- Home

- »

- Consumer F&B

- »

-

Ready To Drink Shakes Market Size & Share Report, 2030GVR Report cover

![Ready To Drink Shakes Market Size, Share & Trends Report]()

Ready To Drink Shakes Market Size, Share & Trends Analysis Report By Packaging (Bottles, Cans, Tetra Pack), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-096-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Ready To Drink Shakes Market Trends

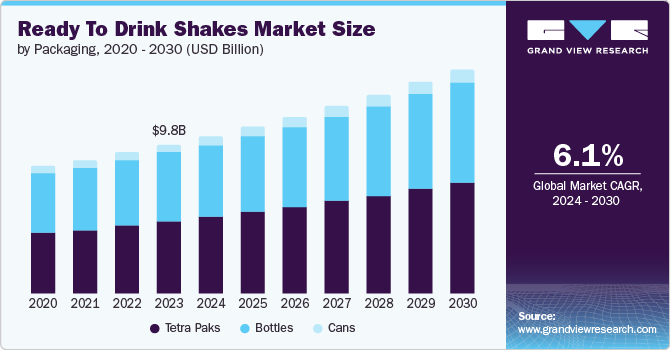

The global ready to drink shakes market size was valued at USD 9.81 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. Increasing awareness & focus on health & fitness and the growing inclination of customers towards healthy and easy to consume beverages are driving the market growth. Ready to drink shakes are convenient products and helps consumer with necessary nutrients as fast as possible. Modern lifestyle experiences a lot of pressure and has led to an increased demand for ready to eat food and beverages.

Protein is one of the most important nutrients that is used in the building of muscles, in weight loss programs and in general health. Most ready to drink shakes are protein based and are consumed by people especially those who exercise frequently, athletes, and those who want to add protein to their diet. Many ready to drink shakes producers are introducing new variants based on flavors, compositions, and packaging to attract customers.

Increased accessibility of ready to drink shakes due to the availability in supermarkets, convenience stores and online sales has propelled the market growth. Increased incidences of people shifting to vegan or plant-based diets for various reasons such as health, ethics, or the environment has created demand for vegan-friendly ready to drink shakes made from plant-based proteins such as soy, almond, or pea. Shakes can have extra functional ingredients like probiotics, antioxidants, fibers and superfoods for improved health.

Packaging Insights

The tetra pak segment dominated the market and accounted for a revenue share of 48.4% in 2023 and is expected to grow during the forecast period. This growth can be attributed to its convenience, sustainability and portability. Tetra pack is designed to protect the content from external factors such as light, air and moisture, thereby extending the shelf life of the product. Tetra pak offers a wide range of packaging sizes and shapes, allowing brands to cater to different consumer preferences and market segments effectively.

The cans segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. Cans are light proof, airtight, and moisture proof which are perfect to preserving the ready to drink shakes for a longer time. This longer shelf life also has a positive impact on consumers as they get an assurance of the freshness of food. Also, it reduces food waste and inventory management costs for manufacturers. Customers are now more aware of environmental problems and, therefore, are adopting more eco-friendly packaging methods.

Aluminum cans are easier to recycle and have a relatively lower impact on the environment than most packaging materials. Thus, the brands selecting the cans packaging can attract the customers concerned with the environmental issue and improve the image of their brands. Cans also have enough space for the company’s branding and marketing information, which makes it possible for firms to convey brand positioning and product attributes to the consumers.

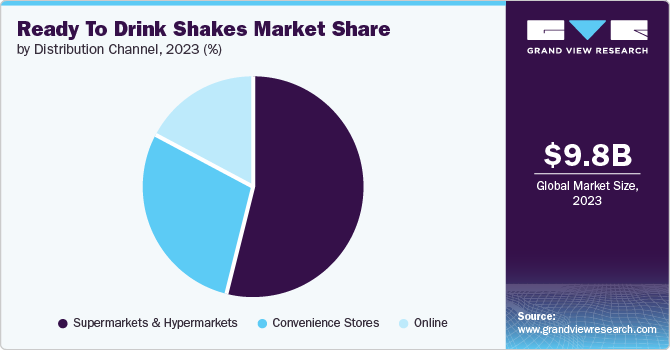

Distribution Channel Insights

The supermarkets & hypermarkets segment dominated the market and accounted for a revenue share of 48.4% in 2023 and is expected to grow rapidly during the forecast period. Changes in consumer behavior due to increasing urbanization and supermarket chains in urban and suburban areas are increasing the visibility, reach and sales of the ready to drink shakes.

