- Home

- »

- Medical Devices

- »

-

Medical Device Contract Research Organization Market Report 2030GVR Report cover

![Medical Device Contract Research Organization Market Size, Share & Trends Report]()

Medical Device Contract Research Organization Market (2024 - 2030) Size, Share & Trends Analysis Report By Phase (Preclinical, Clinical), By Service, By Device Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-599-7

- Number of Report Pages: 183

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Contract Research Organization Market Summary

The global medical device contract research organization market size was estimated at USD 7.75 billion in 2023 and is projected to reach USD 14.0 billion by 2030, growing at a CAGR of 8.95% from 2024 to 2030. The market growth can be attributed to the increase in the number of medical device-specific clinical trials, growing demand for advanced medical devices, and the rise in focus among medical device companies to reduce the cost associated with research.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Mexico is expected to register the highest CAGR from 2024 to 2030.

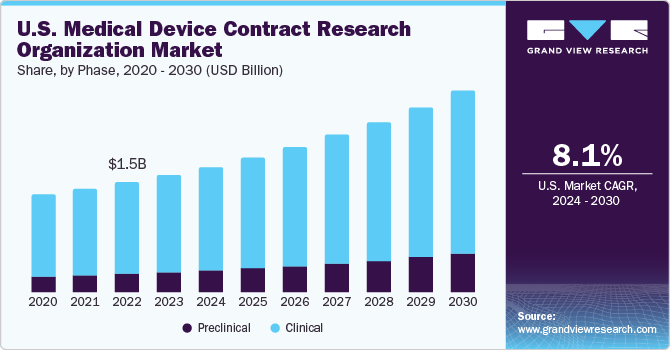

- Based on phase, the clinical segment dominated the market and accounted for the largest revenue share of 85.1% in 2023.

- Based on service, the clinical monitoring segment led the global market in 2023 accounting for a revenue share of 21.0% in 2023.

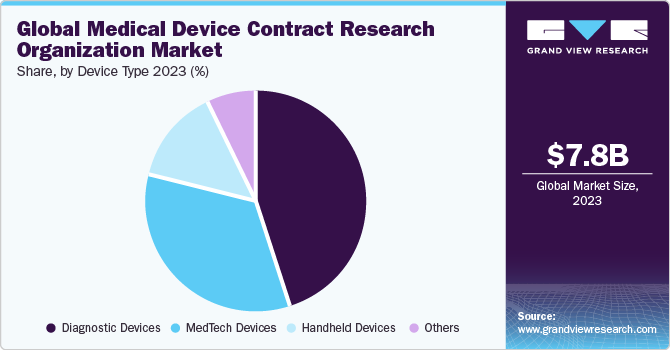

- Based on device type, the diagnostic devices segment led the market with a maximum share of 44.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.75 Billion

- 2030 Projected Market Size: USD 14.0 billion

- CAGR (2024-2030): 8.95%

- Asia Pacific: Largest market in 2023

During the COVID-19 recovery period, the medical devices pipeline witnessed a steady rise in recent years. The growing demand for novel technologies and need to make devices patient-friendly are expected to provide robustness to the pipeline of medical devices during the forecast period. Owing to stringent regulations by regulatory agencies such as the FDA and EMA, medical device companies outsource their medical affair needs to streamline the regulatory process. Thus, this is expected to positively impact market growth in the coming years.

The medical device contract research organization (CRO) market is growing at a steady pace owing to access to advanced technological resources. It saves time and is cost-efficient. CROs are becoming important in the medical and healthcare sectors. CROs have deep knowledge of complex regulatory requirements and audits as they work in clinical compliance on a daily basis. This helps them address all compliance challenges. Furthermore, high demand for effective medical devices, a growing patient population, and funding & grants provided by the government for certain medical devices are also projected to drive the market.

The current trend in the medical device industry is of small & portable products that need more components & sophisticated manufacturing technologies along with automation systems. Medical products, including a variety of life-assistance devices, drug delivery systems, therapeutic devices, and patient monitors, are all becoming smaller in size, while features & performance are improving. Wearable and implantable devices that monitor, administer, treat, & track patient conditions are common requirements. In order to remain competitive in the market, medical device companies are trying to develop enhanced versions of their devices, which is expected to promote the demand for contract research services for medical devices in the coming years.

Market Concentration & Characteristics

Market growth stage is stable and is expected to accelerate over the estimated period. The medical device contract research organization market is characterized by technologies, regulatory considerations, and globalization & outsourcing of product processes to influence advantages and specialized capabilities.

The design and development of products have observed significant advancements collectively aiming to achieve high-quality products driving innovation in this field in terms of technology & manufacturing capabilities, thereby offering commercial opportunities for market expansion.

A robust understanding of regulatory requirements is crucial for the medical device industry's success as the regulatory landscape is intricate. The medical device industry is subject to stringent regulations to ensure the safety and efficacy of devices. Regulatory experts help CROs navigate and adhere to complex & evolving regulatory requirements, ensuring that clinical trials are conducted in compliance with applicable laws.

