- Home

- »

- Clothing, Footwear & Accessories

- »

-

Mechanical Watch Market Size, Share, Industry Report, 2033GVR Report cover

![Mechanical Watch Market Size, Share & Trends Report]()

Mechanical Watch Market (2025 - 2033) Size, Share & Trends Analysis Report By Price (Entry-Level, Luxury), By End-user (Men, Women), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-763-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mechanical Watch Market Summary

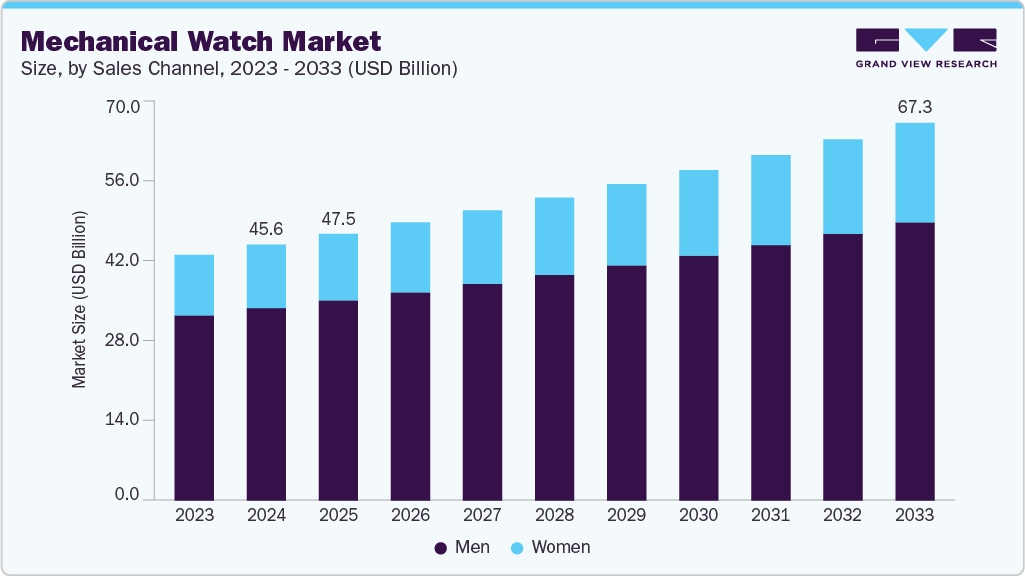

The global mechanical watch market size was estimated at USD 45.57 billion in 2024 and is projected to reach USD 67.28 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. Rising consumer demand for luxury, craftsmanship, and status-symbol timepieces supports this growth.

