- Home

- »

- Medical Devices

- »

-

Aesthetic Medicine Market Size, Share, Growth Report, 2030GVR Report cover

![Aesthetic Medicine Market Size, Share & Trends Report]()

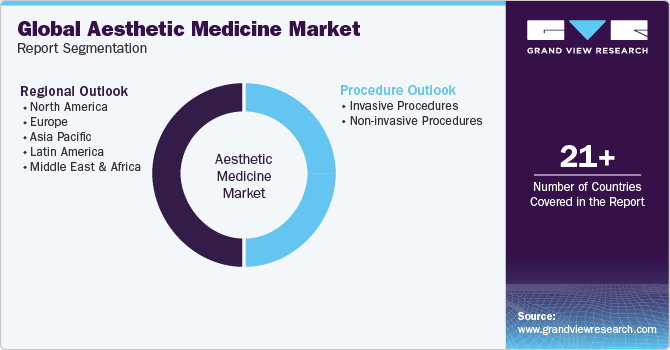

Aesthetic Medicine Market Size, Share & Trends Analysis Report By Procedure Type (Invasive Procedures, Non-invasive Procedures), By Region (North America, Asia Pacific, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-733-9

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Aesthetic Medicine Market Size & Trends

The global aesthetic medicine market size was valued at USD 127.11 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 14.9% from 2024 to 2030. A significant driver for the thriving aesthetic medicine market is the rising societal focus on individual appearance, propelling an increased desire for aesthetic procedures. This shift in cultural norms, combined with an expanding awareness of the diverse cosmetic solutions now accessible, has played a pivotal role in driving the market's upward trajectory. The growing acknowledgment and acceptance of various cosmetic interventions reflect an evolving mindset towards personal aesthetic enhancement, serving as a key driver in sustaining the aesthetic market's growth.

The 2022 data from the International Society of Aesthetic Plastic Surgery (ISAPS) highlights key trends in the top five global surgical procedures, providing insights into the factors shaping the aesthetic medicine market. Liposuction emerged as the most performed procedure, totaling 2,303,929, followed closely by Breast Augmentation at 2,174,616. Eyelid Surgery secured the third position with 1,409,103, and Abdominoplasty claimed the fourth spot with 1,180,623. The fifth spot was occupied by Breast Lift, recording 955,026 procedures.

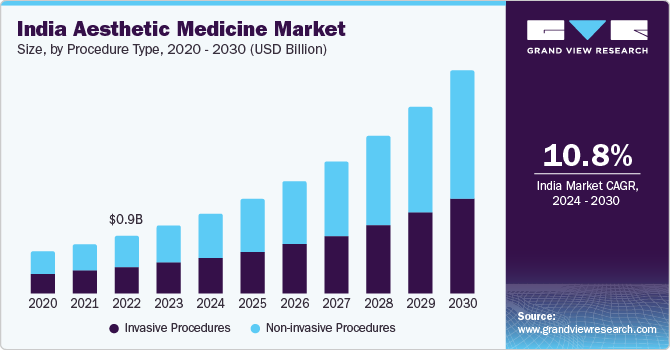

Thus, the market has witnessed a spike during the past few months and is expected to be in high demand throughout the forecasted period. The growing awareness about fitness and overall appearance has increased the demand for aesthetic treatments in developing countries. Aesthetic procedures, such as liposuction, nose reshaping, and Botox injections, are gaining consumer interest in countries, such as India and South Korea. According to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2022, India was ranked among the top 5 countries performing non-surgical procedures at a global level. This highlights the lucrative growth prospects that lie ahead for industry players in the country.

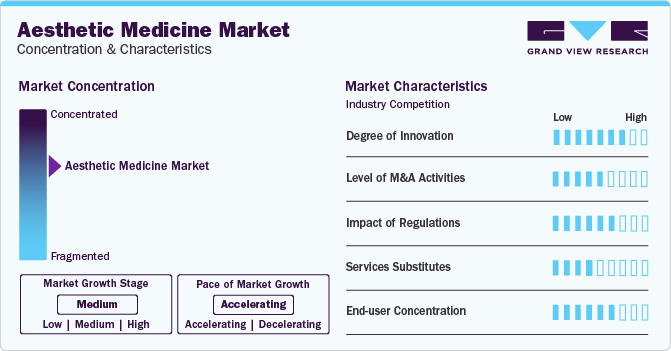

Market Concentration & Characteristics

The aesthetic medicine market has witnessed significant expansion, propelled by a combination of factors, and key industry players have played a central role in shaping its trajectory. Increasing consumer awareness and a societal emphasis on appearance have driven the surge in demand for aesthetic treatments. Advancements in technology, especially in non-invasive procedures, have widened the market's attractiveness, drawing in a varied clientele seeking safer and more efficient solutions.

