- Home

- »

- Medical Devices

- »

-

Medical Automation Market Size And Share Report, 2030GVR Report cover

![Medical Automation Market Size, Share & Trends Report]()

Medical Automation Market (2025 - 2030) Size, Share & Trends Analysis Report By Application Type (Therapeutic Automation, Laboratory & Pharmacy Automation), By End -use (Hospitals & Diagnostic Centers, Pharmacies), By Region, And Segment Forecasts

- Report ID: 978-1-68038-911-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Automation Market Summary

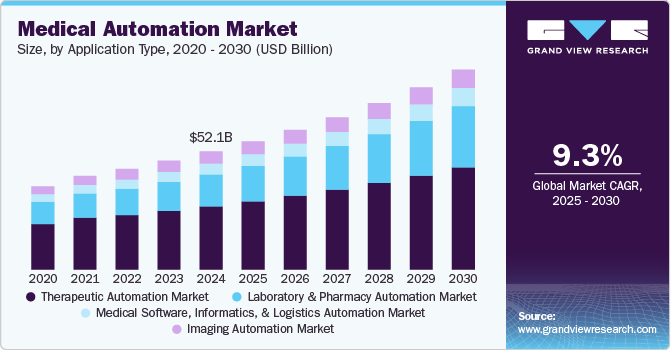

The global medical automation market size was estimated at USD 52.09 billion in 2024 and is projected to reach USD 88.11 billion by 2030, growing at a CAGR of 9.26% from 2025 to 2030. The market is driven by several key factors, including the increasing demand for efficiency and accuracy in healthcare delivery, the rise in chronic diseases necessitating improved diagnostic and treatment options, advancements in technology, and the push for regulatory compliance and enhanced patient safety.

Key Market Trends & Insights

- North America dominated the global medical automation market with the largest revenue share of 42.05% in 2024.

- The medical automation market in the U.S. led the North America region and held the largest revenue share in 2024.

- By application, the therapeutics automation segment led the market with the largest revenue share of 53.05% in 2024.

- By end use, the pharmacies segment is expected to grow at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 52.09 Billion

- 2030 Projected Market Size: USD 88.11 Billion

- CAGR (2025-2030): 9.26%

- North America: Largest market in 2024

For instance, in June 2024, Keragon Inc. launched Keragon, an AI-powered HIPAA-compliant automation platform, which has launched from stealth as the first no-code workflow automation solution for U.S. healthcare. It is already being used by clinics, digital health startups, hospitals, and NASDAQ-listed companies nationwide to streamline operations and improve efficiency.

Healthcare providers are under pressure to reduce costs while improving service quality, leading to a significant interest in technologies that streamline processes. According to the National Centre for Biotechnology Information (NCBI), hospitals implement automated laboratory testing and medication management systems, enabling them to serve more patients with better outcomes. This drive for efficiency pushes healthcare organizations to invest in automated solutions to meet rising patient expectations.

Technological advancements also play a pivotal role in driving the market. Innovations in artificial intelligence, machine learning, and robotics are transforming healthcare delivery, enabling the development of advanced automated systems that enhance diagnostic accuracy and treatment precision. As technology evolves, healthcare providers increasingly adopt these automated solutions to stay competitive and improve patient care outcomes.

The push for regulatory compliance and improved patient safety significantly influences the market. Stringent regulations imposed by healthcare authority demand that medical devices and processes adhere to high safety standards, making automation an appealing option for compliance. Automation helps minimize human errors, which can lead to adverse events in patient care.

Case Study & Insights:

A case study titled “Automating DaVita Labs to Increase Productivity" was published by Siemens Healthcare Private Limited in December 2021. This research shows significant enhancements in performance and efficiency achieved through the automation of diagnostic laboratories, especially when combined with effective implementation and change management strategies.

Challenge:

Creating a new lab with advanced processes and sufficient throughput to replace two high-volume facilities posed significant challenges. Maintaining current throughput in the older facilities until the new lab was operational added complexity. DaVita faced the critical task of training laboratory professionals for the new facility. The presence of various middleware solutions in older facilities hindered cross-training flexibility. Standardizing middleware and equipment solutions was essential to enhance adaptability to volume changes, enabling certification for around 250 team members.

