- Home

- »

- Consumer F&B

- »

-

Matcha Tea Market Size And Share, Industry Report, 2033GVR Report cover

![Matcha Tea Market Size, Share & Trends Report]()

Matcha Tea Market (2026 - 2033) Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Product (Powder, Ready-to-drink Beverage, Instant Premixes), By Type Unflavored/Regular, Flavored), By Price Range, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-473-4

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Matcha Tea Market Summary

The global matcha tea market size was estimated at USD 965.8 million in 2025 and is projected to reach USD 1,748.2 million by 2033, growing at a CAGR of 7.8% from 2026 to 2033. The market is expanding due to increasing consumer demand for health-conscious products, driven by matcha’s antioxidant and energy-boosting properties.

Key Market Trends & Insights

- Asia Pacific held the largest share of the matcha tea market in 2025, accounting for 51.2%.

- The Middle East & Africa matcha tea industry is experiencing significant growth, projecting a CAGR of 10.1% from 2026 to 2033.

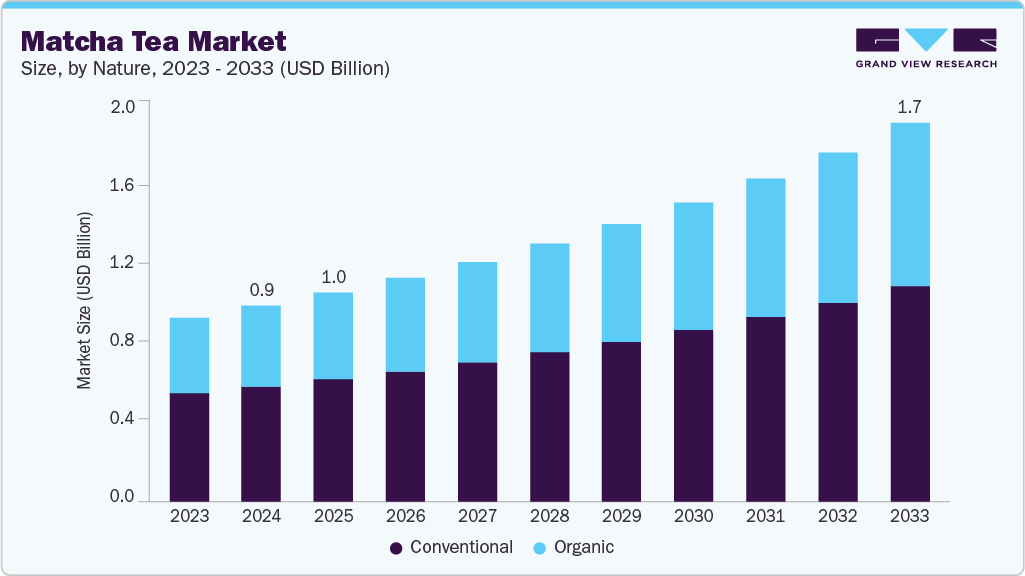

- By nature, the conventional matcha tea segment held a larger revenue share of 58.6% in 2025.

- By product, the powder segment contributed a global revenue share of 59.1% in 2025.

- By type, the unflavoured/regular segment accounted for a global revenue share of 63.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 965.8 Million

- 2033 Projected Market Size: USD 1,748.2 Million

- CAGR (2026-2033): 7.8%

- Asia Pacific: Largest market in 2025

- Middle East & Africa: Fastest growing market

The growing interest in organic, natural, and plant-based foods, combined with rising awareness of Japanese culture and wellness trends, further accelerates market growth. The market for functional drinks, including matcha tea, is experiencing strong growth due to shifting consumer preferences toward healthier, more natural beverages. As people become increasingly aware of the importance of nutrition and wellness, they are actively seeking drinks that offer additional benefits beyond simple hydration. Matcha tea, known for its high antioxidant content, natural energy boost, and stress-relieving properties, has gained significant popularity among health-conscious consumers.

