- Home

- »

- Medical Devices

- »

-

Medical Device Regulatory Affairs Market Size Report, 2030GVR Report cover

![Medical Device Regulatory Affairs Market Size, Share & Trends Report]()

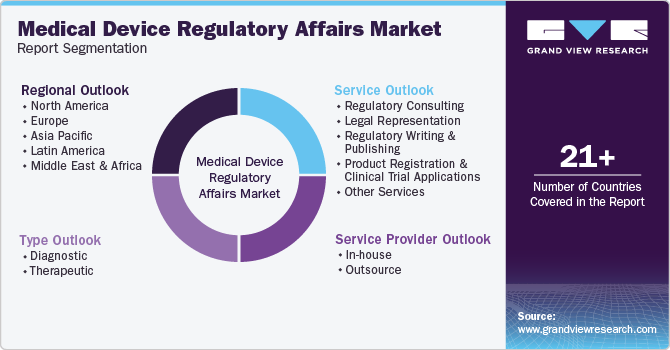

Medical Device Regulatory Affairs Market Size, Share & Trends Analysis Report By Type (Diagnostics, Therapeutics), By Service Provider (In-house, Outsource), By Service, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-360-4

- Number of Report Pages: 172

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global medical device regulatory affairs market size was estimated at USD 6.16 billion in 2023 and is projected to grow at a CAGR of 9.55% from 2024 to 2030. The shifting regulatory landscape and the rising demand for faster approval processes will drive market growth during the forecast period. In addition, the demand for new technology-based medical device products, the growing investment of medical device companies for outsourcing, the increasing pipeline of medical devices, and favorable government initiatives contribute to market growth.

These factors are anticipated to create lucrative opportunities for market growth over the forecast period.

In the medical device industry, regulatory approval is increasingly becoming more stringent & time-consuming, wherein the market players aim to receive faster product approvals to gain a higher market share. Hence, medical device companies continuously manage changing regulatory requirements, spanning various business activities and geographies. Besides, non-compliance with changing regulatory requirements can certainly result in delays & penalties, leading to loss of revenue. Therefore, geographic expansion by medical device companies aiming for speedy approvals in global markets is expected to increase the adoption of outsourcing models for regulatory affairs services.

Likewise, the medical device business is under continuous pressure to regulate costs without compromising the R&D processes, time to market, or the associated safety & quality. Novel technologies, process developments, and a rapidly aging population drive segment growth. As a result, regulations become stringent and complex with increased market competition. Medical device Original Equipment Manufacturers (OEMs) can benefit from increased agility, low operational costs, reduced time to market, and high return on investment by outsourcing some of their operations. OEMs can also transform their companies into strategic investments from cost centers. Hence, this is expected to create demand for medical affairs outsourcing services.

Furthermore, several medical device companies prioritize their core strengths and delegate noncore functions to enhance their productivity & operational efficiency. Therefore, these companies need support to comply with global regulations, which can be lengthy and tedious. Thus, the race to launch novel devices in the market in a feasible timeline and cost will likely propel the demand for CROs. Companies that previously outsourced their R&D and manufacturing functions to emerging economies from the Asia Pacific and the MEA have also started outsourcing regulatory affairs to CROs or regulatory service providers to reduce costs & increase focus on core functions. Besides, small or midsized companies that typically do not have an in-house regulatory functions department and are trying to venture into new markets must outsource their regulatory affairs. Small or specialty companies are hiring regulatory affairs consultants to assist them in these functions of international markets. Such factors drive the market growth over the estimated period.

Hence, the above factors have led medical device companies to have a regulatory department in-house or outsource their regulatory affairs functions owing to stringent regulatory requirements due to changing global regulatory scenarios. Establishing an in-house department for regulatory services in offshore countries is not feasible. Therefore, companies opt for outsourcing services depending on the size and priority of projects, which contribute to the growth of the market, specifically across the outsourcing domain.

Market Concentration & Characteristics

The medical device regulatory affairs industry growth stage is moderate, with an accelerating pace. It is characterized by the level of merger and acquisition activities, degree of innovation, impact of regulations, service expansion, and regional expansion.

