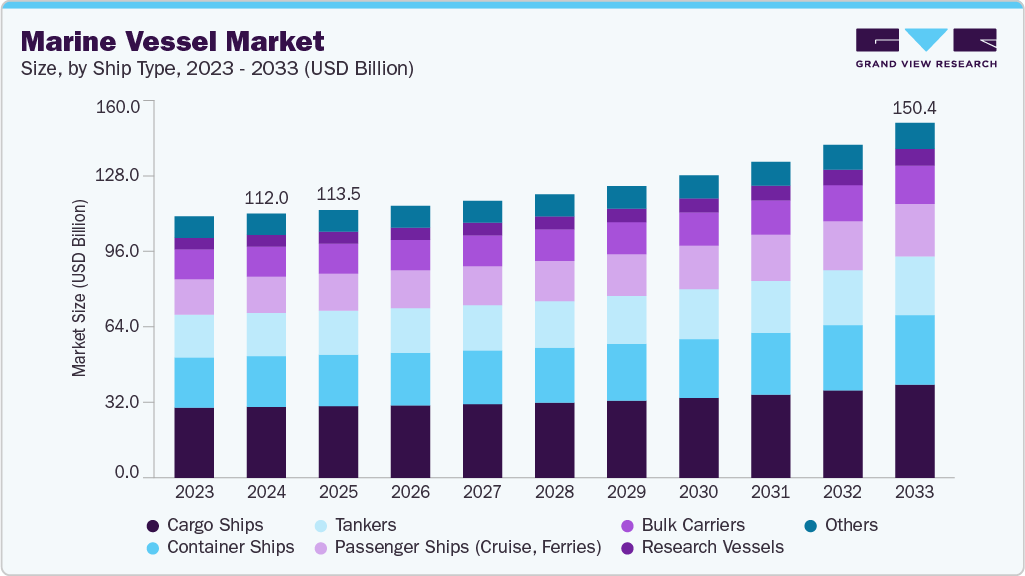

The global marine vessel market size was estimated at USD 112.02 billion in 2024, and is projected to reach USD 150.45 billion by 2033, growing at a CAGR of 3.6% from 2025 to 2033. The naval vessel market is being driven by a combination of rising geopolitical tensions, maritime security concerns, and fleet modernization programs.

Key Market Trends & Insights

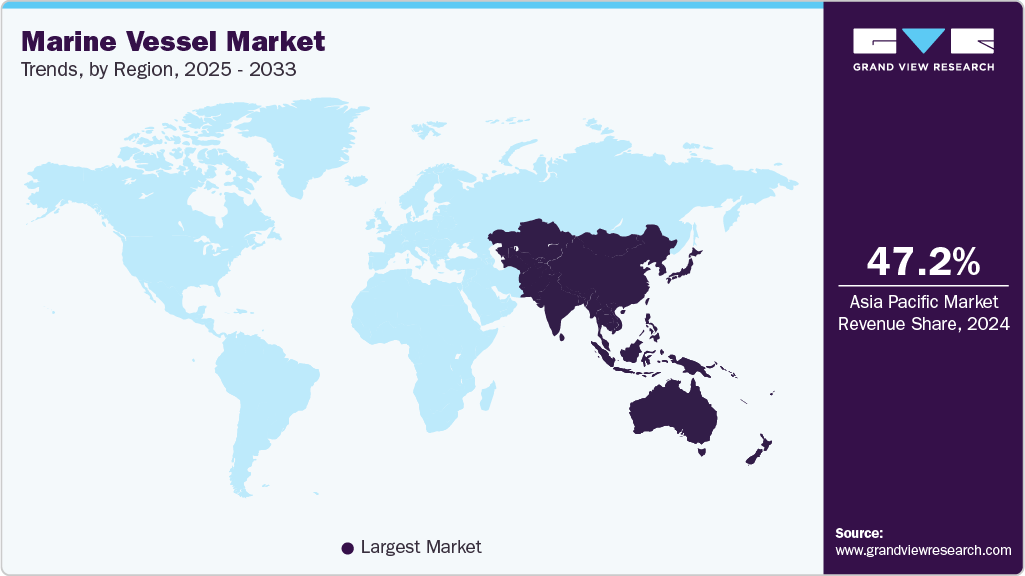

- Asia Pacific marine vessel market accounted for a 47.2% share of the overall market in 2024.

