- Home

- »

- Clothing, Footwear & Accessories

- »

-

Medical Footwear Market Size & Share Report, 2020-2027GVR Report cover

![Medical Footwear Market Size, Share & Trends Report]()

Medical Footwear Market Size, Share & Trends Analysis Report By End Use (Men, Women), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-951-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The global medical footwear market size was valued at USD 8.30 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2020 to 2027. The rising number of foot-related issues, such as plantar fasciitis, bunions, arthritis, foot and ankle injuries, corns, and flat feet, on account of poorly fitting shoes, is a key factor driving the market. According to the American Podiatric Medical Association (APMA) 2019, in the U.S., about 77% of Americans have encountered foot disorders and related issues. Usage of ill-fitted shoes for a prolonged period of time for normal walks or running can result in sprains, strains, or trauma in the feet, which can limit the wearers’ mobility to perform day-to-day activities. The longer these conditions are left untreated, the worse the pain and discomfort become for the people. However, growing awareness regarding the benefits of medical footwear among consumers is expected to propel the product demand. These footwear offers cushion to the entire foot, providing it with the support to the wearer to move freely.

Additionally, patients with medical conditions, including diabetes, are among the leading consumers of therapeutic footwear to heal ankle and foot. Inadequately controlled blood sugar in the case of these patients can damage many parts of the body, including the nerves and vessels that go to the feet, which makes them more prone to develop feet problems and a condition called neuropathy. Medical footwear is categorically designed shoes that can help reduce risk and promote healthy blood circulation, mobility, and support to the feet.

According to Diabetes.co.uk, a global community in the area of diabetes estimated that close to 415 million people were living with diabetes in the world as of 2019, which is estimated to be 1 in 11 of the world’s adult population. This figure is expected to rise to 642 million people living with diabetes worldwide by 2040. Growing cases of diabetes are expected to eventually boost market growth across the world.

Apart from medical-related issues, long-distance runners, sports enthusiasts, and military combats who perform high-intensity outdoor activities are likely to suffer from knee pain and ankle sprains and require medical footwear to recover feet and heal. Enthused by the opportunity existence, many companies have been focusing on offering footwear designed to appeal to this segment of people. For instance, in May 2020, a startup named Kingetics made a technological innovation in footwear for military combats. The Kignetics mechanical insole system lever has advanced composite insoles that reduce stress fractures and injury rates during training. It is an orthopedic design that incorporates lever and spring plate to reduce the impact of injuries, which is about 16% and shoots up to 30% in infantry units.

In the face of adversity and the coronavirus pandemic, there has been a shift in the purchasing pattern of the consumers. According to a Vertical Web Media report, online sales have surged during the lockdown period. However, the demand for essential products, such as groceries, medicines, and other food items, is dominating customer requirements. Consumers have become more conscious of their spending habits and are avoiding buying non-essential products, thereby declining the growth for the footwear industry, including medical footwear, among consumers.

End-use Insights

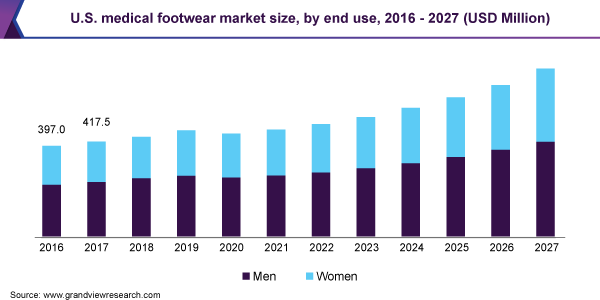

The men segment led the market and accounted for 57.2% share of the global revenue in 2019. Increasing cases of medical conditions, including diabetics, among men have been driving the segment. According to Diabetes.co.uk, men accounted for close to 56% of the U.K. adults with diabetes in 2019. Similarly, according to the U.S. National Library of Medicine, globally, more males are diagnosed with diabetes compared to women annually. Increasing diabetic patients are expected to have a positive impact on the growth of the segment during the forecast period.

The women segment is expected to register the fastest CAGR of 5.9% from 2020 to 2027. Increasing outdoor activities, running, climbing, and other adventure activities among women are likely to drive demand for medical footwear to prevent knee pain and risk of injuries. Established companies have been focusing on research and development to offer appropriate footwear to consumers. For instance, in October 2019, New Balance Athletics, Inc., a sports footwear and apparel manufacturer, collaborated with a medical apparel company FIGS to bring functional and fashionable footwear. 574S is a performance-focused shoe available for women with water-resistant attributes and fresh foam midsoles to offer increased support.