The medical device regulatory affairs have observed a degree of innovation due to the rapid adoption of technology across the regulatory space. Rapid advancements in medical device technology, such as connected devices, software as a medical device (SaMD), and artificial intelligence applications, require expertise in addressing the unique regulatory challenges associated with these innovations. This has led to a rise in medical device regulatory affairs services requirements for various medical devices.

The rising demand for various medical devices has made the market more competitive, leading to a rise in mergers and acquisitions. Besides, consolidation in the medical device industry through mergers and acquisitions often results in the need to harmonize and manage diverse regulatory portfolios, driving demand for regulatory expertise.

Increasing regulatory requirements among medical devices to maintain and establish comprehensive regulations and manage risk appropriately have increased the demand for medical device regulatory affairs services, further driving the market's growth over the estimated time period.

A competitive market has led to a surge in the development of new medical devices. Companies are eager to gain a competitive edge through faster market approvals, leading to greater demand for regulatory expertise. Besides, demand for various medical devices propels the regulatory affairs requirement for medical devices.

Medical device companies are expanding their operations to international markets. This expansion necessitates a deep understanding of varied regulatory landscapes, leading to increased demand for regulatory affairs services to gain market access in different regions, further driving market growth.

Service Provider Insights

Based on the service provider segment, the market is segmented into outsourced and in-house. The outsource segment held the largest revenue share of 58.2% in 2023. The segment growth can be attributed to the reduced cost & staff training time, offshoring of medical device manufacturing to emerging countries, changing regulatory landscape, and rising medical device companies’ collaboration with regulatory compliance for device approval and product launches.

In addition, numerous medical device companies are outsourcing research & development (R&D) activities for their medical devices. The availability of various outsourcing service providers for large to mid & small-size companies is anticipated to boost segment growth. Moreover, medical device companies opt to outsource to reduce costs & staff training time, improve overall efficiency, and provide greater flexibility, leading to enhanced effectiveness of the company.

In 2023, the in-house segment is anticipated to grow at a significant CAGR over the forecast period. The segment is expected to grow at a moderate pace due to the need for more funds & infrastructure among medical device companies to support in-house regulatory affairs. These services are flexible for low-to-medium production among small to mid-sized companies. It allows the company to achieve optimal product management and operational and cost efficiency. In addition, well-established medical device companies have a skilled team for regulatory affairs due to their extensive product portfolios, pipelines, and the ability to attract experienced professionals, which makes it a feasible & practical option. Such factors are anticipated to drive the market growth over the estimated period.

Service Insights

Based on service segment, the market is segmented into legal representation, regulatory consulting, product registration & clinical trial applications, regulatory writing & publishing, and other services. In 2023, the regulatory writing & publishing segment dominated the market, accounting for a revenue share of 36.4%. The demand for regulatory writing & publishing is expected to surge as they provide high-quality documentation from the early stages of product development to premarket approval. Besides, regulatory writing & publishing plays a significant role in the success of a product’s clarity, conciseness, and accuracy in the market. Such factors are anticipated to drive the market growth.

The product registration and clinical trial segment is also expected to grow significantly over the forecast period due to stringent regulations, legal/regulatory reforms, and increasing FDA approvals in emerging markets. Besides, product registration and clinical trial application services assure regulatory agencies, healthcare professionals, and patients that medical devices are safe for use in medical settings. Hence, these services are anticipated to witness lucrative growth over the forecast period.

Type Insights

Based on type segment, the market is segmented into diagnostics and therapeutics. In 2023, the therapeutics segment held the largest revenue share in the market. Growth in the segment can be attributed to the increasing prevalence of chronic diseases, such as diabetes, cancer, cardiovascular diseases & respiratory disorders, and favorable government initiatives. Moreover, the demand for technologically advanced products, such as pen needles or auto-injectors, for effective & efficient insulin delivery in diabetic patients is fueling the therapeutics medical devices regulatory affairs growth.

The diagnostics segment is anticipated to grow at a CAGR of 10.73% over the forecast period in 2023. The growing prevalence of chronic and infectious diseases and the requirement for technologically advanced diagnostic devices are expected to create opportunities for key players in the market. In addition, the increasing number of diagnostic device launches, the growing entry of companies in the global market, and the rising demand for faster approval processes for breakthrough devices are some factors propelling market growth.

