- Home

- »

- Medical Devices

- »

-

Mechanical Ventilator Market Size And Share Report, 2030GVR Report cover

![Mechanical Ventilator Market Size, Share & Trends Report]()

Mechanical Ventilator Market Size, Share & Trends Analysis Report By Product (Critical Care, Neonatal, Transport & Portable), By Ventilation Mode (Invasive, Non-invasive), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-543-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Mechanical Ventilator Market Size & Trends

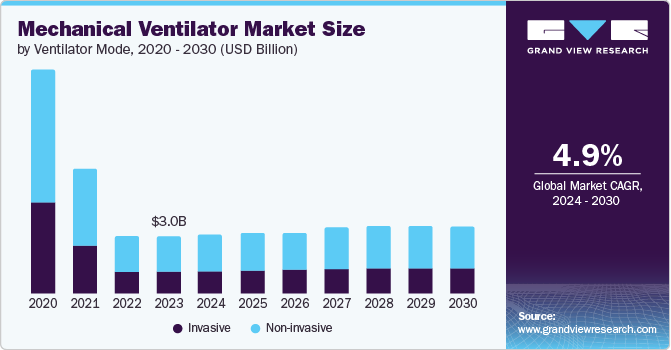

The global mechanical ventilator market size was estimated at USD 3.05 billion in 2023 and is projected to grow at a CAGR of 4.90% from 2024 to 2030. The increasing prevalence of chronic respiratory conditions such as chronic obstructive pulmonary disease (COPD), acute respiratory distress syndrome, asthma, obstructive sleep apnea, exertional dyspnea, and pulmonary embolism is fueling market growth. As of October 2023, National Council on Aging data indicates that Obstructive Sleep Apnea (OSA), characterized by irregular breathing and reduced oxygen supply to the brain, affects about 39 million adults in the U.S. and an estimated 936 million globally.

Furthermore, intensive research and development efforts focused on respiratory interventions and the introduction of innovative devices are anticipated to offer lucrative growth opportunities for the market in the coming years. Major players in the market are directing investments towards the development of cost-effective mechanical ventilators, with a favorable regulatory environment further facilitating market expansion. For instance, in July 2022 -Nihon Kohden OrangeMed, Inc. received U.S. FDA clearance for the NKV-330 Ventilator System. This system is non-invasive and provides respiratory support in emergencies.

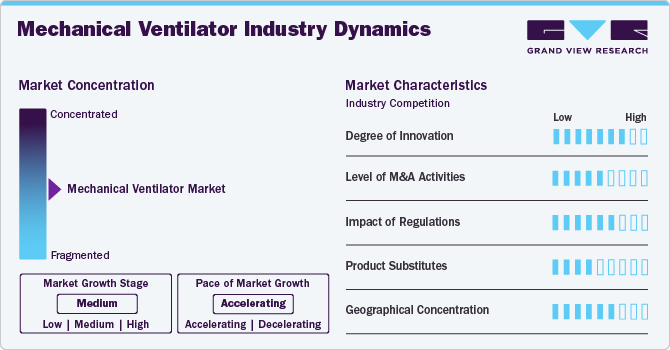

Market Concentration & Characteristics

The mechanical ventilator market is currently experiencing moderate growth with an accelerating pace, propelled by factors including a growing geriatric population, a substantial patient pool with respiratory disorders, and the introduction of technologically advanced devices. For example, in August 2023, Getinge received U.S. FDA clearance for its non-invasive wall gas-independent mechanical ventilator, Servo-air Lite.

In the mechanical ventilator market, a noteworthy emphasis has been placed on innovation to enhance patient comfort, compliance, efficacy, and overall treatment outcomes. The integration of smart technology and digital sensors plays a pivotal role in augmenting therapy management, contributing significantly to the market's momentum.

The market is witnessing an upswing in mergers and acquisitions, with companies strategically utilizing multiple acquisitions to bolster product portfolios, extend their global presence, diversify offerings, integrate technologies, and strengthen their positioning within the industry.

The prevalence of respiratory disorders globally introduces opportunities and competitive dynamics across various regions. Markets such as the United Kingdom (UK), Germany, France, Italy, and Spain are experiencing growth propelled by factors such as aging populations, lifestyle influences, healthcare reforms, and regulatory standardization. In contrast, the well-established markets in the U.S. and Canada exhibit high COPD prevalence rates and sophisticated healthcare systems.

Product Insights

The transport and portable mechanical ventilator segment held the largest market share in 2023 and is anticipated to grow at the fastest CAGR of 5.4% from 2024 to 2030. The market growth can be attributed to the efficiency of mechanical ventilators in various applications across diverse care delivery settings. The evolution of cost-effective, patient-friendly, and portable devices further fuels their increasing adoption. For instance, in May 2022, Max Ventilator introduced non-invasive ventilators featuring humidifiers and oxygen therapy capabilities, demonstrating versatility in applications for both adult and neonatal care.

Portable ventilators have diverse applications, ranging from home care to ambulatory centers. The market for point-of-care treatment is expanding, driven by an increase in medical emergencies, serving as a key factor for the growth of this segment. Hospitals are proactively promoting portable ventilators that facilitate swift and convenient patient care, ensuring seamless transitions from ambulances to hospital beds. Moreover, the accessibility of portable ventilators is fostering a trend toward home care, gaining popularity among patients seeking flexible healthcare options.