The online segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. This is due to convenience, wider reach, increasing internet penetration and changing consumer behavior. The millennial and Gen Z consumers prefer easy and convenient shopping experiences which have contributed to the online segment growth. In addition, as the internet and smartphones become more widely used in the global market, more people are switching to online purchasing of their foods and drinks. Also, E-commerce platforms use promotional strategies including coupons, rebates, special promotions, and marketing initiatives to attract consumers.

Regional Insights & Trends

North America dominated the global ready to drink shakes market with a revenue share of 31.9% in 2023. It is attributed to increasing health consciousness and modern & busy lifestyle in this region. The region is home to many food and beverage companies that are continuously innovating and developing new flavors, formulations and packaging for ready to drink shakes.

U.S. Ready To Drink Shakes Market Trends

The ready to drink shakes market in the U.S. dominated the North America market in 2023. PepsiCo, one of the leading companies established in America, relaunched plant-based shakes under the name of Evolve.

Europe Ready To Drink Shakes Market Trends

Europe ready to drink shakes market was identified as a lucrative region in 2023 due to increasing health and nutrition awareness and availability of various products.

The UK ready-to-drink shakes market is expected to grow significantly in the coming years and it can be attributed to changing consumer preferences towards healthier options and continuous innovation in product development.

The Germany ready to drink shakes market held a substantial market share in 2023 owing to increasing busy lifestyle and convenience. Ready to drink shake offer a convenient and portable way to get a quick and nutritious meal or snack.

Asia Pacific Ready To Drink Shakes Market Trends

Asia Pacific ready to drink shakes market is anticipated to witness the fastest CAGR in the coming years. This growth is owing to the growing popularity of fitness activities, busy lifestyle, disposable income, evolving distribution channels such as online shopping.

Ready to drink shakes market in India is expected to grow rapidly from 2024 to 2030 due to, the increasing disposable income allowing customers to spend on premium and functional ready to shakes.

The Japan ready to drink shakes market is expected to grow rapidly in the coming years due to the rise in busy lifestyle and increasing consumers demand for quick and easy ways to get nutrients.

Key Ready To Drink Shakes Company Insights

Some of the key companies in the ready to drink shakes market include Nestlé S.A.; Soylent; Atkins Nutritionals, Inc.; Bolthouse Farms, Inc. and Huel Inc. Organizations in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

BELLRING BRANDS, INC. (BRBR) is focused on convenient nutrition. Its Premier Protein brand offers ready to drink shakes in various flavors, targeting consumers seeking protein for muscle building or health goals.

-

Vega specializes in plant-based nutrition products. It offers a variety of protein powders and shakes designed to support an active lifestyle. It offers Vega Protein+ shake which is a shake with 20-gram plant-based protein.

Key Ready To Drink Shakes Companies:

The following are the leading companies in the ready to drink shakes market. These companies collectively hold the largest market share and dictate industry trends.

- BELLRING BRANDS, INC. (BRBR)

- Nestlé S.A.

- PepsiCo

- Vega

- Starbucks Coffee Company

- OWYN

- Soylent

- Atkins Nutritionals, Inc.

- Bolthouse Farms, Inc.

- Huel Inc.

Recent Developments

-

In March 2024, BellRing Brands launched a new premier protein Cookie Dough High Protein Shake, expanding its flavor offerings. This offering ensure healthy and tasty choices for health conscious customers.

Ready To Drink Shakes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.83 billion

Revenue forecast in 2030

USD 14.77 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Packaging, distribution channel, region

Regional scope

North America, Europe, Asia Pacific

Country scope

U.S., UK, Germany, China, India

Key companies profiled

BELLRING BRANDS, INC. (BRBR); Nestlé S.A.; PepsiCo; Vega; Starbucks Coffee Company; OWYN; Soylent; Atkins Nutritionals, Inc.; Bolthouse Farms, Inc.; Huel Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ready to Drink Shakes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ready to drink shakes report based on packaging, distribution channel and region.

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Tetra Paks

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."