Key Market Trends & Insights

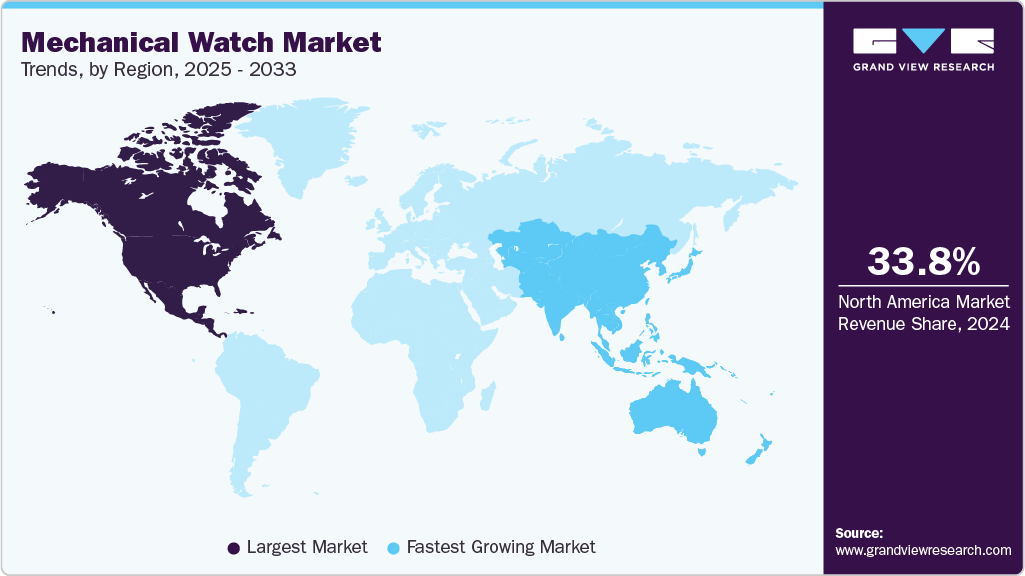

- North America held a market share of 33.79% in 2024.

- The mechanical watch market in the U.S. is anticipated to witness a CAGR of 4.3% from 2025 to 2033.

- By price, luxury mechanical (USD 3,000 - 20,000) led the market and accounted for a share of 44.45% in 2024.

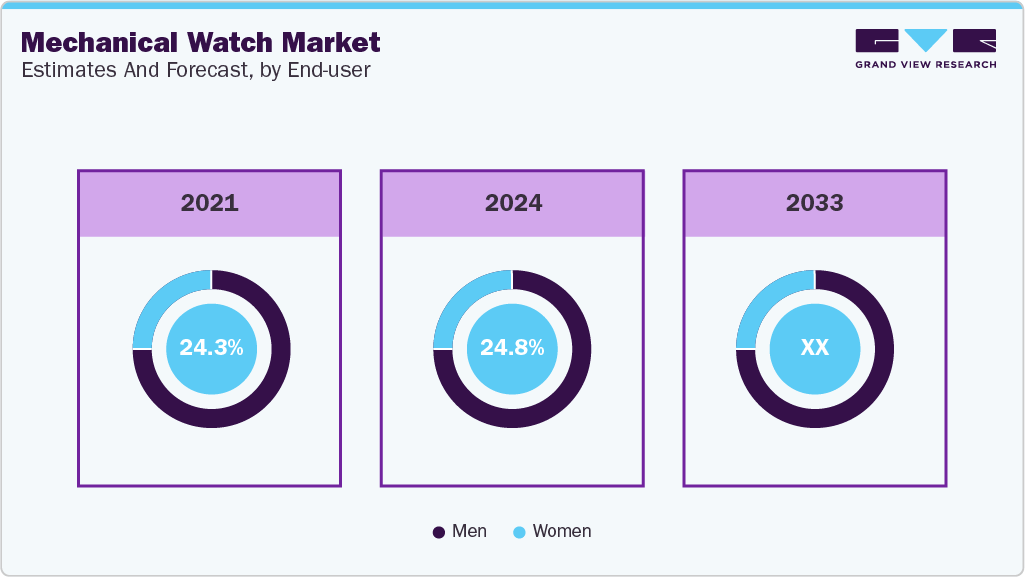

- By end user, men led the market and accounted for a share of 75.21% in 2024.

