- Home

- »

- Medical Devices

- »

-

Medical Equipment Rental Market Size & Share Report, 2030GVR Report cover

![Medical Equipment Rental Market Size, Share & Trends Report]()

Medical Equipment Rental Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Personal, Institutes, Hospitals), By Product (Storage & Transport, Durable, Surgical), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-460-4

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Equipment Rental Market Summary

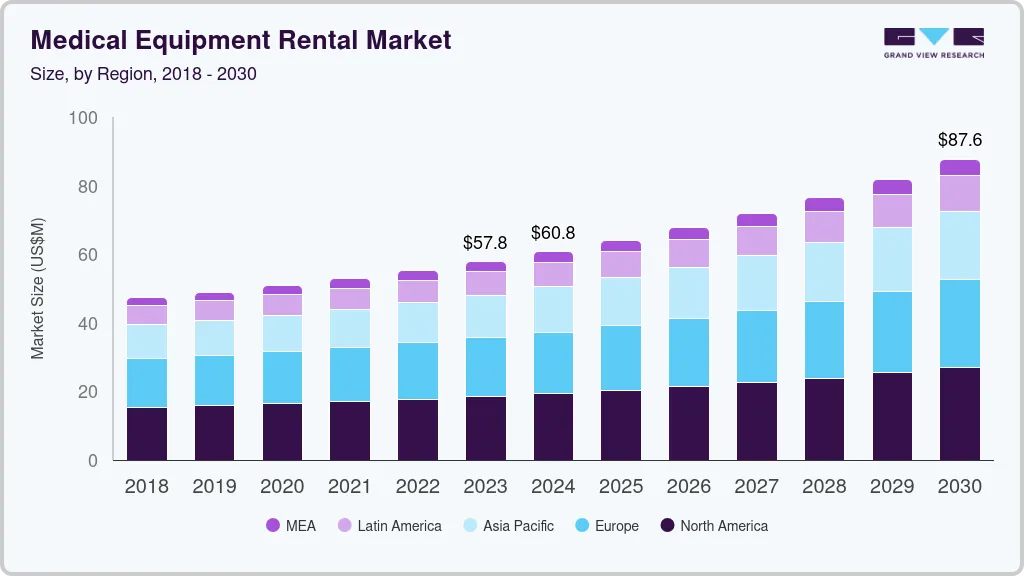

The global medical equipment rental market size was estimated at USD 57.8 billion in 2023 and is projected to reach USD 87.6 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The growing adoption of medical rental devices and the rising demand due to speedy technological developments are among the key market growth trends.

Key Market Trends & Insights

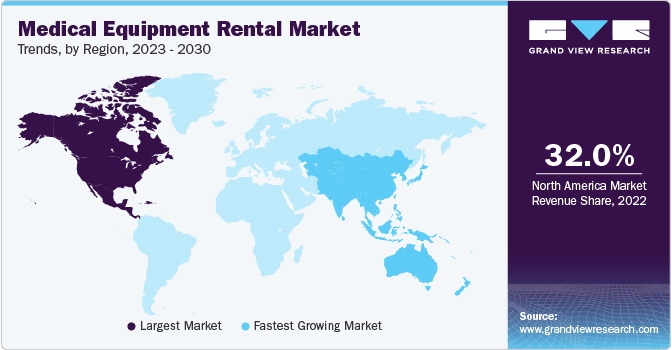

- North America dominated the global market in 2022 with over 32% revenue share.

- Asia Pacific is projected to be the fastest-growing regional market, with an anticipated CAGR of 6.7% during the forecast period.

- By product, the durable medical equipment (DME) segment held the largest market share in 2022.

- By end use, the personal/home care segment is anticipated to exhibit the highest CAGR of 6.2% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 57.8 Billion

- 2030 Projected Market Size: USD 87.6 Billion

- CAGR (2024-2030):6.3%

- North America: Largest market in 2022

Rising R&D activities in the medical device industry are resulting in the introduction of advanced variants with enhanced effectiveness, which is leading to a surge in the prices of various equipment.

The global healthcare industry has observed a shifting trend from procuring to leasing of devices over the past few decades. Healthcare providers across the globe are aiming for improved infrastructural facilities and reduced capital required to achieve the same. The trend is likely to stay, thus sustaining the growth of the market. However, the presence of insurance coverage for some of the medical devices is expected to pose a threat to the rental/leasing market.

Shortened product lifecycle is another factor anticipated to propel market growth during the forecast period. The constant availability of advanced devices is leading to price hikes and thus causing a burden on healthcare providers. To keep up with the competition, healthcare providers need to pay keen attention to technological upgrades. Therefore, rising involvement in R&D is poised to propel market expansion.

For instance, according to a report published by the National Science Foundation, from 2000 to 2019, worldwide R&D spending grew threefold, reaching an estimated USD 2.4 trillion from USD 726 billion. In 2019, the U.S. was the top spender on R&D, but its global share has declined, as some middle-income countries have experienced faster R&D growth. This shows that R&D investments have increased globally, with other countries making notable progress in this area, catching up to the U.S.

