- Home

- »

- Communication Services

- »

-

Maritime Surveillance Market Size, Industry Report, 2030GVR Report cover

![Maritime Surveillance Market Size, Share & Trends Report]()

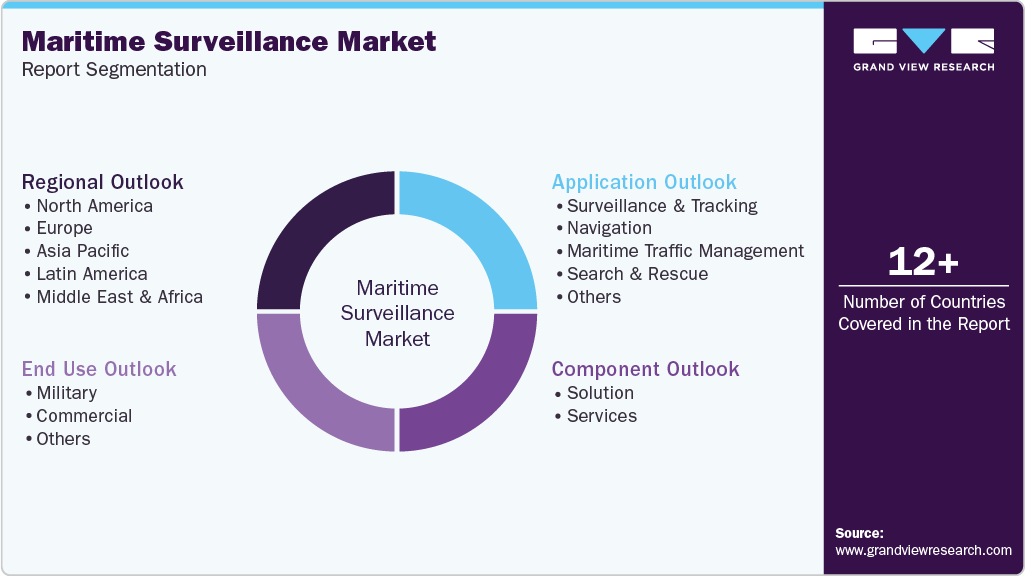

Maritime Surveillance Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Application (Surveillance and Tracking, Navigation), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-393-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Maritime Surveillance Market Summary

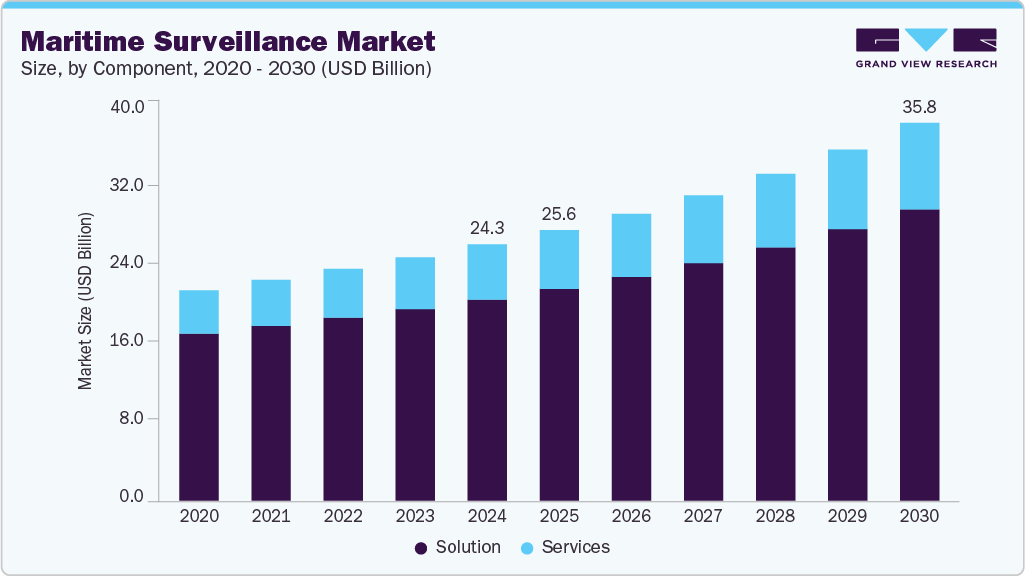

The global maritime surveillance market size was estimated at USD 24.30 billion in 2024 and is projected to reach USD 35.83 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The increasing need for national security and the protection of maritime borders is a significant driving factor of the maritime surveillance market.