Solution:

DaVita aimed to understand staff perceptions of their laboratories and their expectations for a new facility to enhance collaboration. Together with Siemens Healthineers HCS, they created a tailored survey to gauge employee views. The findings informed a communication strategy addressing identified issues and contributed to training modules for the transition.

The shift to the new laboratory involved more than acquiring new skills; the team needed to adopt a different culture for the project to succeed. Unlike the previous labs, which had distinct workflows based on specific disciplines, the new lab was created as an integrated multidisciplinary space where hematology, chemistry, and immunoassay would operate on a unified system.

“We invested a lot of energy into designing the new multidisciplinary workstations and communicating with the staff on how to move to that model.”

-Senior Manager of Global Healthcare Consulting Solutions at Siemens Healthineers.

Outcome:

The DaVita team views the results as highly favorable. The new facility completely replaced the previous two laboratories. The laboratory professionals at DaVita fully adopted the latest automated systems, and staff engagement levels are at an all-time high. This reflects the outstanding performance of the DaVita team and the effective training and change management implemented by both DaVita and Siemens Healthineers.

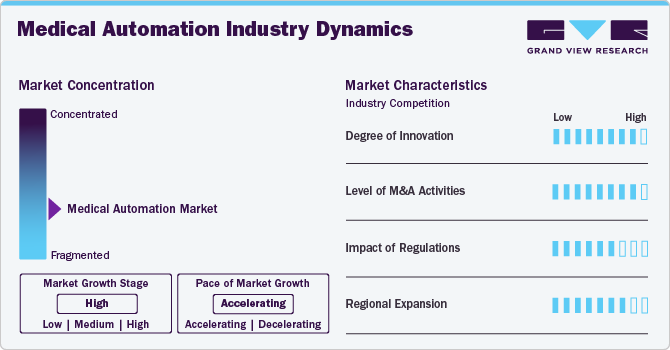

Market Concentration & Characteristics

The degree of innovation in the market is high, characterized by rapid advancements in technologies such as artificial intelligence, robotics, and data analytics. Companies are increasingly integrating AI into diagnostic tools and treatment protocols, enhancing accuracy and efficiency. For instance, in July 2024, FUJIFILM Healthcare Americas Corporation launched the APERTO Lucent, a 0.4T MRI system featuring advanced permanent magnet technology and a unique single-pillar design.

The level of mergers and acquisitions (M&A) activities in the market is high, with a continuous flow of strategic partnerships to expand capabilities and market reach. For instance, in May 2023, Aspirion acquired FIRM Revenue Cycle Management Services, Inc. (“FIRM RCM”), which works with hospital systems to recover medical insurance claims that were denied, unpaid, or underpaid.

The impact of regulations on the market is medium, as compliance with strict healthcare standards is essential for product development and market entry. Regulatory bodies like the FDA in the U.S. and the EMA in Europe impose rigorous guidelines on medical devices and software, affecting the pace of innovation. For instance, in December 2023, Abbott's innovative solution, GLP Systems Track, received approval from the U.S. FDA and is now accessible in the U.S. This system provides laboratories with advanced features to meet high-volume demands and enhance productivity.

Regional expansion in the market is driven by varying factors across key geographies. In North America, advanced healthcare infrastructure, early adoption of cutting-edge technologies, and strong regulatory frameworks are accelerating growth. Europe is witnessing increased investments in automation to improve patient care, driven by government initiatives focused on digital health and aging populations. In the Asia-Pacific region, rapid urbanization, expanding healthcare access, and rising demand for high-quality care are promoting the adoption of medical automation technologies. Countries such as China and India are emerging as significant markets due to growing healthcare expenditure and the need to enhance efficiency in hospitals and clinics. Latin America and the Middle East are also gaining momentum as healthcare providers in these regions seek to modernize operations and address the increasing burden of chronic diseases.

Application Type Insights

The therapeutic automation segment held the largest revenue share of 53.60% in 2024,primarily due to the increasing adoption of advanced technologies in treatment protocols. Key drivers include the rising prevalence of chronic diseases that require complex treatment regimens and the growing demand for personalized medicine. Automation technologies, such as robotic surgical systems and automated infusion pumps, enhance precision and consistency in therapies, ultimately improving patient outcomes.

In addition, automated drug delivery systems ensure accurate dosing and minimize the risk of medication errors, further solidifying the role of therapeutic automation in modern healthcare. This segment's growth reflects a broader trend toward leveraging technology to enhance treatment efficacy and patient safety in clinical settings.