In addition, the rising popularity of home healthcare owing to reduced hospital stays and the widening geriatric and disabled patient pool is boosting the demand for rental devices. Increasing mishaps such as muscular dystrophy, spinal malfunctioning, and brain or skeletal injury/disorders are leading to an increasing disabled population pool. All these factors are working in favor of the market’s growth.

For instance, according to a WHO Report in 2022, around 1 billion people are aged 60 years and above. This number is expected to grow to 1.4 billion by 2030. By 2050, the population of people aged 60 years and older is predicted to double and reach 2.1 billion. Additionally, the number of individuals aged 80 years or older is expected to triple from 2020 to 2050, reaching 426 million. This means that the world's older adult population is increasing significantly, with more people reaching the age of 60 and above and a considerable rise in those aged 80 and older.

The COVID-19 pandemic has affected the supply chain of medical equipment adversely. However, there was tremendous growth in the demand for respiratory medical devices such as O2 cylinders, BiPAP and CPAP machines, NIV machines, and ventilators owing to the coronavirus infection’s rapid spread. This has helped push the market for rental medical equipment. By renting out equipment, companies have fulfilled the demands of hospitals and homecare.

However, the availability of various grants and government provisions for the disabled population is projected to impede the market's growth. Provision grants such as financial support for procuring equipment and funds for building infrastructural facilities for people with disabilities are lowering the need for renting equipment. This, in turn, is estimated to limit the market from realizing its utmost potential.

The growing geriatric population, which is prone to diseases that can lead to immobility, is expected to have a direct positive impact on demand for patient care devices, such as mobility devices, bathroom assist devices, and hospital furniture. In addition, the increasing incidences of paralysis and spinal injuries have led to a rise in the disabled patient population. Other factors contributing to the increase in the disabled population include the growing prevalence of muscular dystrophy, arthritis, Parkinson's disease, Huntington's disease, and other CNS disorders.

According to the WHO, the global prevalence of Parkinson's disease (PD) has doubled over the past 25 years, with more than 8.5 million people estimated to live with PD in 2019. Notably, disability and death caused by PD are increasing at a faster rate than any other neurological disorder. In simple terms, Parkinson's disease is becoming more common worldwide, and its impact on disability and mortality is growing rapidly compared to other neurological conditions.

Product Insights

The durable medical equipment (DME) segment acquired the highest share of the market in 2022. The rising need for mobility and assistance equipment owing to the increasing disabled and geriatric population is contributing to market growth. However, the surgical equipment segment is likely to witness significant gains in rental revenues during the forecast period, owing to the rising prevalence of cardiac and neurological disorders. For instance, according to a report by the World Health Organization (WHO), cardiovascular diseases (CVDs) are the leading cause of death globally.

In 2019, CVDs were responsible for an estimated 17.9 million deaths, accounting for 32% of all global deaths that year. Among these fatalities, 85% were attributed to heart attacks and strokes. It is noteworthy that more than three-quarters of CVD-related deaths occur in low- and middle-income countries. Additionally, CVD accounted for 38% of the 17 million premature deaths (occurring before the age of 70) that were caused by non-communicable diseases in 2019.

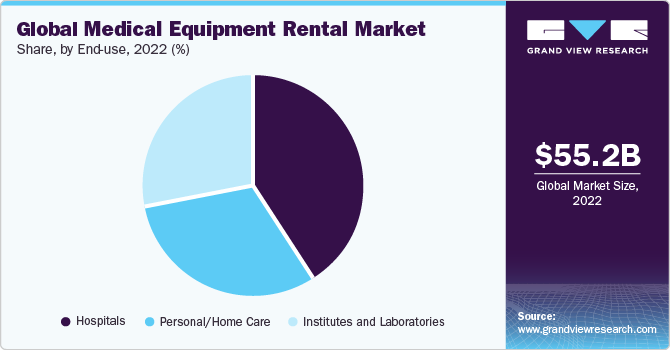

End-use Insights

The hospital segment accounted for the largest revenue share of around 41.1% of the market in 2022. The segment's growth can be attributed to the rising patient pool and increasing government reforms regarding the adoption of advanced healthcare infrastructure. In addition, COVID-19 has surged the market's growth in the hospital segment due to the sudden and tremendous requirement of respiratory medical devices.

Over the past few years, equipment procurement has been observed to be substituted by financing systems such as renting/leasing. In addition, the convenience of splitting capital expenditure over a few months in case of rental services is poised to benefit healthcare providers. Moreover, rising concerns for diagnostic efficiency and enhanced patient output rates, coupled with spiraling demand for lowered pre-therapeutic costs, are projected to augment overall market expansion.

The personal/home care segment is estimated to emerge with the highest CAGR of 6.2% during the forecast period. The rising need for geriatric care centers and home healthcare devices is one of the primary factors spurring the segment's growth. Due to the rapidly growing older population and rate of chronic diseases such as hypertension and hyperglycemia, the need for equipment such as insulin pumps and digital BP apparatus has pushed market expansion.