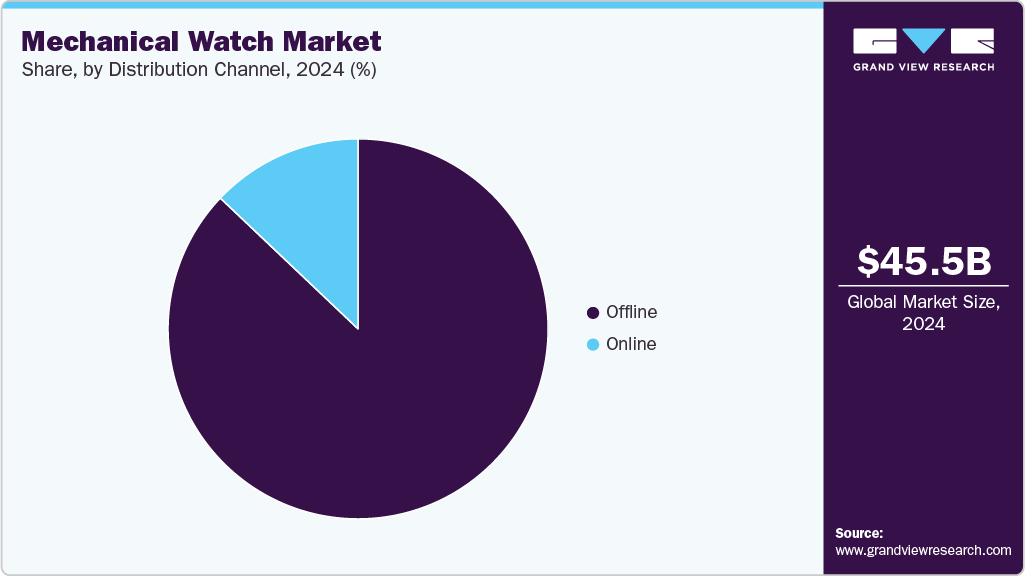

- By distribution channel, the offline sales held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 45.57 Billion

- 2033 Projected Market Size: USD 67.28 Billion

- CAGR (2025-2033): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This growth is fueled by its enduring allure of intricate engineering, timeless design, and artisanal excellence. Manufacturers leverage the perception of sophistication and durability, enabling premium pricing and brand prestige. This appeal resonates with seasoned collectors in established markets and aspirational buyers in emerging regions, ensuring steady demand and reinforcing the market’s position as a symbol of craftsmanship and luxury.Consumers, especially in North America, Europe, and APAC, increasingly value products that signify status and craftsmanship. With their intricate movements and heritage branding, mechanical watches are seen as collectibles rather than mere timekeeping tools. Limited-edition releases, collaborations with luxury fashion brands, and bespoke customization options create hype and drive sales, particularly among millennials and Gen Z buyers who view these watches as investment pieces and lifestyle statements. A May 2025 article by Chrono24 reports that over one-third of Gen Z either already own a high-quality watch or plan to purchase one.

Mechanical watches are increasingly treated as assets rather than just accessories. The secondary market for pre-owned and vintage watches is booming, with brands like Rolex, Patek Philippe, and Audemars Piguet commanding significant premiums. Watch auctions, and social media communities foster a culture of collecting and trading, encouraging both first-time buyers and seasoned collectors to participate in the market. This trend reinforces brand value and drives continuous demand for new models with limited availability. For instance, in June 2024, Audemars Piguet introduced a new watch batch that blends heritage and innovation. Key highlights include the [RE]Master02 Self-winding, a modern take on a 1960s asymmetric model with an 18-carat sand gold case and midnight blue dial, the Royal Oak Selfwinding Full Gemset featuring 861 baguette-cut gemstones in pixelated camouflage patterns.

While established markets like Europe and North America remain strong, rising disposable incomes in countries such as China, India, and the Middle East drive demand for premium watches. E-commerce, digital marketing, and brand-owned online stores have made these products more accessible, allowing consumers in previously underserved regions to explore and purchase mechanical watches directly from renowned brands.