Regional Insights

North America medical device regulatory affairs market is expected to grow at a CAGR of 9.63% during the forecast period. This region is home to numerous medical device companies outsourcing regulatory consulting and clinical trial applications to regulatory service providers, thereby contributing to the growth of the market. Besides, the rapid increase in medical device manufacturing is expected to meet the high demand for efficient healthcare in the region. It is expected to be one of the major factors contributing to market growth in North America.

U.S. Medical Device Regulatory Affairs Market Trends

The medical device regulatory affairs market in the U.S. held the largest revenue share of the North America region in 2023. The presence of many medical device companies operating in the U.S. proceeding toward regulatory affairs and consulting for their product registration, clinical trial application, and legal representation is contributing to the market growth. In addition, increased efforts by the government and regulatory agencies to avoid medical device failure & injurious effects are expected to propel the regional market growth. Furthermore, the modernized healthcare system in the country has increased the requirement for more innovative medical devices. This is expected to boost the market demand for various medical devices, propelling the requirement for regulatory affairs for medical devices.

Europe Medical Device Regulatory Affairs Market Trends

The medical device regulatory affairs market in Europe is expected to grow significantly. The region is one of the most advanced regions across the globe, with advanced technologies and infrastructure, resulting in better healthcare facilities and patient care. In addition, small and midsized medical device regulatory companies are emerging in the region to satisfy the high demand for regulatory affairs created due to the increased production of medical devices.

The medical device regulatory affairs market in Germany held the largest share in 2023, owing to the development of healthcare infrastructure. According to the International Trade Administration in December 2023, Germany has grown as the third-largest medical technology market after the U.S. and Japan. In addition, the growth of the medical device market in the country is boosting regional market growth.

The medical device regulatory affairs market in the UK is anticipated to grow over the forecast period owing to the continuous efforts of the government to encourage the development of healthcare and infrastructure. For instance, in March 2022, the UK government announced an investment of USD 316 million to support healthcare research and the development of medical devices. Therefore, the growing government's efforts to improve user safety in healthcare increase the demand for medical device regulatory affairs, boosting the market growth.

Asia Pacific Medical Device Regulatory Affairs Market Trends

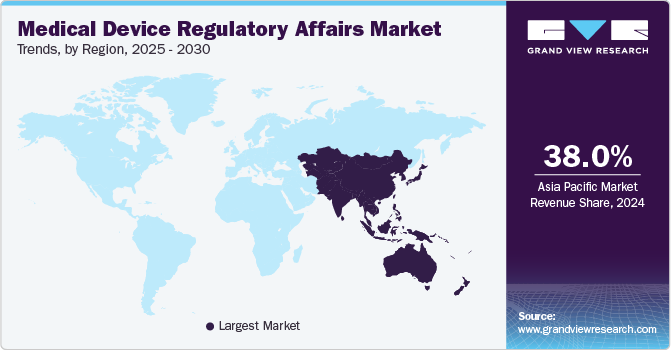

The Asia Pacific medical device regulatory affairs market held the largest global revenue share of 37.82% in 2023. This can be attributed to an improved regulatory landscape, an increasing number of medical device companies, and a growing number of clinical trials across the region. Other factors contributing to the growth are increased R&D activities, rising prevalence of chronic diseases, growing geriatric population, and favorable government initiatives in the healthcare sector.

Furthermore, low-cost manufacturing possibilities in the Asia Pacific region attract medical device manufacturers. Moreover, the growing geriatric population, rising prevalence of chronic diseases among people, and increasing government support for the healthcare sector are contributing to the growth of the regional market. Hence, these factors are anticipated to increase the number of market entrants, thereby fueling the market growth in the region.

China medical device regulatory affairs market held the largest share in 2023. The country is driven by technological advancement, which significantly contributes to the healthcare industry of the region. In addition, the rise in the geriatric population and the presence of a large population belonging to the middle-income group increases the demand for innovative & cost-effective medical equipment, which is expected to attract major medical device companies to this region.