Prominent players in the dynamic aesthetic medicine market include Allergan (now a part of AbbVie), renowned for its iconic Botox and Juvederm offerings; Alma Lasers, acknowledged for pioneering laser and light-based devices; Galderma, a leading force in dermatology, emphasizing aesthetic solutions; Syneron Medical Ltd., providing a diverse array of aesthetic devices; and Cynosure, specializing in innovative laser technologies. These industry leaders consistently propel innovation, conduct extensive research and development, and shape the market by introducing state-of-the-art products and strategic initiatives. Their influence extends beyond product portfolios, impacting market trends, standards, and the overall evolution of the aesthetic medicine market.

Procedure Type Insights

Based on procedure type, the industry has been segmented into invasive procedures and non-invasive procedures. The non-invasive procedures segment dominated the market with a share of 55.0% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Less pain, instant results, and low cost are some of the factors that have boosted the demand for non-invasive procedures at a global level. Popular non-invasive procedures include Botox injections, soft tissue fillers, and chemical peel. Moreover, invasive procedures, such as liposuction, breast augmentation, and nose reshaping, are some of the popular aesthetic procedures. The growing focus on physical appearance has increased the demand for these invasive procedures.

Regional Insights

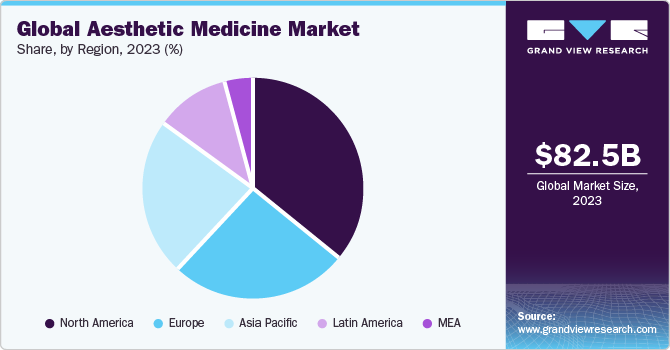

In 2023, North America accounted for the largest share of 34.9% of the global aesthetic medicine market revenue. Advanced healthcare infrastructure, high adoption of cosmetic procedures, increasing prevalence of skin disorders, and the presence of several certified & skilled cosmetic surgeons in the region are some of the major factors contributing to the growth of the regional market.

In 2022, the International Society of Aesthetic Plastic Surgery (ISAPS) revealed that a substantial number of aesthetic procedures were performed in the United States, totaling 7,448,196. This data underscores the country's continued popularity and demand for aesthetic enhancements, thus driving the U.S. aesthetic medicine market.

Asia Pacific is projected to grow at the highest CAGR during the forecast period. The region is backed by countries, such as China, India, Malaysia and South Korea. The availability of technologically advanced products and growing focus on physical appearance also support the growth. Moreover, South Korea is considered the hub of cosmetic surgeries, which is another key factor driving regional growth.

Key Aesthetic Medicine Company Insights

Some of the key players operating in the market include AbbVie; Cynosure; Evolus Inc.; Revance Therapeutics, Inc; Galderma; Lumenis; Solta Medical; Syneron Candela; Alma Laser.

- AbbVie is a global pharmaceutical company that focuses on the development of advanced therapies in multiple therapeutic areas. AbbVie's diverse portfolio includes medications for conditions such as rheumatoid arthritis, cancer, hepatitis C, and Parkinson's disease. AbbVie is committed to advancing science and innovation to address unmet medical needs and improve patient outcomes. With a diverse portfolio and a focus on research and development.