Ventilation Mode Insights

The non-invasive ventilation mode segment held the largest market share of 57.7% share in 2023. The segment is anticipated to witness the fastest growth at a CAGR of 5.1 from 2024 to 2030. The growth of the segment is attributed to its wide range of applications and its ability to provide precise and higher concentrations of oxygen. The delivery of non-invasive ventilation is made possible with advanced intensive care ventilators that offer various respiratory support modes.

Extensive research and development investments, combined with rising per capita income, are driving the growth of the healthcare sector. The surge in the prevalence of respiratory diseases is a key factor fueling the overall market growth for Continuous Positive Airway Pressure (CPAP) devices. These devices are crucial in emergency settings and hospitals, serving as an efficient oxygen source for patients facing respiratory challenges. Furthermore, CPAP devices provide vital oxygen support to patients undergoing heart treatments. These factors collectively contribute to the anticipated market growth over the forecast period.

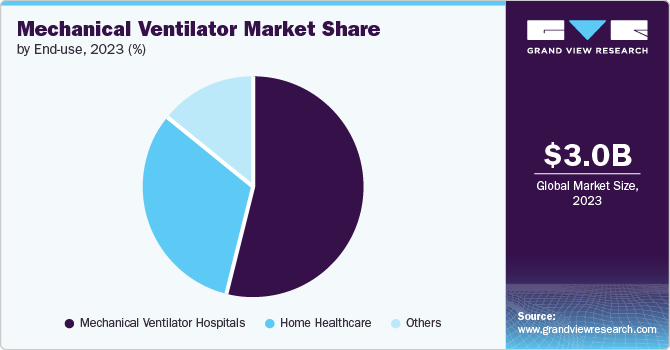

End-use Insights

In 2023, the hospitals segment held the largest market share, owing to hospitals' increasing expenditure on technologically advanced ventilators. Furthermore, the availability of skilled healthcare providers to operate these ventilators and the emphasis on better health outcomes contributed to the segment growth. In addition, patients are more likely to prefer healthcare facilities that offer constant monitoring from hospital staff, which further boosts the market growth.

Moreover, the home healthcare segment is expected to witness the fastest growth from 2024 to 2030, owing to the increasing number of government initiatives aimed at curbing healthcare expenditures by promoting home healthcare to support market growth. In addition, value-based healthcare is another major factor contributing to market growth. In the U.S., Medicare reimbursements are highly favorable in providing value-based healthcare for improved patient outcomes at a low cost.

Regional Insights

North America mechanical ventilator market dominated globally with a revenue share of over 43.21% in 2023. The increasing prevalence of respiratory conditions, such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and sleep apnea, is driving the therapeutic respiratory devices market in the region. According to the American Lung Association, 11.7 million people, which is 4.6% of adults, reported a diagnosis of COPD (chronic obstructive pulmonary disease, chronic bronchitis, or emphysema in 2022. Moreover, key market players, such as GE Healthcare; CAIRE, Inc.; Koninklijke Philips N.V.; Invacare, Medtronic, and React Health, are employing strategies, such as acquisitions, collaborations, expansions, & new product launches, to extend their product offerings and geographical reach.

U.S. Mechanical Ventilator Market Trends

The mechanical ventilator market in the U.S. is driven by several key factors, including a high prevalence of chronic respiratory diseases such as COPD and asthma, an aging population, and advancements in healthcare infrastructure. According to an article published by the American Lung Association in February 2023, over 34 million U.S. individuals suffer from chronic lung diseases, including COPD, asthma, chronic bronchitis, and emphysema. The COVID-19 pandemic has also heightened the demand for ventilators, leading to rapid innovation and production scaling. Advanced technologies like AI are being integrated for monitoring and predictive analytics, and portable ventilator models are being developed for various healthcare settings.

Europe Mechanical Ventilator Market Trends

Europe mechanical ventilator market, particularly in the UK, is shaped by stringent regulatory requirements, technological advancements, and a growing elderly population. There is a notable emphasis on developing ventilators that are energy-efficient, environmentally friendly, and capable of providing personalized patient care. The Medical Device Regulations (MDR), which came into effect in May 2021, harmonizes the regulation of medical devices across the European Union (EU). It sets stringent requirements for the safety, performance, and quality of mechanical ventilators and other medical devices. Manufacturers must comply with detailed technical documentation, clinical evaluation, and post-market surveillance requirements to obtain and maintain CE marking.

Asia Pacific Mechanical Ventilator Market Trends

The mechanical ventilator market in the Asia Pacific region is anticipated to witness significant growth at a CAGR of 7.0% over the forecast period. The segment growth is attributed to the high burden of respiratory disorders and the high risk of lifestyle factors such as smoking and allergies resulting in several respiratory conditions. According to the World Health Organization, China has one of the highest smoking populations in the world, with over 300 million smokers, contributing significantly to respiratory health issues. This has driven a robust demand for mechanical ventilators capable of providing both invasive and non-invasive ventilation support. In addition, government initiatives to boost ventilator production and collaborations between manufacturers to create advanced ventilators to meet high demand are also propelling the region’s growth.

The Japan mechanical ventilator market is anticipated to grow due to the demand for advanced ventilator technologies that improve patient outcomes and operational efficiency, driven by an aging population and high healthcare standards in the region. According to the Population Reference Bureau, in 2021, over 28% of Japan's population was aged 65 or older, creating a substantial demand for healthcare solutions that cater to age-related respiratory conditions and critical care needs. This demographic shift compels healthcare providers to adopt advanced ventilators equipped with features like non-invasive ventilation modes, high-flow oxygen therapy, and integrated monitoring systems to enhance patient care and manage complex respiratory cases more effectively.

