- Home

- »

- Next Generation Technologies

- »

-

Maritime Safety System Market Size, Industry Report, 2033GVR Report cover

![Maritime Safety System Market Size, Share & Trends Report]()

Maritime Safety System Market (2025 - 2033) Size, Share & Trends Analysis Report By System (Automatic Identification Systems, Navigation & Surveillance Systems), By Component (Hardware, Software), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-634-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Maritime Safety System Market Summary

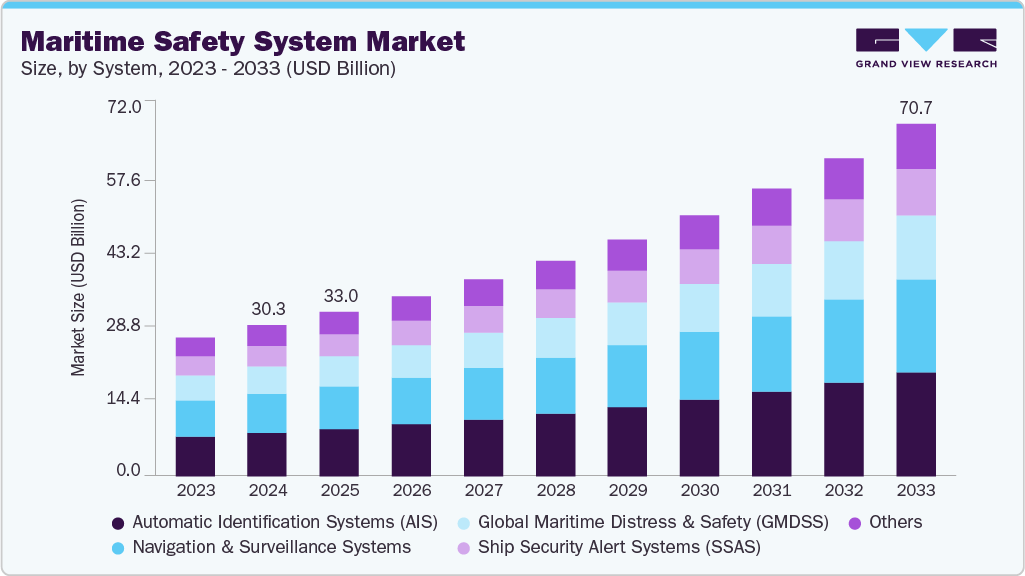

The global maritime safety system market size was estimated at USD 30.31 billion in 2024, and is projected to reach USD 70.68 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. The integration of advanced cybersecurity protocols and AI-powered navigation systems has emerged as a significant trend in the global maritime safety system industry, driven by rising cyber threats, autonomous vessel development, and the digitization of port operations.

Key Market Trends & Insights

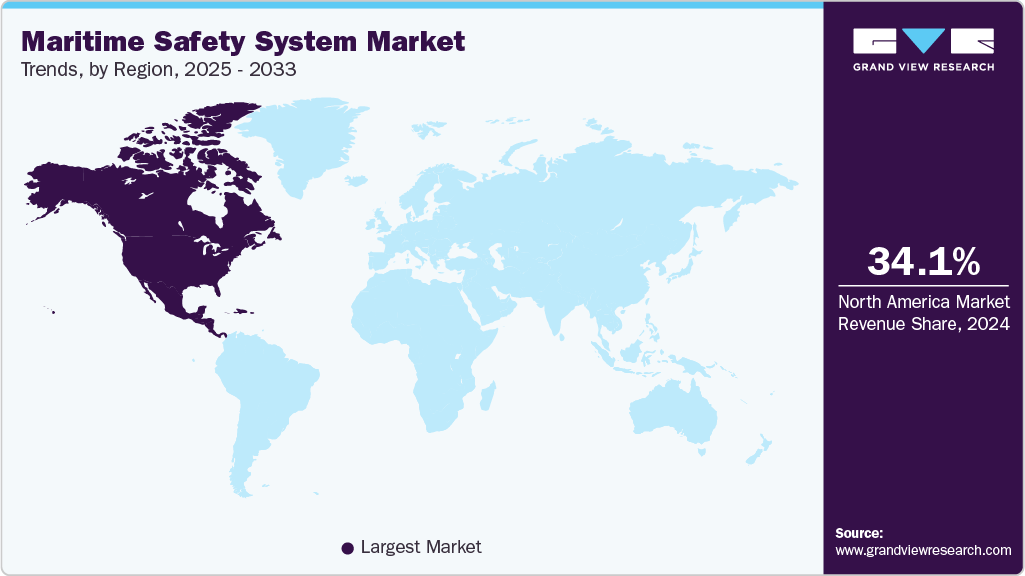

- The North America maritime safety system industry accounted for a 34.1% share of the overall market in 2024.