- The marine vessel industry in the China held a dominant position in 2024.

- By ship type, the cargo ships segment accounted for the largest share of 26.8% in 2024.

- By deadweight tonnage, the more than 15000 DWT segment held the largest market share in 2024.

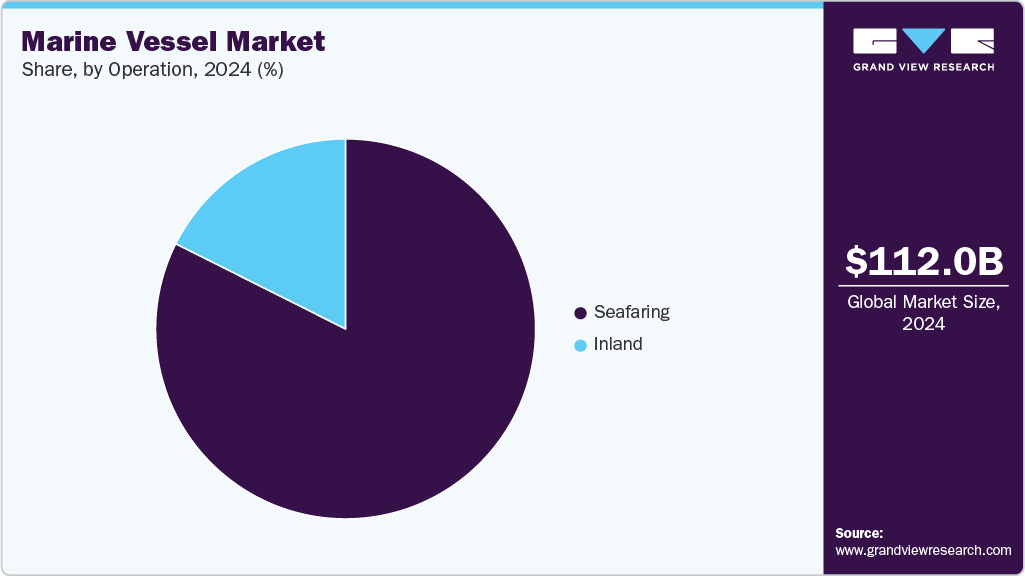

- By operation, the seafaring segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 112.02 Billion

- 2033 Projected Market Size: USD 150.45 Billion

- CAGR (2025-2033): 3.6%

- Asia Pacific: Largest market in 2024

Increased emphasis on naval deterrence and blue-water capabilities has led to the procurement of advanced surface and sub-surface vessels by both developed and developing nations. Technological advancements are reshaping the naval vessel market, with a growing focus on automation, stealth, and integrated combat systems. Platforms are increasingly being designed with modular architectures to allow for rapid upgrades and multi-role capabilities. Artificial intelligence, unmanned systems, and sensor fusion technologies are being integrated into new-generation vessels to enhance situational awareness and mission efficiency. Electric and hybrid propulsion systems, along with advanced materials that reduce radar signatures, are also being widely adopted to improve operational sustainability and survivability.

Governments and defense contractors are allocating significant investments toward research, development, and production of next-generation naval platforms. Budget allocations for naval procurement have been increased across key markets such as the U.S., China, India, and several NATO countries. Strategic partnerships, multi-national shipbuilding programs, and long-term maintenance and support contracts have been formed to enhance industrial capabilities and supply chain resilience. Private sector engagement in naval shipbuilding and upgrades has also been encouraged through offset agreements and public-private collaboration models.