The laboratory and pharmacy automation segment is expected to grow at the fastest CAGR of 11.51% over the forecast period, driven by the increasing demand for efficiency, accuracy, and rapid turnaround times in diagnostic and pharmaceutical services. In laboratories, automation technologies such as robotic sample handlers and automated analyzers streamline processes, allowing for higher throughput and minimizing human error in test results.

This growth is further propelled by the increasing expansion of key companies. For instance, KMGI Tech Co., Ltd. (MGI), a provider of advanced tools and technologies for life sciences and healthcare research, has announced a strategic expansion of its automation product portfolio. This expansion enhances its offerings in sample pretreatment, sample preparation, and integrated testing, further leveraging MGI's innovative expertise in genetic sequencing and multi-omics technologies. By broadening its automation capabilities, MGI aims to streamline critical research workflows, driving greater efficiency and precision in life science research and clinical applications.

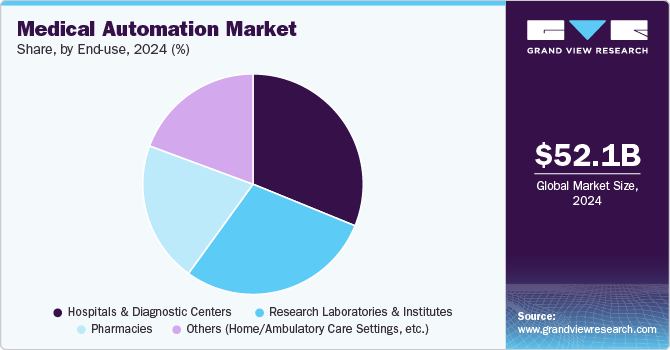

End-use Insights

The hospital and diagnostic centers segment held the largest revenue share of the market in 2024. The rising need to enhance operational efficiency, reduce human error, and improve patient outcomes. Increasing patient volumes, coupled with the growing complexity of healthcare services, have prompted hospitals to adopt automation technologies such as robotic surgery systems, automated medication dispensing, and AI-driven diagnostic tools. The shift towards value-based care, which emphasizes improved patient outcomes and cost efficiency, is further boosting the demand for automated systems in hospitals.

The pharmacies segment is expected to grow at significant CAGR from 2025 to 2030, driven by the increasing demand for efficiency, accuracy, and improved patient safety in medication dispensing and management. As healthcare systems evolve, pharmacies are adopting automated solutions such as robotic dispensing systems, automated pill packaging, and inventory management tools to streamline operations and reduce the risk of human error in medication delivery. The growing prevalence of chronic diseases and an aging population further contribute to the need for efficient pharmacy operations, as more patients require ongoing medication management.

Regional Insights

North America medical automation market dominated the global market with the largest revenue share of 42.05% in 2024. The increasing adoption of robotic surgical systems and automation in laboratory processes enhance precision and efficiency in medical procedures. The region is also witnessing a wave of mergers and acquisitions as companies aim to consolidate their positions and expand their technological capabilities, further fueling advancements in medical automation. For instance, in June 2023, Med-Metrix, LLC acquired Tritech Healthcare Management, LLC (“Tritech”), specializing in complex claims solutions for health systems, hospitals, and other healthcare providers. This acquisition enhances Med-Metrix’s complex claims offerings.

U.S. Medical Automation Market Trends

The medical automation market in the U.S. is characterized by a strong focus on improving patient safety and reducing operational costs through advanced automation technologies. The regulatory framework plays a crucial role, with regulatory bodies such as the FDA actively promoting automated device use while ensuring compliance with safety standards. For instance, according to article by Healthcare Finance published in February 2021, the U.S. healthcare system is projected to save approximately USD 16.3 billion through automation initiatives, highlighting the financial benefits of these technologies.

Europe Medical Automation Market Trends

The Europe medical automation market is experiencing considerable expansion fueled by technological innovations and a growing need for effective healthcare solutions. A notable trend is the rise in adopting robotic surgery systems and automated diagnostic tools, which enhance precision and reduce patient recovery times. For instance, in June 2023, BD (Becton, Dickinson, and Company) introduced a new automated device designed for preparing samples for clinical diagnostics using flow cytometry.