- The maritime safety system industry in the U.S. held a dominant position in 2024.

- By system, the automatic identification systems (AIS) segment accounted for the largest share of 28.7% in 2024.

- By component, the hardware segment held the largest market share in 2024.

- By application, the port & vessel security segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 30.31 Billion

- 2033 Projected Market Size: USD 70.68 Billion

- CAGR (2025-2033): 10.0%

- North America: Largest market in 2024

The International Maritime Organization (IMO)'s e-navigation strategy has been instrumental in boosting the market for maritime safety systems. Designed to harmonize the collection, exchange, and analysis of marine information, this framework has accelerated the adoption of integrated navigation systems. The IMO’s Strategy Implementation Plan (SIP) prioritized key functionalities such as bridge alert management and ship-shore reporting systems. Notably, the SIP’s RCO 6 initiative, “Improved Shore-Based Services,” has propelled the market by catalyzing investments in port digital infrastructure, enabling real-time data exchange, and reducing collision risks. As maritime stakeholders increasingly prioritize digital situational awareness, e-navigation continues to act as a foundational enabler for the modern maritime safety landscape.

The rapid expansion of the Long Range Identification and Tracking (LRIT) system has significantly boosted the market, particularly in regions lacking terrestrial coverage. Managed by the U.S. Coast Guard’s National Data Center (NDC), LRIT has achieved over 90% coverage among eligible SOLAS vessels by 2025, supporting real-time satellite tracking up to 1,000 nautical miles offshore. This capability has propelled adoption across governments and commercial fleets alike, especially in geopolitically sensitive waters like the South China Sea and the Arctic. By filling surveillance gaps and detecting non-compliant vessels (e.g., AIS-disabled ships), LRIT has become a core system in national security and fisheries enforcement strategies.

The deployment of the VHF Data Exchange System (VDES) has transformed traditional maritime communication, replacing analog voice transmissions with high-speed digital data services. Formalized through SOLAS Chapter V amendments in 2025, VDES compatibility is now mandatory for newbuild ships. This shift has propelled the market by enabling seamless integration with shore-based NAVDAT systems, allowing for features like real-time weather routing and digital port clearance. In regions like the Baltic Sea, VDES has contributed to a 40% drop in navigation-related incidents, demonstrating its role in improving operational efficiency and safety, thereby creating strong growth momentum for maritime safety vendors.

Reinforced vessel identification protocols, particularly the mandatory use of fixed IMO numbers, have boosted regulatory demand for integrated tracking solutions. These permanent identifiers ensure vessel traceability across changes in ownership or flag states, closing compliance loopholes exploited by illicit actors. Integration of IMO numbers with AIS and LRIT has enabled authorities to conduct anomaly detection and vessel profiling with greater accuracy. For instance, in 2023, the U.S. Coast Guard intercepted 15 unflagged vessels through mismatched IMO-MMSI data, driving regulatory enforcement and further propelling the market for unified maritime identification systems.

The automation of ship-shore processes and the development of intelligent maritime infrastructure have significantly boosted market growth. Initiatives like the IMO’s RCO 4 directive for automated ship-shore reporting have led to widespread deployment of AI-powered compliance tools and digital documentation platforms. Smart ports such as Singapore and Rotterdam now mandate electronic pre-arrival declarations integrated with VDES and AIS, slashing processing times by 70%. Moreover, the integration of Position, Navigation, and Timing (PNT) systems with the IHO’s S-100 charting framework has reduced navigation errors caused by outdated hydrographic data. These innovations have collectively propelled the market into a new era of resilience, automation, and responsiveness.

System Insights

The Automatic Identification Systems (AIS) segment accounted for the largest share of 28.7% in 2024. The AIS segment continues to gain traction as maritime nations scale up vessel monitoring and compliance enforcement. Governments are expanding AIS coverage from coastal waters to open seas using satellite-enabled networks, which has driven robust AIS retrofitting across older commercial fleets. Rising concerns around piracy, illegal fishing, and vessel collisions, especially in high-traffic routes like the Malacca Strait, have pushed AIS from a compliance tool to an operational imperative, prompting deeper integration with analytics software for anomaly detection and fleet behavior modeling.