Both national defense policies and international maritime laws influence the regulatory environment governing the naval vessel market. Export regulations, defense procurement standards, and classification society rules are being enforced to ensure vessel integrity, security compliance, and interoperability among allied fleets. Environmental compliance regulations, such as restrictions on emissions and ballast water treatment, are increasingly being applied to military vessels, particularly in peacetime operations. In addition, cybersecurity mandates for critical defense infrastructure are being incorporated into naval vessel specifications.

Despite robust demand, several challenges are restraining the growth of the naval vessel market. High capital expenditure requirements, extended development timelines, and complex regulatory approvals continue to pose entry barriers. Budget constraints in developing countries and economic uncertainty in post-pandemic environments have delayed procurement cycles and modernization initiatives. Furthermore, skilled labor shortages, component supply disruptions, and geopolitical trade restrictions have affected shipbuilding timelines and cost structures. These factors are compelling stakeholders to prioritize selective procurement and platform standardization.

Ship Type Insights

The cargo ships segment accounted for the largest share of 26.8% in 2024. The continued expansion of global trade and supply chain globalization is driving the growth of cargo ships. As e-commerce and cross-border trade accelerate, demand for efficient and reliable freight transport has increased significantly, especially for general cargo and breakbulk operations that require versatile vessel capabilities. Fleet modernization programs aimed at improving fuel efficiency and meeting IMO regulations are also encouraging the replacement of older cargo ships with next-generation, low-emission vessels.

The passenger ships segment is expected to grow at the fastest CAGR during the forecast period. The rebound of global tourism and rising investments in marine public transport infrastructure drive growth of the segment. Cruise lines are expanding fleets to cater to increased travel demand, especially in Asia Pacific and Europe, where cruise tourism is gaining momentum among new demographics. Governments and city planners are also investing in ferry systems as a sustainable and congestion-free urban mobility alternative, particularly in coastal and island communities.

Deadweight Tonnage Insights

The more than 15000 DWT segment held the largest market share of 52.1% in 2024. The rising demand for high-capacity vessels in global trade and energy transportation fuels growth of the segment. Large container ships, oil tankers, and bulk carriers fall within this category and are essential for transoceanic shipping routes. Growth in energy exports such as crude oil, LNG from the U.S., the Middle East, and Africa to Asia and Europe is fueling demand for Very Large Crude Carriers (VLCCs) and Ultra Large Container Vessels (ULCVs).

The 5000 DWT to 15000 DWT segment is expected to grow at the fastest CAGR during the forecast period. The segment is growing rapidly, driven by the need for flexible, mid-sized vessels that can operate in both regional and global waters. These ships are ideal for short-sea shipping, inter-island logistics, and routes with moderate cargo volumes, making them increasingly important in emerging markets and congested trade corridors. Growing demand for feeder vessels that transport goods from smaller ports to major transshipment hubs is contributing to fleet expansion in this range.

Operation Insights

The seafaring segment dominated the market in 2024. Growth in seafaring marine vessels is being driven by the expansion of global maritime trade, increased energy transportation, and growing naval modernization programs. As international shipping continues to handle over 80% of global trade by volume, the demand for large ocean-going vessels, including container ships, tankers, and bulk carriers, remains robust. Rising exports of LNG, crude oil, and raw materials from the U.S., the Middle East, and Africa to Asia and Europe are supporting long-haul maritime transport.

The inland segment is projected to grow at the fastest CAGR of 3.9% over the forecast period. Inland marine vessels are experiencing accelerated growth due to government-led infrastructure development, rising adoption of low-emission transport, and regional logistics optimization. Inland waterways are being increasingly utilized as cost-effective and sustainable alternatives to road and rail, especially for bulk commodities and short-haul cargo movement. Significant investments in river port modernization, dredging, and inland navigation corridors, particularly in Asia (India, China), Europe, and Latin America, are enabling smoother, more efficient inland shipping.

Regional Insights

The North America marine vessel market held a significant share in 2024. The growth of the market in the region is driven by the region’s increasing investments in naval modernization and offshore energy infrastructure. The region benefits from a robust shipbuilding industry, advanced defense technologies, and a strong presence of key OEMs and defense contractors.