- Alma Lasers is a global medical and aesthetic device company that specializes in the development and manufacturing of laser, light-based, and radiofrequency devices for various medical and cosmetic applications. Alma Lasers has gained recognition for its innovative technologies used in dermatology, plastic surgery, aesthetics, and other medical specialties. The company's product portfolio includes devices for skin rejuvenation, hair removal, tattoo removal, and body contouring. Alma Lasers is known for its commitment to advancing non-invasive and minimally invasive solutions, catering to the growing demand for aesthetic and medical procedures with reduced downtime.

The global market is highly fragmented with many local players competing with international players. However, the strict regulatory approval process is challenging the entry of new products into the market. Primary parameters affecting the competitive nature are the rapid adoption of advanced devices for improved treatment and technological advancement. Leading players are adopting various strategies, such as mergers & acquisitions, to retain their industry share and position. For instance,

-

In December 2021, Allergen Aesthetics, part of AbbVie, acquired a medical technology company, Soliton, Inc. This acquisition helped strengthen its portfolio of non-invasive body contouring treatments

-

In September 2020, Allergan Aesthetics, part of AbbVie and Skinbetter Science, announced the launch of a new educational partnership DREAM: Driving Racial Equity in Aesthetic Medicine initiative. The Dream Initiative™ is committed to advancing the principles of racial and ethnic diversity, inclusion, respect, and understanding in the fields of plastic surgery and dermatology

-

In March 2020, Galderma announced a significant investment in its aesthetic portfolio including expansion of U.S. salesforce and digital advancements in ASPIRE Galderma Rewards. Such investments have strengthened its position in the medical aesthetics market

Key Aesthetic Medicine Companies:

The following are the leading companies in the aesthetic medicine market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these aesthetic medicine companies are analyzed to map the supply network.

- AbbVie

- Cynosure

- Evolus Inc.

- Revance Galderma

- Lumenis

- Solta Medical

- Syneron Candela

- Alma Laser

Aesthetic Medicine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 127.1 billion

Revenue forecast in 2030

USD 332.1 billion

Growth rate

CAGR of 14.9% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; China; India; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie; Cynosure; Evolus Inc.; Revance Galderma; Lumenis; Solta Medical; Syneron Candela; Alma Laser

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aesthetic Medicine Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the aesthetic medicine market based on procedure type and region:

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Invasive Procedures

-

Breast augmentation

-

Liposuction

-

Nose reshaping

-

Eyelid Surgery

-

Tummy tuck

-

Others

-

-

Non-invasive Procedures

-

Botox injections

-

Soft tissue fillers

-

Chemical peel

-

Laser hair removal

-

Microdermabrasion

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aesthetic medicine market size was estimated at USD 112.0 billion in 2022 and is expected to reach USD 127.1 billion in 2023.

b. The global aesthetic medicine market is expected to grow at a compound annual growth rate of 14.7% from 2023 to 2030 to reach USD 332.1 billion by 2030.

b. North America dominated the aesthetic medicine market with a share of 35.4% in 2022. This is attributable to the well-developed healthcare infrastructure, adoption of cosmetic procedures, increasing prevalence of skin disorders, and the presence of board-certified and skilled cosmetic surgeons in the region are some of the major factors contributing to the growth.

b. Some key players operating in the aesthetic medicine market include Allergan, Hologic (cynosure), Johnson & Johnson, Galderma, Lumenis, Solta Medical, Syneron candela, and Alma Laser.

b. Key factors that are driving the aesthetic medicine market growth include innovation in aesthetic devices in the past decade. The introduction of technically advanced products, such as non-invasive body contouring systems using controlled cooling technology is projected to create growth opportunities for the market in near future.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market segmentation & scope

1.2. Information procurement

1.2.1. Purchased database

1.2.2. GVR’s internal database

1.2.3. Secondary sources & third-party perspectives

1.2.4. Primary research

1.3. Information analysis

1.3.1. Data analysis models

1.4. Market formulation & data visualization

1.5. Data validation & publishing

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Aesthetic Medicine Market Variables, Trends & Scope

3.1. Market Lineage outlook

3.1.1. Parent market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Increasing adoption of minimally invasive treatments