Medical device contract research organization players leverage strategies such as collaborations, partnerships, and acquisitions to promote the reach of their offerings and increase their product capabilities globally. For instance, in February 2022, a subsidiary of the company, Eurofins Clinical Testing Lux Sarl, acquired a Vietnam-based genetic testing provider, Genetic Testing Service JSC. This acquisition was expected to help the company expand its network of clinical diagnostics laboratories in Asia.

The rising number of clinical studies, and technologically advanced medical device innovations fuel market growth.

Phase Insights

The clinical segment dominated the market and accounted for the largest revenue share of 85.1% in 2023. On the basis of phase, the market has been bifurcated into clinical and preclinical. This is mainly because of the growing emphasis on decreasing the cost associated with research among medical device companies. Furthermore, a large pipeline of medical devices in the clinical phase supports the segment growth.

The preclinical segment is expected to grow at the fastest CAGR of 10.2% over the forecast period. Increasing product complexity and tight governmental restrictions are driving demand for medical device preclinical CRO services. Moreover, there is a growing demand for advanced medical devices. This is expected to improve the number of preclinical medical device clinical trials, and thus support the demand for preclinical CRO services for medical devices in the coming years.

Service Insights

The clinical monitoring segment led the global market in 2023 accounting for a revenue share of 21.0% in 2023. On the basis of services, the market is segmented into project management/clinical supply management, data management, regulatory/medical affairs, medical writing, clinical monitoring, quality management/assurance, bio-statistics, investigator payments, laboratory, patient & site recruitment, technology, and others. The segment is anticipated to maintain its position over the forecast period owing to a large number of clinical trials performed and, to study them, increasing demand for clinical trial monitoring. The introduction of devices, such as smart analytics and real-time, is estimated to improve clinical monitoring data and thus further support the segment market growth.

The regulatory/medical affairs segment is expected to grow at the fastest CAGR of 12.4% over the forecast period. The regulatory approval process reflects the different challenges involved in the development of medical devices. Medical device companies are outsourcing regulatory affairs to CROs, which is helping them focus on their core competencies. Outsourcing helps in reducing variable costs. Regulatory support activities include product labeling, regulatory document submissions, regulatory intelligence, liaison with regulatory authorities, and planning regulatory strategies. The strict regulation for medical devices is expected to support the segment market growth.

Device Type Insights

The diagnostic devices segment led the market with a maximum share of 44.9% in 2023. Based on the device type, the market is segmented into MedTech devices, diagnostic devices, handheld devices, and others. The growing prevalence of diseases worldwide is supporting the demand for CRO activities for diagnostic devices. According to the WHO, 17.9 million people lose their lives every year due to cardiovascular diseases. Moreover, in the case of cancer, roughly 10 million deaths, or nearly one in six deaths, will be caused by cancer in 2020, making it the top cause of death globally. A timely diagnosis can significantly reduce global mortality rates. A significant number of people suffering from these diseases is expected to increase demand for diagnostic devices and support diagnostic device research activities by the CROs

The MedTech devices segment is expected to grow at the fastest CAGR of 9.2% during the forecast period. One of the primary reasons for supporting the medical device CRO market in MedTech is technological advancement. MedTech includes telehealth or telemedicine devices, robotic surgery devices, software, mHealth, and others. The growing need for increased computing power, hardware miniaturization, network connectivity, large data storage capacity, and advanced software capability are some of the major factors supporting the demand for clinical research in MedTech devices and is expected to promote the segment market growth.

Regional Insights

North America is expected to grow at a CAGR of 8.2% during the forecast period. North America is one of the major contributors to the global medical device CRO market. Rapid growth in the development of medical devices to meet the increasing demand for efficient healthcare in the North American region is expected to be one of the key factors propelling the market growth in North America. In addition, the growing demand for reducing costs of medical devices is likely to promote market growth over the forecast period.

U.S. Medical Device Contract Research Organization Market Trends

The medical device contract research organization market in the U.S. held the largest revenue share in 2023. Large medical device companies are outsourcing parts of their functions such as report writing & publishing, clinical trial application services, product design, and regulatory services, thereby contributing to the growth of the overall medical device CRO market in the U.S.

Europe Medical Device Contract Research Organization Market Trends

The Europe medical device CRO market is expected to grow significantly due to advanced technologies and well-established infrastructure, resulting in improved healthcare facilities and patient care. Players seeking entry into the European market require extensive knowledge of regulatory procedures and services in various EU member states.

The medical device contract research organization market in Germany held the largest revenue share in 2023. Germany medical device market size and production have improved consistently in the last 4 years. This steady growth in the medical device market in the future is expected to have a positive impact on the medical device contract research organization market.