The navigation & surveillance systems segment is expected to grow at a significant CAGR during the forecast period. This segment is experiencing renewed momentum due to next-gen electronic chart display and information systems (ECDIS), radar overlays, and optical surveillance integration. The trend toward "smart bridges", where navigation, weather data, and real-time vessel intelligence are coalesced, is fueling market demand from both commercial operators and navies. In addition, investments in coastal radar and long-range electro-optical surveillance for Exclusive Economic Zone (EEZ) protection are driving government contracts, particularly in Southeast Asia, West Africa, and the Arctic region.

Component Insights

The hardware segment held the largest market share in 2024. Hardware remains the backbone of maritime safety infrastructure, driven by replacement cycles and port digitization efforts. Increased adoption of VHF antennas, GNSS receivers, marine radars, and AIS transponders, now with encrypted features, has boosted growth, especially in retrofitting efforts for fleets transitioning to e-navigation standards. Moreover, the need for ruggedized, GPS-resistant systems in geopolitically sensitive waters has triggered R&D investments in jamming-resistant hardware, giving this segment a strong defense-driven push.

The software segment is expected to grow at the fastest CAGR during the forecast period. Software is emerging as the fastest-evolving component, catalyzed by demand for centralized dashboards, fleet analytics, and interoperability with port and customs platforms. Integrated Maritime Domain Awareness (MDA) platforms that aggregate AIS, radar, weather, and drone data are gaining traction, especially among commercial fleets navigating Arctic and polar routes. The push toward automation and predictive safety alerts (e.g., collision prediction using AI) is reshaping procurement patterns, shifting preference toward software-first solutions with hardware bundled secondarily.

Application Insights

The port & vessel security segment dominated the market in 2024. Heightened threats like cargo theft, cyberattacks, and geopolitical disruptions have made port and vessel security the top application segment. Ports are now investing in integrated video surveillance, biometric access control, and AI-based anomaly detection linked with AIS and VDES streams. Globally, smart port development initiatives in China, the UAE, and Northern Europe have propelled this segment, emphasizing real-time situational awareness and incident response coordination.

The search & rescue segment is projected to grow at a significant CAGR over the forecast period. SAR applications are experiencing a technology-led transformation, with drone-assisted reconnaissance, geospatial AI, and VHF Data Exchange Systems (VDES) enabling faster distress localization. Governments are increasingly partnering with commercial satellite providers to improve response times in remote maritime zones. This trend has spurred the adoption of portable beacons, EPIRBs, and interoperable SAR software suites, particularly in countries prone to extreme weather and migration-related maritime incidents.

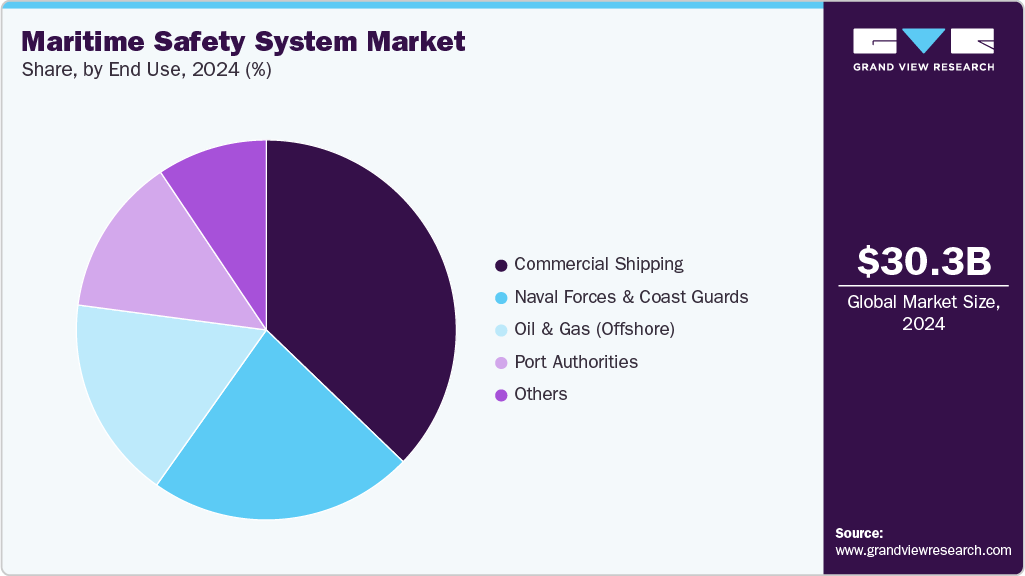

End Use Insights

The commercial shipping segment dominated the market in 2024 and is projected to grow at the fastest CAGR over the forecast period. The commercial shipping segment remains the largest revenue contributor, driven by regulatory mandates, ESG reporting needs, and fuel optimization via route-based safety data. Fleet owners are investing in all-in-one safety suites that integrate AIS, collision avoidance, and cyber-secure navigation tools. Furthermore, decarbonization-linked digital tools providing real-time weather routing and emissions monitoring are blending safety with sustainability, redefining ROI models for safety tech investment in this segment.