U.S. Marine Vessel Market Trends

The U.S. marine vessel market held a dominant position in 2024 due to the significant defense spending and ongoing fleet renewal initiatives by the U.S. Navy and Coast Guard. The presence of major shipbuilders such as Huntington Ingalls Industries and General Dynamics NASSCO positions the country as a global leader in naval vessel manufacturing.

Europe Marine Vessel Market Trends

The Europe marine vessel industry was identified as a lucrative region in 2024. A focus on sustainability, technological innovation, and naval defense expansion characterizes Europe’s marine vessel market. The region is home to globally renowned shipbuilders such as Fincantieri, Damen Shipyards, and Naval Group, which are driving advancements in electric propulsion, smart vessels, and modular ship designs.

The UK marine vessel market is expected to grow rapidly in the coming years. Defense modernization programs and a growing emphasis on sustainable maritime technologies shape the market in the country. The Royal Navy’s fleet expansion and investments in next-generation frigates and autonomous vessels support demand for advanced naval shipbuilding.

The Germany marine vessel industry held a substantial market share in 2024. The country’s expertise in engineering and precision manufacturing has supported the development of technologically advanced vessels, including submarines, corvettes, and research ships. Companies such as Thyssenkrupp Marine Systems are heavily engaged in both domestic and international defense contracts.

Asia Pacific Marine Vessel Market Trends

The Asia Pacific marine vessel market is anticipated to grow at a CAGR of 4.2% during the forecast period. The region is witnessing significant demand for both commercial and military vessels due to economic growth, defense modernization, and expanding offshore energy activities. Governments in the region are also investing heavily in green shipbuilding technologies and smart vessel integration.

The Japan marine vessel industry is expected to grow rapidly in the coming years due to its long-standing shipbuilding tradition and technological expertise. The country’s shipyards are focusing on building high-value vessels, including LNG carriers, advanced cargo ships, and autonomous vessels.

The China marine vessel market held a substantial market share in 2024. The country is rapidly expanding its naval fleet while also dominating commercial vessel exports such as bulk carriers, tankers, and container ships. State-owned enterprises such as CSSC and CSIC are investing in green propulsion, smart shipping, and autonomous vessel technologies. China’s strategic maritime policies and its Belt and Road initiative continue to drive shipbuilding growth both regionally and globally.

Key Marine Vessel Company Insights

Some of the key companies in the marine vessel market include HD Hyundai Heavy Industries Co., Ltd., Hanwha Ocean co., Ltd., Samsung Heavy Industries Co., Ltd, FINCANTIERI S.p.A., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

HD Hyundai Heavy Industries Co., Ltd. (HHI), is a shipbuilding company and a manufacturer of heavy equipment. The company operates four core divisions: Shipbuilding, Offshore & Engineering, Industrial Plant & Engineering, and Engine & Machinery, and oversees several subsidiaries, including Hyundai Electric & Energy Systems, Hyundai Construction Equipment, and Hyundai Robotics. It builds a wide range of vessels such as containerships, tankers, bulk carriers, naval ships, LNG carriers, and offshore platforms, serving clients worldwide across the Americas, Europe, Asia, the Middle East, and Africa.

-

Hanwha Ocean Co., Ltd., formerly known as Daewoo Shipbuilding & Marine Engineering (DSME), is a shipbuilding and offshore company headquartered near the Port of Okpo in Geoje, South Korea. It specializes in a wide range of vessels, including commercial ships such as liquefied natural gas carriers (LNGCs), very large crude carriers (VLCCs), container ships, offshore platforms, drillships, and specialty ships such as submarines and destroyers. The company also provides icebreaking research ships and submarines equipped with air-independent propulsion (AIP) and lithium-ion batteries, enhancing underwater endurance and operational capability.