The UK medical device contract research organization market is anticipated to grow over the forecast period. The main growth drivers of the regional market are presence of various multinational medical device companies, significant R&D spending, growing healthcare research, and rapidly evolving CROs focused on phases I to IV for development of new devices

Asia Pacific Medical Device Contract Research Organization Market Trends

Asia Pacific dominated the market accounting for the largest revenue share of 41.9% in 2023. The region is also expected to grow at the fastest rate during the forecast period due to the availability of a number of opportunities in this region, especially in Japan, China, Australia, and India. Various factors such as improvements in the regulatory framework, higher cost savings, increasing complexity in devices, and a growing number of medical device research organizations in the region are expected to drive the market. Moreover, the rising rate of outsourcing research services from developed economies to emerging economies, such as India & China, and the availability of a skilled workforce at a lower cost than in the U.S. and European countries are expected to accelerate market growth.

The China medical device contract research organization market held the largest revenue share in 2023. As the country is one of the most technologically advanced countries in Asia Pacific and significantly contributes to the healthcare industry in the region. Its growing geriatric population and the presence of a large middle-income group are likely to boost the demand for innovative & cost-effective medical equipment, thus creating an opportunity for clinical research services for medical devices in the country.

The medical device contract research organization market in Japan is expected to grow over the forecast period due to rapid technological advancements and high healthcare expenditure.

The India medical device contract research organization market is anticipated to grow at the fastest CAGR over the forecast period, owing to the availability of skilled laborers, low cost associated with outsourcing research services in India, and increase in government spending on healthcare R&D are supporting the medical device CRO market in India.

Key Medical Device Contract Research Organization Company Insights

The major players operating in the market focus on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, and others. The prominent strategies companies adopt are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of prominent players.

Key Medical Device Contract Research Organization Companies:

The following are the leading companies in the medical device contract research organization market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA, Inc.

- Charles River Laboratories

- ICON, plc

- Syneos Health

- Laboratory Corporation of America Holdings

- WuXi AppTec

- Medpace

- Eurofins Scientific SE

- Promedica International

- Qserve

Recent Developments

-

In February 2023, Laboratory Corporation of America Holdings announced that Fortrea-the new company to be formed by its clinical development business spinoff-will be an independent, publicly traded CRO that offers drug & medical device development services. It will provide Phases I through IV clinical trial management & commercialization solutions to pharmaceutical & biotechnology organizations across the globe.

-

In January 2023, IQVIA company & Alibaba Cloud announced a life sciences industry collaboration in China. The company will provide solutions in China by leveraging Salesforce on Alibaba Cloud. This can enable the company to extend its investments in the platform for engaging with customers.

-

In December 2022, Syneos Health collaborated with Medable, a provider of technology platforms. This collaboration helped Syneos Health perform decentralized trials effectively.

Medical Device Contract Research Organization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.36 billion

Revenue forecast in 2030

USD 14.0 billion

Growth rate

CAGR of 8.95% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Phase, service, device type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

IQVIA, Inc.; Charles River Laboratories; ICON, plc; Syneos Health; Laboratory Corporation of America Holdings; WuXi AppTec; Medpace; Eurofins Scientific SE; Promedica International; Qserve

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

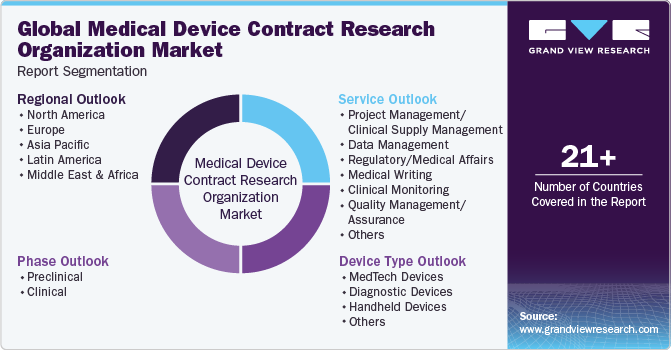

Global Medical Device Contract Research Organization Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global medical device contract research organization market report based on phase, service, device type, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Project Management/Clinical Supply Management

-

Data Management

-

Regulatory/Medical Affairs

-

Medical Writing

-

Clinical Monitoring

-

Quality Management/Assurance

-

Bio-statistics

-

Investigator Payments

-

Laboratory

-

Patient & Site Recruitment

-

Technology

-

Others

-

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

MedTech Devices

-

Diagnostic Devices

-

Handheld Devices

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical device contract research organization market size was estimated at USD 7.75 billion in 2023 and is expected to reach USD 8.36 billion in 2024.

b. The global medical device contract research organization market is expected to grow at a compound annual growth rate of 8.95% from 2024 to 2030 to reach USD 14.0 billion by 2030.

b. Clinical dominated the medical device contract research organization market with a share of 85.1% in 2023. The share is attributed by the fact of technological evolution, globalization of clinical trials, and demand for CROs to conduct clinical trials. Furthermore, a large pipeline of medical devices in the clinical phase supports the segment market.

b. Some key players operating in the medical device CRO market include IQVIA, Inc., Charles River Laboratories, ICON, plc, Syneos Health, Laboratory Corporation of America Holdings, WuXi AppTec, Medpace, Eurofins Scientific SE, Promedica International, Qserve

b. Key factors driving the medical device CRO market growth include rising requirements for advanced products, increasing complexity in product design and engineering, and growing outsourcing demand to emerging countries due to cost-benefit.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.