One key driver behind this trend in the matcha tea industry is the growing demand for natural energy boosters. Many consumers are turning away from high-caffeine, sugar-laden energy drinks due to concerns about side effects, such as energy crashes and jitters. In contrast, matcha provides a sustained energy release due to its combination of caffeine and L-theanine, which simultaneously enhances focus and relaxation. This makes it an appealing choice for students, professionals, and athletes looking for a clean, plant-based energy source.

The rise of functional and adaptogenic beverages has also played a crucial role in the growth of matcha. Consumers now prioritize drinks that support immune health, mental clarity, digestion, and metabolism. Matcha tea is rich in catechins and polyphenols, which provide anti-inflammatory and metabolism-boosting benefits. Additionally, brands are introducing matcha-infused blends with other superfoods, such as turmeric, collagen, and ashwagandha, further expanding its appeal.

Another major factor driving demand in the matcha tea market is the increasing preference for plant-based and clean-label products. Consumers are actively seeking organic, sustainably sourced, and additive-free beverages. Since matcha tea is naturally vegan, gluten-free, and free from artificial preservatives, it aligns perfectly with these expectations. Consumers are also showing interest in ethically sourced matcha, preferring brands that emphasize fair trade and eco-friendly packaging.

Product innovation is significantly boosting the growth of the market for matcha tea by introducing diverse flavors and convenient formats that cater to evolving consumer preferences. Manufacturers are expanding their offerings beyond traditional matcha to include ready-to-drink (RTD) options and unique flavor combinations.

Format matters because it makes the functional benefits of matcha more easily accessible. For a busy person, mixing a sachet or grabbing an RTD is far more likely than starting a full tea ritual with bowl and whisk. Thus, format innovation serves adoption, not just packaging.

While traditional unflavored matcha remains popular among health-conscious consumers, flavored variations are attracting new demographics. Some of the most sought-after flavors include vanilla matcha, which adds a creamy, aromatic twist; chocolate matcha, which blends cacao with matcha’s natural bitterness; and berry-infused matcha, incorporating fruits like blueberry, raspberry, and acai for a sweet-tart balance. Additionally, coconut matcha is gaining traction among dairy-free consumers, while spiced matcha variations with turmeric, ginger, and cinnamon appeal to those seeking functional wellness benefits. Honey and caramel matcha are also becoming popular for their naturally sweetened profiles. In December 2024, Zarraffa’s Coffee introduced a new matcha range, featuring a variety of matcha-infused beverages to cater to the growing demand for green tea flavors. Their lineup includes matcha fusion, iced matcha fusion, and matcha latte, offering a balance of smooth, earthy matcha with creamy textures. This launch reflects the rising popularity of matcha, driven by its health benefits and unique taste.

Consumer Insights for Matcha Tea Market

Matcha tea has witnessed a significant rise in popularity among consumers in recent years, both in its traditional form and as a flavored beverage. This growing demand is largely driven by its numerous health benefits, unique flavor profile, and increasing visibility in the wellness and social media space.

Matcha is particularly rich in antioxidants, such as epigallocatechin gallate (EGCG), which supports cardiovascular health, and L-theanine, an amino acid known for promoting relaxation and enhancing mental clarity. Unlike coffee, matcha provides a sustained energy boost without causing jitters, making it an attractive alternative for health-conscious individuals seeking both functional benefits and enjoyable flavors.

Nature Insights

The conventional segment led the matcha tea industry, accounting for the largest revenue share of 58.6% in 2025. The consumer demand for conventional matcha tea is growing due to factors such as affordability, a stronger flavor profile, and greater versatility. Conventional matcha is more cost-effective compared to organic variants, making it a more accessible and economical option for regular consumption. Its rich flavor appeals to consumers who prefer a traditional tea experience, while its ability to blend seamlessly into various drinks enhances its overall popularity. The growing popularity of tea-based beverages and innovations in matcha tea offerings at the global level further drive the product demand. According to a report published by the Food and Agriculture Organization of the United Nations, global tea consumption increased by approximately 2.0% in 2022 compared to 2021. In addition, over the last decade, the world tea intake increased annually by 3.3%.