Key Companies & Market Share Insights

The competitive landscape of the mechanical ventilator industry features key players such as ResMed, Koninklijke Philips N.V., and Fisher & Paykel Healthcare. These industry leaders are actively engaged in strategic initiatives, including mergers and acquisitions, to strengthen their market positions.

A notable example is the partnership formed in August 2023 between Medline, a prominent U.S.-based medical supplies and devices manufacturer, and Flight Medical, an Israeli respiratory device manufacturer. Within this collaboration, Medline exclusively offers the Flight 60 transportable ventilator. This advanced device seamlessly transitions between invasive and non-invasive ventilation modes, addressing the ventilation needs of high-acuity patients. Notably, the ventilator's portability and durability make it suitable for a diverse range of patients, from pediatric to adult cases.

“This collaboration will make an impact in addressing ventilator availability in the industry and, most importantly, help our providers improve patient care. By joining forces with Flight Medical, we strengthen our respiratory portfolio to meet the needs of customers across the continuum of care.”- Brian Groskopf, Senior Director, Product Management, Medline

Key Mechanical Ventilator Company Insights

Key players in the market employ various strategies, including mergers and acquisitions, product launches, expansion into emerging economies, and enhancing service networks, to strengthen their market positions. For instance, the partnership formed in August 2023 between Medline, a prominent U.S.-based medical supplies and devices manufacturer, and Flight Medical, an Israeli respiratory device manufacturer. Within this collaboration, Medline exclusively offers the Flight 60 transportable ventilator. This advanced device seamlessly transitions between invasive and non-invasive ventilation modes, addressing the ventilation needs of high-acuity patients. Notably, the ventilator's portability and durability make it suitable for a diverse range of patients, from pediatric to adult cases.

Exit Strategies of Key Market Players

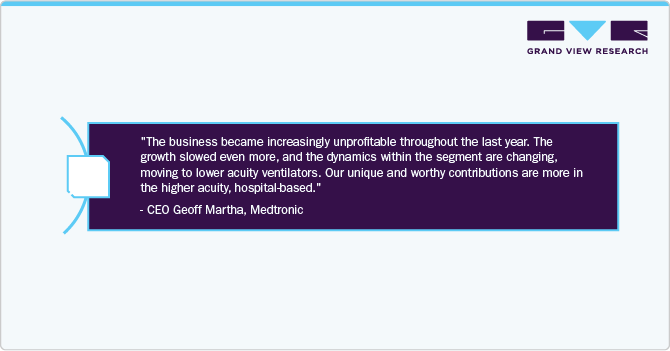

Medtronic

-

In October 2022, Medtronic decided to separate its respiratory interventions (PMRI) and patient monitoring businesses from the ventilator market. The decision was made due to the company's significant expansion during the COVID-19 pandemic, which led to ventilator shortages.

-

Later, Medtronic recognized that the spinoff plan no longer benefited the firm. Therefore, in February 2024, Medtronic announced to exit the ventilator business and merge its Patient Monitoring and Respiratory Interventions (PMRI) segments into a new unit called Acute Care and Monitoring (ACM).

Medtronic Strategy

-

Despite ceasing new sales, Medtronic will continue to honor existing contracts for ventilators. This ensures that their current customers and patients relying on these devices are not abruptly affected.

-

By discontinuing the unprofitable ventilator line, Medtronic reallocated resources, both financial and operational, to other segments within the ACM unit. This move is expected to enhance investment in areas with better growth potential and higher profitability.

Koninklijke Philips N.V.

-

In January 2024, Koninklijke Philips N.V. announced the discontinuation of select respiratory products in the U.S. and its territories, including the ventilators, SimplyGo Mini, SimplyGo, and Everflo oxygen concentrators. This decision is expected to bring notable shifts in the ventilators market. According to a survey poll conducted by HME News in February 2024, approximately 70% of respondents believe that Philips' withdrawal from a significant portion of the U.S. respiratory market will have a considerable influence on the industry.

-

While the discontinuation of respiratory products by Philips Respironics indicates a significant development in the mechanical ventilators industry, it also presents opportunities for other market players to innovate and expand their presence.

Recent Developments

-

In January 2023, Getinge launched its latest mechanical ventilator, the Servo-c, which provides lung-protective therapeutic capabilities for pediatric and adult patients. The Servo-c utilizes modular parts, facilitating intelligent fleet management. This ensures optimal uptime and reduces costs, eliminating the necessity for proprietary disposables. Moreover, the Servo-c is equipped with CO2 monitoring and Servo Compass technology.

“Lung protection challenges come in many shapes and sizes. That is why Servo-c is designed for safe, easy and efficient use that enables personalized respiratory treatments. With the essential functionalities provided, it is ideal for hospitals in the targeted markets looking for a high acuity ventilator at an affordable price point.”

- Elin Frostehav, President of Acute Care Therapies, Getinge

- In October 2021, Movair, a respiratory therapy company, launched Luisa, an advanced ventilator designed for diverse settings such as homes, hospitals, institutions, and portable applications. The U.S. commercial launch of Luisa comes in response to the growing demand for reliable and safe ventilators. Luisa is eligible for use under the FDA's Emergency Use Authorization.

Key Mechanical Ventilator Companies

The following are the leading companies in the mechanical ventilators market. These companies collectively hold the largest market share and dictate industry trends.