Distribution Channel Insights

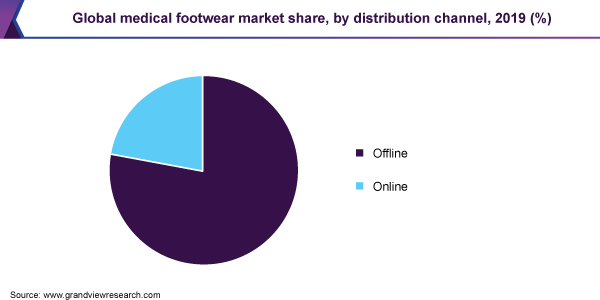

Offline distribution channels dominated the market and accounted for 74.9% share of the global revenue in 2019. Trends in the distribution channels for the medical footwear market underscore an increased consumer inclination towards buying these products from offline stores, such as retail outlets and multi-brand outlets. People prefer to buy these products through stores by physically verifying the durability, comfort, and material of the footwear by trying it. People have become more conscious about the quality of medical footwear, which is one of the main reasons fueling segment growth.

The online distribution channel is expected to witness the fastest growth over the forecast period. The rising popularity of e-commerce channels is likely to lead to considerable growth prospects for the market owing to a wider distribution network. Such factors have been encouraging manufacturers to sell their products through online channels. The growth of the e-commerce industry globally is expected to change market dynamics in the coming years. Consumers are showing a shift in purchasing patterns, particularly in developed regions such as North America and Europe, with increased shipments of medical footwear purchased through online distribution channels.

Regional Insights

North America dominated the market for medical footwear and accounted for 33.5% share of the global revenue in 2019. Increasing foot-related issues owing to diabetes and sports-related fractures, coupled with established healthcare providers, are among the primary reasons fueling the growth of the regional market. According to WebMD LLC. Report 2019, close to 23,000 people in the U.S. including both athletes and non-athletes, require medical care for ankle sprains per day. Moreover, ankle sprains are found to be one of the most common foot and ankle injuries in active-duty personal in the U.S. Army, with close to 103 sprains per 1000 persons per year. Consumers prefer medical footwear to reduce the impact of pain and do not shy away to pay a premium price for these products.

Asia Pacific is expected to witness the fastest growth over the forecast period. An increasing number of diabetic patients and rising cases of foot ankle sprains due to outdoor activities are the key factors driving the regional market. According to the International Diabetes Federation report, in 2016, China and India witnessed the highest number of active diabetic cases across the world. Growing concerns among the people regarding health, along with increasing disposable income in these countries, are expected to drive the product demand during the forecast period.

Key Companies & Market Share Insights

The market for medical footwear is fragmented on account of the presence of prominent players at the regional level, especially in the Asia Pacific region with the same end-use offerings. In this respect, key market participants are expected to invest in research & development activities to remain competitive over the forecast period. Some of the prominent players in the medical footwear market include:

-

New Balance

-

Dr. Comfort

-

Mephisto

-

Aetrex Worldwide, Inc.

-

Orthofeet

-

Duna

-

Darco International Inc.

-

Aetrex Worldwide, Inc.

-

Dr. Zen, Inc.

-

Gravity Defyer Corp.

Medical Footwear Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.12 billion

Revenue forecast in 2027

USD 12.97 billion

Growth Rate

CAGR of 5.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; India; Brazil

Key companies profiled

New Balance; Dr. Comfort; Mephisto; Aetrex Worldwide, Inc.; Orthofeet; Duna; Darco International Inc.; Aetrex Worldwide, Inc.; Dr. Zen, Inc.; Gravity Defyer Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global medical footwear market report on the basis of end-use, distribution channel, and region:

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global medical footwear market size was estimated at USD 8.30 billion in 2019 and is expected to reach USD 8.11 billion in 2020.

b. The global medical footwear market is expected to grow at a compound annual growth rate of 5.7% from 2020 to 2027 to reach USD 12.97 billion by 2027.

b. North America dominated the medical footwear market with a share of 33.5% in 2019. This is attributable to rising foot-related issues owing to diabetes and sports-related fractures coupled with established health care providers are among the primary reason driving segment growth in the region.

b. Some key players operating in the medical footwear market include New Balance, Dr Comfort, Mephisto, Aetrex Worldwide, Inc., Orthofeet, Duna, Darco International Inc., Aetrex Worldwide, Inc., Dr. Zen, Inc., Gravity Defyer Corp.

b. Key factors that are driving the market growth include an increasing number of foot-related issues such as plantar fasciitis, bunions, arthritis, foot and ankle injuries, corns and flat feet because of poorly fitting shoes, and high demand for therapeutic footwear among diabetic consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."