- Home

- »

- Medical Devices

- »

-

Medical Device Testing, Inspection And Certification Outsourcing Market Report, 2030GVR Report cover

![Medical Device Testing, Inspection And Certification Outsourcing Market Size, Share, & Trend Report]()

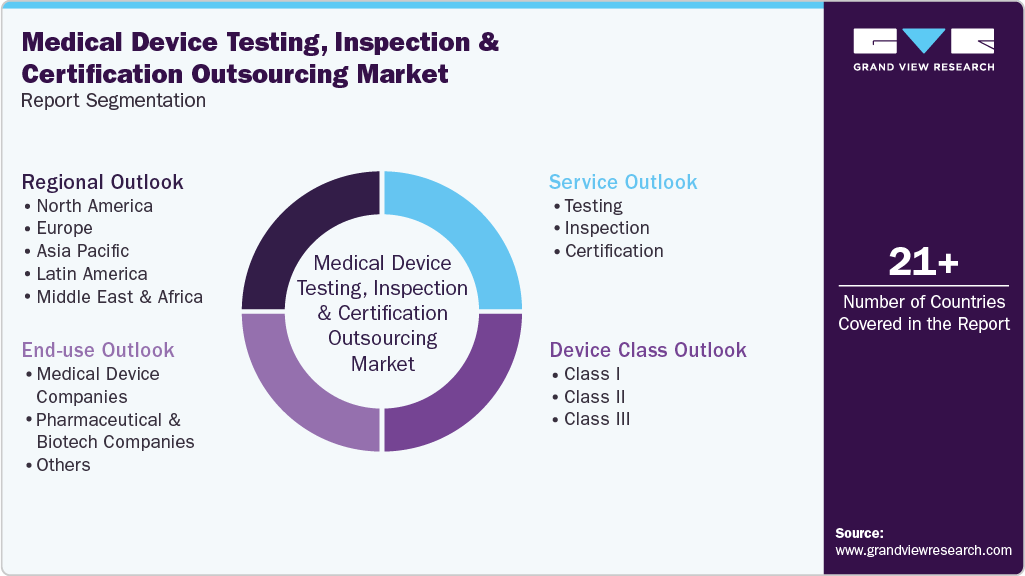

Medical Device Testing, Inspection And Certification Outsourcing Market (2025 - 2030) Size, Share, & Trend Analysis Report By Service (Testing, Inspection, Certification), By Device Class (Class I, Class II, Class III), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-608-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Testing, Inspection And Certification Outsourcing Market Summary

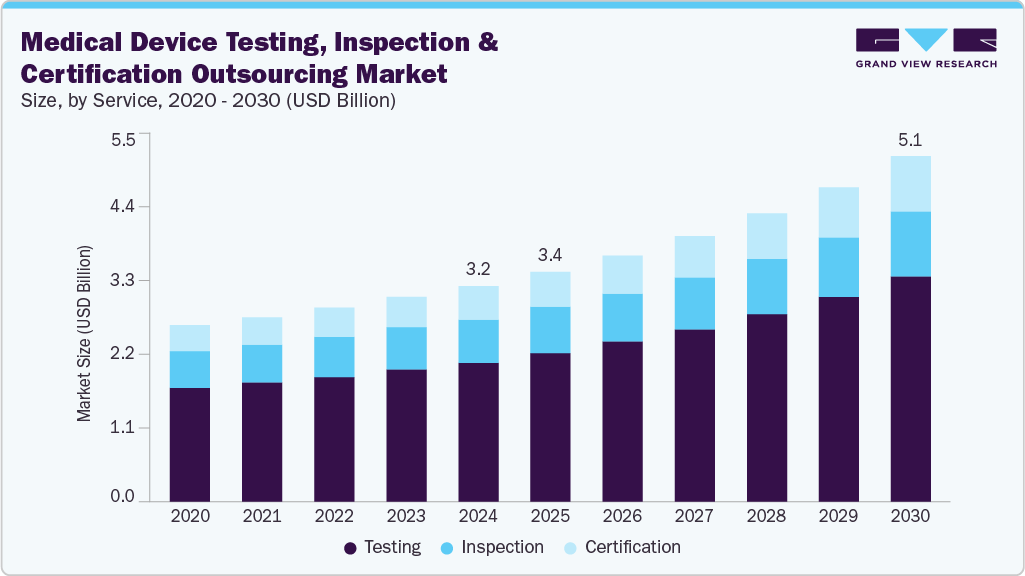

The global medical device testing, inspection, and certification outsourcing market size was estimated at USD 3.18 billion in 2024 and is projected to reach USD 5.11 billion by 2030, growing at a CAGR of 8.48% from 2025 to 2030. The market growth is primarily attributable to the stringent regulatory scenario, accelerated innovation cycles, and expanding device complexity across diagnostic, therapeutic, and wearable categories.