Prominent players

Notable Players Exist

Filed Bankruptcy Player

- Abbott

- Boston Scientific Corporation

- BIOTRONIK

- MicroPort Scientific Corporation

- Stryker

- ResMed

- Fisher & Paykel Healthcare Limited

- Drägerwerk AG & Co. KGaA

- Getinge AB

- ZOLL Medical Corporation (Asahi Kasei Corporation)

- Air Liquide

- VYAIRE MEDICAL, INC.

- GE Healthcare

- Hamilton Medical

- Smiths Group plc

- Allied Medical LLC (A Flexicare Company)

- aXcent Medical GmbH

- Metran Co., Ltd

- MAGNAMED

- Avasarala Technologies Limited

- Airon Corporation

- Bio-Med Devices

- Hill-Rom (Baxter)

- HEYER Medical AG

- Leistung Engineering Pvt. Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- NIHON KOHDEN CORPORATION

- Schiller AG

- Koninklijke Philips N.V.(January, 2024)

- Medtronic

(February, 2024) - Teleflex Incorporated (June, 2021)

Vyaire Medical, Inc.

Mechanical Ventilation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.17 billion

Revenue forecast in 2030

USD 4.22 billion

Growth rate

CAGR of 4.90 % from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors and trends, clinical trials outlook, volume analysis

Segments covered

Product, ventilation mode, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Abbott;; Boston Scientific Corporation; BIOTRONIK; MicroPort Scientific Corporation; Koninklijke Philips N.V.; Stryker; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; NIHON KOHDEN CORPORATION; Schiller AG; ResMed; Fisher & Paykel Healthcare Limited; Drägerwerk AG & Co. KGaA; Getinge AB; ZOLL Medical Corporation (Asahi Kasei Corporation); Air Liquide; VYAIRE MEDICAL, INC.; GE Healthcare; Hamilton Medical; Smiths Group plc; Allied Medical LLC (A Flexicare Company); aXcent Medical GmbH; Metran Co., Ltd; MAGNAMED; Avasarala Technologies Limited; Airon Corporation; Bio-Med Devices; Hill-Rom (Baxter); HEYER Medical AG; Leistung Engineering Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mechanical Ventilator Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mechanical ventilator market report based on product, ventilation mode, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Critical Care

-

Ventilators

-

Accessories

-

-

Neonatal

-

Ventilators

-

Accessories

-

-

Transport & Portable

-

Ventilators

-

Accessories

-

-

Others

-

-

Ventilation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Invasive

-

Non-invasive

-

CPAP

-

BiPAP

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical Ventilator Hospitals

-

Home healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe (EU) (RoE)

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific (RoAPAC)

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America (RoLA)

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa (RoMEA)

-

-

Frequently Asked Questions About This Report

b. The global mechanical ventilator market size was estimated at USD 3.05 billion in 2023 and is expected to reach USD 3.17 billion in 2024.

b. The global mechanical ventilator market is expected to witness a compound annual growth rate of 4.90% from 2024 to 2030 to reach USD 4.22 billion by 2030.

b. Critical care ventilators are expected to account for over 38.0% of the overall mechanical ventilator market share by 2023, owing to technological advancements, such as Spontaneous Breathing Trial (SBT) and AutoTrak.

b. Some of the key players operating in the mechanical ventilator market include Medtronic; Abbott;; Boston Scientific Corporation; BIOTRONIK; MicroPort Scientific Corporation; Koninklijke Philips N.V.; Stryker; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; NIHON KOHDEN CORPORATION; Schiller AG; ResMed; Fisher & Paykel Healthcare Limited; Drägerwerk AG & Co. KGaA; Getinge AB; ZOLL Medical Corporation (Asahi Kasei Corporation); Air Liquide; VYAIRE MEDICAL, INC.; GE Healthcare; Hamilton Medical; Smiths Group plc; Allied Medical LLC (A Flexicare Company); aXcent Medical GmbH; Metran Co., Ltd; MAGNAMED; Avasarala Technologies Limited; Airon Corporation; Bio-Med Devices; Hill-Rom (Baxter); HEYER Medical AG; Leistung Engineering Pvt. Ltd.

b. The U.S. mechanical ventilator market is expected to witness a compound annual growth rate of 2.85% from 2024 to 2030.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product Type

1.2.2. End Use

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product Type outlook

2.2.2. Ventilator Mode Outlook

2.2.3. End Use Outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. Mechanical Ventilator Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing Prevalence Of Respiratory Diseases

3.2.1.2. Technological advancement

3.2.1.3. Increasing Number Of Government Initiatives

3.2.2. Market Restraint Analysis

3.2.2.1. Capital Intensive Nature

3.2.2.2. Product Recall And Failure

3.3. Mechanical Ventilator Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of the suppliers

3.3.1.2. Bargaining power of the buyers

3.3.1.3. Threats of substitution

3.3.1.4. Threats from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and Social landscape

3.3.2.3. Technological landscape

3.4. Impact of COVID-19 on mechanical ventilator market

3.5. Pricing Analysis, at Regional Level

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Latin America

3.5.5. MEA

3.6. Unmet Need in the Market, at Regional Level

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Latin America

3.6.5. MEA

Chapter 4. Mechanical Ventilator Market: Product Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Mechanical Ventilator Market: Product Type Movement Analysis, USD Million, 2023 & 2030