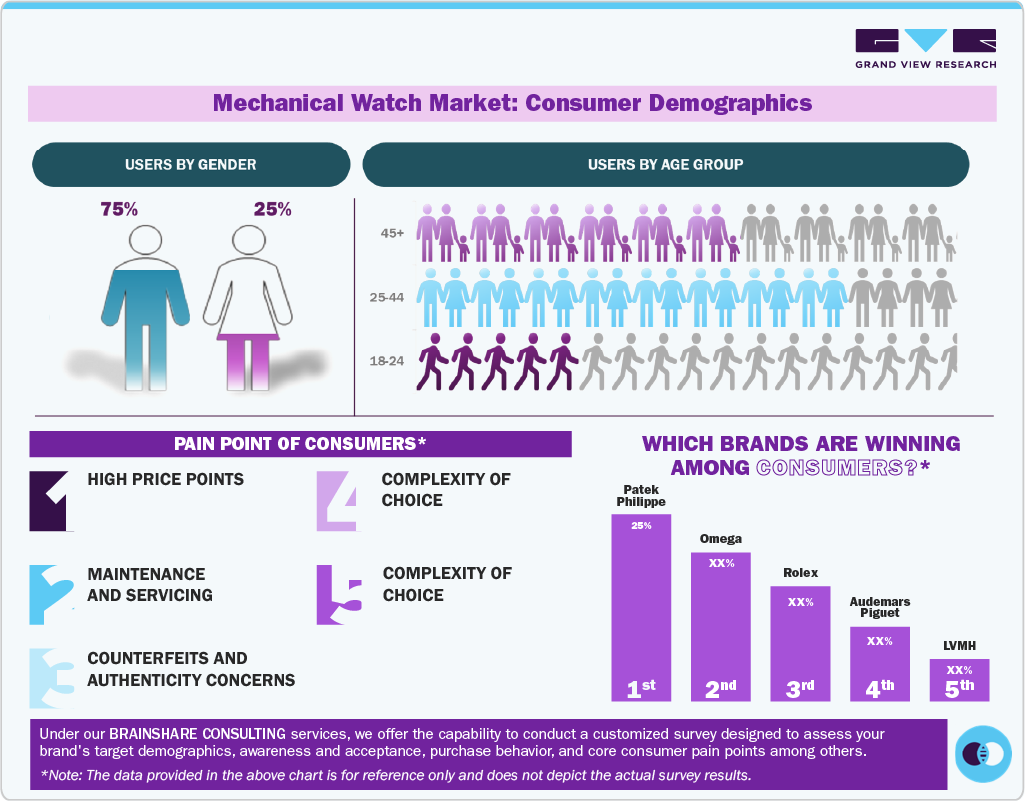

Consumer Insights

The mechanical watch industry remains largely male-dominated, with approximately 70% of buyers being men and 30% women. While men are drawn to these timepieces as status symbols and collectibles, women increasingly enter the market, often opting for smaller, elegant designs from brands like Cartier and Omega. This gender distribution highlights that, while traditional marketing has targeted men, a growing female segment is shaping design and product offerings.

Age-wise, buyers are divided into three main groups. The 25-34 age group is increasingly aspirational, influenced by social media and disposable income, and prefers entry-level to mid-tier luxury watches. The 35-55 age group, often established professionals and collectors, forms the core market, driving demand for mid- to high-end mechanical watches. The 55+ group consists of traditional collectors and repeat buyers, typically investing in ultra-luxury or heritage pieces, often valuing craftsmanship and long-term investment potential over trends.

Despite the market’s appeal, consumers face several challenges. High price points make entry difficult for first-time buyers, while maintenance and servicing requirements add ongoing costs and effort. Complexity in choosing the right model and concerns over counterfeits and authenticity, especially in markets without official brand stores, can discourage potential buyers. These pain points shape consumer behavior, pushing them toward trusted brands and verified purchase channels.

In terms of brand performance, a few key players dominate consumer preference. Rolex leads the market with strong recognition and high resale value, followed by Omega, known for precision and heritage models. Audemars Piguet and Patek Philippe continue to attract ultra-luxury buyers, while LVMH and Richemont’s portfolios cover both mid- and high-tier segments, catering to aspirational buyers and collectors alike. These brands’ focus on craftsmanship, exclusivity, and marketing ensures they remain top choices for mechanical watch enthusiasts worldwide.

End User Insights

Mechanical watches for men accounted for 75.21% in 2024, reflecting the longstanding dominance of male consumers in the luxury and enthusiast segments. Men traditionally demand larger, complication-rich timepieces-such as chronographs, tourbillons, and diver watches-from brands like Rolex, TAG Heuer, and Seiko. The segment’s leadership is reinforced by a strong collector culture, higher disposable incomes, and preferences for watches as status symbols or investment assets, while marketing and retail strategies remain heavily focused on male buyers, maintaining their substantial market share.