The organic segment is projected to grow at the fastest CAGR of 8.4% from 2026 to 2033. Organic matcha tea is a finely ground powder made from shade-grown green tea leaves cultivated without synthetic fertilizers, pesticides, or chemicals. Unlike regular green tea, matcha uses the entire leaf, offering higher levels of antioxidants, vitamins, and amino acids such as L-theanine. Its organic certification ensures eco-friendly farming practices, making it a healthier and more sustainable beverage choice. Furthermore, rising global health awareness and growing interest in natural, antioxidant-rich beverages are driving product demand. Consumers value its energy-boosting and stress-reducing properties, which are derived from caffeine and L-theanine. Increasing health consciousness is also encouraging people to replace sugary and processed beverages with natural and functional options, such as organic matcha. The rise of vegan, clean-label, and plant-based lifestyles has further made organic matcha a preferred choice among consumers worldwide.

Product Insights

The powder segment led the matcha tea market, accounting for the largest global revenue share of 59.1% in 2025. Powdered matcha tea offers numerous health benefits, including a high antioxidant content, improved metabolism, and enhanced mental focus, due to the combination of caffeine and L-theanine. Since the whole tea leaf is consumed in powdered form, it provides more nutrients, including vitamins A, C, and E, making it a powerful superfood for modern health-conscious consumers.

Powdered matcha is highly versatile and is widely used in smoothies, bakery products, confectionery, ice creams, and dairy alternatives such as matcha-flavored yogurt and lattes. In the foodservice sector, it has become a popular ingredient in cafés and restaurants, appealing to consumers seeking both taste and wellness in their beverages and desserts. The powdered form also allows easy blending in both hot and cold recipes, making it suitable for use in ready-to-drink formats, dietary supplements, and energy mixes.

The ready-to-drink (RTD) service segment is expected to register faster growth during the forecast period, with a CAGR of 9.7% from 2026 to 2033. Ready-to-drink (RTD) matcha tea is gaining strong traction worldwide due to its convenience, functional health benefits, and alignment with the growing demand for natural and clean-label beverages. It offers the same antioxidant-rich and energy-boosting properties as traditional matcha but in an easily consumable format, catering to busy, health-conscious consumers. The combination of caffeine and L-theanine in RTD matcha provides sustained energy and focus, making it a preferred alternative to coffee and sugary soft drinks.