4.2.1. Critical Care Ventilators

4.2.1.1. Critical Care Ventilators Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.1.2. Ventilators

4.2.1.2.1. Ventilators Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.1.3. Accessories

4.2.1.3.1. Accessories Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.2. Neonatal

4.2.2.1. Neonatal Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.2.2. Ventilators

4.2.2.2.1. Ventilators Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.2.3. Accessories

4.2.2.3.1. Accessories Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.3. Transport And Portable Ventilators

4.2.3.1. Transport And Portable Ventilators Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.3.2. Ventilators

4.2.3.2.1. Ventilators Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.3.3. Accessories

4.2.3.3.1. Accessories Market Estimates And Forecasts, 2018 - 2030(USD Billion)

4.2.4. Other Ventilators

4.2.4.1. Other Ventilators Market Estimates And Forecasts, 2018 - 2030(USD Billion)

Chapter 5. Mechanical Ventilators Market: Ventilation Mode Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Mechanical Ventilator Market: Ventilation Mode Movement Analysis, USD Million, 2023 & 2030

5.2.1. Invasive

5.2.1.1. Invasive Market Estimates And Forecasts, 2018 - 2030(USD Billion)

5.2.2. Non-Invasive

5.2.2.1. Non-Invasive Market Estimates And Forecasts, 2018 - 2030(USD Billion)

5.2.2.2. Non-Invasive Market Estimates And Forecasts, 2018 - 2030(USD Billion)

5.2.2.3. Continuous Positive Airway Pressure (CPAP)

5.2.2.3.1. CPAP Market Estimates And Forecasts, 2018 - 2030(USD Billion)

5.2.2.4. Bilevel Positive Airway Pressure (BPAP)

5.2.2.4.1. BPAP Market Estimates And Forecasts, 2018 - 2030(USD Billion)

5.2.2.5. Others

5.2.2.5.1. Others Market Estimates And Forecasts, 2018 - 2030(USD Billion)

Chapter 6. Mechanical Ventilator Market: End Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Mechanical Ventilator Market: End Use Movement Analysis, USD Million, 2023 & 2030

6.2.1. Hospitals

6.2.1.1. Hospitals Market Estimates And Forecasts, 2018 - 2030(USD Billion)

6.2.2. Home Healthcare

6.2.2.1. Home Healthcare Market Estimates And Forecasts, 2018 - 2030(USD Billion)

6.2.3. Others

6.2.3.1. Others Market Estimates And Forecasts, 2018 - 2030(USD Billion)

Chapter 7. Mechanical Ventilator Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Global Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