Key Market Trends & Insights

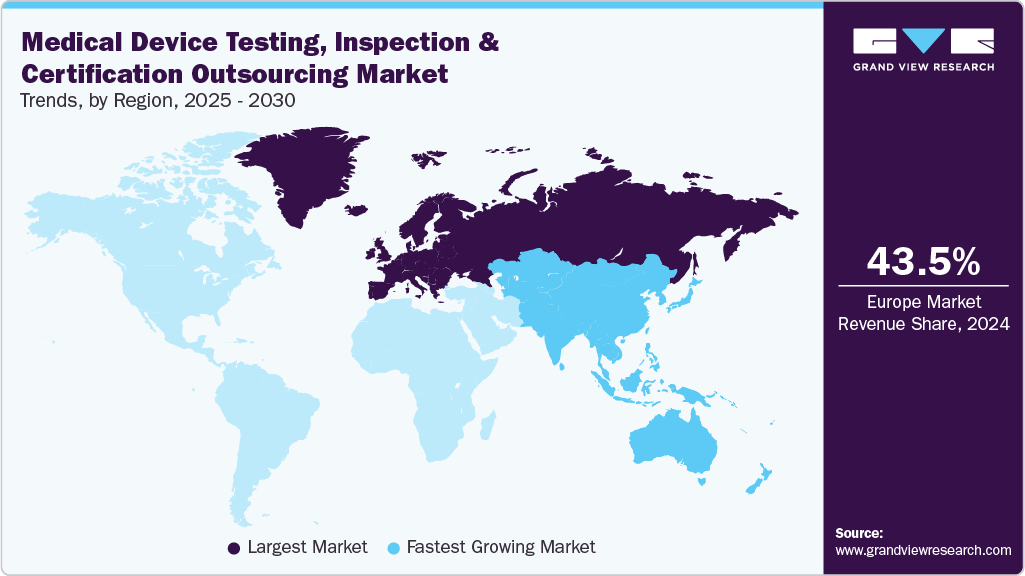

- The medical device testing, inspection, and certification outsourcing market in Europe dominated and accounted for a revenue share of 43.50% in 2024.

- The medical device testing, inspection, and certification outsourcing market in Germany accounted for the highest revenue share in the Europe region.

- By service, the testing service segment dominated the market and accounted for the highest revenue share of 64.77% in 2024.

- By device, the class II medical devices segment accounted for the largest revenue share in the global medical device testing, inspection and certification (TIC) outsourcing market in 2024