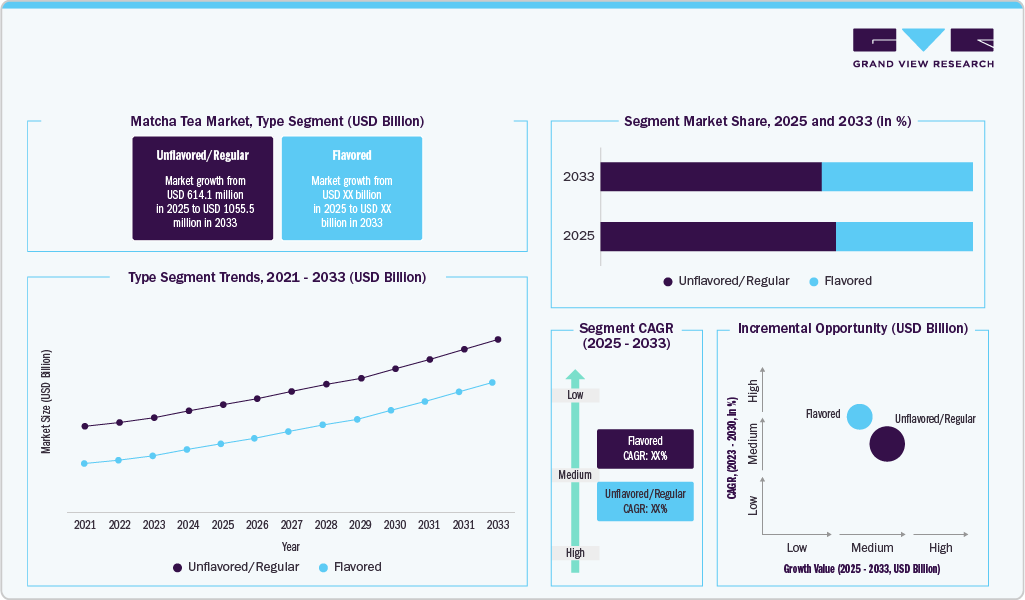

Type Insights

The unflavored/regular accounted for the highest share of 63.6% of the global revenue in 2025, driven by rising consumer awareness of its extensive health benefits and growing preference for natural, minimally processed products. Health-conscious consumers worldwide are turning toward clean, functional beverages that promote energy, focus, and overall well-being. Unflavored matcha, rich in antioxidants, catechins, and L-theanine, has gained popularity as a pure and nutrient-dense option that supports metabolism, mental clarity, and immunity. As global lifestyles shift toward holistic wellness, consumers are increasingly opting for unflavored matcha to experience its authentic taste and full nutritional value, free from additives or sweeteners.

The global market for flavored matcha tea is experiencing robust growth, driven by the rising consumer focus on health, wellness, and flavor innovation. Consumers worldwide are increasingly seeking beverages that combine functional health benefits with enjoyable taste profiles. While traditional matcha is valued for its rich antioxidant content, metabolism-boosting effects, and mental clarity support through L-theanine, its naturally earthy flavor can be intense for some consumers. Flavored matcha, enhanced with natural ingredients such as vanilla, honey, mint, or fruit extracts, offers a more approachable taste, expanding its appeal to a wider audience.

Price Range Insights

The mid-range matcha tea segment led the matcha tea market, with the largest revenue share of 45.9% in 2025, driven by rising consumer awareness and demand for affordable yet high-quality products. The economy segment is expanding rapidly as it offers cost-effective matcha options that make the product accessible to a wider audience. Consumers across the globe are becoming increasingly health-conscious and price-sensitive, leading to a growing preference for affordable yet nutritious options such as matcha tea.

The premium segment is expected to grow at a CAGR of 8.5% from 2026 to 2033. The premium segment’s growth is driven by the rising consumer preference for high-quality, ceremonial-grade matcha that delivers superior taste, authenticity, and health benefits. As health-conscious consumers worldwide increasingly value purity, craftsmanship, and origin, the demand for premium matcha sourced from traditional Japanese tea-growing regions such as Uji and Nishio continues to rise. This global shift toward premium and artisanal beverages aligns with broader lifestyle trends emphasizing wellness, mindfulness, and authenticity.

Distribution Channel Insights

The offline distribution channel held the largest global market share of 64.5% in 2025,driven by the strong presence of traditional retail outlets, including supermarkets, hypermarkets, health food stores, and specialty tea shops. These brick-and-mortar stores continue to play a vital role in consumer purchasing decisions, as they allow buyers to physically evaluate products, read ingredient labels, and seek guidance from in-store experts. This tangible shopping experience builds brand trust and loyalty, particularly for premium and health-focused products like matcha tea.

The online segment is expected to register faster growth during the forecast period, with a CAGR of 10.6% from 2026 to 2033. A major driver behind the success of online platforms globally is their ability to reach diverse and geographically dispersed audiences. Through social media marketing, influencer collaborations, and targeted advertising, matcha brands effectively engage with consumers, educate them on product benefits, and build strong digital communities. Online sales also enable brands to implement subscription models, personalized recommendations, and loyalty programs, which encourage repeat purchases and brand loyalty among regular matcha consumers.

Regional Insights

The North America matcha tea market accounted for a substantial revenue share of 22.3% in 2025. The demand for matcha tea in North America has been steadily rising as consumers seek healthier, natural, and more functional beverage options. The growing wellness culture in the region, driven by increasing awareness of healthy foods, antioxidant-rich ingredients, and plant-based alternatives, is further propelling market growth. Cafés and restaurants across the U.S. and Canada have introduced creative matcha-based beverages to cater to this rising demand. Millennials and Gen Z consumers are particularly drawn to matcha for its vibrant color, social media appeal, and health halo. The increasing popularity of Japanese culture and wellness rituals has also made matcha a symbol of authenticity and mindfulness.