The medical automation market in the UK is experiencing significant growth, driven by several key factors. Government initiatives, particularly through the National Health Service (NHS), are focused on modernizing healthcare infrastructure and fostering increased adoption of automation technologies. The push for digital health transformation, including the widespread implementation of electronic health records (EHRs) and automated patient management systems, is a major driver.

Germany medical automation market is expected to grow significantly over the forecast period. This growth is driven by rapid technological advancements and a robust healthcare infrastructure. Germany's strong emphasis on research and development fosters an environment conducive to innovation in medical technologies. For instance, in April 2024, Hitachi purchased MA Micro Automation in Germany to boost global growth in the robotic system integration business in the medical and other sectors. Automation integration in laboratory settings is also gaining traction, with automated systems being deployed for sample analysis and processing to improve efficiency and accuracy in diagnostics. This focus on innovation is expected to drive further growth in Germany's medical automation sector.

Asia Pacific Medical Automation Market Trends

The medical automation market in Asia Pacific is driven by a surge in healthcare digitization and the adoption of advanced technologies. India and Australia are witnessing a significant push towards smart healthcare solutions, with innovations such as AI-driven diagnostic tools and telehealth services becoming more mainstream. The growth is further supported by numerous mergers and acquisitions among technology firms aiming to expand their offerings and capabilities in automated healthcare solutions. For instance, in July 2023, Ventra Health acquired ArcMed, an Indian billing and automation firm, enhancing service quality and operational efficiency and supporting growth through increased automation capabilities.

Japan medical automation market is expected to grow significantly over the forecast period. Japan's focus on healthcare innovation, supported by government policies promoting the adoption of automation technologies, fosters the integration of robotics, AI, and automated systems in hospitals and healthcare facilities. The country’s leadership in robotic surgery and precision diagnostics, alongside advancements in AI-driven patient monitoring and telemedicine, further drives market expansion.

The medical automation market in China is witnessing substantial growth fueled by rapid technological advancements and increasing healthcare expenditure. The country saw a rise in partnerships among key players as they strived to enhance their product offerings and expand their market reach. For instance, in February 2022, Siemens Healthineers and Universal Medical Imaging partnered to enhance 5G remote imaging diagnostics for primary healthcare in various regions across China. In addition, the Chinese government implemented policies to promote innovation in medical technologies, leading to the development of homegrown solutions such as automated diagnostic systems and telehealth platforms.

Latin America Medical Automation Market Trends

The Latin America medical automation market is experiencing significant growth driven by increasing healthcare investments and rising demand for efficiency in medical facilities. Countries, including Brazil and Mexico, are focusing on digital health innovations, such as telemedicine and robotic-assisted surgeries, which are becoming more prevalent due to the need for improved healthcare access. In addition, the region is seeing a rise in partnerships and collaborations, with companies launching services that cater to specific regional needs. For instance, in June 2023, CHEQ Technologies entered into a strategic partnership agreement with Opuspac, a provider of medical automation equipment located in Brazil.

Middle East & Africa Medical Automation Market Trends

The medical automation market in the Middle East and Africa is characterized by increasing healthcare infrastructure investments, particularly in the Gulf Cooperation Council (GCC) countries, which are driving the adoption of advanced medical technologies. Governments across the region are focusing on modernizing healthcare services, which include integrating automation for improved efficiency and patient care. The rising burden of chronic diseases, such as diabetes and cardiovascular conditions, is further pushing the demand for automated diagnostic and treatment solutions.

Key Medical Automation Company Insights

The market is characterized by intense competition, with numerous companies having a significant presence. This industry is evolving due to the increasing demand for enhanced products as desired by consumers. Companies are adopting strategies such as launching new products, improving technology, and forming partnerships to maintain competitiveness and achieve better market penetration.

For instance, in February 2023, Faulhaber introduced a new compact linear actuator designed specifically for medical applications. This innovative product aims to enhance precision and efficiency in medical devices, catering to the growing demand for advanced technology in healthcare. Its compact design allows for easy integration into various medical systems.

Key Medical Automation Companies:

The following are the leading companies in the medical automation market. These companies collectively hold the largest market share and dictate industry trends.

- Accuray Incorporated

- Tecan Trading AG

- Medtronic

- Swisslog Holding AG

- GE Healthcare

- Intuitive Surgical Operations, Inc.

- Stryker

- Siemens

- Koninklijke Philips N.V.