7.5. North America

7.5.1. U.S.

7.5.1.1. Key country dynamics

7.5.1.2. Regulatory framework/ reimbursement structure

7.5.1.3. Competitive scenario

7.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

7.5.2. Canada

7.5.2.1. Key country dynamics

7.5.2.2. Regulatory framework/ reimbursement structure

7.5.2.3. Competitive scenario

7.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Key country dynamics

7.5.3.2. Regulatory framework/ reimbursement structure

7.5.3.3. Competitive scenario

7.5.3.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

7.6. Europe

7.6.1. UK

7.6.1.1. Key country dynamics

7.6.1.2. Regulatory framework/ reimbursement structure

7.6.1.3. Competitive scenario

7.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

7.6.2. Germany

7.6.2.1. Key country dynamics

7.6.2.2. Regulatory framework/ reimbursement structure

7.6.2.3. Competitive scenario

7.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

7.6.3. France

7.6.3.1. Key country dynamics

7.6.3.2. Regulatory framework/ reimbursement structure

7.6.3.3. Competitive scenario

7.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

7.6.4. Italy

7.6.4.1. Key country dynamics

7.6.4.2. Regulatory framework/ reimbursement structure

7.6.4.3. Competitive scenario

7.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

7.6.5. Spain

7.6.5.1. Key country dynamics

7.6.5.2. Regulatory framework/ reimbursement structure

7.6.5.3. Competitive scenario

7.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

7.6.6. Norway

7.6.6.1. Key country dynamics

7.6.6.2. Regulatory framework/ reimbursement structure

7.6.6.3. Competitive scenario

7.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

7.6.7. Sweden

7.6.7.1. Key country dynamics

7.6.7.2. Regulatory framework/ reimbursement structure

7.6.7.3. Competitive scenario

7.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

7.6.8. Denmark

7.6.8.1. Key country dynamics

7.6.8.2. Regulatory framework/ reimbursement structure

7.6.8.3. Competitive scenario

7.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

7.7. Asia Pacific

7.7.1. Japan

7.7.1.1. Key country dynamics

7.7.1.2. Regulatory framework/ reimbursement structure

7.7.1.3. Competitive scenario

7.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

7.7.2. China

7.7.2.1. Key country dynamics

7.7.2.2. Regulatory framework/ reimbursement structure

7.7.2.3. Competitive scenario

7.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

7.7.3. India

7.7.3.1. Key country dynamics

7.7.3.2. Regulatory framework/ reimbursement structure

7.7.3.3. Competitive scenario

7.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

7.7.4. Australia

7.7.4.1. Key country dynamics

7.7.4.2. Regulatory framework/ reimbursement structure

7.7.4.3. Competitive scenario

7.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

7.7.5. South Korea

7.7.5.1. Key country dynamics

7.7.5.2. Regulatory framework/ reimbursement structure

7.7.5.3. Competitive scenario

7.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

7.7.6. Thailand

7.7.6.1. Key country dynamics

7.7.6.2. Regulatory framework/ reimbursement structure

7.7.6.3. Competitive scenario

7.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

7.8. Latin America

7.8.1. Brazil

7.8.1.1. Key country dynamics

7.8.1.2. Regulatory framework/ reimbursement structure

7.8.1.3. Competitive scenario

7.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

7.8.2. Argentina

7.8.2.1. Key country dynamics

7.8.2.2. Regulatory framework/ reimbursement structure

7.8.2.3. Competitive scenario

7.8.2.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

7.9. MEA

7.9.1. South Africa

7.9.1.1. Key country dynamics

7.9.1.2. Regulatory framework/ reimbursement structure

7.9.1.3. Competitive scenario

7.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

7.9.2. Saudi Arabia

7.9.2.1. Key country dynamics

7.9.2.2. Regulatory framework/ reimbursement structure

7.9.2.3. Competitive scenario

7.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

7.9.3. UAE

7.9.3.1. Key country dynamics

7.9.3.2. Regulatory framework/ reimbursement structure

7.9.3.3. Competitive scenario

7.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

7.9.4. Kuwait

7.9.4.1. Key country dynamics

7.9.4.2. Regulatory framework/ reimbursement structure

7.9.4.3. Competitive scenario

7.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Exit Strategies of Existing Market Players And Their Impact On Market Competitors