The medical device regulatory affairs market in Japan is expected to grow over the forecast period due to growing government support for technological updates and innovations in the country. Medical device manufacturers residing in the country are engaged in producing modern technological medical devices. As the production of medical devices increases, the demand for medical device regulatory affairs also grows. This is expected to increase the presence of more regulatory affairs companies in the region.

The medical device regulatory affairs market in India is anticipated to grow at the fastest CAGR over the forecast period. The country is gradually adopting new technology in medical devices. Certain developments have been made in precision surgical tools for wound closure, obstetrics, orthopedics, neurosurgery, and plastic & reconstructive surgery. The pandemic has further propelled advancements, increasing the demand for automated analysis, precision testing, and shorter turnarounds. The rise in the adoption of new technologies for medical devices in the country is expected to improve the demand among regulatory affairs players in the country for developing new devices. This is creating competition among market players in the country.

Key Medical Device Regulatory Affairs Company Insights

Several key players are adopting various strategic initiatives to strengthen their market position, offering medical device regulatory affairs for innovating various medical devices. The prominent strategies adopted by the key companies are new product launches, agreements, partnerships, expansions, and mergers & acquisitions/joint ventures to increase their revenue share in the market and gain a competitive edge over the competitors.

Key Medical Device Regulatory Affairs Companies:

The following are the leading companies in the medical device regulatory affairs market. These companies collectively hold the largest market share and dictate industry trends.

- ICON, Plc

- Emergo

- Freyr

- Laboratory Corporation of America Holdings

- IQVIA, Inc.

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- Promedica International

- Integer Holdings Corporation

- Medpace

Recent Developments

-

In June 2024, IMed Consultancy launched a new white paper assessing the regulatory state for Artificial Intelligence (AI) & Machine Learning (ML)-powered medical devices in the U.S., UK, and EU.

-

In August 2023, Intertek’s medical division, IMNB UK Ltd, received the UK Approved Body Designation from the Medicines and Healthcare Products Regulatory Agency (MHRA), enabling them to conduct the UK Conformity Assessed (UKCA) marking and issue certificates for various medical devices in the UK post-Brexit, replacing CE marking.

-

In May 2023, Emergo collaborated with the Shanghai Center for Medical Testing and Inspection (CMTC) for ongoing usability testing of medical devices in China. This collaboration was expected to ensure usability testing by following the Human Factors Engineering (HFE) guidelines outlined by China’s National Medical Products Administration (NMPA).

Medical Device Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.75 billion

Revenue forecast in 2030

USD 11.66 billion

Growth rate

CAGR of 9.55% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, type, service provider, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ICON, Plc; Emergo; Freyr; Laboratory Corporation of America Holdings; IQVIA, Inc.; Intertek Group plc; SGS Société Générale de Surveillance SA; Promedica International; Integer Holdings Corporation; Medpace

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Medical Device Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical device regulatory affairs market report based on services, type, service provider, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Therapeutic

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsource

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global medical device regulatory affairs market size was estimated at USD 6.16 billion in 2023 and is expected to reach USD 6.75 billion in 2024.

b. The global medical device regulatory affairs market is expected to witness a compound annual growth rate of 9.55% from 2024 to 2030 to reach USD 11.66 billion by 2030.

b. The Asia Pacific region held the largest share of 37.82% in 2023. This can be attributed to an improved regulatory landscape, an increasing number of medical device companies, and a growing number of clinical trials across the region. Other factors contributing to the growth are increased R&D activities, the rising prevalence of chronic diseases, and favorable government initiatives in the healthcare sector.

b. Some key players operating in the medical device regulatory affairs market include ICON, Plc, Emergo, Freyr, Laboratory Corporation of America Holdings, IQVIA, Inc., Intertek Group plc, SGS Société Générale de Surveillance SA, Promedica International, Integer Holdings Corporation, and Medpace among others

b. Rising demand for faster approval processes, a shifting regulatory landscape, and growing expansion in emerging fields such as therapeutics and diagnostics are expected to drive the market. Besides, the increasing complexity of medical devices and favorable government initiatives are also supporting the medical device regulatory affairs market's growth.

b. The regulatory writing and publishing service segment dominated the market for medical device regulatory affairs, with a 36.4% revenue share in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."