- Danaher Corporation

- Zimmer Biomet

Recent Developments

-

In October 2023, AMETEK, Inc. finalized an agreement to purchase Paragon Medical, a supplier of specialized medical components and instruments, from American Securities LLC affiliates in a cash deal worth around USD 1.9 billion.

-

In May 2023, Medical Manufacturing Technologies (MMT), a company under Arcline Investment Management, acquired Somex Automation, based in Ireland, and specializes in providing custom automation solutions and processes for the medical device manufacturing sector.

-

In June 2022, BD bought Parata Systems, a company specializing in pharmacy automation solutions, for USD 1.525 billion.

-

In April 2021, Siemens Healthineers finalized the purchase of Varian, enhancing its role as a comprehensive partner in the healthcare sector.

Medical Automation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56.58 billion

Revenue forecast in 2030

USD 88.11 billion

Growth rate

CAGR of 9.26% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Accuray Incorporated; Tecan Trading AG; Medtronic, Swisslog Holding AG; GE Healthcare; Intuitive Surgical Operations, Inc.; Stryker; Siemens; Koninklijke Philips N.V.; Danaher Corporation; Zimmer Biomet

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Automation Market Report Segmentation

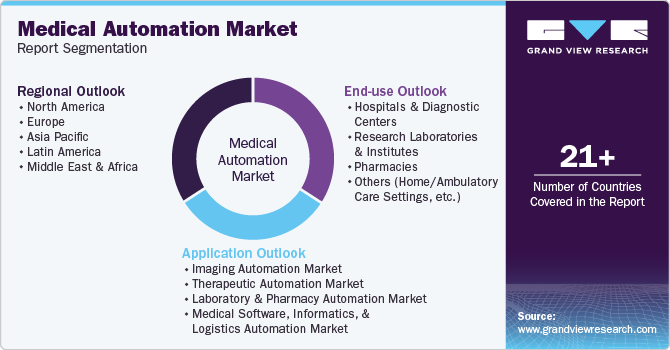

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical automation market report based on application type, end use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Imaging Automation Market

-

Integrated Image Analysis software systems

-

Medical Intraoperative Imaging

-

iCT

-

iUltrasound

-

iMRI

-

C-arm system

-

-

-

Therapeutic Automation Market

-

Non-Surgical Automation Market

-

Defibrillators

-

Implantable Cardioverter Defibrillators

-

Automated External (Portable) Defibrillators

-

Wearable cardioverter defibrillators

-

-

Electronic Drug Delivery Systems

-

-

Surgical Automation Market

-

Surgical Robotic device

-

Intelligent Operating Rooms

-

Surgical Simulators

-

-

-

Laboratory and Pharmacy Automation Market

-

Laboratory Automation

-

Total Automation (Inclusive of Pre-analysis, Transport Mechanisms, Liquid Handling, Sample Storage, & Analysis)

-

Modular Automation Systems (Inclusive of Specimen Acquisition & Identification & Labelling, Transport Mechanisms, Sample Preparation, Sample Loading & Aspiration, Reagent Handling & Storage, Sample Analysis & Measurements)

-

-

Pharmacy Automation

-

-

Medical Software, Informatics, and Logistics Automation Market

-

Software and Informatics

-

Logistics Automation

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Centers

-

Research Laboratories & Institutes

-

Pharmacies

-

Others (Home/Ambulatory Care Settings, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical automation market size was estimated at USD 52.09 billion in 2024 and is expected to reach USD 56.58 billion in 2025.

b. The global medical automation market is expected to grow at a compound annual growth rate of 9.26% from 2025 to 2030 to reach USD 88.11 billion by 2030.

b. North America dominated the market and accounted for a revenue share of over 42.05% in 2024, owing to high R&D investments, product launches, and government initiatives. Furthermore, the growth is attributed to the presence of a well-established healthcare infrastructure, which has increased the use of laboratory automation in the region.

b. Some key players operating in the medical automation market include Accuray Incorporated, Tecan Trading AG, Medtronic, Swisslog Holding AG, GE Healthcare, Intuitive Surgical Operations, Inc., Stryker, Siemens, Koninklijke Philips N.V., Danaher Corporation, Zimmer Biomet.

b. Key factors that are driving the market growth include an increase in technological advancement, favorable government supporting medical automation with funding, rising demand for robotic surgery, and increasing adoption of automation in the healthcare system.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.