U.S. Matcha Tea Market Trends

The U.S. remains the largest market in North America, accounting for 82.3% of the region’s total revenue in 2025. Demand for matcha tea is growing steadily in the U.S. as consumers increasingly prioritize health, natural ingredients, and functional beverages. Matcha is valued for its high antioxidant levels, metabolism-supporting properties, and its ability to provide calm, sustained energy without the crash associated with coffee, making it an appealing choice for wellness-focused individuals. The rising preference for clean-label beverages and nutrient-dense alternatives is encouraging more U.S. consumers to incorporate matcha into their daily routines, further supporting market expansion.

Europe Matcha Tea Market Trends

The matcha tea industry in Europe held a significant revenue share of 17.3% in 2025. The increasing emphasis on clean-label and organic products is another major factor driving the market growth. Consumers are becoming more conscious about the ingredients used in their beverages and are actively seeking products that are natural, minimally processed, and free from artificial additives or preservatives. This growing awareness has led to a rising preference for matcha tea made from organically grown tea leaves, cultivated without the use of pesticides or chemicals. For instance, in October 2023, Clearspring Shop Limited launched a limited-edition Organic Japanese Okumidori Matcha - Ceremonial Grade in Europe, featuring sustainably grown, natural, and minimally processed premium-quality matcha sourced from Wazuka, Uji (Kyoto), Japan.

The Germany matcha tea market accounted for the largest revenue share of 22.2% in 2025, supported by strong consumer interest in premium, natural, and functional beverages. The country has a well-established tea-drinking culture, which has shifted toward healthier and antioxidant-rich alternatives such as matcha. Rising awareness of matcha’s benefits, including sustained energy, detoxification, and metabolic support, continues to fuel adoption. The expansion of specialty cafés, the growing availability of matcha-infused products, and the increasing influence of Japanese wellness trends have further strengthened market growth. Additionally, the preference for organic, clean-label, and low-sugar beverages aligns with Germany’s broader health-conscious consumer base.

Asia Pacific Matcha Tea Market Trends

The Asia Pacific matcha tea industry accounted for the largest revenue share of 51.2% in 2025. The region remains the largest and most influential market for matcha tea, owing to its deep cultural roots, growing health awareness, and the rapid modernization of traditional tea consumption patterns. Matcha has evolved from a ceremonial beverage into a mainstream health and lifestyle product across countries such as Japan, China, South Korea, India, Thailand, and Australia. Consumers in the region are increasingly turning toward functional beverages that offer both taste and wellness benefits, such as high antioxidant content and metabolism-boosting properties.