3.3.1.2. Growing population aged between 25 and 65 years

3.3.2. Market Restraint Analysis

3.3.2.1. Lack of reimbursement coverage

3.3.2.2. Stringent regulatory framework

3.4. Aesthetic Medicine: Market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Supplier Power

3.4.1.2. Buyer Power

3.4.1.3. Substitution Threat

3.4.1.4. Threat from new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political Landscape

3.4.2.2. Environmental Landscape

3.4.2.3. Social Landscape

3.4.2.4. Technology Landscape

3.4.2.5. Legal Landscape

3.4.3. Major Deals & Strategic Alliances Analysis

Chapter 4. Aesthetic Medicine Market: Segment Analysis, By -Procedure Type, 2018 - 2030 (USD Million)

4.1. Definitions & Scope

4.2. Procedure type market share analysis, 2022 & 2030

4.3. Global Aesthetic Medicine Market, By Procedure Type, 2018 to 2030

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Invasive procedures

4.4.1.1. Breast augmentation

4.4.1.2. Liposuction

4.4.1.3. Nose reshaping

4.4.1.4. Eyelid Surgery

4.4.1.5. Tummy tuck

4.4.1.6. Others

4.4.2. Non-invasive procedure

4.4.2.1. Botox injections

4.4.2.2. Soft tissue fillers

4.4.2.3. Chemical peel

4.4.2.4. Laser hair removal

4.4.2.5. Microdermabrasion

4.4.2.6. Others

Chapter 5. Aesthetic Medicine Market: Regional Market Analysis, By Region, 2018 - 2030 (USD Million)

5.1. Definitions & Scope

5.2. Regional market share analysis, 2023 & 2030

5.3. Regional Market Dashboard

5.4. Regional Market: Key Players

5.5. Market Size, & Forecasts, and Trend Analysis, 2023 to 2030:

5.6. North America

5.6.1. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

5.6.2. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.6.3. U.S.