8.3.1. Koninklijke Philips N.V.(January, 2024)

8.3.2. Medtronic (February, 2024)

8.3.3. Teleflex Incorporated (June, 2021)

8.4. Vendor Landscape

8.4.1. Key company market share analysis, 2023

8.4.2. Medtronic

8.4.2.1. Company overview

8.4.2.2. Financial performance

8.4.2.3. Product benchmarking

8.4.2.4. Strategic initiatives

8.4.3. Abbott

8.4.3.1. Company overview

8.4.3.2. Financial performance

8.4.3.3. Product benchmarking

8.4.3.4. Strategic initiatives

8.4.4. Boston Scientific Corporation

8.4.4.1. Company overview

8.4.4.2. Financial performance

8.4.4.3. Product benchmarking

8.4.4.4. Strategic initiatives

8.4.5. BIOTRONIK

8.4.5.1. Company overview

8.4.5.2. Financial performance

8.4.5.3. Product benchmarking

8.4.5.4. Strategic initiatives

8.4.6. MicroPort Scientific Corporation

8.4.6.1. Company overview

8.4.6.2. Financial performance

8.4.6.3. Product benchmarking

8.4.6.4. Strategic initiatives

8.4.7. Koninklijke Philips N.V.

8.4.7.1. Company overview

8.4.7.2. Financial performance

8.4.7.3. Product benchmarking

8.4.7.4. Strategic initiatives

8.4.8. Stryker

8.4.8.1. Company overview

8.4.8.2. Financial performance

8.4.8.3. Product benchmarking

8.4.8.4. Strategic initiatives

8.4.9. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

8.4.9.1. Company overview

8.4.9.2. Financial performance

8.4.9.3. Product benchmarking

8.4.9.4. Strategic initiatives

8.4.10. NIHON KOHDEN CORPORATION

8.4.10.1. Company overview

8.4.10.2. Financial performance

8.4.10.3. Product benchmarking

8.4.10.4. Strategic initiatives

8.4.11. Schiller AG

8.4.11.1. Company overview

8.4.11.2. Financial performance

8.4.11.3. Product benchmarking

8.4.11.4. Strategic initiatives

8.4.12. ResMed

8.4.12.1. Company overview

8.4.12.2. Financial performance

8.4.12.3. Product benchmarking

8.4.12.4. Strategic initiatives

8.4.13. Fisher & Paykel Healthcare Limited

8.4.13.1. Company overview

8.4.13.2. Financial performance

8.4.13.3. Product benchmarking

8.4.13.4. Strategic initiatives

8.4.14. Drägerwerk AG & Co. KGaA

8.4.14.1. Company overview

8.4.14.2. Financial performance

8.4.14.3. Product benchmarking

8.4.14.4. Strategic initiatives

8.4.15. Getinge AB

8.4.15.1. Company overview

8.4.15.2. Financial performance

8.4.15.3. Product benchmarking

8.4.15.4. Strategic initiatives

8.4.16. ZOLL Medical Corporation (Asahi Kasei Corporation)

8.4.16.1. Company overview

8.4.16.2. Financial performance

8.4.16.3. Product benchmarking

8.4.16.4. Strategic initiatives

8.4.17. Air Liquide

8.4.17.1. Company overview

8.4.17.2. Financial performance

8.4.17.3. Product benchmarking

8.4.17.4. Strategic initiatives

8.4.18. VYAIRE MEDICAL, INC.

8.4.18.1. Company overview

8.4.18.2. Financial performance

8.4.18.3. Product benchmarking

8.4.18.4. Strategic initiatives

8.4.19. GE Healthcare

8.4.19.1. Company overview

8.4.19.2. Financial performance

8.4.19.3. Product benchmarking

8.4.19.4. Strategic initiatives

8.4.20. Hamilton Medical

8.4.20.1. Company overview

8.4.20.2. Financial performance

8.4.20.3. Product benchmarking

8.4.20.4. Strategic initiatives

8.4.21. Smiths Group plc

8.4.21.1. Company overview

8.4.21.2. Financial performance

8.4.21.3. Product benchmarking

8.4.21.4. Strategic initiatives

8.4.22. Allied Medical LLC (A Flexicare Company)

8.4.22.1. Company overview

8.4.22.2. Financial performance

8.4.22.3. Product benchmarking

8.4.22.4. Strategic initiatives

8.4.23. aXcent Medical GmbH

8.4.23.1. Company overview

8.4.23.2. Financial performance

8.4.23.3. Product benchmarking

8.4.23.4. Strategic initiatives

8.4.24. Metran Co., Ltd

8.4.24.1. Company overview

8.4.24.2. Financial performance

8.4.24.3. Product benchmarking

8.4.24.4. Strategic initiatives

8.4.25. MAGNAMED

8.4.25.1. Company overview

8.4.25.2. Financial performance

8.4.25.3. Product benchmarking

8.4.25.4. Strategic initiatives

8.4.26. Avasarala Technologies Limited

8.4.26.1. Company overview

8.4.26.2. Financial performance

8.4.26.3. Product benchmarking

8.4.26.4. Strategic initiatives

8.4.27. Airon Corporation

8.4.27.1. Company overview

8.4.27.2. Financial performance

8.4.27.3. Product benchmarking

8.4.27.4. Strategic initiatives

8.4.28. Bio-Med Devices

8.4.28.1. Company overview

8.4.28.2. Financial performance

8.4.28.3. Product benchmarking

8.4.28.4. Strategic initiatives

8.4.29. Hill-Rom (Baxter)

8.4.29.1. Company overview

8.4.29.2. Financial performance

8.4.29.3. Product benchmarking

8.4.29.4. Strategic initiatives

8.4.30. HEYER Medical AG

8.4.30.1. Company overview

8.4.30.2. Financial performance

8.4.30.3. Product benchmarking

8.4.30.4. Strategic initiatives

8.4.31. Leistung Engineering Pvt. Ltd.

8.4.31.1. Company overview

8.4.31.2. Financial performance

8.4.31.3. Product benchmarking

8.4.31.4. Strategic initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Leading Market Players Anticipated to Witness Highest Growth

Table 4 Global Mechanical Ventilator Market, By Region, 2018 - 2030 (USD Million)

Table 5 Global Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 6 Global Mechanical Ventilator Market, By Ventilation Mode, 2018 - 2030 (USD Million)

Table 7 Global Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 8 North America Mechanical Ventilator Market, By Country, 2018 - 2030 (USD Million)

Table 9 North America Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 10 North America Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 11 North America Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 12 U.S. Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 13 U.S. Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 14 U.S. Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 15 Canada Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 16 Canada Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 17 Canada Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 18 Mexico Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 19 Mexico Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 20 Mexico Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 21 Europe Mechanical Ventilator Market, By Country, 2018 - 2030 (USD Million)

Table 22 Europe Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 23 Europe Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 24 Europe Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 25 UK Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 26 UK Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 27 UK Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 28 Germany Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 29 Germany Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 30 Germany Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 31 France Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 32 France Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 33 France Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 34 Italy Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 35 Italy Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 36 Italy Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 37 Spain Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 38 Spain Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 39 Spain Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 40 Denmark Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 41 Denmark Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 42 Denmark Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 43 Sweden Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 44 Sweden Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 45 Sweden Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 46 Norway Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 47 Norway Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 48 Norway Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 49 Asia Pacific Mechanical Ventilator Market, By Country, 2018 - 2030 (USD Million)

Table 50 Asia Pacific Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 51 Asia Pacific Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 52 Asia Pacific Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 53 Japan Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 54 Japan Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 55 Japan Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 56 China Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 57 China Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 58 China Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 59 India Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 60 India Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 61 India Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 62 South Korea Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 63 South Korea Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 64 South Korea Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 65 Australia Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 66 Australia Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 67 Australia Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 68 Thailand Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 69 Thailand Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 70 Thailand Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 71 Latin America Mechanical Ventilator Market, By Country, 2018 - 2030 (USD Million)

Table 72 Latin America Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 73 Latin America Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 74 Latin America Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 75 Brazil Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 76 Brazil Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 77 Brazil Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 78 Argentina Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 79 Argentina Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 80 Argentina Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 81 Middle East and Africa Mechanical Ventilator Market, By Country, 2018 - 2030 (USD Million)

Table 82 Middle East and Africa Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 83 Middle East and Africa Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 84 Middle East & Africa Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 85 South Africa Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 86 South Africa Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 87 South Africa Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 90 Saudi Arabia Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 91 UAE Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 92 UAE Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 93 UAE Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

Table 94 Kuwait Mechanical Ventilator Market, By Product, 2018 - 2030 (USD Million)

Table 95 Kuwait Mechanical Ventilator Market, By Ventilator Mode, 2018 - 2030 (USD Million)

Table 96 Kuwait Mechanical Ventilator Market, By End Use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Mechanical Ventilator market segment scope and definition

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market outlook (2023)

Fig. 10 Strategy framework

Fig. 11 Market driver relevance analysis (Current & future impact)

Fig. 12 Market restraint relevance analysis (Current & future impact)

Fig. 13 Penetration & growth prospect mapping

Fig. 14 Porter’s five forces analysis

Fig. 15 PESTLE analysis

Fig. 16 Mechanical Ventilator market: Product movement analysis

Fig. 17 Mechanical Ventilator market: Product segment dashboard

Fig. 18 Mechanical Ventilator market product outlook: Key takeaways

Fig. 19 Critical care Mechanical Ventilator market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 20 Neonatal Mechanical Ventilator market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 21 Transport & portable Mechanical Ventilator market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 22 Others Mechanical Ventilator market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 23 Mechanical Ventilator market: Ventilator Mode movement analysis

Fig. 24 Mechanical Ventilator market Ventilator Mode outlook: Key takeaways

Fig. 25 Invasive Mechanical Ventilator market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 26 Non-invasive Mechanical Ventilator market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 27 Regional outlook, 2023 & 2030