The incidence of lifestyle-associated diseases such as obesity and diabetes, and other disorders, including cardiac conditions, is likely to bolster the adoption of medical rental equipment. For instance, according to the National Center for Biotechnology Information (NCBI), during the period from 1990 to 2019, the number of individuals aged 30-79 years suffering from hypertension doubled, rising from 331 million women and 317 million men to 626 million women and 652 million men. Interestingly, this increase happened even though the global age-standardized prevalence of hypertension remained constant during the same timeframe.

Regional Insights

North America dominated the market in terms of revenue share of over 32% in 2022. The presence of a large number of service providers and high demand for technologically advanced products are escalating the growth of the regional market. On the other hand, the rising prevalence of chronic diseases such as Parkinson’s, Huntington’s disease, atherosclerosis, and respiratory diseases; the rapid proliferation of home health care services; and the fast-growing geriatric population are providing a fillip to the market’s growth in Europe.

Educational institutes and research laboratories are looking forward to reducing operational and procurement costs, leading to a greater adoption of rental equipment globally. According to the CDC, in the U.S., heart disease is the top cause of death across various genders, races, and ethnic groups. Shockingly, one person loses their life to cardiovascular disease every 33 seconds in the country. In 2021, approximately 695,000 people died from heart disease, accounting for 1 in every 5 deaths. The economic impact of heart disease in the U.S. amounts to about $239.9 billion annually, which includes healthcare expenses, medications, and productivity losses due to premature death.

Asia Pacific is anticipated to exhibit the highest CAGR of 6.7% during the forecast period. The widening base of the geriatric population and growing supportive government initiatives in developing economies are primary growth stimulants for the regional market. China contributes to a considerable share of the global medical equipment rental market revenue. This can be attributed to the rising pool of disabled patients, the growing incidence of obesity, and a rising number of small-scale manufacturers of home healthcare devices in the region.

Key Companies & Market Share Insights

Key players in the market are focusing on adopting growth strategies, such as mergers and acquisitions, developing existing devices, promotional events, and technological advancements. For instance, in November 2022, one of the biggest companies in healthcare equipment, the Germany-based Siemens, has sold medical equipment and devices worth USD 140 million to the U.S.-based Atrium Health, in order to provide enhanced care access to underserved communities.

Prominent players are frequently undertaking mergers & acquisitions in order to expand their product portfolio and strengthen their position in the market. For instance, Stryker, a global medical technology company, expanded its offices in the International Tech Park area of Gurugram, India, in 2021.

Key Medical Equipment Rental Companies:

- Westside Medical Supply

- Universal Hospital Services

- Woodley Equipment Company Ltd.

- Nunn's Home Medical Equipment

- Siemens Financial Services, Inc.

- Stryker

- Hill-Rom Holdings Inc.

- Apria Healthcare Group Inc.

- Agiliti Health, Inc.

- Avante Health Solutions

- GE Healthcare

- US Med-Equip

- Centric Health Ltd.

Medical Equipment Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 60.8 billion

Revenue forecast in 2030

USD 87.6 billion

Growth Rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Westside Medical Supply; Universal Hospital Services; Woodley Equipment Company Ltd.; Nunn's Home Medical Equipment; Siemens Financial Services, Inc.; Stryker; Hill-Rom Holdings Inc.; Apria Healthcare Group Inc.; Agiliti Health, Inc.; Avante Health Solutions; GE Healthcare; US Med-Equip; Centric Health Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

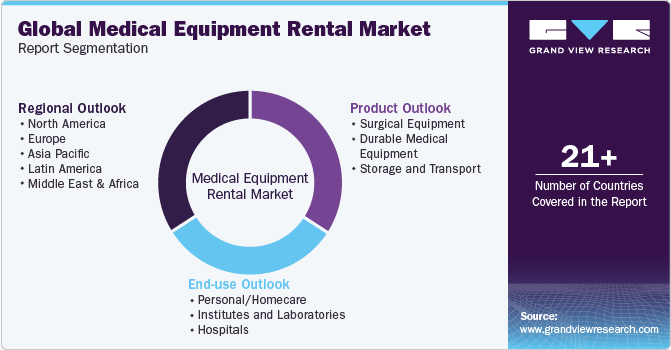

Global Medical Equipment Rental Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global medical equipment rental market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Equipment

-

Durable Medical Equipment

-

Personal Mobility Devices

-

Bathroom Safety and Medical Furniture

-

Monitoring and Therapeutic Devices

-

-

Storage and Transport

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal/Homecare

-

Institutes and Laboratories

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical equipment rental market size was estimated at USD 55.2 billion in 2022 and is expected to reach USD 57.8 billion in 2023.

b. The global medical equipment rental market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 86.2 billion by 2030.

b. North America dominated the global medical equipment rental market with a share of 31.93% in 2022. This is attributable to rising R&D activities in the medical device industry, growing adoption of medical assist devices, and shortened product lifecycle.

b. Some key players operating in the medical equipment rental market include Hill-Rom Holdings, Inc.; Siemens Financial Services, Inc.; Nunn’s Home Medical Equipment; Westside Medical Supply; Universal Hospital Services, Inc.; and Woodley Equipment Company Ltd.

b. Key factors that are driving the medical equipment rental market growth include the rising need for home healthcare owing to reduced hospital stays and a widening geriatric and disabled patient pool.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.