5.6.3.1. Key Country Dynamics

5.6.3.2. Competitive Scenario

5.6.3.3. Regulatory Framework

5.6.3.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.6.4. Canada

5.6.4.1. Key Country Dynamics

5.6.4.2. Competitive Scenario

5.6.4.3. Regulatory Framework

5.6.4.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7. Europe

5.7.1. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

5.7.2. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.3. Germany

5.7.3.1. Key Country Dynamics

5.7.3.2. Competitive Scenario

5.7.3.3. Regulatory Framework

5.7.3.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.4. UK

5.7.4.1. Key Country Dynamics

5.7.4.2. Competitive Scenario

5.7.4.3. Regulatory Framework

5.7.4.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.5. France

5.7.5.1. Key Country Dynamics

5.7.5.2. Competitive Scenario

5.7.5.3. Regulatory Framework

5.7.5.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.6. Italy

5.7.6.1. Key Country Dynamics

5.7.6.2. Competitive Scenario

5.7.6.3. Regulatory Framework

5.7.6.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.7. Spain

5.7.7.1. Key Country Dynamics

5.7.7.2. Competitive Scenario

5.7.7.3. Regulatory Framework

5.7.7.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.8. Sweden

5.7.8.1. Key Country Dynamics

5.7.8.2. Competitive Scenario

5.7.8.3. Regulatory Framework

5.7.8.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.9. Denmark

5.7.9.1. Key Country Dynamics

5.7.9.2. Competitive Scenario

5.7.9.3. Regulatory Framework

5.7.9.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.7.10. Norway

5.7.10.1. Key Country Dynamics

5.7.10.2. Competitive Scenario

5.7.10.3. Regulatory Framework

5.7.10.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.8. Asia Pacific

5.8.1.1. Key Country Dynamics

5.8.1.2. Competitive Scenario

5.8.1.3. Regulatory Framework

5.8.2. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

5.8.3. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.8.4. China

5.8.4.1. Key Country Dynamics

5.8.4.2. Competitive Scenario

5.8.4.3. Regulatory Framework

5.8.4.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.8.5. Japan

5.8.5.1. Key Country Dynamics

5.8.5.2. Competitive Scenario

5.8.5.3. Regulatory Framework

5.8.5.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.8.6. India

5.8.6.1. Key Country Dynamics

5.8.6.2. Competitive Scenario

5.8.6.3. Regulatory Framework

5.8.6.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.8.7. Australia

5.8.7.1. Key Country Dynamics

5.8.7.2. Competitive Scenario

5.8.7.3. Regulatory Framework

5.8.7.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.8.8. South Korea

5.8.8.1. Key Country Dynamics

5.8.8.2. Competitive Scenario

5.8.8.3. Regulatory Framework

5.8.8.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.8.9. Thailand

5.8.9.1. Key Country Dynamics

5.8.9.2. Competitive Scenario

5.8.9.3. Regulatory Framework

5.8.9.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.9. Latin America

5.9.1.1. Key Country Dynamics

5.9.1.2. Competitive Scenario

5.9.1.3. Regulatory Framework

5.9.2. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

5.9.3. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.9.4. Brazil

5.9.4.1. Key Country Dynamics

5.9.4.2. Competitive Scenario

5.9.4.3. Regulatory Framework

5.9.4.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.9.5. Mexico

5.9.5.1. Key Country Dynamics

5.9.5.2. Competitive Scenario

5.9.5.3. Regulatory Framework

5.9.5.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.9.6. Argentina

5.9.6.1. Key Country Dynamics

5.9.6.2. Competitive Scenario

5.9.6.3. Regulatory Framework

5.9.6.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.10. Middle East and Africa

5.10.1. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

5.10.2. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.10.3. South Africa

5.10.3.1. Key Country Dynamics

5.10.3.2. Competitive Scenario

5.10.3.3. Regulatory Framework

5.10.3.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.10.4. Saudi Arabia

5.10.4.1. Key Country Dynamics

5.10.4.2. Competitive Scenario

5.10.4.3. Regulatory Framework

5.10.4.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.10.5. UAE

5.10.5.1. Key Country Dynamics

5.10.5.2. Competitive Scenario

5.10.5.3. Regulatory Framework

5.10.5.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

5.10.6. Kuwait

5.10.6.1. Key Country Dynamics

5.10.6.2. Competitive Scenario

5.10.6.3. Regulatory Framework

5.10.6.4. Market estimates and forecast, by procedure type, 2018 - 2030 (USD Million)

Chapter 6. Aesthetic Medicine Market - Competitive Analysis

6.1. Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

6.2. Vendor Landscape

6.2.1. List of key distributors and channel partners

6.3. Key companies profiled

6.3.1. Evolus, Inc.

6.3.1.1. Company Overview

6.3.1.2. Financial Performance

6.3.1.3. Product Benchmarking

6.3.1.4. Strategic Initiatives

6.3.2. Cynosure.

6.3.2.1. Company Overview

6.3.2.2. Financial Performance

6.3.2.3. Product Benchmarking

6.3.2.4. Strategic Initiatives

6.3.3. Revance Therapeutics, Inc.

6.3.3.1. Company Overview

6.3.3.2. Financial Performance

6.3.3.3. Product Benchmarking

6.3.3.4. Strategic Initiatives

6.3.4. Galderma S.A.

6.3.4.1. Company Overview

6.3.4.2. Financial Performance

6.3.4.3. Product Benchmarking

6.3.4.4. Strategic Initiatives

6.3.5. Alma Lasers

6.3.5.1. Company Overview

6.3.5.2. Financial Performance

6.3.5.3. Product Benchmarking

6.3.5.4. Strategic Initiatives

6.3.6. AbbVie

6.3.6.1. Company Overview

6.3.6.2. Financial Performance

6.3.6.3. Product Benchmarking

6.3.6.4. Strategic Initiatives

6.3.7. Solta Medical

6.3.7.1. Company Overview

6.3.7.2. Financial Performance

6.3.7.3. Product Benchmarking

6.3.7.4. Strategic Initiatives

6.3.8. Lumenis

6.3.8.1. Company Overview

6.3.8.2. Financial Performance

6.3.8.3. Product Benchmarking

6.3.8.4. Strategic Initiatives

6.3.9. Syneron Candela

6.3.9.1. Company Overview

6.3.9.2. Financial Performance

6.3.9.3. Product Benchmarking

6.3.9.4. Strategic Initiatives

List of Tables

Table 1 Global Aesthetic Medicine Market, By Region, 2018 - 2030 (USD Million)

Table 2 Global Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 3 North America Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 4 U.S. Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 5 Canada Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 6 Europe Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 7 UK Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 8 Germany Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 9 France Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 10 Italy Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 11 Spain Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 12 Norway Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 13 Denmark Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 15 Sweden Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 16 Asia Pacific Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 17 Japan Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 18 China Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 19 India Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 20 Australia Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 21 South Korea Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 22 Thailand Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 23 Latin America Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 24 Brazil Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 25 Mexico Aesthetic Medicine Market, By Treatment Type2018 - 2030 (USD Million)