Market Size & Forecast

- 2024 Market Size: USD 3.18 Billion

- 2030 Projected Market Size: USD 5.11 Billion

- CAGR (2025-2030): 8.48%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

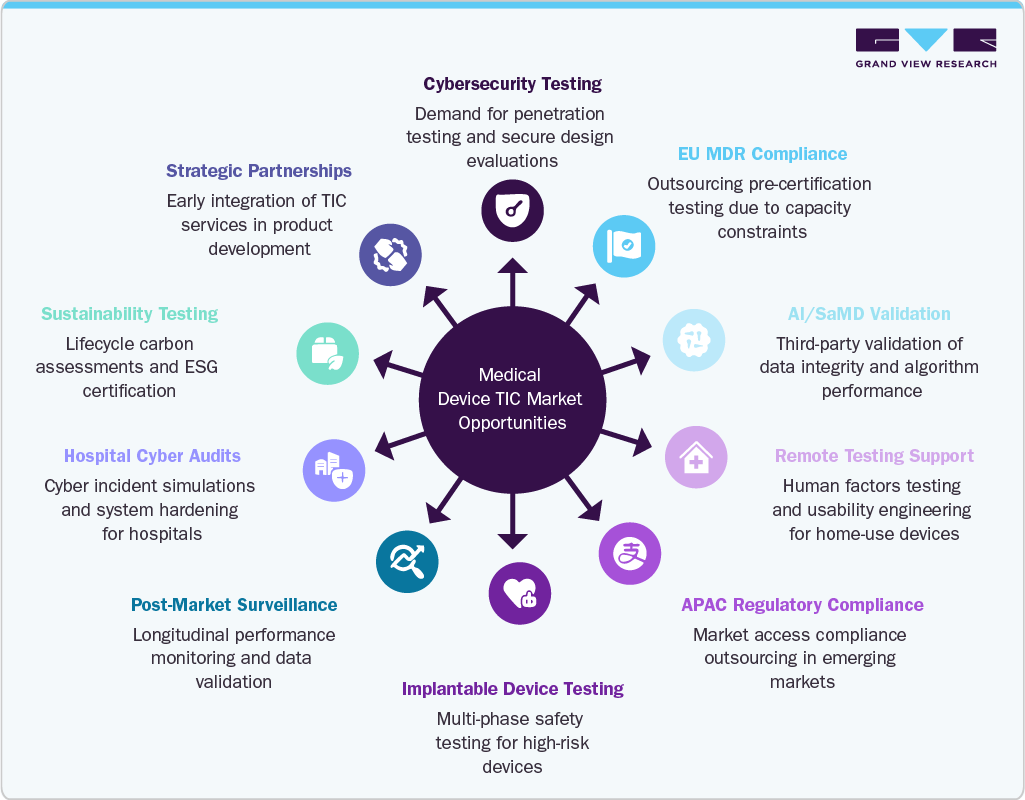

Growing scrutiny from several regulatory bodies across regions, such as the U.S. FDA, EU MDR, and China’s NMPA, has enhanced demand for third-party TIC expertise for compliance, safety assurance, and faster market access. Moreover, rising complexity in device design, particularly with the integration of software, connectivity, and AI, demands advanced testing capabilities that several in-house teams lack, offering growth opportunities. Furthermore, increasing cost pressures and the need for operational efficiency also enhance outsourcing TIC services, especially among small and mid-sized manufacturers. Growing global trade of medical devices further boosts demand for standardized certification services.The accelerating commercialization of high-risk, technologically advanced Class II and III devices, including implantables, active therapeutic systems, and digital diagnostics, has strengthened requirements for clinical validation, electrical safety, biocompatibility, and cybersecurity testing. These devices demand multi-domain TIC expertise, driving demand for specialized third-party service providers. Furthermore, mandatory post-market surveillance (PMS), vigilance reporting, and periodic safety update reporting (PSUR) requirements are increasing the volume and complexity of post-market evidence generation and compliance activities. For instance, the European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have introduced more severe compliance assessments, especially for Class II and III devices. Regulatory authorities often require continuous performance evaluation across device lifecycles, leading OEMs to outsource recurring testing, risk management, and adverse event analytics to qualified TIC partners.

Additionally, global regulators are strengthening oversight on notified bodies and authorized representatives, improving the technical documentation standards required for approvals and renewals. For instance, in April 2021, the FDA accredited UL as an ISO/IEC 17025 laboratory under the Accreditation Scheme for Conformity Assessment (ASCA) for medical device safety testing. Thus, rising regulatory compliance pressure prompts OEMs to mitigate regulatory risk, compress timelines, and optimize cost structures by engaging TIC vendors with accredited capabilities, cross-border regulatory knowledge, and integrated testing portfolios. As a result, the TIC outsourcing market is shifting from a transactional service model toward long-term, compliance-driven partnerships with embedded regulatory intelligence and quality systems expertise.

The globalization of medical device manufacturing and supply chains is a key structural driver accelerating growth in the global medical device testing, inspection, and certification (TIC) outsourcing industry. As Original Equipment Manufacturers (OEMs) diversify production across multiple geographies to mitigate cost, tariff, and regulatory risks, TIC requirements become more complex, multi-jurisdictional, and frequent. This geographic distribution requires independent third-party verification to enhance consistent compliance with region-specific regulatory frameworks such as FDA (U.S.), MDR (EU), and PMDA (Japan), alongside ISO and IEC standards. Moreover, the proliferation of contract manufacturing organizations (CMOs) and increased outsourcing intensity across design, assembly, and component production enhance quality assurance complexity. Global supply chains expand traceability and accountability risks, thereby expanding demand for end-to-end TIC services, particularly in high-risk categories such as implantables, diagnostics, and digitally connected devices.

In parallel, real-time data exchange and software integration in device supply chains require rigorous cybersecurity and software validation audits, further expanding the medical device TIC outsourcing market growth. In addition, as regulatory authorities increase scrutiny of imported devices, manufacturers increasingly rely on third-party TIC providers to expedite market entry while minimizing compliance lapses. For instance, in March 2023, the U.S. FDA introduced Section 524B on "Ensuring Cybersecurity of Devices" under the Consolidated Appropriations Act (Omnibus), 2023, mandating that all new medical device premarket submissions include cybersecurity information. This marked the first legally binding cybersecurity requirement within the Federal Food, Drug, and Cosmetic Act (FD&C Act), impacting all Class II and III device submissions. As a result, TIC outsourcing is evolving from a transactional compliance function to a strategic risk mitigation lever within globalized medical device manufacturing ecosystems.

Market Opportunities

Technology Landscape

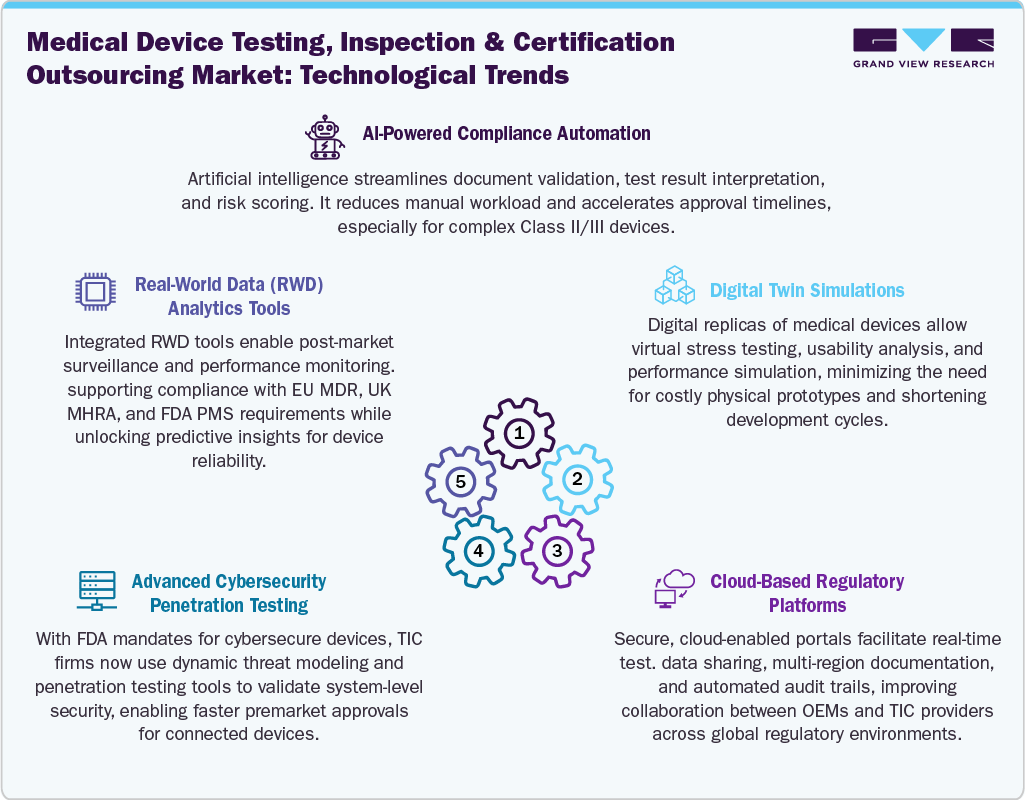

Technological advancements are transforming the medical device testing, inspection and certification (TIC) outsourcing industry by enabling faster, more precise, and lifecycle-integrated compliance services. The integration of AI/ML tools into TIC workflows is enhancing risk prediction, irregularity detection, and automated test data analysis, especially critical in complex devices such as SaMD and AI-powered diagnostics. Digital twins and virtual testing environments are increasingly used for simulating device behavior under varying physiological and cybersecurity scenarios, reducing time-to-validation and costs. Furthermore, cloud-based compliance platforms streamline documentation, audit trails, and multi-region regulatory alignment, supporting OEMs with real-time visibility into test progress and regulatory readiness. These technologies are critical as medical devices become increasingly connected, software-intensive, and regulated under evolving cybersecurity and performance mandates.

The competitive landscape is evolving as TIC providers invest in specialized digital capabilities and sector-focused M&A. Market leaders like TÜV SÜD, Intertek, and SGS are expanding portfolios to include cybersecurity labs, SaMD testing units, and real-world evidence analytics. Collaborations with digital health startups and CDMOs are becoming common, enabling early-phase integration of TIC services. Startups offering automated compliance engines and virtual validation platforms are also entering the landscape, creating a hybrid model of tech-enabled compliance delivery. TIC players with global lab networks, regulatory consulting depth, and digital service orchestration are best positioned to capitalize on the growing demand for faster, scalable, and regulator-aligned TIC solutions.

Pricing Analysis

The global medical device testing, inspection, and certification (TIC) outsourcing market exhibits a stratified pricing structure, primarily driven by the regulatory complexity of the target market, the risk classification of the devices, and the depth and breadth of required validation services. As regulatory bodies such as the U.S. FDA, EU MDR/IVDR, and other national authorities expand requirements for performance testing, cybersecurity assurance, and post-market surveillance, pricing has adjusted upward, particularly for higher-risk and software-intensive medical technologies.

For low-risk Class I devices, pricing generally ranges from USD 5,000 to USD 15,000, covering basic electrical safety, labelling, and documentation compliance. Class II devices, which require more extensive functional testing, risk analysis, and limited human factors evaluation, often range from USD 20,000 to USD 75,000, depending on device connectivity and target markets. Class III devices, such as implantables and life-supporting systems, represent the highest price range. TIC service packages often exceed USD 100,000 to USD 500,000 due to the need for mechanical, biological, clinical, and cybersecurity testing.

Geographic variations also significantly impact the medical device TIC service pricing. In North America, TIC services, particularly for Class II/III connected devices, are priced at a 10–15% premium due to heightened cybersecurity requirements and stringent documentation standards under FDA guidelines. In the European Union, MDR/IVDR compliance drives even higher pricing levels, often 15–20% above U.S. rates, given the scarcity of notified bodies and the need for multilingual technical documentation. On the other hand, markets in Asia-Pacific, such as India, Malaysia, and Indonesia, currently benefit from cost-effective TIC services at 30–40% lower than U.S. and EU levels. However, prices are trending upward as these countries require local regulatory standards, such as India MDR and ASEAN MDA harmonization.

Furthermore, the medical device testing, inspection and certification (TIC) outsourcing industry is witnessing the rise of value-based pricing models. TIC providers offer bundled compliance packages covering pre-market validation, regulatory submission support, and ongoing post-market surveillance. Subscription-based models for continuous cybersecurity monitoring and real-time regulatory intelligence are also gaining traction, especially among digital health firms and CDMOs managing Class III devices.

Service Insights

The testing service segment dominated the market and accounted for the highest revenue share of 64.77% in 2024. The high segment growth is driven by the rising complexity and regulatory scrutiny of high-risk (Class II/III) devices. This segment encompasses a broad range of evaluations, including electrical safety, biocompatibility, mechanical integrity, software validation, and cybersecurity testing, mandated by global regulatory authorities. Increasing adoption of connected, implantable, and software-enabled devices has strengthened demand for specialized testing services, particularly in areas like usability engineering, AI algorithm validation, and penetration testing.

Moreover, OEMs increasingly rely on third-party laboratories to access advanced equipment, reduce compliance risk, and expedite time-to-market under stringent regulatory timelines. For instance, in June 2023, DEKRA launched dedicated AI testing and certification services to meet the rising demand for safety and security in AI-driven medical and industrial products. This strategic move strengthened DEKRA’s position as a leading provider of AI safety certification, enabling it to capture a growing share of the emerging AI assurance market and gain a competitive advantage in next-generation technologies.

On the other hand, the certification service segment is anticipated to register the fastest CAGR over the analysis period. The high segment growth potential is owing to escalating global regulatory scrutiny and mandatory compliance with frameworks such as EU MDR/IVDR, U.S. FDA requirements, and ISO 13485 standards. Certification involves third-party validation of quality systems, product conformity, cybersecurity readiness, and clinical safety, particularly critical for high-risk Class II/III and software-based devices. The limited availability of advisory bodies in Europe and the expansion of regulatory frameworks in APAC and Latin America are accelerating the demand for certification services, creating capacity constraints and price inflation. OEMs increasingly rely on TIC providers for CE marking, FDA 510(k)/PMA support, pre-certification gap assessments, and multi-jurisdictional harmonization strategies.

Device Class Insights

Class II medical devices accounted for the largest revenue share in the global medical device testing, inspection and certification (TIC) outsourcing market in 2024, owing to their moderate risk profile and stringent regulatory scrutiny. These device classes, including infusion pumps, powered wheelchairs, diagnostic imaging systems, and surgical drapes, require extensive performance, biocompatibility, and electromagnetic compatibility testing. The segment's growth is further stimulated by regulatory expansions under the FDA and EU MDR frameworks, rising demand for third-party validation, and rapid technological integration, such as connectivity and software components. Increasing outsourcing by OEMs to navigate complex approval pathways further propels the need for specialized TIC services for Class II devices.

On the other hand, the class I medical devices segment is estimated to grow at a substantial CAGR over the analysis timeframe. High volume and frequent regulatory updates for low-risk products such as surgical instruments, bandages, and non-powered diagnostic tools drive the high segment growth potential. Despite their low-risk profile, increasing global alignment with ISO 13485 standards and country-specific mandates such as India's CDSCO notifications and ASEAN MDA guidelines has heightened compliance requirements. This has stimulated manufacturers to outsource essential TIC services such as safety, labeling, and biocompatibility testing to streamline market entry and manage cost-efficiency across multi-country regulatory environments.

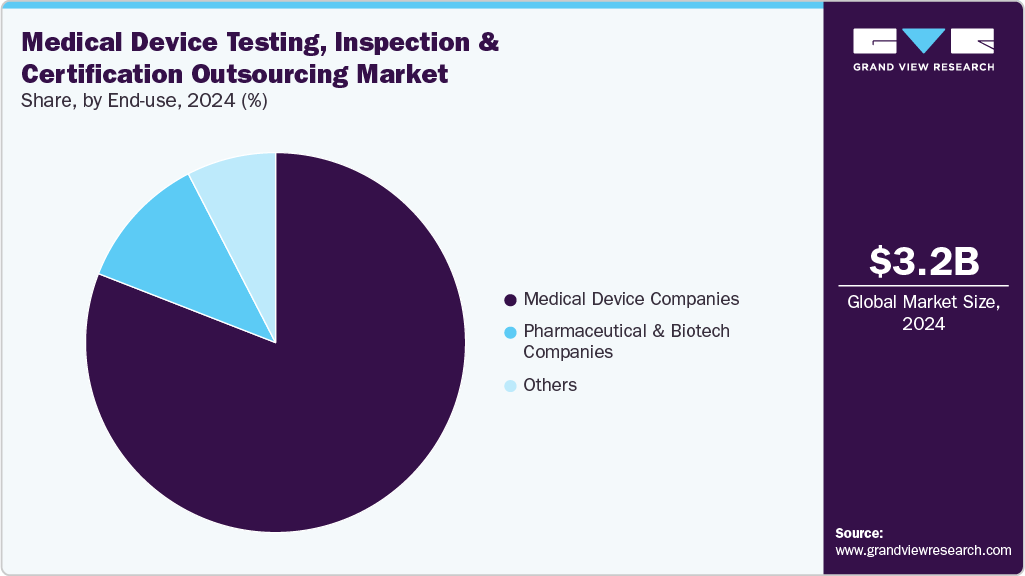

End Use Insights

In 2024, medical device companies held the largest revenue share in the global medical device testing, inspection, and certification (TIC) industry and is anticipated to witness the fastest CAGR over the estimated timeline. This is due to the healthcare sector's stringent regulatory demands and growing technological complexity. Increased adoption of advanced devices like wearables, diagnostics, and implantable medical devices led to rigorous quality and compliance requirements, especially in developed and regulated markets. TIC services are critical for proving that these devices meet international standards, such as FDA and ISO certifications, which are essential for patient safety and market access. Additionally, the rapid pace of innovation in medical devices, including biocompatibility testing and cybersecurity assessments, augmented the need for specialized TIC providers that offer expertise in these areas, allowing manufacturers to reduce time-to-market and focus on innovation.

The pharmaceutical and biotech companies segment is expected to witness substantial growth over the forecast period, driven by their expanding involvement in combination products, drug-delivery devices, and diagnostics. The surge in biologics, mRNA-based therapies, and wearable injectors has increased the demand for integrated testing and regulatory services. These companies increasingly rely on TIC providers for biocompatibility, extractables and leachables (E&L) testing, and cybersecurity validation to meet FDA, EMA, and MDR requirements. Moreover, outsourcing accelerates compliance timelines, reduces in-house regulatory burdens, and ensures alignment with evolving global standards, particularly for Class II/III drug-device combinations targeting oncology, diabetes, and rare disease therapeutic areas

Regional Insights

The medical device testing, inspection, and certification outsourcing market in Europe dominated and accounted for a revenue share of 43.50% in 2024. The growth is propelled by stringent EU MDR and IVDR regulations, requiring enhanced clinical evidence, risk management, and post-market surveillance. The scarcity of notified bodies has led to testing bottlenecks, prompting OEMs to outsource for faster compliance. Additionally, rising demand for TIC services in digital health, wearable, and AI-based devices, coupled with cross-border harmonization pressures and growing cyber-resilience mandates, accelerates reliance on third-party experts to navigate complex regulatory pathways across European markets.

The medical device testing, inspection, and certification outsourcing market in Germany accounted for the highest revenue share in the Europe region. This dominance is attributed to stringent regulatory standards, including compliance with the European Union Medical Device Regulation (EU MDR), which necessitate comprehensive testing and certification processes. Additionally, Germany's strong healthcare infrastructure and emphasis on quality assurance further bolster the demand for specialized TIC services. Technological advancements, such as the integration of artificial intelligence and digital health solutions, are also contributing to the market's expansion by enhancing testing efficiency and accuracy.