Key Market Trends & Insights

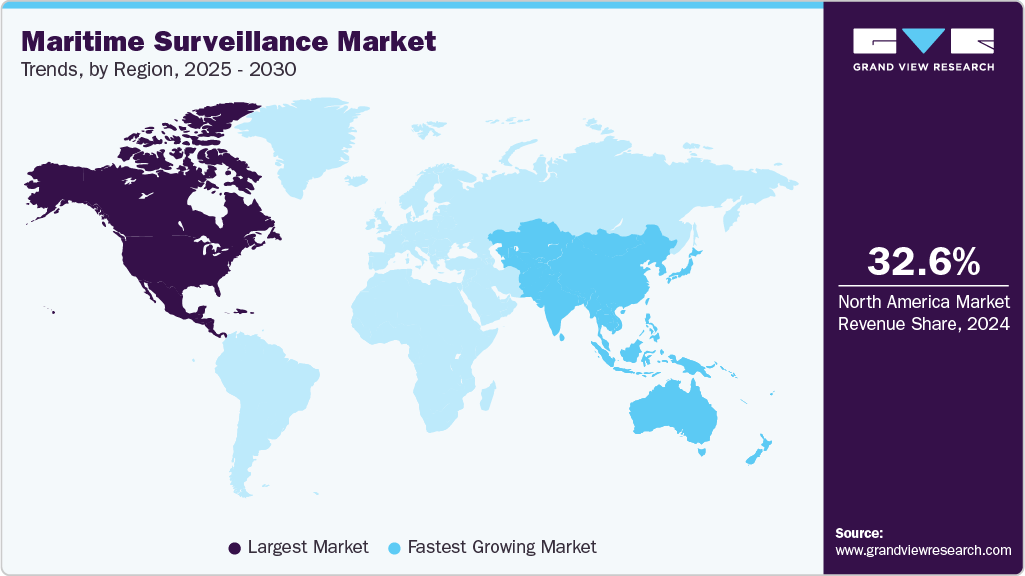

- North America dominated the maritime surveillance industry and accounted for a share of 32.6% in 2024.

- The solution segment dominated the market in 2024 and accounted for the largest share of 78.5%.

- The surveillance and tracking dominated the market in 2024.

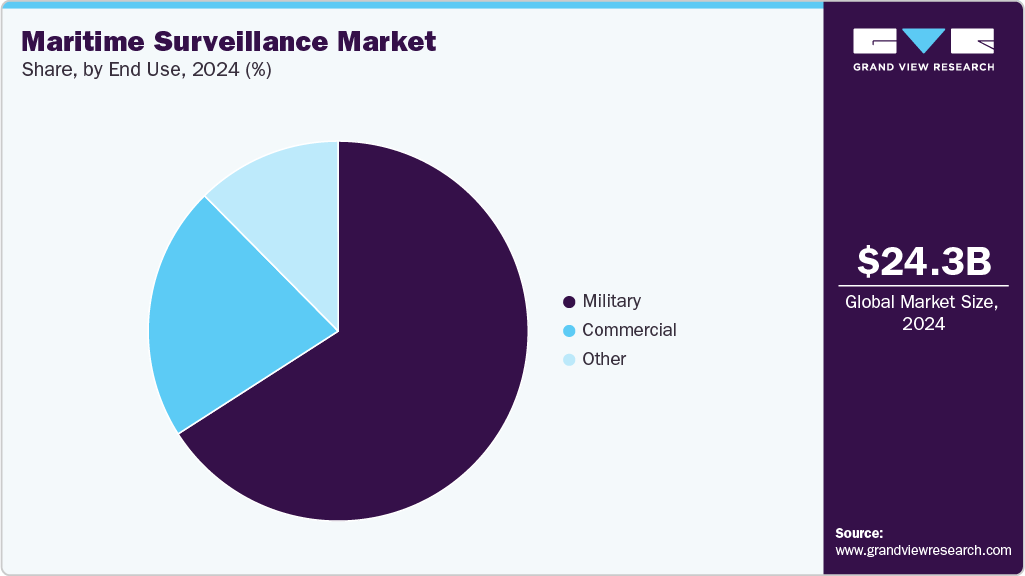

- The military segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.30 Billion

- 2030 Projected Market Size: USD 35.83 Billion

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

Governments worldwide are investing in advanced surveillance systems to monitor and secure their coastlines against illegal activities such as smuggling, piracy, and unauthorized fishing. In addition, the growing adoption of unmanned aerial vehicles (UAVs) and autonomous underwater vehicles (AUVs) for enhanced maritime domain awareness is also contributing to market growth.Technological advancements are transforming the maritime surveillance landscape. The integration of artificial intelligence (AI) and machine learning (ML) is enabling the development of intelligent surveillance systems capable of processing large volumes of data and identifying potential threats with high accuracy. AI-driven analytics are enhancing the capabilities of surveillance systems by automating data analysis and providing actionable insights. In addition, the use of blockchain technology is emerging as a trend in maritime surveillance, offering secure and transparent tracking of vessels and cargo.

Another notable technological trend in maritime surveillance is the deployment of integrated surveillance solutions that combine multiple sensors and data sources. These solutions provide a comprehensive view of maritime activities by fusing data from radar, sonar, satellite imagery, and AIS (Automatic Identification System). The use of big data analytics and cloud computing is also becoming prevalent, enabling the storage, processing, and analysis of vast amounts of surveillance data. This helps in identifying patterns, predicting potential threats, and enhancing decision-making processes.

Regulatory trends are playing a significant role in shaping the maritime surveillance market. International maritime organizations and national regulatory bodies are implementing stringent regulations and guidelines to ensure maritime safety and security. The International Maritime Organization (IMO) has introduced regulations such as the International Ship and Port Facility Security (ISPS) Code, which mandates the implementation of security measures for ships and port facilities. In addition, the European Union's Maritime Security Strategy emphasizes the importance of integrated maritime surveillance for safeguarding European waters.

However, high costs associated with the deployment and maintenance of advanced surveillance systems can be a significant barrier, especially for developing countries with limited budgets. The integration of various surveillance technologies and ensuring interoperability among different systems is another challenge that can affect the efficiency of surveillance operations. In addition, the maritime environment poses unique challenges, such as harsh weather conditions and vast areas to be monitored, which can impact the performance of surveillance systems.

Component Insights

The solution segment dominated the market in 2024 and accounted for the largest share of 78.5%. This dominance is primarily due to the increasing demand for integrated systems encompassing radars, sensors, cameras, AIS transponders, and central control rooms. These comprehensive solutions enhance situational awareness and overall maritime security. As maritime activities continue to expand globally, the solution segment's dominance is expected to persist, driven by ongoing technological advancements and the escalating complexity of maritime threats.

The services segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by the growing need for data analysis, system integration, maintenance, and support services. As maritime surveillance systems become more complex, the demand for skilled professionals to manage and optimize these systems is expected to grow significantly. In addition, the continuous expansion of commercial maritime operations, such as international cargo shipping, offshore energy exploration, and large-scale fisheries management, is boosting the demand for maritime surveillance services.

Application Insights

The surveillance and tracking segment dominated the market in 2024. The growth can be attributed to the growing need for continuous monitoring and securing maritime borders and assets. The increasing prevalence of maritime threats such as piracy, smuggling, and illegal fishing has driven the demand for robust surveillance systems. These systems enable real-time monitoring of vessel movements, identification of suspicious activities, and efficient response to incidents.