Table 26 Argentina Aesthetic Medicine Market, By Treatment Type2018 - 2030 (USD Million)

Table 27 Middle East & Africa Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 28 South Africa Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 29 Saudi Arabia Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 30 UAE Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 31 Kuwait Aesthetic Medicine Market, By Treatment Type, 2018 - 2030 (USD Million)

Table 32 List of Secondary sources

Table 33 List of emerging players

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value chain-based sizing & forecasting

Fig. 6 QFD modelling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Aesthetic medicine market segmentation

Fig. 9 Market driver relevance analysis (Current & future impact)

Fig. 10 Market restraint relevance analysis (Current & future impact)

Fig. 11 Penetration & growth prospect mapping

Fig. 12 SWOT analysis, by factor (political & legal, economic and technological)

Fig. 13 Porter’s five forces analysis

Fig. 14 Aesthetic medicine market: procedure type movement analysis

Fig. 15 Regional marketplace: Key takeaways

Fig. 16 Regional outlook, 2022 & 2030

Fig. 17 North America Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 18 U.S. Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 19 Canada Aesthetic medicine market, 2018 - 2030 (USD Million))

Fig. 20 Europe Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 21 UK. Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 22 Germany Aesthetic medicine market, 2017 - 2030 (USD Million)

Fig. 23 Italy Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 24 Spain Aesthetic medicine market, 2018 - 2030, USD Million)

Fig. 25 France Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 26 Sweden Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 27 Norway Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 28 Denmark Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 29 Asia Pacific Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 27 Japan Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 30 China Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 31 India Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 32 Australia Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 33 South Korea Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 34 Thailand Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 35 Latin America Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 36 Brazil Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 37 Mexico Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 38 Argentina Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 39 MEA Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 40 South Africa Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 41 Saudi Arabia Aesthetic medicine market2018 - 2030 (USD Million)

Fig. 42 UAE Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 43 Kuwait Aesthetic medicine market, 2018 - 2030 (USD Million)

Fig. 44 Strategy frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Aesthetic Medicine Procedure Type Outlook (USD Million, 2018 - 2030)

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Aesthetic Medicine Regional Outlook (USD Million, 2018 - 2030)

- North America

- North America Aesthetic Medicine Market, By Procedure

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- U.S.

- U.S. Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- U.S. Aesthetic Medicine Market, by Procedure Type

- Canada

- Canada Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Canada Aesthetic Medicine Market, by Procedure Type

- North America Aesthetic Medicine Market, By Procedure

- Europe

- Europe Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Germany

- Germany Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Germany Aesthetic Medicine Market, by Procedure Type

- UK

- UK Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- UK Aesthetic Medicine Market, by Procedure Type

- France

- France Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- France Aesthetic Medicine Market, by Procedure Type

- Italy

- Italy Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Italy Aesthetic Medicine Market, by Procedure Type

- Spain

- Spain Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Spain Aesthetic Medicine Market, by Procedure Type

- Denmark

- Denmark Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Denmark Aesthetic Medicine Market, by Procedure Type

- Sweden

- Sweden Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Sweden Aesthetic Medicine Market, by Procedure Type

- Norway

- Norway Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Norway Aesthetic Medicine Market, by Procedure Type

- Europe Aesthetic Medicine Market, by Procedure Type

- Asia Pacific

- Asia Pacific Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Japan

- Japan Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Japan Aesthetic Medicine Market, by Procedure Type

- China

- China Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- China Aesthetic Medicine Market, by Procedure Type

- India

- India Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- India Aesthetic Medicine Market, by Procedure Type

- South Korea

- South Korea Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- South Korea Aesthetic Medicine Market, by Procedure Type

- Australia

- Australia Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Australia Aesthetic Medicine Market, by Procedure Type

- Thailand

- Thailand Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Thailand Aesthetic Medicine Market, by Procedure Type

- Asia Pacific Aesthetic Medicine Market, by Procedure Type

- Latin America

- Latin America Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Brazil

- Brazil Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Brazil Aesthetic Medicine Market, by Procedure Type

- Mexico

- Mexico Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Mexico Aesthetic Medicine Market, by Procedure Type