Mechanical watches for women are anticipated to witness a CAGR of 4.3% from 2025 to 2033, driven by growing interest in luxury and fashion-forward timepieces that combine craftsmanship with style. Brands are increasingly designing smaller, aesthetically refined automatic models tailored to women, such as Omega’s De Ville Prestige or Longines’ Master Collection, which appeal to professional and lifestyle buyers. The segment also benefits from rising female purchasing power and a cultural shift toward collecting watches as statement accessories, supported by targeted marketing campaigns, influencer collaborations, and social media visibility that highlight mechanical sophistication and elegance.

Price Insights

Luxury (USD 3,000 - USD 20,000) accounted for a 44.45% share of the global revenue in 2024, reflecting strong demand for high-quality, accessible prestige timepieces. This segment appeals to enthusiasts and aspirational buyers seeking craftsmanship, brand heritage, and recognizable designs from names like Omega, TAG Heuer, and Longines. Its dominance is supported by widespread availability through authorized boutiques, e-commerce platforms, premium retail partners, regular model updates, limited editions, and marketing campaigns that maintain consumer interest and reinforce the value proposition of luxury mechanical watches.

Ultra-Luxury (Over USD 20,000) is anticipated to grow at a CAGR of 5.3% from 2025 to 2033, owing to sustained demand from high-net-worth individuals and collectors seeking exclusivity, heritage, and investment value. Limited editions, bespoke designs, and rare complications from brands like Patek Philippe, Audemars Piguet, and Vacheron Constantin continue to command premiums, while secondary markets and auction platforms amplify visibility and liquidity. In addition, global expansion of flagship boutiques and personalized concierge services enhances accessibility for affluent buyers, supporting steady growth in this niche, prestige-driven segment.

Distribution Channel Insights

The sale of mechanical watches through offline channels accounted for 87.09% of the market, as consumers purchasing high-value timepieces still prioritize tactile and experiential aspects of shopping. Visiting brand boutiques or authorized retailers enables buyers to feel the weight, examine the finishing, and try on watches-essential experiences for the premium and ultra-luxury segments. Personalized services, such as in-store consultations, after-sales support, and access to limited editions, further strengthen the offline stronghold. Moreover, the prestige and confidence linked to established physical stores continue to foster trust, especially for buyers investing in mechanical watches as status symbols and long-term assets.

The sale of mechanical watches online is expected to grow at a CAGR of 4.3% from 2025 to 2033, as consumer buying habits shift toward digital-first platforms offering greater transparency, variety, and accessibility. Younger buyers, in particular, prefer researching and purchasing online, where side-by-side comparisons, financing options, and resale opportunities are easier to navigate. This blend of convenience, authenticity assurance, and access to new and secondary-market pieces accelerates e-commerce adoption for mechanical watches.

Regional Insights

The mechanical watch market in North America dominated with a revenue share of 33.79% in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2033, supported by the region’s strong culture of collecting and gifting high-value timepieces. Growth is further underpinned by robust retail networks, rising traction of boutique experiences in cities like New York and Los Angeles, and brand-led marketing tied to sports and entertainment. In addition, the expanding secondhand ecosystem and certified pre-owned programs are drawing in buyers who see mechanical watches as lifestyle statements and durable assets, helping sustain long-term demand across income segments.

U.S. Mechanical Watch Market Trends

The mechanical watch market in the U.S. is anticipated to witness a CAGR of 4.3% from 2025 to 2033. This can be attributed to a mix of heritage appeal and shifting consumer behavior. On the ground, younger affluent buyers are increasingly seeking out mechanical watches not just as luxury goods but as long-term assets. Independent brands and microbrands are also fueling growth by offering accessible automatic models-such as Seiko’s Presage or U.S.-based brands like Weiss-that appeal to first-time buyers priced out of traditional Swiss luxury. This blend of scarcity at the top end and democratization at the entry level underpins the market’s steady expansion.

Asia Pacific Mechanical Watch Market Trends

The Asia Pacific mechanical watch market accounted for a share of 29.80% of the global market in 2024, driven by the rapid expansion of luxury consumption, particularly in China, Hong Kong, and Japan, which serve as retail and re-export hubs for Mechanical watches. Moreover, emerging markets such as India and Southeast Asia are experiencing increased brand penetration through flagship boutiques and premium retail partnerships.