The Oil & Gas (Offshore) segment is projected to grow at a significant CAGR over the forecast period. This segment is being revitalized by deep-sea exploration and offshore wind expansion, both of which require robust maritime safety infrastructure. With platforms located in high-risk zones, there’s heightened investment in autonomous surveillance systems, emergency evacuation software, and long-range distress beacons. As offshore energy transitions toward greener alternatives, new offshore assets are being equipped with next-gen safety systems designed for remote, unmanned monitoring and expanding market potential far beyond traditional fossil fuel installations.

Regional Insights

The North America maritime safety system industry accounted for a 34.1% share of the overall market in 2024 and is projected to grow at the fastest CAGR over the forecast period. North America, particularly the U.S., leads in maritime safety system adoption. The region's emphasis on advanced maritime infrastructure and stringent safety regulations has propelled the integration of technologies like Automatic Identification Systems (AIS) and real-time monitoring tools. The U.S. Coast Guard and Maritime Administration (MARAD) play pivotal roles in enforcing safety standards and promoting the use of advanced navigation systems such as Electronic Chart Display and Information Systems (ECDIS) and Vessel Traffic Services (VTS).

U.S. Maritime Safety System Market Trends

The U.S. maritime safety system industry held a dominant position in 2024. The U.S. market is bolstered by a well-developed shipping industry and a strong naval defense sector. Technological implementations are at a high level, with widespread adoption of navigation systems like ECDIS and GPS, and vessel tracking systems such as AIS and VTS. Environmental protection legislations, including the Oil Pollution Act (OPA) and the Clean Water Act (CWA), drive the use of technology in providing real-time monitoring and responding to environmental incidents.

Europe Maritime Safety System Market Trends

The Europe maritime safety system industry is advancing in maritime safety through regional collaborations and a focus on sustainability. The Common Information Sharing Environment (CISE) initiative provides a decentralized framework for information exchange across sectors, enhancing maritime situational awareness and enabling quick responses to crises. Countries like Germany and the UK are at the forefront, investing in unmanned surveillance vessels and adopting AI-backed navigation systems to align with environmental and safety goals.

Germany maritime safety system industry is at the forefront of maritime safety innovations, with a strong focus on sustainability and environmental protection. The Federal Maritime and Hydrographic Agency (BSH) provides maritime services for shipping, economy, and the marine environment, including the issuance of official nautical charts and monitoring of the marine environment. Germany's participation in regional security platforms like CISE further enhances its maritime safety capabilities.

The maritime safety system industry in the UK is enhancing maritime safety through technological innovations and regional cooperation. Development of unmanned surface vessels for persistent surveillance and active participation in initiatives like CISE are key strategy. The UK's maritime safety efforts are also supported by organizations such as the Maritime and Coastguard Agency, which ensures the safety of ships and seafarers.

Asia Pacific Maritime Safety System Market Trends

The Asia Pacific maritime safety system industry is experiencing rapid growth in maritime safety systems due to expanding shipping industries and infrastructure investments. The region's governments are developing maritime infrastructure through the construction of new ports and upgrading existing ones. The rise in autonomous vessels and increasing awareness of maritime safety and security are driving demand for advanced safety solutions.

China maritime safety system industry leads the APAC market through heavy investments and technological advancements. The country has aggressively invested in its maritime safety infrastructure, modernizing sea ports, shipping lanes, and coastal facilities. Implementation of advanced surveillance systems, automated management tools, and real-time monitoring technologies enhances maritime operations' effectiveness and security.

The India maritime safety system industry is enhancing maritime safety through strategic initiatives and infrastructure development. The Sagarmala Programme aims for port-led development, improving logistics efficiency, and reducing costs. Operation Sankalp ensures security in the Indian Ocean Region, while the Information Fusion Centre Indian Ocean Region (IFC-IOR) enhances maritime domain awareness by facilitating information sharing and cooperation among partner nations.