The UK medical device testing, inspection and certification outsourcing market is anticipated to witness the highest CAGR over the forecast period. The country’s growth is primarily attributed to post-Brexit regulatory realignment under MHRA-mandated UKCA requirements, inducing domestic manufacturers and global OEMs to secure UK-specific testing and certification. Increased NHS procurement of digital health and AI-enabled devices requires rigorous conformity assessments. Additionally, the British Standards Institution’s harmonization efforts and expanding demand for cybersecurity validation driven by MHRA guidance on clinical safety of networked devices are compelling companies to engage third-party TIC partners for expedited market access and ongoing compliance.

The medical device testing, inspection and certification outsourcing market in Italy held a significant share of Europe in 2024. The growth is driven by the increasing complexity of medical devices, requiring advanced testing methodologies, and the rising demand for cost-efficient compliance solutions. Furthermore, the emphasis on stringent regulatory standards and the need for specialized TIC services are stimulating manufacturers to outsource these functions to ensure timely market access and maintain product quality. The integration of digital health technologies and the expansion of Italy's healthcare infrastructure further contribute to the market's growth.

North America Medical Device Testing, Inspection and Certification Outsourcing Market Trends:

North America held the second-largest revenue share in the global medical device testing, inspection, and certification outsourcing industry in 2024. This is attributed to substantial industry players in the region, a combination of advanced regulatory frameworks, and a strong focus on innovation. The region's stringent regulatory requirements, particularly those imposed by the U.S. Food and Drug Administration (FDA), require comprehensive testing and certification processes to ensure device safety and efficacy. This regulatory framework requires manufacturers to seek specialized TIC services to navigate complex compliance landscapes efficiently. Additionally, the increasing complexity of medical devices, incorporating advanced technologies such as artificial intelligence and the Internet of Things (IoT), demands sophisticated testing methodologies, further propelling the demand for TIC outsourcing.

U.S. Medical Device Testing, Inspection and Certification Outsourcing Market Trends

The medical device testing, inspection, and certification outsourcing industry in the U.S. accounted for the largest revenue share in North America in 2024. The growth is owing to the FDA’s evolving cybersecurity mandates (e.g., Section 524B of the FD&C Act) and premarket submission guidelines for connected devices. Additionally, fast-track innovation programs such as Breakthrough Devices and increasing AI/ML-based product submissions are intensifying demand for specialized validation. Rising liability risks, combined with the FDA’s heightened scrutiny post-pandemic, are pushing OEMs to engage accredited third-party labs for accelerated compliance, technical documentation support, and risk-based testing, particularly for SaMD and Class II/III therapeutics.

The medical device testing, inspection, and certification outsourcing market in Mexico held a considerable revenue share of North America in 2024. The market growth is owing to the country's strategic position as a major nearshoring destination for U.S. and global OEMs, offering cost-effective manufacturing and proximity to North American markets. Additionally, the concentration of medical device manufacturing clusters, such as the Cali-Baja Biotech Cluster in Baja California, enhances Mexico's appeal for TIC services. The increasing complexity of medical devices and the need for compliance with international standards are prompting manufacturers to outsource TIC services to ensure timely market access and maintain product quality.

Asia Pacific Medical Device Testing, Inspection and Certification Outsourcing Market Trends

The Asia Pacific medical device testing, inspection and certification outsourcing industry is anticipated to grow at the fastest CAGR over the forecast period. The region's growth is due to rapid economic growth and increasing healthcare expenditure. The increasing complexity of medical devices necessitates advanced testing methodologies and the rising demand for cost-efficient compliance solutions. Additionally, the emphasis on stringent regulatory standards and the need for specialized TIC services are prompting manufacturers to outsource these functions to ensure timely market access and maintain product quality.

The China medical device testing, inspection and certification outsourcing market held the largest revenue share in Asia Pacific in 2024. The National Medical Products Administration's (NMPA) initiatives to streamline regulatory processes and align with international standards are thereby increasing the demand for specialized TIC services. Additionally, the integration of digital health technologies and the expansion of China's healthcare infrastructure further contribute to the market's growth.

The medical device testing, inspection and certification outsourcing market in India is expected to grow at the fastest CAGR over the estimated period. The market growth is primarily driven by the implementation of the Medical Device Rules (MDR) 2017, which introduced rigorous regulatory frameworks aligning with global standards. The country’s expanding domestic manufacturing under the Make in India initiative is pushing OEMs to ensure robust compliance through third-party testing. Additionally, increasing adoption of affordable diagnostic devices for a large rural population, coupled with growing government investments in healthcare infrastructure and emerging local accredited testing labs, is accelerating outsourcing demand. The evolving regulatory landscape and rising quality expectations are fostering a shift from in-house to outsourced TIC services to meet stringent market access and export requirements.

The Japan medical device testing, inspection and certification outsourcing market is witnessing growth, driven by its aging population and a growing emphasis on advanced medical technologies. The stringent regulatory environment, including the Pharmaceuticals and Medical Devices Agency (PMDA) standards, requires thorough testing and certification processes, increasing demand for healthcare TIC outsourcing services.