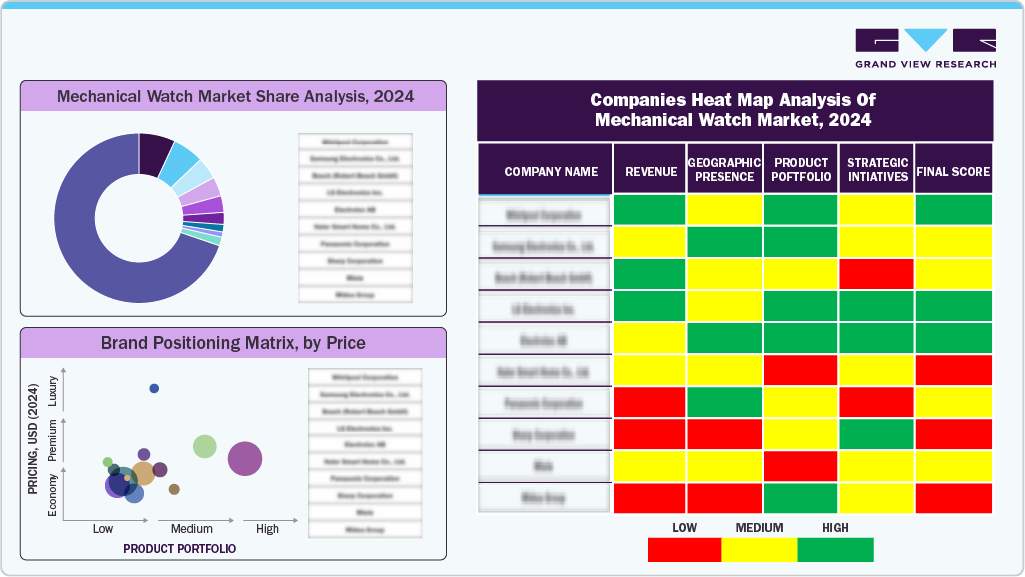

Key Mechanical Watch Company Insights

The market is characterized by a diverse mix of global powerhouses, established luxury maisons, and emerging independents, each shaping the industry’s competitive dynamics differently. While heritage-driven brands such as Seiko, Citizen, and Grand Seiko anchor the mid- to premium segments with strong value propositions, European houses like A. Lange & Söhne, IWC, and Jaeger-LeCoultre continue to push technical boundaries in haute horlogerie. Independent makers and microbrands are steadily gaining visibility, leveraging direct-to-consumer channels and niche designs to capture younger, digitally savvy buyers.

Market share leadership varies by price point and geography. Japanese brands hold significant strength in entry and mid-tier categories, Swiss maisons dominate the luxury and ultra-luxury ranges, while boutique independents increasingly compete in the enthusiast community. Companies focus on limited editions, brand collaborations, and heritage-inspired reissues to retain customer loyalty and differentiate in a crowded market. Strategic investment in service networks, personalization options, and sustainability initiatives is also reshaping brand equity, signaling a shift from pure product excellence to holistic brand experiences.

Key Mechanical Watch Companies:

The following are the leading companies in the mechanical watch market. These companies collectively hold the largest market share and dictate industry trends.

- Rolex

- Patek Philippe

- Audemars Piguet

- Swatch Group

- LVMH

- Richemont

- Seiko Group

- Citizen Watch Co.

- Casio

- Fossil Group

Recent Developments

-

In September 2025, Casio India officially entered the mechanical watch segment by launching its first-ever automatic timepiece collection in India-the Edifice EFK-100 series. Drawing inspiration from motorsports, this lineup includes five distinctive models, featuring premium finishes like forged carbon on select watches for a lightweight yet durable design aesthetic.