- Argentina

- Argentina Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Argentina Aesthetic Medicine Market, by Procedure Type

- Latin America Aesthetic Medicine Market, by Procedure Type

- MEA

- MEA Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- South Africa

- South Africa Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- South Africa Aesthetic Medicine Market, by Procedure Type

- Saudi Arabia

- Saudi Arabia Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Saudi Arabia Aesthetic Medicine Market, by Procedure Type

- UAE

- UAE Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- UAE Aesthetic Medicine Market, by Procedure Type

- Kuwait

- Kuwait Aesthetic Medicine Market, by Procedure Type

- Invasive Procedures

- Breast augmentation

- Liposuction

- Nose reshaping

- Eyelid Surgery

- Tummy tuck

- Others

- Non-invasive Procedures

- Botox injections

- Soft tissue fillers

- Chemical peel

- Laser hair removal

- Microdermabrasion

- Others

- Invasive Procedures

- Kuwait Aesthetic Medicine Market, by Procedure Type

- MEA Aesthetic Medicine Market, by Procedure Type

- North America

Aesthetic Medicine Market Dynamics

Driver: Increasing adoption of minimally invasive treatments

The demand for aesthetic procedures is increasing and reimbursements for traditional insurance‐based medicine are declining. An increasing number of medical practitioners, regardless of their specialties, are engaged in medical aesthetic practices. Minimally invasive surgeries offer advantages such as smaller incisions, shorter hospital stays, lesser pain, rapid wound healing, fewer surgical wounds, and lower risk of complications as compared to invasive surgeries. Moreover, efficacy and results of currently available minimally invasive surgeries are similar to conventional surgical treatments.

Minimally invasive surgeries are rapidly replacing invasive surgeries. For instance, according to the American Society of Plastic Surgeons (ASPS), in the U.S, non-invasive/minimally invasive fat reduction procedures increased by around 7% between 2016 and 2019. Nearly 13.2 million minimally invasive & surgical cosmetic procedures were performed in 2021. Thus, increasing adoption of minimally invasive surgeries, coupled with availability of a wide range of minimally invasive treatment options, is driving the growth of aesthetic medicine market.

Driver: Technological product advancements

Signs of aging such as wrinkles, reduced skin elasticity, and dark spots start appearing between 25 and 30 years of age and become more prominent between 30 and 65 years. Thus, presence of a large population that is susceptible to various signs of aging is boosting the demand for aesthetic medicines. For instance, as per CIA World Fact Book, around 30.5% of the total German population was aged between 25 and 54, and around 13.6% was aged between 55 and 65 in 2018. Similarly, approximately 46.81% of the total population in China was aged between 25 and 54 years in 2020. Population aged between 20 and 64 years accounted for 54% of the global population in 2000 and is expected to reach 57% in 2050. Thus, perpetual growth in population aged between 25 and 65 is expected to drive growth of aesthetic medicine market.

Restraint: Lack of proper reimbursement coverage

All aesthetic procedures are not covered under private and government insurance plans. Procedures mainly intended to reduce wrinkles, fats, hair removal, tattoo removal, excess skin removal, and liposuction for enhancement of external appearance are not covered for reimbursement. However, treatments that are necessary for a patient are eligible for reimbursement. Such treatments include, but are not limited, to facial reconstruction after an accident and weight loss surgery to reduce complications due to being overweight. The percentage of surgical treatments supported by medical reasons is lower than that of procedures performed for enhancing aesthetic appearance. Thus, lack of reimbursement coverage for majority of the procedures may restrain growth of the overall market.

What Does This Report Include?

This section will provide insights into the contents included in this aesthetic medicine market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Aesthetic medicine market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Aesthetic medicine market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the aesthetic medicine market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for aesthetic medicine market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of aesthetic medicine market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Aesthetic Medicine Market Categorization:

The aesthetic medicine market was categorized into two segments, namely procedure type (Invasive Procedures, Non-invasive Procedures), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The aesthetic medicine market was segmented into procedure type, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The aesthetic medicine market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into eighteen countries, namely, the U.S.; Canada; the UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Aesthetic medicine market companies & financials:

The aesthetic medicine market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Cynosure, earlier a part of Hologic, develops and manufactures a broad range of medical treatment systems and light-based aesthetic devices. The company offers different products for scar treatment, skin rejuvenation, and hair care. It markets various light-based treatments, including hair removal, body contouring, and pigmentation lesions surgical processes for acne removal. In March 2017, Cynosure was acquired by Hologic, Inc., allowing the latter to enter the medical aesthetics market. Other segments include diagnostics, breast health, medical esthetics, gynecologic surgeries, and skeletal health.

-

Johnson & Johnson Services, Inc. is involved in R&D, manufacturing, and sales of a wide range of healthcare products. The company operates through three business segments - pharmaceuticals, medical devices, and consumers. Its medical devices segment offers an array of healthcare products mainly used by nurses, physicians, clinics, and hospitals. These products include insulin delivery & blood glucose monitoring products; energy, biosurgical, neurological, & orthopedic products; infection prevention products; disposable contact lenses; and professional diagnostic products. The company operates in over 60 countries across the globe.

-

Galderma Pharmaceuticals is a global manufacturer that specializes in dermatology products. The company offers well-known products such as Sculptra, Dysport, Restylane, and Differin under its portfolio. It primarily focuses on six areas: acne, psoriasis, atopic dermatitis, sun protection, rosacea, and skin cancer. It provides solutions in aesthetics and prescription drugs.

-

Allergan is a European company engaged in manufacturing and marketing of pharmaceuticals, medical devices, and biologic products. The company has products in medical aesthetics, regenerative & dermatology, eye care, women's health, urology, gastroenterology, and anti-infective therapeutics sectors. The company operates in over 100 countries worldwide and has manufacturing and R&D centers in the U.S., France, Ireland, the UK, Germany, Brazil, China, and Japan, among other countries.

-

Solta Medical is a division of Valeant Pharmaceuticals International, Inc. The company has expertise in aesthetic energy devices that are used in areas such as skin resurfacing and rejuvenation, body contouring, acne reduction, skin tightening, and liposuction. In 2014, Solta Medical was acquired by Valeant Pharmaceuticals International and in 2018, the company changed its name to Bausch Health Companies, Inc.

-

Candela Medical is an aesthetic devices company. The company’s offerings are in the areas of hair removal; body contouring; treatment of acne, leg veins, & cellulite; tattoo removal; wrinkle reduction; and improving skin appearance through treatment of superficial benign vascular & pigmented lesions. It offers products under three brands: Candela, CoolTouch, and Syneron. The company has its presence in around 86 countries, including Germany, Portugal, Spain, the UK, France, Japan, the U.S., Australia, China, and Hong Kong. In 2019, Syneron Candela rebranded itself as Candela to demonstrate the unification of Candela and Syneron brands.

-

Lumenis is an Israel-based company that manufactures and supplies equipment & solutions in the aesthetics & beauty space. It is known for its minimally invasive clinical solutions and energy-based technologies, including Laser, Intense Pulsed Light (IPL), and Radio-Frequency (RF). The company has global presence in over 100 countries. It serves technology in treatment areas of hair removal, scars & tattoo removal, skin remodeling, and vascular lesions.

-

Alma Lasers is involved in the designing, manufacturing, and marketing of medical lasers, RF, and ultrasound-based integrated portfolio for aesthetics & medical industry. The company was incorporated in 1999 and has a presence in over 60 countries worldwide. The company is known for its aesthetic treatment product line, especially Pixel, which is a skin rejuvenation technique based on resurfacing technology. Shanghai Fosun Pharmaceutical (Group) Ltd. acquired a 95.20% share of Alma Lasers Ltd. in 2013.

-

Revance Therapeutics, Inc. is a biotechnology company that manufactures aesthetic and therapeutic products, as well as financial technology services for aesthetic practices. The company’s Daxibotulinumtoxin A is currently under investigational study but has reported positive results from Phase III Clinical trials. The company also manufactures hyaluronic acid fillers for treatment of wrinkles.

-

Merz Pharma is an aesthetic and neurotoxin manufacturing company headquartered in Germany. The portfolio of the company comprises medical aesthetics, injectables, fillers, skincare products, and also neurotoxin therapy. They also have expertise in internal R&D with over USD 111.68 million investment every year. Merz Pharma has acquired numerous companies in the medical aesthetic industry since 2015.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Aesthetic Medicine Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2018 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Aesthetic Medicine Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."