The search & rescue segment is expected to grow at the fastest CAGR during the forecast period. Search & rescue operations rely on a combination of technologies, including UAVs, satellite communications, and advanced radar systems, to locate and assist vessels or individuals in distress. The growing volume of maritime traffic, along with the rising incidence of natural disasters and maritime accidents, underscores the importance of efficient search & rescue capabilities. Innovations such as automated distress signals, real-time tracking, and AI-driven decision support systems are enhancing the effectiveness and speed of search & rescue missions, thereby fueling segment growth.

End Use Insights

The military segment dominated the market in 2024. Military organizations rely heavily on advanced surveillance technologies to monitor maritime borders, secure strategic assets, and ensure the sovereignty of territorial waters. This segment leverages a wide array of sophisticated systems, including advanced radar, sonar, satellite imaging, UAVs, and AI-powered analytics, to detect and respond to potential threats swiftly. In addition, significant investments in advanced surveillance technologies, coupled with the critical need for maritime security are expected to fuel the growth of the segment.

The commercial segment is expected to witness the notable CAGR over the forecast period. Key commercial players, including shipping companies, port authorities, and offshore energy operators, are adopting advanced surveillance technologies to safeguard their assets, streamline operations, and ensure safe navigation. Technologies such as AIS, satellite tracking, and real-time monitoring systems enable commercial entities to enhance situational awareness, prevent accidents, and comply with stringent international maritime regulations. Moreover, increasing maritime trade, offshore energy exploration, and the need for vessel safety have driven the adoption of maritime surveillance solutions by commercial entities.

Regional Insights

North America dominated the Maritime Surveillance industry and accounted for a share of 32.6% in 2024. The U.S. is a significant contributor, investing heavily in advanced surveillance technologies such as unmanned systems, satellite-based monitoring, and AI-driven analytics. The U.S. Coast Guard and Navy continuously upgrade their surveillance capabilities to address threats such as illegal immigration, smuggling, and piracy. In addition, the integration of surveillance systems with homeland security initiatives bolsters the market.

U.S. Maritime Surveillance Market Trends

The U.S. maritime surveillance market held a dominant position in the region in 2024. The U.S. maritime surveillance market is experiencing robust growth, primarily driven by a comprehensive approach to national security and defense. The country has implemented sophisticated surveillance systems to monitor its extensive coastline, which spans over 12,000 miles. The U.S. Navy and Coast Guard are at the forefront, deploying advanced radar, sonar, and satellite systems to detect and mitigate maritime threats.

Europe Maritime Surveillance Market Trends

Europe maritime surveillance market is expected to register a moderate CAGR from 2025 to 2030. Europe maritime surveillance market is characterized by collaborative efforts among countries to enhance regional security and environmental monitoring. The European Maritime Safety Agency (EMSA) and the European Border and Coast Guard Agency (Frontex) lead initiatives to integrate surveillance systems across member states.

The Germany maritime surveillance market is expected to grow at a significant CAGR from 2025 to 2030. The market growth in the country is driven by increasing government investment in next-generation naval platforms, rising security concerns over maritime borders and offshore assets, and the adoption of advanced surveillance technologies including AI-enabled tracking and satellite monitoring.

The UK maritime surveillance market held a substantial market share in 2024. The UK has continued to prioritize maritime surveillance to strengthen national security, protect critical sea lanes, and support NATO operations. To enhance situational awareness and monitor strategic maritime regions, advanced technologies and multi-platform surveillance systems have been deployed.

Asia Pacific Maritime Surveillance Market Trends

The Asia Pacific Maritime Surveillance market is expected to grow at a fastest CAGR of 8.1% during the forecast period, driven by the region's strategic importance, extensive maritime boundaries, and increasing maritime trade activities. Countries such as China, Japan, India, and Australia are heavily investing in advanced surveillance technologies to secure their waters.

India’s maritime surveillance market is expected to grow at the fastest growth rate during the forecast period driven by a combination of trade-driven infrastructure growth and strategic imperatives such as protecting an extensive EEZ, energy and offshore assets, and ensuring secure sea-lines of communication. Government programs to modernize ports and coastal connectivity increase demand for coastal radars, vessel-tracking systems, airborne maritime patrols and analytics services.