Fig. 28 Regional market dashboard

Fig. 29 Regional market place: Key takeaways

Fig. 30 North America Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 31 U.S. Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 32 Canada Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 33 Mexico Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 34 Europe Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 35 UK Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 36 Germany Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 37 Spain Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 38 France Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 39 Italy Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 40 Denmark Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 41 Sweden Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 42 Norway Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 43 Asia Pacific Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 44 Japan Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 45 China Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 46 India Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 47 South Korea Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 48 Australia Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 49 Thailand Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 50 Latin America Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 51 Brazil Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 52 Argentina Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 53 MEA Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 54 South Africa Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 55 Saudi Arabia Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 56 UAE Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 57 Kuwait Mechanical Ventilator market, 2018 - 2030 (USD Million)

Fig. 58 Heat map analysis

Fig. 59 Market differentiatorsWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Mechanical Ventilator Product Outlook (Revenue, USD Million, 2018 - 2030)

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Mechanical Ventilator Ventilation Mode Outlook (Revenue, USD Million, 2018 - 2030)

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Mechanical Ventilator End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Mechanical Ventilator Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- North America Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- North America Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- U.S.

- U.S. Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- U.S. Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- U.S. Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- U.S. Mechanical Ventilator Market, By Product

- Canada

- Canada Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Canada Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Canada Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Canada Mechanical Ventilator Market, By Product

- Mexico

- Mexico Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Mexico Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Mexico Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Mexico Mechanical Ventilator Market, By Product

- North America Mechanical Ventilator Market, By Product

- Europe

- Europe Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Europe Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Europe Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- UK

- UK Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- UK Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- UK Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- UK Mechanical Ventilator Market, By Product

- Germany

- Germany Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Germany Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Germany Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Germany Mechanical Ventilator Market, By Product

- France

- France Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- France Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- France Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- France Mechanical Ventilator Market, By Product

- Italy

- Italy Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Italy Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Italy Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Italy Mechanical Ventilator Market, By Product

- Spain

- Spain Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Spain Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- SpainMechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Spain Mechanical Ventilator Market, By Product

- Denmark

- Denmark Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Denmark Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Denmark Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Denmark Mechanical Ventilator Market, By Product

- Sweden

- Sweden Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Sweden Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Sweden Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Sweden Mechanical Ventilator Market, By Product

- Norway

- Norway Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Norway Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Norway Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Norway Mechanical Ventilator Market, By Product

- Rest of Europe (EU) (RoE)

- Rest of Europe (EU) (RoE) Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Rest of Europe (EU) (RoE) Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Rest of Europe (EU) (RoE) Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Rest of Europe (EU) (RoE) Mechanical Ventilator Market, By Product

- Europe Mechanical Ventilator Market, By Product

- Asia Pacific

- Asia Pacific Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Asia Pacific Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Asia Pacific Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Japan

- Japan Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Japan Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Japan Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Japan Mechanical Ventilator Market, By Product

- China

- China Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- China Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- China Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- China Mechanical Ventilator Market, By Product

- India

- India Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- India Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- India Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- India Mechanical Ventilator Market, By Product

- South Korea

- South Korea Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- South Korea Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- South Korea Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- South Korea Mechanical Ventilator Market, By Product

- Australia

- Australia Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Australia Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Australia Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Australia Mechanical Ventilator Market, By Product

- Thailand

- Thailand Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Thailand Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Thailand Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Thailand Mechanical Ventilator Market, By Product

- Rest of Asia Pacific (RoAPAC)

- Rest of Asia Pacific (RoAPAC) Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Rest of Asia Pacific (RoAPAC) Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Rest of Asia Pacific (RoAPAC) Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Rest of Asia Pacific (RoAPAC) Mechanical Ventilator Market, By Product

- Asia Pacific Mechanical Ventilator Market, By Product

- Latin America

- Latin America Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Latin America Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Latin America Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Brazil

- Brazil Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Brazil Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Brazil Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Brazil Mechanical Ventilator Market, By Product

- Argentina

- Argentina Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Argentina Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Argentina Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Argentina Mechanical Ventilator Market, By Product

- Rest of Latin America (RoLA)

- Rest of Latin America (RoLA) Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Rest of Latin America (RoLA) Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Rest of Latin America (RoLA) Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Rest of Latin America (RoLA) Mechanical Ventilator Market, By Product

- Latin America Mechanical Ventilator Market, By Product

- Middle East & Africa

- Middle East & Africa Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Middle East & Africa Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Middle East & Africa Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- South Africa

- South Africa Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- South Africa Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- South Africa Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- South Africa Mechanical Ventilator Market, By Product

- Saudi Arabia

- Saudi Arabia Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Saudi Arabia Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Saudi Arabia Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Saudi Arabia Mechanical Ventilator Market, By Product

- UAE

- UAE Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- UAE Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- UAE Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- UAE Mechanical Ventilator Market, By Product

- Kuwait

- Kuwait Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Kuwait Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Kuwait Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Kuwait Mechanical Ventilator Market, By Product

- Rest of Middle East & Africa (RoMEA)

- Rest of Middle East & Africa (RoMEA) Mechanical Ventilator Market, By Product

- Critical care

- Ventilators

- Accessories

- Neonatal

- Ventilators

- Accessories

- Transport & portable

- Ventilators

- Accessories

- Other

- Critical care

- Rest of Middle East & Africa (RoMEA) Mechanical Ventilator Market, By Ventilation Mode

- Invasive

- Non-invasive

- CPAP

- BiPAP

- Others

- Rest of Middle East & Africa (RoMEA) Mechanical Ventilator Market, By End Use

- Mechanical Ventilator Hospitals

- Home healthcare

- Others

- Rest of Middle East & Africa (RoMEA) Mechanical Ventilator Market, By Product

- Middle East & Africa Mechanical Ventilator Market, By Product

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments