- Home

- »

- Consumer F&B

- »

-

Meal Replacement Products Market, Industry Report, 2030GVR Report cover

![Meal Replacement Products Market Size, Share & Trends Report]()

Meal Replacement Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Powder, Ready-to-Drink, Protein Bar), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-580-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Meal Replacement Products Market Summary

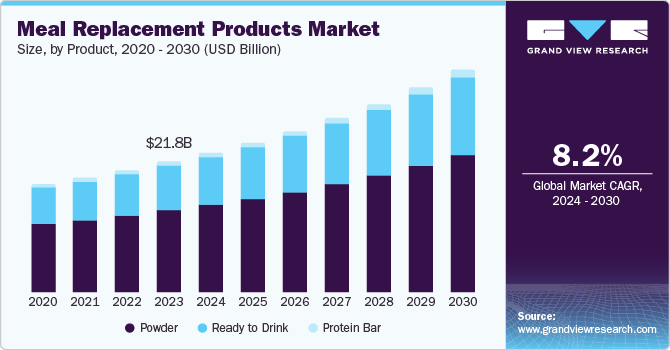

The global meal replacement products market size was valued at USD 21.75 billion in 2023 and is projected to reach USD 37.28 billion by 2030, growing at a CAGR of 8.2% from 2024 to 2030. The increasing prevalence of lifestyle-related ailments such as obesity, diabetes, and cardiovascular diseases has heightened consumer awareness about the importance of weight management and healthy eating habits.

Key Market Trends & Insights

- North America meal replacement products market dominated the global market with the largest revenue share of 43.6% in 2023.

- The U.S. meal replacement products market is expected to grow significantly over the forecast period.

- Based on product, the powder segment accounted for the largest revenue share of 62.8% in 2023.

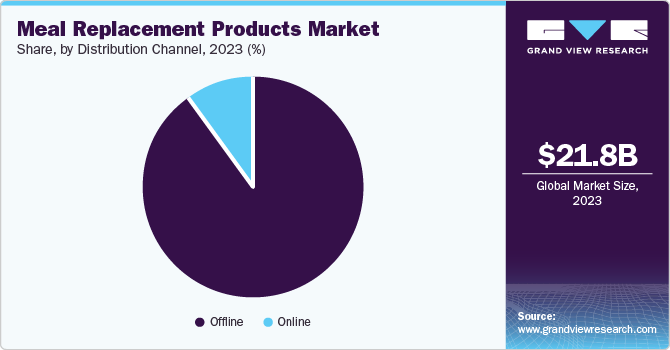

- Based on the distribution channel, the offline channel dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 18.25 billion

- 2030 Projected Market Size: USD 37.28 billion

- CAGR (2024-2030): 8.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market in 2023

This has led to a surge in demand for meal replacement products, which offer convenient and nutritionally balanced options for those looking to manage their weight or improve their overall health. The busy lifestyles and time constraints have made meal replacements an attractive alternative to traditional meals, providing a quick and easy solution for maintaining a healthy diet on the go. The rising disposable incomes and urbanization in various regions have also contributed to the market’s growth, as more people can afford and access these products. Furthermore, the growing popularity of plant-based meal replacements and the continuous innovation in product formulations to enhance taste and nutritional value are expected to expand the market.

The increasing fitness and wellness trend, particularly among millennials and Gen Z, is significantly boosting the demand for meal replacement products. These consumers are more inclined to maintain a healthy lifestyle and actively seek products that support their fitness goals. Furthermore, key industry players' increasing investment in marketing and promotional activities is helping to raise awareness and drive sales. Companies are leveraging social media, influencer partnerships, and targeted advertising campaigns to reach a broader audience and educate consumers about the benefits of meal replacement products.

Product Insights

The powder segment accounted for the largest revenue share of 62.8% in 2023. The convenience and versatility of powdered meal replacements make them popular among consumers, particularly those with busy lifestyles and fitness enthusiasts. These products are easy to store, have a long shelf life, and can be quickly prepared by mixing them with water or other liquids, making them an ideal option for on-the-go nutrition. The growing awareness of health and wellness has also increased the demand for meal replacements that support weight management and provide balanced nutrition.

The ready to drink segment is expected to grow at the fastest CAGR of 8.7% over the forecast period. The increasing consumer awareness about health and wellness leads to a higher demand for convenient, nutritious alternatives to traditional meat products. Environmental concerns and the desire to reduce carbon footprints motivate consumers to choose plant-based options. The advancements in food technology have also enabled manufacturers to create products with improved taste, texture, and nutritional profiles, making them more appealing to a broader audience. Furthermore, the rising popularity of vegan and vegetarian diets, particularly among younger generations, significantly contributes to the market’s expansion.

Distribution Channel

The offline channel dominated the market with the largest revenue share in 2023. Traditional retail outlets, such as supermarkets and specialty stores, continue to be the preferred choice for many consumers who value the ability to physically inspect products before purchasing. The established trust and familiarity with these offline channels also play a significant role in their sustained popularity. These stores' extensive distribution networks and strategic locations also ensure easy accessibility for a wide range of consumers, further bolstering their market share. Moreover, offline channels often provide personalized customer service and immediate product availability, key advantages over online shopping.

The online channel is expected to grow at the fastest CAGR over the forecast period. The increasing penetration of the internet and the widespread use of smartphones have made online shopping more accessible and convenient for consumers. Additionally, the COVID-19 pandemic has accelerated the shift towards e-commerce, as more people have become accustomed to the convenience of shopping from home. Online platforms also offer a wider variety of products and brands, often at competitive prices, which attracts a diverse customer base. Furthermore, advancements in logistics and delivery services have significantly improved the efficiency and reliability of online shopping, enhancing customer satisfaction. Integrating advanced technologies such as AI and machine learning in online retail has also personalized the shopping experience, making it more engaging and tailored to individual preferences. These factors collectively contribute to the robust growth of the online channel in the market.

Regional Insights

North America meal replacement products market dominated the global market with the largest revenue share of 43.6% in 2023. The region’s high consumer awareness and acceptance of meal replacement products, driven by a strong focus on health and wellness, play a crucial role. Additionally, the presence of major market players and their extensive distribution networks ensure the wide availability and accessibility of these products. The growing trend of busy lifestyles and the need for convenient, nutritious meal options further fuel the demand in North America. Moreover, the region’s advanced food technology and innovation capabilities contribute to developing high-quality meal replacement products that cater to diverse consumer preferences. These factors collectively reinforce North America’s leading position in the global market.

U.S. Meal Replacement Products Market Trends

The U.S. meal replacement products market is expected to grow significantly over the forecast period. Increasing health consciousness among consumers is driving the demand for convenient and nutritious meal options. The busy lifestyles of many Americans also contribute to the popularity of meal replacement products, as they offer a quick and easy solution for maintaining a balanced diet. Additionally, advancements in food technology have led to the development of more appealing and diverse meal replacement options, catering to a wide range of dietary preferences and needs. The growing trend of fitness and wellness, coupled with the influence of social media and health influencers, further boosts the market’s expansion. These factors collectively create a favorable environment for the robust growth of the U.S. meal replacement products market.

Europe Meal Replacement Products Market Trends

Europe's meal replacement products market is identified as a lucrative region. The region's growth is attributed to growing consumer awareness about health, fitness, and balanced nutrition, which is anticipated to drive market growth. Furthermore, the growing number of aging people in Europe and rising disposable income are anticipated to boost the demand for meal replacement products.

Asia Pacific Meal Replacement Products Market Trends

Asia Pacific meal replacement products market is expected to grow at the fastest CAGR of 9.8% over the forecast period. Rapid urbanization and the rise of a busy, fast-paced lifestyle among the working population are driving the demand for convenient, nutritious meal options, making meal replacements an attractive choice. Furthermore, rising disposable incomes in emerging economies such as China, India, and Japan are expected to drive market growth.

Key Meal Replacement Products Company Insights

Some key companies in the meal replacement products market include Soylent, Abbott Nutrition, Unilever, Nestle, Herbalife, and others. Companies are focusing on launching new flavors and increasing product ranges. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Abbott Nutrition plays a significant role in the meal replacement product market by offering various science-based nutritional solutions to support different health needs. It provides a wide range of products designed for infants, children, and adults, including specialized nutrition for those with specific health needs. The company’s most well-known meal replacement product is Ensure. This product offers balanced nutrition with essential vitamins and minerals, making it suitable for adults to maintain weight and improve nutrition.

-

Nestlé plays a significant role in the meal replacement market through its subsidiary, Nestlé Health Science. It offers a range of meal replacement products designed to provide balanced nutrition, support weight management, and promote healthier dietary choices.

Key Meal Replacement Products Companies:

The following are the leading companies in the meal replacement products market. These companies collectively hold the largest market share and dictate industry trends.

- Soylent

- Abbott Nutrition

- Unilever

- Nestle

- Herbalife

- SlimFast

- Wild Oats Markets

- Blue Diamond Growers

- General Mills

- Glanbia

Recent Developments

-

In September 2024, Arla, Danish dairy major, launched meal-replacement milk-based drinks range in Denmark. The new range will be rolled out in the Netherlands and England following its domestic launch.

-

In January 2024, global nutrition science leader Abbott introduced its new PROTALITY brand, a high-protein shake designed to aid adults in weight loss while preserving muscle mass and ensuring optimal nutrition.

Meal Replacement Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.30 billion

Revenue forecast in 2030

USD 37.28 billion

Growth Rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, and South Africa

Key companies profiled

Soylent; Abbott Nutrition; Unilever; Nestle; Herbalife; SlimFast; Wild Oats Markets; Blue Diamond Growers; General Mills; Glanbia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meal Replacement Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global meal replacement products market report based on product, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Ready to Drink

-

Protein Bar

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.