-

In August 2025, Seiko expanded its heritage-driven portfolio by introducing its latest releases, led by the Prospex Marinemaster “Shinkai.” Limited to 600 pieces, this professional diver features a titanium case with diamond-like coating, a deep-sea inspired dial, and Seiko’s new 8L45 automatic movement with a three-day power reserve. Alongside it, the King Seiko VANAC Collection debuted with five colorful models, reviving 1970s design flair while celebrating Tokyo’s vibrant skyline.

Mechanical Watch Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.49 billion

Revenue forecast in 2033

USD 67.28 billion

Growth rate (revenue)

CAGR of 4.5% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price, end user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Rolex; Patek Philippe; Audemars Piguet; Swatch Group; LVMH; Richemont; Seiko Group; Citizen Watch Co.; Casio; Fossil Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

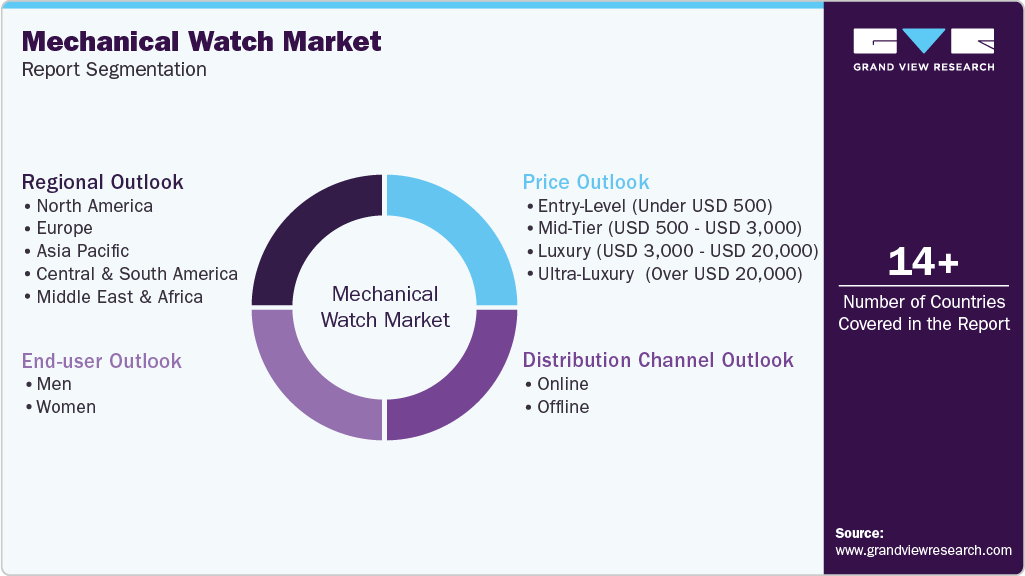

Global Mechanical Watch Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mechanical watch market report based on price, end user, distribution channel, and region:

-

Price Outlook (Revenue, USD Million, 2021 - 2033)

-

Entry-Level (Under USD 500)

-

Mid-Tier (USD 500 - USD 3,000)

-

Luxury (USD 3,000 - USD 20,000)

-

Ultra-Luxury (Over USD 20,000)

-

-

End User Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

-

Distribution Channel (Revenue, USD Million; 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the mechanical watch market include Rolex, Patek Philippe, Audemars Piguet, Swatch Group, LVMH, Richemont, Seiko Group, Citizen Watch Co., Casio, and Fossil Group.

b. The global mechanical watch market’s growth is fueled by its enduring allure of intricate engineering, timeless design, and artisanal excellence. Manufacturers leverage the perception of sophistication and durability, enabling premium pricing and brand prestige.

b. The global mechanical watch market size was estimated at USD 45.57 billion in 2024 and is expected to reach USD 47.49 billion in 2025.

b. The global mechanical watch market is expected to grow at a compound annual growth rate (CAGR) of 4.5 % from 2025 to 2033 to reach USD 67.28 billion by 2033.

b. The luxury (USD 3,000 - USD 20,000) mechanical watch revenue accounted for a 44.45% share of the global revenue in 2024, owing to widespread availability through authorized boutiques, e-commerce platforms, and premium retail partners, as well as regular model updates, limited editions, and marketing campaigns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.