Key Medical Device Testing, Inspection and Certification (TIC) Outsourcing Company Insights

Key companies in the medical device testing, inspection and certification outsourcing market is characterized by intense competition among leading specialized service providers, including SGS, TÜV SÜD, Intertek, UL, and Bureau Veritas. These players utilize advanced testing technologies, strategic acquisitions, and expanded service portfolios to meet evolving regulatory demands and technological complexities. Market leaders focus on geographic expansion, particularly into emerging markets, and invest heavily in digital and cybersecurity testing capabilities to address the rising demand for connected devices. Collaborative partnerships with OEMs and regulatory bodies further enhance their competitive positioning, driving innovation and comprehensive compliance solutions globally.

Key Medical Device Testing, Inspection and Certification Outsourcing Companies:

The following are the leading companies in the medical device testing, inspection and certification outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- SGS SA

- Intertek Group plc

- Eurofins Scientific SE

- DEKRA CERTIFICATION B.V.

- UL Solutions Inc.

- TÜV SÜD

- ALS Limited

- Bureau Veritas SA

- NSF International

- Element Materials Technology

- Nelson Labs

- Pace Analytical Life Sciences

- ITS Testing Services

- DNV (Det Norske Veritas)

- Korea Testing Certification

Recent Developments

-

In July 2024, SGS SA announced the acquisition of Gossamer Security Solutions in the U.S. and Analisis Quimico y Microbiologico SAS (AQM) and Cromanal SAS in Colombia. These acquisitions aimed to enhance SGS's cybersecurity capabilities by acquiring Gossamer, particularly in IT security certification. Meanwhile, AQM and Cromanal strengthen SGS's footprint in the Colombian pharmaceutical testing market.

-

In June 2023, Applus+ Technologies, Inc. acquired Rescoll, a prominent materials testing and R&D technological partner in France. Through this acquisition, the company broadened its service offerings in Europe.

Medical Device Testing, Inspection and Certification Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.40 billion

Revenue forecast in 2030

USD 5.11 billion

Growth Rate

CAGR of 8.48% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, drug class, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; India; China; Japan; Australia; South Korea; Thailand; Indonesia; Singapore; Malaysia; Taiwan; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Kuwait; Israel

Key companies profiled

SGS SA; Intertek Group plc; Eurofins Scientific SE; DEKRA CERTIFICATION B.V.; UL Solutions Inc.; TÜV SÜD; ALS Limited; Bureau Veritas SA; NSF International; Element Materials Technology; Nelson Labs; Pace Analytical Life Sciences; ITS Testing Services; DNV (Det Norske Veritas); Korea Testing Certification

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as part of customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Testing, Inspection And Certification Outsourcing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical device testing, inspection and certification outsourcing market report based on service, drug class, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Testing

-

Inspection

-

Certification

-

-

Device Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Class I

-

Class II

-

Class III

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical and Biotech Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

Singapore

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global medical device testing, inspection, and certification outsourcing market size was estimated at USD 3.18 billion in 2024 and is expected to reach USD 3.40 billion in 2025.

b. The global medical device testing, inspection, and certification outsourcing market is expected to grow at a compound annual growth rate of 8.48% from 2025 to 2030 to reach USD 5.11 billion by 2030.

b. The testing segment dominated the medical device TIC outsourcing market, with a share of 64.87% in 2024. The segment's growth is owing to stringent global regulatory mandates for safety, biocompatibility, and performance validation. Rising adoption of complex, connected, and high-risk Class II/III devices boosts demand for electrical, mechanical, chemical, and cybersecurity testing. Increasing regulatory scrutiny under MDR, FDA 21 CFR, and ISO 10993 further accelerates outsourced testing investments across key markets.

b. Some key players operating in the medical device TIC outsourcing market include SGS SA, Intertek Group plc, Eurofins Scientific SE, DEKRA CERTIFICATION B.V., UL Solutions Inc., TÜV SÜD, ALS Limited, Bureau Veritas SA, NSF International, Element Materials Technology, Nelson Labs, Pace Analytical Life Sciences, ITS Testing Services, DNV (Det Norske Veritas), Korea Testing Certification.

b. Key factors that are driving the market growth include continuous reforms across global medical device regulations such as EU MDR and FDA 524B, rising complexity of Class II/III and connected devices, post-market surveillance mandates, and accelerated product innovation. Demand for specialized validation such as cybersecurity, usability, and biocompatibility, combined with cost containment pressures and regulatory bottlenecks, is prompting OEMs to partner with third-party TIC providers across development and lifecycle stages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.