Key Marine Vessel Companies:

The following are the leading companies in the marine vessel market. These companies collectively hold the largest market share and dictate industry trends.

- HD Hyundai Heavy Industries Co., Ltd.

- Hanwha Ocean co., Ltd.

- Samsung Heavy Industries Co., Ltd

- FINCANTIERI S.p.A.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Oshima Shipbuilding co., Ltd.

- General Dynamics NASSCO

- Rolls-Royce plc

- Kongsberg Maritime

- Damen Shipyards Group

Recent Developments

-

In July 2025, Cochin Shipyard Limited (CSL), India's largest state-owned shipbuilder, has entered into a strategic Memorandum of Understanding (MoU) with South Korea's HD Hyundai through its shipbuilding arm, HD Korea Shipbuilding & Offshore Engineering Co. Ltd. (HD KSOE). The collaboration is aimed at strengthening India's shipbuilding capabilities and expanding its footprint in the global maritime industry. The partnership is aligned with national initiatives such as the 'Maritime Amrit Kaal Vision 2047' and 'Maritime India Vision 2030', with a focus on fostering growth, innovation, and self-reliance in the Indian maritime sector. Key areas of cooperation include the joint pursuit of shipbuilding opportunities both in India and abroad, the transfer of advanced Korean shipbuilding technologies, productivity enhancement, and workforce skill development.

-

In June 2025, Eureka Naval Craft, a U.S.-based defense company, collaborated with Australian marine technology firm Greenroom Robotics to develop next-generation autonomous naval vessels. Their collaboration has led to the launch of the AIRCAT Bengal, a 36-meter, multi-mission Surface Effect Ship (SES) engineered for fully autonomous operations. The partnership aims to transform the naval sector by delivering vessels that are faster, more cost-efficient, and simpler to construct than conventional ships.

Marine Vessel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 113.47 billion

Revenue forecast in 2033

USD 150.45 billion

Growth rate

CAGR of 3.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report deadweight tonnage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ship type, deadweight tonnage, operation, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

HD Hyundai Heavy Industries Co., Ltd.; Hanwha Ocean co., Ltd.; Samsung Heavy Industries Co., Ltd; FINCANTIERI S.p.A.; MITSUBISHI HEAVY INDUSTRIES, LTD.; Oshima Shipbuilding co., Ltd.; General Dynamics NASSCO; Rolls-Royce plc; Kongsberg Maritime; Damen Shipyards Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Vessel Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global marine vessel market report based on ship type, deadweight tonnage, operation, and region.

-

Ship Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cargo Ships

-

Container Ships

-

Tankers

-

Passenger Ships

-

Bulk Carriers

-

Research Vessels

-

Others

-

-

Deadweight Tonnage Outlook (Revenue, USD Billion, 2021 - 2033)

-

100 DWT to 500 DWT

-

500 DWT to 5000 DWT

-

5000 DWT to 15000 DWT

-

More than 15000 DWT

-

-

Operation Outlook (Revenue, USD Billion, 2021 - 2033)

-

Inland

-

Seafaring

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global marine vessel market size was estimated at USD 112.02 billion in 2024 and is expected to reach USD 113.47 billion in 2025.

b. The global marine vessel market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2033 to reach USD 150.45 billion by 2033.

b. Asia Pacific dominated the marine vessel market with a share of 47.2% in 2024. The region is witnessing significant demand for both commercial and military vessels due to economic growth, defense modernization, and expanding offshore energy activities.

b. Some key players operating in the marine vessel market include HD Hyundai Heavy Industries Co., Ltd.; Hanwha Ocean co., Ltd.; Samsung Heavy Industries Co., Ltd; FINCANTIERI S.p.A.; MITSUBISHI HEAVY INDUSTRIES, LTD.; Oshima Shipbuilding co., Ltd.; General Dynamics NASSCO; Rolls-Royce plc; Kongsberg Maritime; Damen Shipyards Group.

b. The naval vessel market is being driven by a combination of rising geopolitical tensions, maritime security concerns, and fleet modernization programs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.