The China maritime surveillance market held a substantial market share in 2024, supported by a dual civil-and-military modernization push, with the People’s Liberation Army, coast guard and port authorities investing heavily in sensors, patrol platforms and networked C4ISR systems to strengthen territorial enforcement, enhance fleet operations and expand maritime domain awareness. This momentum is further supported by a strong domestic shipbuilding and defense-industrial base that enables rapid procurement and large-scale deployment of surveillance assets.

Key Maritime Surveillance Company Insights

Some of the key companies in the Maritime Surveillance industry include Thales Group, Raytheon Technologies, and Saab AB, among others. Strategic partnerships and new product launches have become a key competitive strategy to gain a competitive edge in the market.

-

Thales Group offers defense, aerospace, and security technologies, including comprehensive maritime surveillance solutions. Its offerings span naval radars, maritime communications, and integrated command and control systems. The maritime segment provides solutions for both coastal and offshore monitoring. Notable products include Smart-S Mk2 radar and Thales maritime operations centers that deliver real-time situational data.

-

Raytheon Technologies Corporation delivers defense and aerospace technologies, with capabilities in sensors, radars, and integrated maritime solutions. Its offerings in maritime surveillance include maritime radar systems, sonar solutions, and communication networks for naval operations. The company provides scalable systems for coastal monitoring and offshore security. The advanced maritime communication platforms enhance situational awareness across maritime domains.

Key Maritime Surveillance Companies:

The following are the leading companies in the maritime surveillance market. These companies collectively hold the largest market share and dictate industry trends.

- Indra Sistemas, SA

- Raytheon Technologies Corporation

- Saab AB

- Elbit Systems Ltd.

- Bharat Electronics Limited

- Thales Group

- Dassault Aviation SA

- Kongsberg Gruppen ASA

- Furuno Electric Co., Ltd.

- SRT Marine Systems plc

Recent Developments

-

In October 2025, Raytheon Technologies Corporation product SPY-6(V)1 radar selected by the German government for installation on eight F127 frigate. The radar features four array faces with 37 modular assemblies each, delivering continuous 360-degree situational awareness, and is part of the U.S. Navy's SPY-6 family used for air and missile defense. The contract includes comprehensive support to integrate the radar with the frigates' design, enhancing the German Navy's multi-mission capabilities and enabling faster, more informed decision-making at sea.

-

In July 2025, Bharat Electronics Limited (BEL) signed a contract with the Indian Navy for the implementation of the National Maritime Domain Awareness (NMDA) project aimed at enhancing maritime and coastal security. The project involves upgrading the existing National Command, Control, Communication and Intelligence (NC3I) Network to the advanced NMDA Network, integrating AI-enabled software for improved data collation, analysis, and information sharing among maritime stakeholders.

Maritime Surveillance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.66 billion

Revenue forecast in 2030

USD 35.83 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Indra Sistemas, SA; Raytheon Technologies Corporation; Saab AB; Elbit Systems Ltd.; Bharat Electronics Limited; Thales Group; Dassault Aviation SA; Kongsberg Gruppen ASA; Furuno Electric Co., Ltd.; SRT Marine Systems plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maritime Surveillance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global maritime surveillance market report based on component, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surveillance and Tracking

-

Navigation

-

Maritime Traffic Management

-

Search & Rescue

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Military

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global maritime surveillance market size was estimated at USD 24.30 billion in 2024 and is expected to reach USD 25.66 billion in 2025.

b. The global maritime surveillance market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 35.83 billion by 2030.

b. North America dominated the maritime surveillance market in 2024. The U.S. is a significant contributor to the North American market, investing heavily in advanced surveillance technologies such as unmanned systems, satellite-based monitoring, and AI-driven analytics.

b. Some key players operating in the maritime surveillance market include Indra Sistemas, SA, Raytheon Technologies Corporation, Saab AB, Elbit Systems Ltd., Bharat Electronics Limited, Thales Group, Dassault Aviation SA, Kongsberg Gruppen ASA, Furuno Electric Co., Ltd., SRT Marine Systems plc

b. Key factors that are driving the market growth include the increasing need for national security and the protection of maritime borders and the rising deployment of integrated surveillance solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.