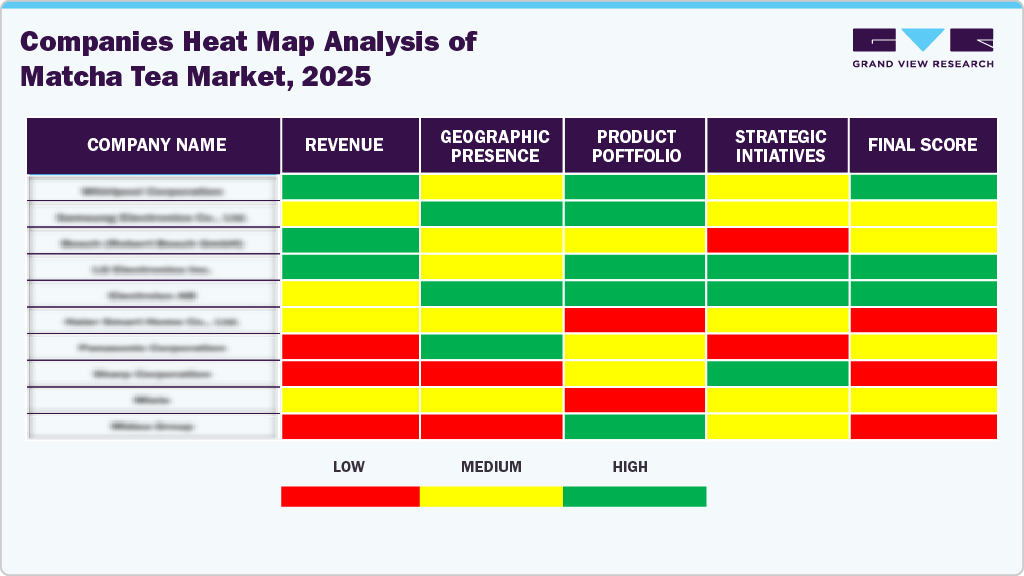

Key Matcha Tea Company Insights

Several leading brands in the matcha tea market have recognized significant growth potential across their portfolios and are implementing targeted strategies to leverage these opportunities. Companies are emphasizing novel product formats, increased personalization, and refined marketing initiatives that align with changing consumer habits and cultural trends. By focusing on niche segments and adapting to evolving demand patterns, these players are strengthening their market footprint and enhancing their competitive position on a global scale.

Key Matcha Tea Companies:

The following are the leading companies in the matcha tea market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- Tata Global Beverages Ltd.

- Lipton Teas and Infusions

- The AOI Tea Company

- Green Foods Corporation

- Marukyu-Koyamaen Co. Ltd.

- Encha

- Tenzo Tea, Inc.

- Aiya America Inc.

Recent Developments

-

In October 2025, PureHealth Research announced the launch of its new matcha green tea capsules supplement, a single-ingredient formula designed to deliver the benefits of authentic Japanese matcha. The simple, convenient capsule enables health-conscious consumers to incorporate the superfood into their daily routines without the complex preparation required for traditional matcha tea.

-

In May 2025, Zenkyu Matcha, a Tokyo-based wellness brand rooted in Zen philosophy and the Japanese tea ceremony, announces its global launch. With a mission to elevate matcha from a drink to a ritual for health and mindfulness, Zenkyu Matcha offers Japan's finest ceremonial matcha, made from first-harvest Kyoto leaves, blended by Japan's top tea master, and stone-ground using traditional methods.

-

In December 2024, Zarraffa’s Coffee introduced a new matcha range in Australia, featuring a variety of matcha-infused beverages to cater to the growing demand for green tea flavors. Their lineup includes Matcha Fusion, Iced Matcha Fusion, and Matcha Latte, offering a balance of smooth, earthy matcha with creamy textures. This launch reflects the rising popularity of matcha in Australia, driven by its health benefits and unique taste.

-

In October 2024, Aiya America, a leader in premium matcha products, launched its latest innovation: Sweetened Matcha Latte Pods. These convenient pods feature a smooth, high-quality Matcha blend with rich notes of vanilla, appealing to both Matcha enthusiasts and newcomers alike.

Matcha Tea Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 1,033.5 million

Revenue Forecast in 2033

USD 1,748.2 million

Growth rate

CAGR of 7.8% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, product, type, price range, distribution channel, and region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Nestlé S.A.; Tata Global Beverages Ltd.; Lipton Teas and Infusions; The AOI Tea Company; Green Foods Corporation; Marukyu-Koyamaen Co. Ltd.; Encha; Tenzo Tea, Inc.; ITO EN, LTD.; Aiya America Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Matcha Tea Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the matcha tea market report based on nature, product, type, price range, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2021 - 2033)

-

Organic

-

Conventional

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Powder

-

Ready-To-Drink (RTD)

-

Instant Premixes

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Unflavored/Regular

-

Flavored

-

-

Price Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-range

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global matcha tea market size was estimated at USD 965.8 million in 2025 and is expected to reach USD 1,033.5 million in 2026.

b. The global matcha tea market is expected to grow at a compound annual growth rate of 7.8% from 2026 to 2033 to reach USD 1,748.2 million in 2033.

b. Asia Pacific dominated the matcha tea market with a share of 51.2% in 2025. This is attributed to the growing population and health consciousness in countries such as Japan, China, India, Singapore, and Australia.

b. Some key players operating in the matcha tea market include The AOI Tea Company; Nestlé S.A., Tata Global Beverages Ltd, Lipton Teas and Infusions, Green Foods Corporation, Green Foods Corporation, Encha, Tenzo Tea, Inc., ITO EN, LTD, Aiya America Inc.

b. Key factors that are driving the market growth include rising awareness regarding health and fitness of the product coupled with gaining popularity of healthy beverages rich with antioxidants and vitamins.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.