Key Maritime Safety System Company Insights

Some of the major players in the maritime safety system industry include Anschütz, BAE Systems, Elbit Systems Ltd., Honeywell International Inc., L3Harris Technologies, Inc., among others. These companies offer highly reliable and technologically advanced systems such as radar, navigation, surveillance, communication, and emergency response tools that are essential for modern maritime safety. Their solutions comply with international maritime regulations and are integrated across various vessel types, ranging from commercial shipping to naval fleets, due to their proven performance in complex operational environments. In addition, their global presence, robust distribution networks, and ability to deliver end-to-end maritime safety solutions have further solidified their leadership in this market.

-

Honeywell International Inc. plays a significant role in the maritime safety system industry through its advanced technologies in sensors, automation, and control systems. The company leverages its deep expertise in aerospace and industrial automation to deliver robust marine solutions, including fire and gas detection, environmental monitoring, and integrated control systems. Its maritime offerings are designed for both commercial and defense applications, ensuring operational reliability, safety compliance, and efficient shipboard management. Honeywell’s strong global footprint, continuous innovation, and adherence to maritime safety standards make it a trusted provider in the industry.

-

Smiths Group plc contributes to the maritime safety system industry primarily through its subsidiary Smiths Detection, which specializes in advanced threat detection and security screening technologies. The company’s products support port and vessel security by identifying potential threats, contraband, and hazardous materials through X-ray, trace detection, and imaging systems. With a solid reputation in homeland security and critical infrastructure protection, Smiths Group enhances maritime domain awareness and ensures regulatory compliance. Its focus on technological innovation, reliable performance in challenging environments, and service support has cemented its role in securing maritime operations.

Key Maritime Safety System Companies:

The following are the leading companies in the maritime safety system market. These companies collectively hold the largest market share and dictate industry trends.

- Anschütz

- BAE Systems

- Elbit Systems Ltd.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Northrop Grumman

- OSI MARITIME SYSTEMS

- Saab Group

- Smiths Group plc

- Thales

Recent Developments

-

In July 2023, Honeywell acquired SCADAfence, a leading provider of cybersecurity solutions for OT and IoT networks, enhancing its capabilities in asset discovery, threat detection, and security governance for maritime operations. This move strengthens Honeywell’s portfolio in protecting maritime infrastructure from cyber threats, aligning with the growing emphasis on cybersecurity in the industry.

-

In October 2023, Smiths Group launched the HI-SCAN 7555 DV, a dual-view X-ray scanner with superior image quality and automatic explosives detection, designed for high-threat port security applications. This development enhances screening efficiency and safety at maritime ports, reinforcing Smiths Group’s leadership in detection technologies.

Maritime Safety System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.02 billion

Revenue forecast in 2033

USD 70.68 billion

Growth Rate

CAGR of 10.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, component, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Anschütz; BAE Systems; Elbit Systems Ltd.; Honeywell International Inc.; L3Harris Technologies, Inc.; Northrop Grumman; OSI MARITIME SYSTEMS; Saab Group; Smiths Group plc; Thales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maritime Safety System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global maritime safety system market report based on system, component, application, end use, and region.

-

System Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automatic Identification Systems (AIS)

-

Navigation & Surveillance Systems

-

Global Maritime Distress & Safety (GMDSS)

-

Ship Security Alert Systems (SSAS)

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Port & Vessel Security

-

Search & Rescue

-

Communication & Emergency Response

-

Environmental & Accident Monitoring

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial Shipping

-

Naval Forces & Coast Guards

-

Oil & Gas (Offshore)

-

Port Authorities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global maritime safety system market size was estimated at USD 30.31 billion in 2024 and is expected to reach USD 33.02 billion in 2025.

b. The global maritime safety system market size is expected to grow at a significant CAGR of 10.0% to reach USD 70.68 billion in 2033.

b. North America held the largest market share of 34.1% in 2024. North America, particularly the U.S., leads in maritime safety system adoption. The region's emphasis on advanced maritime infrastructure and stringent safety regulations has propelled the integration of technologies like Automatic Identification Systems (AIS) and real-time monitoring tools.

b. Some of the players in the maritime safety system market are Anschütz, BAE Systems, Elbit Systems Ltd., Honeywell International Inc., L3Harris Technologies, Inc., Northrop Grumman, OSI MARITIME SYSTEMS, Saab Group, Smiths Group plc, and Thales.

b. The key driving trend in the maritime safety system market is the adoption of digital technologies like AIS, e-Navigation, and satellite tracking to enhance real-time vessel monitoring, improve emergency response, and comply with IMO safety regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.